ERP Software Market by Component (Software, and Services), Deployment (On-Premise, Cloud, and Hybrid), Business Function (Enterprise Asset Management, Financial Management System, Human Capital Management (HCM), and Others), Application (Manufacturing, BFSI, Healthcare, Retail & Distribution, Government, IT & Telecom, and Others), and End Users (Small & Medium Enterprises, and Large Enterprises) – Global Trends and Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 04-Jul-2025 | No of Pages: 280 | No. of Tables: 366 | No. of Figures: 311 | Format: PDF | Report Code : IC327

Enterprise Resource Planning (ERP) Software Market Overview

The global Enterprise Resource Planning (ERP) Software Market size was valued at USD 97.77 billion in 2024 and is projected to grow to USD 115.30 billion by 2025. Additionally, the industry is expected to continue its growth trajectory, reaching USD 199.59 billion by 2030, with a CAGR of 11.6% from 2025 to 2030.

The market is witnessing robust growth, driven by government investments in digital transformation, rising demand for cloud-based solutions, and increasing adoption across the manufacturing sector. Public sector modernization efforts are accelerating ERP deployment to enhance service delivery and operational transparency, while SMEs are embracing cloud ERP platforms for their scalability and cost-effectiveness. In manufacturing, ERP systems are vital for streamlining supply chains and production management, prompting the launch of industry-specific solutions.

However, high implementation costs continue to hinder wider adoption, especially among smaller enterprises. The integration of IoT technology into ERP platforms presents new opportunities by enabling real-time monitoring, predictive maintenance, and improved efficiency. Additionally, the market valuation in this report also includes Customer Relationship Management (CRM) systems within its scope.

Surge in Cloud-First Strategies Accelerates ERP Modernization

Organizations are rapidly shifting toward cloud-first strategies to increase agility, reduce infrastructure overhead, and enable remote operations. This trend is fueling demand for SaaS-based ERP systems that offer greater flexibility, lower upfront costs, and seamless updates. Cloud ERP adoption is especially prominent among SMEs and rapidly scaling enterprises seeking fast deployment and global accessibility, leading to an overall market shift from legacy, on-premise deployments to cloud-native platforms.

Industry 4.0 and Digital Twins Drive ERP Transformation in Manufacturing

The integration of ERP systems with Industry 4.0 technologies—such as IoT, robotics, and digital twins—is revolutionizing the manufacturing sector. Real-time production monitoring, predictive maintenance, and supply chain transparency are now enabled through ERP platforms integrated with operational technology (OT) data. As smart factories proliferate, ERP systems are evolving into intelligent command centers that align physical and digital manufacturing environments for better control, efficiency, and traceability.

Growing Demand for ESG Reporting and Sustainability Compliance

Enterprises are increasingly focused on environmental, social, and governance (ESG) metrics and regulatory compliance. Modern ERP systems are being enhanced with ESG modules and sustainability tracking capabilities to support carbon accounting, ethical sourcing, and compliance reporting. This new dimension of enterprise reporting is becoming a critical ERP adoption driver, especially among large global corporations and publicly listed firms subject to evolving disclosure mandates.

High Customization Costs and Complex Deployment Cycles Limit Adoption

Despite technological advancements, ERP implementation remains a costly and complex endeavor, especially for enterprises with unique workflows or compliance requirements. Deep customization often results in extended deployment timelines, increased consulting fees, and difficulty in applying future software updates. These cost-related and technical challenges discourage adoption among cost-sensitive industries and small businesses with limited IT resources.

Composable Erp Architecture Enables Agile And Scalable Enterprise Solutions

The emergence of composable ERP—modular, API-first systems built on microservices—offers enterprises the flexibility to deploy only the functionalities they need, when they need them. This approach reduces vendor lock-in, simplifies upgrades, and aligns with agile development practices. As businesses increasingly demand scalable, interoperable, and best-of-breed applications, composable ERP architecture presents a significant growth opportunity for solution providers and enterprises alike.

By Component, Software Holds the Dominant Share in the ERP Software Industry

Software remains the dominant component in the industry due to its critical role in streamlining operations, integrating business functions, and enabling digital transformation across finance, supply chain, HR, and customer relations. The growing preference for cloud-based ERP valued for its scalability, flexibility, and real-time data access continues to reinforce this dominance.

Integration with emerging technologies like AI, machine learning, and analytics is accelerating adoption, enhancing agility and competitiveness. Notable developments include SAP and AWS launching “GROW with SAP” in December 2024 to deliver AI-powered SAP S/4HANA Cloud via AWS Marketplace.

Additionally, Marg ERP’s release of its cloud-based GST-compliant platform in August 2024, featuring real-time financial analytics. These advancements underscore the software segment’s central role in driving the market growth and technological innovation.

By Application, Retail & Distribution, Holds the Highest CAGR of 13.6%

The retail and distribution sector is the fastest-growing application segment in the industry, driven by the need for streamlined operations, real-time inventory management, and enhanced customer experiences in a digital-first environment. ERP systems support supply chain integration, multi-channel sales management, and adaptability to evolving consumer behavior, especially with the rise of omnichannel retailing and e-commerce. These platforms enable real-time stock tracking, accurate demand forecasting, and unified online-offline operations, enhancing efficiency and competitiveness. Reflecting this momentum, Odoo launched Odoo 18 in January 2025 with AI-driven inventory forecasting and integrated POS systems.

Additionally, in March 2025, Oracle NetSuite rolled out a distribution management module to automate warehouse operations and improve fulfillment. These advancements underscore the sector’s pivotal role in ERP market expansion through innovation, automation, and scalability.

North America Region Dominates the ERP Software Sector

North America continues to dominate the ERP software market share, primarily driven by the rapid growth of the banking, financial services, and insurance (BFSI) sector, which increasingly adopts ERP systems to streamline complex financial operations, ensure regulatory compliance, and enhance customer service. The BFSI industry demands robust solutions for managing transactions, mitigating risk, and detecting fraud, especially amid the expansion of digital banking and fintech innovations.

In November 2024, the Canadian government allocated USD 150 million to support digital transformation in financial services, with a focus on ERP adoption to improve operational efficiency, according to Statistics Canada. This investment highlights how the sector’s digital evolution fuels the ERP software market demand and growth.

Additionally, the healthcare industry’s growing dependence on ERP software to manage patient data, optimize inventory, and comply with strict regulations further accelerates market expansion in the region.

The U.S. Centers for Medicare & Medicaid Services reported a 6% increase in hospital admissions in 2024, totaling 37 million, indicating a rising need for digital tools in healthcare. This surge in healthcare-specific ERP adoption emphasizes the industry's vital role in driving technological advancement and operational efficiency in the ERP software market.

Asia-Pacific is Expected to Show a Steady Growth in the ERP Software Market Trends

The Asia-Pacific region is poised for steady growth in the market, driven by the expanding retail sector in India and the booming construction industry in China. In India, the retail sector, particularly e-commerce, is one of the key growth driver, as businesses seek to meet rising consumer expectations for seamless online shopping experiences. As India’s retail landscape rapidly shifts toward omnichannel models, companies are increasingly adopting ERP systems to integrate online and offline sales, manage inventory in real time, and streamline order fulfillment.

The Ministry of Commerce and Industry projects India’s e-commerce market to reach USD 325 billion by 2030, underscoring the significant growth potential and the critical need for ERP solutions to handle large-scale operations, reduce errors, and improve customer satisfaction. This surge in digital retail activity highlights ERP software as an essential tool for retailers to stay competitive in a fast-evolving market.

Moreover, the booming construction sector in the region significantly contributes to the expansion of the market. China’s focus on smart cities, high-speed rail networks, and sustainable infrastructure projects requires advanced ERP systems to manage complex workflows, optimize resource allocation, and ensure compliance with environmental and regulatory standards.

In 2024, China’s State Taxation Administration implemented fully digital e-fapiao (electronic invoicing) with ERP integration across the country, enhancing tax transparency and compliance for construction firms while streamlining financial processes. This digital initiative, coupled with China’s ongoing infrastructure investments underscores the growing reliance on ERP software to improve project efficiency, reduce costs, and support the country’s ambitious construction goals.

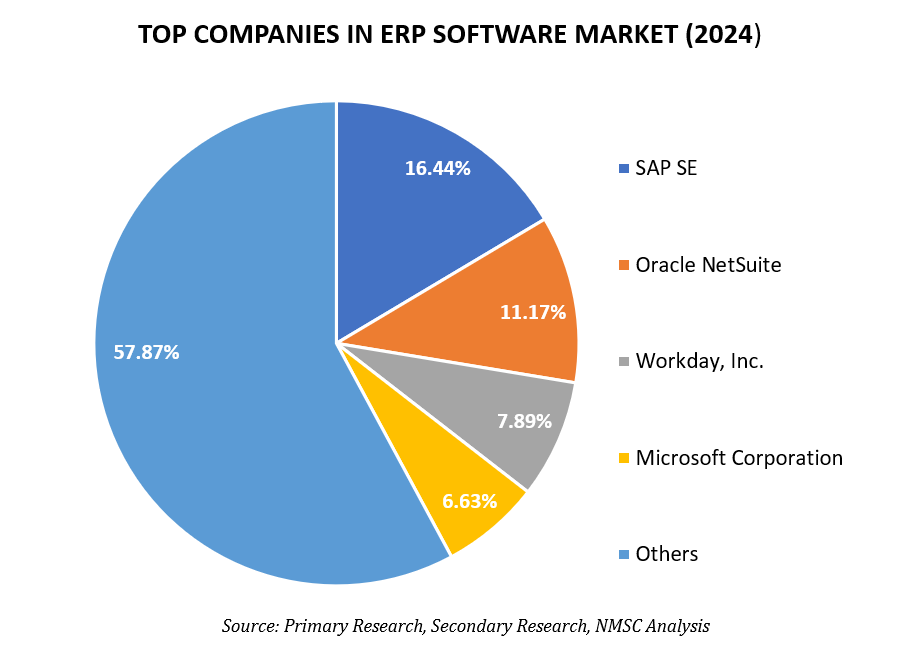

Strategic Analysis of Companies in ERP Software Industry

The industry is growing rapidly as key players integrate digital technologies to enhance efficiency, accuracy, and scalability in business operations. A major trend is the incorporation of AI and IoT into ERP systems, enabling real-time data insights and predictive analytics for better decision-making.

In April 2025, SAP SE Reported Q1 FY 2025 results: cloud revenue rose 27% YoY to €4.99 billion; cloud backlog increased 28% to $18.2 billion. The Cloud ERP Suite grew 34%, while total revenue was up 12% to $9.01 billion.

In addition, strategic partnerships and innovative launches are further accelerating market growth. In February 2025, Workday, Inc. launched 2025 R1 release, featuring 350+ new enhancements across HCM, Finance, security, and AI-driven features.

Additionally, in April 2025, Infor released an Industry AI update, providing tailored AI-driven analytic tools for enterprise agility.

Despite challenges such as high implementation costs and the complexity of integrating new technologies, the increasing adoption of AI and IoT, along with the demand for scalable ERP solutions, continues to drive the market forward, positioning it for sustained growth.

ERP Software Market Key Segments

By Component

-

Software

-

Service

By Deployment

-

On Premise

-

Cloud

-

Hybrid

By Business Function

-

Enterprise Asset Management (EAM)

-

Record Assets (Asset Mgmt)

-

Analytics & BI

-

Disposal of Assets

-

Others

-

-

Financial Management System

-

Core Financials

-

Corporate Performance Mgmt (CPM)

-

Financial Consolidation

-

Others

-

-

Human Capital Management (HCM)

-

Talent Management

-

Administrative HR

-

Workforce Management

-

Others

-

-

Manufacturing and Operations

-

Production Planning and Scheduling Products

-

Production Ops and Control Products

-

Manufacturing Information Mgmt Products

-

Others

-

-

Supply Chain Management (SCM)

-

Inventory management

-

Warehouse management

-

Transportation management

-

Procurement

-

Contract Management

-

-

Others

By Application

-

Manufacturing

-

BFSI

-

Healthcare

-

Retail & Distribution

-

Government

-

IT & Telecom

-

Construction

-

Aerospace & Defense

-

Other Industries

By End Users

-

Small and Medium-Sized Enterprise

-

Large Enterprise

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

SAP SE

-

Oracle NetSuite

-

Workday, Inc.

-

Microsoft Corporation

-

Xero Limited

-

Sage Group plc

-

Infor

-

Deltek, Inc.

-

Epicor Software Corporation

-

Acumatica, Inc.

-

SYSPRO

-

Infor

-

Unit4

-

Ramco Systems

-

Rockwell Automation

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 97.77 Billion |

|

Revenue Forecast in 2030 |

USD 199.59 Billion |

|

Growth Rate |

CAGR of 11.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst