U.S. Distributed Control System Market (DCS) by Component (Hardware, Software, and Services), by Architecture (Centralized Controller Systems, Hybrid / Distributed Hybrid Systems, and Fully Redundant High-Availability Systems), by Application (Batch, and Continuous Process), by Project Type (New Construction, Replacement, and Upgrade/Expansion), by Plant Size (Small, Medium, and Large), and by End User (Oil & Gas, and others) - Opportunity Analysis and Industry Forecast 2024–2030

Industry: Semiconductor & Electronics | Publish Date: 08-Sep-2025 | No of Pages: 102 | No. of Tables: 133 | No. of Figures: 78 | Format: PDF | Report Code : SE943

Market Definition

U.S. Distributed Control System (DCS) Market was valued at USD 7.12 billion in 2023, and is predicted to reach USD 10.18 billion by 2030, with a CAGR of 5.2% from 2024 to 2030. A Distributed Control System (DCS) is a computer-based control system widely employed to oversee and automate industrial processes. It comprises a network of controllers distributed throughout industrial facilities, facilitating communication and coordination in the automation of various processes. DCS systems find applications across diverse industries, including but not limited to the chemical, petrochemical, pharmaceutical, food and beverage, and power generation sectors.

These systems are particularly valuable in large-scale industrial processes demanding a high level of automation and control, such as those in oil refineries, chemical plants, and power stations. They serve to regulate and oversee a range of operations, including drilling, refining, blending, manufacturing, filtration, and disinfection, ensuring processes run with precision, efficiency, and safety.

The utilization of DCS systems offers numerous advantages, including enhanced process control, heightened efficiency, and improved safety, along with reduced downtime. DCS achieves this by distributing control functions across multiple controllers, providing redundancy and fault tolerance. This means that even in the event of a controller failure, industrial processes can continue to operate without disruptions.

DCS systems have evolved into indispensable components of modern industrial automation setups, substantially enhancing the reliability and efficiency of industrial processes. Furthermore, they contribute to safety by enabling real-time control and process monitoring. They are capable of detecting potential safety hazards and promptly alerting operators to take corrective measures.

DCS systems are also instrumental in predictive maintenance, facilitating proactive maintenance practices that minimize downtime. They collect and analyze data from sensors, offering valuable insights for continuous process improvement.

Advancements in Smart Manufacturing and Industrial Automation

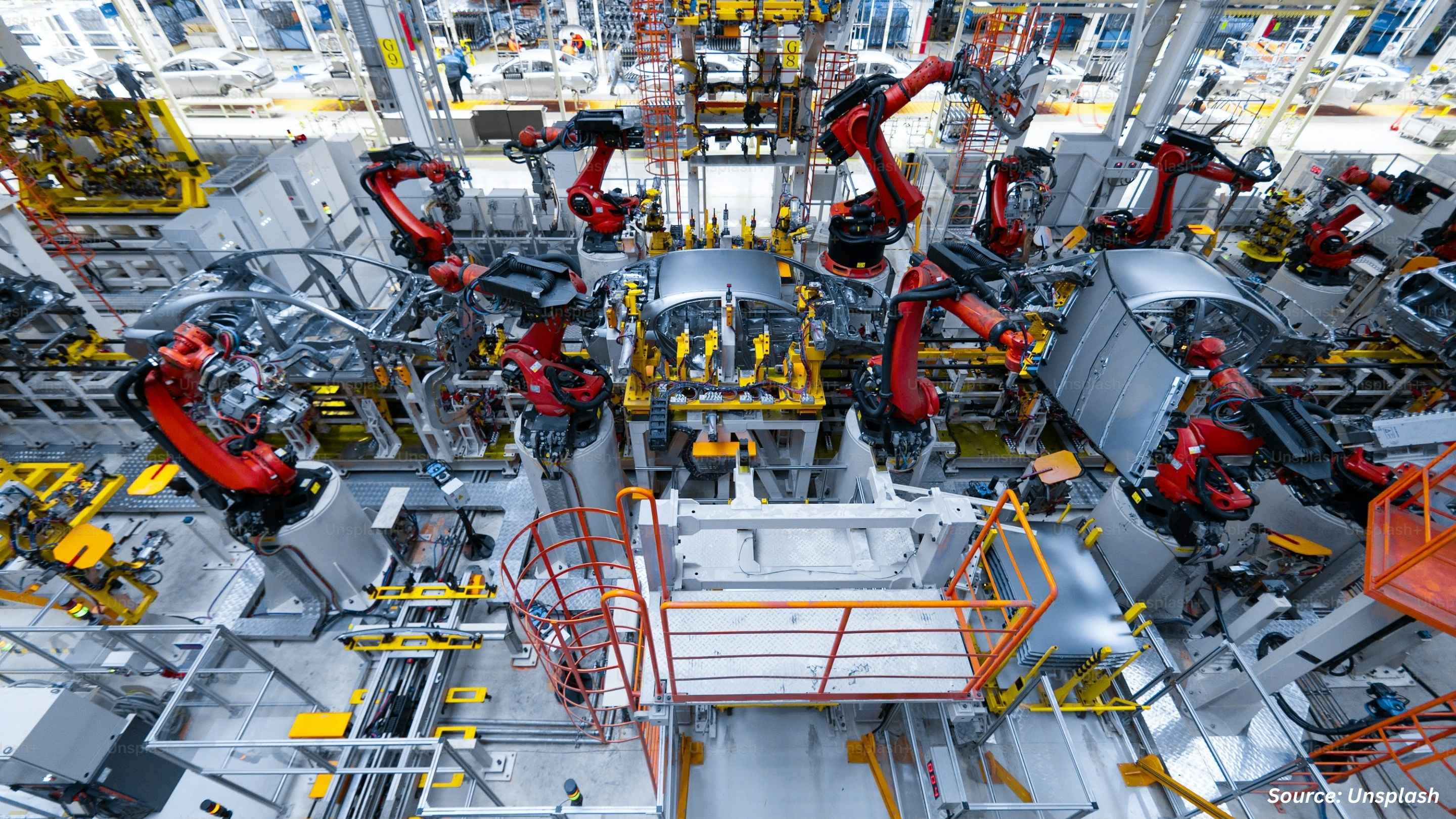

The United States is witnessing a paradigm shift in industrial operations driven by the rapid adoption of smart manufacturing technologies. The integration of Industrial Internet of Things (IIoT), artificial intelligence (AI), and real-time data analytics into production lines is transforming traditional factories into connected, intelligent ecosystems. Distributed Control Systems (DCS) are emerging as the backbone of these developments, offering seamless coordination across multiple processes and enabling predictive maintenance, self-optimization, and enhanced process visibility.

In the U.S., key sectors such as chemicals, pharmaceuticals, food processing, and automotive manufacturing are increasingly deploying DCS platforms to modernize aging infrastructure, reduce downtime, and meet evolving regulatory standards. Federal and state-level initiatives promoting automation and digital transformation in domestic industries are further accelerating the demand for scalable, future-ready DCS architectures.

Energy Transition and Grid Modernization

The growing push for energy diversification and decarbonization is a major catalyst for DCS adoption in the U.S. As the country increases its reliance on renewable energy sources such as wind, solar, and hydro, managing the variability and complexity of these distributed energy resources requires robust, real-time control frameworks. DCS solutions offer advanced load balancing, energy storage integration, and grid stability functions essential to the success of utility-scale renewable projects.

Simultaneously, the modernization of conventional power plants—especially natural gas and nuclear facilities—has created a renewed demand for sophisticated control systems that ensure operational safety, regulatory compliance, and cyber-physical system integration. In nuclear facilities in particular, DCS systems play a critical role in managing safety protocols and process automation under stringent performance standards

Escalating Cybersecurity Risks in Operational Technology Environments

One of the primary challenges restraining the growth of the DCS market in the U.S. is the heightened vulnerability of industrial control systems to cyber threats. As DCS platforms evolve to support remote access, cloud integration, and real-time data exchange, they become more susceptible to cyberattacks targeting critical infrastructure. This concern is especially pronounced in sectors like energy, water utilities, and manufacturing, where operational disruptions can have severe national implications.

Despite growing awareness and federal investments in cybersecurity resilience, many legacy systems in the U.S. industrial base remain inadequately protected. Small to mid-sized enterprises often struggle with budget constraints, outdated protocols, and a lack of skilled cybersecurity professionals. This creates a gap in securing operational technology (OT) environments and slows down the adoption of next-generation DCS platforms that require fortified digital ecosystems.

Rise of Modular, Interoperable DCS Solutions for Mid-sized Industries

An emerging opportunity in the U.S. DCS market lies in the growing preference for modular, interoperable control systems tailored to the needs of mid-sized enterprises. Unlike traditional monolithic DCS models, modern solutions offer flexibility through scalable modules, open architecture, and seamless integration with programmable logic controllers (PLCs), edge devices, and cloud analytics platforms.

This shift is particularly beneficial for industries undergoing phased digital upgrades or transitioning to hybrid manufacturing models. Modular DCS platforms enable cost-effective implementation, reduced downtime, and simplified training for plant personnel. Furthermore, the growing focus on sustainable operations and energy efficiency is pushing businesses to adopt intelligent control systems that can optimize resource usage and minimize emissions—all of which align with the capabilities of modern DCS.

Competitive Landscape

The U.S. distributed control system (DCS) industry includes several market players such as Honeywell International Inc, Emerson Electric Co, Siemens AG, ABB Ltd, Schneider Electric SE, Rockwell Automation Inc, Yokogawa Electric Corp, GE Vernova, Valmet Oyj, Hitachi, Ltd, Azbil Corporation, Toshiba Corporation, Mitsubishi Heavy Industries, Ltd, NovaTech Automation, LLC, Ingeteam S.A.

U.S. Distributed Control System (DCS) Market Key Segments

By Component

-

Hardware

-

Controller

-

I/O

-

Workstation

-

Networking Hardware

-

-

Software

-

Service

-

Integration and Implementation

-

Managed Services

-

Support and Consultation

-

By Architecture

-

Centralized Controller Systems

-

Hybrid / Distributed Hybrid Systems

-

Fully Redundant High-Availability Systems

By Application

-

Batch

-

Continuous Process

By Project Type

-

New Construction

-

Replacement

-

Upgrade/Expansion

By Plant Size (Controller I/O)

-

Small (Greater than 5000 I/O)

-

Medium (5000 to 15000 I/O)

-

Large (Less than 15000 I/O)

By End User

-

Oil & Gas

-

Upstream

-

Midstream

-

Downstream and Refineries

-

-

Chemicals & Refining

-

Energy & Power

-

Thermal Power Plants

-

Renewable and Battery Storage Plants

-

Nuclear Power Plants

-

-

Pulp & Paper

-

Metals & Mining

-

Pharmaceutical & Biotech

-

Food & Beverages

-

Cement & Glass

-

Water & Wastewater

-

Others

Key Players

-

Honeywell International Inc.

-

Emerson Electric Co.

-

Siemens AG

-

ABB Ltd.

-

Schneider Electric SE

-

Rockwell Automation Inc.

-

Yokogawa Electric Corp.

-

GE Vernova

-

Valmet Oyj

-

Hitachi, Ltd.

-

Azbil Corporation

-

Toshiba Corporation

-

Mitsubishi Heavy Industries, Ltd.

-

NovaTech Automation, LLC

-

Ingeteam S.A.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 7.12 Billion |

|

Revenue Forecast in 2030 |

USD 10.18 Billion |

|

Growth Rate |

CAGR of 5.2% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst