Tactile Sensor Market by Technology (MEMS, Capacitive, Piezoresistive, and Others), by Product Type (High-Density Array Sensors, Single Point Sensor, Fingertip Modules, and Others), by Application (Dexterous Robotic Manipulation & Grasping, Precision Assembly & Quality Control, Human-Robot Interaction (HRI) & Safety, and Others), by Industry Vertical (Industrial Automation and Manufacturing, Robotics and Cobots, and Others)– Global Opportunity Analysis and Industry Forecast, 2025–2030.

Industry: Semiconductor & Electronics | Publish Date: 16-Sep-2025 | No of Pages: 1094 | No. of Tables: 706 | No. of Figures: 631 | Format: PDF | Report Code : SE2109

Tactile Sensor Market Overview

The global Tactile Sensor Market size was valued at USD 5.44 billion in 2024 and is predicted to reach USD 9.81 billion by 2030, with a CAGR of 9.6% from 2025 to 2030. In terms of volume the market size was 2473 million units in 2024 and is projected to reach 5408 units in 2030, with a CAGR of 13.1% from 2025 to 2030.

The tactile sensor market refers to the sector focused on the development and application of sensors that detect and measure physical touch or pressure. These sensors convert pressure, vibration, and texture, into electrical signals, allowing machines, robots, or devices to perceive and respond to their environment in a manner similar to human touch. These sensors are crucial in various applications across multiple industry verticals.

They employ advanced technologies such as capacitive, resistive, piezoelectric, and optical sensing to provide detailed feedback on physical contact, thereby enabling improved functionality within complex systems. The market for sensory feedback encompasses their entire lifecycle, including manufacturing, distribution, and application.

Growing Demand For Automation And Robotics Across Industries Boosts The Tactile Sensors Market

Industries worldwide are increasingly adopting automation and robotics to enhance productivity, efficiency, and safety, creating a significant demand for tactile sensors. These sensors are essential components that give machines a sense of touch, enabling them to handle delicate objects, perform precision tasks, and interact safely with human workers. The rapid expansion of industrial automation, particularly in manufacturing, logistics, and healthcare, is a primary driver for the market. As collaborative robots (cobots) and automated systems become more integrated into complex workflows, the need for advanced tactile feedback to ensure accuracy and reduce errors is accelerating market growth.

Rising Adoption Of Advanced Consumer Electronics And Wearables Fuels Demand

The continuous growth and innovation in the consumer electronics sector, including smartphones, wearables, and gaming peripherals, are fueling the demand for tactile sensors. In these devices, sensors are critical for enabling intuitive touch interfaces, force-sensitive controls, and immersive haptic feedback, which significantly enhance the user experience. The trend towards more sophisticated and responsive human-machine interfaces in everyday gadgets, from smartwatches that monitor health metrics to gaming controllers that provide realistic feedback, relies heavily on the integration of high-performance tactile sensors.

Expansion Of The Automotive Sector's Reliance On Sensor Technology Drives Growth

The automotive industry is another key driver for the tactile sensor market, particularly with the development of Advanced Driver Assistance Systems (ADAS) and autonomous vehicles. In modern vehicles, tactile sensors are used for a variety of functions, including in-cabin controls, infotainment systems, and safety features that require precise touch input. As vehicles become more connected and autonomous, the demand for reliable sensors to facilitate seamless interaction between the driver, passengers, and the vehicle itself is expected to grow substantially, further propelling the market.

High Production Costs And Manufacturing Complexity Constrain Market Penetration

Despite growing demand, the adoption of tactile sensors is restrained by high manufacturing costs and technical complexity. The production of high-performance sensors often requires specialized, premium materials and sophisticated engineering processes, which increases the overall unit cost. This can make them prohibitively expensive for mass-market adoption, particularly in price-sensitive industries or for smaller companies. Furthermore, challenges related to scaling production while maintaining high precision and low defect rates can limit availability and slow down widespread integration into new applications.

Integration Of Ai And Advancements In Emerging Technologies Create New Growth Frontiers

A significant opportunity for the tactile sensor market lies in the integration of artificial intelligence (AI) and machine learning. AI algorithms can process and interpret complex data from tactile sensors in real-time, enabling more intelligent and autonomous systems in fields like robotic surgery, advanced prosthetics, and industrial quality control. Additionally, emerging technologies such as quantum sensing, which promise unprecedented levels of sensitivity and precision, are expected to open up new applications. These innovations will likely drive the development of next-generation sensors for use in precision engineering, scientific research, and sophisticated computing systems.

By Type, Resistive Tactile Sensors Holds the Dominant Share in the Tactile Sensor Market

Resistive Tactile Sensors Holds 40.3% share of the tactile sensor industry, these sensors work by detecting changes in resistance when pressure is applied, offering high precision for a variety of applications, including robotics, automotive systems, and consumer electronics. Their ease of integration into existing devices and simple operational mechanisms make them an attractive option for industries that prioritize functionality and affordability.

By Application, Robotics Holds the Highest CAGR of 12.5%

Robotics is expected for significant growth, with a projected CAGR of 12.5%. This expansion is driven by the increasing adoption of automation across various industries, such as manufacturing, healthcare, and logistics. As robots become more integrated into everyday operations, the demand for advanced sensory technologies, like tactile sensors, is rising.

Tactile sensors play a critical role in improving robots' ability to interact with their environment, enhancing precision, feedback mechanisms, and overall functionality. With advancements in sensor technologies, tactile sensors are expected to become more sensitive, adaptive, and reliable, further driving the growth of the robotics sector.

Asia Pacific Region Dominates the Tactile Sensor Market, with the Highest Projected CAGR of 10.7% till 2030

Asia-Pacific region holds the dominant in the tactile sensor market share, contributing 58.9% to the global market in 2024 due to the increasing emphasis on automation for enhancing productivity and competitiveness in the industrial sector. According to the 2023 report from the International Federation of Robotics, China's substantial investment in industrial robotics propelled it to the 5th position in global robot density rankings, surpassing the United States in 2022, with 322 operational industrial robots per 10,000 employees in the manufacturing industry.

In addition, the increasing adoption of these sensors in electronic products in Japan is significantly driving the tactile sensor market growth in the region. As companies incorporate touch sensors into devices such as smartphones and automotive electronics, they aim to enhance user interaction and ensure product reliability. This trend is supported by the growth of the electronic industry, as highlighted by the notable production figures reported by the Japan Electronic and Information Technology Industries Association.

For instance, in February 2024 alone, Japan's electronics production reached an impressive USD 5,839.08 million, with expectations of reaching USD 11,484.87 million by the end of the year. With the electronic sector expected to continue expanding and evolving due to ongoing technological advancements, the demand for these sensors in Japan is set to rise further. This growth trajectory positions Japan as a significant contributor of the Asia-Pacific touch sensor market, reflecting its commitment to advancing technology and delivering high-quality products.

Moreover, the gaming industry in South Korea, characterized by its vibrant esports culture and tech-savvy population, serves as a key driver for the escalating tactile sensor market demand in gaming peripherals. These sensors are integral to devices such as controllers, keyboards, and virtual reality (VR) equipment, enriching user interaction with responsive touch feedback and precise motion tracking.

According to the International Trade Administration's 2023 report, South Korea ranks among the top-four largest gaming markets globally, with over 74% of Koreans aged 10-65 regularly engaging in gaming activities. The country's gaming industry was valued at USD 17.6 billion in 2022. With such rapid growth in the gaming sector, there is a growing need for touch sensors as companies aim to deliver immersive gaming experiences and innovative peripheral devices.

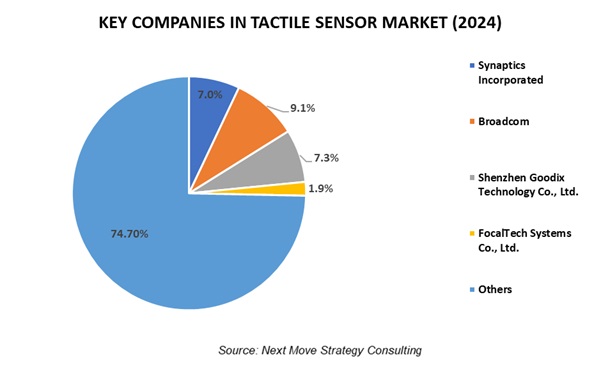

Competitive Landscape

Several key players operating in the global tactile sensor industry include Broadcom, Shenzhen Goodix Technology Co., Ltd., Synaptics Incorporated, ALPS Electric (Cirque Corporation), STMicroelectronics N.V., FocalTech Systems Co., Ltd., Elan Microelectronics, Pressure Profile Systems, AIS Global group (Touch International Inc.), Touchence Inc., XELA Robotics, Contactile, Omron Corporation, Bosch Sensortec GmbH, TE Connectivity, Autonics Corporation, Infineon Technologies AG, Future Electronics, and Mouser Electronics, Tekscan Inc., and others.

Other companies include ForceN, Contactile, Sensobright X-Sensors, and others.

These companies are adopting various strategies including product launches across various regions to maintain their dominance in the touch sensors market. By continuously innovating and launching new offerings, they aim to meet the evolving demands of customers and also enables them to capture new opportunities and expand their market share.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

| February 2025 | Tekscan, Inc. |

Entered into a strategic partnership with FLEXOO to expand printed sensor capabilities.

|

| July 2025 | STMicroelectronics N.V. |

Agreed to acquire part of NXP Semiconductors’ MEMS sensors business for up to US$950 million, expanding its portfolio in MEMS sensors including pressure sensors and industrial/automotive applications. |

|

|

Omron Corporation | Omron noted expanding presence in India for health-devices: building its first manufacturing plant in Chennai to improve access to blood pressure monitors and ECG devices. (This is more medical devices, less explicitly tactile sensors.) |

| August 2025 | Hanwei Electronics Group Corporation |

Presented a new 3-dimensional force tactile sensor at the World Robot Conference 2025, capable of detecting both pressure magnitude and direction in real time. |

| March 2025 | Beijing Tashan Technology Co., Ltd. |

Hosted a visit from the Hong Kong Productivity Council to explore collaboration in AI-driven tactile sensing and embodied intelligence for robotics.

|

| June 2025 |

XELA Robotics Co., Ltd. |

Announced participation in Smart Sensing 2025 in Tokyo to exhibit its latest tactile sensing solutions for robotics. |

Tactile Sensor Market Key Segments

By Technology

-

MEMS (Micro-electromechanical Systems)

-

Capacitive

-

Piezoresistive

-

Piezoelectric

-

Optical Vision Based

-

Triboelectric

-

Magnetic

-

Inductive

-

Others

By Product Type

-

High-Density Array Sensors

-

Single Point Sensor

-

Fingertip Modules

-

Tactile Skin Full Surface Skins

-

Glove Integrated Sensors

-

Pressure Mapping Mats

-

Integrated Sensor Module

-

Vision-Tactile Fusion Modules

By Application

-

Dexterous Robotic Manipulation & Grasping

-

Precision Assembly & Quality Control

-

Human-Robot Interaction (HRI) & Safety

-

Haptic Feedback & User Interfaces

-

Medical & Surgical Assistance

-

Test Measurement and Pressure Mapping

By Industry Vertical

-

Industrial Automation and Manufacturing

-

Robotics and Cobots

-

Healthcare and Medical Devices

-

Automotive and Transportation

-

Consumer Electronics and Peripherals

-

Aerospace and Defense

-

Agriculture Automation

-

Research Education and Labs

-

Other v=Verticals

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Poland

-

Netherlands

-

Austria

-

Sweden

-

Czech Republic

-

Hungary

-

Belgium

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Malaysia

-

Taiwan

-

Thailand

-

Vietnam

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Tekscan, Inc.

-

Pressure Profile Systems, Inc.

-

SynTouch, Inc.

-

Tacterion GmbH

-

Weiss Robotics GmbH & Co. KG

-

Sensor Products Inc.

-

Hanwei Electronics Group Corporation

-

Beijing Tashan Technology Co., Ltd.

-

New Degree Technology Co., Ltd.

-

XELA Robotics Co., Ltd.

-

GelSight, Inc.

-

Baumer Group

-

Omron Corporation

-

Honeywell International Inc.

-

Siemens AG

-

STMicroelectronics N.V.

-

Fujifilm Holdings Corporation

-

Synaptics Incorporated

-

Canatu Oy

-

Peratech Holdco Ltd.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 5.44 Billion |

|

Revenue Forecast in 2030 |

USD 9.81 Billion |

|

Growth Rate |

CAGR of 9.6% from 2025 to 2030 |

|

Market Volume in 2024 |

2473 Million Units |

|

Volume Forecast in 2030 |

5408 Million Units |

|

Growth Rate (Volume) |

CAGR of 13.1% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Market Volume Estimation |

Million Units |

|

Growth Factors |

|

|

Countries Covered |

30 |

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst