Houseware Market by Product Type (Kitchenware), by Kitchenware Type (Cookware), by Serveware and Tableware Type (Dinnerware), by Storage and Organization Type (Food Storage), by Cleaning Tools Type (Mops), by Thermoware and Insulated Products Type (Flasks), by Gift and Decorative Housewares Type (Corporate Gifting Sets), by Bath and Sanitary Products Type (Bathroom Organizers), by Distribution Channel (Supermarkets), by End-User (Residential Consumers) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The Houseware Market size was valued at USD 300.75 billion in 2024, and is expected to be valued at USD 313.83 billion by the end of 2025. The industry is projected to grow, hitting USD 388.29 billion by 2030, with a CAGR of 4.35% between 2025 and 2030.

The houseware market is undergoing rapid transformation, driven by rising urbanization, evolving consumer lifestyles, and increasing demand for functional, aesthetic, and sustainable home solutions. Globally, the surge in residential construction, growth of smart homes, and rising disposable incomes are fueling demand for innovative and multifunctional houseware products. Expanding retail networks, e-commerce penetration, and home-improvement trends amplified by lifestyle influencers and digital platforms are reshaping consumer preferences. Advancements in eco-friendly materials, ergonomic designs, and smart, connected homeware are driving product innovation. Furthermore, sustainable manufacturing practices, customizable designs, and aesthetic appeal are enhancing user experience, fostering brand loyalty, and redefining modern living spaces.

What are the key trends in Houseware Market?

What are the major technological trends shaping the Market?

Technological advancements are redefining the houseware landscape. Smart kitchen appliances, IoT-enabled homeware, and AI-integrated devices are enhancing user convenience and efficiency. Automation in manufacturing ensures product precision, durability, and mass customization. Materials innovation, such as non-toxic coatings, antimicrobial surfaces, and heat-resistant composites, improves product performance and longevity. Additionally, sustainable manufacturing technologies like energy-efficient production lines, recyclable materials, and biodegradable packaging are gaining prominence. Digitalization in design, prototyping, and inventory management further accelerates product development and delivery, catering to fast-changing consumer demands.

How is demographic change influencing the Market?

Demographic and societal shifts are significantly influencing market dynamics. Rapid urbanization, rising middle-class populations, and the growth of nuclear families are increasing the need for compact, efficient, and stylish homeware solutions. Younger consumers prefer multifunctional, tech-integrated, and sustainable products that align with modern living. Meanwhile, aging populations in developed regions are driving demand for ergonomic, easy-to-use, and safety-enhanced houseware products. These demographic patterns are encouraging manufacturers to diversify offerings, balancing aesthetics, functionality, and convenience across age groups and lifestyles.

What role does government support play in driving industry growth?

Government policies and initiatives are fostering sustainable and competitive growth in the houseware industry. Incentives for domestic manufacturing, export facilitation, and MSME development are boosting local production and innovation. Sustainability mandates and circular economy policies are encouraging manufacturers to adopt recyclable materials and reduce carbon footprints. Housing development programs and smart city initiatives are indirectly driving demand for modern household products. Moreover, quality certification standards and safety regulations enhance consumer trust and product reliability, supporting long-term market expansion.

How is consumer preference changing in the Market?

Consumer behavior is rapidly shifting toward personalized, design-led, and sustainable houseware solutions. Buyers increasingly value aesthetics, convenience, and environmental responsibility alongside functionality. The trend of “smart living” is prompting demand for connected appliances, while minimalism and organized living are fueling growth in modular storage and multipurpose kitchenware. Ethical sourcing, transparency, and eco-friendly materials are now major purchase drivers. Overall, consumers are viewing houseware not merely as utilitarian items but as expressions of lifestyle, identity, and conscious consumption, transforming how brands design, market, and deliver products.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Houseware industry in next decade?

The houseware market is witnessing robust growth driven by urbanization, rising disposable incomes, and changing consumer lifestyles. Increasing demand for space-efficient, multifunctional, and aesthetically appealing products is fuelling adoption among urban households and nuclear families. The rapid expansion of e-commerce and modern retail channels is enhancing product accessibility, promoting premium offerings, and enabling smaller brands to compete effectively. At the same time, high raw material and production costs pose challenges, potentially limiting affordability for price-sensitive consumers. Meanwhile, the growing popularity of smart and connected homeware presents significant opportunities for innovation, allowing manufacturers to offer technology-integrated, eco-friendly, and space-saving solutions that cater to modern, convenience-oriented, and environmentally conscious consumers.

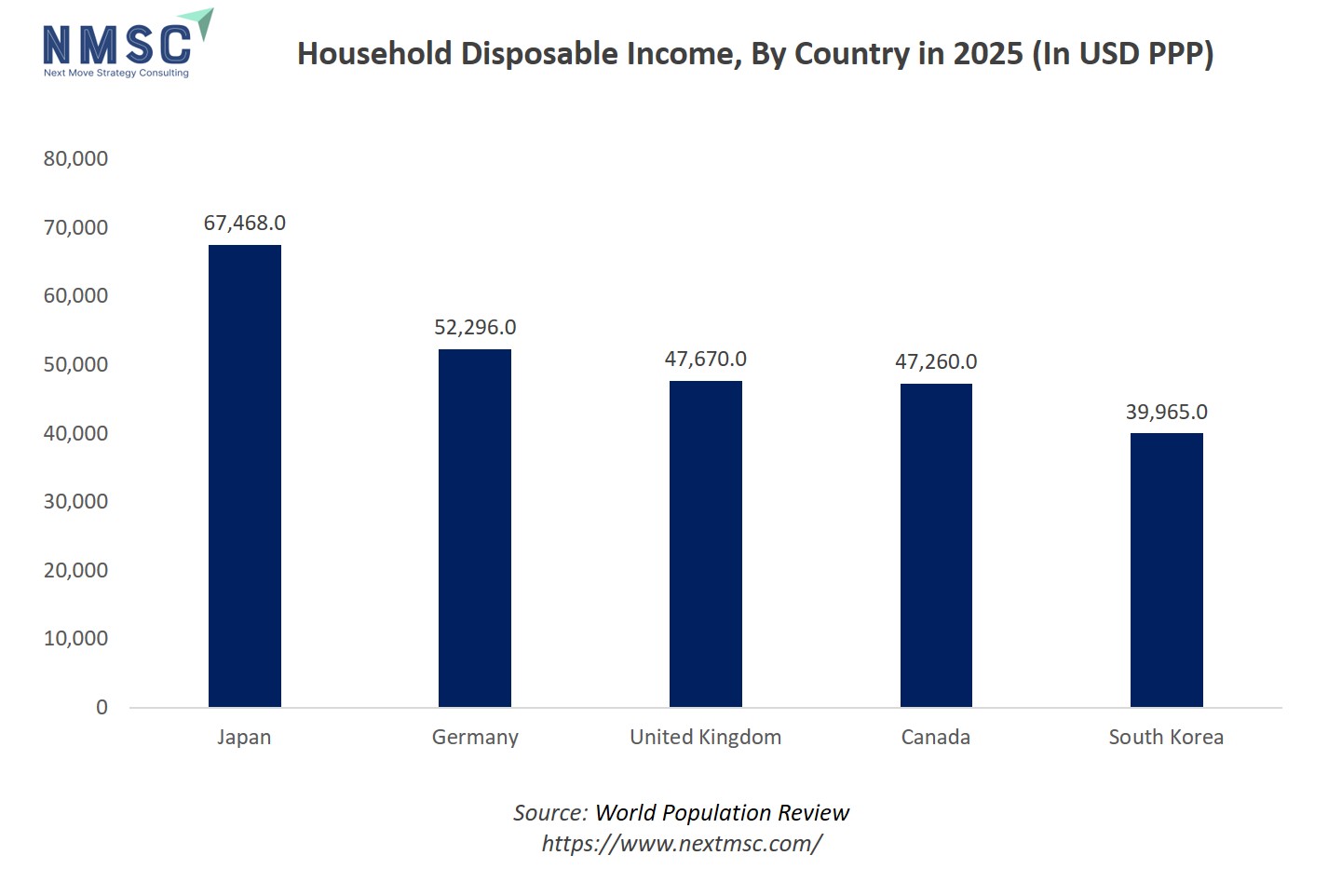

The bar chart illustrates household disposable income in USD PPP for selected countries in 2024–2025. Among the countries shown, Japan has the highest per capita disposable income at USD 67,468, followed by Germany at USD 52,296, the United Kingdom at USD 47,670, Canada at USD 47,260, and South Korea at USD 39,965. Higher disposable income in these countries directly correlates with increased spending capacity on houseware products, particularly premium, multifunctional, and design-focused items. Consumers in Japan and Germany are more likely to invest in high-quality kitchenware, serveware, storage solutions, and decorative housewares, driving demand for both innovative and branded products. In contrast, countries with relatively lower disposable income prioritize affordable and essential houseware items, influencing product mix and pricing strategies in the global market.

Growth Drivers:

How is Urbanization & Rising Disposable Incomes Driving the Market Demand?

Urbanization, coupled with rising disposable incomes, is a major driver of the houseware market. According to the World Bank, 66% of China’s population and 84% of the U.S. population now live in urban areas, highlighting the growing concentration of consumers in cities. This urban shift is driving demand for space-efficient, multifunctional, and aesthetically appealing houseware designed for compact modern homes. Higher income levels in these urban centres allow consumers to invest in premium and durable home products, moving beyond basic utility items toward solutions that combine functionality with style. The trend is particularly evident among urban professionals and nuclear families, who increasingly prefer modern cookware, storage solutions, smart home accessories, and design-focused décor. As a result, manufacturers are innovating with compact designs, advanced materials, and technology-integrated features to cater to the evolving needs of urban households.

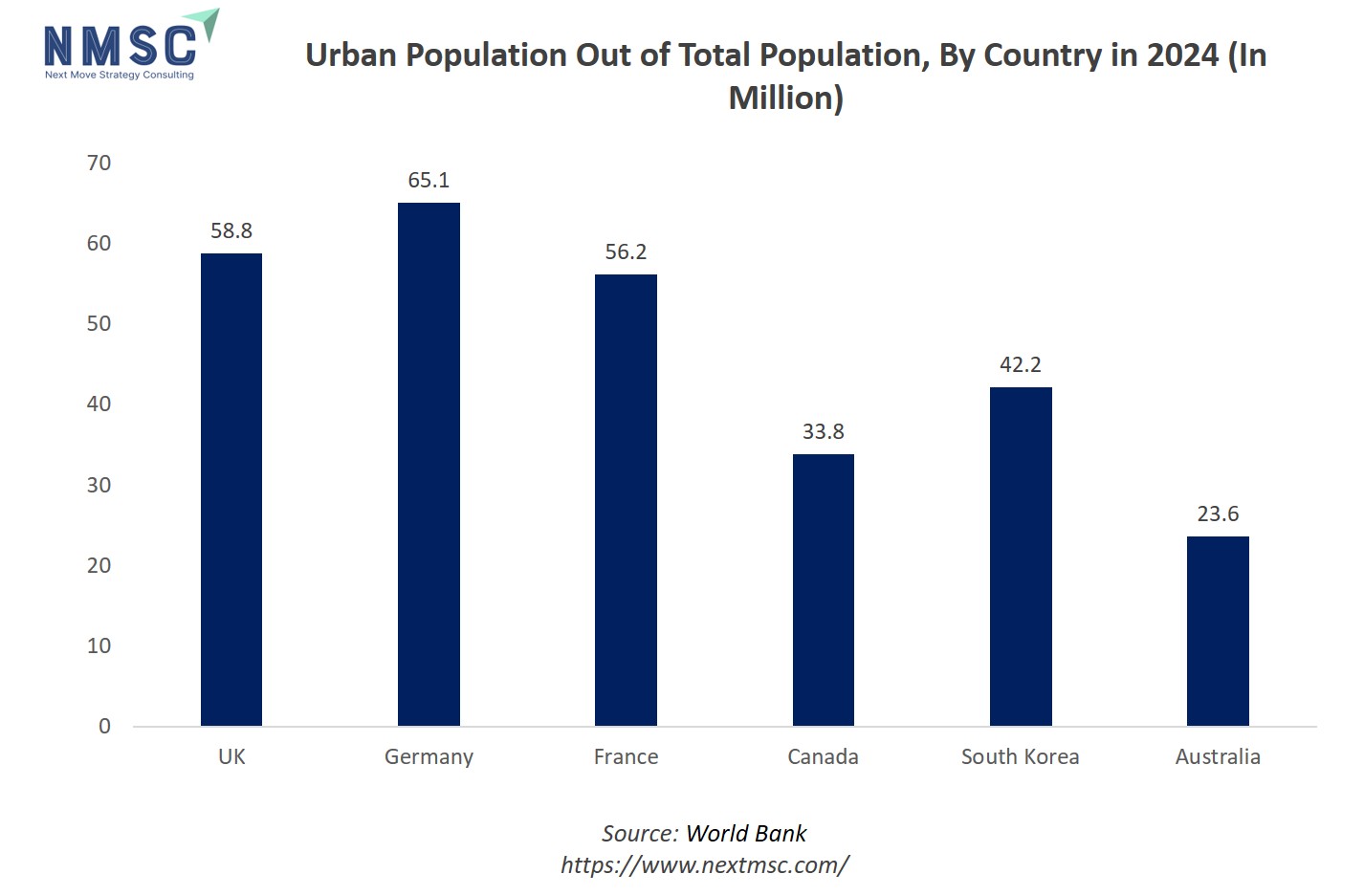

The chart illustrates the urban population in million across selected countries in 2024. Germany has the largest urban population at 65.05 million, followed by the UK at 58.76 million, France at 56.21 million, South Korea at 42.17 million, Canada at 33.84 million, and Australia at 23.60 million. Larger urban populations typically drive higher demand for houseware products, as city dwellers tend to have greater purchasing power, access to modern retail and e-commerce channels, and a preference for space-efficient, multifunctional, and premium household items. Countries like Germany, the UK, and France are therefore expected to contribute significantly to global houseware market growth, while markets with smaller urban populations focus more on basic and essential household solutions.

Is Expansion of E-Commerce and Modern Retail Channels Accelerating the Market Growth?

The rapid expansion of e-commerce and modern retail channels is a significant driver of the houseware market. Online platforms and omnichannel retailing have made houseware products more accessible to a wider range of consumers, enabling them to browse, compare, and purchase products conveniently from anywhere. This ease of access has not only increased overall market reach but also allowed smaller and niche brands to enter the market and compete alongside established players. Modern retail formats, such as organized supermarkets, specialty homeware stores, and lifestyle chains, provide consumers with enhanced shopping experiences, including product demonstrations, bundled offers, and loyalty programs. Together, these developments are accelerating market growth by boosting sales volumes, promoting premium and innovative products, and encouraging impulse purchases. Additionally, the integration of digital marketing, mobile apps, and AI-driven personalized recommendations in online platforms is further stimulating demand and shaping consumer preferences toward modern, convenient, and stylish houseware solutions.

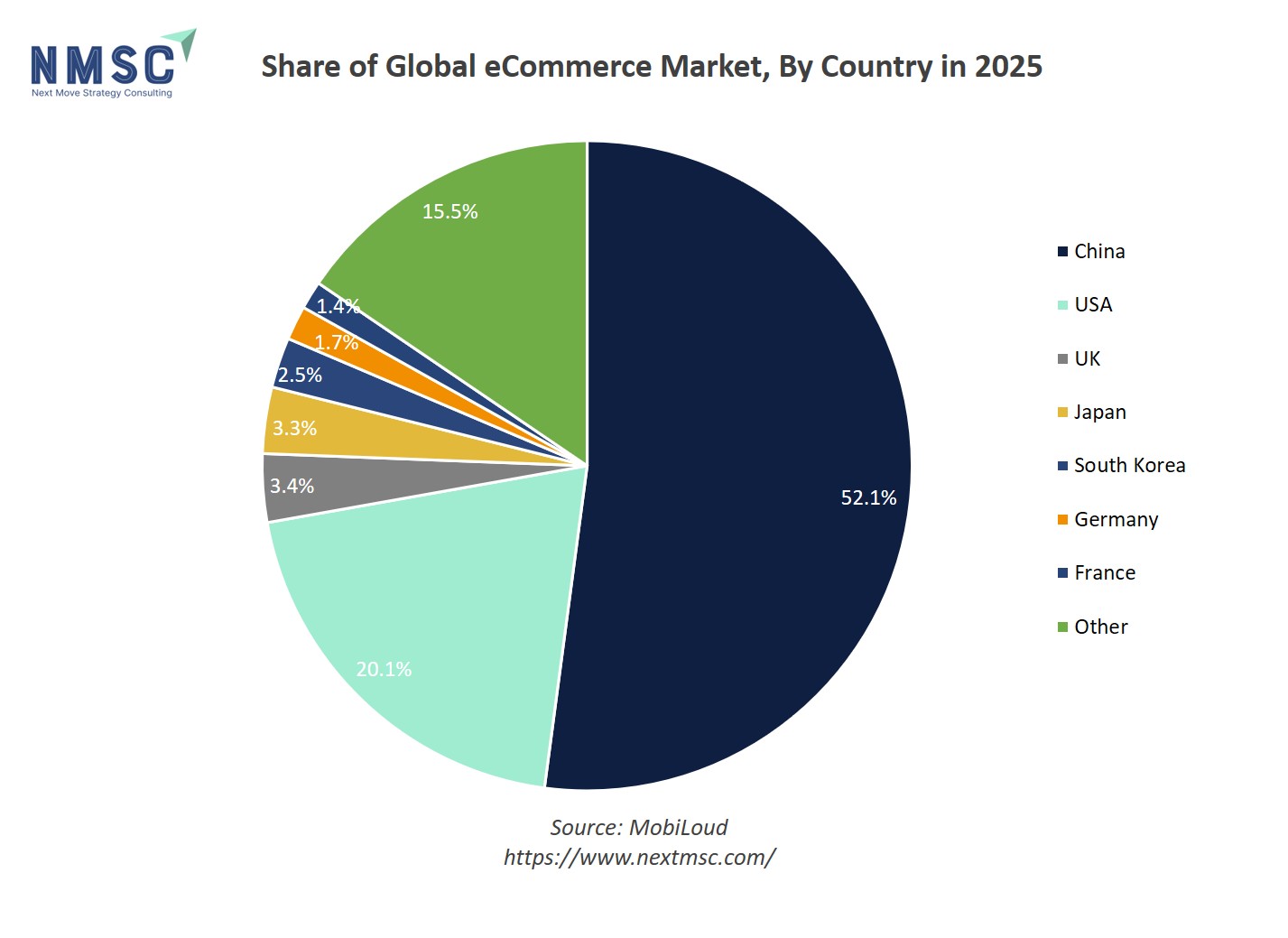

The pie chart depicts the global e-commerce market share by country in 2025, with China leading at 52.1%, followed by the USA at 20.1%. The UK and Japan contribute 3.4% and 3.3%, while South Korea, Germany, and France hold 2.5%, 1.7%, and 1.4%, respectively. The remaining countries collectively account for 15.5% under “Other.” The dominance of e-commerce in countries like China and the USA indicates a significant opportunity for houseware companies to reach consumers through online channels. Digital retail enables convenient access to kitchenware, storage solutions, cleaning tools, and decorative products, particularly for urban and tech-savvy consumers. Markets with smaller e-commerce penetration rely more on physical retail, but global trends suggest growing online adoption is likely to shape houseware distribution strategies worldwide.

Growth Inhibitors:

How Does High Raw Material and Production Costs Fluctuations Limit the Growth of the Market?

One significant restraint in the houseware market is the high cost of raw materials and production. Many houseware products rely on materials such as stainless steel, high-quality plastics, glass, and advanced composites, which have seen price volatility due to global supply chain disruptions and inflationary pressures. These increased costs lead to higher retail prices, making products less affordable for price-sensitive consumers, particularly in emerging markets.

Additionally, investments in modern manufacturing technologies, sustainable materials, and smart home integrations further raise production expenses. As a result, smaller manufacturers struggle to maintain competitive pricing, while consumers delay or limit purchases, moderating overall market growth despite strong demand from urban and high-income segments.

How is Growing Demand for Growing Demand for Smart and Connected Houseware Creating Opportunity for the Market?

A major opportunity in the houseware market lies in the rising demand for smart and connected homeware products. With increasing adoption of IoT devices and smart home technologies, consumers are looking for appliances and household items that offer convenience, automation, and energy efficiency. Products such as smart kitchen appliances, automated cleaning tools, and app-controlled lighting and storage solutions are gaining popularity among tech-savvy urban households. This trend opens opportunities for manufacturers to innovate, differentiate, and offer premium, technology-integrated products. Additionally, combining smart functionality with eco-friendly and space-saving designs attract environmentally conscious and modern consumers, enabling brands to capture new market segments and drive long-term growth in both developed and emerging economies.

How Houseware Market is segmented in this report, and what are the key insights from the segmentation analysis?

By Kitchenware Insights

Which Kitchenware Is Expected to Drive the Houseware Market in 2025?

On the basis of kitchenware, the market is segmented into Cookware, Bakeware, Kitchen Tools, Small Appliances, Food Preparation Accessories, and Others. The Market in 2025 is expected to be primarily driven by Cookware. Cookware continues to dominate consumer preference due to its essential role in daily meal preparation, durability, versatility, and widespread availability across households. It also appeals to consumers seeking efficiency, convenience, and quality cooking solutions, with increasing interest in ergonomic, non-stick, and eco-friendly materials further boosting its market share.

While other segments such as Bakeware, Kitchen Tools, Small Appliances, Food Preparation Accessories, and Others are gaining traction owing to convenience, specialty applications, and lifestyle trends, Cookware remains the backbone of the Kitchenware market. Additionally, the others segment is emerging as a high-potential category, driven by rising consumer interest in innovative, multifunctional, and premium kitchen products that cater to modern cooking habits, compact living spaces, and sustainable design preferences.

By Serveware and Tableware Insights

Which Segment of Serveware and Tableware Is Expected to Lead the Houseware Market in 2025?

On the basis of Serveware and Tableware, the market is segmented into Serveware, Dinnerware, Drinkware, and Table Accessories. The Market in 2025 is expected to be primarily driven by Dinnerware. Dinnerware continues to dominate consumer preference due to its essential role in everyday dining, versatility for both casual and formal meals, and wide availability across households. Increasing demand for durable, aesthetically appealing, and eco-friendly dinner sets further strengthens its market position.

While other segments such as Serveware, Drinkware, and Table Accessories are gaining traction owing to convenience, design trends, and premium or niche offerings, Dinnerware remains the backbone of the Serveware and Tableware market. Additionally, the Table Accessories segment is emerging as a high-potential category, driven by rising consumer interest in stylish, multifunctional, and customizable tableware products that enhance dining experiences and complement modern home decor.

By Storage and Organization Insights

Which Storage Solutions Are Shaping the Future of the Houseware Market in 2025?

On the basis of Storage and Organization, the market is segmented into Food Storage, Household Storage, and Laundry Storage. The Market in 2025 is expected to be primarily driven by Food Storage. Food Storage continues to lead consumer preference due to its vital role in keeping food fresh, reducing waste, and providing convenience for daily meal preparation. Growing demand for modular, airtight, and environmentally friendly containers further reinforces its market dominance.

While Household Storage and Laundry Storage are witnessing increasing adoption due to space optimization and multifunctional utility, Food Storage remains the cornerstone of the Storage and Organization market. Additionally, Laundry Storage is emerging as a high-potential category, fueled by consumer interest in compact, durable, and innovative solutions that enhance household efficiency and organization.

By Cleaning Tools Insights

Which Cleaning Essentials Are Driving Household Efficiency in 2025?

On the basis of Cleaning Tools, the market is segmented into Mops, Brushes, Sponges, Dusters, and Cleaning Accessories. The Market in 2025 is expected to be primarily driven by Mops. Mops continue to dominate consumer preference due to their essential role in maintaining hygiene, ease of use, and versatility across different floor types. Increasing demand for ergonomic, quick-drying, and multi-functional mops further strengthens their market position.

While other segments such as Brushes, Sponges, Dusters, and Cleaning Accessories are gaining traction owing to convenience, specialized cleaning applications, and innovative designs, Mops remain the backbone of the Cleaning Tools market. Additionally, Dusters and cleaning accessories are emerging as high-potential categories, fuelled by rising consumer interest in efficient, compact, and sustainable cleaning solutions for modern households.

By Thermoware and Insulated Products Insights

Which Heat-Retaining Solutions Are Poised to Lead the Houseware Market in 2025?

On the basis of Thermoware and Insulated Products, the market is segmented into Flasks, Casseroles, and Insulated Containers. The Market in 2025 is expected to be primarily driven by Flasks. Flasks continue to dominate consumer preference due to their essential role in keeping beverages and liquids at the desired temperature, portability, and convenience for both home and outdoor use. Rising demand for high-quality, leak-proof, and eco-friendly materials further strengthens their market position.

While other segments such as Casseroles and Insulated Containers are gaining traction owing to home-cooking trends, meal prepping, and multifunctional designs, Flasks remain the backbone of the Thermoware and Insulated Products market. Additionally, Insulated Containers are emerging as a high-potential category, driven by consumer interest in thermal storage solutions for fresh meals, beverages, and on-the-go lifestyles.

By Gift and Decorative Housewares Insights

Which Decorative and Gifting Solutions Are Capturing Consumer Attention in 2025?

On the basis of Gift and Decorative Housewares, the market is segmented into Corporate Gifting Sets, Decorative Items, and Showpieces. The Market in 2025 is expected to be primarily driven by Decorative Items. Decorative Items continue to dominate consumer preference due to their ability to enhance home aesthetics, complement modern interior designs, and reflect personal style. Growing interest in premium, customizable, and eco-friendly décor further strengthens their market position.

While other segments such as Corporate Gifting Sets and Showpieces are gaining traction owing to festive occasions, corporate gifting trends, and luxury positioning, Decorative Items remain the backbone of the Gift and Decorative Housewares market. Additionally, Showpieces are emerging as a high-potential category, fueled by rising consumer interest in curated, artisanal, and multifunctional décor products that combine aesthetics with utility.

By Bath and Sanitary Products Insights

Which Bath and Hygiene Solutions Are Shaping the Houseware Market in 2025?

On the basis of Bath and Sanitary Products, the market is segmented into Bathroom Organizers, Bathroom Storage, and Hygiene Accessories. The Market in 2025 is expected to be primarily driven by Bathroom Organizers. Bathroom Organizers continue to dominate consumer preference due to their essential role in maintaining order, maximizing space, and enhancing convenience in modern bathrooms. Growing demand for stylish, compact, and durable organizers further strengthens their market position.

While other segments such as Bathroom Storage and Hygiene Accessories are gaining traction owing to space optimization, multifunctional use, and lifestyle trends, Bathroom Organizers remain the backbone of the Bath and Sanitary Products market. Additionally, Hygiene Accessories are emerging as a high-potential category, driven by increasing consumer focus on personal care, cleanliness, and innovative, eco-friendly solutions for everyday bathroom use.

By Distribution Channel Insights

Which Channels Are Driving the Growth of the Houseware Market in 2025?

On the basis of distribution channel, the market is segmented into Supermarkets and Hypermarkets, Specialty Stores, Online Stores, and Others. The Market in 2025 is expected to be primarily driven by Supermarkets and Hypermarkets. These channels continue to dominate consumer preference due to their widespread reach, convenience, competitive pricing, and the ability to offer a wide range of products under one roof.

While other channels such as Specialty Stores, Online Stores, and Others are gaining traction owing to niche offerings, personalized shopping experiences, and digital convenience, Supermarkets and Hypermarkets remain the backbone of the houseware distribution landscape. Additionally, Online Stores are emerging as a high-potential channel, fuelled by increasing e-commerce adoption, doorstep delivery, and consumer preference for comparing products and accessing reviews before purchase.

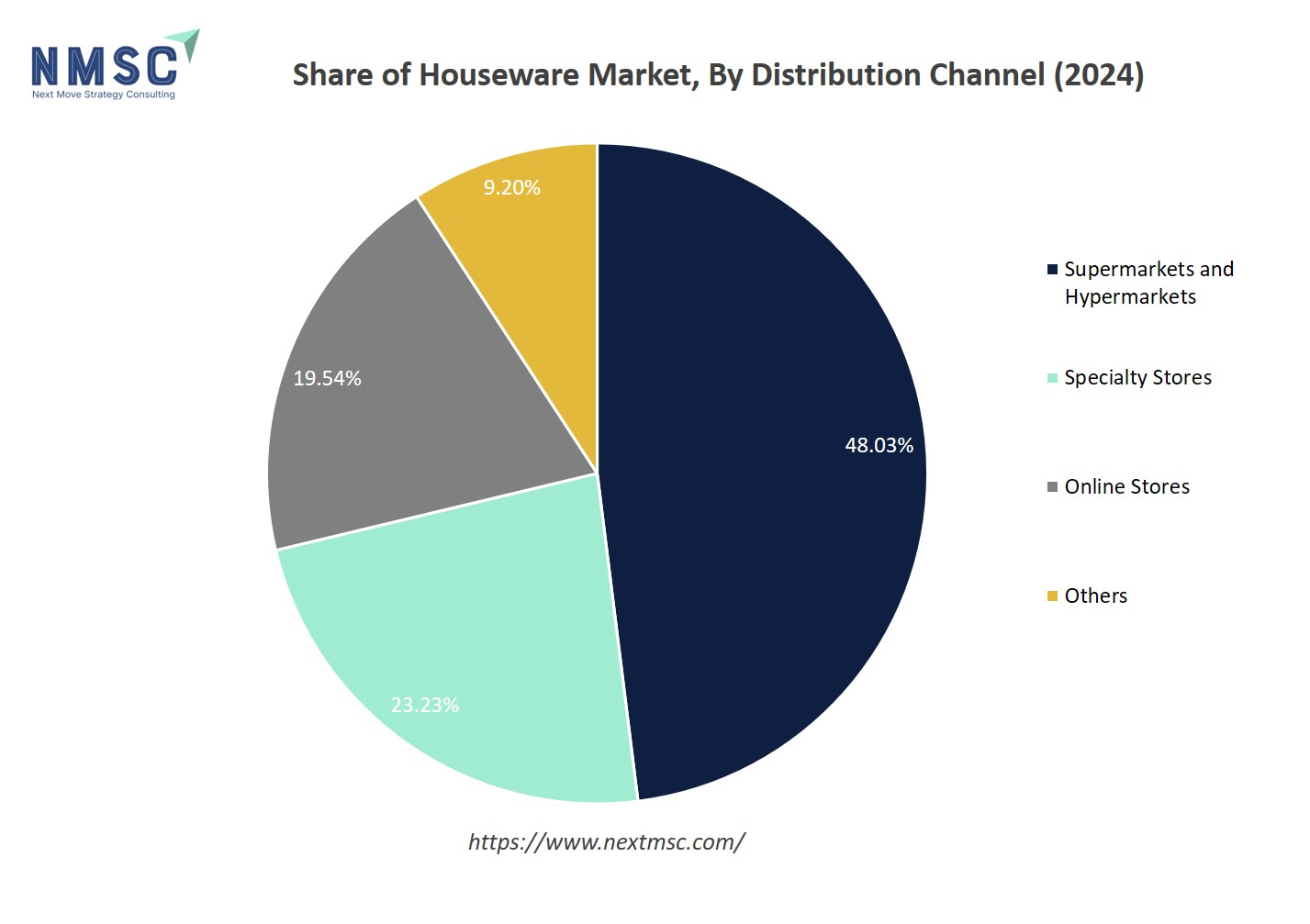

The pie chart illustrates the share of different distribution channels in the global houseware market. Supermarkets and Hypermarkets dominate the market with 45%, reflecting their widespread presence, convenience, and ability to offer a broad range of houseware products under one roof. Specialty Stores account for 25%, serving niche and premium segments with curated and high-quality offerings. Online Stores hold a 20% share, highlighting the growing trend of e-commerce adoption driven by convenience, doorstep delivery, and digital discovery of products. The remaining 10% falls under Others, including local retailers, wholesale distributors, and emerging retail formats.

The data indicates that while traditional retail channels remain the backbone of the houseware market, online channels are gaining significance, shaping marketing strategies, product offerings, and consumer engagement in the industry.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Houseware Market in North America

The North American Market is being driven by urbanization, rising disposable incomes, and changing consumer lifestyles. Increasing demand for multifunctional, space-saving, and aesthetically appealing houseware is fueling growth, while expanding retail networks, including supermarkets, specialty stores, and e-commerce platforms, are enhancing product accessibility and visibility. Consumers are increasingly seeking premium, durable, and eco-friendly home products, creating opportunities for innovative designs, smart home integration, and sustainable materials.

Houseware Market in the United States

In the U.S., market growth is primarily fueled by the adoption of premium, smart, and multifunctional houseware products. Tech-savvy and design-conscious consumers are seeking solutions that combine functionality, convenience, and aesthetics. The expansion of organized retail, online channels, and direct-to-consumer platforms allows brands to reach diverse consumer segments effectively. Innovation in smart home devices, ergonomic designs, and sustainable materials is enabling differentiation and fostering brand loyalty..

Houseware Market in Canada

In Canada, demand is driven by urbanization, higher disposable incomes, and growing preference for eco-friendly and durable houseware. Consumers favor products that are space-efficient, multifunctional, and design-focused, while modern retail formats and e-commerce platforms expand reach and accessibility. Rising awareness of sustainability encourages manufacturers to innovate in materials, energy-efficient appliances, and modular home solutions, aligning with environmentally conscious and lifestyle-oriented consumer preferences.

Houseware Market in Europe

The European Market benefits from a strong focus on sustainability, design, and functionality. Consumers are adopting premium, multifunctional, and eco-friendly houseware with modern aesthetics and durable materials. Growth is supported by retail modernization, expanding e-commerce, and rising awareness of energy efficiency and environmental impact. Innovation in smart appliances, space-saving solutions, and ergonomic designs provides opportunities for brands to cater to varied consumer preferences across the region.

Houseware Market in the United Kingdom

In the U.K., market growth is driven by urbanization, higher disposable incomes, and increasing demand for premium, smart, and multifunctional houseware. Consumers prioritize design, durability, and convenience, while e-commerce and modern retail channels improve product accessibility and choice. Sustainability trends, including eco-friendly materials and energy-efficient solutions, are shaping purchasing decisions. Additionally, government initiatives supporting sustainable housing and modern living further encourage adoption of innovative houseware products, sustaining steady market growth.

Houseware Market in Germany

Germany’s Market is primarily driven by consumers’ preference for premium, multifunctional, and eco-friendly homeware products. Urban populations with higher disposable incomes are increasingly investing in durable, stylish, and space-saving household items such as cookware, storage solutions, and smart appliances that enhance convenience and aesthetics. The market benefits from the expansion of modern retail outlets, specialty stores, and e-commerce platforms, which make products more accessible across urban and semi-urban regions. Sustainability is a significant consideration, with consumers favoring eco-friendly materials, energy-efficient appliances, and recyclable products, encouraging manufacturers to innovate and offer differentiated solutions that combine functionality, design, and environmental responsibility.

Houseware Market in France

In France, the Market growth is supported by urbanization, rising disposable incomes, and a strong focus on health, wellness, and sustainable living. Consumers are increasingly seeking premium, multifunctional, and environmentally conscious products that align with modern lifestyles and eco-friendly values. Retail modernization, including supermarkets, lifestyle stores, and e-commerce platforms, is enhancing product visibility and convenience, allowing consumers to explore diverse houseware options. There is also growing demand for design-oriented, ergonomic, and smart home products, creating opportunities for brands to differentiate through innovation in aesthetics, functionality, and sustainability, catering to consumers who prioritize comfort, style, and long-term value.

Houseware Market in Spain

Spain’s Market is witnessing strong growth, driven by rising urban populations, increasing disposable incomes, and expanding access to modern retail and online shopping platforms. Urban consumers are showing preference for premium, multifunctional, and space-efficient houseware, such as modular storage, smart kitchen appliances, and ergonomically designed products. Sustainability trends and eco-conscious purchasing behavior are encouraging manufacturers to adopt recyclable materials, chemical-free products, and energy-efficient solutions. Additionally, consumers are increasingly looking for products that combine convenience, durability, and aesthetic appeal, creating opportunities for brands to innovate in product design, smart home integration, and lifestyle-oriented offerings.

Houseware Market in Italy

The Italian Market is fueled by growing awareness of health and wellness, urbanization, and rising disposable incomes. Consumers are increasingly seeking premium, multifunctional, and sustainable houseware products that enhance comfort, convenience, and home aesthetics. Modern retail chains, specialty stores, and e-commerce platforms are expanding product accessibility and providing opportunities for impulse purchases and customized offerings. There is a growing trend toward eco-friendly, energy-efficient, and smart home solutions, allowing brands to differentiate through innovation in design, functionality, and sustainability. This focus on wellness and environmentally conscious products is driving both market growth and brand loyalty in Italy.

Houseware Market in the Nordics

In the Nordic countries, the Market is driven by high consumer awareness of wellness, sustainability, and product quality. Urban households with higher disposable incomes are seeking premium, multifunctional, and eco-friendly homeware, including smart appliances, ergonomic furniture, and energy-efficient kitchen and storage solutions. Strong trends toward environmental responsibility and sustainable lifestyles encourage manufacturers to innovate in materials, production methods, and product designs. Modern retail outlets and e-commerce platforms provide enhanced accessibility and convenience, allowing consumers to explore a wide range of products. The combination of functionality, sustainability, and aesthetics supports steady market growth in the region.

Houseware Market in Asia Pacific

The Asia Pacific Market is expanding rapidly, driven by urbanization, rising disposable incomes, and growing health and lifestyle awareness. Countries such as India, China, South Korea, and Australia are witnessing strong demand for premium, multifunctional, and eco-friendly homeware products. Consumers are increasingly seeking space-efficient solutions, modern designs, and smart home-integrated appliances that enhance convenience and lifestyle quality. Expansion of modern retail chains, specialty stores, and e-commerce platforms is improving product visibility and reach. Additionally, rising awareness of sustainability and energy efficiency is encouraging manufacturers to innovate with eco-friendly materials, reusable products, and smart functionalities, creating substantial opportunities for market growth and differentiation.

Houseware Market in China

China’s Market growth is fuelled by rapid urbanization, rising disposable incomes, and increasing demand for premium, multifunctional, and eco-friendly homeware. Urban consumers are seeking durable, space-saving, and aesthetically appealing household products, including smart kitchen appliances, modular storage, and ergonomic furniture. The proliferation of e-commerce platforms and modern retail chains enhances product accessibility across both urban and semi-urban regions. Growing awareness of sustainability, energy efficiency, and environmentally responsible manufacturing is encouraging innovation in materials, design, and product functionality. This combination of rising consumer expectations and technological advancements is driving steady market expansion and creating opportunities for both domestic and international brands.

Houseware Market in Japan

Japan’s Market is shaped by aging populations, high health consciousness, and the premiumization of home and personal care products. Consumers increasingly seek gentle, multifunctional, and ergonomically designed houseware that caters to convenience, wellness, and comfort in daily living. The demand for space-saving, durable, and aesthetically appealing products is rising, particularly among urban households. Accessibility is supported by modern retail chains, specialty stores, and online shopping platforms. Meanwhile, sustainability trends and eco-friendly materials are encouraging manufacturers to innovate with natural, energy-efficient, and environmentally responsible houseware solutions, enhancing product differentiation and brand loyalty.

Houseware Market in India

India’s Market is witnessing significant growth, driven by rapid urbanization, rising disposable incomes, and increasing awareness of modern home solutions. There is a concentrated demand for premium, multifunctional, and space-efficient products suited for contemporary households. Consumers are increasingly seeking eco-friendly, durable, and design-oriented houseware, while the expansion of e-commerce platforms and organized retail enhances product accessibility and variety. Growing health consciousness, changing lifestyles, and a focus on sustainability are encouraging innovation in materials, smart home integration, and multifunctional designs, creating substantial opportunities for both domestic and international brands.

Houseware Market in South Korea

In South Korea, market growth is driven by urbanization, rising disposable incomes, and growing consumer focus on convenience, wellness, and sustainability. Urban households increasingly demand premium, multifunctional, and eco-friendly houseware, including smart appliances, modular storage, and ergonomic furniture. Availability through modern retail outlets and e-commerce platforms ensures broad access to products, while consumers’ preference for durable, energy-efficient, and stylish items is driving innovation. Manufacturers are responding with technology-integrated solutions, eco-conscious materials, and customizable designs, supporting consistent market expansion across urban centers.

Houseware Market in Taiwan

Taiwan’s Market is fueled by health-conscious and lifestyle-oriented consumers, urbanization, and rising disposable incomes. Consumers show strong interest in premium, multifunctional, and sustainable products, including smart kitchenware, modular storage solutions, and ergonomically designed household items. Exposure to global trends encourages adoption of eco-friendly, durable, and chemically safe materials. The growth of modern retail chains and online shopping platforms improves product accessibility, while trends toward sustainability and environmentally responsible designs create opportunities for manufacturers to differentiate through innovation and design aesthetics.

Houseware Market in Indonesia

Indonesia’s Market is driven by rapid urbanization, an expanding middle-class population, and increasing awareness of modern home solutions. Urban consumers demand premium, multifunctional, and space-efficient houseware, while e-commerce and modern retail channels improve accessibility, variety, and convenience. Rising interest in eco-friendly, durable, and chemical-free products encourages innovation in design, materials, and smart functionalities. Manufacturers are introducing innovative, sustainable, and visually appealing products to cater to evolving urban and semi-urban households, creating strong growth potential across the market.

Houseware Market in Australia

Australia’s Market is driven by urbanization, rising disposable incomes, and growing consumer preference for premium and multifunctional products. Urban households increasingly seek eco-friendly, durable, and design-oriented houseware that combines functionality with aesthetics. The expansion of modern retail chains, specialty stores, and online platforms enhances product accessibility and visibility. Additionally, sustainability trends and environmentally conscious purchasing behavior are encouraging manufacturers to innovate with biodegradable, chemical-free, and energy-efficient products, supporting market growth and fostering differentiation among brands.

Houseware Market in Latin America

In Latin America, market growth is fueled by rapid urbanization, increasing disposable incomes, and growing awareness of modern home solutions and wellness. Countries such as Brazil, Mexico, and Argentina are witnessing strong demand for premium, multifunctional, and space-efficient houseware. Expansion of organized retail and e-commerce platforms improves accessibility and variety, while consumer interest in eco-friendly, durable, and design-focused products drives innovation. Urban and semi-urban populations are particularly adopting products that combine functionality, aesthetics, and sustainability, creating significant growth opportunities for both local and international brands.

Houseware Market in the Middle East & Africa

The houseware market in the Middle East and Africa is supported by urbanization, rising disposable incomes, and increasing consumer focus on wellness and modern living solutions. Consumers are seeking premium, multifunctional, and durable houseware products that combine convenience, style, and environmental responsibility. The growth of retail chains, specialty stores, and e-commerce platforms enhances accessibility and visibility across urban centers. Additionally, trends toward sustainable, eco-friendly, and energy-efficient products are encouraging innovation, enabling manufacturers to differentiate their offerings and drive steady market growth across the region.

Competitive Landscape

Which Companies Dominate the Houseware Market and How Do They Compete?

The global houseware market is dominated by both established multinational manufacturers and regional specialists such as Brabantia, Umbra (Umbra Concepts Inc.), Zepter International, Joseph Joseph Ltd., Trudeau Corporation (1889 Inc.), Hamilton Housewares Pvt. Ltd. (Milton), Borosil, All Star Houseware Ltd., Win Top Houseware Co., Ltd., Metline Houseware Ltd., World Houseware Producing Co., Ltd., Saral Houseware Pvt. Ltd. (Esteelo), HUACI Group, Simplehuman, LLC, and QEC Solutions. These companies compete by offering a wide range of houseware products including kitchen accessories, storage solutions, smart homeware, cookware, cleaning tools, and multifunctional home products, targeting mass-market, premium, eco-conscious, and niche segments.

Market leaders differentiate themselves through innovative designs, multifunctional products, premium materials, smart home integration, and sustainable solutions. They also focus on expanding distribution networks, both online and offline, enhancing brand recognition, running marketing campaigns, and diversifying product portfolios. Regional specialists and niche players compete by providing customized, artisanal, eco-friendly, or technology-integrated houseware, catering to local preferences and premium segments. Companies that combine innovation, sustainability, operational efficiency, and modern design trends are capturing market share and building strong consumer loyalty in the global houseware market.

Market dominated by Houseware Market Giants and Specialists

The houseware market is characterized by a dual structure, with large multinational manufacturers coexisting alongside regional and niche players. Large companies leverage brand recognition, extensive distribution networks, and broad product portfolios to offer a wide range of houseware solutions, from mass-market to premium and specialty variants. In contrast, smaller or specialized brands focus on organic, eco-friendly, or customized products, catering to local consumer preferences, wellness trends, or premium segments. This dynamic allows consumers to either rely on established brands for reliability and variety or choose niche offerings that provide unique features, sustainability, or personalized solutions.

Innovation and Adaptability Drive Market Success

Success in the houseware market is increasingly linked to innovation and adaptability. Leading companies are investing in advanced production technologies, sustainable materials, and eco-conscious packaging, while developing multifunctional, ergonomic, and design-oriented products. Trends such as personalization, wellness-focused solutions, and natural or chemical-free materials are shaping product development strategies. Continuous innovation in functionality, aesthetics, durability, and sustainability enables brands to differentiate themselves, strengthen market presence, and build consumer loyalty. Companies that rapidly adapt to evolving lifestyle and sustainability trends maintain a competitive edge in a crowded marketplace.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Mergers and acquisitions have become a prominent strategy for Houseware companies to expand product portfolios, enter new geographic markets, and acquire specialized expertise. Leading manufacturers are acquiring regional or niche brands to strengthen market share, diversify offerings, and integrate advanced production technologies. These M&A activities allow companies to tap into emerging consumer segments, scale operations efficiently, and meet the rising demand for premium, multifunctional, and eco-friendly houseware. By consolidating capabilities and market presence, companies enhance competitive positioning across both mass-market and specialized categories while responding effectively to evolving consumer needs.

List of Key Houseware Companies

-

Brabantia

-

Zepter International

-

Joseph Joseph Ltd.

-

Hamilton Housewares Pvt. Ltd. (Milton)

-

Borosil

-

All Star Houseware Ltd.

-

Win Top Houseware Co., Ltd.

-

Metline Houseware Ltd.

-

World Houseware Producing Co., Ltd.

-

Saral Houseware Pvt. Ltd. (Esteelo)

-

HUACI Group

-

QEC Solutions

What are the Latest Key Industry Developments?

-

July 2025 - Joseph collaborated with the TV series "The Bear" to promote its Space Steel collection, aligning with the show's themes of chaos and order.

-

January 2025 - Umbra showcased its unique spin on decor and storage products at The Inspired Home Show in 2024, highlighting its innovative designs in the housewares industry.

-

January 2025 - Umbra presented a new collection featuring curved, sustainable designs in black wood, emphasizing eco-conscious materials and contemporary aesthetics.

-

February 2024 - Brabantia launched a new garment care collection at The Inspired Home Show, featuring the Refresh and Steam line. This collection offers flexible steaming solutions and space-saving drying options to help users refresh and de-wrinkle garments efficiently.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Houseware Market?

The houseware market is attracting increasing investor interest as global demand rises for premium, multifunctional, and design-oriented household products. Companies that offer innovative, space-efficient, eco-friendly, and technologically integrated houseware are particularly appealing, with investments directed toward scalable production, R&D, and product innovation. Market activity is especially strong in North America, Europe, and Asia-Pacific, where urbanization, rising disposable incomes, lifestyle changes, and growing focus on convenience and sustainability are driving adoption of modern homeware solutions. Strategic mergers, acquisitions, and partnerships by leading manufacturers indicate consolidation as a major growth strategy. For investors, the most promising opportunities lie in companies that combine diverse product portfolios, technological and design innovation, operational efficiency, and the ability to meet evolving consumer preferences across mass-market, premium, and niche segments.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the houseware market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major the global market segments.

Report Scope

|

Parameters |

Details |

|

Market Size in 2025 |

USD 313.83 Billion |

|

Revenue Forecast in 2030 |

USD 388.29 Billion |

|

Growth Rate |

CAGR of 4.35% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

28 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Houseware Market Key Segments

By Kitchenware

-

Cookware

-

Bakeware

-

Kitchen Tools

-

Small Appliances

-

Food Preparation Accessories

-

Others

By Serveware and Tableware

-

Serveware

-

Dinnerware

-

Drinkware

-

Table Accessories

By Storage and Organization

-

Food Storage

-

Household Storage

-

Laundry Storage

By Cleaning Tools

-

Mops

-

Brushes

-

Sponges

-

Dusters

-

Cleaning Accessories

By Thermoware and Insulated Products

-

Flasks

-

Casseroles

-

Insulated Containers

By Gift and Decorative Housewares

-

Corporate Gifting Sets

-

Decorative Items

-

Showpieces

By Bath and Sanitary Products

-

Bathroom Organizers

-

Bathroom Storage

-

Hygiene Accessories

By Distribution Channels

-

Supermarkets and Hypermarkets

-

Specialty Stores

-

Online Stores

-

Others

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on Houseware Market transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Houseware Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst