Blood and Organ Bank Market Surges in 2025 with Advanced Transfusion Tech and Regional Growth

Published: 2025-08-12

Cutting-edge technologies and strategic investments are reshaping the global blood and organ bank market, driving new efficiencies and expanding access.

As of 2025, the Blood and Organ Bank Market is undergoing transformative growth propelled by technological integration, rising demand for transfusions and organ transplants, and cross-sector applications. From the deployment of artificial intelligence in donor matching to virtual reality (VR) for workforce training, recent advancements are setting new standards for precision, safety, and accessibility.

Latest Developments (2024–2025): Transforming Lifesaving Services

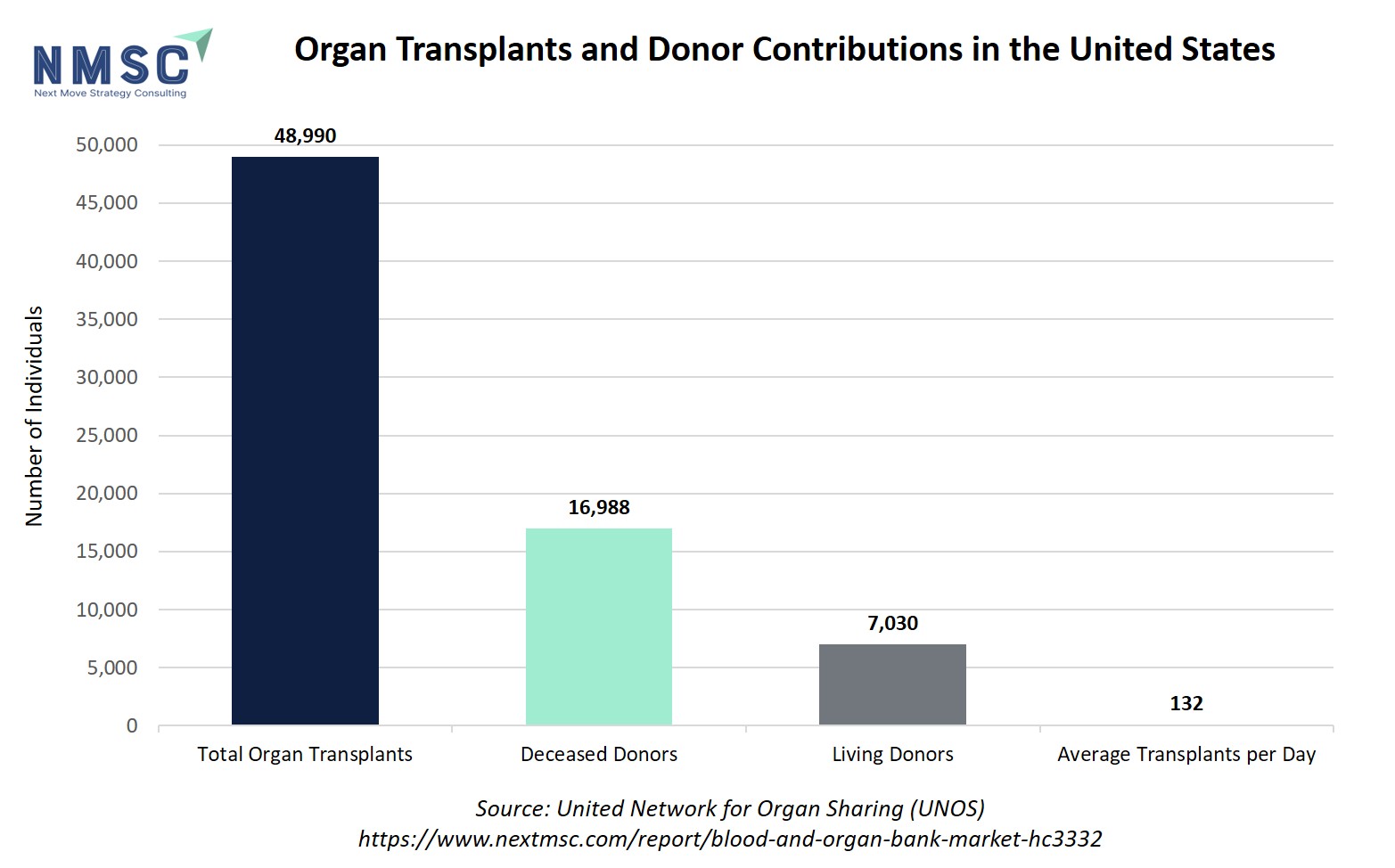

According to data from the Organ Procurement and Transplantation Network (OPTN). This is the first time the United States has ever performed more than 48,000 organ transplants in one year and represents a critical step in the nationwide effort to increase the number of lifesaving organ transplants while improving the system.

In the UK, NHS Blood and Transplant (NHSBT) says, they will deliver a significant number of new services announced today through the NHS England-run MedTech Funding Mandate. NHSBT Therapeutic Apheresis Services (TAS) teams will give more transfusions with the automated Spectra Optia machine, which gives faster and more effective care than normal transfusions.

Additionally, NHS Blood and Transplant (NHSBT) has released its first innovative virtual reality training app ‘NHSBT Blood Identification’ which realistically simulates the process of testing blood for lifesaving blood transfusions.

Meanwhile, the plasma donor centre in Reading collected over 8,668 litres of plasma, which was the highest volume collected across the 3 dedicated NHS plasma donor centres in England.

Applications Across Industries: From Healthcare to Research

Blood and organ banking extend far beyond clinical transfusions or transplant procedures. Key industry applications include:

-

Oncology: Some types of chemo can damage cells in the heart, kidneys, bladder, lungs, and nervous system.

-

Trauma Care and Surgery: In the first 24 hours, blood centers rely on their existing inventory, emphasizing the importance of maintaining an adequate supply at all times.

Key Components of the Market

|

Component |

Role |

|

Whole Blood |

Collected for general transfusion |

|

Plasma |

Used in treatment of burns, shock, and clotting disorders |

|

Red Blood Cells (RBCs) |

Used in Anemic patients |

|

Platelets |

Crucial for chemotherapy and immune-deficient patients |

|

Organs (Kidney, Liver) |

Life-saving interventions for end-stage organ failure |

|

Tissues & Stem Cells |

Used in reconstructive surgery and cellular therapies |

Regional Analysis: Dominant vs Fastest-Growing Markets

North America: Dominant Region

-

The United States has a high rate of organ transplants and performed a record 48,149 transplants in 2024—an all-time high and 3.3 % increase over 2023.

-

The FDA Food Safety Modernization Act mandates an inspection frequency of at least once every three years for domestic high-risk facilities and at least once every five years for non-high-risk facilities.

Asia-Pacific: Fastest-Growing Region

-

Government-led blood and organ donation campaigns, supported by strengthened healthcare infrastructure, are critical for improving voluntary donation rates.

-

WHO recommends universal screening of donated blood for HIV, hepatitis B, hepatitis C, and syphilis. While high-income countries achieve near-complete testing, low-resource regions still face gaps. Strengthening national blood policies and quality systems is critical to ensuring global blood safety.

Europe: Technological Leadership

-

The UK is pioneering in tech adoption, such as Spectra Optia and VR training for blood transfusion training.

Key Players and Strategic Moves

Leading Companies

|

Company |

Recent Strategy |

|

NHS Blood & Transplant |

NHSBT Therapeutic Apheresis Services (TAS) teams will give more transfusions with the automated Spectra Optia machine, which gives faster and more effective care than normal transfusions. |

|

United Network for Organ Sharing (UNOS) |

Developing innovative technologies and initiatives, leveraging data-driven research to improve transplant outcomes, advocating for patients, and leading collaborative efforts across the organ donation and transplant community to save lives. |

Emerging Organizations

|

Emerging Player |

Focus Area |

|

NHSBT Donor Centers (e.g., Reading) |

To ensure our donor profile and component collection are representative of the changing patient demand and that we collect and issue blood via an efficient, resilient and safe supply chain while innovating for the future |

Future Outlook: Smarter Systems, Greater Reach

Looking ahead, the blood and organ banking sector is expected to integrate further with AI-powered matching, blockchain-enabled donor records, and cross-border transplant registries. These technologies aim to:

-

Reduce wastage by optimizing shelf life.

-

Improve equity in transplant distribution across underserved populations.

-

Expand scope of transplant compatibility through innovations in xenotransplantation and bioprinting.

Reading Plasma Donor Centre Relocation (NHSBT, 25 June 2025)

Donor Growth Since 2021: Since opening in April 2021, over 4,470 local donors have registered.

Volume Collected (Apr 2024–Mar 2025): 8,668 L—the highest among England’s three dedicated NHS plasma centres.

Cumulative Volume (Jun 2022–May 2025): Approximately 18,818 L, from 41,000 donor appointments.

U.S. Organ Transplants Record (UNOS, 15 January 2025)

-

2024 Total Transplants: 48,149, the first time surpassing 48 000 in one year.

-

Daily Average: 132 transplants per day.

-

Donor Breakdown: 16,988 deceased donors; 7,030 living donors.

VR Training for Blood Matching (NHSBT, 27 February 2024)

-

App Launch: ‘NHSBT Blood Identification’ VR training released on Meta Quest App Lab.

-

Use Cases: NHSBT staff training; recommended for secondary schools, colleges, universities.

-

Scale: NHSBT issues 1.4 million blood components annually.

-

Development: Collaboration with Make Real; 14 minutes, users meet a patient, then enter a virtual laboratory where they test a sample of their blood by selecting reagents, mixing them and checking to see if the cells clump together. They then select a unit of blood and hang it by the patient bedside for transfusion. The handset realistically recreates the sense of holding items such as the pipettes.

Recent Developments

-

In most cases, platelet demand is met within 24 hours due to strong coordination among national blood centers, though regional or short-term shortages may still occur.

-

American Red Cross asks for blood donors to prevent shortage.

About Next Move Strategy Consulting:

Next Move Strategy Consulting is a premier market research and management consulting firm that has been committed to provide strategically analysed well documented latest research reports to its clients. The research industry is flooded with many firms to choose from, what makes NextMSC different from the rest is its top-quality research and the obsession of turning data into knowledge by dissecting every bit of it and providing fact-based research recommendation that is supported by information collected from over 500 million websites, paid databases, industry journals and one on one consultations with industry experts across a diverse range of industry sectors. The high-quality customized research reports with actionable insights and excellent end-to-end customer service help our clients to take critical business decisions that enables them to move beyond time and have competitive edge in the industry.

We have been servicing over 1000 customers globally that includes 90% of the Fortune 500 companies over a decade. Our analysts are constantly tracking various high growth markets and identifying hidden opportunities in each sector or the industry. We provide one of the industry’s best quality syndicates as well as custom research reports across 10 different industry verticals. We are committed to deliver high quality research solutions in accordance to your business needs. Our industry standard delivery solutions that range from the pre consultation to after-sales services, provide an excellent client experience and ensure right strategic decision making for businesses.

For more information,

Next Move Strategy Consulting

5th Floor 867

Boylston St, STE 500,

Boston, MA 02116, U.S.

E-Mail: [email protected]

Direct: +18577585017

Visit Our Website: https://www.nextmsc.com/

Add Comment