Automated Teller Machine (ATM) Market by Type (Conventional Bank ATMs, White Label ATMs, & Others), by Deployment (Onsite, Offsite, Worksite, Mobile ATMs), by Service Model (Deployment Solutions, Managed ATM Services, ATMaaS), by Application (Cash Withdrawal Only, Cash Deposit Enabled, Fund Transfer, Cardless or Contactless Transactions, Biometric Authentication), and Others – Global Opportunity Analysis and Industry Forecast, 2025–2030.

Industry Outlook

The global ATM Market size was valued at USD 63.29 billion in 2024, and is expected to be valued at USD 71.75 billion by the end of 2025. The industry is projected to grow, hitting USD 134.31 billion by 2030, with a CAGR of 13.3% between 2025 and 2030.

The ATM market is evolving rapidly, driven by the growing demand for convenience, digital integration, and secure banking access. Consumers increasingly prefer intelligent and contactless ATMs that offer fast, seamless, and personalised transactions, catering to lifestyles shaped by digital banking and cashless trends. Rising awareness about cybersecurity, accessibility, and financial inclusion is influencing deployment strategies, with banks and service providers focusing on user-friendly interfaces, biometric authentication, and remote monitoring. Manufacturers and operators are responding through energy-efficient systems, cloud-based connectivity, and sustainable operations. By combining technology, security, and accessibility, the ATM industry is aligning with modern financial behaviour while driving innovation and global market expansion.

What are the key trends in the ATM industry?

How is ATM Modernisation with Smart Features Changing Cost Economics for Operators?

ATM modernisation is shifting capital spend from simple dispensers to multifunction platforms with cash recycling, biometric readers, contactless acceptance and remote monitoring; Diebold Nixdorf and other suppliers emphasise service and software revenue growth even as hardware unit growth slows. Upgrading to cash recycling materially cut cash-transport and replenishment intervals, improve ATM uptime and reduce logistics cost per transaction. Operators should evaluate the total cost of ownership using real fleet telemetry and prioritise retrofit recycling modules for high-volume sites to maximize ROI within 18–30 months. In practice, this means deploying analytics-driven predictive maintenance to reduce service calls and using managed services to convert capex into more predictable opex. Evidence from vendor financials and industry association commentary shows vendors monetising software and services post 2024, indicating a commercial shift operators must plan for.

Will Security Threats Accelerate ATM Replacement and Managed Service Adoption?

High-profile ATM vulnerabilities and rising organised ATM crime have forced banks and deployers to accelerate patching, hardware hardening and surveillance investments. Independent research disclosed ATM security weaknesses as recently as 2024, prompting vendor patches and customer remediation programs. The practical effect is an increased replacement and upgrade cycle for legacy ATM fleets and a stronger market for managed security services and certified software stacks. For deployers, this implies a short to medium term capital window where upgrades are commercially justified; operators should conduct an inventory of exposed systems, prioritise critical patches, and consider vendor-managed security subscriptions to reduce exposure and transfer liability. Failure to act increase theft losses and regulatory scrutiny.

How are Financial Inclusion Initiatives and Off-Branch Deployment Driving ATM Footprint Strategies?

Public policy and central bank financial inclusion objectives continue to encourage off-branch access in underbanked areas, where ATMs act as mini branches delivering deposits and cash out. Global financial inclusion programmes and regional strategies emphasise digital rails plus physical access. ATM deployers capture incremental volumes by collocating devices at retail, transport hubs and government service points, especially where POS card acceptance is uneven. Operators should partner with postal networks, retailers and governments to secure site sponsorship and cost sharing. World Bank and industry association narratives from 2024–2025 underline the role of cash access in vulnerable populations, making targeted deployments in rural and peri-urban zones a defensible growth play while digital adoption matures.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the ATM Industry in Next Decade?

Financial infrastructure modernisation and evolving consumer payment preferences together drive the ATM strategy. On one hand, digital wallets and cards reduce routine cash demand in some geographies; on the other hand, cash remains important for retail, informal economies and last-mile access. Operators face an inflection where upgrades to multifunctional ATMs and managed services create recurring revenue opportunities while security and regulatory requirements raise cost of ownership. Strategic partners and investors are prioritizing asset-light models such as ATM as a Service to optimise returns.

Growth Drivers:

How is the Demand for Convenience and 24×7 Accessibility Driving ATM Growth?

Consumer lifestyles increasingly favour instant, round-the-clock access to cash and basic banking services. ATMs fulfil this need by operating 24×7 in locations where traditional bank branches are not feasible, including malls, transport hubs, and shopping centres. Off-branch deployments, such as retail shops, airports, and convenience stores, further enhance accessibility and convenience, expanding the overall ATM footprint. For operators, prioritising high-traffic offsite locations enables higher transaction volumes and customer satisfaction, translating into incremental revenue opportunities. Research indicates that consumers’ preference for anytime banking continues to be a critical growth factor for the global market.

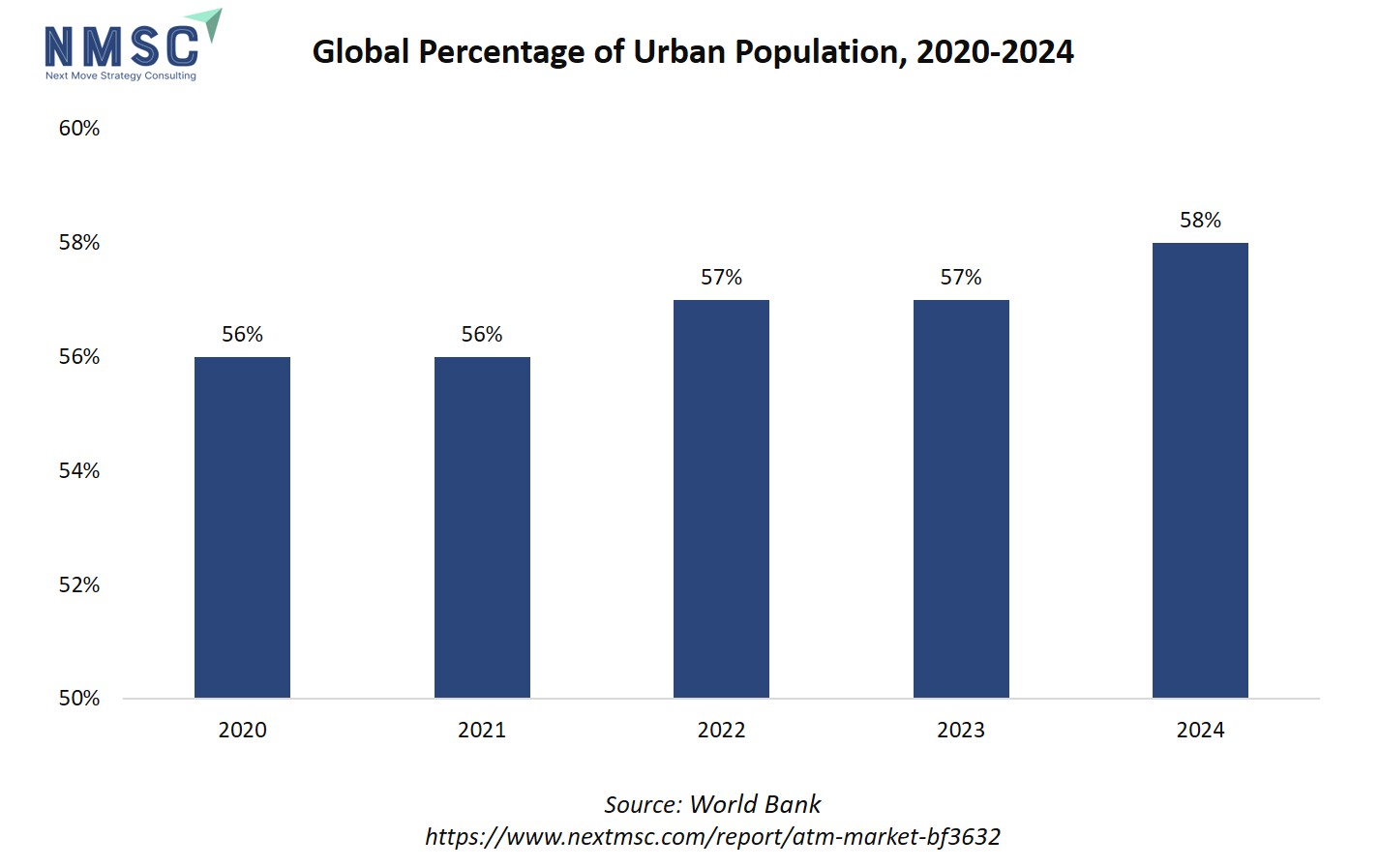

Based on the provided chart showing the global percentage of urban population from 2020 to 2024, the steady growth in urbanisation directly impacts the ATM market demand by increasing the demand for convenient cash access points. As more people concentrate in cities, the need for ATMs in high-traffic urban areas, such as transit hubs, shopping districts, and residential complexes, rises significantly. This trend encourages financial institutions and independent ATM deployers to expand and modernise their networks, incorporating advanced features like cash recycling, biometric authentication, and multi-function kiosks to serve a denser, more tech-savvy population. Consequently, urbanisation drives both the volume and technological evolution of the market.

How is Urbanisation and Retail Expansion Supporting ATM Deployment?

Rapid urbanization and the expansion of retail and commercial infrastructure, including shopping malls, supermarkets, markets, and office complexes, are fuelling increased footfall and transaction volumes, creating strong demand for ATMs. Banks and retailers strategically position ATMs in high-traffic zones to deliver convenient banking services while reinforcing brand visibility. Deploying machines in commercial hubs enables operators to capture dense transactional flows, optimize site economics, and enhance customer engagement. In 2024, 84% of the U.S. population residing in urban areas, according to the World Bank, demand for secure and real-time transaction services continues to rise. Additionally, integration with digital banking solutions, contactless withdrawals, and biometric authentication is increasingly driving usage and customer satisfaction. Industry insights reveal that urban centers remain the most attractive segments for ATM deployment, offering a combination of convenience, measurable transaction growth, and opportunities for technological innovation.

Growth Inhibitors:

What is the Key Inhibitor to Market Growth?

Ageing ATM fleets and fragmented operator economics are emerging as major barriers to market growth. Many deployed machines feature diverse hardware, outdated software, and inconsistent standards, making system-wide upgrades complex and costly. Operators, particularly small and independent deployers, face thin profit margins that limit their ability to invest in modernisation. The capital-intensive nature of large-scale fleet replacement, combined with the operational challenges of patching and maintaining heterogeneous networks, slows the adoption of newer, more advanced ATMs. Consequently, the market experiences slower technology refresh cycles, reduced efficiency, and constrained service offerings, highlighting the need for innovative solutions that balance modernisation with economic feasibility.

Where is an Emerging Investment Opportunity?

Software solutions and managed security services are becoming the next key growth frontier for the automated teller machine market. Companies offering fleet management platforms, security subscription services, analytics, and ATM-as-a-Service (ATMaaS) create recurring revenue streams while helping operators maximise the value of each endpoint. These solutions enable ATMs to go beyond traditional cash withdrawals, facilitating bill payments, identity verification, and other digital financial services. By integrating software-driven capabilities with hardware, deployers improve operational efficiency, enhance security, and unlock new monetisation opportunities. Market trends suggest that technology-enabled services represent a high-potential segment, attracting investment and driving long-term industry innovation.

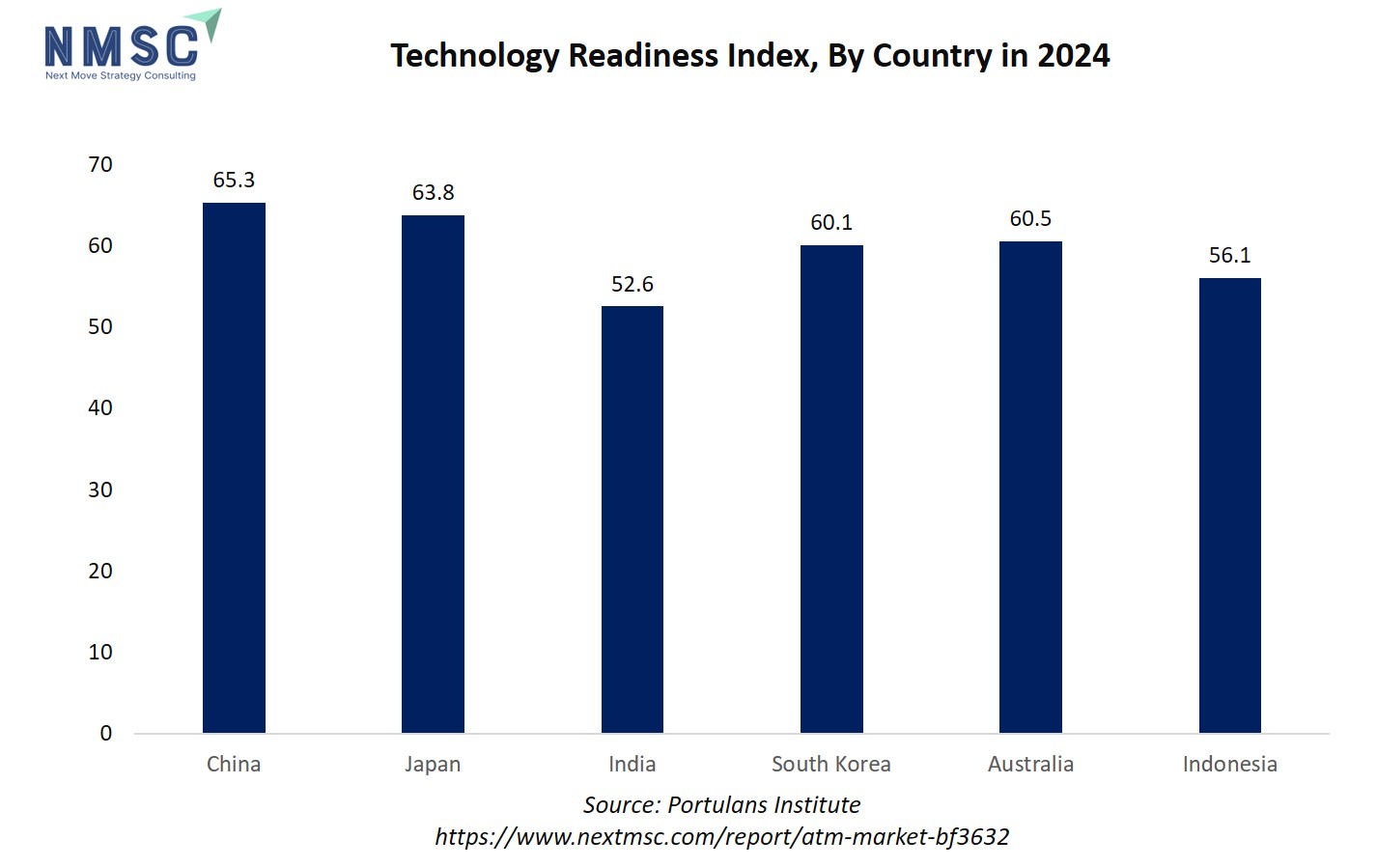

Based on the Technology Readiness Index for 2024, the varying levels of technological advancement across key Asia-Pacific countries will significantly shape the ATM market trends. In highly ranked countries like Japan and South Korea, the ATM landscape is poised for further integration with cutting-edge features such as AI-driven customer service, advanced biometric security, and seamless integration with digital payment platforms. In contrast, in developing nations like India and Indonesia, the focus remains on expanding basic ATM network coverage and reliability to achieve financial inclusion, albeit with a growing adoption of newer technologies like cardless cash withdrawals. This disparity drives global and regional ATM manufacturers and service providers to offer a diversified product portfolio, catering to both the high-tech innovation demands of mature markets and the scalable, cost-effective solutions needed in growth markets.

How is the ATM Industry Segmented in this Report, and What are the Key Insights from Segmentation Analysis?

By Type Insights

Is Intelligent or Smart ATMs Dominating the Market in 2025?

Based on type, the market is segmented into conventional bank ATMs, white label ATMs, brown label ATMs, intelligent or smart ATMs, and cash dispenser ATMs.

Intelligent or smart ATMs are the fastest growing hardware subsegment as deployers prefer multifunction devices that support recycling, contactless transactions and biometrics. Vendor financials and industry commentary in 2024–2025 show increased RFPs for devices with enhanced software and service integrations. Operators should treat smart ATM investments as a differentiated service layer: prioritize high footfall and mixed transaction sites for smart deployments to capture both cash and account servicing value. Diebold Nixdorf’s FY24 commentary highlights services revenue growth tied to smarter devices.

By Deployment Insights

Are Offsite ATMs Driving Deployment Growth in 2025?

Based on deployment, the market is segmented into onsite ATMs (bank branch), offsite ATMs (retail locations), worksite ATMs (corporate or industrial facilities), and mobile ATMs (temporary or event-based).

Offsite ATMs located in retail, transport hubs and convenience channels account for a large share of new placements as banks and independent deployers chase convenience. Industry association reporting shows growth in offsite placements and retailer partnerships. Offsite ATM placement reduces branch dependency and captures incremental transactions; operators should secure long term site agreements and focus on uptime guarantees to maximize revenue per site.

By Service Model Insights

Is Managed ATM Services the Dominant Service Model Now?

Currently, Managed ATM Services represent one of the dominant service models in the global ATM market, and their share continues to expand steadily. This growth is primarily driven by the increasing adoption of outsourced operations, where banks and financial institutions rely on third-party vendors to handle ATM monitoring, cash management, maintenance, and compliance.

Outsourcing allows financial institutions to reduce operational costs, improve uptime, and focus on core banking activities. Moreover, as the complexity of ATM networks increases—with integration of digital payments, contactless transactions, and real-time analytics—managed service providers offer the technological expertise and scalability banks need.

While ATM as a Service (ATMaaS) is gaining traction due to its subscription-based flexibility, Managed ATM Services currently dominate because of their proven efficiency, established vendor ecosystem, and the growing demand for comprehensive end-to-end management solutions

By Application Insights

Are Cash Deposit-Enabled Applications Growing Fastest?

Based on application, the market is segmented into cash withdrawal only, cash deposit enabled, fund transfer, cardless or contactless transactions, and biometric authentication.

Cash deposit-enabled ATMs and recycling functionality are growing due to their efficiency for branchless deposit capture and self-service. Central banks and corporates that need branch alternatives for deposit services are prime adopters. Deployers should evaluate deposit volumes and prioritise sites with a high deposit-to-withdrawal ratio for deposit-enabled machines. Evidence from vendor solutions rollout in 2024 signals operator interest in deposit-capable devices.

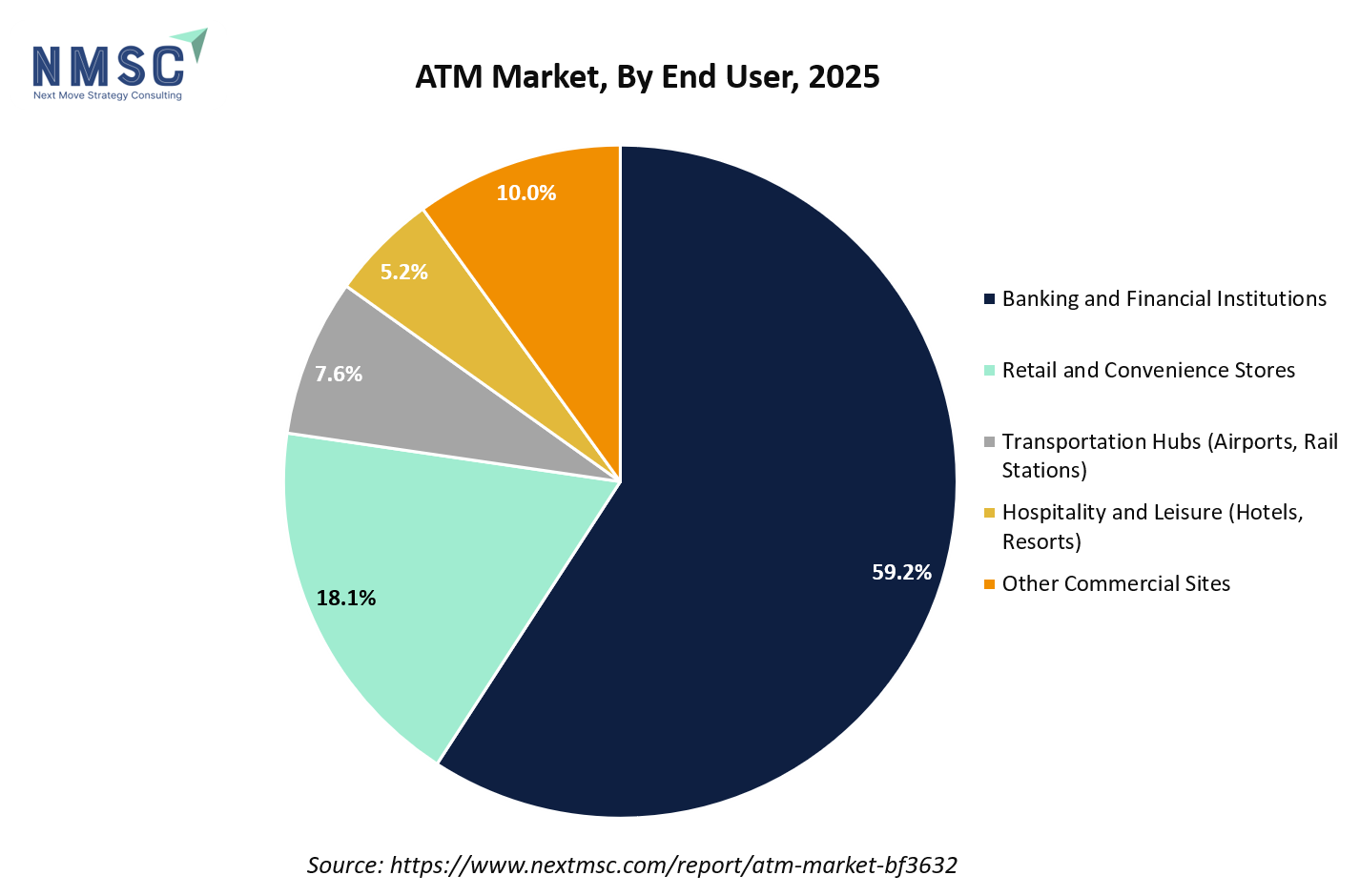

By End User Insights

Which End Users are Expanding ATM Usage Fastest?

Based on end user, the market is segmented into banking and financial institutions, retail and convenience stores, transportation hubs (airports, rail stations), hospitality and leisure (hotels, resorts), and other commercial sites.

Retail and transportation hubs remain primary end users for high-frequency transactions; governments and financial inclusion programs are increasing installations in rural and semi-urban markets. Retail partnerships and transport node placements yield higher transaction density and commercial income, while rural deployments support inclusion goals and have subsidy or programme support. Operators should balance commercial yields with strategic placement for regulatory or social objectives.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, Latin America and the Middle East & Africa and each region is further studied across countries.

ATM Market in North America

The ATM market share in North America is witnessing steady growth, driven by urbanisation, high digital banking adoption, and strong banking infrastructure. Banks and independent deployers are increasingly deploying multifunctional ATMs that support withdrawals, deposits, fund transfers, bill payments, and cardless transactions, enhancing convenience and operational efficiency. Smart features such as contactless interfaces, biometric authentication, AI-powered predictive maintenance, and advanced fraud prevention improve security and reliability.

Expansion across urban, semi-urban, and regional locations enhances financial inclusion, while sustainability initiatives, including energy-efficient and solar-powered ATMs, help reduce operational costs. Consumer preference for hybrid banking, combining physical and digital channels, supports ongoing ATM usage. These factors position North America’s market for steady growth, technological advancement, and modernisation of ATM networks.

ATM Market in the United States

The U.S. ATM market growth is driven by the modernisation of banking infrastructure and the shift toward digital integration. Financial institutions are increasingly adopting AI-powered ATMs with biometric verification, predictive maintenance, and cloud connectivity to enhance operational reliability and security. The growing preference for cardless and contactless withdrawals via mobile apps is reshaping consumer experiences. Additionally, offsite and drive-through ATMs are expanding in convenience stores and fuel stations, improving accessibility. As cash remains vital for small transactions, banks are strategically balancing digital and physical banking, leading to sustained investments in advanced, self-service ATMs across urban and suburban regions.

ATM Market in Canada

Canada’s market is witnessing steady growth, driven by financial inclusion initiatives and the expansion of ATM networks across remote and semi-urban regions. The increasing adoption of multifunctional ATMs that support bill payments, money transfers, and cheque deposits is significantly enhancing customer convenience. Financial institutions are also prioritising energy-efficient and compact ATM models to reduce operational costs and align with sustainability goals. Moreover, strategic collaborations between banks and independent ATM deployers are helping extend the country’s ATM footprint. With 82% of Canada’s population residing in urban areas, according to the World Bank, demand for secure and real-time transaction services continues to rise. To meet these expectations, the market is rapidly embracing innovations such as biometric authentication and encrypted communication systems to improve reliability, efficiency, and user trust.

ATM Market in Europe

The European ATM market is evolving with increasing digital banking adoption, regulatory support for financial inclusion, and ongoing modernisation of banking infrastructure. Financial institutions and independent deployers are rolling out multifunctional ATMs that enable withdrawals, deposits, fund transfers, bill payments, and cardless transactions, with smart features such as contactless interfaces, biometric authentication, and advanced fraud prevention.

Urban centres demand high-capacity ATMs, while smaller towns and rural areas rely on compact, energy-efficient models. Government initiatives promoting cash accessibility and sustainability, combined with hybrid banking trends, are driving adoption and operational efficiency. Innovations in networked ATMs with predictive maintenance and remote monitoring further enhance reliability, positioning Europe’s ATM market for steady growth and technological advancement.

ATM Market in the United Kingdom

In the UK, between five and eight million people rely on cash for their daily needs, including low-income groups, the elderly, vulnerable populations, and those unable to access digital services. The ATM market is evolving as banks and independent operators strive to maintain cash accessibility amid rising digital payments. The government-backed “Access to Cash” initiative has promoted the deployment of free-to-use ATMs in rural and underserved areas. Concurrently, urban centres are seeing increasing adoption of smart ATMs with biometric authentication and contactless features. Growing consumer preference for hybrid banking, blending physical and digital channels, continues to support ATM usage. Additionally, the introduction of energy-efficient and solar-powered ATMs aligns with sustainability goals, ensuring modern cash points remain secure, reliable, and responsive to changing financial service needs.

ATM Market in Germany

Germany’s market remains robust due to the country’s enduring cash preference and conservative shift toward full digitalisation. Germans continue to rely on ATMs for daily transactions, particularly in small towns and suburban areas. The market is witnessing an upgrade cycle toward ATMs with enhanced encryption, fraud detection, and contactless withdrawal features. Additionally, cooperative and savings banks are focusing on shared ATM networks to reduce operational costs while maintaining accessibility. The emergence of cash-recycling machines and energy-efficient models reflects both environmental and operational priorities, ensuring that ATMs continue to serve as a dependable component of Germany’s financial infrastructure.

ATM Market in France

France’s ATM market is supported by ongoing innovations in the banking sector and strong cash usage habits in smaller towns and semi-urban areas. French banks are upgrading their ATM infrastructure with enhanced cybersecurity systems and touchscreen interfaces to provide faster, safer transactions. The integration of ATMs with mobile banking apps allows users to withdraw money using QR codes or smartphones, aligning with digital transformation trends. Furthermore, regional banks and cooperatives are expanding ATM services to offer utility bill payments and fund transfers. These advancements ensure that despite rising digital adoption, ATMs remain a key touchpoint in France’s banking ecosystem.

ATM Market in Spain

Spain’s ATM industry is supported by growing urbanisation, digital banking adoption, and government initiatives promoting financial inclusion. The increasing integration of smart ATMs with mobile and contactless banking features enhances convenience for urban consumers. Banks and independent deployers are expanding ATM networks to retail hubs, transport centres, and remote areas, improving accessibility. Additionally, demand for multifunctional ATMs offering bill payments, fund transfers, and deposits is rising, reflecting consumer preference for consolidated banking solutions. These factors collectively drive the modernisation of ATM infrastructure, creating strong growth opportunities across Spain’s financial services sector.

ATM Market in the Asia Pacific

The Asia-Pacific market is expanding rapidly due to growing urban banking infrastructure, increasing cashless transactions, and rising demand for automated banking solutions. China is driving growth with government-backed digital payment initiatives, AI-integrated ATMs, and rapid urbanisation, enabling broader financial inclusion. Japan’s market is fuelled by technological upgrades, aging population demands, and high-security ATM deployments. India benefits from financial inclusion programs, increasing retail banking penetration, and innovative ATM networks in rural and urban regions. South Korea and Australia focus on contactless and self-service banking solutions, while regional investments in advanced cash management, security features, and network modernization make Asia-Pacific a key growth hub for ATM deployment.

ATM Market in China

China’s ATM market is experiencing rapid growth, driven by digitalization, urbanization, and widespread mobile banking adoption. Innovative solutions, such as gold ATMs that allow users to melt jewellery and receive cash within 30 minutes, exemplify the market’s technological advancement. Banks are increasingly deploying AI-enabled ATMs with facial recognition, predictive maintenance, and advanced fraud detection to enhance security and reliability. The rise of cashless transactions has prompted the introduction of multifunctional ATMs capable of withdrawals, deposits, payments, and cardless operations. Government initiatives supporting financial inclusion and the modernisation of rural banking infrastructure further accelerate deployment, positioning China as a leading market for advanced, technology-integrated ATM networks in the Asia-Pacific region.

ATM Market in Japan

Japan’s ATM sector is steadily growing, supported by a highly urbanised population and widespread adoption of digital banking. As of early 2024, the country had 104.4 million internet users, representing 84.9% internet penetration, which drives demand for secure, efficient, and technology-integrated cash management solutions. Banks are upgrading ATM networks with contactless interfaces, biometric authentication, and multifunctional capabilities to enhance convenience and operational efficiency. High-capacity ATMs are deployed in urban retail and transport hubs, while rural regions adopt smaller, energy-efficient models. Regulatory support for cash accessibility, combined with innovations in networked ATMs featuring remote monitoring, predictive maintenance, and fraud prevention, ensures reliability and positions Japan as a mature yet steadily expanding market for modern ATM solutions.

ATM Market in India

India’s market is witnessing rapid growth, driven by increasing financial inclusion, rising internet penetration, and government initiatives promoting cashless and hybrid banking. Deployment of multifunctional ATMs offering deposits, withdrawals, fund transfers, and utility bill payments is expanding across urban and semi-urban areas. Banks are investing in AI-powered ATMs with predictive maintenance, biometric authentication, and cardless withdrawal options to enhance security and operational efficiency. Rising disposable incomes and evolving urban lifestyles are boosting adoption in metro cities. Government-backed schemes, such as Pradhan Mantri Jan Dhan Yojana, further support financial accessibility, presenting significant growth opportunities for both established and emerging ATM vendors.

Innovative solutions, such as India’s first 24/7 “Grain ATM” launched in Bhubaneswar in August 2024 in partnership with the United Nations World Food Programme and the Odisha Government, demonstrate the potential of ATMs beyond cash. These machines provide round-the-clock access to food grains under the National Food Security Act, highlighting the role of technology-driven distribution in promoting social welfare and financial inclusion.

ATM Market in South Korea

South Korea’s market is driven by advanced digital infrastructure, strong cybersecurity focus, and high mobile banking adoption. Banks are deploying contactless and AI-enabled ATMs capable of fraud detection, predictive maintenance, and multifunctional banking. Expansion of ATM networks in urban commercial hubs and transport centres supports consumer convenience. Rising demand for cash-recycling machines reduces operational costs while improving efficiency. Regulatory initiatives promoting secure financial services and technological innovation further enhance market growth. South Korea’s tech-savvy urban population ensures strong uptake of modern ATM features, positioning the country as a key regional market in Asia-Pacific.

ATM Market in Australia

Australia’s ATM market is witnessing steady growth, supported by high urbanisation, strong banking infrastructure, and widespread adoption of digital and mobile banking. With 86.75% of the population living in urban areas in 2024 (World Bank), demand for secure, convenient, and multifunctional ATM services is rising. Banks and independent deployers are investing in smart ATMs equipped with contactless, biometric, and multifunctional features. Expansion in retail, transport, and regional locations enhances financial inclusion, while energy-efficient and solar-powered ATMs reduce operational costs. Additionally, strong venture capital investments in fintech and banking technologies are fuelling innovation, positioning Australia as a high-potential market for advanced ATM solutions.

ATM Market in Latin America

Latin America’s market is growing due to financial inclusion programs, rising urbanisation, and digital banking adoption. Banks are deploying smart ATMs with cardless transactions, cash recycling, and bill payment functions to improve customer convenience and reduce operational costs. Regulatory support for secure financial services encourages modernisation of ATM networks, particularly in urban and semi-urban areas. Additionally, collaboration between banks and independent deployers expands ATM coverage in rural regions. Rising demand for contactless and mobile-integrated ATMs, combined with government-backed initiatives, makes Latin America a high-potential market for technology-driven ATM deployment.

ATM Market in the Middle East & Africa

The Middle East & Africa ATM market is driven by urbanisation, growing digital banking adoption, and financial inclusion initiatives. Banks are investing in smart, contactless, and multifunctional ATMs to enhance convenience and security in both urban and remote areas. Rising tourism and retail activities in major cities further fuel demand. Government regulations promoting secure transactions and fintech integration encourage modernisation of ATM infrastructure. Additionally, expansion of independent ATM networks ensures wider coverage, particularly in underserved regions. Combined, these factors position the Middle East & Africa as a fast-growing market for advanced, technology-enabled ATM solutions.

Competitive Landscape

Who are the Leading Companies in the ATM Industry and How are they Competing?

The ATM market is heavily influenced by large original equipment manufacturers and specialized service providers, including Diebold Nixdorf, NCR/Atleos, Fujitsu, and GRG Banking. These players leverage their scale to offer fully integrated hardware, software, and managed service solutions, enabling global installations, fleet analytics, and recurring service revenues. Their comprehensive offerings create high entry barriers for smaller vendors, particularly those lacking end-to-end capabilities or international reach. Vendor reports for 2024 highlight significant revenue contribution from service lines, reinforcing the dominance of major incumbents. The market structure underscores that scale, service breadth, and technological integration are decisive factors in sustaining leadership and driving long-term customer loyalty.

Innovation and Adaptability Drive Market Success

Long-term market success increasingly favours firms that combine hardware with software subscriptions, remote monitoring, and advanced security services. Post-2024 trends indicate that operators prioritize partners who deliver rapid software patching, analytics, and enhanced security features, reflecting growing concern for reliability and compliance. Vendors that adapt to emerging deposit services, multi-currency transactions, and customer experience requirements are securing long-term contracts and strengthening client relationships. The focus on software-enabled differentiation positions adaptable companies as preferred partners for operators seeking competitive advantage. Overall, innovation, flexibility, and a service-oriented approach are emerging as critical axes for market leadership in the evolving ATM ecosystem.

Market Players to Opt for Partnership & Collaboration Strategies to Expand their Presence

Consolidation and strategic M&A activity remain pivotal tools for the ATM market expansion, enabling firms to acquire geographic presence, intellectual property, and enhanced service capabilities. Spin-offs and corporate restructurings, such as NCR Atleos’ recent strategic realignments, demonstrate a trend toward refocusing ATM business lines and optimising portfolios. Targeted acquisitions in software, analytics, and managed services are expected to accelerate, allowing incumbents to broaden their solution offerings and capture recurring revenue opportunities. M&A activity not only strengthens market positioning but also supports technological innovation and operational scale, making it a key strategy for both incumbents and ambitious new entrants seeking to compete effectively in a rapidly evolving global ATM market.

List of Key ATM Companies

-

GRGBanking

-

Hitachi Channel Solutions

-

NCR Corporation

-

Hyosung TNS

-

OKI Electric Industry Co., Ltd.

-

Triton Systems of Delaware, Inc.

-

Genmega, Inc.

-

Hantle, Inc.

-

HESS Cash Systems GmbH & Co. KG

-

Shenzhen Yihua Computer Co., Ltd.

-

Eastcompeace Technology Co., Ltd.

-

Perto S.A.

-

Vortex ATM Solutions

What are the Latest Key Industry Developments?

-

August 2025- Diebold Nixdorf introduced its branch automation solutions portfolio for banks to improve their physical channels operations. The portfolio is built to manage the entire cash ecosystem at the ATM, TCR and branch level.

-

November 2024- Fujitsu formed a strategic partnership with AMD in October 2024 to develop next-gen AI/HPC computing platforms, supporting ATM innovation and banking infrastructure modernization.

-

October 2025- NCR Atleos and Moto extended their collaboration in October 2025 to expand self-service ATM access and cash management in the UK retail and hospitality sector.

-

October 2024- Hyosung Americas partnered with eGlobal in October 2024 for a pilot program launching Hyosung Pay, a new cash-recycling ATM for retail environments.

What are the Key Factors Influencing Investment Analysis & Opportunities In Atm Market?

Investment analysis should prioritise recurring revenue streams such as managed services, software subscriptions, and ATMaaS, which de-risk cash flow compared with one-time hardware sales. Valuation premiums are likely for firms demonstrating high service attach rates, robust security offerings, and proven fleet analytics. Investment hotspots include software platforms for fleet management, security patching services, and retrofit modules for recycling and contactless acceptance. Macro drivers include financial inclusion programmes and regulatory compliance budgets that underpin near-term capex. Investors should stress test models for declining cash transaction volumes in mature digital markets and identify markets with resilient cash usage where ATM economics remain strong.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) provides a detailed investment analysis of the global ATM market, covering historical trends from 2020 to 2024 and offering forecasts through 2030. The study provides insights at global, regional, and country levels, analysing market size, growth drivers, investment hotspots, challenges, and opportunities. Stakeholders gain actionable intelligence on emerging trends, strategic partnerships, and high-potential market segments. This comprehensive coverage enables investors, industry players, and strategic decision-makers to identify optimal entry points, evaluate risk-reward scenarios, and develop informed strategies to maximize returns in the dynamic and rapidly expanding the market.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 71.75 billion |

|

Revenue Forecast in 2030 |

USD 134.31 Billion |

|

Growth Rate |

CAGR of 13.3% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

33 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Type

-

Conventional Bank ATMs

-

White Label ATMs

-

Brown Label ATMs

-

Intelligent Smart ATMs

-

Cash Dispenser ATMs

By Deployment

-

Onsite ATMs (Bank Branch)

-

Offsite ATMs (Retail Locations)

-

Worksite ATMs (Corporate Industrial)

-

Mobile ATMs (Temporary or Event-Based)

By Service Model

-

Deployment Solutions

-

Managed ATM Services

-

ATM as a Service (ATMaaS)

By Application

-

Cash Withdrawal Only

-

Cash Deposit Enabled

-

Fund Transfer

-

Cardless Contactless Transactions

-

Biometric Authentication

By End User

-

Banking and Financial Institutions

-

Retail and Convenience Stores

-

Transportation Hubs (Airports, Rail Stations)

-

Hospitality and Leisure (Hotels, Resorts)

-

Other Commercial Sites

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on the market transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s ATM Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst