The Intralogistics Software Market is Expected to Reach USD 23.56 Billion By 2030

Published: 2025-06-30

Rising adoption of Industry 4.0 technologies and IoT is driving the intralogistics software market growth.

According to Next Move Strategy Consulting, the global Intralogistics Software Market size was valued at USD 9.51 billion in 2024 and is expected to be valued at USD 11.30 billion by the end of 2025. The industry is projected to grow further, hitting USD 23.56 billion by 2030, with a CAGR of 15.8% between 2025 and 2030.

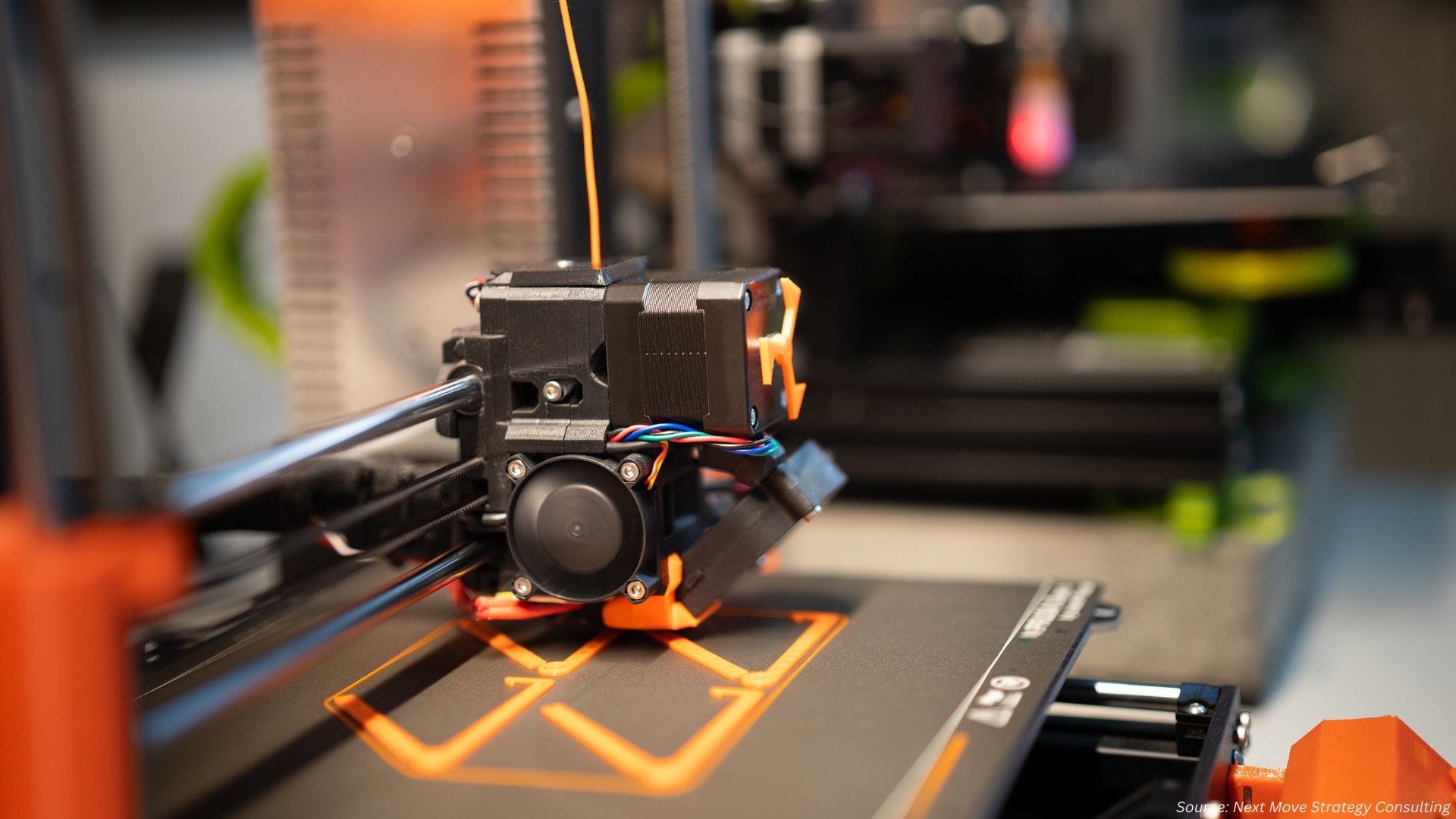

The widespread adoption of Industry 4.0 technologies, including artificial intelligence (AI), the Internet of Things (IoT), cloud computing, and advanced robotics, is significantly driving the intralogistics software market expansion. These technologies enable real-time optimization, predictive analytics, and seamless data integration across warehouse and supply chain operations, resulting in increased efficiency, reduced downtime, and improved scalability.

In 2025, Siemens introduced its Simatic Robot Pick AI, a vision-based AI solution that enhances robotic picking precision and speed, while in 20244 Continental launched advanced software for autonomous mobile robots (AMRs) powered by Amazon Web Services (AWS) to improve navigation and coordination in complex warehouse environments.

These developments are not only transforming traditional warehouse operations but are also encouraging broader adoption of intelligent intralogistics software across sectors such as manufacturing, retail, and e-commerce.

Moreover, the integration of digital twins, edge computing, and 5G connectivity is further enhancing the responsiveness and agility of intralogistics systems, positioning Industry 4.0 as a critical enabler of future-ready supply chain infrastructure.

However, high implementation and ownership costs remain a significant barrier to the widespread adoption of intralogistics solutions, especially among small and mid-sized enterprises. The expenses involved in software integration, customization, employee training, and ongoing maintenance create a substantial financial hurdle.

While large corporations are investing heavily in digital warehouse management systems, many SMEs hesitate due to uncertain return on investment and limited budgets. These cost challenges are particularly acute in emerging markets and capital-sensitive industries, restricting the overall potential of the intralogistics software market trends.

On the other hand, the adoption of emerging technologies like generative AI and blockchain presents promising opportunities to address these challenges and drive the intralogistics software market demand. In 2024, Mecalux applied generative AI to improve demand forecasting and resource planning by analysing historical sales data, seasonal trends, and customer behaviour, thereby optimizing inventory management and workforce allocation.

Meanwhile, the integration of AI and blockchain is enhancing supply chain transparency and traceability, enabling automated compliance, improving shipment accuracy, and speeding up issue resolution through secure, real-time data visibility. As companies increasingly embrace these innovations, the intralogistics sector is set to enter a new era of intelligent and scalable growth.

Curious about the Intralogistics Software Market? Grab a FREE Sample Now

According to the report, leading players in the intralogistics software industry include Jungheinrich AG, Dematic Corp, Midea Group Co., Ltd., Honeywell International Inc., Daifuku Co., Ltd., SSI SCHÄFER, Vanderlande Industries B.V., KNAPP AG, TGW Logistics Group GmbH, AutoStore AS, among others.

Significant advancements in 2024 and 2025 mark the competitive landscape of the global intralogistics software market share. Jungheinrich AG enhanced its Logistics Interface with AI-driven analytics, while DEMATIC improved scalability with cloud-based features in its iQ platform. KUKA AG upgraded its robotic software, and Honeywell incorporated IoT into its WMS for real-time tracking. Additionally, Daifuku Co., Ltd. developed software to support material handling systems, and SSI Schaefer optimized its WAMAS suite for robotic coordination.

Looking ahead, Midea Group's Swisslog plans to integrate generative AI into its SynQ software, and Vanderlande is focusing on cloud-based WES solutions. Knapp introduced AI-driven picking software, and TGW Logistics enhanced Rovolution for autonomous robots. Despite these innovations, high implementation costs and cybersecurity risks remain, particularly in Asia-Pacific. However, the integration of AI, cloud computing, and robotics continues to drive warehouse automation.

Key Insights from the Intralogistics Software Market Report:

-

The information related to key drivers, restraints, and opportunities and their impact on the intralogistics market is provided in the report.

-

The value chain analysis in the market study provides a clear picture of the role of each stakeholder.

-

The market share of the global Intralogistics market key players and their competitive analysis are provided in the report.

Add Comment