ERP Software Market by Component (Software, and Services), Deployment (On-Premise, Cloud, and Hybrid), Business Function (Enterprise Asset Management, Financial Management, Human Capital Management, and Others), Application (Manufacturing, BFSI, Healthcare, Retail & Distribution, Government, IT & Telecom, and Others), and End Users (Small & Medium Enterprises, and Large Enterprises) – Global Trends and Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 15-May-2025 | No of Pages: 564 | No. of Tables: 396 | No. of Figures: 321 | Format: PDF | Report Code : IC327

US Tariff Impact on ERP Software Market

Trump Tariffs Are Reshaping Global Business

Enterprise Resource Planning (ERP) Software Market Overview

The global Enterprise Resource Planning (ERP) Software Market size was valued at USD 97.77 billion in 2024 and is projected to grow to USD 115.30 billion by 2025. Additionally, the industry is expected to continue its growth trajectory, reaching USD 199.59 billion by 2030, with a CAGR of 11.6% from 2025 to 2030.

The market is witnessing robust growth, driven by government investments in digital transformation, rising demand for cloud-based solutions, and increasing adoption across the manufacturing sector. Public sector modernization efforts are accelerating ERP deployment to enhance service delivery and operational transparency, while SMEs are embracing cloud ERP platforms for their scalability and cost-effectiveness. In manufacturing, ERP systems are vital for streamlining supply chains and production management, prompting the launch of industry-specific solutions.

However, high implementation costs continue to hinder wider adoption, especially among smaller enterprises. The integration of IoT technology into ERP platforms presents new opportunities by enabling real-time monitoring, predictive maintenance, and improved efficiency. Additionally, the market valuation in this report also includes Customer Relationship Management (CRM) systems within its scope.

Government Investments in Digital Transformation Drive the ERP Adoption

Government initiatives aimed at modernizing public sector operations through digital transformation are significantly accelerating the adoption of ERP software. Investments in upgrading legacy systems and deploying cloud-based ERP solutions are helping governments improve efficiency, transparency, and service delivery.

For instance, in November 2024, the UK government allocated USD 366 million to modernize its ERP systems as part of the Synergy Programme, partnering with Oracle and IBM to streamline various areas of government operations.

Similarly, in October 2024, the U.S. Department of Veterans Affairs awarded a USD 2 billion contract to implement Oracle Cerner’s EHR system across its healthcare facilities, aiming to enhance veterans’ services and healthcare efficiency. These high-value public sector initiatives underscore the growing role of ERP systems in driving digital transformation and are contributing substantially to market growth.

Increasing Demand for Cloud-Based ERP Solutions Fuels Market Expansion

The rapid adoption of cloud-based ERP solutions, especially among small and medium-sized enterprises (SMEs), is a major factor contributing to the ERP software market expansion. Cloud ERP platforms offer scalability, affordability, and real-time access to data, making them an ideal choice for businesses seeking operational agility.

In December 2024, SAP and AWS jointly launched “GROW with SAP” on the AWS Marketplace, allowing organizations to adopt SAP S/4HANA Cloud with integrated AI functionalities to improve operational efficiency. This trend of cloud adoption, supported by strategic partnerships and innovative product offerings, is propelling the market forward by addressing a wide range of enterprise needs.

Growing Demand from the Manufacturing Sector Boosts ERP Software Market Growth

The manufacturing industry's increasing dependence on ERP software to manage production processes, streamline supply chains, and ensure regulatory compliance is driving significant market demand. ERP systems are helping manufacturers enhance efficiency, minimize downtime, and maintain product quality in a competitive environment.

In January 2025, Infor introduced Infor CloudSuite Industrial Enterprise 2025 a manufacturing-focused ERP platform offering improved supply chain visibility and predictive maintenance capabilities. These sector-specific ERP innovations highlight the growing need for industry-tailored solutions, contributing to the robust growth of the market.

High Implementation Costs Restrain the ERP Software Market Growth

Despite the market’s upward trajectory, the high costs associated with ERP implementation remain a substantial barrier, particularly for SMEs. Expenses related to software licensing, system customization, employee training, and long-term maintenance can discourage businesses from adopting ERP systems. These financial challenges slow down market penetration in cost-sensitive sectors and remain a critical constraint on overall market expansion.

IoT Integration Enhances ERP Capabilities Offers Promising Opportunities for Market Expansion

The integration of Internet of Things (IoT) technology with ERP systems is emerging as a key growth opportunity, offering real-time data visibility and advanced operational control. IoT-enabled ERP platforms allow businesses to track inventory, monitor equipment, and predict maintenance needs, significantly boosting efficiency in sectors such as manufacturing and logistics.

In March 2025, Epicor Software Corporation launched Epicor Kinetic 2025, a next-generation ERP solution with enhanced IoT integration for real-time monitoring and predictive maintenance in manufacturing environments. This technological advancement underscores the potential of IoT to transform ERP functionalities, driving demand for connected and intelligent enterprise solutions.

By Component, Software Holds the Dominant Share in the ERP Software Industry

Software remains the dominant component in the industry due to its critical role in streamlining operations, integrating business functions, and enabling digital transformation across finance, supply chain, HR, and customer relations. The growing preference for cloud-based ERP valued for its scalability, flexibility, and real-time data access continues to reinforce this dominance.

Integration with emerging technologies like AI, machine learning, and analytics is accelerating adoption, enhancing agility and competitiveness. Notable developments include SAP and AWS launching “GROW with SAP” in December 2024 to deliver AI-powered SAP S/4HANA Cloud via AWS Marketplace.

Additionally, Marg ERP’s release of its cloud-based GST-compliant platform in August 2024, featuring real-time financial analytics. These advancements underscore the software segment’s central role in driving the market growth and technological innovation.

By Application, Retail & Distribution, Holds the Highest CAGR of 13.6%

The retail and distribution sector is the fastest-growing application segment in the industry, driven by the need for streamlined operations, real-time inventory management, and enhanced customer experiences in a digital-first environment. ERP systems support supply chain integration, multi-channel sales management, and adaptability to evolving consumer behavior, especially with the rise of omnichannel retailing and e-commerce. These platforms enable real-time stock tracking, accurate demand forecasting, and unified online-offline operations, enhancing efficiency and competitiveness. Reflecting this momentum, Odoo launched Odoo 18 in January 2025 with AI-driven inventory forecasting and integrated POS systems.

Additionally, in March 2025, Oracle NetSuite rolled out a distribution management module to automate warehouse operations and improve fulfillment. These advancements underscore the sector’s pivotal role in ERP market expansion through innovation, automation, and scalability.

North America Region Dominates the ERP Software Sector

North America continues to dominate the ERP software market share, primarily driven by the rapid growth of the banking, financial services, and insurance (BFSI) sector, which increasingly adopts ERP systems to streamline complex financial operations, ensure regulatory compliance, and enhance customer service. The BFSI industry demands robust solutions for managing transactions, mitigating risk, and detecting fraud, especially amid the expansion of digital banking and fintech innovations.

In November 2024, the Canadian government allocated USD 150 million to support digital transformation in financial services, with a focus on ERP adoption to improve operational efficiency, according to Statistics Canada. This investment highlights how the sector’s digital evolution fuels the ERP software market demand and growth.

Additionally, the healthcare industry’s growing dependence on ERP software to manage patient data, optimize inventory, and comply with strict regulations further accelerates market expansion in the region.

The U.S. Centers for Medicare & Medicaid Services reported a 6% increase in hospital admissions in 2024, totaling 37 million, indicating a rising need for digital tools in healthcare. This surge in healthcare-specific ERP adoption emphasizes the industry's vital role in driving technological advancement and operational efficiency in the ERP software market.

Asia-Pacific is Expected to Show a Steady Growth in the ERP Software Market Trends

The Asia-Pacific region is poised for steady growth in the market, driven by the expanding retail sector in India and the booming construction industry in China. In India, the retail sector, particularly e-commerce, is one of the key growth driver, as businesses seek to meet rising consumer expectations for seamless online shopping experiences. As India’s retail landscape rapidly shifts toward omnichannel models, companies are increasingly adopting ERP systems to integrate online and offline sales, manage inventory in real time, and streamline order fulfillment.

The Ministry of Commerce and Industry projects India’s e-commerce market to reach USD 325 billion by 2030, underscoring the significant growth potential and the critical need for ERP solutions to handle large-scale operations, reduce errors, and improve customer satisfaction. This surge in digital retail activity highlights ERP software as an essential tool for retailers to stay competitive in a fast-evolving market.

Moreover, the booming construction sector in the region significantly contributes to the expansion of the market. China’s focus on smart cities, high-speed rail networks, and sustainable infrastructure projects requires advanced ERP systems to manage complex workflows, optimize resource allocation, and ensure compliance with environmental and regulatory standards.

In 2024, China’s State Taxation Administration implemented fully digital e-fapiao (electronic invoicing) with ERP integration across the country, enhancing tax transparency and compliance for construction firms while streamlining financial processes. This digital initiative, coupled with China’s ongoing infrastructure investments underscores the growing reliance on ERP software to improve project efficiency, reduce costs, and support the country’s ambitious construction goals.

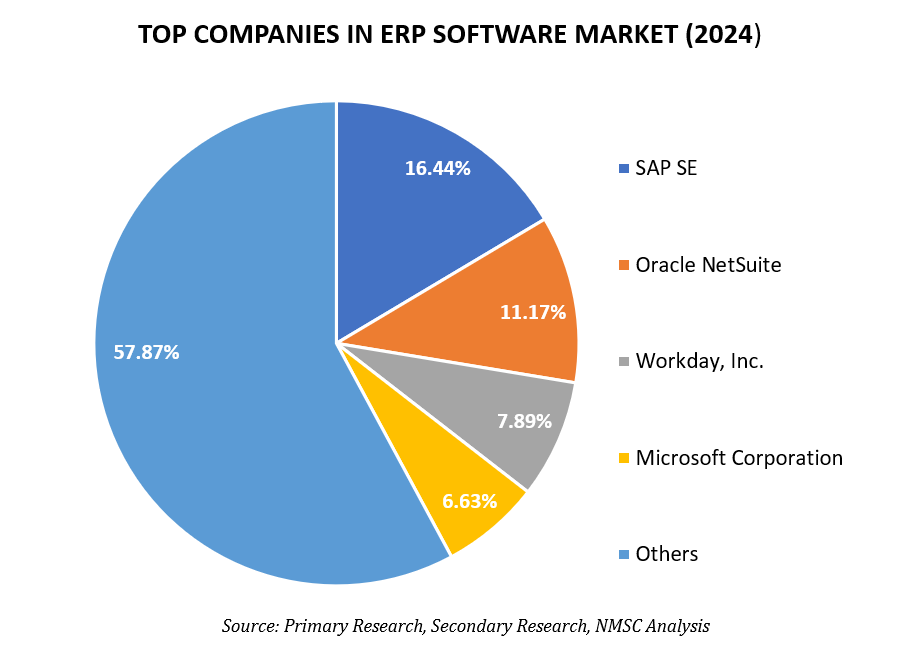

Strategic Analysis of Companies in ERP Software Industry

The industry is growing rapidly as key players integrate digital technologies to enhance efficiency, accuracy, and scalability in business operations. A major trend is the incorporation of AI and IoT into ERP systems, enabling real-time data insights and predictive analytics for better decision-making.

In September 2024, Teckzilla Technologies launched Odoo 18, featuring advanced AI capabilities to streamline business workflows and enhance operational efficiency. Similarly, in August 2024, Marg ERP introduced Marg ERP Cloud, a cloud-based solution with GST compliance and multilingual support, improving accessibility for SMEs.

In addition, strategic partnerships and innovative launches are further accelerating market growth. In February 2025, a leading Microsoft Dynamics 365 and Acumatica partner announced a new website launch, enhancing its ERP offerings with AI-driven analytics and IoT integration for improved supply chain management.

Additionally, in November 2024, ServiceNow and Rimini Street partnered to deliver a new enterprise software model, enabling faster ERP transformations with enhanced automation and digital workflows.

Despite challenges such as high implementation costs and the complexity of integrating new technologies, the increasing adoption of AI and IoT, along with the demand for scalable ERP solutions, continues to drive the market forward, positioning it for sustained growth.

ERP Software Market Key Segments

By Component

-

Software

-

Service

By Deployment

-

On Premise

-

Cloud

-

Hybrid

By Business Function

-

Enterprise Asset Management (EAM)

-

Record Assets (Asset Mgmt)

-

Analytics & BI

-

Disposal of Assets

-

Others

-

-

Financial Management System

-

Core Financials

-

Corporate Performance Mgmt (CPM)

-

Financial Consolidation

-

Others

-

-

Human Capital Management (HCM)

-

Talent Management

-

Administrative HR

-

Workforce Management

-

Others

-

-

Manufacturing and Operations

-

Production Planning and Scheduling Products

-

Production Ops and Control Products

-

Manufacturing Information Mgmt Products

-

Others

-

-

Supply Chain Management (SCM)

-

Inventory management

-

Warehouse management

-

Transportation management

-

Procurement

-

Contract Management

-

-

Others

By Application

-

Manufacturing

-

BFSI

-

Healthcare

-

Retail & Distribution

-

Government

-

IT & Telecom

-

Construction

-

Aerospace & Defense

-

Other Industries

By End Users

-

Small and Medium-Sized Enterprise

-

Large Enterprise

Key Players

-

SAP SE

-

Oracle NetSuite

-

Workday, Inc.

-

Microsoft Corporation

-

Xero Limited

-

Sage Group plc

-

Infor

-

Deltek, Inc.

-

Epicor Software Corporation

-

Acumatica, Inc.

Other Notable Key Players

-

Odoo

-

SYSPRO

-

Unit4

-

Ramco Systems

-

abas software AG

-

Priority Software

-

FinancialForce

-

Plex Systems

-

ERPNext

-

IFS AB

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 97.77 Billion |

|

Revenue Forecast in 2030 |

USD 199.59 Billion |

|

Growth Rate |

CAGR of 11.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst