Industrial Robots Market to Hit USD 88.66 Billion by 2030 Driven by ABB, FANUC, Yaskawa, Mitsubishi, and KUKA

Published: 2025-10-31

As per NMSC analysis, the global Industrial Robots Market is set to maintain strong growth momentum, with the industry size expected to reach around USD 88.66 billion by 2030, marking a solid CAGR of 12.7%. Valued at USD 41.22 billion in 2024, the sector is projected to rise to USD 48.75 billion by 2025. In terms of volume, the market recorded 541 thousand units in 2024, with forecasts indicating growth to 653 thousand units by 2025 and further to 1,288 thousand units by 2030, reflecting a CAGR of 14.5% over the same period.

The industrial robots market growth is undergoing a profound transformation, fueled by rising automation, technological innovation, and the diversification of manufacturing hubs worldwide. Once limited to heavy industries like automotive, industrial robots are now integral to a wide range of sectors including electronics, logistics, healthcare, and food processing.

The industrial robots market demand is accelerating for flexible, AI-enabled, and collaborative robotic systems that enhance productivity, precision, and adaptability. While established markets in Asia-Pacific continue to dominate, regions such as Europe and North America are expanding rapidly, and emerging economies are adopting automation at scale. Together, these shifts are redefining how industries operate and compete globally.

Industrial Robots Market Overview

The global industrial robots market is expanding rapidly as enterprises across manufacturing, logistics, healthcare, and electronics increasingly adopt automation solutions that merge precision, adaptability, and intelligence. Modern collaborative robots are redefining production environments with advanced features such as AI-powered vision systems, predictive maintenance software, collaborative safety protocols, and seamless integration with digital manufacturing platforms.

With the adoption of real-time data analytics, cloud-enabled monitoring, and IoT connectivity, robots now deliver adaptive performance, operational efficiency, and improved quality outcomes. The growing emphasis on smart factories and Industry 4.0 is further accelerating demand, allowing robotic automation systems to seamlessly interact with enterprise IT networks, supply chains, and digital ecosystems while responding intelligently to dynamic operational needs.

Furthermore, the industrial robots market is witnessing rising demand for modular, customizable, and sector-specific robotic solutions across industries such as automotive, semiconductors, food and beverage, and e-commerce. The need for interoperability between robots, production lines, and enterprise systems is fostering innovation in more scalable and integrated platforms.

Both manufacturers and integrators are prioritizing sustainability, safety, and efficiency through energy-optimized drives, low-maintenance designs, and AI-enabled quality control tools that enhance productivity while reducing operational costs. As reshoring, workforce shortages, and digital transformation gain momentum, industrial robots are emerging as central enablers of agile, resilient, and future-ready production strategies, solidifying their role at the intersection of automation, intelligence, and competitiveness.

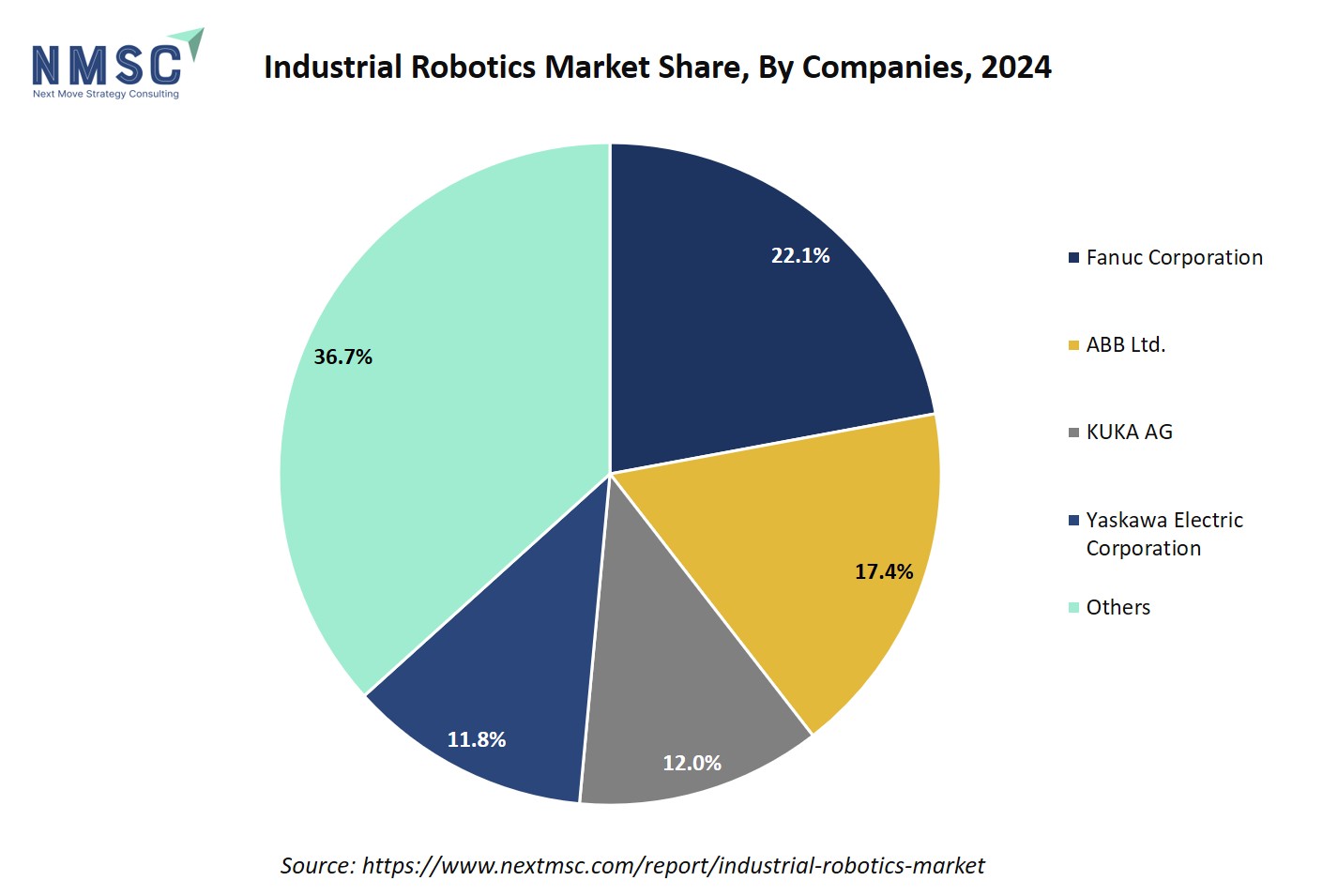

Several major companies dominating the industrial robot industry include ABB, FANUC, Yaskawa Electric, KUKA, and Mitsubishi Electric, among others. These industry leaders are driving innovation in automation through their emphasis on AI integration, cloud connectivity, and user-friendly programming interfaces.

By embedding predictive analytics, IoT-enabled services, collaborative robot designs, and flexible deployment models, they are enabling manufacturers to improve uptime, accelerate changeovers, and scale production efficiently. Their continued investments in sustainable robotics, modular automation cells, workforce training programs, and partnerships with system integrators strengthen global supply chains while supporting digitalized, energy-efficient operations.

These capabilities empower industries to enhance productivity, adapt to labor challenges, and capture new opportunities in advanced manufacturing, positioning these companies as key enablers of the global industrial robots market future.

For an in-depth Analysis of the Industrial Robot Industry, Try a FREE Sample

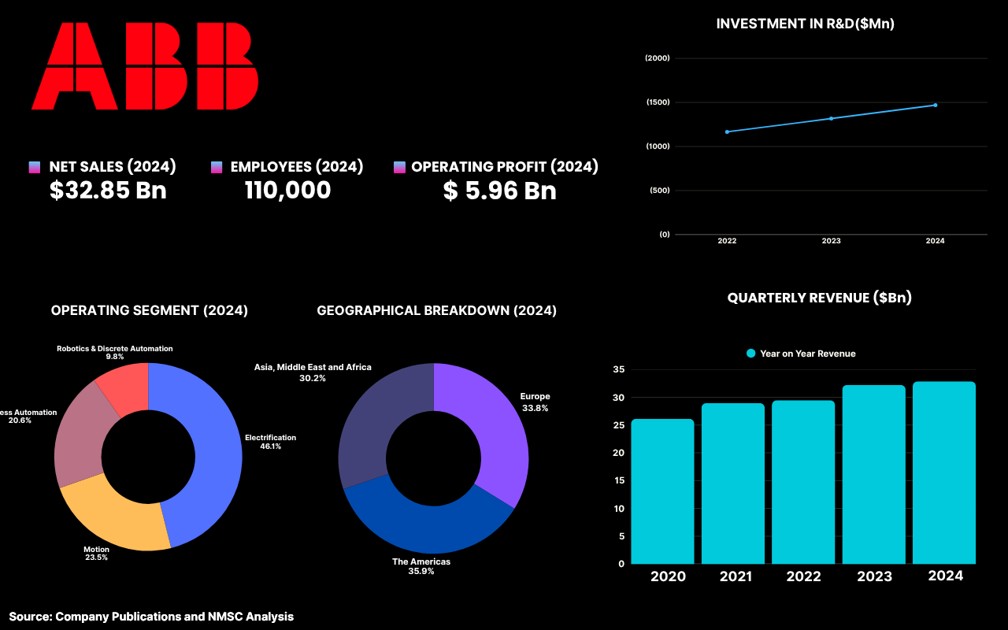

Highlights of Abb Ltd.

ABB Ltd., headquartered in Zurich, Switzerland, is a global leader in electrification, automation, and robotics. The company specializes in providing innovative solutions across various industries, including utilities, transport, and infrastructure. ABB's industrial robotics division plays a pivotal role in its portfolio, offering advanced robotic systems that enhance manufacturing efficiency and flexibility.

The industrial robots market significantly impacts ABB by driving demand for automation solutions that improve productivity and reduce operational costs, thereby reinforcing the company's position in the competitive industry landscape.

In 2024, ABB launched its next-generation robotics control platform, OmniCore, representing a strategic investment of USD 170 million. OmniCore integrates ABB's complete range of hardware and software, enabling faster, more precise, and more autonomous automation. This development enhances ABB's capabilities in delivering advanced, sustainable automation solutions across various sectors.

Additionally, ABB expanded its robot lineup in China with the introduction of three new robot families, Lite+, PoWa, and the next-gen IRB 1200, designed to support the growing mid-market segment. These robots cater to sectors like electronics, food and beverage, and metals, performing tasks such as pick-and-place, basic inspection, and product polishing. The expansion aims to meet the increasing demand for accessible, user-friendly automation solutions in China.

Highlights of Fanuc Corporation

Fanuc Corporation, headquartered in Oshino-mura, Japan, is a global leader in industrial automation, specializing in robotics, CNC systems, and factory automation solutions. With over 1 million robots installed worldwide, Fanuc is a dominant force in the industrial robots market, providing advanced automation solutions that enhance manufacturing efficiency and productivity.

The company's extensive portfolio includes a wide range of robotic arms, collaborative robots (cobots), and CNC machines, catering to diverse industries such as automotive, electronics, and consumer goods. Fanuc's commitment to innovation and quality has solidified its position as a trusted partner for manufacturers seeking to automate their production processes.

In 2024, Fanuc introduced the M-950iA heavyweight industrial robot, capable of handling payloads up to 500 kg. This addition to their product lineup enhances their offerings in heavy-duty automation applications, particularly in industries like automotive and construction. The M-950iA's versatility and precision are expected to strengthen Fanuc's competitive edge in the industrial robots market.

Additionally, Fanuc's expansion into European markets, including increased sales hubs in Spain and facilities in Germany, Italy, and Turkey, reflects a strategic response to rising labor costs and the growing demand for automation solutions in the region. These developments position Fanuc to capitalize on the increasing adoption of robotics in Europe, further solidifying its global industrial robots market presence.

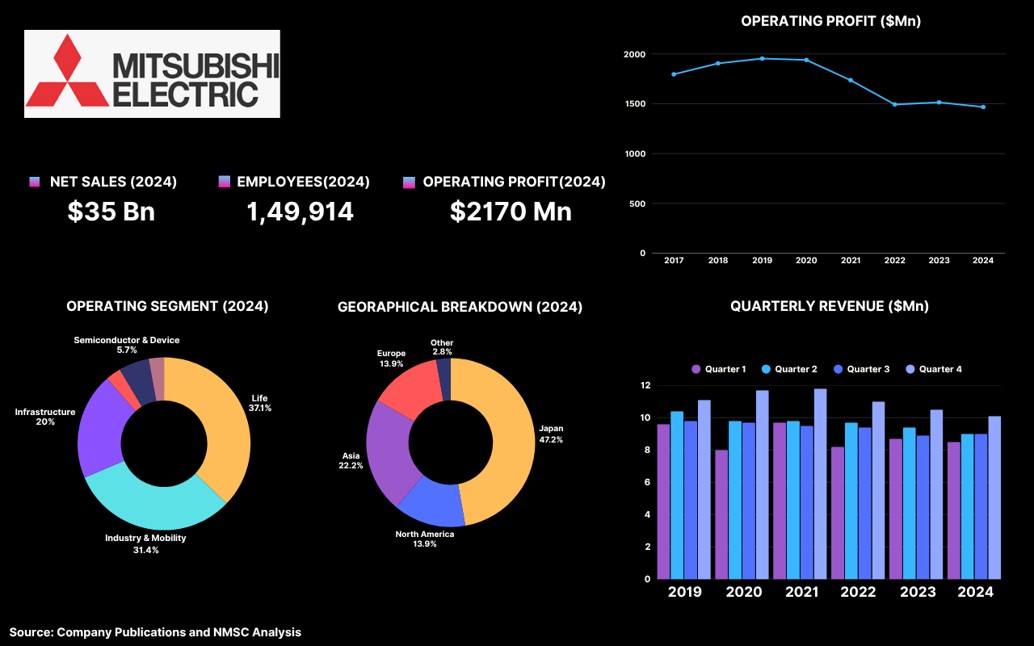

Highlights of Mitsubishi Electric Corporation

Mitsubishi Electric Corporation, headquartered in Tokyo, Japan, is a global leader in electrical and electronic equipment with a long-established factory-automation and industrial-robotics business that spans controllers, drives, machine tools, and the MELFA robot family. The company specialises in high-reliability automation systems, motion control, and integrated solutions for industries such as automotive, electronics, semiconductors and general manufacturing, and it operates global R&D and production networks to support those offerings.

The industrial robots market directly influences Mitsubishi Electric’s product roadmap and commercial strategy by shaping demand for higher-precision manipulators, force-sensing options, and integrated control platforms that tie robots into broader factory-automation ecosystems.

In recent years Mitsubishi Electric has expanded its robot lineup and partnerships to sharpen its competitive position. In October 2024 it launched the MELFA FR PLUS enhancements, featuring the MELFA High Drive function and an expanded force-sensor lineup to boost trajectory accuracy and support force-sensitive tasks.

Also, in March 2025 the company introduced compact SCARA models (RH-10/20CRH) aimed at high-accuracy, space-constrained applications, reinforcing its focus on flexible, easy-to-integrate cells for SMEs and OEMs. Mitsubishi Electric Group also advanced autonomous-material-handling use cases through a large-scale Cartken deployment agreement in June 2025, signalling increased interest in combining manipulators with AMR ecosystems for full-line automation.

Together, these moves broaden Mitsubishi Electric’s product portfolio across payloads and form factors, improve its software/hardware integration story, and position the company to capture growth in precision assembly, logistics automation, and Industry 4.0 retrofits.

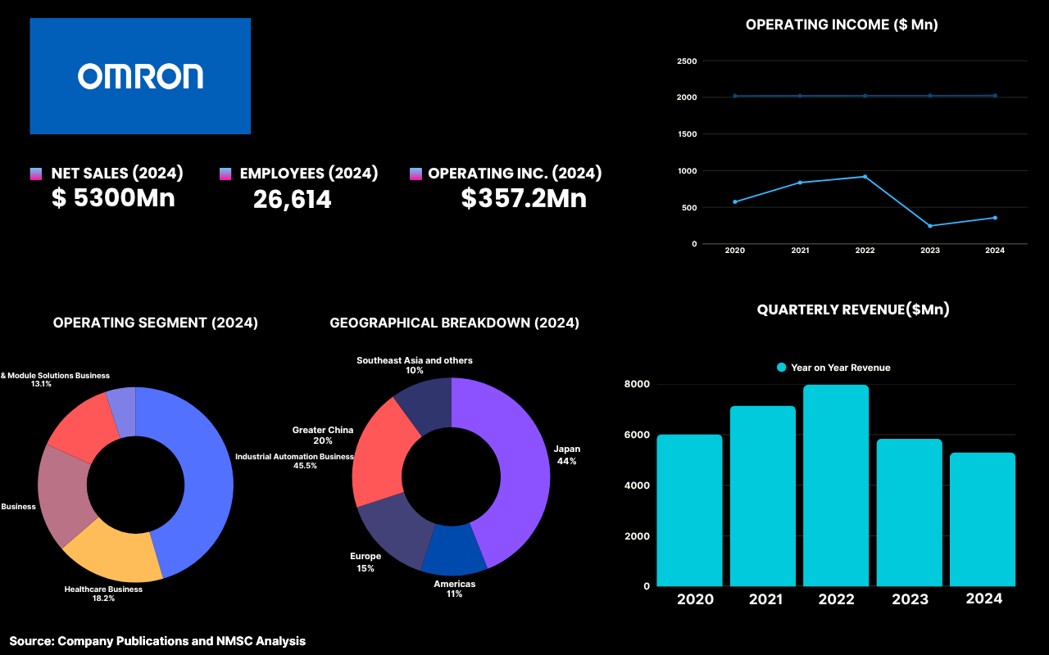

Highlights of Omron Corporation

Omron Corporation, headquartered in Kyoto, Japan, is a global leader in industrial automation, robotics, and healthcare technology. Established in 1933, the company specializes in providing innovative solutions across various industries, including manufacturing, logistics, and medical devices. Omron's industrial robots division plays a pivotal role in its portfolio, offering advanced robotic systems that enhance manufacturing efficiency and flexibility.

The industrial robots market trends significantly impacts Omron by driving demand for automation solutions that improve productivity and reduce operational costs, thereby reinforcing the company's position in the competitive landscape.

In 2024, Omron partnered with Neura Robotics to unveil the iCR cognitive robot at Automate 2024. This collaboration integrates advanced AI and 3D vision technology to enhance the robot's adaptability and performance in complex manufacturing environments.

Additionally, Omron established a dedicated global robotics organization in April 2025 to strengthen its focus on robotics as a core component of its automation solutions. These strategic initiatives position Omron to capitalize on the growing demand for intelligent automation in the industrial robots sector, reinforcing its competitive edge and market presence.

Highlights of Kuka Ag

KUKA AG is a leading global automation company headquartered in Augsburg, Germany. Established in 1898, KUKA specializes in industrial robots, automated production lines, and intelligent automation solutions. As a subsidiary of China's Midea Group, KUKA operates in over 50 countries, employing approximately 15,000 people.

The industrial robots market significantly impacts KUKA, driving demand for advanced automation technologies across various industries, including automotive, electronics, and consumer goods. The company's comprehensive portfolio enables manufacturers to enhance efficiency, flexibility, and scalability in their production processes.

In 2024, KUKA introduced the KR FORTEC industrial robot, designed for heavy-duty applications requiring high payload capacities and extended reach. This addition to their product lineup strengthens KUKA's position in sectors such as automotive manufacturing, where robust and precise robotic solutions are essential. The launch of the KR FORTEC aligns with the growing demand for manufacturing robotics, capable of handling complex tasks with increased efficiency and reliability. By expanding its offerings to include high-performance robots, KUKA aims to meet the evolving needs of its customers and maintain a competitive edge in the industrial robots industry.

Summary of Industrial Robots Market

The global industrial robot market expansion is undergoing a profound transformation, fueled by Industry 4.0 adoption, workforce shortages, and the rising need for efficiency and precision in manufacturing. Once limited to automotive assembly lines, robots have now become integral to diverse industries such as electronics, logistics, healthcare, and food processing, offering scalable, tech-enabled solutions that drive productivity, flexibility, and cost savings.

While Asia-Pacific remains the largest hub for robotics deployment, rising labor costs and reshoring trends are accelerating adoption across North America and Europe, where smart factories and digital ecosystems are gaining momentum.

Technology and sustainability are further reshaping the sector’s trajectory. Vendors are embedding AI-driven vision, predictive maintenance, and IoT-enabled monitoring into robotic systems, enabling adaptive operations, seamless integration, and enhanced uptime. At the same time, growing ESG commitments and regulatory frameworks are pushing for energy-efficient drives, safer collaborative robots, and sustainable automation solutions.

With robust demand across SMEs and large enterprises, and strong investments from global leaders such as ABB, FANUC, Yaskawa, and KUKA, the industrial robot market share is poised for significant growth, solidifying its role as a cornerstone of the future of global manufacturing and advanced automation.

About the Author

Mayurima Roy is a seasoned researcher with over two years of experience, specializing in various industry verticals such as intralogistics software, recycling, electric vehicles, and consumer electronics. With a strong passion for writing, she views blogging as a valuable platform to share her industry insights and expertise. Outside of tracking market trends and developments, Mayurima enjoys crafting, cooking, and exploring her creativity through photography.

Mayurima Roy is a seasoned researcher with over two years of experience, specializing in various industry verticals such as intralogistics software, recycling, electric vehicles, and consumer electronics. With a strong passion for writing, she views blogging as a valuable platform to share her industry insights and expertise. Outside of tracking market trends and developments, Mayurima enjoys crafting, cooking, and exploring her creativity through photography.

About the Reviewer

Sikha Haritwal is a researcher with more than 3 years of experience. She has been keeping a close eye on several industry verticals, including Banking, Financial Services, and Insurance (BFSI), personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography.

Sikha Haritwal is a researcher with more than 3 years of experience. She has been keeping a close eye on several industry verticals, including Banking, Financial Services, and Insurance (BFSI), personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography.

Add Comment