Construction Market by Type (Renovation, and New Construction), Construction Method (Traditional, Prefabricated/Modular, 3D-Printed, and Green/Sustainable), Contractor Type (Large, Medium, and Small), and Sector (Real Estate (Residential [Affordable, and Luxury], Commercial [Retail, Office, and Others], Infrastructure [Transportation, and Others], Industrial [Manufacturing Plants, Warehouses, and Others]) – Global Industry Trends and Forecast, 2025–2030

Industry: Construction & Manufacturing | Publish Date: 17-May-2025 | No of Pages: 200 | No. of Tables: 299 | No. of Figures: 244 | Format: PDF | Report Code : CM439

US Tariff Impact on Construction Market

Trump Tariffs Are Reshaping Global Business

Construction Market Overview

The global Construction Market size is valued at USD 11.39 trillion in 2024, and is projected to grow to USD 12.34 trillion by 2025. Additionally, the industry is expected to continue its growth trajectory, reaching USD 16.11 trillion by 2030, with a CAGR of 5.5% from 2025 to 2030.

The growth of the construction industry is driven by economic expansion, rapid urbanization, and government investments in sustainable infrastructure. Economic growth fuels demand for residential, commercial, and infrastructure projects, while urban migration increases the need for housing, public services, and transportation. Government focus on renewable energy and green development further propels the sector growth. However, challenges like regulatory requirements, complex permitting, and policy changes sometimes delay projects and increase costs. Despite these hurdles, the adoption of digital technologies like Building Information Modeling (BIM) offers new opportunities for the construction companies to enhance project accuracy, coordination, and resource management.

Global Economic Expansion Fuels Growth in the Construction Market

Economic expansion is a key driver of construction industry growth. As economies grow, demand rises for infrastructure, commercial establishments, and residential buildings. Increased disposable income and consumer confidence further boost demand for housing, leading to the construction of residential complexes. For instance, Saudi Arabia’s GDP witnessed a 4.3% rise from non-oil sectors in 2024. India’s GDP grew by 6.2% in the same period, reflecting strong economic activity, while Argentina saw a 2.8% GDP growth in 2024, supported by recovery in key sectors. These figures underscore the construction sector's role in fostering economic prosperity.

Rapid Population Growth and Urbanization Drives the Demand for Construction Activities

The rise in population and increasing urbanization globally are key drivers of the construction industry. Rapid urban migration demands the development of residential, commercial, and public infrastructure. The United Nations projects the world population will grow by 1 billion over the next 5 years, reaching 8.6 billion by 2030. Expanding urban areas also require essential services such as healthcare, education, and utilities, spurring a surge in construction projects. The World Bank forecasts the urban population will reach 6 billion by 2045, a 1.5 times increase, with over half of the global population already living in cities. This growth positions the construction industry to shape future urban landscapes and ensure resilient, inclusive cities.

Government Investments in Sustainable Infrastructure Boost Construction Market Growth

Government investments in sustainable infrastructure are fuelling construction industry growth as nations prioritize climate resilience and green development. Projects like renewable energy, eco-friendly transit, and resilient urban infrastructure are central to these efforts. In 2024, the U.S. Department of Energy allocated USD 2.5 billion for clean energy construction, while the European Commission committed USD 150 million to promote recyclable materials and energy-efficient building designs. These initiatives boost construction activity and foster sustainable practices, aligning the industry with future environmental and economic goals.

Stringent Regulatory Complexities Associated with Construction Projects is Hindering the Construction Industry Growth

The construction companies face challenges from complex government regulations and permitting processes. Projects often require multiple approvals at various levels, covering zoning, environmental impact, building codes, and safety standards. Delays, bureaucratic inefficiencies, and inconsistent rules sometimes extend timelines and raise costs. Sudden policy changes may also disrupt projects and deter investment. In the U.S., the EPA regulates air quality, waste management, lead control, and water use. While essential for safety and environmental protection, these regulatory complexities continue to hinder project efficiency and investor confidence.

Integration of Digitalization and Building Information Modeling (BIM) Creates Opportunity

The digital transformation of the construction sector, driven by increased adoption of Building Information Modeling (BIM), is creating significant growth opportunities. BIM enables digital design, simulation, and management of infrastructure, improving accuracy, coordination, and resource efficiency. In April 2024, ALLPLAN launched Allplan 2024-1 to enhance BIM and cloud workflows, highlighting the shift toward digital project delivery. The U.S. General Services Administration’s push for BIM in federal projects also underscores institutional support. Integration with AI, IoT, and cloud computing further boosts real-time collaboration, predictive maintenance, and facility management.

Real Estate Holds the Largest Market Share Among All Sectors in the Construction Market

The real estate segment dominates the global construction market due to its role in addressing the rising demand for residential, commercial, and mixed-use properties. Rapid urbanization, space constraints, and economic growth drive the construction of high-density developments, especially in cities.

Visionary megaprojects like NEOM in northwest Saudi Arabia aim to transform the Red Sea coast into a futuristic, sustainable city. It's a key part of Saudi Arabia's Vision 2030 plan to diversify its economy and reduce reliance on oil. The ambitious Gulf Railway Project with a construction budget of USD 250 billion, is expected to connect six Gulf countries, such as Kuwait, Saudi Arabia, Qatar, the UAE, Oman, and Bahrain, with a 2,177 km rail network. In early 2025, Oberoi Realty initiated development on an 81-acre luxury residential-commercial project in Alibaug, India. These developments reflect the sector’s ongoing focus on urban growth, sustainability, and evolving lifestyle needs.

New Construction Emerges as the Fastest-Growing Segment Among All Other Construction Types

New construction is emerging as the fastest growing segment in the global construction market, driven by rising demand for modern infrastructure, housing, and commercial spaces to support expanding populations and urban growth. This segment is central to meeting the needs of new developments across residential, commercial, industrial, and institutional sectors, as economies prioritize expansion over renovation or maintenance.

Recent developments illustrate this upward trajectory. Deliveries of fully affordable housing in the U.S. are expected to reach a multi-year peak of 70,500 units by the end of 2025. China’s aggressive urban expansion led to the construction of multiple new urban zones, including the Xiong'an New Area. In India, the Pradhan Mantri Awas Yojana (PMAY) continued driving large-scale housing projects for low and middle income families. These trends affirm the rise of new construction as the leading growth segment within the broader construction industry.

Asia-Pacific is Predominantly Leading the Construction Industry

The construction sector in the Asia-Pacific region is experiencing significant growth, driven by substantial government funding for infrastructure. Governments are investing heavily in transportation, energy, water systems, and urbanization projects to boost economic growth and modernization. For example, China’s fixed asset investment reached approximately USD 7.2 trillion under its 14th Five-Year Plan (2021–2025), with USD 521 billion dedicated to transport infrastructure and USD 940 billion to the clean energy sector in 2024. Similarly, India’s National Infrastructure Pipeline (NIP) has earmarked USD 1.4 trillion for infrastructure, with major portions dedicated to renewable energy, roads, urban development, and railways.

Additionally, a growing focus on sustainable construction and energy efficiency is driving market expansion. South Korea’s Seoul City, for instance, strengthened its green building regulations in 2024 to meet its 2050 carbon neutrality target. India’s renewable energy initiatives further contribute to the region’s commitment to sustainable infrastructure. These efforts are promoting the adoption of energy-efficient designs and eco-friendly materials, fostering innovation and growth within the Asia-Pacific construction industry.

North America is Expected to Witness the Fastest Growth in the Construction Industry

North America holds a major share of the global construction market, largely fuelled by strong government investments in infrastructure. A key driver is the U.S. government's push to modernize public infrastructure, including a USD 2.4 billion allocation under the Bipartisan Infrastructure Law, supporting over 122 rail projects in 41 states and Washington, D.C.. The EPA also invested USD 90 million in environmental cleanup projects, such as the Ottawa Radiation Areas in Illinois, further advancing sustainable infrastructure goals. These investments are spurring demand for materials, labor, and advanced technologies across the region.

The region’s growth is also propelled by rising megaprojects in transportation and energy. In Metrolinx’s 2024‑25 Business Plan, GO and UP Express combined ridership is forecast to reach 74.7 million trips in 2024‑25, up from approximately 70 million in 2023‑24 (a roughly 6.7% bump). Additionally, in Mexico, the government launched the Mexico–Queretaro Train in April 2025, aimed at reducing travel time and serving 10.75 million passengers yearly. These large-scale, federally funded initiatives are enhancing regional mobility and opening significant opportunities for construction stakeholders, reinforcing North America’s momentum in the global construction industry.

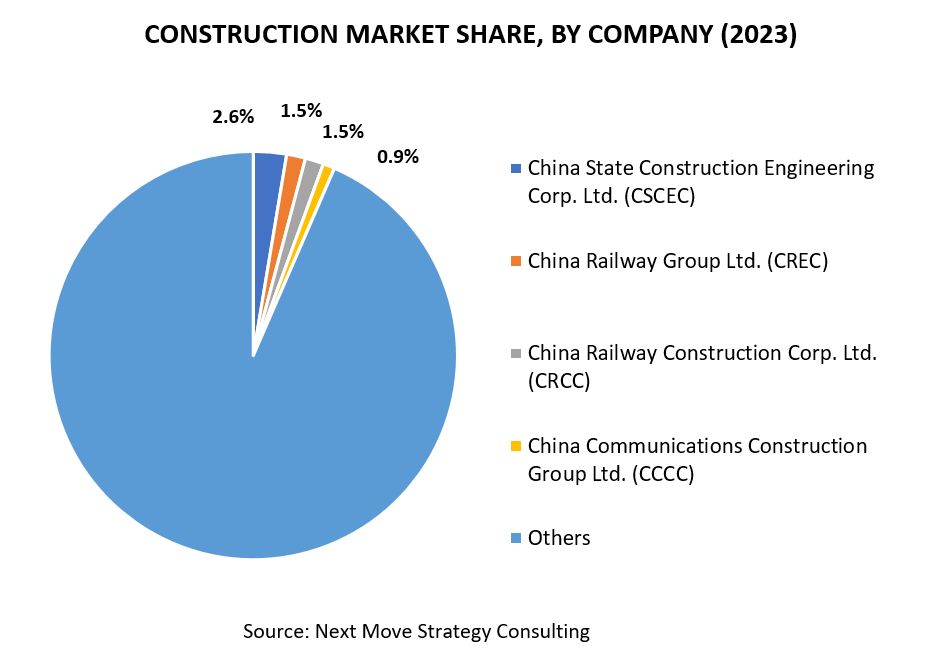

Strategic Analysis of Companies in Construction Industry

The global construction industry is undergoing a transformative phase as key players adopt innovative strategies to meet rising demands, technological advancements, and sustainability goals. A key trend is the integration of green building practices and advanced technologies to reduce environmental impact and improve project efficiency.

Major players are focusing on infrastructure projects to drive economic growth and urbanization. Companies are also leveraging digital tools and modular construction to boost efficiency. In November 2023, Kiewit launched the Coastal Virginia Offshore Wind project, incorporating modular construction techniques to accelerate assembly. While the industry faces various challenges, significant opportunities lie in leveraging digitalization, such as AI and IoT for real-time project monitoring, and expanding into emerging markets. Companies that innovate and adapt to these trends are well-positioned to lead the market.

Note: For the latest market share analysis and in-depth construction industry insights, you can reach out to us.

Construction Market Key Segments

By Type

-

Renovation

-

New Construction

By Construction Method

-

Traditional Construction

-

Prefabricated/Modular Construction

-

3D-Printed Construction

-

Green/Sustainable Construction

By Type of Contractor

-

Large Contractor

-

Medium Contractor

-

Small Contractor

By Sector

-

Real Estate

-

Residential

-

Affordable

-

Luxury

-

-

Commercial

-

Retail Buildings

-

Office Buildings

-

Hospitality

-

Healthcare Facilities

-

Educational Institutes

-

Entertainment Ventures

-

-

- Infrastructure

-

Transportation

-

Airport

-

Port

-

Rail

-

Road

-

-

Water and Wastewater

-

Energy

-

Telecommunication

-

-

Industrial

-

Manufacturing Plant

-

Warehouses

-

Power Plants

-

Oil Refineries

-

Chemical Plants

-

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Austria

-

Hungary

-

Poland

-

Czech Republic

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

- RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

China State Construction Engineering Corp. Ltd. (CSCEC)

-

China Railway Group Ltd. (CREC)

-

China Railway Construction Corp. Ltd. (CRCC)

-

China Communications Construction Group Ltd. (CCCC)

-

Metallurgical Corporation of China Ltd. (MCC)

-

Power Construction Corp. of China

-

Vinci SA

-

China Energy Engineering Corp. (CEEC)

-

Shanghai Construction Group (SCG)

-

Bouygues Group

-

Skanska AB

-

Bechtel Corporation

-

Hochtief AG

-

Obayashi Corporation

-

Balfour Beatty plc

-

Other Notable Key Players

-

Hyundai Engineering & Construction Co., Ltd.

-

Shimizu Corporation

-

Turner Construction Company

-

Fluor Corporation

-

PCL Construction

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 11.39 Trillion |

|

Revenue Forecast in 2030 |

USD 16.11 Trillion |

|

Growth Rate |

CAGR of 5.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Trillion (USD) |

|

Growth Factors |

|

|

Countries Covered |

32 |

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst