Top Companies Shaping the Future of Aluminum Production and Supply

Published: 2025-09-11

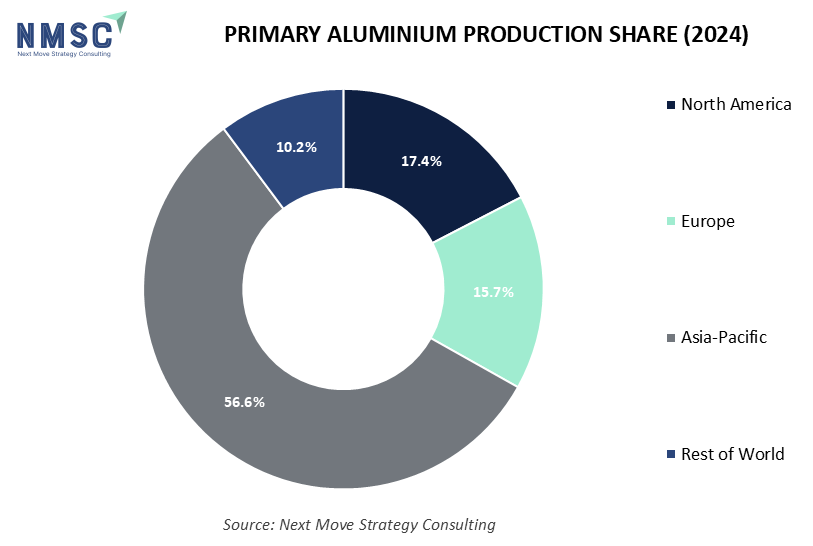

According to NMSC analysis, the aluminum industry is expected to maintain its upward trajectory, expanding to approximately USD 340.12 billion by 2030, reflecting a mind-boggling 1.5X growth from 2025 to 2030. The global aluminum market, valued at USD 244.34 billion in 2024, is projected to grow to USD 264.07 billion by 2025, driven by accelerating demand and innovation. With a strong CAGR of 5.1% from 2025 to 2030, the industry’s growth is propelled by advancements in manufacturing technologies, rising demand for lightweight and durable materials, and a heightened global focus on sustainability. These factors are transforming the aluminum sector and unlocking new opportunities across key industries such as construction, automotive, packaging, and aerospace.

Aluminum Market Overview

The aluminum market is driven by increasing demand in many sectors including aerospace, automotive, construction, and packaging. The increasing priority of sustainability and energy efficiency drives the aluminum industry and increased aluminum consumption in electric cars and renewable energy projects. Rising need for aluminum in construction and transportation is also propelled by industrialization and urbanization in developing nations.

Additionally, technical advancement in manufacturing processes including the use of inert anode technology is improving the output and environmental impact of aluminum production. Through consistent investments in research and development, these dominant firms are well-poised to capitalize on the expanding global demand for aluminum while dealing with environmental issues.

For the latest market share analysis and in-depth Aluminum Industry insights, Get Your FREE Sample Now!

Several major companies operating in the aluminum market, includes Aluminum Corporation of China Limited (CHALCO), China Hongqiao Group Limited, Hindalco Industries Ltd., Norsk Hydro ASA, Rio Tinto, Alcoa Corporation, United Company RUSAL PLC, East Hope Group Company Limited, Emirates Global Aluminum PJSC, Xinfa Group Co., Ltd. among others. These companies are leaders in production capacity, innovation, and sustainability initiatives, playing a crucial role in shaping the industry's future. With ongoing investments in research and development, these key players are well-positioned to meet the growing global demand for aluminum while addressing environmental concerns.

For an in-depth analysis of aluminum industry insights, you can reach out to us or add the report to your cart to proceed with purchase

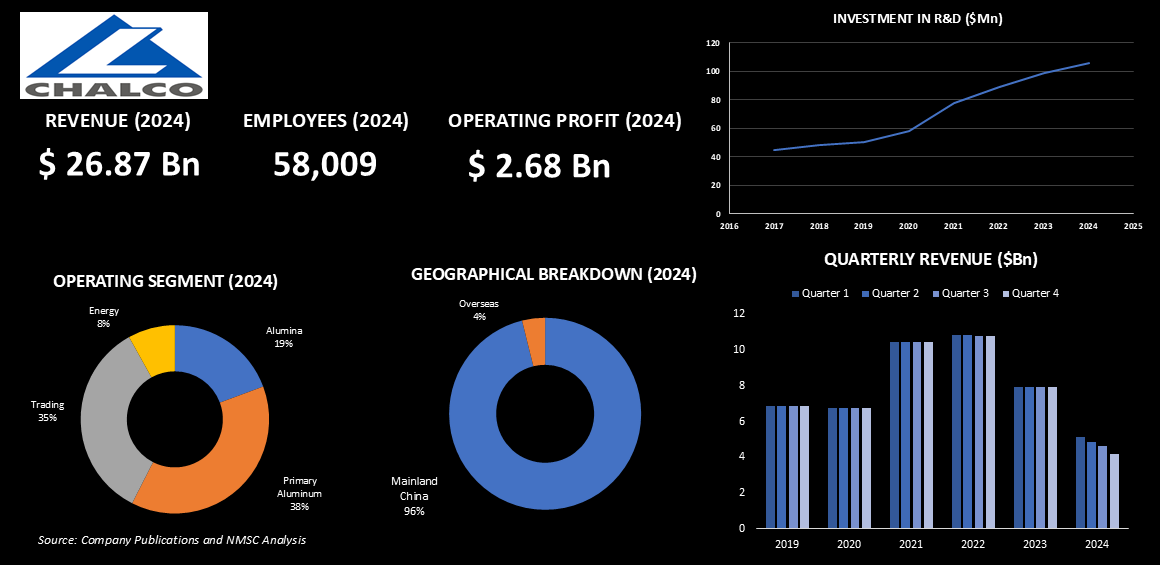

HIGHLIGHTS OF ALUMINUM CORPORATION OF CHINA LIMITED (CHALCO)

Aluminum Corporation of China Limited (Chalco) is one of the leading global players in the aluminum market, with core expertise in the production and distribution of aluminum and its associated products. Headquartered in Beijing, China, the company operates across the entire aluminum value chain, encompassing bauxite mining, alumina refining, and primary aluminum smelting.

Chalco's business is structured into four major segments, Primary Aluminum, Alumina, Trading, and Energy, with Primary Aluminum being the primary revenue driver, followed by Alumina.

In 2024, the company recorded revenues of USD 26.87 billion and an operating profit of USD 2.68 billion, supported by a workforce of 58,009 employees. While most of Chalco’s revenue originates from Mainland China, the company is steadily increasing its global presence, reflecting its dominant domestic market position alongside its international expansion.

Chalco’s integrated operations and advanced production capabilities allow it to serve a wide range of industries including construction, transportation, and packaging. The company has consistently increased its investment in research and development, which grew from approximately USD 50 million in 2016 to nearly USD 90 million by 2025, focusing on improving production efficiency and developing sustainable aluminum technologies.

From 2019 to 2024, Chalco’s quarterly revenues ranged between USD 5 billion and USD 8 billion, reflecting robust financial performance and a strong capacity to invest in future growth. The company remains committed to sustainability, aligning its operations with China’s carbon neutrality goals by optimizing energy use and reducing emissions throughout its production processes.

In 2024, Chalco expanded its alumina refining capacity at its Guangxi branch by 1.2 million tons per year to address growing global demand. Further strengthening its environmental initiatives, Chalco launched a new low-carbon aluminum product line in early 2025, branded “Chalco GreenAl.” This line leverages renewable energy in the smelting process, cutting carbon emissions by up to 20% compared to conventional methods.

Targeting sectors such as electric vehicle manufacturing, Chalco GreenAl supports the industry’s shift toward environmentally responsible materials. Through these strategic initiatives and sustained investments, Chalco reinforces its leadership in the global aluminum sector, driving innovation, efficiency, and sustainability across the value chain.

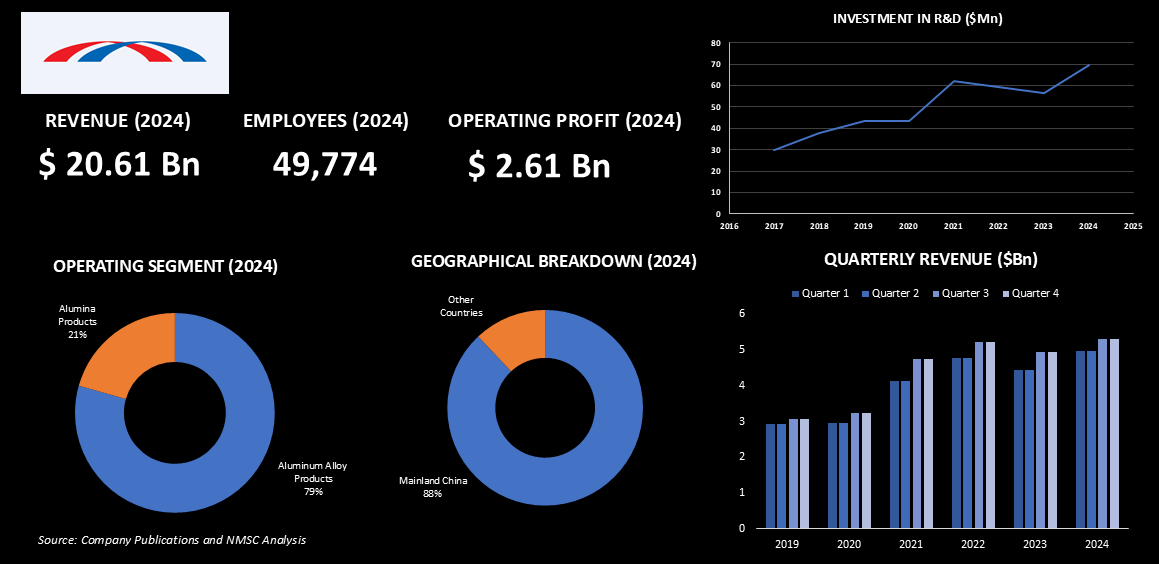

HIGHLIGHTS OF CHINA HONGQIAO GROUP LIMITED

China Hongqiao Group Limited is a globally leading aluminum company recognized for its extensive production and marketing capabilities in the aluminum sector. Headquartered in Shandong, China, the company has established itself as a top manufacturer through continuous growth and innovation.

In 2024, China Hongqiao reported revenues of USD 20.61 billion and an operating profit of USD 2.61 billion, supported by a workforce of 49,774 employees. The company operates primarily within a single reportable segment focused on the production and sale of aluminum products, including alumina and aluminum alloy offerings. While the majority of its revenue is generated from Mainland China, China Hongqiao is also steadily expanding its international footprint, reinforcing its strong domestic presence with growing global outreach.

The company’s specialized focus on aluminum has enabled it to streamline operations and enhance its competitiveness in the global market. Its investment in research and development has risen consistently, reaching approximately USD 60 million by 2025 from around USD 40 million in 2016. This investment supports advancements in manufacturing technology and improvements in product quality.

From 2019 to 2024, China Hongqiao maintained quarterly revenues in the range of USD 4 billion to USD 5 billion, reflecting a stable financial performance and capacity for strategic investment. The company places strong emphasis on sustainability, aligning with global efforts to improve energy efficiency and reduce emissions across the aluminum production process.

In 2024, China Hongqiao expanded its production capacity by commissioning a new smelting facility at its Shandong base, increasing annual aluminum output by 500,000 tons. This expansion was undertaken to meet rising global demand for lightweight and durable aluminum, particularly in the automotive and renewable energy sectors.

In early 2025, the company introduced a new high-purity aluminum alloy product under the brand name “Hongqiao UltraPure.” Designed for advanced applications in electronics and aerospace, this product offers improved strength and corrosion resistance, highlighting the company’s commitment to innovation and quality. Through these strategic initiatives and sustained investment, China Hongqiao continues to expand its influence in the global aluminum industry, driving improvements in production capabilities and market competitiveness.

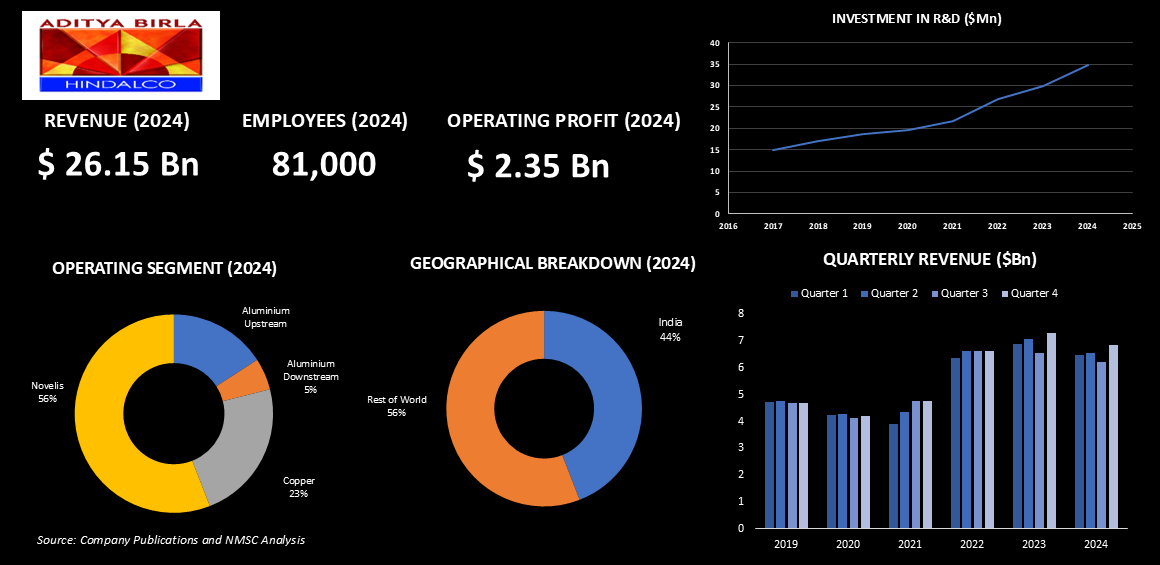

HIGHLIGHTS OF HINDALCO INDUSTRIES LTD.

Hindalco Industries Ltd., the flagship company of the Aditya Birla Group, stands as a prominent force in the global aluminum market with a strong emphasis on sustainable production and technological innovation. Based in Mumbai, India, the company operates across the full aluminum value chain, including bauxite mining, alumina refining, aluminum smelting, and the manufacturing of downstream products.

In 2024, Hindalco recorded revenues of USD 26.15 billion and an operating profit of USD 2.35 billion, backed by a workforce of 81,000 employees. The company’s operations are divided into four main segments, aluminum downstream, aluminum upstream, copper, and novelis, with novelis contributing the most to overall revenue, followed by Aluminum Downstream and Copper. While the bulk of Hindalco’s revenue is derived from the Indian market, the company is steadily expanding its international presence through its global subsidiaries and strategic exports.

The company’s integrated structure and focus on high-value aluminum solutions allow it to serve critical sectors such as automotive, construction, and packaging. Hindalco has consistently increased its investment in research and development, which grew from around USD 20 million in 2016 to approximately USD 30 million by 2025. This funding supports the development of advanced production techniques and sustainable materials.

From 2019 to 2024, Hindalco maintained quarterly revenues between USD 5 billion and USD 7 billion, reflecting stable financial performance and a strong foundation for continued growth. Sustainability remains central to Hindalco’s operations, as it intensifies efforts to transition toward renewable energy sources and reduce greenhouse gas emissions in alignment with global climate objectives.

In 2024, Hindalco expanded its aluminum smelting capacity by enhancing its Aditya Aluminum facility in Odisha, adding an annual output of 200,000 metric tonnes to address increasing demand from the renewable energy and electric vehicle industries.

In early 2025, the company introduced a new sustainable aluminum product named “Eterna Green.” This product contains up to 50 percent recycled content and is manufactured using renewable energy, resulting in a 30 percent reduction in carbon emissions compared to traditional methods.

Designed for use in eco-friendly packaging and green construction, Eterna Green reflects Hindalco’s commitment to advancing the circular economy. Through its continuous innovation, strategic capacity expansion, and dedication to responsible manufacturing, Hindalco is shaping the future of the aluminum industry both in India and across the globe.

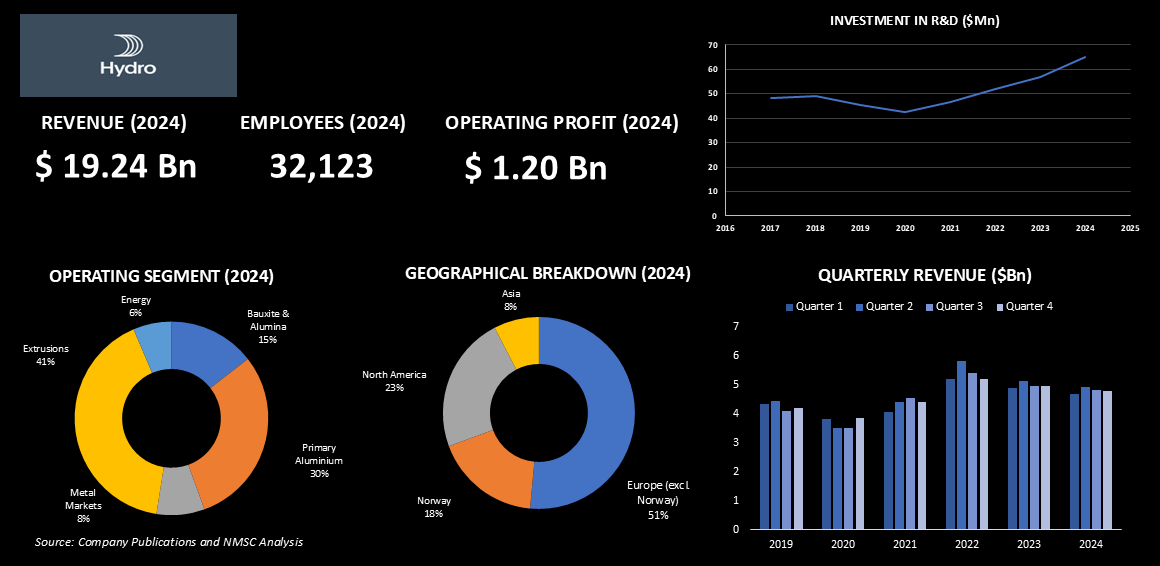

HIGHLIGHTS OF THE NORSK HYDRO ASA

Norsk Hydro ASA, headquartered in Oslo, Norway, stands as a prominent global force in both the aluminum and renewable energy sectors, recognized for its commitment to sustainability, innovation, and circular practices. The company maintains a comprehensive presence across the aluminum value chain, encompassing bauxite extraction, alumina refining, primary aluminum production, downstream processing, and large-scale recycling.

In 2024, Norsk Hydro generated USD 19.24 billion in revenue and posted an operating profit of USD 1.20 billion, supported by a workforce of 32,123 employees. Its operations are diversified across five core segments: Bauxite & Alumina, Primary Aluminum, Metal Markets, Extrusions, and Energy. Among these, the Extrusions segment remains a key contributor to the company’s revenue. Regionally, its strongest earnings are derived from Europe (excluding Norway), followed by contributions from Norway, North America, and Asia, highlighting a broad global footprint.

As a trailblazer in low-carbon aluminum production, Norsk Hydro continues to lead the transition to greener industrial practices. More than 70 percent of its primary aluminum output is powered by renewable sources, primarily hydropower, positioning the company at the forefront of environmentally responsible manufacturing. Its long-term ambition of reaching net-zero emissions by 2050 is supported by innovations such as the HalZero technology, which aims to eliminate process emissions from aluminum production.

While the company’s R&D expenditure has varied, it is expected to reach approximately USD 50 million by 2025, slightly down from its 2016 peak of USD 60 million. These investments have focused on optimizing energy use, advancing recycling processes, and improving product efficiency. Between 2019 and 2024, Norsk Hydro maintained quarterly revenue in the range of USD 4 billion to USD 5 billion, underscoring the company’s financial strength and consistent operational performance.

Among its recent developments, the company finalized the construction of a state-of-the-art aluminum recycling facility in Cassopolis, Michigan, in 2024. This plant, designed to produce up to 120,000 metric tonnes of recycled aluminum annually, significantly enhances Hydro’s recycling footprint in the North American market. In early 2025, Norsk Hydro further expanded its commitment to sustainability by entering into a collaboration with Hydro Rein and Macquarie to develop a hybrid wind and solar power project in Brazil. The initiative is targeted at powering the Alunorte alumina refinery, with an expected reduction of 200,000 tonnes of CO2 emissions per year, contributing directly to cleaner industrial operations.

Also in 2024, the company launched Hydro CIRCAL 100R, a 100 percent post-consumer recycled aluminum product with a remarkably low carbon footprint of less than 0.5 kg CO2 per kilogram. Tailored for sectors that demand both high performance and environmental responsibility, such as construction and electronics, this product showcases Hydro’s role in promoting circular economy principles. Through its innovative technologies, global collaborations, and steadfast focus on sustainability, Norsk Hydro continues to redefine standards in the aluminum industry and support the shift toward a more climate-resilient future.

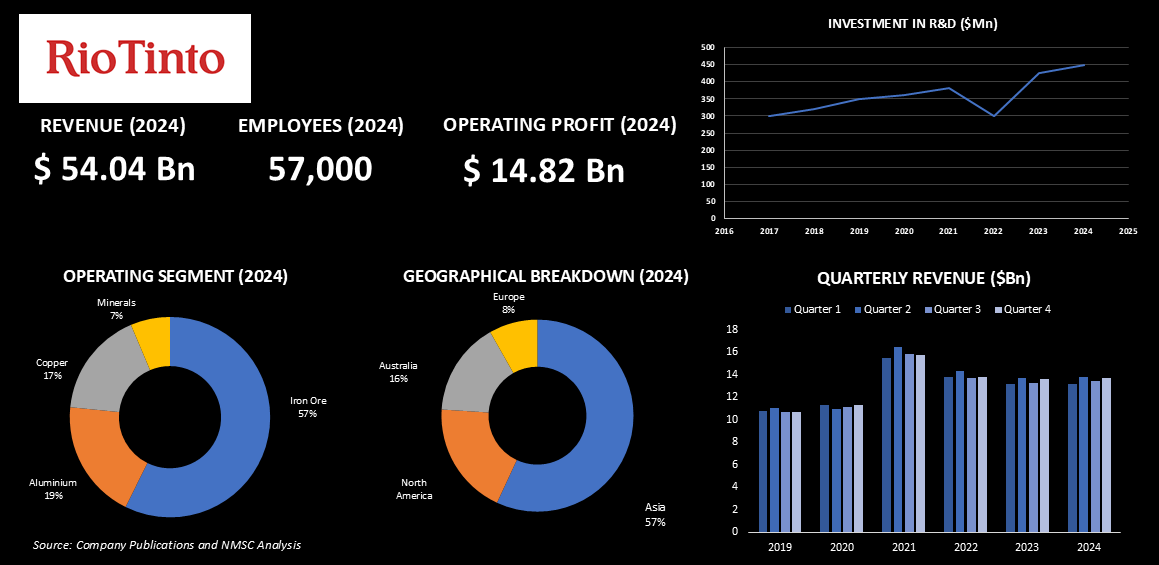

HIGHLIGHTS OF RIO TINTO

Rio Tinto, a prominent multinational mining corporation headquartered in London, United Kingdom, holds a strong foothold in the global aluminum industry through its fully integrated operations and strategic focus on sustainability. Operating in 35 countries with a workforce of 57,000 employees, the company has built a robust presence across key mining segments. In 2024, Rio Tinto reported total revenues of USD 54.86 billion and an operating profit of USD 15.12 billion, with its aluminum division playing a significant role in its overall growth.

The business is structured around four primary segments, iron ore, aluminum, copper, and minerals with aluminum emerging as one of the company’s vital growth drivers. A geographically diverse revenue base highlights its global reach, with major contributions from Greater China (including Taiwan), followed by the United States, Europe (excluding the UK), Japan, Australia, and other markets.

The company’s aluminum operations cover the full production cycle, from bauxite mining and alumina refining to smelting and recycling. This vertical integration enables Rio Tinto to maintain high operational efficiency and quality control while advancing its environmental objectives.

A notable portion of the company’s aluminum smelting processes is powered by renewable energy, particularly hydropower, reinforcing its position as a leader in low-carbon aluminum production. By 2025, Rio Tinto’s R\&D spending is expected to reach approximately USD 100 million, up from USD 80 million in 2016. These investments focus on advancing clean technologies, improving production efficiency, and supporting decarbonization initiatives.

Between 2019 and 2024, the company consistently recorded quarterly revenues between USD 12 billion and USD 14 billion, indicating strong financial health and resilience. In 2024 alone, Rio Tinto allocated USD 94 million to decarbonization projects, targeting a reduction of more than 15 percent in overall emissions by 2025.

Among its recent milestones, Rio Tinto successfully completed its joint venture with Matalco in 2024, significantly expanding its recycling and remelting capabilities in North America. This venture is expected to produce up to 900,000 tonnes of recycled aluminum annually, reinforcing the company’s push toward a circular economy. In early 2025, the company unveiled “Rio Tinto RenewAl,” a new low-carbon aluminum product manufactured entirely with renewable energy and achieving a carbon footprint of less than 4 kilograms of CO2 per kilogram of aluminum.

The product is tailored for high-demand sectors such as automotive and construction, aligning with global sustainability and emissions reduction goals. Additionally, the company continues to advance the Simandou project through the Simfer joint venture, enhancing long-term security of bauxite supply to support future aluminum production. Through these efforts and its sustained commitment to innovation and responsible production, Rio Tinto strengthens its leadership in the aluminum sector, positioning itself at the forefront of the industry’s transition to sustainable and low-emission manufacturing.

Summary of Aluminum Market

The global aluminum market is anticipated to witness a period of tremendous growth due to the demand from a lot of industries and also due to the very strong efforts to develop sustainability. The market is experiencing very high demand in recent years, attributed primarily to the rising production of electric cars that use aluminum for not only its lightness but also its capability to save energy. Additionally, the construction industry continues to increase the use of aluminum that helped increase the market further.

On the other hand, sustainability measures adopted by business organizations, promotion of the energy effectiveness in production through the implementation of energy-saving techniques, the existence of recycled aluminum, and the contracts concluded by the companies to use the principles of the circular economy and how they re-utilize already available materials that otherwise can be emitted inside the atmosphere. Moreover, the aluminum sector, closely connected with global environmental objectives, will thrive as more companies develop their equipment and products made out of it.

About the Author

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography.

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others. When she is not following industry updates and trends, she spends her time reading, writing poetry, cooking, and photography.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment