Impact of Green Policies and Carbon Regulations on Aluminum Markets

Published: 2025-09-15

The global aluminum market is undergoing a pivotal transformation as environmental sustainability becomes a central focus of policy and industrial strategy. Governments worldwide are implementing stricter green regulations and carbon reduction targets, compelling industries to reassess their production methods and environmental footprints.

In this context, the aluminum sector, long known for its energy-intensive production processes, is facing mounting pressure to decarbonize. This shift is not merely regulatory but structural, influencing how aluminum is produced, traded, and consumed across global markets.

From carbon pricing systems and emissions trading schemes to renewable energy mandates and trade adjustments, green policies are actively reshaping industry operations. At the same time, leading aluminum producers are responding with technological innovations and strategic investments in sustainable practices to align with climate goals and maintain competitiveness.

For the latest market share analysis and in-depth Aluminum Industry insights, Get Your FREE Sample Now!

This blog explores the far-reaching implications of these green policies and carbon regulations on the aluminum market. It highlights the resulting changes in production economics, trade flows, and corporate initiatives that are shaping a more sustainable future for the industry.

The Push for Decarbonization in Aluminum Production

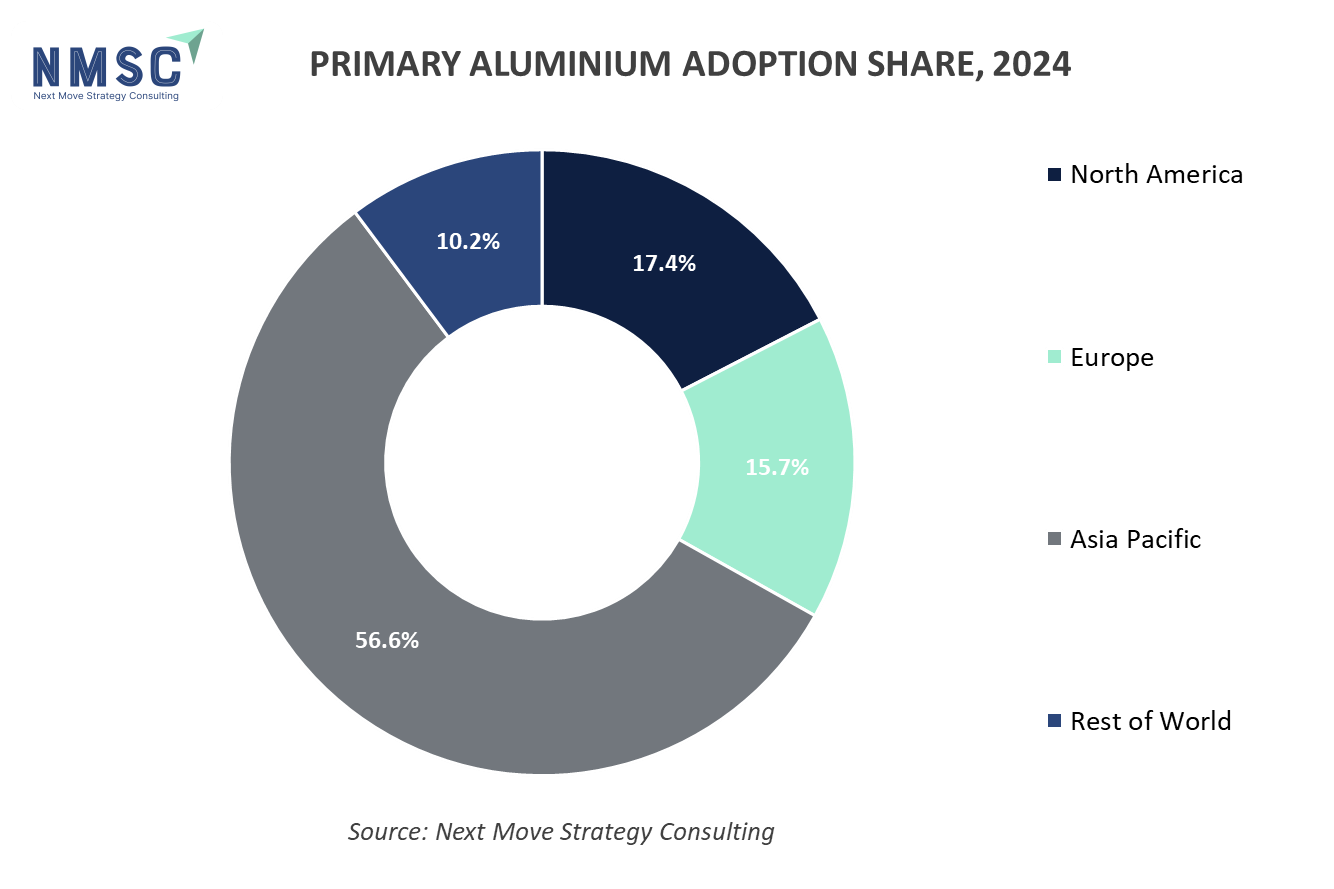

Aluminum production, particularly the primary smelting process, is one of the most carbon-intensive manufacturing processes, due to its reliance on electricity and carbon-heavy methods like the Hall-Héroult process. To address the environmental impact, green policies, carbon pricing mechanisms, and renewable energy mandates are prompting producers to rethink their operations. These regulations, designed to reduce emissions, are also raising production costs, influencing market dynamics in the aluminum sector. The worldwide rate of primary aluminum production is on high rise as depicted in the pie chart below:

Carbon Pricing and Emissions Trading Systems

The introduction of carbon pricing mechanisms has become a powerful lever in driving industrial decarbonization. Schemes like the European Union’s Emissions Trading System (EU ETS) and China’s national ETS are compelling aluminum producers to account for their carbon footprints. Under the EU ETS, companies must buy allowances to cover their emissions, which increases financial pressure on high-emission producers

With the rollout of the EU's Carbon Border Adjustment Mechanism (CBAM) in its transitional phase, importers must now report embedded emissions, a requirement that will soon carry financial implications. Full implementation by 2026 is anticipated to drive increased investment in low-carbon technologies across Europe.

In China, the ETS was expanded in 2024 to include aluminum and other heavy industries. Unlike the EU’s cap-and-trade model, China’s system measures emissions per unit of output, offering some flexibility but still increasing production costs. Future changes, such as auctioning emission permits, are likely to intensify these impacts.

Renewable Energy Mandates and Green Premiums

As countries scale up their renewable energy commitments, aluminum producers are being urged to transition away from fossil fuels. The European Union's updated Renewable Energy Directive sets ambitious targets for renewable energy consumption, prompting smelters to adopt cleaner energy sources.

In the U.S., provisions under the Inflation Reduction Act are offering financial incentives to promote renewable adoption across industrial sectors. This policy environment is enabling producers to explore solar, wind, and hydro-powered operations to reduce their carbon footprints.

The transition has also given rise to the concept of a “green premium”, higher prices for aluminum produced using low-carbon methods. This trend is especially prominent in sectors like electric vehicles and consumer electronics, where sustainable materials are gaining preference among buyers. However, producers without cost-effective access to renewables are finding it challenging to compete in this evolving landscape.

Supply Chain Disruptions and Trade Policies

Green policies are increasingly influencing global supply chains, particularly with the introduction of trade measures such as the Carbon Border Adjustment Mechanism (CBAM). In addition to the existing ban on imports of processed aluminum products from Russia, a new package of measures introduces a ban on primary aluminum imports from Russia into the EU. This ban will be implemented gradually.

During a transitional period, economic operators will still be permitted to import limited quantities of aluminum under a quota system. This quota allows for the import of 275,000 tons—equivalent to 80% of the EU’s imports from Russia in 2024—over a 12-month period. By the end of 2026, the import of any Russian aluminum into the EU will be completely prohibited.

The EU has already seen a notable decline in aluminum imports from Russia, with dependency falling from 16% in 2020 to just 6% in 2024.

Growing Demand for Low-Carbon Aluminum

The global demand for low-carbon aluminum is increasing, driven by sustainability goals in industries like construction and electric vehicles (EVs). The surge in demand for sustainable products, particularly in the automotive sector, is a major driver.

In Asia-Pacific, government policies like India’s Carbon Credit Trading Scheme, which is set to impose mandatory emission reduction targets on aluminum producers starting in 2025, are fueling demand for green aluminum. A 2025 Bureau of Energy Efficiency report outlines specific GHG targets for Indian aluminum plants, projecting a 10% reduction in emissions by 2027.These efforts are encouraging domestic producers to invest in cleaner technologies and meet emission reduction targets.

Shutdowns of Aluminum Plants Due to Emission Issues

Environmental regulations are not only transforming business strategies but also leading to operational shutdowns in some cases. Aluminum manufacturers heavily dependent on fossil fuels are facing mounting pressure to reduce emissions, with some unable to remain viable under stricter environmental mandates.

For instance, the closure of the Rheinwerk plant in Germany by aluminum company Speira highlights the real-world implications of these policies. Tight energy markets and carbon reduction requirements have rendered operations unsustainable in certain contexts, particularly in Europe where energy transition costs remain high.

These developments serve as a warning that adaptation is no longer optional and that sustainability must be embedded in long-term operational strategies.

Conclusion

The push for decarbonization and the implementation of carbon regulations are dramatically reshaping the aluminum market. While these policies increase production costs and disrupt supply chains, they also create new opportunities for innovation and market growth. the future of aluminum production lies in low-carbon technologies and renewable energy.

With growing demand for sustainable aluminum in sectors like automotive and construction, the industry is undergoing a transformation that will shape its future for years to come. Ultimately, these green policies and carbon regulations are driving the aluminum industry toward a more sustainable and resilient future, even as they introduce challenges and complexities along the way.

About the Author

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography.

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment