What Do Consumers Want from Bakeries in 2025—and Who’s Delivering?

Published: 2025-09-10

The worldwide Bakery Market is booming, with a global valuation of a projected growth to $557.59 billion by 2030 at a compound annual growth rate (CAGR) of 4.8%. Among bakery products, bread & biscuits are the most popular and nutritional products. Bakery products are in high demand due to their pleasant taste and health benefits, as they are made from various grains such as maize, wheat, and oats. The other ingredients used for baking include eggs, baking soda, and nuts. These products provide both convenience and affordability to buyers.

This blog dives into the latest advancements from top bakery companies to uncover how they’re shaping the future of the industry. Let’s explore what’s cooking in the bakery world!

The Bakery Market in 2025: A Snapshot

The market is driven by availability of low trans-fat, whole grain, low fat, multigrain, and organic baked merchandise, making these products more preferable among consumers. Europe holds the largest market share at 42.8%, thanks to its rich bakery traditions, busy lifestyle of individuals and expansion of fast-food businesses that employ middle-class people to make burgers, snacks, and sandwiches.

Also, the availability of organic baked items, breakfast cereals, and allergy-free baked products suitable for people suffering from allergies and intolerances boosts the market growth in this region.

Leading players like Associated British Foods, General Mills, and Mondelez International are at the forefront, leveraging innovation to meet evolving consumer needs.

Key Players and Their Innovations

Associated British Foods (ABF): Leading Food Innovation and Sustainability

Associated British Foods (ABF), a global food and ingredients powerhouse, showcases a diverse portfolio through its subsidiary brands, emphasizing innovation and market leadership. The company’s business spans international, US, UK, and Australia/New Zealand markets, with a strong focus on bakery and food solutions.

Business Highlights:

-

Global Reach: ABF’s international brands, such as Twinings (teas since 1706, sold in over 120 countries) and Patak’s (authentic Indian food), cater to diverse culinary preferences worldwide.

-

US Market: Through ACH Food Companies, ABF leads in Mexican and Canadian cooking oils (e.g., Mazola, Capullo) and baking products (e.g., Fleischmann’s yeast), with a 50% stake in Stratas Foods.

-

UK Leadership: Allied Bakeries’ Kingsmill brand offers a wide range of bakery products, while Ryvita leads in crispbreads, and Silver Spoon and Billington’s dominate the sugar market.

-

Australia/New Zealand: Tip Top is a recognized bread and baked goods brand, supported by Artisanal Group’s high-quality offerings and Yumi’s leadership in dips and snacks.

ABF’s robust business model, showcased through its global brand portfolio, positions it as a key player in the food and bakery sector, with potential for innovation driven by its diverse market presence as of July 2025.

-

ABF plays a great role in sustainability as well. As a leading provider of food, ingredients and clothing, packaging contributes significantly to our groupwide environmental footprint. The company’s food businesses have contributed to this decrease by reducing packaging, improving recyclability and replacing plastic with alternative materials such as cardboard.

-

For example, AB World Foods reduced the weight of Patak’s glass packaging for a sauce range, eliminating approximately 192 tonnes of glass and 6.1 tonnes of steel. Twinings is removing plastic overwraps across its markets and switching to 100% recyclable paper envelopes on individual tea bags, and 97% of sugar packaging from our sugr businesses in Africa is now recyclable.

ABF’s commitment to sustainability shines through its efforts to reduce packaging, enhance recyclability, and adopt eco-friendly materials, setting a strong example for the industry.

General Mills: A Legacy of Trust in Baking Excellence

General Mills is one of the oldest and most trusted food companies, with products in 90% of American pantries:

-

The company has its hold over multiple brands like Pillsbury - For nearly 150 years, families everywhere have trusted Pillsbury™ to make mealtimes special.

-

General Mills delivers a comprehensive flour portfolio tailored to diverse baking needs, featuring four key brands. General Mills flour ensures consistency with select wheat varieties for various applications. Gold Medal™, trusted since 1880, uses premium wheat for reliable baking results. Pillsbury™ leads with innovative milling technology for specialty flours, while Sperry™ Organic offers certified organic products with meticulous blending. This diverse lineup solidifies General Mills’ position as a baking industry leader.

-

General Mills, a trusted food company present in 90% of American pantries, upholds a rich heritage with brands like Pillsbury™, a family favorite for nearly 150 years. The company offers a comprehensive flour portfolio, featuring General Mills flour for consistent results, Gold Medal™ for premium wheat reliability since 1880, Pillsbury™ with innovative milling technology, and Sperry™ Organic for certified organic quality. This diverse lineup reinforces General Mills’ leadership in the baking industry.

Mondelez International: Premium and Sustainable Indulgence

-

Mondelez International is known for brands like Oreo and Chips Ahoy!:

-

The company’s innovative take on the iconic Chips Ahoy cookie brand - The food leader is expanding the $1 billion-plus treat into new snacking territories, including cakes and pastries. Chips Ahoy!, which traces its roots to 1963, is the second-largest cookie brand in the U.S. behind Oreo, which also is owned by Mondelēz.

-

In recent years, Mondelēz has seen growth driven by minis and introduced innovations like a triple-sized cookie, a gluten-free variant, and new flavors such as chocolate caramel, red velvet, and s’mores. Last year, the company revamped the classic cookie recipe, incorporating chocolate chips with increased cacao and Madagascar vanilla extract, marking the most significant update for the $1 billion brand in almost a decade.

-

In 2024, Mondelēz International and Lotus Bakeries announced a strategic partnership to expand and grow the Lotus Biscoff® cookie brand in India, and to develop exciting new chocolate products combining the unique, caramelized, crunchy Biscoff® taste and texture with Mondelēz’s iconic Cadbury, Milka and other key chocolate brands in Europe, with the option to expand globally. This partnership provides new opportunities for both companies to accelerate their growth ambitions in the attractive cookie and chocolate categories, with potential options to expand into additional markets and/or adjacent segments.

-

Through this partnership, Mondelēz will leverage its extensive distribution network and local market presence to manufacture, market, distribute and sell Biscoff® cookies in India. Lotus Bakeries aims to achieve significant visibility and sales growth in this high-potential market, while Mondelēz will build upon its already strong presence in both traditional and modern trade to expand its cookie offerings into high-demand premium spaces.

-

Furthermore, Mondelēz’s Oreo in the U.S., has become the world’s top selling cookie and is enjoyed in more than 100 countries. In markets around the world, Oreo comes in surprising local flavors, like blueberry and green tea ice cream, and fun shapes and forms. But no matter where in the world you find Oreo, one thing remains right at the heart of milk’s favorite cookie: the iconic “twist, lick, dunk” ritual that brings people together like no other biscuit can!

-

The company aims for an at least 25% reduction in virgin plastic use in its rigid plastic packaging or a 5% reduction in virgin plastic use in its overall plastic packaging portfolio, assuming constant portfolio mix.

-

“Our support for a more sustainable future for plastics is clear,” said Dirk Van de Put, Chairman and Chief Executive Officer, for Mondelēz International. “We’re already one of the most efficient users of plastic packaging in the consumer goods space and we’ve made significant strides to reduce plastic packaging use, substitute plastics for other materials and design for recyclability.”

-

“Given the strong progress we’ve made in packaging, and our focus on leading a sustainable future for snacking, we’re committing to reductions in virgin plastics use and investments in innovation to remove packaging or switch to more easily recyclable materials.”

-

-

These commitments build on the company’s existing 2025 goals to use 5% recycled content by weight across its plastic packaging and to design all packaging for recyclability, a goal the company is on track to achieve with 94% of packaging already designed to be recycled.

-

The company currently invests over $30 million a year in technology, resources and recycling infrastructure and anticipates an acceleration in this investment over time. In total, between 2019 and 2025, Mondelēz International anticipates spending approximately $300 million in creating a sustainable future for plastics.

-

Hence, Mondelez is balancing indulgence with health and sustainability, driving growth through premium and eco-friendly products.

Dawn Foods: Innovating Cake Solutions for Global Bakers

Dawn Foods, a global bakery ingredient supplier, introduced vegan cake mixes and a new flavouring paste, Dawn Exceptional® Yuzu Compound, as part of their Total Cake Solutions concept.

Dawn’s Total Cake Solutions concept has been developed for bakers across all channels and features exciting new recipe inspiration from across Europe, trends and insights on cake consumption, along with expert advice on maximizing cakes sales.

Emerging Trends Shaping Innovations

The bakery industry is evolving with consumer-driven trends.

Did you know that the sourdough trend doesn't only concern bread, but also viennoiseries?

-

Sourdough’s popularity surged, generating 629K mentions online with a remarkable 44% increase from the previous year, alongside 88 million interactions representing a 29% growth.

-

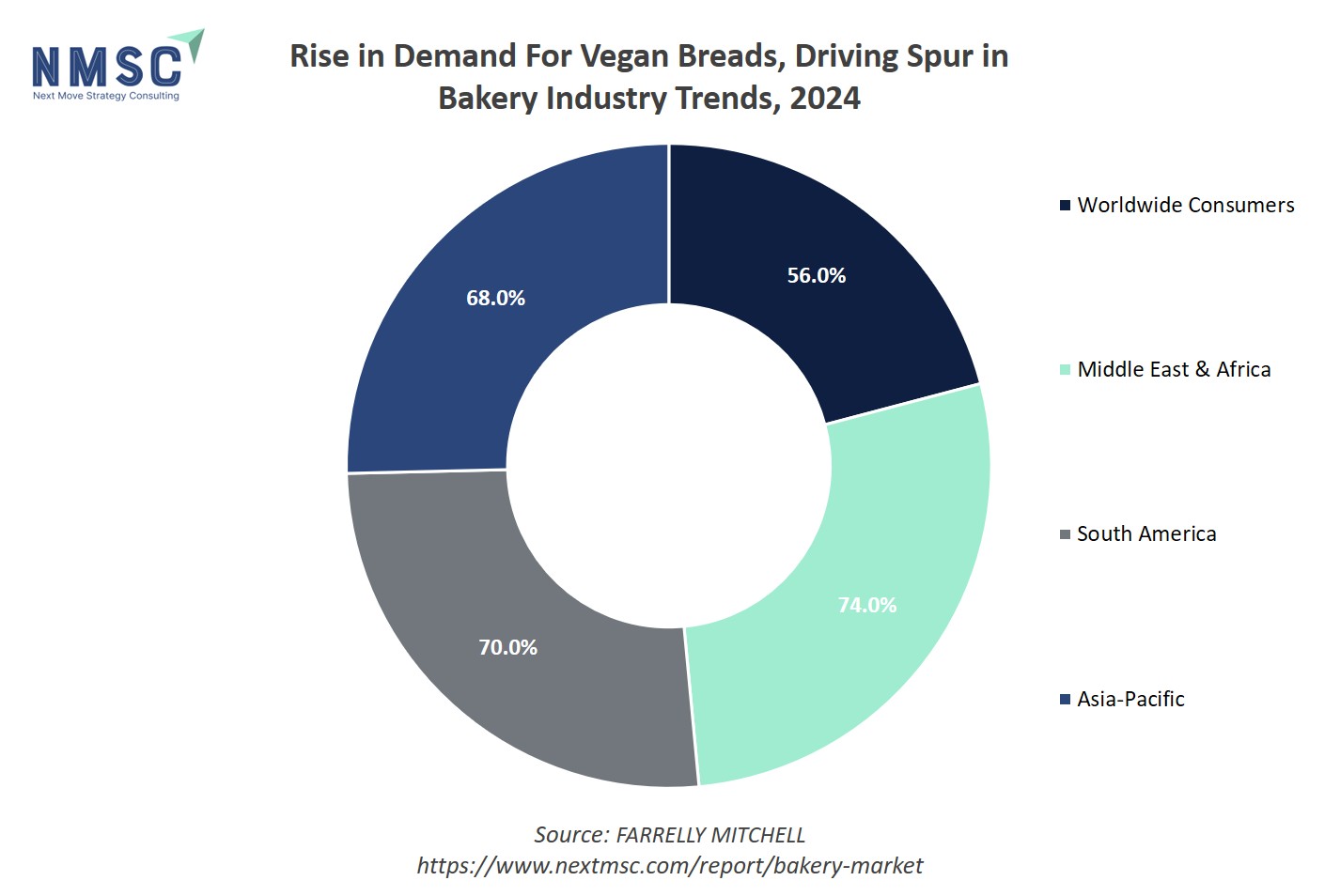

Additionally, the steady growth in organic and plant-based diets worldwide has spurred a rise in demand for vegan breads, with reports estimating that 56% of consumers worldwide are interested in plant-based alternatives for sweet bakery items. This demand is particularly pronounced in the Middle East and Africa (74%), South America (70%), and several countries in the Asia-Pacific region (68%). In particular, the Saudi bakery industry has seen significant growth.

-

These figures underscore the growing demand for innovation in this area. Brands that can satisfy both needs – through fortified products using natural ingredients as well as effectively communicating the health benefits of their offerings – are more likely to be successful.

Next Steps for Bakery Businesses

To stay competitive in the dynamic bakery market, businesses must act strategically. Here are actionable takeaways based on the 2024-2025 trends:

1. Expand Plant-Based and Vegan Product Lines

Meet growing global demand by introducing more vegan breads, cakes, and pastries, especially in high-interest markets like the Middle East, Africa, and Asia-Pacific.

2. Adopt Sustainable Packaging Practices

Reduce plastic use, improve recyclability, and switch to eco-friendly materials such as cardboard and lightweight glass, following leaders like ABF and Mondelez.

3. Innovate with Premium and Functional Products

Develop new flavors, formats, and fortified bakery items using natural ingredients to attract health-conscious and indulgence-seeking consumers.

4. Leverage Strategic Partnerships for Market Expansion

Collaborate with regional brands and distributors (e.g., Mondelez’s partnership with Lotus Bakeries) to access emerging markets and diversify product offerings.

Conclusion:

In 2025, bakery market growth is fueled by health-conscious innovation, sustainability, and evolving consumer tastes. Industry leaders like ABF, General Mills, Mondelez, and Dawn Foods are driving change through plant-based options, eco-friendly packaging, and premium product innovation. As demand rises for organic, vegan, and allergen-free goods, companies that combine tradition with modern solutions are best positioned to lead the future of baking.

About the Author

Sneha Chakraborty is a seasoned SEO Executive and Content Writer with over 4 years of experience in the digital marketing space, bringing a strong command of online visibility strategies and a keen insight into the evolving digital landscape. She specializes in enhancing online visibility and user engagement through data-driven strategies and creative content solutions. She has been closely observing trends across various industry domains, bringing insightful perspectives into her writing. Sneha is passionate about translating complex digital concepts into accessible content for a wide audience. Outside of work, she enjoys reading, sketching, and exploring the outdoors through nature photography.

Sneha Chakraborty is a seasoned SEO Executive and Content Writer with over 4 years of experience in the digital marketing space, bringing a strong command of online visibility strategies and a keen insight into the evolving digital landscape. She specializes in enhancing online visibility and user engagement through data-driven strategies and creative content solutions. She has been closely observing trends across various industry domains, bringing insightful perspectives into her writing. Sneha is passionate about translating complex digital concepts into accessible content for a wide audience. Outside of work, she enjoys reading, sketching, and exploring the outdoors through nature photography.

About the Reviewer

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Add Comment