Australia Distributed Control System Market (DCS) by Component (Hardware, Software, and Services), by Architecture (Centralized Controller Systems, Hybrid / Distributed Hybrid Systems, and Fully Redundant High-Availability Systems), by Application (Batch, and Continuous Process), by Project Type (New Construction, Replacement, and Upgrade/Expansion), by Plant Size (Small, Medium, and Large), and by End User (Oil & Gas, and others) - Opportunity Analysis and Industry Forecast 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 26-Sep-2025 | No of Pages: 101 | No. of Tables: 133 | No. of Figures: 78 | Format: PDF | Report Code : SE838

Market Definition

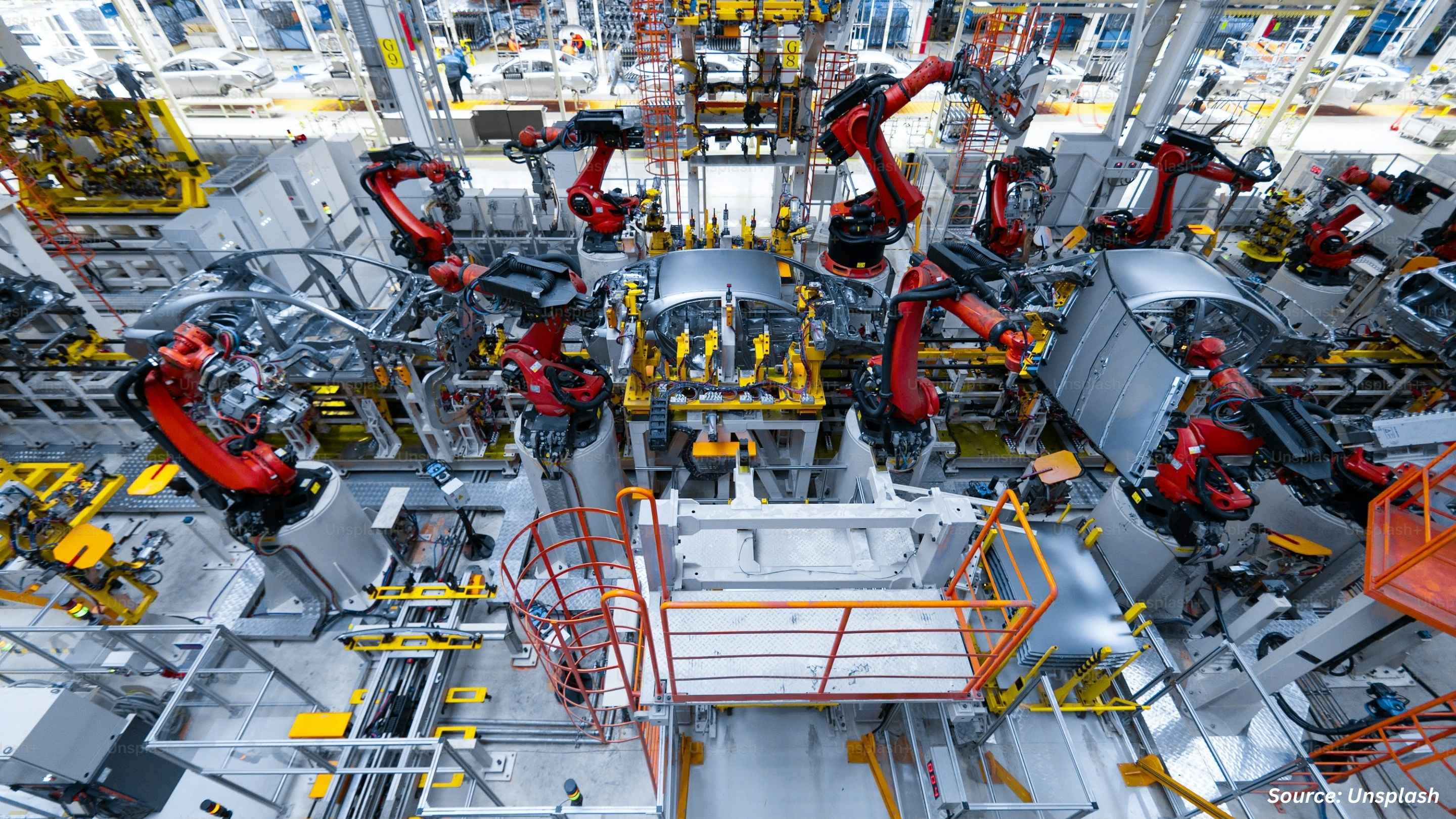

Australia Distributed Control System (DCS) Market size was valued at USD 387.46 million in 2024 and is predicted to reach USD 430.70 million by the end of 2025. The industry is predicted to reach USD 592.89 million by 2030 with a CAGR of 6.6% from 2025 to 2030. A Distributed Control System (DCS) is a computer-based control system widely employed to oversee and automate industrial processes. It comprises a network of controllers distributed throughout industrial facilities, facilitating communication and coordination in the automation of various processes. DCS systems find applications across diverse industries, including but not limited to the chemical, petrochemical, pharmaceutical, food and beverage, and power generation sectors.

These systems are particularly valuable in large-scale industrial processes demanding a high level of automation and control, such as those in oil refineries, chemical plants, and power stations. They serve to regulate and oversee a range of operations, including drilling, refining, blending, manufacturing, filtration, and disinfection, ensuring processes run with precision, efficiency, and safety.

The utilization of DCS systems offers numerous advantages, including enhanced process control, heightened efficiency, and improved safety, along with reduced downtime. DCS achieves this by distributing control functions across multiple controllers, providing redundancy and fault tolerance. This means that even in the event of a controller failure, industrial processes can continue to operate without disruptions.

DCS systems have evolved into indispensable components of modern industrial automation setups, substantially enhancing the reliability and efficiency of industrial processes. Furthermore, they contribute to safety by enabling real-time control and process monitoring. They are capable of detecting potential safety hazards and promptly alerting operators to take corrective measures. DCS systems are also instrumental in predictive maintenance, facilitating proactive maintenance practices that minimize downtime. They collect and analyse data from sensors, offering valuable insights for continuous process improvement.

Increasing Digitalization of Process Industries and Smart Factory Initiatives

Australia’s industrial landscape is undergoing rapid modernization, with strong adoption of digital transformation strategies in energy, mining, chemicals, and manufacturing. Smart factory projects are accelerating the demand for DCS platforms capable of integrating IIoT-enabled sensors, AI-driven analytics, and cloud-based supervisory control. These systems provide industries with greater agility, predictive maintenance capabilities, and improved operational intelligence.

Additionally, government-backed initiatives aimed at advancing Industry 4.0 adoption are fostering wider use of intelligent automation. By enabling seamless integration between operational technology (OT) and information technology (IT), DCS platforms are becoming central to Australia’s push for more resilient and competitive process industries.

Expansion of Renewable Energy and Grid Modernization Projects

Australia’s aggressive clean energy transition is emerging as a key growth driver for the DCS market. The rising share of solar, wind, and hydropower generation, coupled with grid modernization projects, requires sophisticated control systems to balance fluctuating loads, improve energy efficiency, and ensure grid stability.

DCS platforms provide the redundancy, real-time monitoring, and advanced control logic necessary to optimize renewable energy plants and integrate them into national smart grids. With large-scale investments in renewable projects and storage systems across New South Wales, Victoria, and Western Australia, DCS adoption is accelerating in power generation and transmission infrastructure.

High Cost of Deployment and Integration For Small and Mid-sized Enterprises

Despite the clear benefits, the upfront cost and complexity of implementing DCS solutions remain significant barriers for Australia’s small and mid-sized enterprises (SMEs). Unlike large industrial players, SMEs often lack the capital expenditure budgets required for comprehensive DCS integration, including hardware, software, training, and cybersecurity upgrades.

This challenge is further compounded when industries attempt to retrofit DCS platforms into legacy infrastructure, where compatibility and integration issues drive additional expenses. As a result, many mid-tier industries continue to rely on programmable logic controllers (PLCs) or hybrid automation systems, slowing the broader penetration of DCS across Australia.

Growing Demand for Modular and Scalable DCS Solutions in New Energy and Manufacturing Sectors

A major opportunity lies in the shift toward modular and scalable DCS architectures that cater to diverse industry needs. Unlike traditional monolithic systems, modular DCS platforms allow phased implementation, hybrid integration with PLCs and IoT devices, and cost-effective scaling as operational requirements grow.

This is particularly attractive to renewable energy developers, mining operators, and regional manufacturing hubs in Australia, where flexible deployment and lower upfront investment are crucial. Modular DCS also supports seamless integration with smart manufacturing ecosystems, enabling real-time optimization, improved supply chain coordination, and sustainable operation.

Competitive Landscape

The Australia distributed control system (DCS) industry includes several market players such as ABB Ltd., Emerson Electric Co., Honeywell International Inc., Yokogawa Electric Corporation, Siemens Aktiengesellschaft, Schneider Electric SE, Rockwell Automation, Inc., GE Vernova LLC, Valmet Oyj, ANDRITZ AG, Toshiba Corporation, Azbil Corporation, Fuji Electric Co., Ltd., Hitachi, Ltd., Mitsubishi Electric Corporation.

Australia Distributed Control System (DCS) Market Key Segments

By Component

-

Hardware

-

Controller

-

I/O

-

Workstation

-

Networking Hardware

-

-

Software

-

Service

-

Integration and Implementation

-

Managed Services

-

Support and Consultation

-

By Architecture

-

Centralized Controller Systems

-

Hybrid / Distributed Hybrid Systems

-

Fully Redundant High-Availability Systems

By Application

-

Batch

-

Continuous Process

By Project Type

-

New Construction

-

Replacement

-

Upgrade/Expansion

By Plant Size (Controller I/O)

-

Small (Greater than 5000 I/O)

-

Medium (5000 to 15000 I/O)

-

Large (Less than 15000 I/O)

By End User

-

Oil & Gas

-

Upstream

-

Midstream

-

Downstream and Refineries

-

-

Chemicals & Refining

-

Energy & Power

-

Thermal Power Plants

-

Renewable and Battery Storage Plants

-

Nuclear Power Plants

-

-

Pulp & Paper

-

Metals & Mining

-

Pharmaceutical & Biotech

-

Food & Beverages

-

Cement & Glass

-

Water & Wastewater

-

Others

Key Players

-

ABB Ltd.

-

Emerson Electric Co.

-

Honeywell International Inc.

-

Yokogawa Electric Corporation

-

Siemens Aktiengesellschaft

-

Schneider Electric SE

-

Rockwell Automation, Inc.

-

GE Vernova LLC

-

Valmet Oyj

-

ANDRITZ AG

-

Toshiba Corporation

-

Azbil Corporation

-

Fuji Electric Co., Ltd.

-

Hitachi, Ltd.

-

Mitsubishi Electric Corporation

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2025 |

USD 430.70 Million |

|

Revenue Forecast in 2030 |

USD 592.89 Million |

|

Growth Rate |

CAGR of 6.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst