Industrial Robotics Market By Type (Articulated Robots, SCARA Robots, and Others), By Offering Hardware, Software, and Services), By Payload Capacity (≤ 100 KG, 101-200 KG, 201-500 KG and Others), By Mobility (Stationary, and Mobile Robots), By Mounting Type (Floor mounted, Wall-mounted, and Others), By Application (Material Handling, and Others), By Industry Vertical (Automotive, Semiconductor & Electronics, and Others) – Southeast Asia Analysis & Forecast, 2025–2030

Industry: ICT & Media | Publish Date: 01-Nov-2025 | No of Pages: 459 | No. of Tables: 638 | No. of Figures: 583 | Format: PDF | Report Code : IC428

Industry Outlook

The global Industrial Robotics Market size was valued at USD 41.22 billion in 2024 and is expected to reach USD 48.75 billion by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 88.66 billion by 2030, registering a CAGR of 12.7% from 2025 to 2030. In terms of volume, the market recorded 541 thousand units in 2024, with forecasts indicating growth to 653 thousand units by 2025 and further to 1287 thousand units by 2030, reflecting a CAGR of 14.5% over the same period.

Applications now span traditional heavy manufacturing to logistics, food and pharma, and emerging service roles; common use cases include high-throughput pick-and-place, precision welding and assembly, machine tending, automated material handling, and inspection aided by machine vision.

Looking ahead, the field is converging on more capable, flexible systems, from cloud-connected fleets and Robot-as-a-Service models to AI-driven, general-purpose manipulators, which expands robotics into smaller firms and new sectors while reshaping workforce roles toward orchestration, maintenance, and data-driven optimization. Advances in embodied AI and human-robot collaboration point to broader, more autonomous deployments in the coming years.

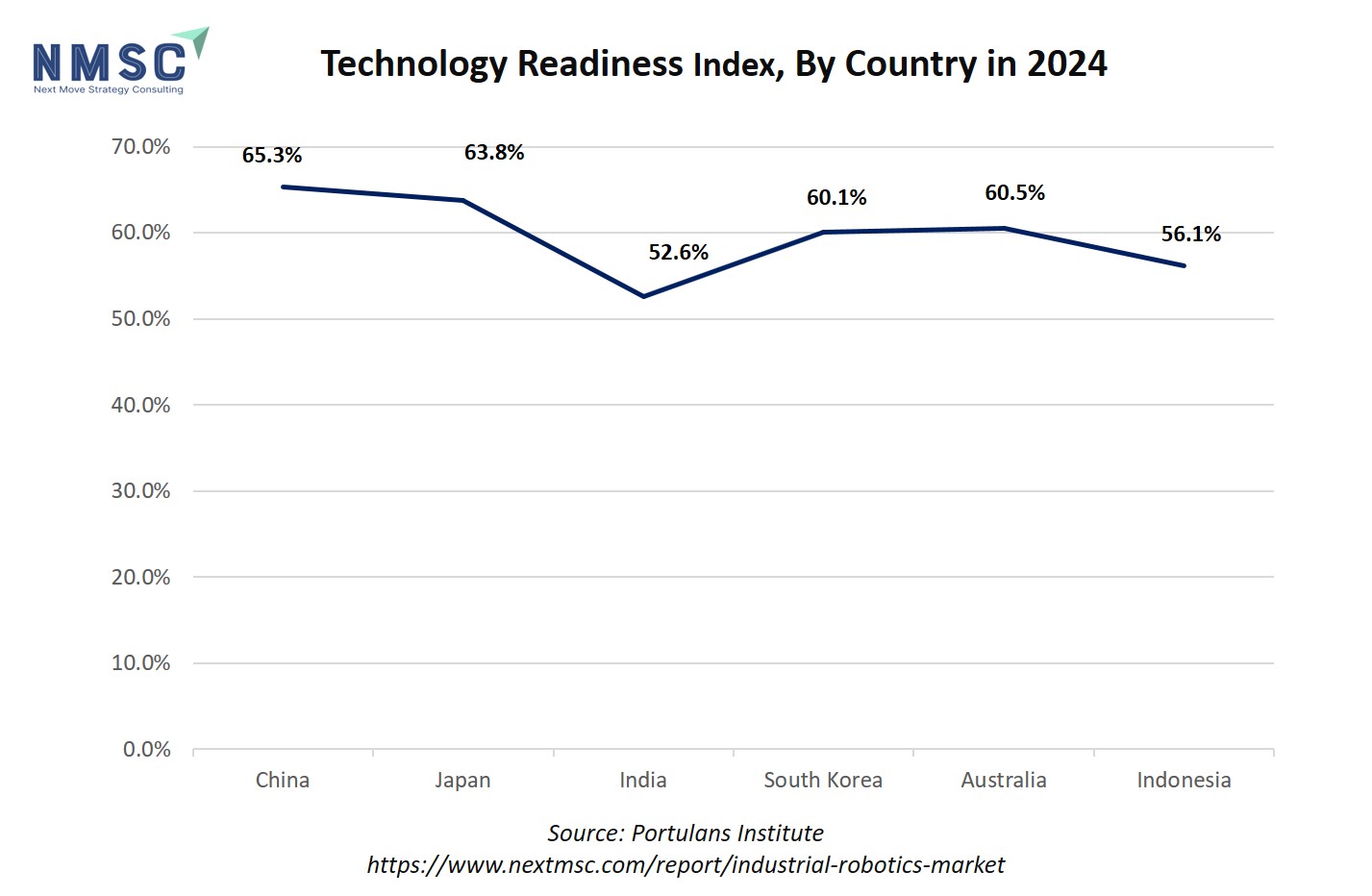

Also, technological readiness significantly impacts the industrial robotics market growth by enabling the adoption and integration of advanced automation technologies such as AI, machine learning, cloud robotics, and IoT. Higher technological readiness facilitates improved efficiency, precision, and cost reduction in industrial operations, which drives demand for robotics automation systems across industries like automotive, electronics, and healthcare. Additionally, readiness in terms of infrastructure, workforce skills, and organizational processes allows manufacturers to effectively implement and scale robotic solutions, fostering market expansion.

The chart shows the Technology Readiness Index of different countries, highlighting the percentage scores for China, Japan, India, South Korea, Australia, and Indonesia. China and Japan lead with higher readiness levels above 63%, while India and Indonesia have lower scores around 52.6% and 56.1%, respectively. This illustrates that countries with higher technological readiness are better positioned to adopt and integrate advanced Industrial Robotics, leading to greater market growth.

What are the Key Trends in the Industrial Robotics Industry?

How are Embodied Ai and Advanced Perception Reshaping the Industrial Robotics Market?

Robots are no longer just programmed arms; advances in embodied AI and on-board perception are letting manipulators reason about messy, real-world tasks and learn from interaction. Robots today handle unstructured tasks once reserved for humans, and several reports note faster progress in humanoid-capable perception and manipulation. That shift means suppliers pair mechanical upgrades with software investment, improving sensor fusion, on-device learning, and simulation-to-reality pipelines, which unlock new use cases while reducing integration time.

Practically, companies have started small with mixed-human/robot workflows that captured labeled interaction data, this lowers risk while creating a proprietary dataset that accelerates performance. For R&D and product teams, prioritizing modular perception stacks and tools to continuously fine-tune models in the field yields outsized returns as embodied AI moves from lab demos to production pilots.

How is Robot-as-a-service (raas) Changing Access to Automation for Industrial Users?

Subscription and outcome-based robotics are finally moving from niche trials to mainstream procurement because businesses want flexibility without big CAPEX. It has been analysed that expanding RaaS deployments across logistics, healthcare, and smaller manufacturers demonstrates that the model lowers the cost and skills barrier while enabling rapid scalability.

For vendors, that means shifting commercial playbooks. Instead of only selling hardware, offering integrated service tiers (deployment, analytics, maintenance) and clear SLAs, customers see measurable productivity gains. For adopters, RaaS is a low-risk way to validate ROI and build internal capability. Companies that instrument robots to deliver near-real-time usage analytics win repeat business because operators prefer transparent, outcome-linked billing.

How are Amrs and Fleet Automation Transforming Warehousing and Industrial Logistics?

Autonomous Mobile Robots (AMRs) and integrated fleet-management platforms are the visible engine behind today’s warehouse modernization, operators are replacing point solutions with coordinated fleets that handle sorting, goods-to-person tasks, and inventory checks. Recent industry material shows strong AMR adoption in response to e-commerce growth and labor shortages, with software & services (fleet orchestration, analytics) becoming the fastest-growing value layer. The implication is clear, where mechanical capability alone won’t win; success depends on scalable orchestration, predictable uptime, and easy integration with WMS/ERP.

Logistics firms’ pilot multi-vendor interoperability tests and insist on open APIs so they can mix best-of-breed AMRs without vendor lock-in. Suppliers, meanwhile, also productize fleet-level features, such as dynamic task allocation, predictive maintenance dashboards, and simple safety certification paths, to move from single-robot sales to enterprise operations contracts.

How are Collaborative Robots and Human–robot Collaboration Evolving on the Shop Floor?

Cobots are maturing from safe boxes to true teammates. Improved force sensing, easier programming UIs, and small-payload agility let them take on assembly, polishing, and inspection tasks that used to need specialized fixturing. Post-2024 analyses point to a recovery and refocusing in the collaborative segment toward flexible, light-payload automation in SMEs and lab-style environments.

For manufacturers, they redesign workcells for fluid human–robot handoffs, map tasks by variability and safety envelope, then deploy cobots where variability is moderate and human oversight adds value. Vendors who bundle simple ROI calculators, turnkey cell layouts, and rapid training packages accelerates deployments among smaller buyers who need fast, visible wins.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Industrial Robotics Industry in the Next Decade?

The industrial-robot industry is in broad commercial deployment. Factories now host millions of operational robots and global robot density has roughly doubled over the past seven years, reflecting faster adoption across Asia, Europe, and the Americas. Automation is moving from isolated cells to connected systems, fleets, vision-enabled manipulators, and cloud/edge software, so providers are packaging hardware with software, services, and integration to deliver outcomes rather than standalone machines.

That shift is being driven by labor constraints, reshoring and productivity needs, plus rapid improvements in AI, perception, and safety that expand use cases beyond repetitive tasks into inspection, flexible assembly, and mixed human–robot workflows. Regional deployment is concentrated in Asia (the majority of new installations) while governments and industrial policy increasingly support automation investments as part of competitiveness strategies.

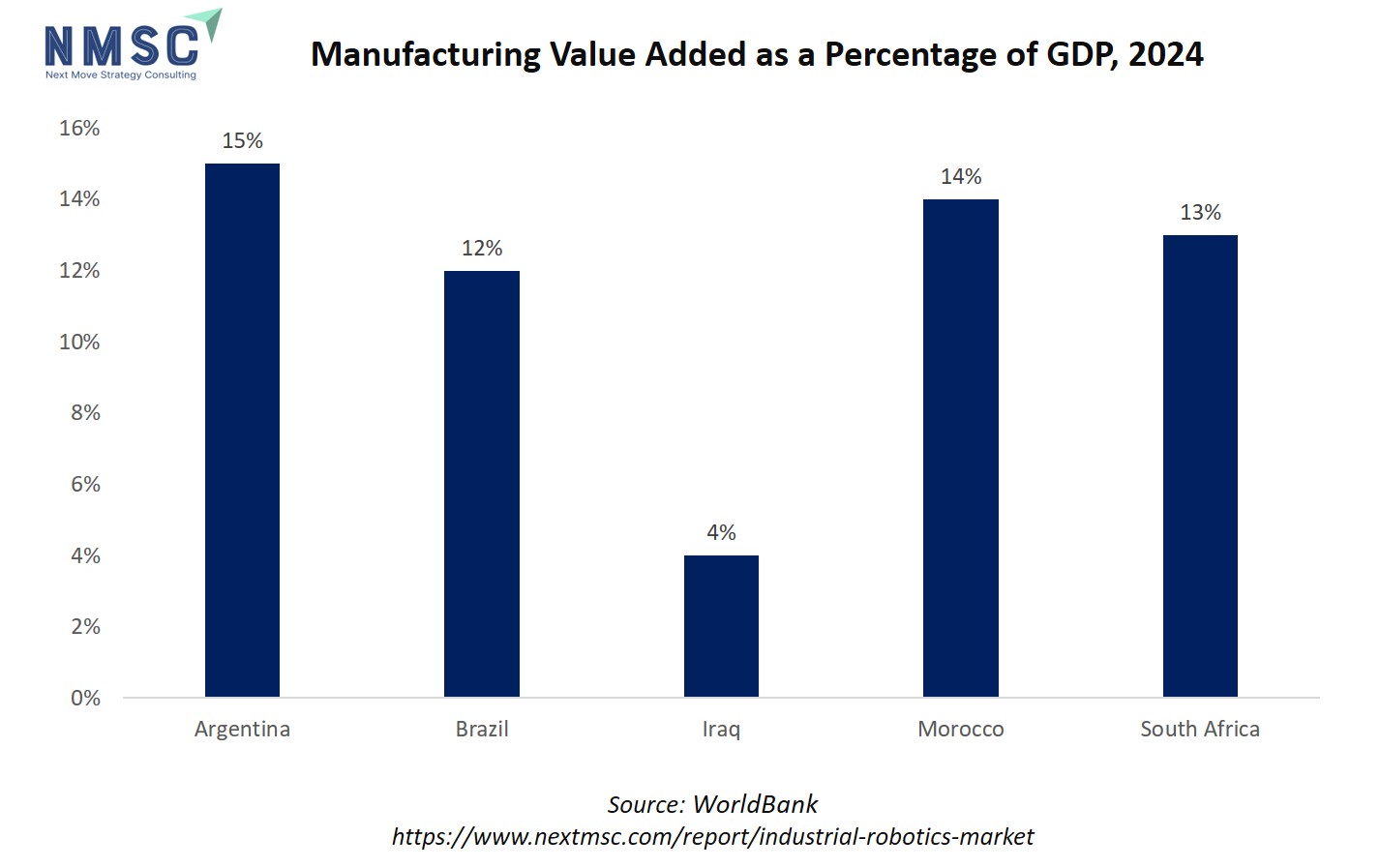

Moreover, manufacturing value added directly influences the industrial robotics market demand because a higher share of manufacturing in a country's GDP reflects strong and expanding industrial activity, which fuels demand for automation to boost productivity, efficiency, and competitiveness.

Nations or regions with a significant manufacturing base are more likely to invest in advanced robotics to optimize their production processes and reduce labor costs, especially as competition intensifies and margins tighten. This industrial expansion not only accelerates the adoption of manufacturing robotics technology but also fosters ongoing innovation and integration of smart manufacturing technologies, thereby driving the market's overall growth trajectory.

The chart presents the manufacturing value added for Argentina, Brazil, Iraq, Morocco, and South Africa in 2024, with values ranging from 4% in Iraq to 15% in Argentina. These figures reflect the relative size and importance of the manufacturing sector within each country's economy. Higher manufacturing value added typically signals a robust industrial base, which increases the demand for advanced manufacturing solutions such as parallel robots. Countries with a greater contribution from manufacturing are more likely to invest in automation to boost productivity, efficiency, and global competitiveness, thereby accelerating the industrial robotics market opportunities.

Growth Drivers:

How does Rising Robot Density and Regional Automation Drive Near-term Growth?

Global robot stock reached over four million operational units, and average factory robot density hit a new high, about 162 robots per 10,000 employees, signaling widespread manufacturing automation. That concentration means new demand not only for arms but for systems, integration, vision, end-effectors, and fleet orchestration.

Companies, therefore, prioritize modular solutions that plug into existing lines and offer clear integration playbooks; integrators and software vendors able to demonstrate fast time-to-productivity will capture the next wave of orders. For regionally focused players, aligning product roadmaps with Asia’s scale-first deployments and Europe’s high-precision needs unlocks complementary markets.

How are Labor Shortages, Demographic Shifts and Supply-chain Rebalancing Creating Sustained Demand?

Aging workforces and persistent hiring difficulty in manufacturing and logistics are pushing firms toward automation as a continuity and quality solution. Governments encouraging onshoring and industrial upgrading are accelerating capital allocation to automation tools, so demand is less cyclical and more strategic.

Practically, vendors offering financing or outcome-based contracts make automation achievable for firms facing short-term cash constraints; buyers prioritizing worker safety and upskilling programs will smooth deployment. Position offerings as workforce-augmentation rather than replacement, and bundle quick-training packages to speed operator acceptance.

Growth Inhibitors:

Why do High Upfront Costs and Integration Complexities Still Restrain Adoption?

High upfront costs, complex integration with legacy lines, and a shortage of skilled integrators remain major brakes on faster adoption. Even with declining per-unit prices in some regions, total project cost plus downtime risk and custom engineering often delays projects. Security and standards harmonization (safety, network, API) also complicate multi-vendor fleets.

To overcome this, vendors are scaling pre-validated, low-disruption retrofit kits and publishing open APIs and certifiable safety modules; buyers are also piloting with short-term performance SLAs to de-risk rollout. Public funding and training partnerships substantially lower the adoption barrier in underserved regions.

Why are Software, Services, and Raas the Strongest Investment Opportunities Today?

Software and services, such as fleet orchestration, predictive maintenance, vision/AI stacks, and RaaS (Robot-as-a-Service) commercial models, present high-leverage openings because they increase recurring revenue and broaden the buyer base. As hardware commoditizes, differentiation shifts to data, uptime guarantees, and outcome-linked billing.

Investors and product teams focus on platforms that enable multi-vendor interoperability, offering strong analytics, and deploying with minimal integration effort; these capabilities convert single sales into enterprise-wide contracts and recurring streams. Demonstrable SLAs and transparent usage analytics are the fastest route to scaling from pilot to fleet.

How is the Industrial Robotics Market Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Type Insights

Which Robot Types are Driving the Industrial Robotics Market In 2024?

Based on type, the industrial robotics market share is segmented into articulated robots, SCARA robots, cylindrical robots, cartesian/linear robots, parallel robots, collaborative robots, autonomous mobile robots (AMRs), automated guided vehicles (AGVs), and other robots.

Articulated arms remain the backbone of industrial automation, accounting for the largest share of new installations due to their multi-axis flexibility and suitability for welding, painting, and complex assembly. Their dominance reflects ongoing demand in automotive and metalworking, where reach and dexterity matter. SCARA units continue to win in high-speed, planar pick-and-place and small-parts assembly (electronics, medical devices). Their speed and compact footprint make them ideal for dense production lines; manufacturers are emphasising quick changeover tooling and embedded vision to keep SCARA attractive as lines shift to smaller batch sizes.

Cylindrical designs persist where simple linear-and-rotary motions and radial access are needed (machine tending, simple handling). They’re cost-competitive for fixed-layout cells. Parallel kinematic robots excel at ultra-fast pick-and-place in packaging and food lines thanks to low moving mass. As e-commerce and fast fulfilment pressure throughput, delta vendors are integrating vision and soft-gripping options to broaden applications beyond standard totes.

Cobots account for roughly ~7% of industrial robot installations and remain the fastest route into SMEs because of safety, ease of programming, and flexible deployment. Use cases cluster around machine tending, assembly and inspection. AMRs, on the other hand, are part of the service-robot surge, and they’re transforming fulfilment and intralogistics by enabling dynamic, multi-path navigation in changing environments.

By Offering Insights

How are Hardware, Software, and Services Shaping the Industrial Robotics Market?

On the basis of offering, the market is segmented into hardware, software, and services.

Hardware remains the largest contributor to industrial robot revenues, as the demand for articulated, SCARA, and mobile robots continues to grow across automotive, electronics, and logistics sectors. The emphasis is on higher payloads, precision, and flexible end-effectors. Companies that offer modular and upgradeable robotic hardware are better positioned to capture retrofitting projects and long-term deployments. Hardware innovation also drives adoption in high-mix, low-volume production lines.

Software is becoming a key differentiator, covering robot programming, fleet management, simulation, and AI-driven vision systems. Integrated software enables predictive maintenance, task optimization, and remote monitoring, improving productivity and reducing downtime. Vendors focusing on cloud-based orchestration platforms or user-friendly interfaces expand adoption, particularly among SMEs seeking automation without extensive in-house expertise.

Services, including consulting, integration, training, maintenance, and Robot-as-a-Service (RaaS) offerings, are growing rapidly, providing recurring revenue and helping companies overcome deployment barriers. By offering turnkey solutions and SLA-backed maintenance, service providers ensure faster ROI and smoother workforce integration. Companies that combine hardware, software, and services in bundled solutions capture larger enterprise contracts and improve long-term client retention.

By Payload Capacity Insights

How is Payload Capacity Driving Industrial Robotics Deployments in 2024?

On the basis of payload capacity, the market is segmented into ≤ 100 KG, 101-200 KG, 201-500 KG, 501-1000 KG, 1001-2000 KG, 2001-5000KG, and more than 5000 KG.

Robots with payloads under 100 KG dominate applications in electronics, pharmaceuticals, and small-parts assembly. Their compact size, high speed, and precision make them ideal for pick-and-place, inspection, and lab automation. The 101-200 KG category is widely used for machine tending, packaging, and moderate-load assembly. Their combination of flexibility and moderate lifting capacity allows deployment in automotive sub-assembly and logistics sorting lines.

The 2001-5000KG is found in steel, shipbuilding, and heavy infrastructure manufacturing. These robots enable handling extremely heavy components safely and efficiently. The ultra-heavy robots cater to niche applications such as aerospace assembly, large-scale construction, and mining operations. The segment is highly specialized, and companies can capitalize by offering custom solutions, lifecycle support, and precision calibration services.

By Mobility Insights

How is Mobility Shaping the Industrial Robotics Market in 2024?

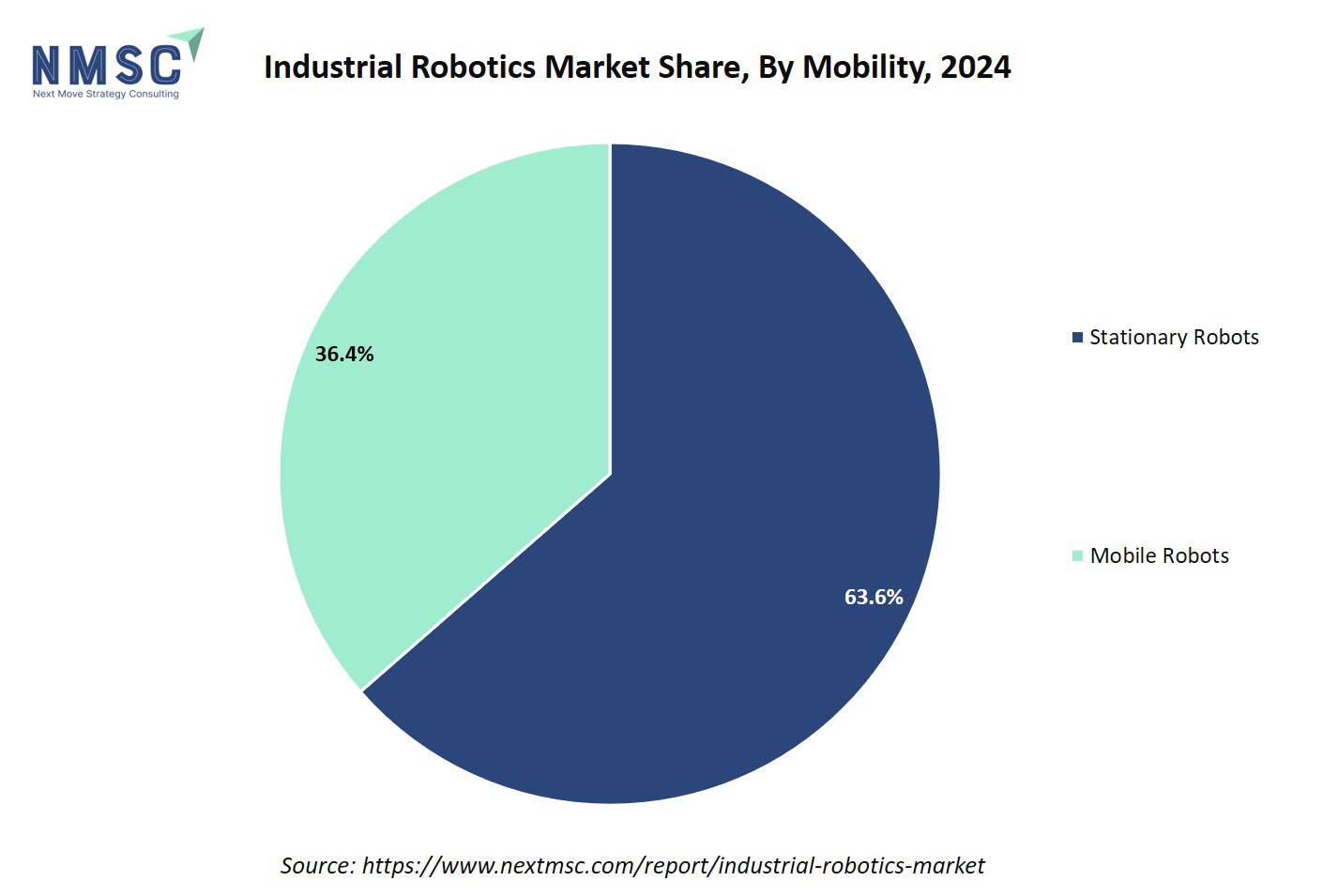

Based on mobility, the market is divided into stationary robots, and mobile robots.

Stationary robots, including articulated, SCARA, cylindrical, and Cartesian types, remain the backbone of industrial automation. They excel in high-precision, repetitive tasks such as welding, assembly, painting, and machine tending. These robots are widely deployed in automotive, electronics, and heavy machinery sectors due to their stability, accuracy, and ability to handle medium-to-high payloads. They possess a market share of around 63% and dominate the current market.

Mobile robots, including Autonomous Mobile Robots (AMRs) and Automated Guided Vehicles (AGVs), are transforming logistics, warehousing, and intrafactory material handling. Unlike stationary robots, they offer dynamic navigation, route optimization, and fleet coordination, allowing manufacturers to reduce labor dependency and improve throughput.

By Mounting Type Insights

How are Mounting Types Influencing Industrial Robotics Deployments in 2025?

Based on the mounting type, the market is divided into floor-mounted, wall-mounted, ceiling-mounted, and rail-mounted.

Floor-mounted robots are the most common, offering stability, versatility, and support for medium-to-heavy payloads. They are widely deployed in automotive assembly, welding, machine tending, and palletizing. Their ease of installation and ability to handle high loads make them ideal for traditional manufacturing setups. Wall-mounted robots are suited for space-constrained environments or where floor space must remain free. Common in electronics, light assembly, and painting operations, they provide reach without obstructing the workspace.

On the other hand, ceiling-mounted robots are deployed in cleanrooms, lightweight assembly, and small-parts handling. By utilizing overhead space, they free up floors and improve workflow efficiency. Rail-mounted robots extend stationary robots along a track to cover large production areas, enabling long-stroke applications such as automotive body painting, panel handling, and heavy logistics. They combine the precision of stationary robots with extended reach.

By Application Insights

Which Applications are Powering the Industrial Robotics Revolution in 2025?

Based on the application, the market is divided into material handling, assembling & disassembling, processing, cleanroom, dispensing, welding and soldering, pick and place, and others.

Material handling remains the largest application for robotic welding systems, including palletizing, packaging, and logistics tasks, covering a market share of approximately 63%. Robots improve throughput, reduce labor costs, and ensure consistency in heavy industries, automotive, and warehousing. Processing robots perform machining, cutting, grinding, and polishing tasks. Their repeatability, durability, and ability to handle harsh environments make them essential in metalworking and heavy machinery production. Integration with sensors and automated monitoring increases efficiency and reduces scrap.

Assembly robots handle electronics, automotive sub-components, and medical devices with precision and speed. Disassembly applications in recycling and remanufacturing are also emerging. Processing robots perform machining, cutting, grinding, and polishing tasks. Their repeatability, durability, and ability to handle harsh environments make them essential in metalworking and heavy machinery production.

Welding and soldering robots are standard in automotive, shipbuilding, and electronics manufacturing. Advanced vision-guided welding and adaptive parameters increase joint quality and reduce rework. Pick-and-place robots dominate electronics, food, and light assembly applications due to speed and precision. Vision guidance, soft grippers, and AI for variable products improve efficiency. Modular, easy-to-program systems appeal to SMEs and high-mix lines.

By Industry Vertical Insights

Which Industry Verticals are Accelerating the Industrial Robotics Market in 2024?

On the basis of industry vertical, the market is segmented into automotive, semiconductor & electronics, plastic and chemical products, metal and machinery, logistics, food & beverages, healthcare & pharmaceutical, and others.

Automotive remains the largest adopter of smart manufacturing robotics, using articulated, SCARA, and welding robots for assembly, painting, and material handling. High automation levels improve productivity, reduce defects, and support complex vehicle variants. Robots in electronics and semiconductor manufacturing perform precision assembly, pick-and-place, dispensing, and cleanroom handling. High-speed, accurate, and small-parts capability is essential.

Logistics and warehousing use AMRs, AGVs, and material handling robots to optimize storage, retrieval, and intra-facility transport. Dynamic routing, fleet management, and WMS integration are key drivers. Adoption grows as e-commerce and last-mile efficiency demand automation. Robots are used in laboratory automation, dispensing, cleanroom handling, and medical device assembly. High precision, traceability, and regulatory compliance are key.

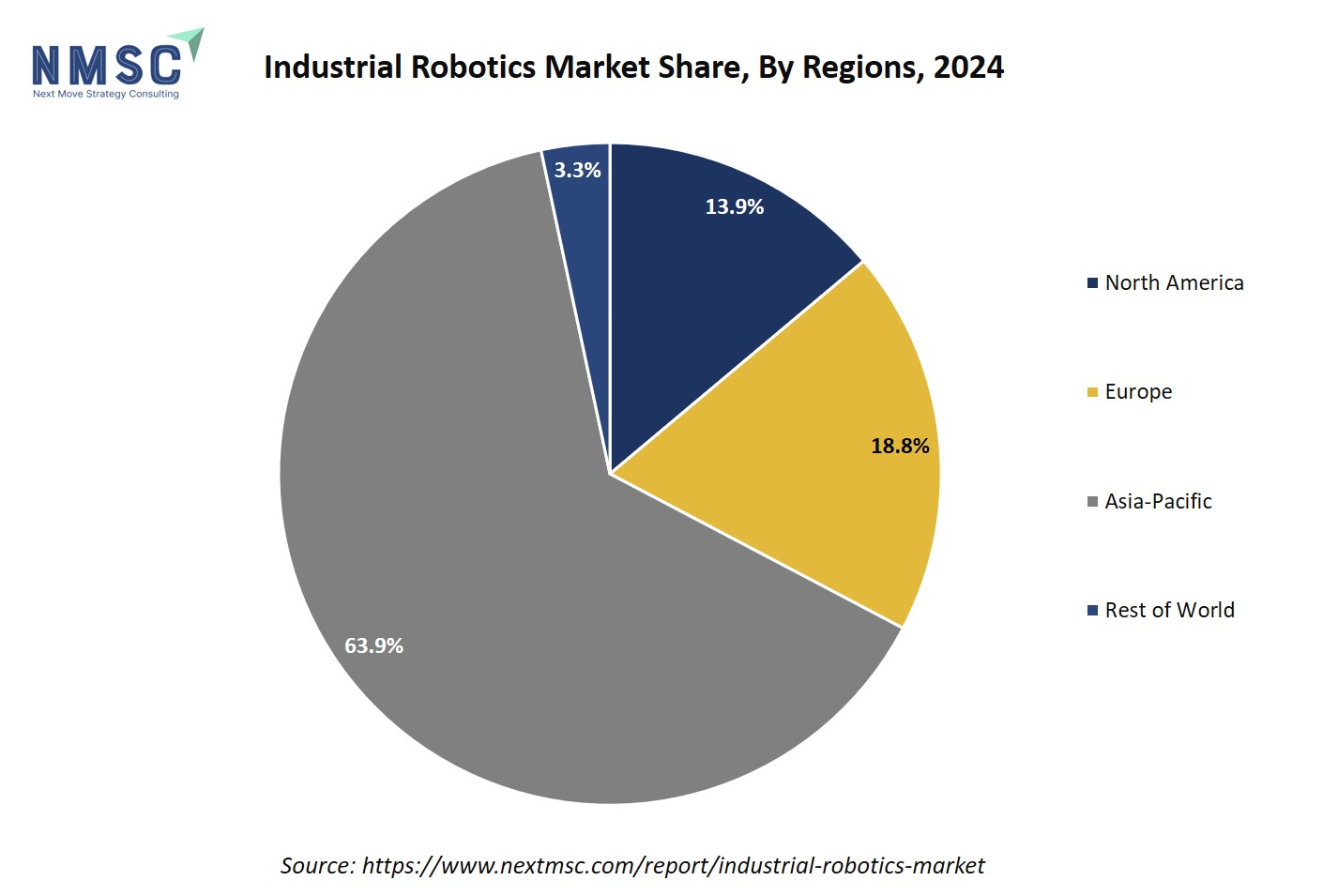

Regional Outlook

The industrial robotics market share is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Industrial Robotics Market in North America

North America’s automation story is driven by mature manufacturing, logistics modernization and fast uptake of smart software on top of robot fleets. U.S. and Canadian firms increasingly pair traditional articulated robots with vision, edge AI and fleet orchestration to squeeze more uptime from existing lines; service models and training are rising as commercial levers. The region still sees strong investment in retrofit kits and software-led differentiation because hardware alone no longer wins, vendors that bundle analytics and maintenance services tend to win larger, multi-site contracts.

Industrial Robotics Market in the United States

The U.S. market blends high robot stock with stronger moves into AI-enabled perception, digital twins and on-site training centers. IFR notes the U.S. operational robot base is large and growing, and suppliers are investing in local R&D and training hubs to reduce integration friction. That focus on software and systems integration is why many OEMs expand service arms and why outcome-based deals (RaaS) are becing attractive to mid-sized manufacturers who cannot swallow big CAPEX easily.

Industrial Robotics Market in Canada

Canada’s robotics ecosystem is smaller but accelerating: businesses report rising AI adoption and pilot robotics programs across manufacturing and logistics. Statistics Canada surveys show AI and automation use are climbing, with a cluster of ~300 robotics firms concentrated in applied research and SME-focused integration. Given its nascent domestic market, Canadian vendors succeed by offering turnkey services, cloud diagnostics, and partnerships with research institutions to de-risk deployments for local manufacturers.

Industrial Robotics Market in Europe

Europe’s pattern is regional specialization. Germany’s precision and Italy’s SME automation co-exist with rising fleet and software demand across the EU. IFR data show Europe remains a major adopter, and differences across economies, Italy’s strong machinery cluster versus Germany’s automotive precision, mean suppliers sell tailored bundles. Robust hardware plus software for predictive maintenance and regulatory compliance. Policy incentives, energy costs, and labour rules shape procurement cycles, so vendors are localizing financing and integration services.

Industrial Robotics Market in the United Kingdom

The UK market combines pockets of advanced adoption with a broader SME gap. Official ONS work on technology adoption highlights that firms with stronger management practices are more likely to integrate AI and robotics; Make UK and industry groups stress targeted support to bring SMEs up to speed. The practical effect is uneven automation: high-value firms push AI-enabled robotics, while many smaller manufacturers still need low-friction, service-backed automation offers and skills programs to scale.

Industrial Robotics Market in Germany

Germany remains a technology leader with strong robotics R&D and established automation OEMs, but competition from low-cost, high-volume producers has pressured margins. Government and industry bodies (VDMA/GTAI) emphasise AI-based robotics and export orientation; still, domestic investment cycles are sensitive to industrial demand and energy costs. Suppliers are prioritizing higher-value software, retrofit solutions, and testbeds that showcase AI-guided welding and inspection to defend share against aggressive international entrants.

Industrial Robotics Market in France

France’s robotics uptake reflects a mix of automotive, aerospace and pharma use, with recent years showing stronger installations and a push into precision assembly and life-sciences automation. Public-private initiatives and cluster programs support adoption of vision-guided robots and cleanroom-compatible cells. For vendors, positioning robots with validated compliance for pharma and traceability tooling attracts buyers facing regulatory scrutiny and quality-driven purchase decisions.

Industrial Robotics Market in Spain

Spain is growing as a European automation market with rising installations in automotive and general industry; recent reports show renewed investment post-COVID, particularly in material handling and packaging. Spanish buyers often prioritize hygienic design and flexible palletizing, plus WMS integrations for logistics hubs. Vendors with strong systems-integration capabilities and regional service networks are capturing the broadening demand across industrial and distribution sectors.

Industrial Robotics Market in Italy

Italy’s industrial structure, many specialised SMEs and strong machinery exports, encourages flexible automation (small-footprint robots, SCARAs, cobots) rather than only heavy payload systems. Central banks and industry studies link robotization to competitiveness in parts and assembly; suppliers that offer quick-change tooling, modular controllers and SME-friendly financing see faster adoption. In short, Italy favors adaptable, cost-efficient automation that fits mixed-product lines.

Industrial Robotics Market in the Nordics

The Nordics combine very high robot densities in pockets with strong emphasis on digitalization and sustainability. Manufacturers there lean into energy-efficient robots, advanced sensors, and cloud analytics to meet strict environmental and efficiency goals. National innovation bodies and export-focused OEMs push AI research into practical use, where predictive maintenance, energy management and multi-robot coordination are common. That creates opportunity for software-first suppliers and for hardware partners providing low-energy, high-uptime systems.

Industrial Robotics Market in Asia Pacific

Asia-Pacific leads global installations, driven by China, Korea, Japan and rising India. The region’s pattern is scale-first automation in big factories plus fast adoption of AMRs in logistics. IFR shows Asia accounts for the majority of new deployments, and the dominant trend is embedding AI and vision on the robot itself to handle unstructured tasks. For vendors, cloud-edge stacks and multi-site orchestration are essential because buyers demand rapid scaling across plants and countries.

Industrial Robotics Market in China

China’s automation push is state-supported and scale-centric. IFR and press coverage document massive installations and rising domestic supplier share. Local makers and policy incentives drive cheaper, higher-volume deployments, with heavy emphasis on robotics for electronics, EVs and consumer goods. The practical outcome is fierce price competition but huge opportunity for software, vision, and fleet orchestration that can tame scale challenges and make large-scale, AI-powered automation predictable.

Industrial Robotics Market in Japan

Japan blends world-class robot manufacturing with steady domestic automation in automotive and electronics; the industry also invests heavily in resilience and embodied AI for high-precision tasks. IFR data show Japan remains a top producer of robot hardware even as the field shifts toward AI-driven perception and simulation-to-reality workflows. This creates a dual market, hardware exports plus domestic pilots for advanced, AI-enabled use cases.

Industrial Robotics Market in India

India is a fast-growing adopter, with IFR reporting a big year-on-year increase in installations as manufacturing and e-commerce scale. National AI and manufacturing strategies encourage local assembly automation and cloud robotics pilots; the practical effect is quick uptake in automotive hubs and warehousing. For suppliers, low-cost deployment models, pay-per-outcome contracts and strong local training enable faster penetration across thousands of SMEs that are just beginning to automate.

Industrial Robotics Market in South Korea

South Korea leads on robot density and combines electronics and the auto industries to sustain very high automation levels. National champions and government R&D push fast perception, 5G-enabled coordination, and factory-scale automation. The upshot is rapid moves from pilot to full-fleet operations, meaning suppliers must support large-scale orchestration, deterministic safety, and close integration with local supply chains to succeed.

Industrial Robotics Market in Taiwan

Taiwan’s market mixes strong component manufacturing with rising domestic automation for semiconductors and electronics. Trade and industry agencies actively promote robotics and chip-linked initiatives that encourage local robot and drone production; exporters remain strong. For robotics firms, Taiwan offers a high-tech buyer base that values integration with precision motion controllers and semiconductor-grade cleanroom compatibility.

Industrial Robotics Market in Indonesia

Indonesia is in early but accelerating adoption. Government AI and industrial roadmaps plus SME incentives are nudging factories and logistic hubs toward automation. Practical drivers are labor shortages in certain sectors and the need to upgrade export competitiveness. While base automation is still limited, momentum is clear, vendors that offer low-CAPEX, scalable AMRs and simple retrofit packages stand to capture early growth as national policy and infra improve.

Industrial Robotics Market in Australia

Australia’s robotics profile mixes strong R&D (CSIRO) with targeted industrial adoption in mining, agriculture and medical. National robotics strategies emphasize niche, high-value systems, autonomous mining vehicles, agri-robots and medical lab automation, rather than mass factory deployment. This drives demand for specialized integrators and reliable, ruggedized hardware plus the AI stacks that support remote operations across large geographies. Local suppliers that package domain expertise with lifecycle support win tenders in resource sectors.

Industrial Robotics Market in Latin America

Latin America shows uneven but rising automation. Mexico and Brazil lead regional installations, driven by automotive, appliance and agritech use cases. IFR regional data and local industry bodies highlight a patchwork of adoption where export-oriented manufacturers and larger firms automate first; smaller firms follow later. For vendors, the pattern demands flexible financing, bilingual service networks and pragmatic ROI cases that address labor, quality and export competitiveness.

Industrial Robotics Market in the Middle East & Africa

The Middle East and Africa exhibit nascent but strategic robotics uptake, GCC states invest in logistics, energy and airport automation while several African countries pilot agri- and mining robots. Surveys show AI and automation are seen as transformational, but infrastructure and skills gaps slow scale. Suppliers combine remote-first support, local training, and solutions tuned for power/heat constraints which can access significant public-sector and natural-resources opportunities.

Competitive Landscape

Which Companies Dominate the Industrial Robotics Industry and How do they Compete?

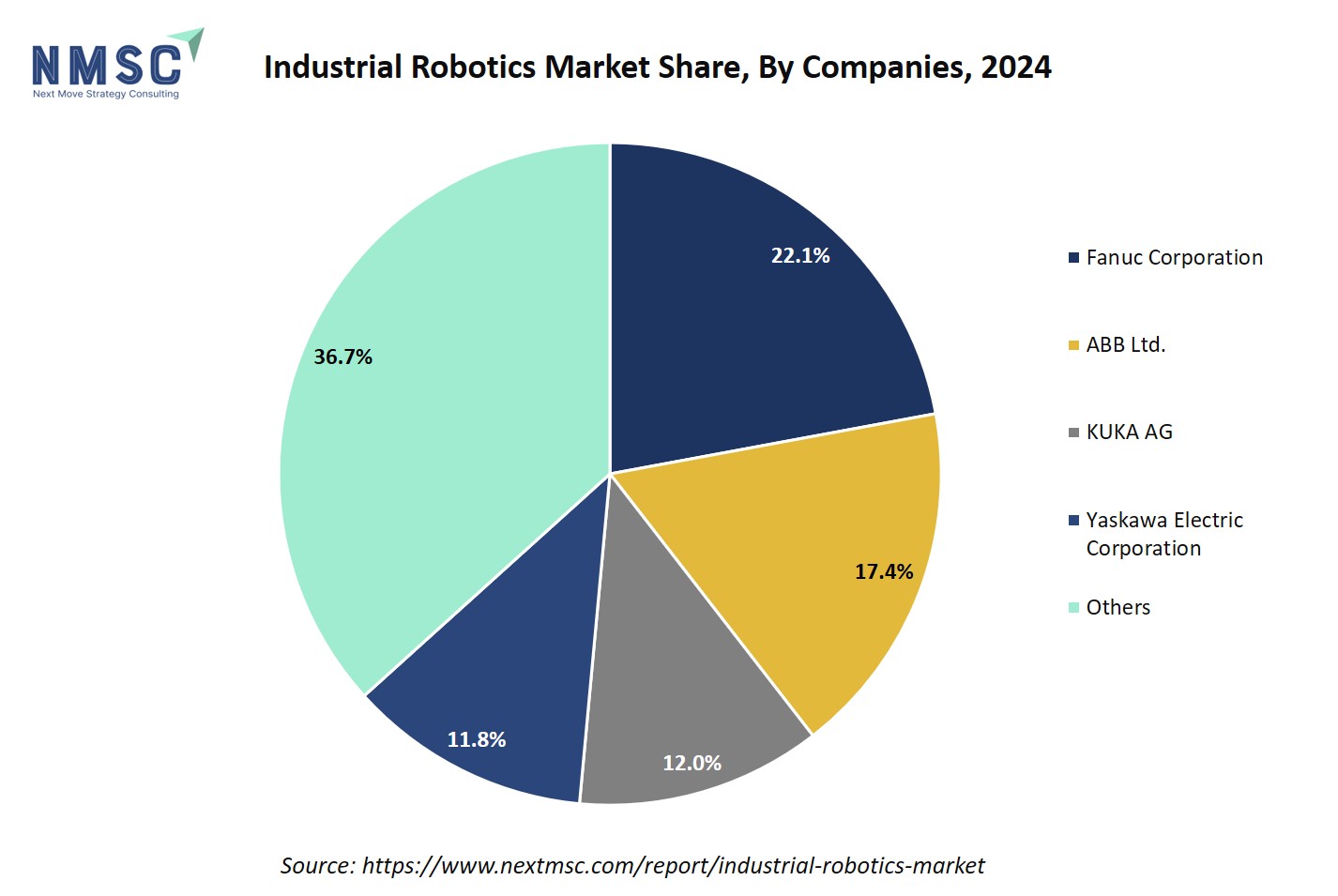

The industrial robotics market is led by prominent companies such as FANUC, ABB, Yaskawa Electric, Mitsubishi Electric, KUKA, Kawasaki Heavy Industries, Denso Wave, Shibaura Machine, Omron, Seiko Epson, Staubli, Kawada Robotics, Yamaha Motor, and NEURA Robotics.

FANUC holds the largest market share globally, renowned for its precision and reliability. ABB, the second-largest player, is undergoing a strategic spin-off of its robotics division to enhance focus and growth potential.

Companies like Yaskawa and Mitsubishi Electric offer versatile robotic solutions, while KUKA and Kawasaki specialize in automation for heavy industries. Emerging players such as NEURA Robotics focus on collaborative and mobile robotics, introducing innovative solutions to meet diverse industry needs.

Market Dominated by Industrial Robotics Giants and Specialists

The industrial robotics market is characterized by a dual structure: established giants and specialized innovators. Companies like FANUC, ABB, Yaskawa, and KUKA dominate high-volume applications with robust, reliable robots. These giants maintain a significant presence in sectors like automotive and electronics.

In contrast, specialists such as NEURA Robotics and Kawada Robotics focus on specific niches, offering tailored solutions that address unique challenges. This division fosters a competitive landscape where large corporations leverage scale and established networks, while specialized firms drive innovation and cater to emerging market demands.

Innovation and Adaptability Drive Market Success

Leading industrial robot manufacturers are investing in advanced technologies to maintain competitiveness. ABB's decision to spin off its robotics division aims to create a more agile entity, enhancing innovation and responsiveness to market changes. Similarly, companies like Yaskawa and Mitsubishi Electric continue to develop versatile robotic solutions that can adapt to various industrial applications.

Specialists such as NEURA Robotics focus on collaborative and mobile robotics, introducing innovative solutions that meet the evolving needs of industries seeking flexible automation. These strategies underscore the importance of innovation and adaptability in sustaining success in the industrial robotics sector.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Mergers and acquisitions are strategic avenues for growth in the industrial robotics market. For instance, ABB's planned spin-off of its robotics division is a move to enhance focus and growth potential. Similarly, companies like Yaskawa and Mitsubishi Electric continue to expand their portfolios through strategic partnerships and acquisitions, strengthening their positions in the market. Specialized firms such as NEURA Robotics also explore collaborations to integrate advanced technologies into their offerings. These strategic moves enable companies to broaden their capabilities, enhance product offerings, and strengthen their market presence in a competitive landscape.

Key Players

-

ABB Ltd.

-

Fanuc Corporation

-

Yaskawa Electric Corporation

-

Mitsubishi Electric Corporation

-

KUKA AG

-

Kawasaki Heavy Industries

-

Nachi-Fujikoshi Corp.

-

Denso Wave Inc.

-

Shibaura Machine CO., LTD

-

Omron Corporation

-

Seiko Epson Corporation

-

Staubli International AG

-

Kawada Robotics Corporation

-

Yamaha Motor Co., Ltd.

-

NEURA Robotics GmbH

What are the Latest Key Industry Developments?

June 2025- Yaskawa Electric plans to invest USD 180 million to build an 800,000 sq. ft. campus in Franklin, Wisconsin, consolidating U.S. operations, expanding training facilities, and increasing robotics and semiconductor production capacity. This investment enhances local manufacturing capabilities and strengthens workforce development in advanced automation.

April 2025- ABB revealed that it will spin off its Robotics division into a separately listed company by Q2 2026. This move aims to sharpen focus, unlock shareholder value, and accelerate robotics-specific research, development, and market expansion.

April 2025- Omron announced the formation of a specialized robotics organization to accelerate customer-focused solutions, streamline global proof-of-concept centers, and integrate AI and IT capabilities. This initiativhe underscores Omron’s commitment to robotics as a core growth pillar and strengthens its position in collaborative and industrial automation markets.

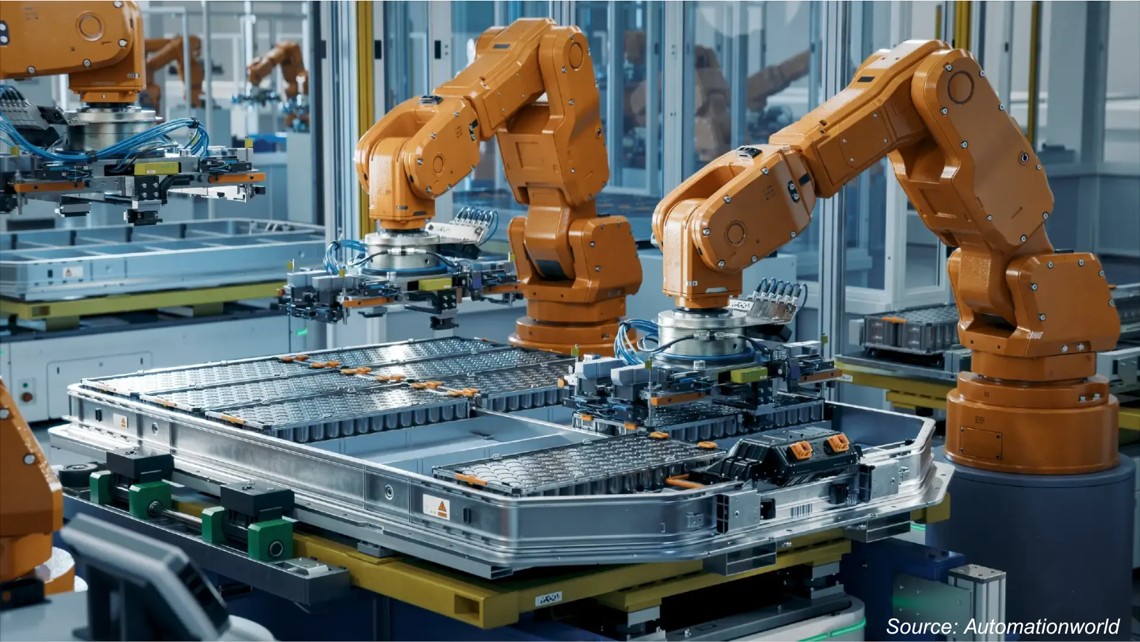

November 2024- FANUC introduced the M-950iA, capable of handling up to 500 kg payloads, designed for large-part manufacturing and EV battery-tray assembly. This strategic launch strengthens FANUC’s position in high-payload applications and supports the growing demand in electric vehicle and heavy manufacturing sectors.

October 2024- Mitsubishi Electric unveiled the MELFA FR PLUS series, offering enhanced drive functions and expanded force-sensor options. The series is aimed at flexible, force-sensitive tasks like assembly and inspection, allowing manufacturers to implement adaptable automation solutions without significant retooling, boosting efficiency and precision.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Industrial Robotics Market?

The industrial robotics market is witnessing strong investment momentum, driven by increasing demand for automation, AI-enabled solutions, and flexible manufacturing systems. Investors are focusing on both established robotics firms and innovative startups, particularly those offering collaborative robots, autonomous mobile robots, and vision-guided systems. Funding trends indicate that strategic partnerships, technology licensing, and software-driven solutions are becoming key drivers for investment decisions, as companies aim to integrate robotics with AI and IoT ecosystems for smarter, more efficient operations.

Investment hotspots are emerging in regions with robust manufacturing bases and supportive government policies. China, Japan, and South Korea lead in adoption due to strong industrial infrastructure and policy support, while North America and parts of Europe are attracting capital through innovation hubs and advanced robotics research centers. These regions benefit from clusters of talent, R&D capabilities, and integration expertise, making them attractive for strategic investments. Overall, the market presents opportunities in AI integration, mobile robotics, and collaborative solutions for diverse industries.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the industrial robotics market trends, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major segments.

The industrial robotics industry creates value for multiple stakeholders by enhancing efficiency, productivity, and technological capability across the manufacturing ecosystem. Investors benefit from high-growth opportunities driven by automation demand, AI integration, and adoption in high-value sectors such as automotive, electronics, and logistics, allowing for strategic returns through equity, partnerships, and M&A activity. Customers, including manufacturers and logistics operators, gain from reduced labor costs, improved precision, faster production cycles, and enhanced safety.

Additionally, access to flexible, AI-enabled robots enables companies to scale operations quickly, adapt to changing market needs, and maintain a competitive advantage, while investors capitalize on the long-term potential of an industry that is central to the future of smart manufacturing and industrial transformation.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 48.75 Billion |

|

Revenue Forecast in 2030 |

USD 88.66 Billion |

|

Growth Rate |

CAGR of 12.7% from 2025 to 2030 |

|

Market Volume in 2025 |

653 thousand units |

|

Volume Forecast in 2030 |

1287 thousand units |

|

Growth Rate |

CAGR of 14.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

28 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Industrial Robotics Market Key Segments

By Type

-

Articulated Robots

-

SCARA Robots

-

Cylindrical Robots

-

Cartesian/Linear Robots

-

Parallel Robots

-

Collaborative Robots

-

Autonomous Mobile Robots (AMRs)

-

Automated Guided Vehicles (AGVs)

-

Other Robots

By Offering

-

Hardware

-

Software

-

Robot Control Software

-

Vision & Perception Software

-

Other Software

-

Services

By Payload Capacity

-

≤ 100 KG

-

101-200 KG

-

201-500 KG

-

501-1000 KG

-

1001-2000 KG

-

2001-5000KG

-

More than 5000 KG

By Mobility

-

Stationary Robots

-

Mobile Robots

By Mounting Type

-

Floor mounted

-

Wall-mounted

-

Ceiling mounted

-

Rail mounted

By Application

-

Material Handling

-

Assembling & Disassembling

-

Processing

-

Cleanroom

-

Dispensing

-

Welding and Soldering

-

Pick and Place

-

Others

By Industry Vertical

-

Automotive

-

Semiconductor & Electronics

-

Plastic and Chemical Products

-

Metal and Machinery

-

Logistics

-

Food & Beverages

-

Healthcare & Pharmaceutical

-

Others

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on Industrial Robot’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Industrial Robotics Market Report serves as an indispensable resource for navigating the evolving landscape.

The industrial robotics market is poised for sustained growth, driven by advancements in AI, collaborative robotics, and autonomous systems, as well as rising automation across diverse industries. Strategic takeaways for stakeholders include the importance of investing in innovation, integrating software and AI capabilities with hardware, and targeting high-growth regions with supportive policies and manufacturing ecosystems.

Companies that focus on adaptability, turnkey solutions, and strategic partnerships or M&A will strengthen their market position. Looking ahead, the industry is expected to expand into emerging sectors, capitalize on labor-optimization trends, and continue evolving toward intelligent, connected, and flexible robotic solutions that redefine manufacturing, logistics, and service operations globally.

Speak to Our Analyst

Speak to Our Analyst