Middle East Distributed Control System (DCS) Market by Component (Hardware, Software, and Services), by Maintenance Type (Preventive Maintenance, Predictive Maintenance, and Others), by Deployment Type (On-premise, Cloud-based, and Hybrid), by Application (Batch and Continuous Process), by Project Type, (New Construction, Replacement, and Upgrade/Expansion), and by End User (Oil & Gas, Chemicals & Refining, Energy & Power, and Others) - Opportunity Analysis and Industry Forecast 2024–2030

Industry: Semiconductor & Electronics | Publish Date: 11-Sep-2025 | No of Pages: 248 | No. of Tables: 176 | No. of Figures: 121 | Format: PDF | Report Code : SE954

Market Definition

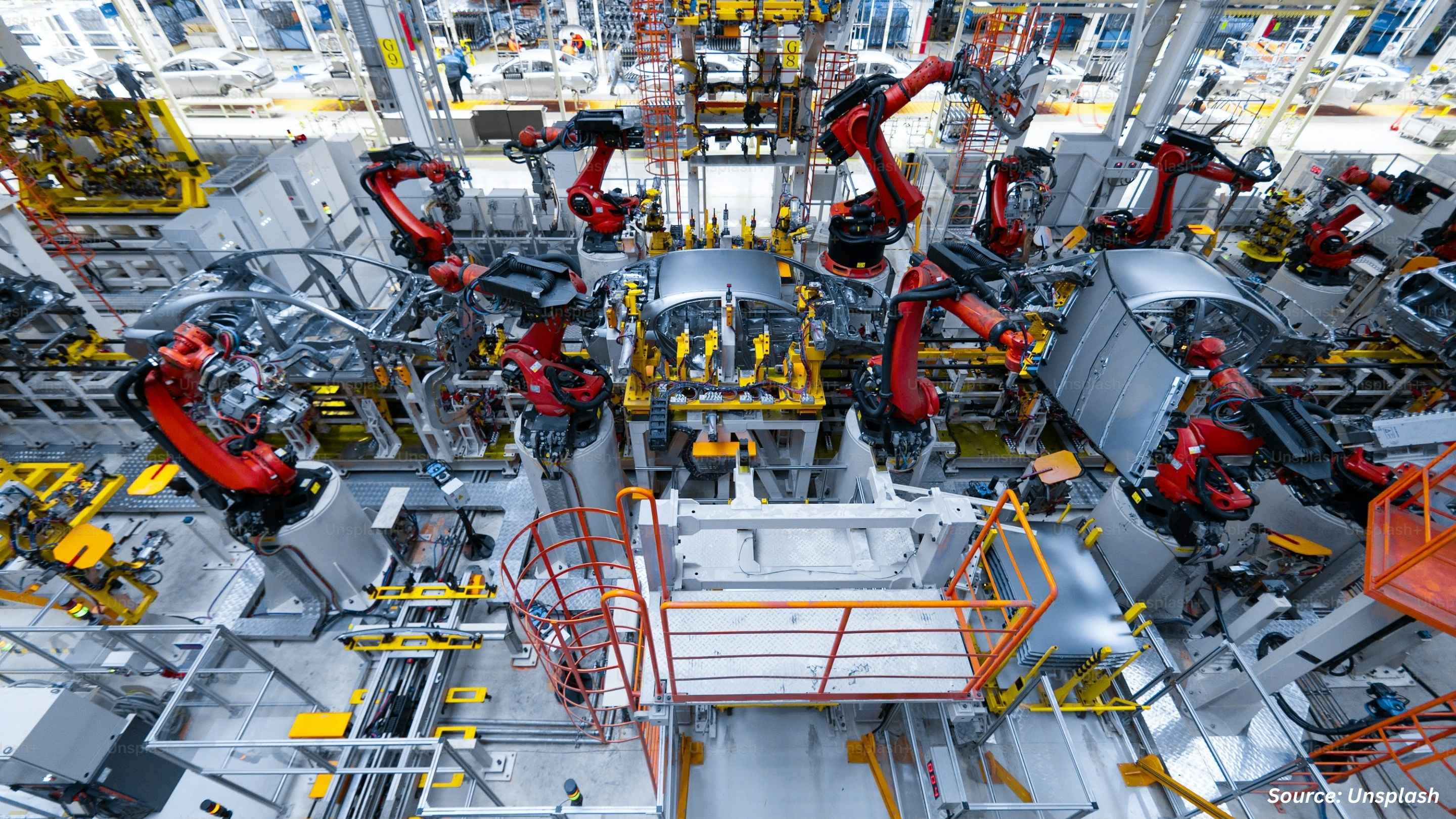

Middle East Distributed Control System (DCS) Market was valued at USD 937.43 million in 2023, and is predicted to reach USD 1333.5 million by 2030, with a CAGR of 5.1% from 2024 to 2030. A Distributed Control System (DCS) is a computer-based control system widely employed to oversee and automate industrial processes. It comprises a network of controllers distributed throughout industrial facilities, facilitating communication and coordination in the automation of various processes. DCS systems find applications across diverse industries, including but not limited to the chemical, petrochemical, pharmaceutical, food and beverage, and power generation sectors.

These systems are particularly valuable in large-scale industrial processes demanding a high level of automation and control, such as those in oil refineries, chemical plants, and power stations. They serve to regulate and oversee a range of operations, including drilling, refining, blending, manufacturing, filtration, and disinfection, ensuring processes run with precision, efficiency, and safety.

The utilization of DCS systems offers numerous advantages, including enhanced process control, heightened efficiency, and improved safety, along with reduced downtime. DCS achieves this by distributing control functions across multiple controllers, providing redundancy and fault tolerance. This means that even in the event of a controller failure, industrial processes can continue to operate without disruptions.

DCS systems have evolved into indispensable components of modern industrial automation setups, substantially enhancing the reliability and efficiency of industrial processes. Furthermore, they contribute to safety by enabling real-time control and process monitoring. They are capable of detecting potential safety hazards and promptly alerting operators to take corrective measures. DCS systems are also instrumental in predictive maintenance, facilitating proactive maintenance practices that minimize downtime. They collect and analyse data from sensors, offering valuable insights for continuous process improvement.

Advancing Renewable Energy Integration with DCS Solutions

As Middle Eastern nations accelerate efforts to diversify energy portfolios, the integration of solar, wind, and other renewable sources has gained strategic importance. Distributed Control Systems (DCS) are central to managing the complexities of these variable energy inputs, enabling real-time monitoring, grid stability, and seamless energy distribution. In countries like the UAE and Saudi Arabia, where large-scale renewable projects are underway, DCS ensures that clean energy infrastructure operates efficiently and aligns with national sustainability goals. The technology's ability to support hybrid systems and microgrid control further strengthens its role in advancing low-carbon energy transitions.

Enabling Automation Across Expanding Industrial Infrastructure

Rapid industrialization and mega infrastructure projects across the Middle East—ranging from smart cities and desalination plants to advanced manufacturing hubs—are driving the need for high-performance process automation. DCS platforms offer scalable and secure control systems that streamline operations in critical facilities such as oil refineries, wastewater treatment plants, and power stations. As governments push for digital-first industrial ecosystems under national visions like Saudi Vision 2030 and UAE’s Industrial Strategy 300bn, the adoption of modern DCS solutions is becoming a core enabler of operational efficiency, safety compliance, and long-term asset optimization.

Increasing Exposure to Cyber Threats Amid Growing Digital Integration of Critical Infrastructure

The increasing digitalization of industrial operations in the Middle East has exposed Distributed Control Systems (DCS) to higher cybersecurity risks. As DCS networks become more interconnected through cloud platforms, remote access tools, and IIoT integration, they also become more susceptible to targeted cyberattacks. Threat actors focusing on critical infrastructure—such as oil refineries, desalination plants, and power grids—pose serious risks to operational continuity and public safety. Despite growing awareness, the region still faces gaps in cybersecurity readiness, particularly in legacy systems with outdated protections. These vulnerabilities can delay DCS adoption, as companies weigh the risks of exposure against the benefits of automation.

Adoption of Scalable DCS Architectures for Smart Industrial Growth

The growing focus on smart manufacturing and adaptive industrial automation across the Middle East is creating strong opportunities for the deployment of scalable, next-generation Distributed Control Systems (DCS). Unlike legacy systems, modern DCS platforms are designed with flexible, open architectures that support modularity, seamless integration with third-party systems, and cloud-enabled operations. These capabilities are highly aligned with regional digitalization strategies aimed at enhancing operational agility and reducing engineering complexity.

Industries in the Middle East—particularly pharmaceuticals, food processing, and advanced materials—are showing increasing interest in modular DCS configurations that allow for incremental expansion and rapid reconfiguration. Such systems support faster project deployment, simplified maintenance, and improved process standardization across multiple sites. With rising investment in localized manufacturing, modular DCS solutions offer a cost-effective path to automation, especially for facilities looking to scale operations without committing to full traditional DCS infrastructure.

Competitive Landscape

The Middle East distributed control system (DCS) industry includes several market players such as Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, Siemens AG, ABB Ltd., Schneider Electric SE, Rockwell Automation Inc., Mitsubishi Electric Corporation, Intech Automation, Hitachi Ltd., Avanceon Ltd, Valmet Oyj, Toshiba Corporation, GE Vernova (General Electric Co.), Azbil Corporation.

Middle East Distributed Control System (DCS) Market Key Segments

By Component

-

Hardware

-

Controller

-

I/O

-

Workstation

-

Networking Hardware

-

-

Software

-

Service

-

Integration and Implementation

-

Managed Services

-

Support and Consultation

-

By Architecture

-

Centralized Controller Systems

-

Hybrid / Distributed Hybrid Systems

-

Fully Redundant High-Availability Systems

By Application

-

Batch

-

Continuous Process

By Project Type

-

New Construction

-

Replacement

-

Upgrade/Expansion

By Plant Size (Controller I/O)

-

Small (Greater than 5000 I/O)

-

Medium (5000 to 15000 I/O)

-

Large (Less than 15000 I/O)

By End User

-

Oil & Gas

-

Upstream

-

Midstream

-

Downstream and Refineries

-

-

Chemicals & Refining

-

Energy & Power

-

Thermal Power Plants

-

Renewable and Battery Storage Plants

-

Nuclear Power Plants

-

-

Pulp & Paper

-

Metals & Mining

-

Pharmaceutical & Biotech

-

Food & Beverages

-

Cement & Glass

-

Water & Wastewater

-

Others

By Region

-

Middle East

-

Saudi Arabia

-

United Arab Emirates (UAE)

-

Israel

-

Qatar

-

Kuwait

-

Oman

-

Other Countries

-

Key Players

-

Emerson Electric Co.

-

Honeywell International Inc.

-

Yokogawa Electric Corporation

-

Siemens AG

-

ABB Ltd.

-

Schneider Electric SE

-

Rockwell Automation Inc.

-

Mitsubishi Electric Corporation

-

Intech Automation

-

Hitachi Ltd.

-

Avanceon Ltd

-

Valmet Oyj

-

Toshiba Corporation

-

GE Vernova (General Electric Co.)

-

Azbil Corporation

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2023 |

USD 937.43 Million |

|

Revenue Forecast in 2030 |

USD 1333.5 Million |

|

Growth Rate |

CAGR of 5.1% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

Adoption of distributed control systems (DCS) in oil and gas industry. The adoption of DCS in mining industry. |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst