Cyber Liability Insurance Market: Surging Demand Amid Rising Threats

Published: 2025-09-15

The Cyber Liability Insurance Market is witnessing unprecedented growth as businesses grapple with escalating cyber threats and regulatory pressures. From partnerships enhancing coverage to AI-driven innovations, this market is evolving rapidly to meet the needs of a digital-first world.

Cyber Liability Insurance Market: Key Developments in 2024–2025

The cyber liability insurance industry is undergoing significant transformation, driven by increasing cyber threats and regulatory mandates. The market revenue was valued at USD 16.29 billion in 2024 and is predicted to reach USD 54.83 billion by 2030 with a CAGR of 22.5%, reflecting robust demand.

A notable development is the partnership between MSIG and Coalition, announced in early 2024, which introduced a new cyber insurance offering for global businesses in the U.S. This collaboration leverages Coalition’s real-time risk monitoring, incident response tools, and AI-powered threat detection, distributed through MSIG USA’s brokerage partners.

Additionally, the passage of India’s Digital Personal Data Protection (DPDP) Act in 2023 has spurred demand for cyber insurance to cover potential violations, reinforcing its role as a critical risk management tool. Insurers are also addressing AI-related threats, with some adding endorsements to clarify coverage for AI-driven attacks like deepfakes, ensuring policies remain relevant.

Applications Across Industries

Cyber liability insurance is becoming indispensable across various sectors due to the rising frequency and sophistication of cyberattacks:

-

Banking, Financial Services, and Insurance (BFSI): High regulatory and operational risks drive adoption, with BFSI leading in policy purchases due to stringent compliance requirements.

-

IT and Technology: These sectors face constant threats like data breaches and ransomware, necessitating comprehensive coverage.

-

Healthcare: Vulnerable to data breaches involving sensitive patient information, healthcare firms increasingly rely on cyber insurance to mitigate financial losses.

-

Logistics and E-commerce: Growing digital transactions and supply chain dependencies heighten the need for protection against cyber fraud and interruptions.

-

Startups: Emerging companies are adopting cyber insurance to meet contractual and investor requirements, enhancing their market credibility.

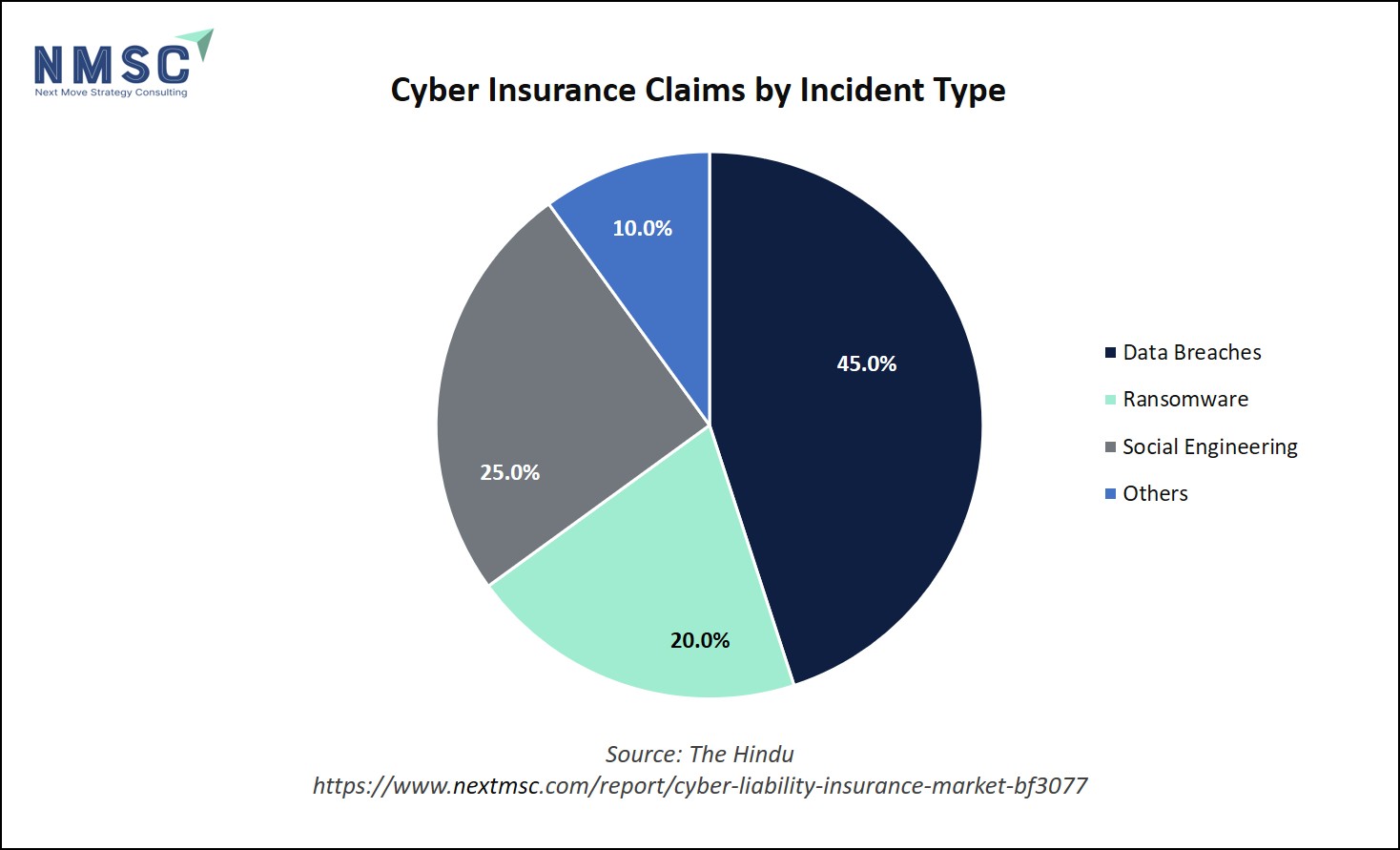

Cyber insurance typically covers first-party losses (e.g., business interruption, legal fees) and third-party liabilities (e.g., claims from affected clients), addressing incidents like ransomware (20% of claims), social engineering attacks (25%), and data breaches (45%).

Regional Analysis: Dominating and Fastest-Growing Markets

|

Region |

Status |

Top Countries |

Key Drivers |

|

North America |

Dominating |

USA, Canada |

Mature market, high adoption (49% of brokers have cyber practices), regulatory push |

|

Asia-Pacific |

Fastest-Growing |

India, China |

Rising internet penetration, regulatory changes (e.g., DPDP Act), increasing cyberattacks |

|

Europe |

Significant Growth |

Germany, Sweden, Denmark |

Expanding insurance offerings, partnerships with global insurers |

Why They Lead

-

USA and Canada: North America dominates due to its mature cyber insurance market, with 49% of brokers maintaining dedicated cyber practices. The U.S. benefits from advanced cybersecurity infrastructure and partnerships like MSIG-Coalition, enhancing coverage accessibility.

-

India and China: Asia-Pacific is the fastest-growing region, driven by India’s 900 million internet users by 2025 and a 33% surge in cyberattacks in Q1 2024. India’s DPDP Act has further accelerated demand, particularly among BFSI and tech firms.

-

Germany and Denmark: Europe is expanding through strategic partnerships, such as Coalition’s entry into Denmark, Sweden, and Germany, leveraging local brokerage networks.

Key Players and Recent Strategies

|

Company |

Status |

Recent Strategy/Deal |

Product/Innovation Link |

|

Coalition |

Leading |

Partnered with MSIG for a new U.S. cyber insurance offering with AI-powered threat detection |

Coalition Cyber Insurance |

|

Bajaj Allianz |

Leading |

Offers comprehensive cyber insurance for individuals and businesses in India |

Bajaj Allianz Cyber Protect |

|

ICICI Lombard |

Leading |

Provides affordable cyber insurance with premiums from Rs. 2,000–5,000/month |

ICICI Lombard Cyber Insurance |

|

Armilla AI |

Emerging |

Launched AI-specific insurance to address legal and financial harms, excluding bodily injury |

Armilla AI Insurance |

Strategy Insights

-

Coalition enhances its global reach through partnerships with insurers like MSIG, Allianz, and Lloyd’s, integrating advanced cybersecurity tools.

-

Bajaj Allianz and ICICI Lombard focus on affordability and accessibility in India, targeting SMEs and individuals with tailored policies.

-

Armilla AI pioneers niche AI-specific coverage, addressing emerging risks in AI development, though limited in scope.

Future Prospects and Examples

The cyber liability insurance market is poised for sustained growth, driven by rising cyber threats and regulatory compliance needs. Key trends include:

-

Integration with Cybersecurity Services: Insurers like Coalition combine risk assessment, threat detection, and response with insurance, creating holistic solutions.

-

AI-Specific Coverage: While standalone AI insurance remains limited, endorsements for AI-driven threats are gaining traction.

-

SME Penetration: In India, SMEs with turnovers above Rs. 10 crore are increasingly adopting cyber insurance, driven by regulatory and contractual needs.

Example: In 2020, the Insurance Regulatory and Development Authority of India (IRDAI) had set up a working group to study cyber liability insurance. The main objective was to provide suggestions to popularise cyber insurance in India. The working group had provided their recommendations regarding framing of cyber risk insurance policy, the process for claim settlement, and steps to increase the awareness about cyber insurance.

About Next Move Strategy Consulting:

Next Move Strategy Consulting is a premier market research and management consulting firm that has been committed to provide strategically analysed well documented latest research reports to its clients. The research industry is flooded with many firms to choose from, what makes Next Move different from the rest is its top-quality research and the obsession of turning data into knowledge by dissecting every bit of it and providing fact-based research recommendation that is supported by information collected from over 500 million websites, paid databases, industry journals and one on one consultations with industry experts across a diverse range of industry sectors. The high-quality customized research reports with actionable insights and excellent end-to-end customer service help our clients to take critical business decisions that enables them to move beyond time and have competitive edge in the industry.

We have been servicing over 1000 customers globally that includes 90% of the Fortune 500 companies over a decade. Our analysts are constantly tracking various high growth markets and identifying hidden opportunities in each sector or the industry. We provide one of the industry’s best quality syndicate as well as custom research reports across 10 different industry verticals. We are committed to deliver high quality research solutions in accordance to your business needs. Our industry standard delivery solutions that ranges from the pre consultation to after-sales services, provide an excellent client experience and ensure right strategic decision making for businesses.

For more information, please contact:

Next Move Strategy Consulting

5th Floor 867

Boylston St, STE 500,

Boston, MA 02116, U.S.

E-Mail: [email protected]

Direct: +18577585017

Website: www.nextmsc.com

Add Comment