Europe Buy Now Pay Later (BNPL) Market by Channel (Online and Point of Sale (PoS)),by Enterprise Type (Small and Medium Enterprises (SMEs) and Large Enterprises), by Application (Consumer Electronics, Fashion & Garments, Media & Entertainment, Healthcare & Wellness, Automotive, Furnishing, and Other Application), and by End User (Millennials, GenZ, GenX, and Baby Boomers) – Opportunity Analysis and Industry Forecast, 2024–2030

Industry: BFSI | Publish Date: 24-Oct-2025 | No of Pages: 220 | No. of Tables: 158 | No. of Figures: 103 | Format: PDF | Report Code : BF2110

Europe BNPL Market Overview

The Europe BNPL Market size was valued at USD 2.69 billion in 2023 and is predicted to reach USD 6.17 billion by 2030, registering a CAGR of 11.5% from 2024 to 2030.

The Europe BNPL market is rapidly expanding within the financial services sector, offering consumers the ability to make immediate purchases and defer payments over a set period, often without interest. This growth is driven by increasing demand for flexible payment options and the widespread adoption of digital and e-commerce platforms across Europe.

BNPL services are seamlessly integrated into both online and physical retail environments, providing straightforward repayment plans with minimal barriers to entry. Benefits of installment payment plans include enhanced purchasing power for consumers, improved conversion rates and average order values for merchants, and a more accessible alternative to traditional credit. As European consumers and retailers increasingly adopt these flexible payment solutions, BNPL become a key component of interest-free financing options in the region.

E-commerce Expansion In Emerging European Markets Accelerates BNPL Adoption

The rapid proliferation of e-commerce in Europe, especially in emerging markets such as Poland, Romania, Hungary, and the Baltics, is significantly fueling BNPL adoption. Established online marketplaces like Zalando, Otto, Allegro, and About You, alongside global giants such as Amazon and eBay, are embedding BNPL options as a standard payment method at checkout. This integration is proving effective in boosting conversion rates, reducing cart abandonment, and encouraging higher average order values, particularly for mid-to-high-ticket items such as electronics, designer fashion, furniture, and travel bookings.

Furthermore, the rise of social commerce and mobile-first shopping platforms has amplified BNPL’s visibility and convenience. With younger, digitally savvy consumers increasingly preferring flexible, interest-free installment options over credit cards, BNPL is becoming an integral part of the omnichannel retail experience. Even in physical retail environments, merchants are integrating BNPL via point-of-sale (POS) terminals linked directly to e-commerce accounts, enabling customers to carry over their financing preferences from online to offline purchases. This synergy between e-commerce expansion and BNPL availability is expected to remain a central growth driver over the next five years, as Europe’s online retail penetration continues to climb.

Sustainability-focused BNPL Solutions Open New Industry Verticals and Consumer Segments

A notable evolution in the European BNPL market is its expansion into sustainability-driven sectors such as renewable energy solutions, electric mobility, and energy-efficient home upgrades. BNPL providers are increasingly partnering with merchants in these industries to make eco-conscious purchases—such as solar panel installations, EV chargers, heat pumps, and smart home energy systems—more financially accessible to consumers. This aligns with the growing environmental awareness among European shoppers, particularly in markets like Germany, the Netherlands, and Nordic countries, where green consumerism is deeply ingrained.

Government-backed climate incentives, subsidies, and tax benefits are amplifying this trend by reducing the upfront cost of such products, making BNPL a natural enabler for households hesitant to make large lump-sum payments. Additionally, corporates and SMEs are beginning to explore BNPL as a financing tool for sustainable infrastructure upgrades, further broadening the market scope. This green financing push not only differentiates BNPL providers in a crowded payments landscape but also enhances their brand credibility, as sustainability becomes a key driver of purchasing decisions. Over the coming years, this segment is expected to grow at an accelerated pace, supported by Europe’s regulatory push toward carbon neutrality by 2050 and the rising number of ESG-conscious consumers seeking flexible, interest-free payment solutions.

Tightening Regulatory Framework and Increasing Compliance Burden

A significant restraint for the Europe BNPL market is the introduction of stricter regulations, such as the Second Consumer Credit Directive (CCD2) in the EU and new rules from the UK’s Financial Conduct Authority (FCA). These measures aim to classify BNPL as formal credit, requiring providers to conduct affordability and credit checks, enforce transparent disclosures, cap interest rates, and offer access to complaint resolution channels.

Full implementation of CCD2 across EU member states is expected by late 2025, while the UK will enforce mandatory affordability checks and enhanced consumer protections from mid-2026. These changes will compel BNPL providers to redesign operational models, invest in compliance systems, and possibly adjust pricing or restrict access to maintain profitability. While these rules are intended to safeguard consumers, they may also reduce BNPL’s convenience and slow its adoption among both shoppers and merchants.

Integration of BNPL into Subscription-Based and Recurring Payment Models

An emerging growth opportunity for the Europe BNPL market is the integration of installment payment options into subscription-based and recurring billing models. As sectors like streaming services, fitness memberships, software-as-a-service (SaaS), and premium content platforms expand, consumers are seeking more flexible ways to manage ongoing expenses without relying on traditional credit.

BNPL providers are now piloting solutions that allow users to split annual or multi-month subscription fees into smaller, manageable installments—while enabling merchants to secure longer customer commitments. This model not only boosts affordability for price-sensitive consumers but also enhances retention for service providers. With subscription commerce projected to grow rapidly in Europe through 2026, BNPL’s entry into this segment could unlock new customer bases, particularly among younger demographics who value both convenience and budget control. As fintech APIs improve and real-time payment rails expand across the EU and UK, this cross-industry integration is set to become a major competitive differentiator for BNPL providers.

By Component, Online Holds the Predominating Share in the Europe BNPL Industry

The online channel of BNPL refers to BNPL services integrated into e-commerce platforms, allowing consumers to choose flexible payment options during online transactions. As per our analysis, online channel dominates as well as estimated to witness fastest growth rate till 2030 in the channel segment of the BNPL market. This is due to its advantages that includes convenience for consumers shopping from home and easy integration with existing digital payment systems.

However, it includes potential challenges in verifying creditworthiness and lower consumer engagement compared to point-of-sale BNPL, that provides immediate financing options during in-person retail transactions and offers a more seamless checkout experience.

By Application, Fashion & Garments is Projected to Witness the Highest CAGR Growth Until 2030

The fashion and garments segment offer flexible payment solutions for apparel and accessories, including clothing, footwear, and handbags. As per our analysis, this segment is both the dominating and the fastest-growing in application. It serves consumers seeking to manage their spending on fashion items, which are generally priced lower than high-value electronics.

BNPL options in this segment often come with shorter repayment periods, reflecting the lower cost of fashion goods and the frequent nature of fashion purchases driven by seasonal trends and style updates. The flexibility offered by BNPL in the fashion segment allows consumers to make immediate purchases while spreading the cost over a few weeks or months.

This approach not only helps in managing budget constraints but also aligns with the regular buying habits in fashion, where consumers frequently update their wardrobes. Comparatively, while the fashion and garments segment benefits from BNPL’s ability to facilitate frequent, lower-cost purchases, the consumer electronics segment leverages BNPL to handle higher-cost items with longer payment terms.

Competitive Landscape

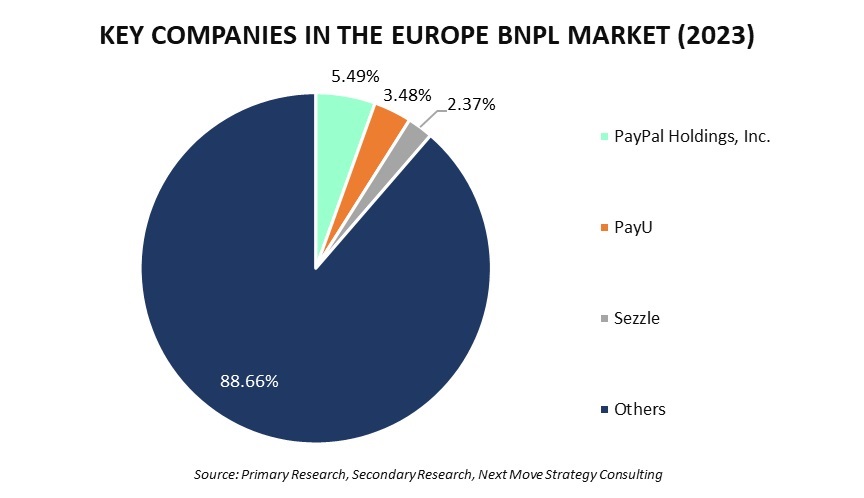

The promising key players operating in the Europe BNPL industry include Affirm Holdings, Inc., Block Inc. (Clearpay), Creation Consumer Finance Ltd., DivideBuy (Zopa), Humm Group Limited, Klarna Bank AB, Monzo Flex, Multifi, Newpay, Payl8r, , PayPal Holdings, Inc., Splitit, Tymit, ViaBill, Zilch Technology Limited among others.

These players are engaged in partnership across various regions to maintain their dominance in the Europe BNPL market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

Jul-24 |

Scalapay |

Scalapay S.R.L partnered with Adyen to integrate its BNPL service that allows thousands of merchants to offer flexible payment options. This collaboration aims to boost sales and enhance the shopping experience for consumers in Southern Europe. |

|

Jul-23 |

Klarna Bank AB |

Klarna Bank AB collaborated with UK-based Money Adviser Network to provide customers with fast and free access to debt advice. This initiative addresses growing concerns over financial well-being in the context of increasing consumer debt. |

|

Jun-23 |

PayPal |

PayPal collaborated with KKR to enhance its BNPL services in Europe and invested USD 3.26 billion to better serve its customers in the competitive BNPL landscape while optimizing its financial strategy. |

|

May-23 |

Alma |

Alma collaborated with Numeral, and BNP Paribas to automate and enhance the payment processes for merchants, responding to the growing demand for flexible payment options in the retail sector. |

|

Mar-22 |

Ratepay |

Ratepay GmbH partnered with PayPal to become the exclusive payment-by-invoice provider for "PayPal Checkout" in Germany. This collaboration allows online merchants using PayPal to offer Ratepay's white label payment solutions. Thus, it enhances customer trust and potential to increase conversion rates, as customers remain within the merchant's site during checkout. |

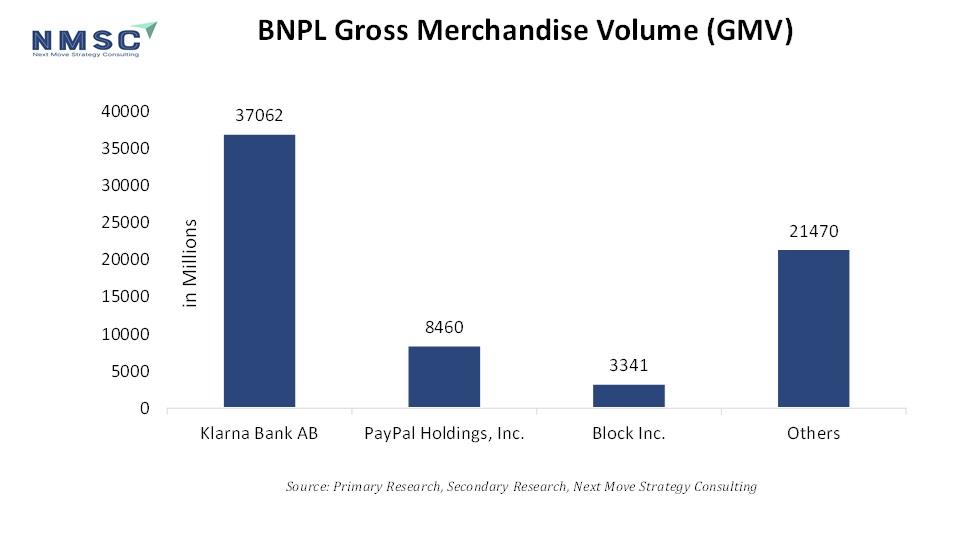

We have also evaluated companies based on their BNPL gross merchandise volume (GMV). This metric reflects the total value of goods and services processed through BNPL platforms, offering a clear indicator of each company's scale and market presence.

By analyzing GMV, we gain insights into consumer adoption, transaction volumes, and the relative performance of BNPL providers within the competitive landscape. This approach allows for a more comprehensive understanding of how these companies are positioned in the market based on their transactional throughput. For a detailed breakdown of company-wise gross merchandise volume (GMV), purchase our full report here.

Comparison of BNPL Gross Merchandise Volume (GMV) Across Key Players

Europe BNPL Market Key Segments

By Channel

-

Online

-

Point of Sale (PoS)

By Enterprise Type

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

By Application

-

Consumer Electronics

-

Fashion & Garments

-

Media & Entertainment

-

Healthcare & Wellness

-

Automotive

-

Furnishing

-

Other Application

By End User

-

Generation X

-

Generation Z

-

Millennials

-

Baby Boomers

By Region

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

United Kingdom

-

Russia

-

Sweden

-

Norway

-

Denmark

-

Netherlands

-

Finland

-

Rest of Europe

-

Key Players

-

Affirm Holdings, Inc.

-

Block Inc. (Clearpay)

-

Creation Consumer Finance Ltd.

-

DivideBuy (Zopa)

-

Humm Group Limited

-

Klarna Bank AB

-

Monzo Flex

-

Multifi

-

Newpay

-

Payl8r

-

PayPal Holdings, Inc.

-

Splitit

-

Tymit

-

ViaBill

-

Zilch Technology Limited

Report Scope And Segmentation

|

Parameters |

Details |

|

Market Size Value in 2023 |

USD 2.69 Billion |

|

Revenue Forecast in 2030 |

USD 6.17 Billion |

|

Value Growth Rate |

CAGR of 11.5% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

14 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst