Aluminum Market Surges with Green Innovations & Shifts

Published: 2025-09-15

The global Aluminum industry is undergoing a structural transformation, driven by government support, strategic investments, and a sharper focus on sustainable smelting. From energy-efficient production to its expanding applications across industrial sectors, Aluminum is set to remain a key enabler of global infrastructure and decarbonization goals.

Key Developments (2024–2025): State Support, Smelting Expansion, and ESG Focus

The Aluminum market has experienced notable developments in 2024–2025:

-

Government Support in Smelting: According to an OECD analysis, government support—such as energy subsidies and below-market financing—is observed across the Aluminum value chain, with particularly heavy support in China and Gulf Cooperation Council (GCC) countries. The report also highlights the significant role of state enterprises, especially in China's aluminum sector.

-

Green Smelting Projects: Century Aluminum, one of two remaining aluminum producers in the U.S., was awarded up to $500 million from the U.S. Department of Energy in 2024 for a similarly sized “Green Aluminum Smelter” project through a federal program designed to reduce greenhouse gas emissions from heavy industry. The company received an initial $10 million in grant funding in January.

-

Investment Surge in the U.S.: The Aluminum Association reported a $10 billion wave of investments since 2021 in downstream facilities, recycling, and alloy innovation in the U.S., with momentum continuing into 2025.

Applications: A Cross-Industry Essential

Aluminum’s unique properties—lightweight, corrosion resistance, and high conductivity—position it as critical in multiple sectors:

|

Industry |

Key Use Cases |

|

Automotive |

Lightweight vehicle frames, battery enclosures for EVs |

|

Construction |

Structural framing, cladding, window and door systems |

|

Aerospace |

Aircraft skins, interior components, structural alloys |

|

Packaging |

Beverage cans, food containers, foil packaging |

|

Electrical & Electronics |

Power transmission lines, heat sinks, enclosures |

|

Renewable Energy |

Solar panel frames, wind turbine components |

Regional Analysis: Dominance and Growth Patterns

Dominating Region – Asia-Pacific

Top Country: China

China remains the largest producer and consumer of Aluminum, accounting for more than 56% of global smelting capacity. According to the International Aluminum Institute (IAI), China’s output is backed by strong domestic demand and state support.

Key drivers for China’s dominance include:

-

Heavy government subsidies in energy costs for smelters

-

Vertical integration of mining, refining, and production

-

Increased demand from infrastructure, automotive, and electronics

India, another dominant player in Asia-Pacific, possesses significant bauxite reserves and is ramping up domestic smelting capacity with a government push under the “Make in India” scheme.

Fastest-Growing Region – North America

Top Country: United States

The United States is experiencing a resurgence in Aluminum investment, particularly in secondary (recycled) Aluminum production, driven by decarbonization mandates and EV demand.

-

The new EGA smelter in Oklahoma is projected to use hydroelectric power, targeting zero-emission primary Aluminum for automotive and aerospace clients in North America.

-

U.S. Aluminum companies have committed $10 billion since 2021, with investments accelerating in 2024–2025, as per the Aluminum Association.

Key Players and Strategic Developments

Leading Companies

|

Company |

Recent Strategy |

|

Emirates Global Aluminum (EGA) |

Planning to build U.S.-based green smelter with significant planned annual capacity targeting EVs and aerospace sectors. |

|

Hindalco Industries (India) |

Increasing downstream Aluminum value chain investments under “Make in India.” |

Emerging Players & Startups

-

Century Aluminum (U.S.): Benefiting from state support and power subsidies, Century is expanding recycling and value-added extrusion capabilities.

-

Vedanta Aluminum (India): Plans to build a new 550,000 tons/year smelter in Odisha with captive renewable power to reduce carbon footprint.

Future Outlook: Sustainability, Supply Chains, and Technology

The Aluminum industry is positioned for sustained long-term growth, aligned with global decarbonization and electrification trends. Key trends shaping the next decade include:

-

Decarbonized Smelting: Innovations such as EGA’s hydro-powered smelter in the U.S. are setting the standard for green Aluminum.

-

Circular Economy: According to the International Energy Agency, recycled Aluminum accounted for approximately 36% of global production in 2022 and is projected to 42% by 2030, supporting global efforts toward decarbonization.

-

State Enterprise Influence: According to a 2024 OECD analysis, government-supported enterprises—particularly in China and energy-rich countries—are playing an increasingly dominant role in shaping global Aluminum production and trade dynamics.

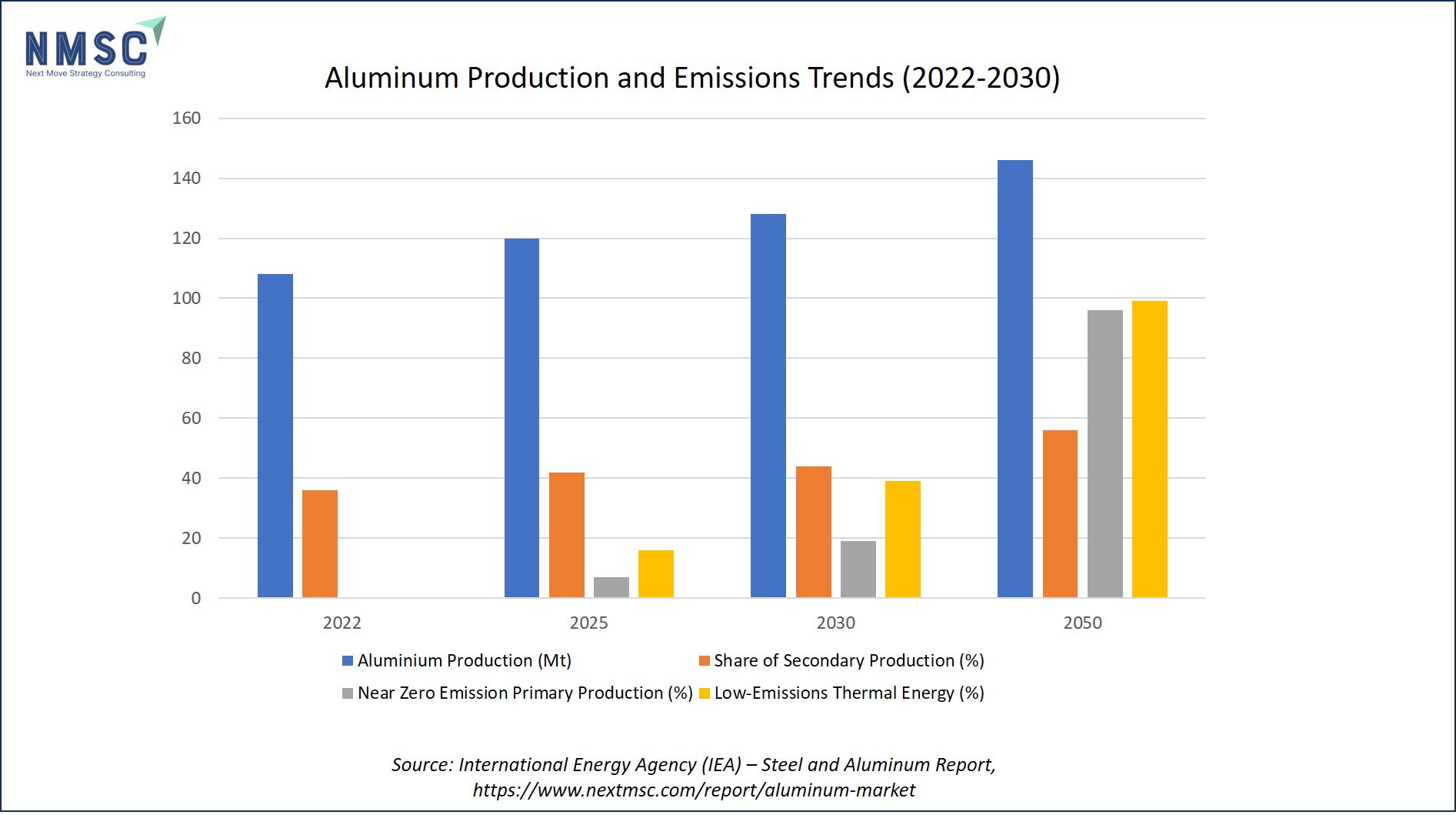

The below chart illustrates the global aluminum production split between primary and recycled sources, highlighting a key trend in sustainability:

-

Primary Aluminum (made from raw materials like bauxite) is more carbon-intensive, especially when powered by fossil fuels.

-

Recycled Aluminum (also called secondary aluminum) uses only about 5% of the energy required to produce primary aluminum.

Key Takeaway:

As of 2022, recycled aluminum accounted for ~36% of global production, and the IEA projects this will rise to ~42% by 2030. This shift is driven by industry and policy efforts to reduce carbon emissions and embrace circular economy models.

The graph titled "Aluminum Production and Emissions Trends (2022–2050)", sourced from the International Energy Agency (IEA) – Steel and Aluminium Report, highlights the evolving landscape of aluminum production and sustainability efforts.

Key insights:

-

Aluminum production is projected to grow from approximately 110 million metric tons (Mt) in 2022 to 145 million metric tons (Mt) by 2050.

-

The share of secondary production (recycled aluminum) is expected to increase steadily from around 35% in 2022 to 55% by 2050.

-

There is a significant shift towards sustainability, with near zero-emission primary production rising from 0% in 2022 to nearly 95% by 2050.

-

The use of low-emissions thermal energy also shows a strong increase, from negligible levels in 2022 to around 95% in 2050.

This transition reflects global efforts to decarbonize the aluminum industry and achieve climate goals through cleaner technologies and recycling.

Conclusion

From China's state-driven dominance to the U.S.'s sustainability-led resurgence, the global Aluminum market is entering a new era defined by technology, environmental stewardship, and strategic investments. As Aluminum becomes the backbone of modern infrastructure and clean energy systems, stakeholders across the value chain must adapt quickly to remain competitive.

About Next Move Strategy Consulting:

Next Move Strategy Consulting is a premier market research and management consulting firm that has been committed to provide strategically analysed well documented latest research reports to its clients. The research industry is flooded with many firms to choose from, what makes Next Move different from the rest is its top-quality research and the obsession of turning data into knowledge by dissecting every bit of it and providing fact-based research recommendation that is supported by information collected from over 500 million websites, paid databases, industry journals and one on one consultations with industry experts across a diverse range of industry sectors. The high-quality customized research reports with actionable insights and excellent end-to-end customer service help our clients to take critical business decisions that enables them to move beyond time and have competitive edge in the industry.

We have been servicing over 1000 customers globally that includes 90% of the Fortune 500 companies over a decade. Our analysts are constantly tracking various high growth markets and identifying hidden opportunities in each sector or the industry. We provide one of the industry’s best quality syndicate as well as custom research reports across 10 different industry verticals. We are committed to deliver high quality research solutions in accordance to your business needs. Our industry standard delivery solutions that ranges from the pre consultation to after-sales services, provide an excellent client experience and ensure right strategic decision making for businesses.

For more information, please contact:

Next Move Strategy Consulting

5th Floor 867

Boylston St, STE 500,

Boston, MA 02116, U.S.

E-Mail: [email protected]

Direct: +18577585017

Website: www.nextmsc.com

Add Comment