VPX SBC Market by Form (Standard, and Custom), by Rack Unit (3U, and 6U), by Processor (Intel-based Architecture, NXP Power, and ARM ), by Processing Power (High, Medium, and Low), by Memory Storage (0-16 GB, 16-32 GB, and others), by Switch Fabric (Ethernet, InfiniBand, and others), by Cooling Mode (Air-Cooled, and others), by Application (Radar, Electronic Warfare, and others), by End User (Military, Aerospace, and others) – Global Opportunity Analysis and Industry Forecast 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 10-Sep-2025 | No of Pages: 388 | No. of Tables: 543 | No. of Figures: 488 | Format: PDF | Report Code : SE2909

VPX SBC Market Overview

The global VPX SBC Market size was valued USD 209.8 million in 2024, and it is projected to reach USD 499.9 million by 2030, with a CAGR of 14.4% from 2025-2030.

The VPX single board computer (SBC) also known as VITA 46 represents a system architecture that includes processing power, memory and I/O interfaces within a single electronics board through advanced ethernet and other integrative connections that promote fast data movement and flexible system design. The factors including rising military expenditure along with expenditure towards aerospace sector and growing semiconductor industry propels the growth of the market.

However, high cost associated with the development of VPX SBCs is significant restraining the industry’s growth. On the contrary, introduction of 5G and AI-enabled SBCs creates significant opportunity for the VPX SBC industry.

Moreover, leading players in the industry such as Logic Fruit Technologies, Kontron AG, and others are taking initiatives including product launch to maintain their market position and enhance their product offerings. These initiatives are expected to foster innovation and drive the adoption of VPX SBCs across various industries, ensuring robust growth for the market.

Rising Military Expenditures Drives the Demand for Vpx Sbcs

Global military spending reached approximately USD 2.44 trillion in 2023, marking a 6.8% year-over-year increase. This trend continued into 2024, with military expenditure climbing further to an estimated USD 2.72 trillion—a 9.4% rise. This surge reflects the ongoing focus by global powers on modernizing defense capabilities, particularly in the United States, NATO countries, and key Asia-Pacific nations such as China, India, and South Korea.

As military operations become increasingly dependent on real-time data processing and ruggedized electronics, demand for VPX single-board computers (SBCs) has grown. These boards are essential for high-performance applications in radar systems, unmanned vehicles, command-and-control networks, and electronic warfare. Their modularity, durability, and superior computing capabilities make them critical components in advanced defense systems.

Growing Aerospace Expenditure Fuels, the Vpx SBC Industry

The aerospace industry continues to exhibit strong growth, with U.S. aerospace and defense sector revenues exceeding USD 955 billion in 2023, followed by further expansion in 2024. Export performance and investments in both commercial and military aviation have driven the need for robust, high-speed embedded computing platforms like VPX SBCs.

Applications such as avionics, flight control systems, satellite platforms, and autonomous aircraft increasingly rely on real-time processing and resilient computing architectures. VPX SBCs, known for their high reliability and scalability, are well-positioned to meet these requirements. The continued focus on next-generation aircraft, space exploration, and satellite communication systems further accelerates adoption of these technologies.

Semiconductor Sector Growth Boosts Vpx SBC Adoption

Global semiconductor sales rebounded to USD 627.6 billion in 2024, with projections indicating continued double-digit growth, reaching nearly USD 700 billion by 2025. This momentum is fueled by increasing demand from sectors like AI, cloud computing, industrial automation, and telecom infrastructure.

VPX SBCs are closely tied to the performance of the semiconductor industry, as they utilize advanced chipsets and packaging technologies. Innovations such as high-density interconnects, System-on-Chip (SoC) integration, and energy-efficient processors have enhanced VPX SBC capabilities. As industries demand more compact, powerful, and reliable embedded computing platforms, the reliance on advanced VPX SBCs continues to grow across mission-critical environments.

High Development Costs Limit Market Entry

The development of VPX SBCs involves complex engineering, high-end materials, and integration of cutting-edge semiconductor components, all of which contribute to elevated costs. This creates challenges for small and mid-sized companies attempting to enter the market. Additionally, increasing prices of semiconductor wafers and fabrication further compound the issue.

For instance, the average cost of a finished 12-inch wafer has risen significantly year over year, increasing the financial burden on manufacturers. These cost barriers limit product accessibility in cost-sensitive applications and restrict innovation to larger, well-capitalized players, slowing broader industry growth.

5g And Ai-enabled SBCS Open New Growth Opportunities

The emergence of 5G networks and AI-enabled edge computing is creating a substantial opportunity for the VPX SBC market. These technologies demand high-throughput, low-latency computing solutions capable of processing large volumes of data in real-time. VPX SBCs—with their rugged form factor, modular scalability, and powerful processing capabilities—are ideal for supporting such applications.

Recent innovations in AI-driven 5G SBCs featuring enhanced connectivity (e.g., 5G, Wi-Fi 6E) and edge analytics demonstrate the expanding role of embedded computing in future digital infrastructures. As telecommunications, aerospace, and defense sectors adopt these emerging technologies, the demand for high-performance VPX SBCs is expected to grow significantly, opening new revenue streams and development paths for manufacturers.

By Form, Standard Holds the Dominant Share of the VPX SBC industry

The standard VPX SBCs arrive as ready-to-use systems that feature general industrial-prepared configurations. Standard VPX SBCs are extensively used in military applications together with aerospace systems and industrial control solutions because of proven performance characteristics and dependable operation.

These boards obtain high value from their modular nature together with their seamless integration capability and expedited deployment processes. VPX SBC standard platforms match the needs of organizations requiring dependable ready-to-implement solutions while needing minimal customization work. The necessity for standardized systems in defense and aerospace applications driven by regulatory requirements leads organizations to use standard VPX SBCs.

By Rack Unit, 3U Holds the dominant Share of the of the Market

The 3U VPX SBCs are smaller form-factor systems designed to fit in 3U-sized racks that provides compact and space-efficient solutions. The systems are commonly deployed in applications where size and weight constraints are crucial, such as military, aerospace, and industrial sectors.

The 3U VPX SBCs strike a balance between performance and portability, making them ideal for embedded systems, unmanned vehicles, and lightweight mission-critical operations. The growing demand for 3U systems is fueled by the need for compact, high-performance computing solutions in space-constrained environments, including small aircraft, naval vessels, and drones.

North America Dominates the VPX SBC Market Share During the Forecast Period

The increased investment in the defense sector by the government fuels the VPX SBC market demand in the North America region, with increasing demand from such sectors that require high-density, high-performance computing solutions for mission-critical activities.

Modernization of military technologies, satellite communication, and aerospace innovations collectively lead the demand toward VPX single-board computers. Data from the Stockholm International Peace Research Institute shows the United States boosted its defense budget by USD 55 billion between 2022 and 2023 as part of increased military assistance for Ukraine's war against ongoing aggression. VPX SBCs experience elevated demand because the United States allocates military funding that exceeds combined funding from the following nine national defense leaders China, Russia, India, Saudi Arabia, the UK, Germany, Ukraine, France and Japan.

Moreover, the regional aerospace industry contributes to market expansion because aerospace applications require increasingly sophisticated computational solutions. The increasing production of commercial and defense aircraft, alongside innovations in space exploration technologies, fuels the adoption of reliable and high-performance systems such as VPX single-board computers.

The State of Canada's Aerospace Industry Report - Summer 2024 demonstrated that aerospace activities contributed USD 20.09 billion to national GDP growth and maintained 218,000 jobs by 2024 while demonstrating growth through additional USD 1.18 billion and 5,400 jobs from 2022. The industry achieved export success by delivering worth USD 13.21 billion of goods and services into global markets through active global supply chain participation.

Asia-Pacific is Expected to Witness Substantial Growth in the Market

The rapid growth of 5G deployment and the integration of industrial IoT technologies across sectors such as manufacturing, transportation, and energy create significant growth opportunities for the VPX industry in the region. The advancements in 5G enable high-speed, low-latency communication critical for industrial IoT applications, driving the need for reliable and efficient computing platforms including VPX systems.

As per the Asian Insiders, China aims to transition from low-cost manufacturing to an advanced industrial technology hub, driven by significant growth in industrial automation. The factory automation market, valued at nearly USD 150 billion in 2024, is expected to surpass USD 250 billion by 2029. With over six million manufacturing firms contributing 31% of global output, China leads in industrial robot adoption, though exact figures are uncertain due to potential subsidy-related data inflation.

Furthermore, the renowned semiconductor and electronics industry in the region further boosts the VPX SBC market expansion. The strong presence of leading semiconductor manufacturers and advanced electronics production capabilities drives innovation and improves the availability of high-quality VPX systems.

For instance, South Korea's exports increased 1.4% year-on-year in November 2024, reaching USD 56.35 billion, up for 14 consecutive months. This increase primarily driven by a 30.8% surge in semiconductor exports, reaching USD 12.5 billion, a record for the fourth consecutive month.

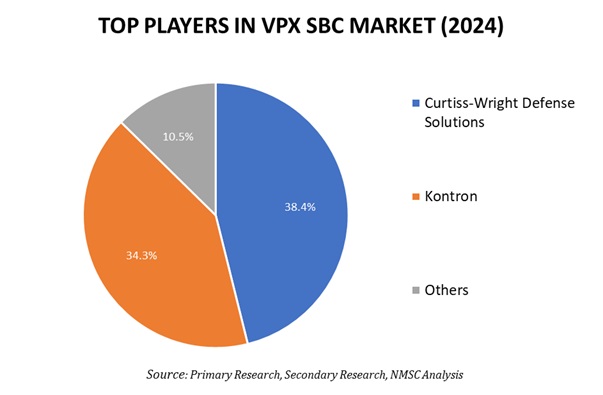

Competitive Landscape

The VPX SBC industry comprises various key market players such as Curtiss-Wright Defense Solutions, Kontron AG, Mercury Systems, Inc., ADLINK Technology Inc., General Electric Company, Logic Fruit Technologies, Elma Electronic, North Atlantic Industries, Aitech, Extreme Engineering Solutions, Inc, General Micro Systems, Inc., Interface Concept, Acromag, EIZO Rugged Solutions, Sital Technology and others.

These market players are adopting strategies including product launch across various regions to maintain their dominance in VPX SBC industry.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

December, 2025 |

Kontron AG |

Kontron launched the VX6011-S a 6U VPX SBC to enhance performance in demanding applications across various sectors including defense, aerospace, and in other industries. |

|

September, 2025 |

Logic Fruit Technologies |

Logic Fruit Technologies launched Kritin iXD 6U VPX SBC designed specifically for high-demand applications in the aerospace and defense sectors that support up to 10 cores and features advanced capabilities such as Intel® AVX-512 for enhanced vector processing. |

|

August, 2025 |

ADLINK Technology Inc. |

ADLINK Technology Inc. launched 3.5-inch SBCs designed specially to meet the growing demands for compact and efficient computing solutions in various sectors including automation, IoT, and edge computing. |

|

March, 2025 |

Abaco Systems |

Abaco Systems launched SBC3513L designed to provide robust processing capabilities while incorporating FPGA-based Time Sensitive Networking (TSN) Endpoint functionalities, essential for mission-critical systems. |

VPX SBC Market Key Segment

By Form

-

Standard

-

Custom

By Rack Unit

-

3U

-

6U

By Processor

-

Intel-based Architecture

-

NXP Power Architecture

-

ARM Architecture

By Processing Power

-

Low

-

Medium

-

High

By Memory Storage

-

0-16 GB

-

16-32 GB

-

32-48 GB

-

48-64 GB

By Switch Fabric

-

Ethernet

-

InfiniBand

-

PCI Express (PCIe)

-

Serial RapidlO (SRIO)

-

Other Switch Fabrics

By Cooling Mode

-

Air-Cooled

-

Conduction-Cooled

-

Other Cooling Modes

By Application

-

Radar Processing

-

Electronic Warfare

-

Signal Processing

-

Mission Computing

-

Interrupt Service Routine (ISR)

By End User

-

Military

-

Land

-

Naval

-

Airforce

-

-

Aerospace

-

Industrial

-

Transportation

-

Telecommunications

-

Healthcare

-

Energy

-

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Curtiss-Wright Defense Solutions

-

Kontron AG

-

Abaco Systems

-

Mercury Systems, Inc.

-

ADLINK Technology Inc.

-

General Electric Company

-

Logic Fruit Technologies

-

Elma Electronic

-

North Atlantic Industries

-

Aitech

-

Extreme Engineering Solutions, Inc

-

General Micro Systems, Inc.

-

Interface Concept

-

Acromag

-

EIZO Rugged Solutions

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 209.8 Million |

|

Revenue Forecast in 2030 |

USD 499.9 Million |

|

Growth Rate |

CAGR of 14.4% from 2024 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst