Canada Construction Market By Type (Renovation, and New Construction), By Sector (Real Estate (Residential (Affordable, and Luxury), and Commercial (Retail Buildings, Hospitality and Others), Infrastructure (Transportation (Airport, Port and Others), Energy and Others), and Industrial (Manufacturing Plant, Warehouses and Others)), By Construction Method (Traditional, 3D Printed Construction, and Others), By Contractor Type (Small, Medium, and Large) – Canada Analysis & Forecast, 2025–2030

Industry: Construction & Manufacturing | Publish Date: 04-Sep-2025 | No of Pages: 153 | No. of Tables: 117 | No. of Figures: 62 | Format: PDF | Report Code : CM2195

Canada Construction Industry Outlook

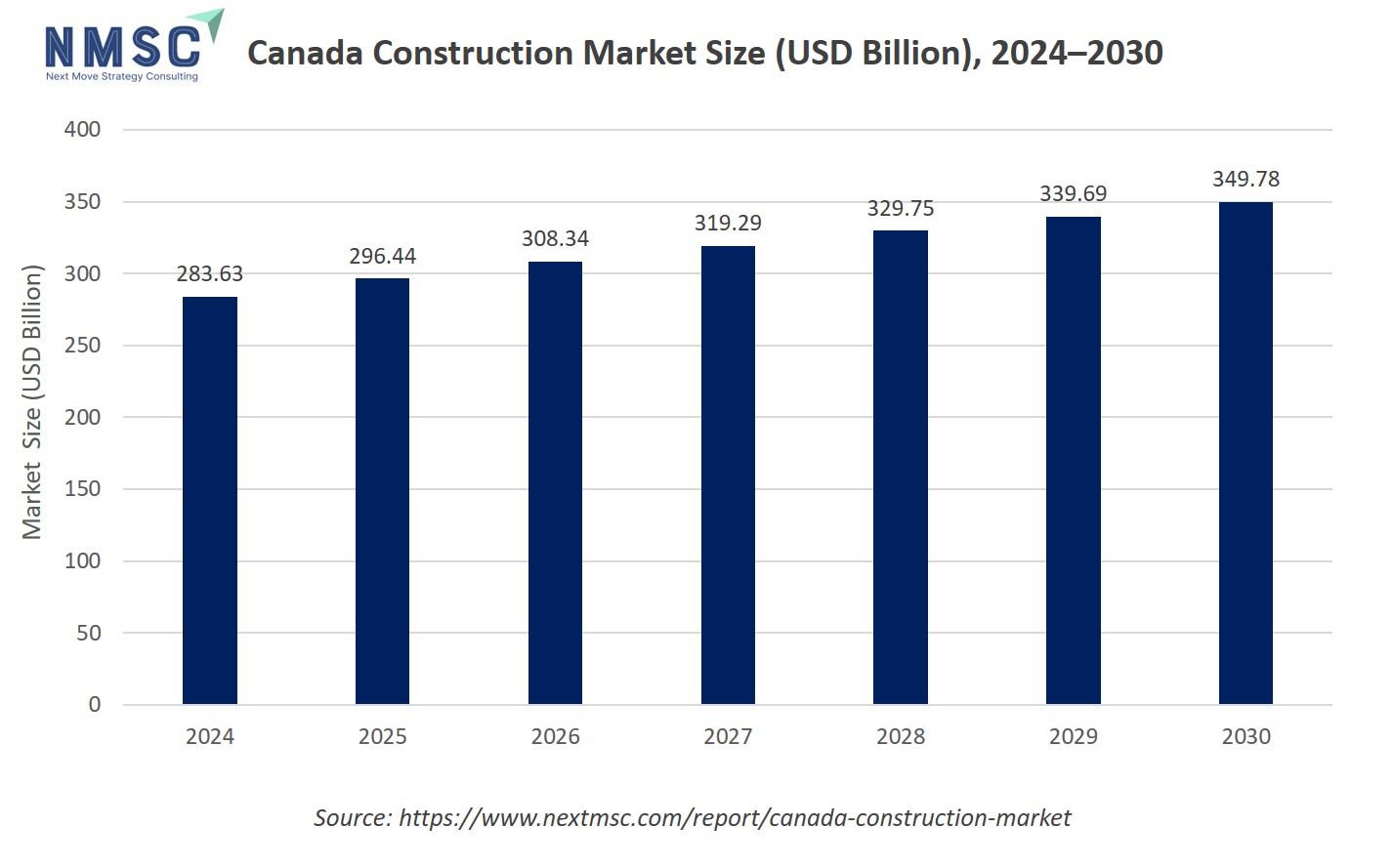

The Canada Construction Market size was valued at USD 283.63 billion in 2024, and is expected to be valued at USD 296.44 billion by the end of 2025. The industry is projected to grow, hitting USD 349.78 billion by 2030, with a CAGR of 3.36% between 2025 and 2030.

The market continues to show stable growth in 2025, driven by ongoing urbanization, population growth, and government-led infrastructure investments. Major cities like Toronto, Vancouver, Calgary, and Montreal remain focal points for high-rise residential, commercial, and mixed-use developments. Public infrastructure projects, including transit expansions, hospitals, schools, and green energy facilities, are further fueling demand, supported by the federal government’s multi-billion-dollar plan.

The industry is rapidly adopting digital tools, modular construction, and sustainable building practices to improve efficiency and meet Canada’s 2050 net-zero targets. Green building certifications, energy codes, and circular construction strategies are gaining traction across sectors. However, the market faces challenges such as labor shortages, rising material costs, and tightening regulatory standards at both federal and provincial levels. Continued emphasis on smart infrastructure and resilient design is shaping the future of Canada's built environment.

The chart illustrates the projected market size of the Canada construction market from 2024 to 2030, highlighting the values (in billions). The value is expected to grow steadily from USD 283.63 billion in 2024 to USD 349.78 billion in 2030.

What are the key trends in the Canada Construction Industry?

How is the digital revolution accelerating productivity in Canada’s construction market?

Nine in ten Canadian construction leaders now report that digital tools are essential for boosting productivity and keeping pace with project demands, a figure that underscores a rapid shift toward advanced technologies in 2025. Embracing building information modelling, digital twins, and AI‐driven project management platforms is no longer an option but a necessity, as firms using these tools have reduced on-site rework by up to 20% and cut project timelines by an average of three months.

Companies can capitalize on this transformation by establishing in-house digital centres of excellence and forging partnerships with technology vendors to pilot cloud‐based collaboration suites on smaller projects before scaling across their portfolios. By developing bespoke training programs and integrating real-time data analytics into decision making, contractors and developers stand to unlock substantial efficiency gains, mitigate cost overruns, and improve safety outcomes across every phase of the build cycle.

What impact is modular construction having on housing delivery in Canada?

Modular construction is taking on a growing role in provinces like New Brunswick and Nova Scotia, where 63% of single-detached modular homes sold in 2024 fell into the USD 100,000 to USD 200,000 price bracket, signalling both affordability and scalability in factory-built housing. Since modules are assembled off-site under controlled conditions, builders can shave several weeks off traditional construction schedules, accelerating time to market and reducing exposure to weather-related delays.

Forward-thinking developers are already integrating modular components for kitchens and bathrooms into multi-unit residential projects, cutting on-site labour needs by as much as 30%. To stay competitive, players across the value chain should explore strategic alliances with certified modular manufacturers and invest in digital pre-planning tools that synchronize design, manufacturing, and logistics, ensuring seamless module installation and unlocking faster returns on capital

How are sustainability and decarbonization retrofits redefining Canada’s building sector?

Meeting Canada’s net-zero goals is driving an unprecedented wave of energy-efficiency upgrades, over 819,000 homes will require deep retrofits between 2024 and 2032, and heat pump installations must ramp to 700,000 units annually by 2030 to hit interim emissions targets. This retrofit surge is not just regulatory compliance but a strategic growth avenue, which means, firms offering integrated upgrade packages are securing projects with average margins 5% higher than standard renovations.

For construction companies, building specialized retrofit divisions, complete with certified energy auditors and trained retrofit crews can tap into government incentives and carbon-credit programs, translating sustainability into a reliable revenue stream while helping clients lock in long-term utility savings.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Canada Construction industry in next decade?

Canada’s building sector is being propelled by shifting demographics and targeted public spending. As metropolitan populations swell, demand for mixed-use towers and residential complexes has surged. At the same time, federal and provincial stimulus packages are underwriting major transit, healthcare and renewable-energy projects. This confluence of private-sector momentum and government-backed infrastructure programs has catalysed innovations, ranging from off-site modular assembly to cloud-based project management, that are streamlining schedules and curbing costs.

Nonetheless, the sector faces headwinds from labour shortages, supply-chain disruptions and volatile material prices, which threaten project timelines and budgets. At the same time, rising demand for sustainable and resilient buildings has opened doors for specialized retrofit services and innovative materials like mass timber. This dynamic landscape presents a blend of challenges and opportunities for industry players willing to invest in technology, workforce development and green solutions.

Growth Drivers:

How is urbanization and government infrastructure spending fueling growth?

Accelerated urban migration and projections indicating a 15% rise in Canada’s urban population by 2030 are significantly increasing the demand for residential, commercial, and mixed-use developments across major metropolitan regions.

Simultaneously, the federal government’s Investing in Canada Plan, committing over USD 131.4 billion in infrastructure funding through 2028 is driving large-scale investments in public transit, healthcare facilities, and educational institutions. This dual momentum of demographic growth and public spending is reshaping the construction market landscape, creating long-term opportunities for companies that strategically align with infrastructure tenders and high-growth urban corridors.

How are technological innovations transforming project delivery?

Advanced digital technologies, such as Building Information Modeling integrated with AI-powered scheduling tools and drone-based visual site inspections are revolutionizing Canada’s construction workflows. These innovations are driving measurable efficiency gains, including up to 20% cost reduction from minimized rework, and enabling projects to finish as much as 12 weeks ahead of schedule compared to traditional methods.

Drone enabled progress tracking can cut inspection time by as much as 50%, while AI driven tools enhance risk forecasting and resource allocation in real time. By investing in in house tech teams and collaborating with leading software providers on pilot programs, firms can standardize these efficiencies and build a reputation for timely, high quality delivery.

Growth Inhibitors:

What challenges do labor shortages and material cost inflation pose?

BuildForce Canada’s latest outlook projects that 270,000 retirements and rising project demand will create a need for 380,500 new workers by 2034. Even with 272,200 young entrants, a skilled labor shortfall of 108,300 is expected.

Meanwhile, escalating material costs are compounding sector pressure: lumber futures surged nearly 25% year-over-year, and recent 25% tariffs on steel and aluminum imports have dramatically increased input prices, squeezing margins and delaying schedules. To confront these challenges, firms must proactively engage in workforce strategies, like apprenticeship programs tied to local colleges and leverage bulk purchasing or hedging programs to shield against material volatility.

Where do green building and mass timber represent emerging investment opportunities?

Canada’s commitment to achieving net-zero emissions is accelerating growth in green building and mass timber construction, opening attractive avenues for investment. The residential retrofit market, for instance, is poised for transformation, with millions of homes primed for energy-efficient upgrades.

Recent data from Green Communities Canada highlights early momentum, with tens of thousands of deep retrofit projects already completed. Meanwhile, RBC’s Climate Action Institute emphasizes the advantages of mass timber, which can significantly lower embodied carbon, streamline construction timelines, and reduce on-site disruption. These trends present compelling opportunities for stakeholders to invest in sustainable materials, partner with engineered wood suppliers, and leverage government-backed programs to drive climate-aligned construction outcomes.

How Canada Construction market is segmented in this report, and what are the key insights from the segmentation analysis?

By Type Insights

Is Renovation or New Construction Leading Canada’s Construction Sector in 2025?

On the basis of type, the market is segmented into renovation, and new construction.

New construction continues to dominate Canada’s construction market, driven by large-scale infrastructure projects, high-rise residential developments, and urban expansion across cities like Toronto, Vancouver, and Montréal. However, renovation and retrofit work is gaining momentum, and is projected to grow steadily due to aging building stock and Canada’s net-zero emissions targets.

Federal programs like the Canada Greener Homes Initiative, and rising energy costs are accelerating demand for deep retrofits, particularly in the residential and institutional sectors. Contractors focusing solely on new builds should consider diversifying into renovation services to tap into this rising segment, especially as governments continue to fund climate-resilient upgrades and code-compliant building enhancements. Firms that integrate digital tools and offer bundled retrofit services stand to gain long-term, sustainable business from this segment’s expansion.

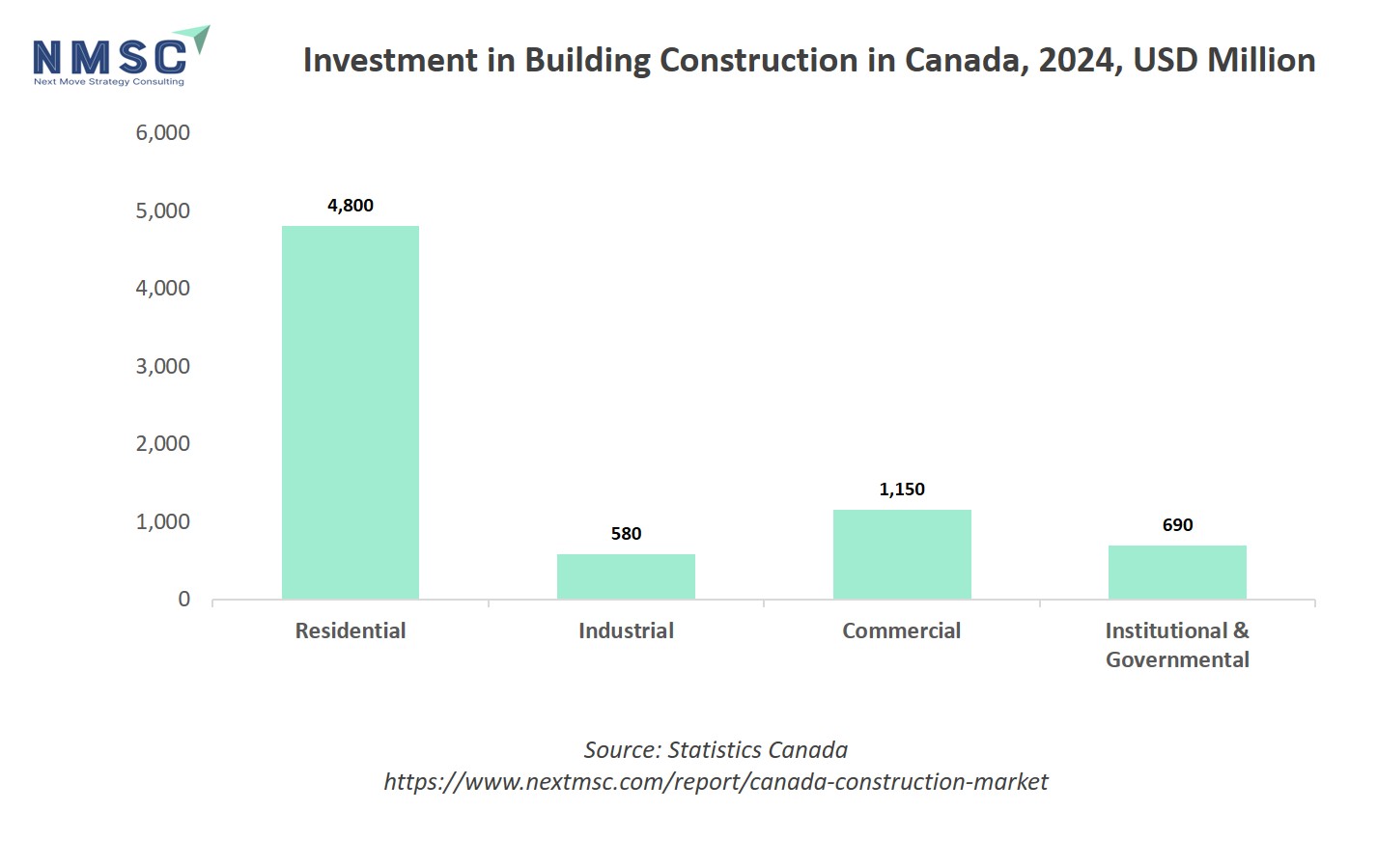

The chart illustrates the distribution of investment in building construction across Canada in 2024, measured in USD billion. Residential construction dominates the market with an investment nearing USD 4.80 billion, highlighting strong demand for housing and urban development. Industrial construction, though the smallest segment at around USD 0.58 billion, remains vital for supporting manufacturing and logistics activities.

Commercial construction follows with just over USD 1.15 billion, reflecting steady growth in office, retail, and mixed-use facilities. Institutional and governmental construction sees approximately USD 0.69 billion in investment, supported by public infrastructure projects such as schools and hospitals.

By Sector Insights

Is real estate eclipsing infrastructure and industrial segments in Canada’s 2024–25 market?

Based on sector, the market is segmented into real estate, infrastructure, and industrial. Real estate offers the backbone of industry activity, with urban infill, condominium developments and mixed-use towers driving steady demand in major centres. Simultaneously, public-sector infrastructure projects, ranging from transit expansions and renewable energy installations to water and wastewater upgrades ensure a consistent pipeline of large-scale work. In parallel, industrial construction is emerging through data centres, logistics facilities and advanced-manufacturing plants that support Canada’s digital and clean-energy transition. Firms that seamlessly integrate strengths in residential, infrastructure, and industrial sectors will secure more balanced, resilient growth.

By Construction Method Insights

Are modular, 3D‐printed, and sustainable methods transforming Canada’s construction landscape beyond traditional practices?

Based on construction method, the market is bifurcated into traditional construction, prefabricated/modular construction, 3D printed construction, and green/sustainable construction. While conventional, on-site construction remains the industry’s bedrock, relying on established workflows and skilled labour, the emergence of prefabricated and modular techniques is redefining project timelines and quality control.

Simultaneously, 3D printing is beginning to demonstrate its potential for customizable, waste-minimizing components, and green building approaches are increasingly integrated into design and execution to satisfy stricter environmental standards. Companies that blend time-tested construction expertise with off-site manufacturing pilots, additive-construction trials, and comprehensive sustainability protocols will be best positioned to lead in a market that values efficiency, innovation, and ecological responsibility.

By Contractor Type Insights

Are small, medium and large contractors each finding their niche in Canada’s construction market?

On the basis of contractor type, the market is segmented into small contractor, medium contractor, and large contractor. Small contractors continue to thrive on residential renovations and local projects, leveraging agility and close client relationships to capture niche opportunities. Medium-sized firms bridge this gap by handling mid-scale commercial and light-industrial builds, balancing flexibility with growing technical expertise. Large contractors dominate major infrastructure, high-rise and public-sector works, drawing on extensive resources and bonding capacity. Companies that clearly define their service scope, develop strategic partnerships, and invest in targeted capabilities can sharpen their competitive edge across all contractor tiers.

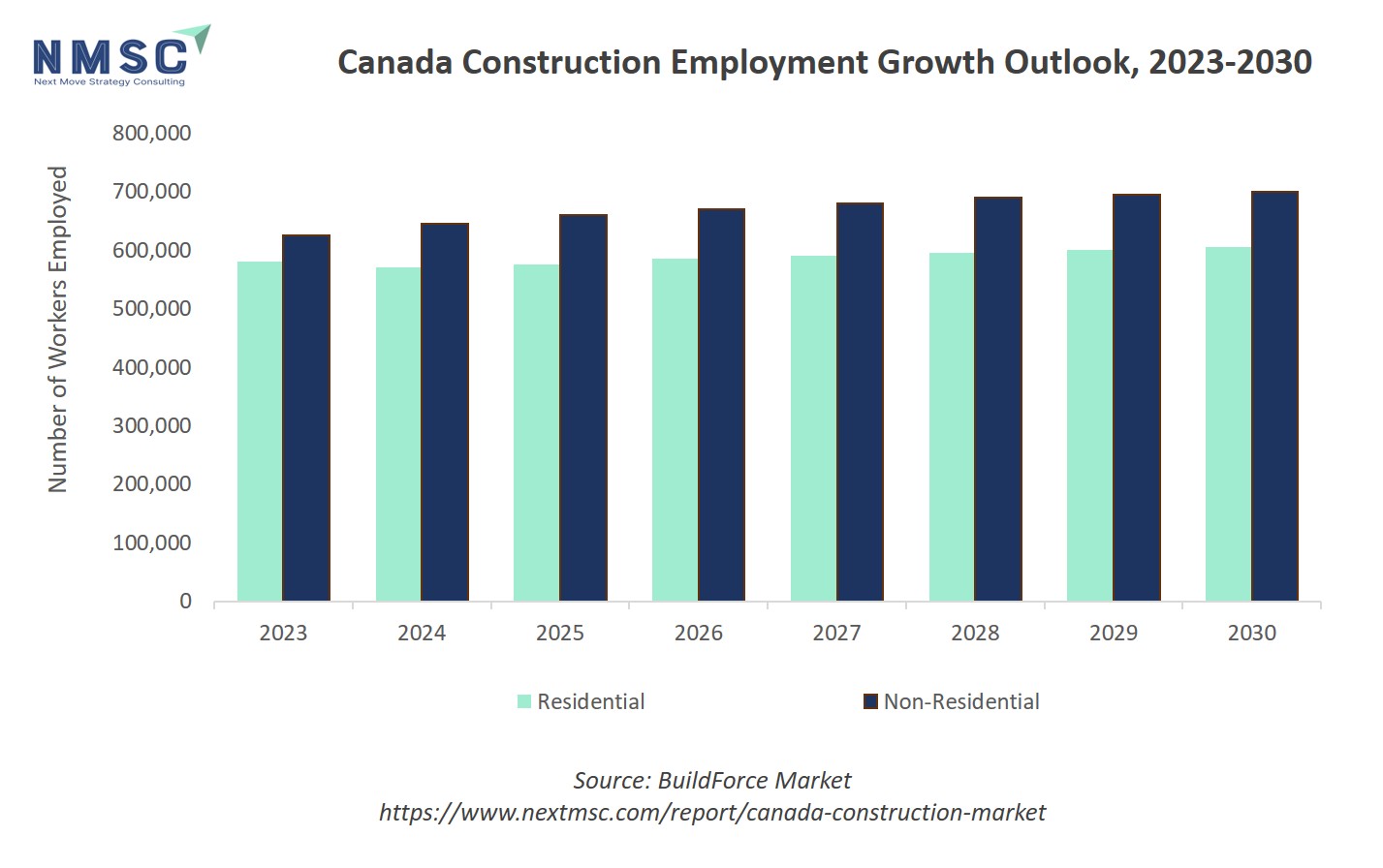

Also, Canada’s construction industry plays a pivotal role in driving the nation’s economic growth, with both residential and non-residential sectors contributing significantly to employment. As infrastructure investments increase and housing demands evolve, the sector is poised for steady workforce expansion over the coming years. The employment trends are shaped by a mix of urbanization, public infrastructure projects, and private development initiatives.

The chart presented above shows the projected employment growth in Canada’s construction sector from 2023 to 2030, broken down into residential and non-residential categories. It shows that while both segments are expected to witness gradual increases in workforce numbers, non-residential construction consistently employs more workers than the residential sector. By 2030, residential employment is forecast to reach approximately 605,000, while non-residential employment is projected to hit 700,000, reflecting the sector’s expanding scope and sustained demand.

Competitive Landscape

Which Companies Dominate the Construction Industry in Canada and How Do They Compete?

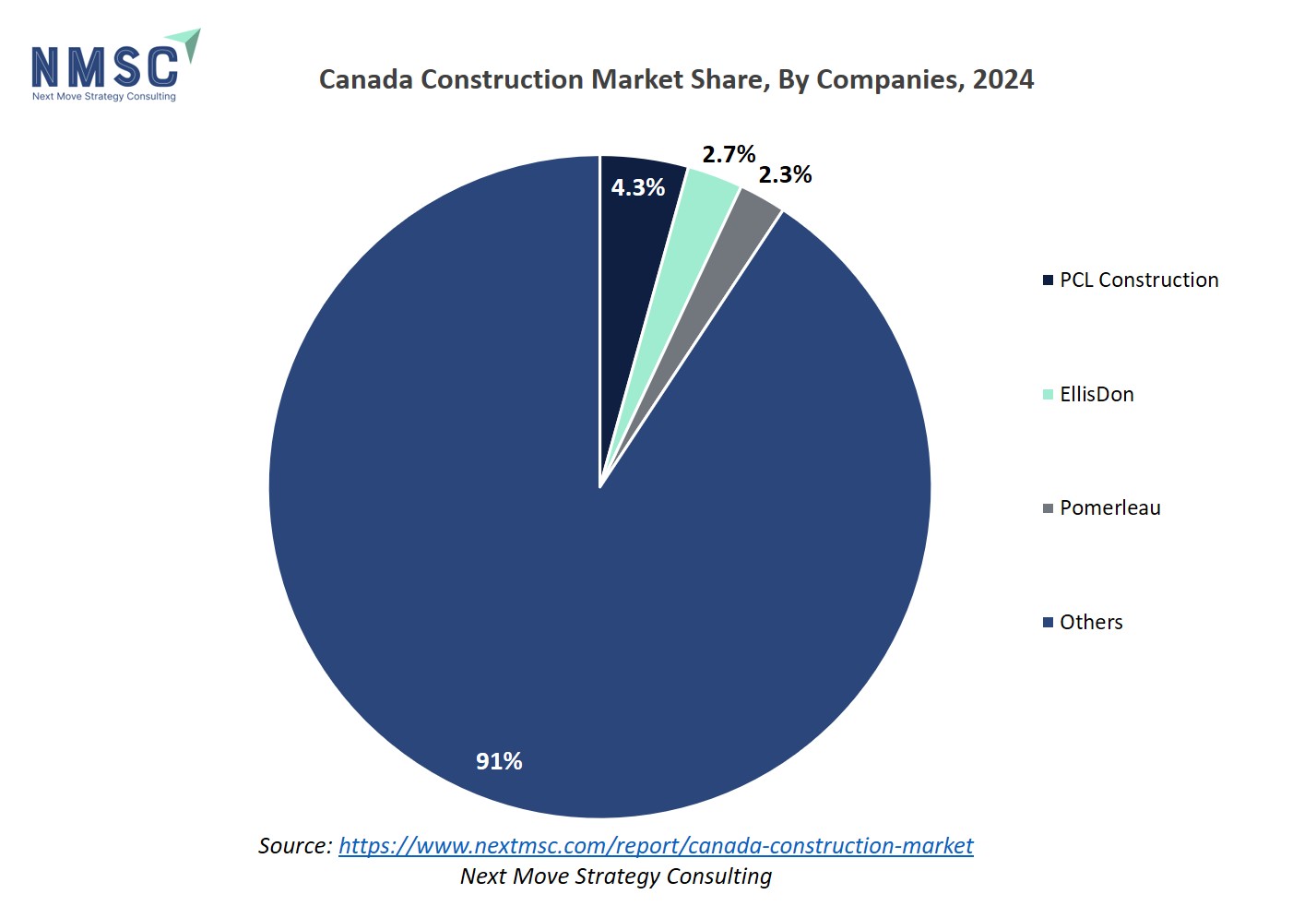

The market is led by major players such as PCL Construction, EllisDon, Pomerleau, Graham Construction, Broccolini Construction, Chandos Construction, Aecon Group Inc. and others. These leading firms are fueling growth by prioritizing innovation and sustained investment in research and development. Their strategies emphasize the integration of advanced construction technologies such as AI-driven project monitoring, predictive maintenance tools, and energy-efficient building systems. To maintain a competitive edge, many are also leveraging modular construction techniques and cloud-based platforms that enable faster project execution and customization across residential, commercial, and infrastructure developments. These approaches are reshaping delivery models and driving efficiency across the sector.

The competitive landscape of the market is evolving through frequent technology upgrades, with a strong focus on automation, enhanced safety systems, and data-driven project management models. Leading construction firms are strengthening their national presence by investing in infrastructure, forming regional partnerships, and pursuing strategic acquisitions. To stay ahead, they are also building innovation ecosystems by collaborating with academic institutions, training centers, and technology providers, supporting the development of advanced construction solutions tailored to Canada's expanding urban environments and high-density growth corridors.

Market Dominated by Construction Giants and Specialist Firms

Canada’s construction landscape is led by a handful of powerhouse firms, such as, PCL Construction (USD 12.16 billion in 2024 revenues), EllisDon (USD 7.56 billion), Ledcor (USD 3.62 billion), and Aecon (USD 2.74 billion) which together account for a higher percent of annual industry billings.

While these giants execute large-scale infrastructure and high-rise projects in urban hubs, regional specialists and mid-tier players are carving out niches in renewable-energy facilities, Indigenous community developments, and smart-building retrofits. This dual structure fosters healthy competition, as national leaders leverage scale and financing power while specialists innovate in underserved or rapidly evolving segments.

Innovation and Adaptability Drive Market Success

Leading firms are investing heavily in digital and sustainable practices to differentiate themselves. Major players such as, PCL, EllisDon, and Aecon are deploying advanced BIM workflows, AI-assisted scheduling, and off-site prefabrication to boost productivity and reduce waste.

Meanwhile, green-material adoption, like carbon-sequestering mass timber and in-house carbon-accounting platforms, enables these companies to meet rising ESG mandates and attract institutional clients. By maintaining dedicated innovation units and forging tech partnerships, top players are not only improving margins but also positioning themselves as market leaders in tomorrow’s low-carbon economy.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Strategic acquisitions have become a cornerstone of growth. For instance, in June 2024, Bird Construction acquired Jacob Brothers Construction in British Columbia for about USD 0.74 million, expanding its heavy civil capabilities and regional presence in paving and infrastructure projects. Similarly, Assembly Corp. imported a Swedish robotic panel-manufacturing line to Toronto, bolstering its modular and mass timber capacity and accelerating the adoption of factory-built construction methods in Canada.

Similar consolidation moves by other giants are enabling cross-border expansion, service-line diversification, and stronger bids on large public tenders, underscoring M&A as a key competitive lever. These transactions illustrate how integrated firms are expanding geographically, diversifying services, and deepening technological capabilities to win larger contracts and deliver innovation across Canada's construction sector

List of Key Canada Construction Companies

-

PCL Construction

-

EllisDon

-

Pomerleau

-

Graham Construction

-

Broccolini Construction

-

Chandos Construction

-

Maple Reinders Constructors Ltd.

-

Ledcor Group

-

Aecon Group Inc

-

Flynn Group of Companies

-

Bird Construction

-

EBC Inc

-

Kiewit Canada

-

Magil Construction Canada Inc.

-

Turner Construction Company

-

FlatironDragados

What are the Latest Key Industry Developments?

-

On May, 2025, Kiewit and WSP were awarded a USD 2.3 billion contract by the Nuclear Waste Management Organization to deliver the above-ground portion of Canada’s deep geological repository in northwestern Ontario.

-

On March 2025, PCL launched its Digital Twin Services, a cloud-based platform integrating real-time site data with 3D BIM models to optimize operations and reduce field rework by 15%. This innovation reinforces PCL’s reputation as a digital-first contractor and supports premium infrastructure and urban-residential bids.

-

On December, 2024, Aecon Group Inc. closed its previously announced acquisition of U.S.-based United Engineers & Constructors, integrating specialized nuclear and power-generation services into its portfolio. This strategic move strengthens Aecon’s North American energy infrastructure offering and positions the firm to bid on larger, cross-border power and industrial projects.

-

On June, 2024, Bird Construction announced that it will acquire Surrey, B.C.–based Jacob Bros Construction for USD 100 million, bolstering its heavy-civil capabilities and expanding its regional infrastructure footprint. This deal enhances Bird’s ability to win large municipal and utility contracts across Western Canada while streamlining resource allocation and project delivery in high-growth corridors.

-

On February, 2024, EllisDon formed new partnerships with The Link and Provision, the winners of its inaugural ConTech Accelerator program, bringing AI-driven tools for contract analysis and project-specification insights into its construction workflow.

What are the Key Factors Influencing Investment Analysis & Opportunities in Canada Construction Market?

Canada’s construction market is witnessing renewed investor interest, driven by robust public infrastructure funding, especially under the Investing in Canada plan. This initiative commits over USD 180 billion through 2028 toward transit, green infrastructure, and social development, making government-backed projects a reliable investment hotspot. Additionally, provinces like Ontario, British Columbia, and Alberta are seeing concentrated activity in housing, healthcare facilities, and transit-oriented development, attracting institutional and private equity players seeking stable long-term returns.

Valuations in the sector are becoming increasingly tied to companies’ digital maturity and ESG alignment. Firms adopting technologies like modular construction, BIM, and sustainable building practices are commanding premium valuations due to their cost efficiency and regulatory alignment. Meanwhile, growing demand for affordable housing and green retrofitting continues to shift capital toward residential and low-carbon construction. Strategic mergers, such as Bird Construction’s 2024 acquisition of Jacob Bros, further highlight consolidation opportunities that enhance regional presence and project diversification

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the Canada Construction market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Canada’s construction segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 296.44 billion |

|

Revenue Forecast in 2030 |

USD 349.78 billion |

|

Growth Rate |

CAGR of 3.36% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Type

-

Renovation

-

New Construction

By Sector

-

Real Estate

-

Residential

-

Affordable

-

Luxury

-

-

-

Commercial

-

Retail Buildings

-

Office Buildings

-

Hospitality

-

Healthcare Facilities

-

Educational Institutes

-

Entertainment Venues

-

-

Infrastructure

-

Transportation

-

Airport

-

Port

-

Rail

-

Road

-

-

-

Water and Wastewater

-

Energy

-

Telecommunication

-

Industrial

-

Manufacturing Plant

-

Warehouses

-

Power Plants

-

Oil Refineries

-

Chemical Plants

-

By Construction Method

-

Traditional Construction

-

Prefabricated/Modular Construction

-

3D Printed Construction

-

Green/Sustainable Construction

By Contractor Type

-

Small Contractor

-

Medium Contractor

-

Large Contractor

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on Canada Construction transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Canada Construction Market Report serves as an indispensable resource for navigating the evolving Construction landscape.

Speak to Our Analyst

Speak to Our Analyst