Electric ATV & UTV Market By Type (Electric ATV, and UTV), By Propulsion Type ( BEV, and HEV), By Motor Power (<5 kW, 5–15 kW, and 15–30 kW), By Drivetrain (2WD, and 4WD), By Price-Tier (Economy, Mid-Range, and Premium), By Application (Construction & Industrial, Agriculture & Forestry, Recreation & Tourism and Others), By End-User (Individual Consumers, Commercial Enterprises, Government Agencies, and Rental Fleets & Tour Operators) – Global Analysis & Forecast, 2025–2030

Industry: Automotive & Transportation | Publish Date: 06-Nov-2025 | No of Pages: 678 | No. of Tables: 518 | No. of Figures: 463 | Format: PDF | Report Code : AT3661

Industry Outlook

The global Electric ATV & UTV Market size was valued at USD 1408.8 million in 2024 and is expected to reach USD 1798.8 million by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 3682.6 million by 2030, registering a CAGR of 15.4% from 2025 to 2030. In terms of volume, the market recorded 90 thousand units in 2024, with forecasts indicating growth to 120 thousand units by 2025 and further to 283 thousand units by 2030, reflecting a CAGR of 18.7% over the same period.

The market is rapidly evolving as electrification reshapes the off-road mobility landscape. Traditionally dominated by internal combustion engines, the sector is witnessing a strong transition toward electric models driven by advancements in battery technology, sustainability goals, and improved vehicle performance.

Today, electric ATVs and UTVs are gaining popularity across recreation, sports, agriculture, forestry, defence, and industrial applications. Their quiet operation, low maintenance, and zero-emission characteristics make them ideal for environmentally sensitive areas and commercial use cases where efficiency and reliability are paramount. Manufacturers are increasingly focusing on expanding range, enhancing torque delivery, and integrating smart connectivity features to meet modern consumer demands.

Looking ahead, the electric ATV & UTV market future is shaped by the convergence of electrification, digitalization, and sustainability. With growing environmental awareness and regulatory pressures, electric off-road vehicles are becoming essential for fleets, government projects, and adventure tourism operators.

The integration of advanced technologies such as IoT-based performance monitoring, AI-driven terrain adaptation, and quick-charging infrastructure will further accelerate adoption. Moreover, collaborations between traditional powersport OEMs and EV startups are fostering innovation, creating models suited for diverse terrains and professional use. As a result, electric ATVs and UTVs are positioned to redefine the future of off-road mobility with cleaner, smarter, and more versatile solutions.

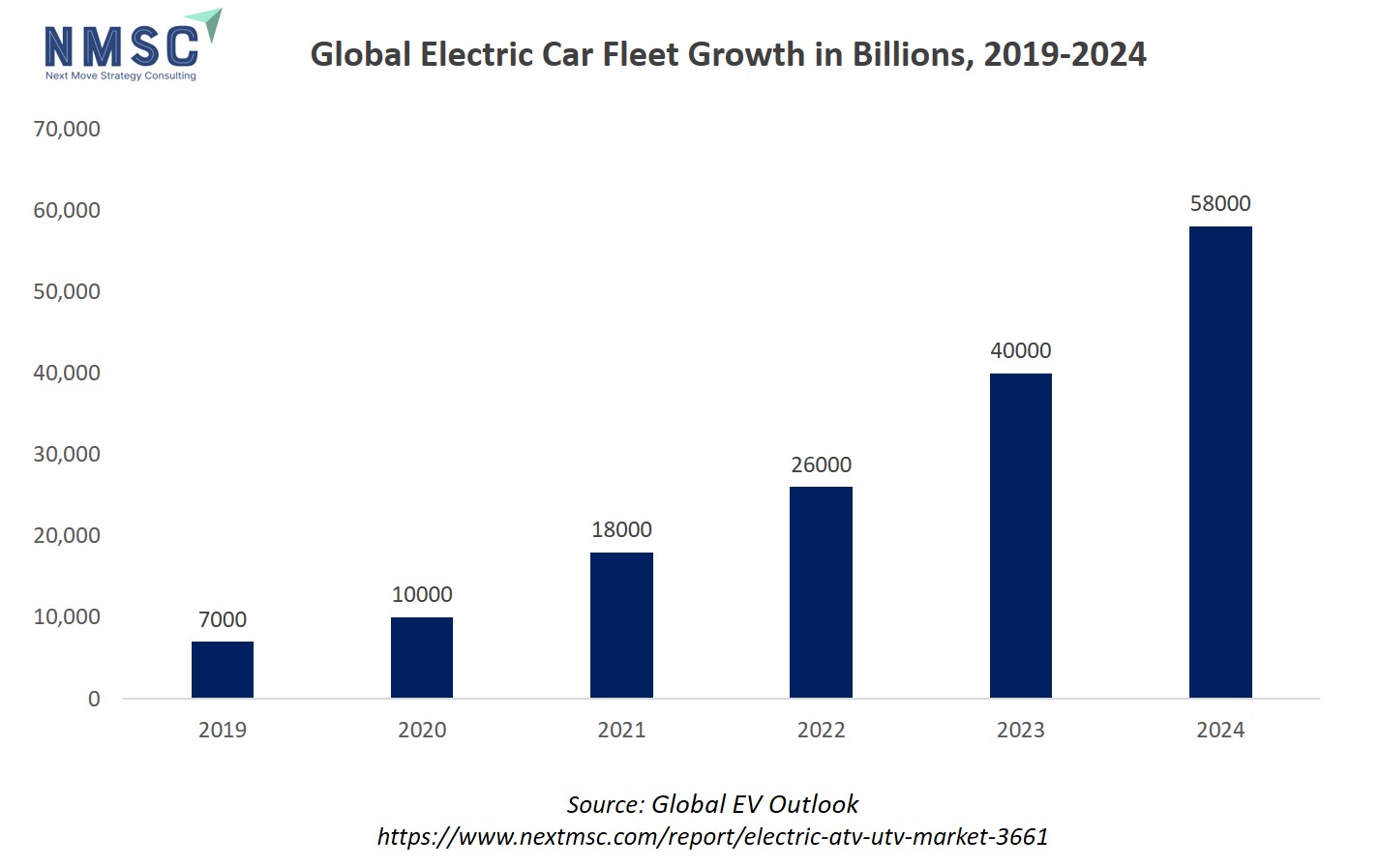

Also, the rapid expansion of the global electric car fleet, significantly boosts the growth prospects for the electric ATV and UTV market. This surge in electric vehicle adoption drives advancements in battery technology, accelerates the development of charging infrastructure, and brings economies of scale that lower manufacturing costs for electric platforms across all vehicle types. As mainstream consumers and businesses become more familiar and comfortable with electric mobility, acceptance of electric ATVs and UTVs for recreational, agricultural, and industrial use is also rapidly expanding.

The above chart visually represents the substantial growth of the global electric car fleet from 2019 to 2024, as measured in millions of vehicles. The rapid escalation in numbers highlights not just growing consumer adoption, but also the impact of supportive policies, technological advancements, and increased manufacturing capacities worldwide. The exponential trend seen in the later years signifies accelerating acceptance and mainstreaming of electric vehicles on a global scale, underscoring a significant shift towards electrification in the automotive sector.

What are the key trends in the Electric ATV & UTV Market?

How is the electric ATV & UTV market enabling off-road charging and trail networks?

Off-road electrification is starting to overcome its biggest hurdle, which is charging accessibility, as pilot trail-charging networks and grant-backed rural projects prove viable for remote recreation and work sites. For example, the first dedicated off-road trail charging network launched in Michigan in 2024 demonstrated how public-private grants paired with battery-storage partners can place chargers deep in trail systems and parks, reducing range anxiety for riders and renters. This shift is important because it changes purchasing calculus, where buyers weigh practical access to power alongside vehicle specs. Companies, partners with energy-storage firms, park operators, and rental platforms and accelerate adoption more than product-only campaigns.

How are next-generation batteries reshaping performance and duty-cycle expectations for the electric ATV & UTV market?

Advances in cell manufacturing and chemistry are pushing energy density, cycle life, and cost improvements that matter for rugged off-road use. Global cell manufacturing capacity grew substantially in 2024, easing supply risk and enabling more vehicle-class battery options for powersports OEMs.

At the same time, rapid progress in solid-state and next-gen lithium chemistries is promising higher energy density and improved safety under shock and vibration, which is key for worksite and long-haul trail use. Practically speaking, manufacturers are re-thinking modular pack designs and thermal management to exploit these chemistries: designing for swappable, repairable packs extends service life and opens B2B leasing or fleet models.

How are commercial and agricultural use cases accelerating the shift to electric UTVs?

Beyond recreation, electric UTVs are proving valuable in farms, utilities, and worksites where quiet operation, precise torque, and lower maintenance translate to measurable operational gains. Field pilots and university extensions have highlighted benefits such as reduced noise disturbance in livestock areas and lower on-site emissions for enclosed facilities, making them attractive for sustainability programs.

Because these customers prioritize uptime and TCO, companies have started focusing on bundled offerings, such as, predictable maintenance contracts, on-site charging solutions (solar + storage), and telematics-driven service alerts. Marketing that quantifies operational savings and case studies with ag-extension partners resonates far more than lifestyle copy when selling into fleets and farms.

How is connectivity and fleet software turning electric ATVs and UTVs into managed assets?

Smart dashboards, OTA updates, and fleet telematics are moving these vehicles from isolated machines to integrated assets that deliver data on utilization, battery health, and mission readiness. Industry roadmaps for EV charging and fleet management now highlight charging-aware dispatch, remote diagnostics, and predictive maintenance as key enablers for commercial adoption. For OEMs and fleet solution providers, embedding secure telematics and offering subscription analytics creates sticky revenue streams and improves lifecycle economics.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the electric ATV & UTV industry in the next decade?

The electric ATV & UTV market demand have moved from niche pilot projects to a pragmatic, multi-use industry where recreation, commercial fleets, and agricultural operators increasingly evaluate electrified options. Policy support, falling battery costs, and pilot charging deployments in remote trail and park systems have reduced the friction that once kept buyers on internal combustion models. OEMs and suppliers are balancing ruggedization, thermal and vibration-resilient battery packs, and telematics to meet both consumer expectations and professional uptime requirements.

Electrified UTVs are proving attractive where quiet operation, lower maintenance, and reduced site emissions matter, such as, think farms, parks, resorts, utilities and conservation projects. Advances in battery manufacturing and federal research into next-gen chemistries are opening paths to higher energy density and safer packs suitable for off-road duty cycles. Industry participants who pair vehicle innovations with charging, telematics and service models are best positioned to convert pilots into repeat commercial purchases.

Growth Drivers:

How will expanded off-road charging networks change buyer behaviour and commercial models?

Off-road electrification is increasingly defined by access to reliable charging. Pilot projects in Michigan’s Upper Peninsula, first off-road public chargers installed in 2024, show that even modest, strategically placed chargers materially reduce range anxiety for trail users and rental programs.

When chargers are paired with solar + storage at trailheads, total cost of ownership for shared fleets improves and rental turnover increases. Companies are viewing charging as a service enabler where partner with parks, tourism boards, or energy firms to co-fund chargers, offer bundled rental plus charging packages, and instrument sites to collect utilization data that informs future siting and battery-capacity decisions.

How are next-generation battery supply and chemistry breakthroughs enabling rugged, long-duty off-road use?

Battery innovation is transforming off-road capabilities. Federal reviews of advanced battery supply chains highlight accelerated cell production and sustained investment in chemistry innovation, which reduces procurement risk for OEMs seeking specialized packs. DOE lab breakthroughs in solid-state and alternative electrolytes point to chemistries with improved safety and reduced reliance on scarce materials, essential for vehicles exposed to shock, water, and temperature swings. Manufacturers are adopting modular pack architectures and validating packs to off-road vibration and ingress standards now, enabling future retrofits to higher-density cells and opening lease/swap business models.

Growth Inhibitors:

How does limited infrastructure slow the electric ATV & UTV market adoption?

Despite technological progress, infrastructure gaps remain the primary adoption barrier. Many commercial and rural applications lack predictable high-power charging and still require long duty cycles far from grid access. Pilot trail chargers help but are insufficient in scale. Until off-grid solutions (solar + storage, swap stations) and standardized rapid interfaces become widespread, operators factor range risk and longer payback periods into purchasing decisions.

Companies are overcoming this by targeting controlled environments, such as resorts, farms, or government fleets, offering hybrid or modular powertrain options during transition, and bundling financing and maintenance to shift perceived risk from operators to providers.

How can integrated charging and telematics unlock new investment potential?

The clearest investment upside lies in combining on-site solar + battery charging, modular battery-swap systems, and telematics-driven subscription services. State pilot programs demonstrate that pairing renewables with local storage reduces incremental charging costs and makes fleet TCO compelling, particularly for agricultural and park fleets that control land or facilities. Investors and OEMs are piloting partnerships with large fleet customers, deploying modular charging site-by-site, and offering subscription analytics that lock in recurring revenue while lowering cost-per-operating-hour, creating a strong value proposition for commercial operators.

How is the Electric ATV & UTV Market Report Segmented, and What are the Key Insights from the Segmentation Analysis?

By Type Insights

Is the Electric ATV & UTV Market Shaped by Vehicle Type in 2024?

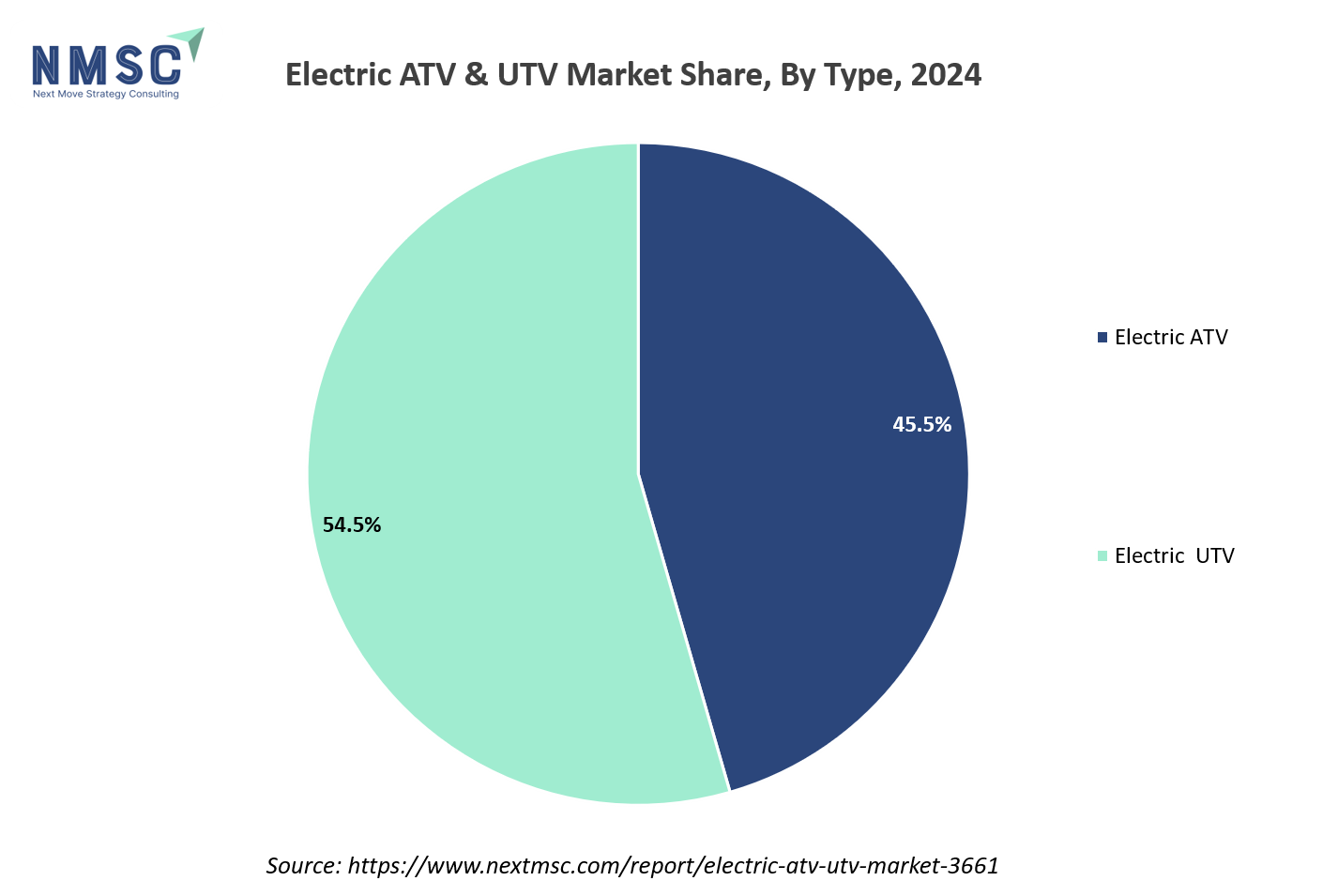

Based on type, the Electric ATV & UTV Market is segmented into electric ATVs and electric UTVs.

Electric ATVs are gaining traction due to their suitability for recreational use and youth-oriented markets. These vehicles offer quiet operation, low maintenance, and zero emissions, appealing to environmentally conscious consumers and families. The electric ATVs are particularly popular among youth riders, providing a safer and more sustainable alternative to traditional gas-powered models. The compact design and affordability of electric ATVs make them accessible for entry-level riders and those seeking casual off-road experiences.

Electric UTVs are emerging as a preferred choice for utility and commercial applications, including agriculture, landscaping, and maintenance services. These vehicles provide higher payload capacities, greater range, and versatility, making them suitable for more demanding tasks. They dominate the market, capturing approximately 54% of the market share. The adoption of electric UTVs is further supported by advancements in battery technology and the expansion of charging infrastructure, addressing previous concerns about range and charging time.

By Propulsion Type Insights

Is Propulsion Technology Steering the Electric ATV & UTV Market?

On the basis of propulsion type, the electric ATV & UTV market is segmented into battery electric vehicle (BEV), and hybrid electric vehicle (HEV).

Battery Electric Vehicles (BEVs) are leading the charge in the electric ATV and UTV market, offering zero-emission solutions with reduced maintenance needs with a market share of ~62.5%. This growth is attributed to factors such as falling battery prices, airport and municipal fleet electrification mandates, and broader acceptance across agriculture and industrial intralogistics. The widespread adoption of BEVs is also supported by tax incentives in regions like the United States and the European Union, which further enhance their appeal to consumers and businesses alike.

Hybrid Electric Vehicles (HEVs) are currently a niche segment in the electric ATV and UTV market. While they offer extended range capabilities by combining internal combustion engines with electric motors, their adoption is limited due to higher complexity and maintenance requirements compared to BEVs.

By Motor Power Insights

Which Motor Power Range is Supercharging the Electric ATV & UTV Market in 2024?

On the basis of motor power, the market is segmented into <5 kW, 5–15 kW, and 15–30 kW.

Electric ATVs with motor powers below 5 kW are primarily targeted at youth riders and entry-level enthusiasts. These vehicles offer a balance between affordability and functionality, making them accessible for recreational use. The low power output ensures safety for younger riders while providing sufficient performance for light off-road activities.

The 5–15 kW power range is emerging as the dominant segment in the electric ATV and UTV market. Vehicles within this power range offer a versatile mix of performance and efficiency, catering to a wide array of applications, including agriculture, utility services, and recreational use.

On the other hand, electric UTVs with motor powers ranging from 15 to 30 kW are positioned as high-performance options, offering enhanced capabilities for demanding tasks. These vehicles are suitable for applications requiring higher payload capacities, greater range, and robust performance, such as industrial operations and heavy-duty utility services. The electric power sports sector, encompassing UTVs, indicates a growing interest in this power range, with vehicles offering a balance between power and efficiency, appealing to enthusiasts seeking exhilarating riding experiences.

By Drivetrain Insights

Is Drivetrain Choice Steering the Electric ATV & UTV Market in 2024?

Based on drivetrain, the market is divided into 2-wheel drive (2WD), and 4-wheel drive (4WD).

2WD electric ATVs are primarily designed for recreational users and entry-level riders. Their lighter weight, simpler drivetrain, and lower cost make them ideal for casual off-road experiences, small farms, or leisure riding on less challenging terrain. 2WD vehicles dominate beginner and youth-oriented off-road segments due to ease of handling and reduced maintenance requirements.

4WD electric UTVs, on the other hand, offer enhanced traction, power distribution, and off-road capability, making them suitable for agriculture, industrial sites, and heavy-duty utility operations. The 4WD vehicles are preferred in fleet and worksite applications due to their ability to handle rough terrain, steep inclines, and higher payloads.

By Price Tier Insights

Which Price Tier is Dominating the Electric ATV & UTV Market in 2024?

Based on the price tier, the market is divided into economy, mid-range, and premium.

Economy electric ATVs and UTVs provide an affordable entry point for new riders and casual off-road enthusiasts. These models typically feature smaller batteries, lower motor power, and basic features, making them ideal for recreational trails and youth riders. Mid-range electric ATVs and UTVs strike a balance between affordability and enhanced performance. These vehicles often feature moderate motor power (5–15 kW), better battery capacity, and additional features like enhanced suspension or basic connectivity. The mid-tier segment is gaining popularity for recreational users seeking higher performance and for small commercial operators. Premium electric ATVs and UTVs target professional operators, heavy-duty applications, and high-end recreational users. These models feature powerful motors (15–30 kW), long-range batteries, advanced suspension, 4WD capability, and telematics for fleet management.

By Application Insights

How Are Different Applications Shaping the Electric ATV & UTV Market?

Based on the application, the market is divided into construction & industrial, agriculture & forestry, recreation & tourism, turf & grounds management, and government, law-enforcement & defence.

Electric UTVs are increasingly used in construction and industrial sites due to their ability to transport personnel, tools, and materials quietly and efficiently. Their low maintenance and zero-emission characteristics reduce operational downtime and comply with workplace environmental standards.

Electric ATVs and UTVs are gaining traction in agriculture and forestry for transporting tools, equipment, and harvested produce across rugged terrain. Their quiet operation minimizes wildlife disturbance, and low emissions help meet sustainability targets. DOE studies indicate that electric utility vehicles can reduce greenhouse gas emissions in farm operations while lowering operational costs.

The recreation and tourism sector increasingly prefers electric ATVs for eco-friendly trail rides, adventure parks, and resort operations. Their quiet, zero-emission performance enhances visitor experiences and minimizes environmental impact in protected areas. According to the National Park Service, trails using electric off-road vehicles report less noise pollution and greater visitor satisfaction.

By End-User Insights

How Are End-Users Shaping the Electric ATV & UTV Market in 2024?

On the basis of end-user, the market is segmented into individual consumers, commercial enterprises, government agencies, and rental fleets & tour operators.

Individual consumers form the backbone of the recreational segment. They prioritize affordability, ease of use, safety, and entertainment value in electric ATVs and UTVs. DOE assessments indicate that personal ownership of low- to mid-power electric vehicles is increasing among eco-conscious families and adventure enthusiasts.

Commercial enterprises, including agriculture, landscaping, construction, and industrial operations, are adopting electric ATVs and UTVs to reduce operational costs and emissions. These users require higher payload capacities, durability, and reliable performance for daily operations. Government agencies are increasingly deploying electric ATVs and UTVs for patrol, maintenance, emergency response, and park management. Zero emissions and low noise make them ideal for urban parks, public events, and sensitive areas. Federal pilot programs show that electrified fleets can significantly reduce fuel consumption and emissions, aligning with sustainability mandates.

Rental fleets and tour operators are adopting ATVs and UTVs with electric technology to offer eco-friendly adventure experiences while lowering operational costs. Quiet, zero-emission vehicles enhance guest satisfaction and enable access to environmentally sensitive areas. The National Park Service notes that electric off-road vehicles improve visitor experience and reduce noise pollution on trails.

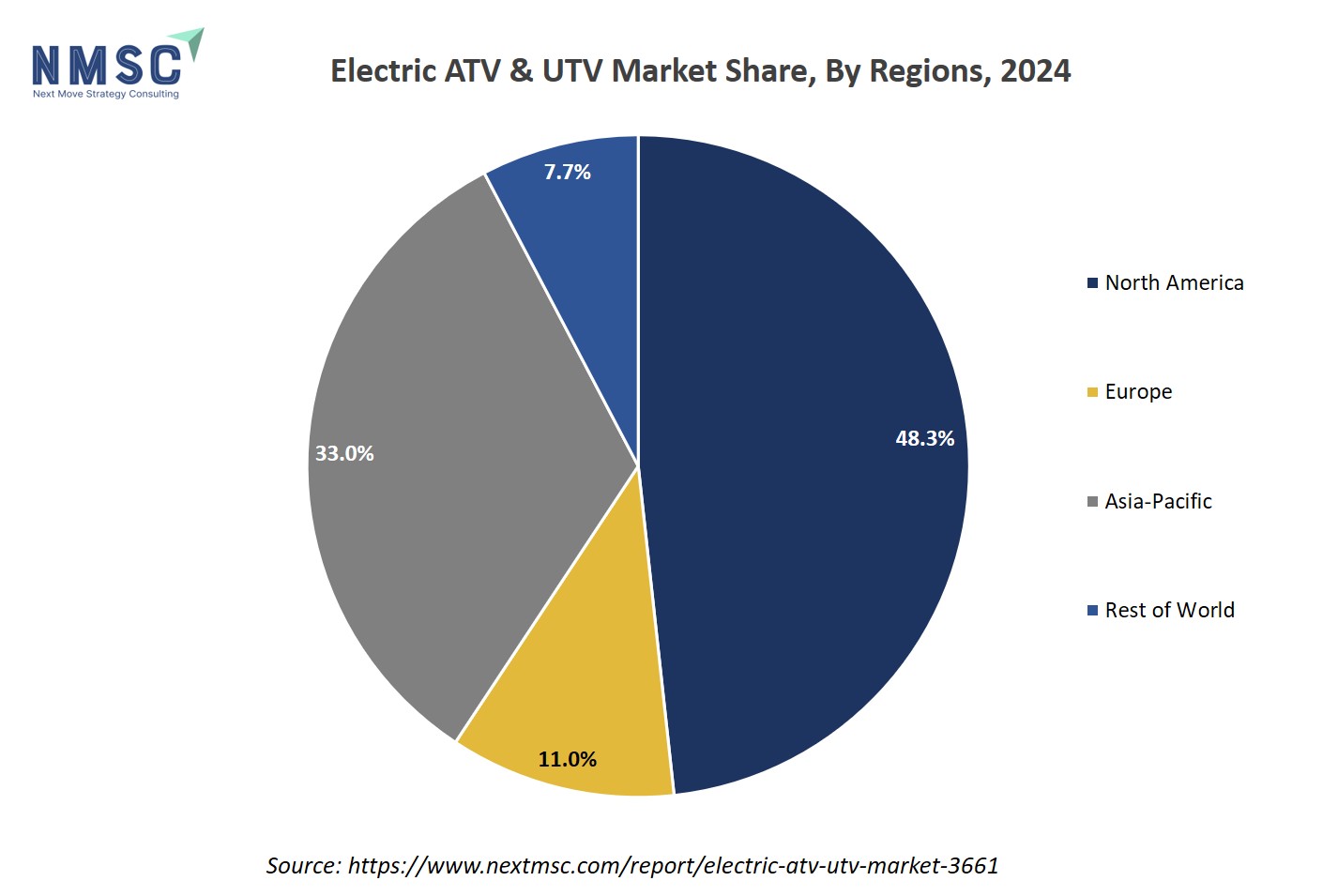

Regional Outlook

The electric ATV & UTV market share is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Electric ATV & UTV Market in North America

North America stands as a significant player in the market, with the United States leading in both adoption and production, with a market share of ~48%. This growth is fueled by increasing environmental awareness, government incentives, and advancements in battery technology.

The U.S. Department of Energy's support for electric vehicle infrastructure and the growing popularity of off-road recreational activities contribute to the market's expansion. Additionally, the integration of electric drivetrains in utility vehicles for agriculture and construction sectors further propels demand.

Electric ATV & UTV Market in the United States

In the United States, the market is expanding rapidly, driven by a combination of environmental policies and consumer demand for sustainable recreational vehicles. Federal and state incentives, such as tax credits and rebates, encourage consumers to adopt electric vehicles. The U.S. Department of Energy's initiatives to promote clean energy and reduce emissions play a pivotal role in this transition.

Moreover, advancements in battery technology have led to longer ranges and shorter charging times, making electric ATVs and UTVs more appealing to consumers seeking eco-friendly alternatives without compromising performance.

Electric ATV & UTV Market in Canada

Europe is at the forefront of the market, driven by stringent environmental regulations and a strong emphasis on sustainability. The European Union's policies, such as the Green Deal and Fit for 55 packages, aim to reduce emissions and promote clean energy, encouraging the adoption of electric vehicles. Additionally, advancements in battery technology and the expansion of charging infrastructure contribute to the market's growth, making electric ATVs and UTVs more accessible to consumers.

Electric ATV & UTV Market in Europe

Europe’s pattern is regional specialization. Germany’s precision and Italy’s SME automation co-exist with rising fleet and software demand across the EU. IFR data show Europe remains a major adopter, and differences across economies, Italy’s strong machinery cluster versus Germany’s automotive precision, mean suppliers sell tailored bundles. Robust hardware plus software for predictive maintenance and regulatory compliance. Policy incentives, energy costs, and labour rules shape procurement cycles, so vendors are localizing financing and integration services.

Electric ATV & UTV Market in the United Kingdom

The United Kingdom's market is experiencing growth, influenced by the government's commitment to achieving net-zero emissions by 2050. Policies such as grants and incentives for electric vehicle purchases, along with investments in charging infrastructure, support this transition. The UK's emphasis on sustainability and environmental conservation aligns with the adoption of electric off-road vehicles for recreational and utility purposes. Moreover, advancements in battery technology and the development of electric drivetrains enhance the performance and appeal of electric ATVs and UTVs in the UK market.

Electric ATV & UTV Market in Germany

Germany's market is expanding, driven by the country's strong automotive industry and commitment to sustainability. Government incentives for electric vehicle purchases and investments in charging infrastructure support the adoption of electric off-road vehicles. The German market benefits from advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors. Additionally, Germany's focus on reducing emissions and promoting clean energy aligns with the growing demand for electric ATVs and UTVs, positioning the country as a key player in the European market.

Electric ATV & UTV Market in France

France's market is witnessing growth, influenced by the government's environmental policies and incentives for electric vehicle purchases. The French market benefits from the country's investments in charging infrastructure and clean energy initiatives, supporting the adoption of electric off-road vehicles. Additionally, advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors contribute to the market's expansion. France's commitment to reducing emissions and promoting sustainability aligns with the increasing demand for electric ATVs and UTVs.

Electric ATV & UTV Market in Spain

Spain's market is emerging, influenced by the government's commitment to achieving net-zero emissions by 2050. Policies such as grants and incentives for electric vehicle purchases, along with investments in charging infrastructure, support this transition. The Spanish market benefits from advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors. Additionally, Spain's focus on reducing emissions and promoting clean energy aligns with the increasing demand for electric ATVs and UTVs, positioning the country as a growing market in Europe.

Electric ATV & UTV Market in Italy

Italy's market is developing, driven by the country's focus on sustainability and environmental conservation. Government incentives for electric vehicle purchases and investments in charging infrastructure support the adoption of electric off-road vehicles. The Italian market benefits from advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors. Additionally, Italy's emphasis on reducing emissions and promoting clean energy aligns with the growing demand for electric ATVs and UTVs, contributing to the market's growth.

Electric ATV & UTV Market in the Nordics

The Nordic countries, including Sweden, Norway, Finland, and Denmark, are leading the adoption of electric vehicles, including ATVs and UTVs, due to their strong environmental policies and commitment to sustainability. Government incentives, such as tax rebates and subsidies for electric vehicle purchases, encourage consumers to transition to electric off-road vehicles. The expansion of charging infrastructure and advancements in battery technology further support this shift. Additionally, the Nordic countries' emphasis on reducing emissions and promoting clean energy aligns with the growing demand for electric ATVs and UTVs, positioning the region as a key player in the European market.

Electric ATV & UTV Market in Asia Pacific

The Asia-Pacific region is experiencing significant growth in the electric ATV and UTV market, driven by increasing disposable income, urbanization, and a shift towards sustainable transportation solutions. Government policies promoting electric vehicles, along with advancements in battery technology, contribute to this growth. The diverse terrain across the region presents unique opportunities for electric ATVs and UTVs to serve recreational and utility purposes, aligning with the region's environmental goals.

Electric ATV & UTV Market in China

China's market is expanding rapidly, influenced by the country's strong manufacturing capabilities and government support for electric vehicles. Policies such as subsidies and incentives for electric vehicle purchases encourage consumers to adopt electric off-road vehicles.

The Chinese government's investments in charging infrastructure and clean energy initiatives further bolster this transition. Additionally, advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors contribute to the market's growth. China's focus on reducing emissions and promoting sustainability aligns with the increasing demand for electric ATVs and UTVs.

Electric ATV & UTV Market in Japan

Japan's market is developing, influenced by the country's commitment to reducing greenhouse gas emissions and promoting sustainable transportation. Government policies, including rebates and incentives for electric vehicle purchases, support this transition. The Japanese government's investments in charging infrastructure and clean energy initiatives further bolster the adoption of electric off-road vehicles. Additionally, advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors contribute to the market's growth. Japan's emphasis on reducing emissions and promoting clean energy aligns with the growing demand for electric ATVs and UTVs.

Electric ATV & UTV Market in India

India's market is emerging, driven by the country's focus on sustainability and reducing pollution. Government incentives for electric vehicle purchases, along with investments in charging infrastructure, support this transition. The Indian government's initiatives to promote clean energy and reduce emissions further bolster the adoption of electric off-road vehicles. Additionally, advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors contribute to the market's growth. India's emphasis on environmental conservation aligns with the increasing demand for electric ATVs and UTVs.

Electric ATV & UTV Market in South Korea

South Korea's market is witnessing growth, influenced by the government's commitment to achieving net-zero emissions by 2050. Policies such as grants and incentives for electric vehicle purchases, along with investments in charging infrastructure, support this transition. Additionally, advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors contribute to the market's expansion.

Electric ATV & UTV Market in Taiwan

Taiwan's market is developing, driven by the country's emphasis on sustainability and environmental conservation. The Taiwanese government's initiatives to promote clean energy and reduce emissions further bolster this transition. Additionally, advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors contribute to the market's growth. Taiwan's focus on reducing emissions and promoting clean energy aligns with the increasing demand for electric ATVs and UTVs.

Electric ATV & UTV Market in Indonesia

Indonesia's market is emerging, influenced by the government's efforts to promote sustainable transportation and reduce emissions. Policies such as subsidies and incentives for electric vehicle purchases encourage consumers to adopt electric off-road vehicles. The advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors contribute to the market's growth. Indonesia's commitment to environmental conservation aligns with the increasing demand for electric ATVs and UTVs.

Electric ATV & UTV Market in Australia

Australia's market is witnessing steady growth, driven by the country's focus on sustainability and reducing greenhouse gas emissions. Government policies, including rebates and incentives for electric vehicle purchases, support the adoption of electric off-road vehicles. The Australian government's investments in charging infrastructure and clean energy initiatives further bolster this transition.

Additionally, advancements in battery technology and the integration of electric drivetrains in utility vehicles for agriculture and construction sectors contribute to the market's expansion. Australia's emphasis on environmental conservation aligns with the growing demand for electric ATVs and UTVs.

Electric ATV & UTV Market in Latin America

Latin America's market is developing, influenced by the region's increasing focus on sustainability and environmental conservation. Government incentives for electric vehicle purchases and investments in charging infrastructure support the adoption of electric off-road vehicles. The region's diverse terrain presents unique opportunities for electric ATVs and UTVs to serve recreational and utility.

Electric ATV & UTV Market in the Middle East & Africa

The Middle East and Africa (MEA) region is experiencing a notable surge in the adoption of electric ATVs and UTVs, driven by a combination of environmental awareness, technological advancements, and a growing demand for sustainable transportation solutions.

Countries like the UAE are leading the way in integrating electric off-road vehicles into their tourism and recreational sectors. The UAE's vast desert landscapes and the popularity of quad biking among tourists have created a strong market. It is further supported by advancements in battery technology, which enhance the performance and range of these vehicles.

Competitive Landscape

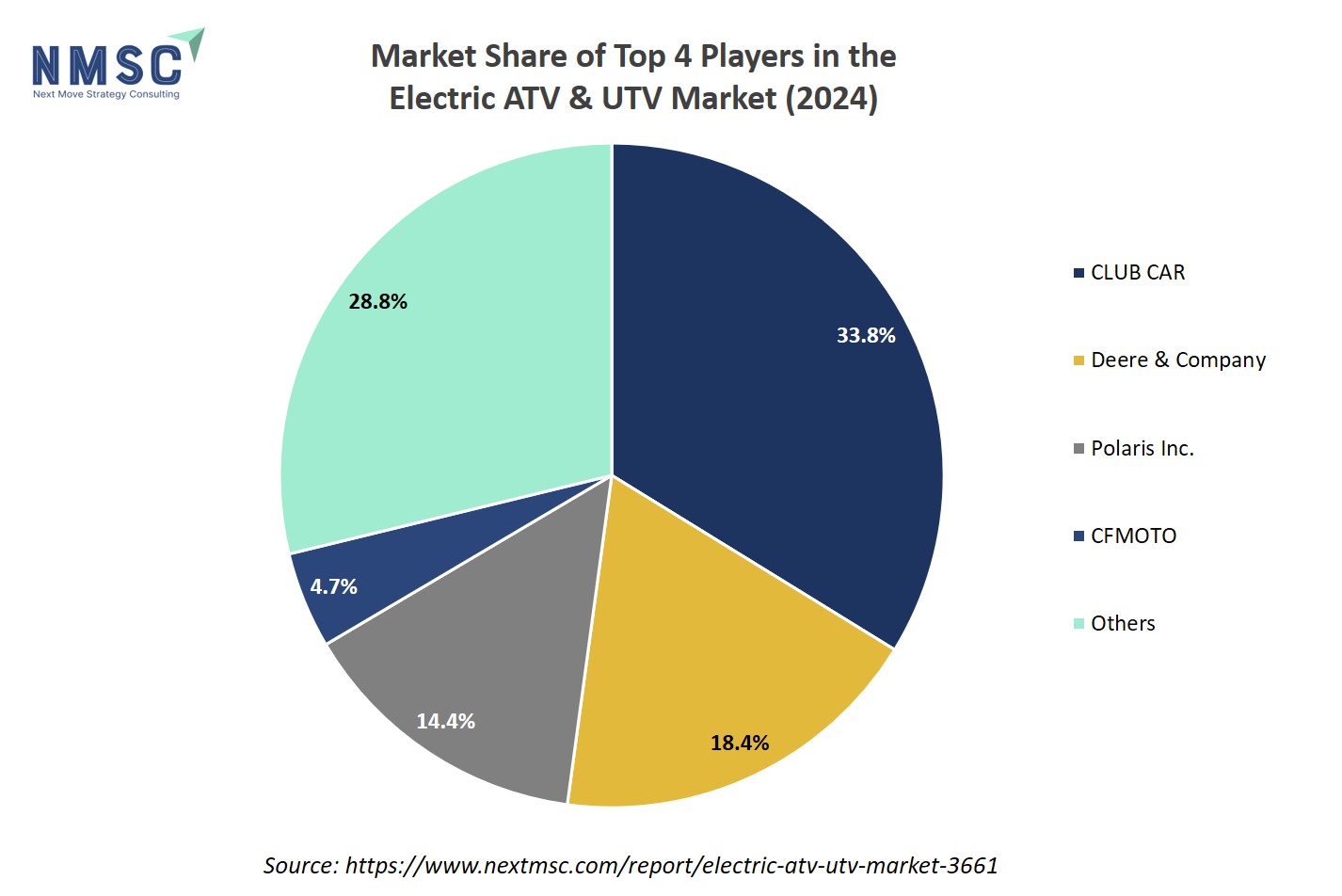

Which Companies Dominate the Electric ATV & UTV Market and How Do They Compete?

Leading the charge in the electric ATV & UTV industry are companies like Polaris Inc., CFMOTO, Landmaster, and DRR USA. Polaris has introduced the 2024 Ranger XP Kinetic, an electric UTV offering up to 80 miles of range and a 5-year battery warranty. Similarly, CFMOTO unveiled the CFORCE EV110, targeting younger riders with its 110cc-equivalent electric motor and 40-mile range. Also, DRR USA's EV Safari 4x4, relaunched in April 2025, has received top rankings from independent reviewers, highlighting its competitive edge in the market.

Market Dominated by Electric ATV & UTV Giants and Specialists

The electric ATV and UTV market is shaped by a blend of established giants and specialized innovators. Polaris, with its extensive distribution network and brand recognition, promotes its electric models through initiatives like the off-road trail charging network in Michigan.

CFMOTO leverages its strong foothold in Europe to introduce electric models catering to the demand for sustainable off-road vehicles. Landmaster focuses on the North American market, with its AMP electric UTV becoming a significant portion of its sales. DRR USA, with its specialized electric drivetrain technology, offers customized solutions for various applications, carving out a niche in the market.

Innovation and Adaptability Drive Market Success

Innovation is a key driver of success in the electric ATV & UTV market. Polaris's Ranger XP Kinetic features a permanent magnet AC motor delivering 110 horsepower and 140 lb-ft of torque, with battery options offering up to 80 miles of range. CFMOTO's CFORCE EV110 is designed for younger riders, offering a 110cc-equivalent electric motor and 40-mile range.

Landmaster's AMP electric UTV emphasizes low maintenance and rugged durability, appealing to utility-focused consumers. DRR USA's EV Safari 4x4 combines cutting-edge technology with eco-friendly benefits, providing a silent and reliable off-road experience.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

To expand their presence in the electric ATV & UTV market, companies are increasingly adopting merger and acquisition strategies. While specific recent M&A activities in this sector are limited, companies like Polaris and CFMOTO are exploring partnerships and collaborations to enhance their technological capabilities and market reach.

For instance, Polaris's collaboration with Yotta Energy to develop an off-road trail charging network in Michigan demonstrates its strategic approach to expanding infrastructure to support electric vehicle adoption. Similarly, CFMOTO's expansion into European markets and its introduction of electric models indicate its strategy to diversify its product offerings and penetrate new markets.

Key Players

-

CLUB CAR

-

CFMOTO

-

Landmaster

-

Powerland

-

Alke

-

DRR USA

-

HuntVe

-

Christini

-

Corvus

-

Volcon

-

Eco Charger Quads

-

Tesla

What Are the Latest Key Industry Developments?

-

August 2025 - DRR USA's EV Safari 4x4 was named the world's best electric ATV, praised for its performance in eco-tour operations since 2017. With features like a 50-mile range and silent operation, it has become a preferred choice for sustainable off-road adventures.

-

2025 - Alke announced the launch of its new ATX 4 range, featuring lithium-ion batteries with up to 24 kWh capacity, enabling a range of up to 200 km. These vehicles are designed for professional use, offering enhanced performance and load capacity.

-

June 2024 - Polaris introduced the Ranger XP Kinetic, its first electric UTV, featuring up to 80 miles of range and a 5-year battery warranty. To support EV adoption, Polaris established the first off-road trail charging network in Ontonagon County, Michigan, in partnership with Yotta Energy and a USD 700,000 grant from the Michigan Office of Future Mobility and Electrification. This initiative underscores Polaris's commitment to enhancing the off-road EV experience.

-

2024 - CFMOTO launched the CFORCE EV110, an electric ATV designed for children, offering a 110cc-equivalent motor, 28 mph top speed, and a 40-mile range. This model combines futuristic styling with advanced features, aiming to provide young riders with a safe and eco-friendly off-road experience.

What Are the Key Factors Influencing Investment Analysis & Opportunities in the Electric ATV & UTV Market?

The electric ATV & UTV market trends is experiencing strong investment momentum, driven by advancements in technology, supportive regulations, and shifting consumer preferences. Growth is being propelled by increasing demand for utility applications, such as agriculture and construction, as well as the rising popularity of recreational activities. Investors are showing interest in companies that can combine sustainability with performance, while innovative features like enhanced battery systems and low-maintenance designs further attract funding.

Investment hotspots are emerging in regions with strong infrastructure and policy support for electric mobility. The trend is being reinforced by government incentives, environmental regulations, and the growing consumer shift toward eco-friendly off-road vehicles. Integration of advanced technologies such as AI and IoT in modern UTVs is enhancing user experience and expanding market opportunities, encouraging companies to explore strategic partnerships, collaborations, and innovative solutions to strengthen their position in this evolving sector.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the Electric ATV & UTV Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at regional and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

The market offers significant benefits to a wide range of stakeholders. Investors gain from the sector’s rapid growth potential, driven by technological advancements, regulatory support, and rising consumer demand for eco-friendly vehicles, enabling attractive returns and opportunities for strategic partnerships or innovations.

Customers, including individual consumers, commercial enterprises, and government agencies, benefit from reduced operating costs, low emissions, and versatile applications across recreation, agriculture, construction, and law enforcement.

Additionally, end-users enjoy enhanced performance, reliability, and access to cutting-edge features like AI-assisted controls and improved battery technology, making electric ATVs and UTVs a sustainable, efficient, and practical alternative to traditional off-road vehicles.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 1798.8 Million |

|

Revenue Forecast in 2030 |

USD 3682.6 Million |

|

Growth Rate |

CAGR of 15.4% from 2025 to 2030 |

|

Market Volume in 2025 |

120 thousand units |

|

Volume Forecast in 2030 |

283 thousand units |

|

Growth Rate |

CAGR of 18.7% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

33 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Electric ATV & UTV Market Key Segments

By Type

-

Electric ATV

-

Electric UTV

By Propulsion Type

-

Battery Electric Vehicle (BEV)

-

Hybrid Electric Vehicle (HEV)

By Motor Power

-

<5 kW

-

5–15 kW

-

15–30 kW

By Drivetrain

-

2-Wheel Drive (2WD)

-

4-Wheel Drive (4WD)

By Price-Tier

-

Economy (<USD 10K)

-

Mid-Range (USD 10K–USD 20K)

-

Premium (>USD 20K)

By Application

-

Construction & Industrial

-

Agriculture & Forestry

-

Recreation & Tourism

-

Turf & Grounds Management

-

Government, Law-Enforcement & Defense

By End-User

-

Individual Consumers

-

Commercial Enterprises

-

Government Agencies

-

Rental Fleets & Tour Operators

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, and consultants with actionable intelligence to capitalize on Industrial Robot’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Electric ATV & UTV Market Report serves as an indispensable resource for navigating the evolving landscape.

The market is poised for sustained growth as technological innovation, environmental awareness, and regulatory support converge to reshape the off-road vehicle landscape. Companies that prioritize advanced battery systems, connectivity features, and versatile applications are likely to secure a competitive edge, while strategic investments and partnerships will accelerate market penetration.

Looking ahead, rising consumer demand for sustainable and recreational vehicles, coupled with expanding infrastructure and government incentives, suggests a promising future for the industry. Stakeholders who adapt quickly, invest in innovation, and address evolving customer needs are well-positioned to capitalize on the long-term opportunities presented by this dynamic and rapidly evolving sector.

Speak to Our Analyst

Speak to Our Analyst