How Digital Revolution is Shaping the U.S. Insurance Market

Published: 2025-09-11

The U.S. insurance industry is undergoing a significant transformation driven by technological advancements and shifting consumer expectations. Fintech companies are playing a pivotal role in reshaping insurance payments and enhancing operational efficiencies. At the same time, the broader trend of digitalization is revolutionizing the industry. This blog explores the impact of fintech innovations on insurance payments, the challenges faced by the industry, and the ongoing digital transformation.

Fintech Companies Transforming Insurance Payments

Digital Transformation of Insurance Processes

Fintech companies are at the forefront of digitizing insurance operations. Insurity, in partnership with OIP Robotics, exemplifies how fintech can automate and streamline the policy lifecycle, making policy management more accessible online. DXC Technology’s collaboration with Mosaic Insurance has introduced an innovative platform that accelerates underwriting and claims processing, further simplifying the insurance experience through digital means.

Customizable Insurance Policies

Advancements in data analytics and AI are enabling fintech disruptors such as Duck Creek Technologies to offer highly customizable insurance policies. Duck Creek Payments, a new SaaS solution, allows insurers to integrate with global payment providers, offering diverse payment options tailored to individual customer preferences. This flexibility enhances the ability of insurers to create personalized plans that better meet the needs of their clients.

Accelerated Claims Processing

Fintech innovations are significantly speeding up claims processing, a critical factor in customer satisfaction. Majesco’s digital payment solution, integrated with One Inc’s ClaimsPay, offers a secure and efficient claims settlement process. This integration reduces manual intervention, allowing for faster processing and payment of claims, which in turn improves customer retention and satisfaction.

Enhanced Risk Management

Fintech companies are also advancing risk management practices through sophisticated technology platforms. By leveraging data analytics and machine learning, platforms provide real-time insights into customer risk profiles, enabling more accurate underwriting and sophisticated risk management strategies. SentinelOne’s Risk Assurance Initiative, for example, helps insurers secure their clients’ networks using advanced AI security technology, reducing cyber threats and potentially lowering insurance premiums.

Rise of Insurance Aggregators

The fintech-driven rise of insurance aggregators is changing how consumers compare and purchase insurance policies. Platforms that facilitate comparison shopping from multiple insurers are enhancing customer convenience and driving competition among insurance providers. Guidewire’s collaboration with Paymentus, which introduces a new accelerator for BillingCenter users, facilitates seamless digital payments across various insurance products, intensifying competition and spurring innovation.

For the latest market share analysis and in-depth U.S. Insurance industry insights, Request for a Sample PDF Report

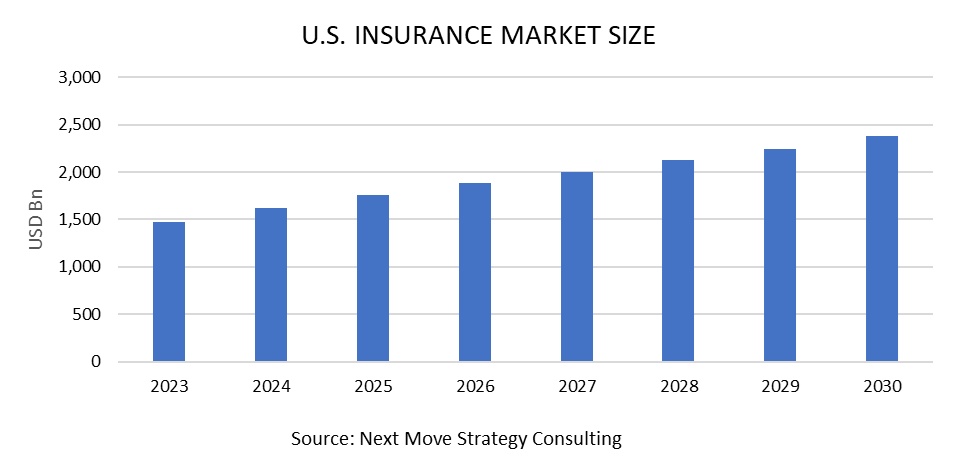

According to Next Move Strategy Consulting, the US Insurance market size was valued at USD 1,476 billion in 2023 and is predicted to reach USD 2.383 billion by 2030, with a CAGR of 6.64% from 2024 to 2030.

Challenges Facing the U.S. Insurance Industry

Regulatory Complexity

The U.S. insurance market is subject to extensive regulation at both federal and state levels, creating a complex compliance environment. Insurers must navigate varying requirements across states, which can be cumbersome and resource-intensive. Recent regulatory changes, particularly in health insurance due to the Affordable Care Act (ACA) and evolving property and casualty regulations, add further complexity. Ensuring compliance while adapting to new rules remains a significant challenge for insurers.

Climate Change and Catastrophe Risks

Increasingly severe weather events and natural disasters driven by climate change pose substantial risks for the property and casualty insurance sector. Insurers are facing higher claims due to these events, necessitating sophisticated risk models and strategic adjustments to underwriting practices. Managing climate-related risks requires investment in advanced analytics, improved disaster preparedness, and resilience strategies.

Evolving Customer Expectations

Consumers today demand more personalized, convenient, and transparent insurance services. Traditional insurance models often fall short of these expectations, leading to dissatisfaction and a need for modernization. Insurers must adapt by offering more flexible and tailored insurance products, improving customer service, and integrating digital solutions to enhance the overall customer experience.

Digitalization in the Insurance Industry: Progress and Barriers

- Factors Contributing to Digitalization Growth

Increased ROI

Modernizing payment systems presents insurers with opportunities to significantly boost return on investment (ROI). By implementing electronic payment methods and process automation, insurers can lower operational costs and improve cash flow management. Automated claims processing and digital payments reduce manual intervention, leading to faster transactions and lower overhead costs, ultimately enhancing profit margins.

Customer Demand for Convenience

Today’s customers expect seamless, instantaneous transactions, making modern payment systems a necessity. The adoption of digital wallets, mobile payments, and other electronic payment methods is increasingly viewed as essential rather than optional. Insurers meeting these expectations with instant claim payouts and digital platforms are seeing higher customer retention and satisfaction rates.

Technological Advancements

The rapid evolution of fintech solutions is driving the integration of advanced payment systems in insurance. Technologies such as blockchain for secure transactions, AI for fraud detection, and machine learning for personalized payment plans are enabling insurers to offer innovative solutions. For instance, pay-as-you-go insurance models align payments with customer usage, reflecting advancements in technology and consumer preferences.

- Adverse Effects of Digitalization

Data Privacy and Security

With the increasing volume of sensitive customer data stored in the cloud, insurers face heightened vulnerability to cyber-attacks. Implementing robust security measures, such as encryption and multi-factor authentication, is crucial but can slow down the adoption of new payment technologies. Insurers must ensure that security protocols are foolproof to protect against potential breaches.

Regulatory Challenges

The insurance industry’s heavy regulation can sometimes clash with digital innovations. For example, using data analytics to tailor payment plans or offer discounts based on behavior may be viewed as discriminatory under certain regulatory frameworks. Insurers must navigate these regulatory complexities and work closely with regulators to ensure compliance, which can be a lengthy and challenging process.

Operational Risks

As insurers transition to technologically-driven payment systems, they face increased operational risks. System failures, software bugs, or integration issues with legacy systems can disrupt payment processes, leading to customer dissatisfaction and potential financial losses. Investment in robust risk management strategies and infrastructure updates is necessary to mitigate these risks, though it may slow the pace of technological adoption.

Have questions? Inquire Before Purchasing

Conclusion

The U.S. insurance industry is navigating a complex landscape marked by significant challenges and transformative opportunities. Fintech companies are leading the charge in modernizing insurance payments and enhancing operational efficiencies, while digitalization is driving broader changes across the industry. Despite the hurdles of regulatory compliance, data security, and operational risks, insurers are making substantial progress. By embracing fintech innovations and digital advancements, the industry is poised to offer more efficient, customer-centric services and adapt to the evolving needs of the market.

About the Author

Saurav Sarkar is an accomplished researcher and writer with over three years of experience in conducting thorough research. His passion for exploring various subjects and delving into in-depth analysis has led him to develop a keen understanding of research nuances. He remains committed to staying current with the latest market trends, recognizing their impact on businesses and society.

Saurav Sarkar is an accomplished researcher and writer with over three years of experience in conducting thorough research. His passion for exploring various subjects and delving into in-depth analysis has led him to develop a keen understanding of research nuances. He remains committed to staying current with the latest market trends, recognizing their impact on businesses and society.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment