Life Insurance Market Tightens Gains as Digital and Demographic Forces Reshape Demand

Published: 2025-09-24

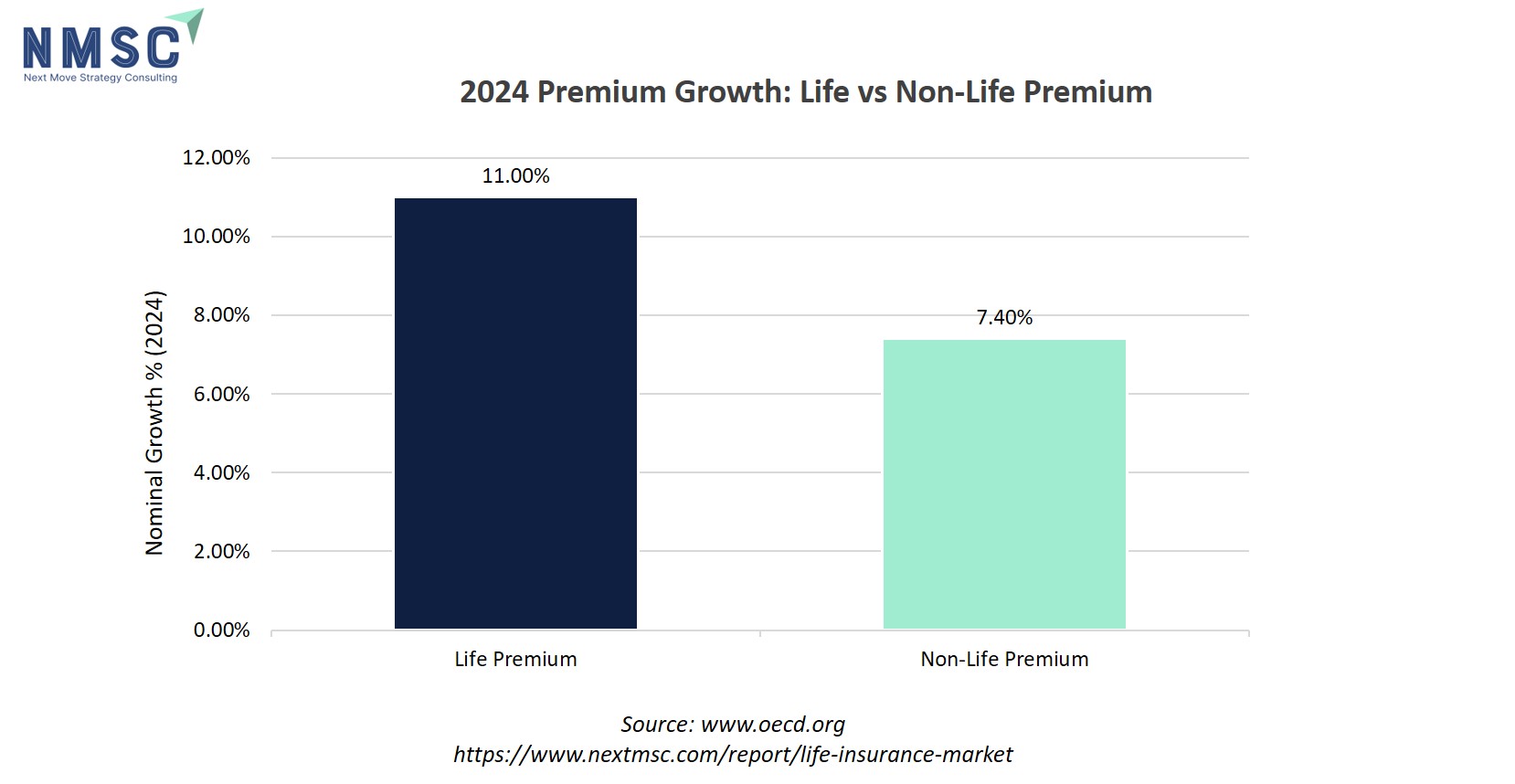

The life insurance sector recorded a strong recovery in 2024 as unit-linked products, annuities and digital channels gathered momentum. Preliminary OECD data show life premiums grew markedly faster than non-life in 2024, while U.S. and Chinese carriers led volume and innovation. Major incumbents are shifting capital toward retirement solutions, product overlays and AI-enabled distribution.

1. Latest developments (2024–2025)

-

Global insurers posted above-trend premium growth in 2024, with the life insurance sector recording average nominal growth of 11% (2024, preliminary)—outpacing non-life. “The life insurance industry recorded a relatively strong growth of premiums written in 2024. Gross written premiums increased by an average of 11% in nominal terms… among 44 reporting jurisdictions.”

-

China recorded robust life & health results in 2024; leading groups reported double-digit improvements in new business value and profits driven by retail demand and digital channels. Reuters: Ping An’s 2024 net profit rose ~48%, with new business value up ~29%.

-

Insurers continued to invest in AI and automation to accelerate underwriting, claims and policy issuance—illustrated by Ping An’s slide showing AI-driven claim settlement and policy issuance improvements (e.g., “Life: 56% of life claims settled in 10 minutes via Smart Quick Claim”).

2. Applications across industries

Life insurers increasingly deliver products or services that touch:

-

Retirement & pensions: annuities and in-plan lifetime-income overlays (growing demand driven by ageing populations and higher yields).

-

Employee benefits & workplace wellness: group life, integrated health management and digital health services.

-

Wealth management / bancassurance: unit-linked and hybrid products that combine protection and investment.

3. Components (product and value-chain view)

-

Core products: term life, whole life, endowment plans, money back plans, child plans, universal life (fixed, indexed, variable), annuities.

-

Distribution: agents, bancassurance, brokers, digital platforms, API/embedded insurance.

-

Operations & risk: underwriting, reinsurance, asset-liability management (ALM), claims.

-

Enablers: data & analytics, LLM/AI for underwriting and claims automation, digital onboarding.

4. Regional analysis

North America — United States

- Evidence of demographic tailwinds: The U.S. cohort reaching 65 in 2024–27 is a material demand driver for annuities and lifetime-income products.

Asia-Pacific — China

- Why it leads: Rapid ageing, large savings pool, and accelerated digital adoption and AI integration by major insurers (Ping An’s AI adoption and product service integration are leading examples). Reuters reports Ping An’s profit and new business expansion in 2024.

5. Key players & recent strategies / deals

-

Ping An (China) — AI and “finance + healthcare” integration; 2024 results show rising new business value and AI claims/issuance metrics.

-

AIG (U.S.) — improved underwriting and capital actions; 2024 results/press release highlight underwriting profit and capital returns as strategic priorities.

-

MetLife — “New Frontier” strategy to prioritize growth areas announced at 2024 Investor Day.

-

Prudential Financial — product innovation: ActiveIncome insurance overlay — new annuity/retirement deployment to managed accounts.

6. Future prospects & examples

-

Outlook: OECD preliminary data and sector forecasts point to continued premium growth in 2025, led by life in many jurisdictions, supported by favourable equity performance and annuity demand.

-

Examples:

-

Insurers will increase product overlays that deliver lifetime income within managed accounts (Prudential’s ActiveIncome is an early example).

-

AI will drive straight-through processing for maturity claims and small-case underwriting (Ping An’s Smart Quick Claim metrics).

-

About Next Move Strategy Consulting:

Next Move Strategy Consulting is a premier market research and management consulting firm that has been committed to provide strategically analysed well documented latest research reports to its clients. The research industry is flooded with many firms to choose from, what makes Next Move different from the rest is its top-quality research and the obsession of turning data into knowledge by dissecting every bit of it and providing fact-based research recommendation that is supported by information collected from over 500 million websites, paid databases, industry journals and one on one consultations with industry experts across a diverse range of industry sectors. The high-quality customized research reports with actionable insights and excellent end-to-end customer service help our clients to take critical business decisions that enables them to move beyond time and have competitive edge in the industry.

We have been servicing over 1000 customers globally that includes 90% of the Fortune 500 companies over a decade. Our analysts are constantly tracking various high growth markets and identifying hidden opportunities in each sector or the industry. We provide one of the industry’s best quality syndicate as well as custom research reports across 10 different industry verticals. We are committed to deliver high quality research solutions in accordance to your business needs. Our industry standard delivery solutions that ranges from the pre consultation to after-sales services, provide an excellent client experience and ensure right strategic decision making for businesses.

For more information please contact:

Next Move Strategy Consulting

5th Floor 867

Boylston St, STE 500,

Boston, MA 02116, U.S.

E-Mail: [email protected]

Direct: +18577585017

Website: www.nextmsc.com

About the Author

Joydeep Dey is an SEO Executive, Content Writer, and AI expert with 2½ years of experience. He specializes in SEO strategy, impactful content, and AI-driven solutions. Passionate about simplifying complex ideas, he helps boost visibility and engagement.

Joydeep Dey is an SEO Executive, Content Writer, and AI expert with 2½ years of experience. He specializes in SEO strategy, impactful content, and AI-driven solutions. Passionate about simplifying complex ideas, he helps boost visibility and engagement.

About the Reviewer

Sanyukta Deb is a skilled Content Writer and Digital Marketing Team Leader, specializing in online visibility strategies and data-driven campaigns. She excels at creating audience-focused content that boosts brand presence and engagement, while also pursuing creative projects and design interests.

Sanyukta Deb is a skilled Content Writer and Digital Marketing Team Leader, specializing in online visibility strategies and data-driven campaigns. She excels at creating audience-focused content that boosts brand presence and engagement, while also pursuing creative projects and design interests.

Add Comment