Bathing Soap Market by Product Type (Bar Soap, Liquid Soap, Others), by Formulation (Organic, Synthetic, Combination), by Distribution Channel (Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Pharmacies, Convenience Stores, Others), by End-User (Individual Consumers, Commercial Use) – Global Analysis & Forecast, 2025–2030.

Industry Outlook

The global Bathing Soap Market size was valued at USD 26.77 billion in 2024, and is expected to be valued at USD 28.16 billion by the end of 2025. The industry is projected to grow, hitting USD 36.29 billion by 2030, with a CAGR of 5.2% between 2025 and 2030.

The market is undergoing rapid transformation, driven by urbanization, rising disposable incomes, growing awareness of personal hygiene, and increasing demand for premium and natural personal care products. Globally, demand for safe, skin-friendly, and eco-conscious soaps is rising sharply, fueled by growth in retail networks, e-commerce platforms, hospitality sectors, and health-conscious consumer segments.

Expansion of online retail, subscription models, and smart retail solutions further intensifies the need for innovative product formulations, packaging, and marketing strategies. Advancements in natural and organic ingredients, moisturizing and antibacterial formulations, fragrance innovations, and sustainable packaging are reshaping product offerings, enhancing consumer experience, and building brand loyalty.

What are the key trends in the Bathing Soap Market?

What are the major technological trends shaping the market for bathing soaps?

Technological advancements are playing a significant role in shaping the market. Innovations in ingredient extraction, glycerin-based formulations, and cold-pressed production are improving product quality and skin benefits. Automated production lines enhance consistency and scalability, while AI-driven consumer insights enable personalized offerings, such as fragrance, texture, and skin-specific soaps. Sustainable manufacturing technologies, including biodegradable packaging, water-efficient processes, and waste reduction methods, are gaining traction as brands respond to environmental concerns.

How is demographic change influencing the Bathing Soap Market?

Demographic and societal shifts are also influencing market growth. Urbanization, rising disposable incomes, and population growth are boosting soap consumption, especially in emerging markets. Younger, health-conscious, and tech-savvy consumers are increasingly seeking organic and multifunctional soaps, while aging populations in developed regions are driving demand for gentle, dermatologically tested, and moisturizing products. These demographic changes are fuelling the development of diverse and targeted product offerings.

What role does government support play in driving industry growth?

Government support is a critical factor in driving the bathing soap market expansion. Initiatives such as health and hygiene campaigns, sanitation programs, and regulatory policies on chemical safety and environmental compliance enhance consumer confidence and adoption. Incentives for domestic manufacturing and MSMEs foster market growth and competition, while public awareness campaigns encourage the regular use of soaps, particularly in hygiene-sensitive regions.

How is consumer preference changing in the Bathing Soap Market?

Consumer preferences are evolving rapidly. Modern buyers favour customized, premium, and multifunctional soaps with clear benefits for skin health and wellness. There is growing emphasis on eco-friendly packaging and ethical sourcing, with consumers moving away from generic soaps toward products that reflect their lifestyle, health, and sustainability values. Overall, the market is transitioning from conventional hygiene products to innovative, consumer-focused, and environmentally responsible solutions that align with contemporary needs.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Bathing Soap Industry in the next decade?

The bathing soap market trends is witnessing robust growth, driven by increasing urbanization, rising disposable incomes, and greater consumer awareness of personal hygiene and wellness. Demand for premium, herbal, and multifunctional soaps is rising as consumers seek products that offer moisturizing, antibacterial, and skin-friendly benefits.

The expansion of e-commerce platforms and modern retail channels is enhancing accessibility and visibility, enabling brands to reach a wider audience and offer personalized solutions. At the same time, market growth is restrained by volatility in raw material prices, which affects production costs and profitability. Opportunities exist in the rising preference for natural, organic, and eco-friendly soaps, encouraging innovation and differentiation in product offerings.

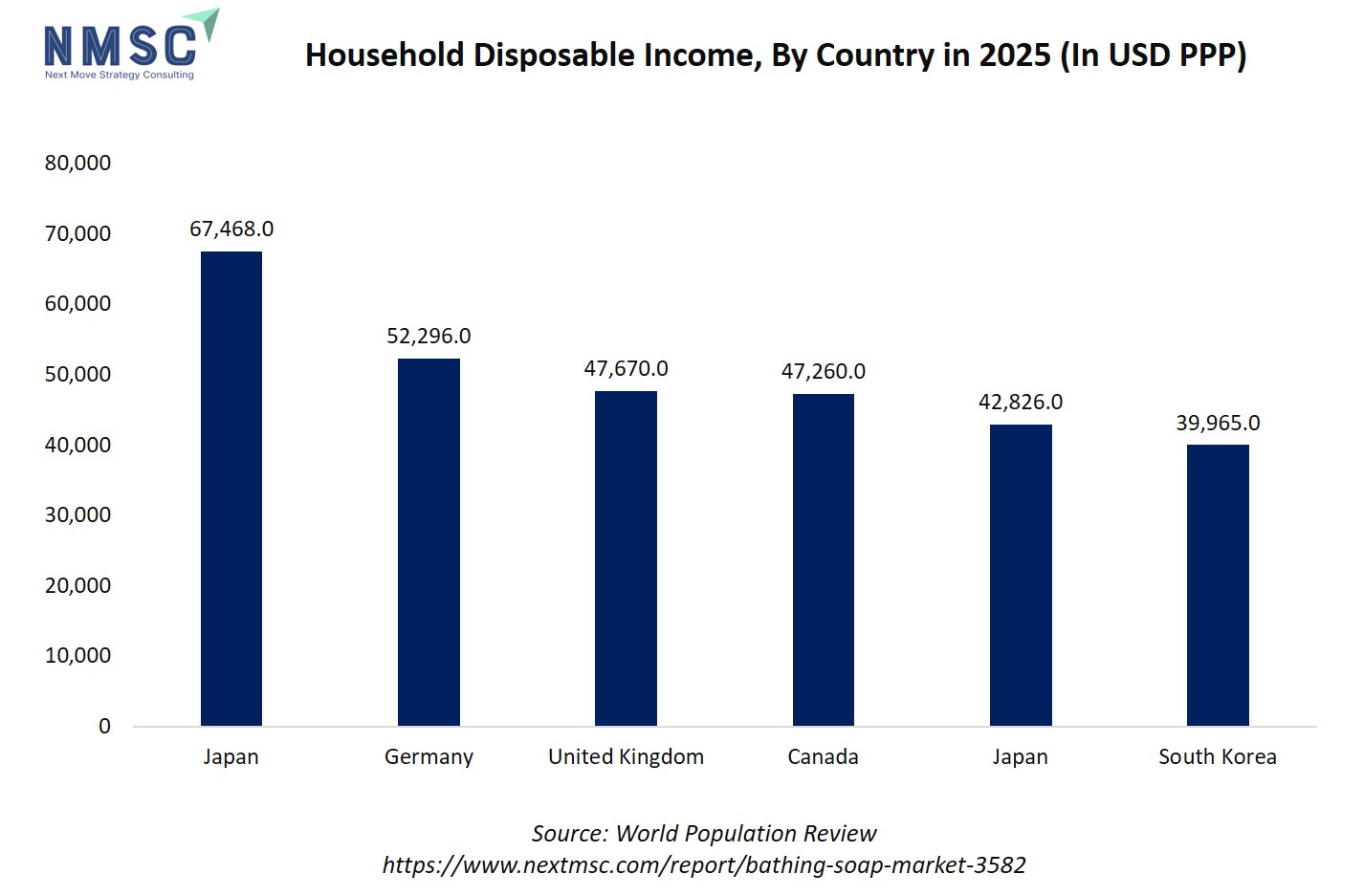

The bar chart illustrates household disposable income in USD PPP for selected countries in 2024–2025. Among the countries shown, Japan has the highest per capita disposable income at USD 67,468, followed by Germany at USD 52,296, the United Kingdom at USD 47,670, Canada at USD 47,260, Japan (again) at USD 42,826, and South Korea at USD 39,965.

Higher household disposable income generally correlates with increased purchasing power and consumer spending on personal care products, including bathing soaps. Countries with elevated disposable incomes, such as Japan, Germany, and the UK, are likely to show stronger demand for premium, organic, and specialty soaps, reflecting consumers’ willingness to invest in quality and branded personal care items. In contrast, countries with relatively lower disposable income, such as South Korea, focus more on value-oriented and mass-market soap products, although rising income levels and urbanization in these regions are gradually expanding opportunities for mid- to high-end products. Overall, the chart highlights that household disposable income is a key driver for market segmentation and product positioning, influencing both product pricing and distribution strategies.

Growth Drivers:

How is Urbanization & Rising Disposable Incomes Driving the Market Demand?

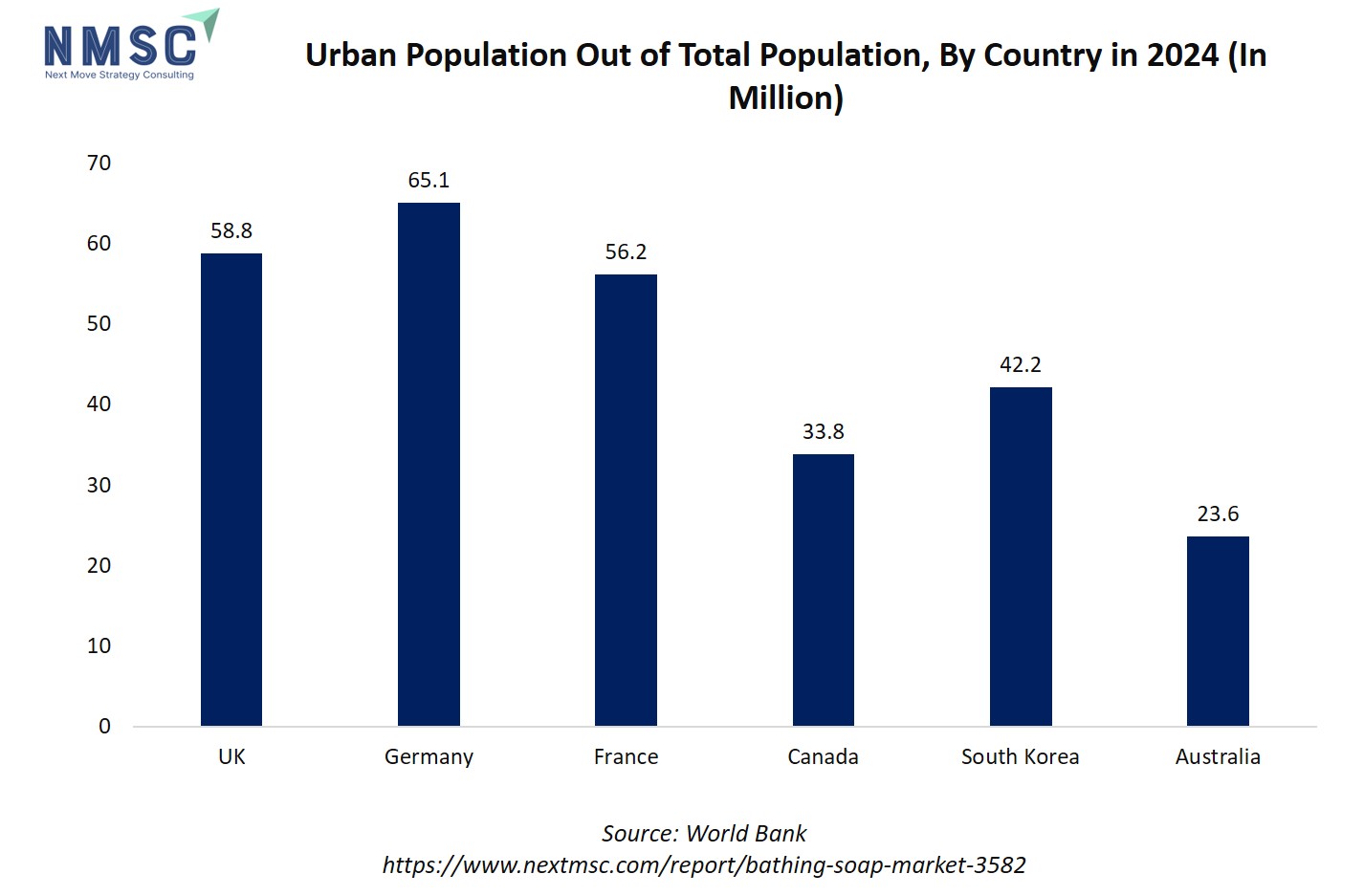

Rapid urbanization is a key driver of the bathing soap market, as it expands the number of consumers with access to modern retail stores, supermarkets, and e-commerce platforms. According to the World Bank, the urban population accounts for 66% of China’s total population and 84% of the U.S. population, highlighting the significant concentration of potential consumers in cities. Urban residents tend to have higher exposure to personal care trends, health awareness campaigns, and premium product offerings. When combined with rising disposable incomes, this demographic shift enables consumers to spend more on premium, herbal, and specialty bathing soaps rather than basic hygiene products. The growth of urban populations, along with increasingly fast-paced lifestyles, drives demand for convenient, multifunctional, and wellness-oriented soaps, making urbanization and income growth critical factors in expanding market size and fostering product innovation.

The chart illustrates the urban population as a percentage of total population across selected countries in 2024. Germany leads the group with 65.05%, followed by the UK at 58.76%, and France at 56.21%, indicating a majority of their populations reside in urban areas. South Korea and Canada have moderately urbanized populations at 42.17% and 33.84%, respectively, while Australia has the lowest share among the listed countries at 23.60%.

This distribution of urban populations has a direct correlation with market demand for consumer and personal care products, including bathing soaps. Higher urbanization typically drives greater consumption due to concentrated population centers, higher disposable incomes, better retail infrastructure, and increased awareness of hygiene and wellness. For example, countries like Germany, the UK, and France, with more than half of their populations living in urban areas, represent strong markets for premium and diversified bathing soap products. Conversely, countries with lower urbanization, such as Australia and Canada, exhibit slower but steady growth, driven by niche or rural-focused product distribution.

Is Expansion of E-Commerce and Modern Retail Channels Accelerating the Market Growth?

The growing presence of online retail platforms, supermarkets, hypermarkets, and convenience stores is significantly driving the market. E-commerce platforms enable consumers to access a wide variety of products, including premium, herbal, and specialty soaps, from the comfort of their homes, increasing overall consumption. Modern retail channels provide visibility for new launches, promotional campaigns, and product differentiation, helping brands reach a broader and more diverse customer base. This expansion also allows companies to leverage digital marketing, subscription models, and personalized recommendations, enhancing brand engagement and driving repeat purchases. As consumers increasingly prefer the convenience, variety, and accessibility offered by online and organized retail, these channels are becoming crucial in boosting sales and accelerating market growth.

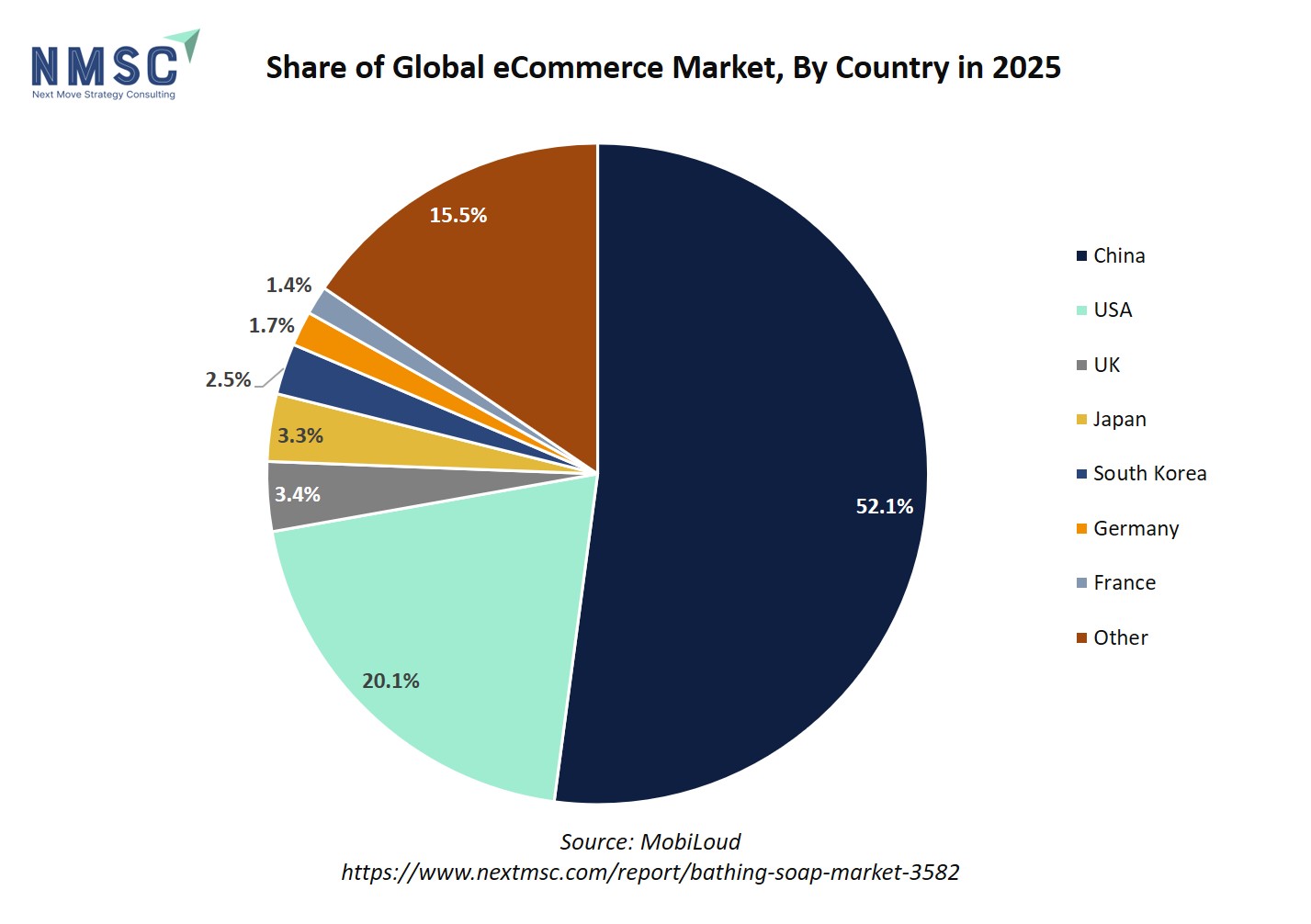

The pie chart depicts the global e-commerce market share by country in 2025. China dominates the market with a 52.1% share, accounting for over half of global e-commerce activity. The USA follows with 20.1%, while the UK and Japan contribute 3.4% and 3.3%, respectively. South Korea, Germany, and France hold smaller shares of 2.5%, 1.7%, and 1.4%, respectively. The remaining countries collectively represent 15.5% under the “Other” category.

This distribution has significant implications for the bathing soap market. Countries with the largest e-commerce shares, such as China and the USA, offer substantial opportunities for online sales of personal care products. Brands leverage e-commerce platforms to reach a vast consumer base, promote premium, organic, and specialized soaps, and implement targeted digital marketing campaigns.

Smaller yet developed markets like the UK, Japan, South Korea, Germany, and France are also increasingly embracing online shopping, creating growth potential for niche and premium bathing soap products. The “Other” category highlights emerging markets where e-commerce penetration is growing, suggesting opportunities for expansion and brand diversification.

Growth Inhibitors:

How Does Raw Material Price Fluctuations Limit the Growth of the Bathing Soap Market?

The market is sensitive to the volatility in raw material prices, particularly for key ingredients like oils, fats, glycerine, and essential oils. Price increases in these raw materials raise production costs, affect profit margins and potentially lead to higher retail prices. Small and medium-sized manufacturers are especially vulnerable to such fluctuations, which impact their competitiveness. Additionally, sourcing high-quality natural or organic ingredients at stable prices remains a challenge, limiting the ability of companies to consistently offer premium or specialty soaps. This volatility acts as a significant restraint on market growth and profitability.

How is Growing Demand for Natural and Organic Soaps Creating Opportunity for the Market?

A major opportunity in the bathing soap market demand lies in the rising consumer preference for natural, herbal, and organic formulations. Increasing health consciousness, awareness of chemical-free products, and concerns over skin sensitivity are driving demand for soaps made from plant-based ingredients, essential oils, and sustainable sources.

Brands that offer eco-friendly, chemical-free, and ethically sourced products have the potential to capture premium segments and build strong brand loyalty. This trend also encourages innovation in new formulations, fragrances, and multifunctional benefits, allowing companies to differentiate themselves in a competitive market while addressing both consumer needs and environmental concerns.

How the Bathing Soap Market is segmented in this report, and what are the key insights from the segmentation analysis?

By Product Type Insights

Which Product Type Is Expected to Drive the Bathing Soap Market in 2025?

On the basis of product type, the market is segmented into Bar Soap, Liquid Soap, and Others. The market in 2025 is expected to be primarily driven by Bar Soap. Bar soaps continue to dominate consumer preference due to their affordability, wide availability, longer shelf life, and ease of use across individual and household settings. They also appeal to health- and hygiene-conscious consumers, with increasing demand for natural and organic formulations further boosting their market share.

While other segments such as Liquid Soap and Others (including specialty gels, powders, and combination products) are gaining traction owing to convenience, luxury positioning, and niche applications, Bar Soap remains the backbone of the market. Additionally, the Others segment is emerging as a high-potential category, driven by rising consumer interest in premium, customized, and multifunctional soap products that cater to specific skin needs, fragrances, and eco-friendly formulations.

By Formulation Insights

Which Formulation Segment Is Poised for Significant Growth in 2025?

On the basis of formulation, the bathing soap market report is segmented into Organic, Synthetic, and Combination soaps. The market, in 2025, is expected to witness significant growth from the Organic segment. Rising consumer awareness about natural ingredients, sustainability, and skin-friendly formulations is driving demand for organic soaps globally. These products are increasingly preferred for their gentle, chemical-free properties, making them particularly popular among health-conscious and environmentally aware consumers.

While Synthetic soaps continue to hold a substantial share due to their cost-effectiveness, widespread availability, and strong cleansing properties, the Combination segment is also emerging as a promising category. Combination soaps, which blend natural and synthetic ingredients, cater to consumers looking for a balance between effectiveness, affordability, and mild formulations. Overall, the growing inclination toward organic and eco-friendly products is expected to redefine formulation trends in the sector.

By Distribution Channel Insights

Which Distribution Channel Is Expected to Lead the Bathing Soap Market in 2025?

On the basis of distribution channel, the market is segmented into Online Retail, Supermarkets/Hypermarkets, Specialty Stores, Pharmacies, Convenience Stores, and Others. The market in 2025 is expected to be primarily driven by Supermarkets and Hypermarkets. These channels offer widespread availability, bulk purchasing options, and the convenience of one-stop shopping, making them highly preferred by individual consumers. Their ability to stock a diverse range of brands and formulations also strengthens their position as the dominant distribution channel.

While Online Retail is witnessing rapid growth due to increasing digital adoption, convenience, and the rise of e-commerce platforms offering doorstep delivery, other channels such as Specialty Stores, Pharmacies, and Convenience Stores continue to contribute to the market by catering to niche consumer segments and specific regional demand. Additionally, the others category, including local retail outlets and pop-up stores, is gaining traction in urban and semi-urban areas, driven by accessibility and personalized shopping experiences.

By End User Insights

Which End-User Segment is Expected to Dominate the Bathing Soap Market in 2025?

On the basis of end-user, the market is segmented into Individual Consumers and Commercial Use. The sector in 2025 is expected to be primarily driven by Individual Consumers, as personal hygiene and daily skincare routines remain the largest source of demand globally. Rising awareness about cleanliness, health, and wellness, along with increasing disposable incomes, is encouraging consumers to opt for a wide range of soaps, including premium, organic, and multifunctional variants.

While Commercial Use, including hotels, spas, gyms, healthcare facilities, and institutional settings, continues to contribute to the market, its growth is more concentrated in specific sectors and regions. Nevertheless, the commercial segment is witnessing increasing adoption of specialty and bulk soaps due to hygiene regulations, brand preferences, and the growing hospitality and healthcare industries. Overall, individual consumers are expected to remain the backbone of the bathing soap sector, driving innovation and shaping demand trends.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Bathing Soap Market in North America

The North American market is being driven by increasing consumer awareness of personal hygiene, rising disposable incomes, and growing preference for premium and natural products. Expanding retail networks, including supermarkets, hypermarkets, and e-commerce platforms, are enhancing product accessibility and visibility. Urban populations are demanding multifunctional, moisturizing, and specialty soaps, while the trend toward eco-friendly and chemical-free products is creating additional growth opportunities for manufacturers across the region.

Bathing Soap Market in the United States

In the U.S., market growth is primarily fueled by the rising adoption of natural, organic, and premium soaps. Health-conscious and wellness-oriented consumers are seeking products with moisturizing, antibacterial, and therapeutic benefits. The expansion of organized retail and online channels allows brands to reach diverse consumer segments, while innovative formulations and eco-friendly packaging are enabling differentiation and brand loyalty.

Bathing Soap Market in Canada

In Canada, demand for bathing soaps is being driven by urbanization, higher disposable incomes, and increasing awareness of natural and skin-friendly products. Consumers prefer soaps that offer additional benefits such as moisturizing, herbal ingredients, or fragrance variety. E-commerce and modern retail channels are expanding reach, while growing interest in environmentally sustainable products encourages manufacturers to innovate in formulations and packaging.

Bathing Soap Market in Europe

The European market is supported by a strong focus on health, wellness, and eco-conscious lifestyles. Consumers are increasingly adopting premium, organic, and multifunctional soaps with natural ingredients and dermatological benefits. Retail modernization, online shopping growth, and sustainability trends are driving product visibility and accessibility. The market is also witnessing innovation in herbal, chemical-free, and luxury formulations, creating opportunities for brands to cater to diverse consumer preferences across countries.

Bathing Soap Market in the United Kingdom

In the U.K., the market is primarily driven by growing consumer focus on personal hygiene, wellness, and premium skincare products. Urban populations and higher disposable incomes are fueling demand for moisturizing, herbal, and specialty soaps, while increasing awareness of natural and eco-friendly ingredients is shaping purchasing preferences. The expansion of modern retail chains and e-commerce platforms is improving product accessibility and visibility, enabling consumers to explore a wider variety of soap offerings. Additionally, government campaigns promoting hygiene and public health further support consistent soap consumption, contributing to steady market growth across the country.

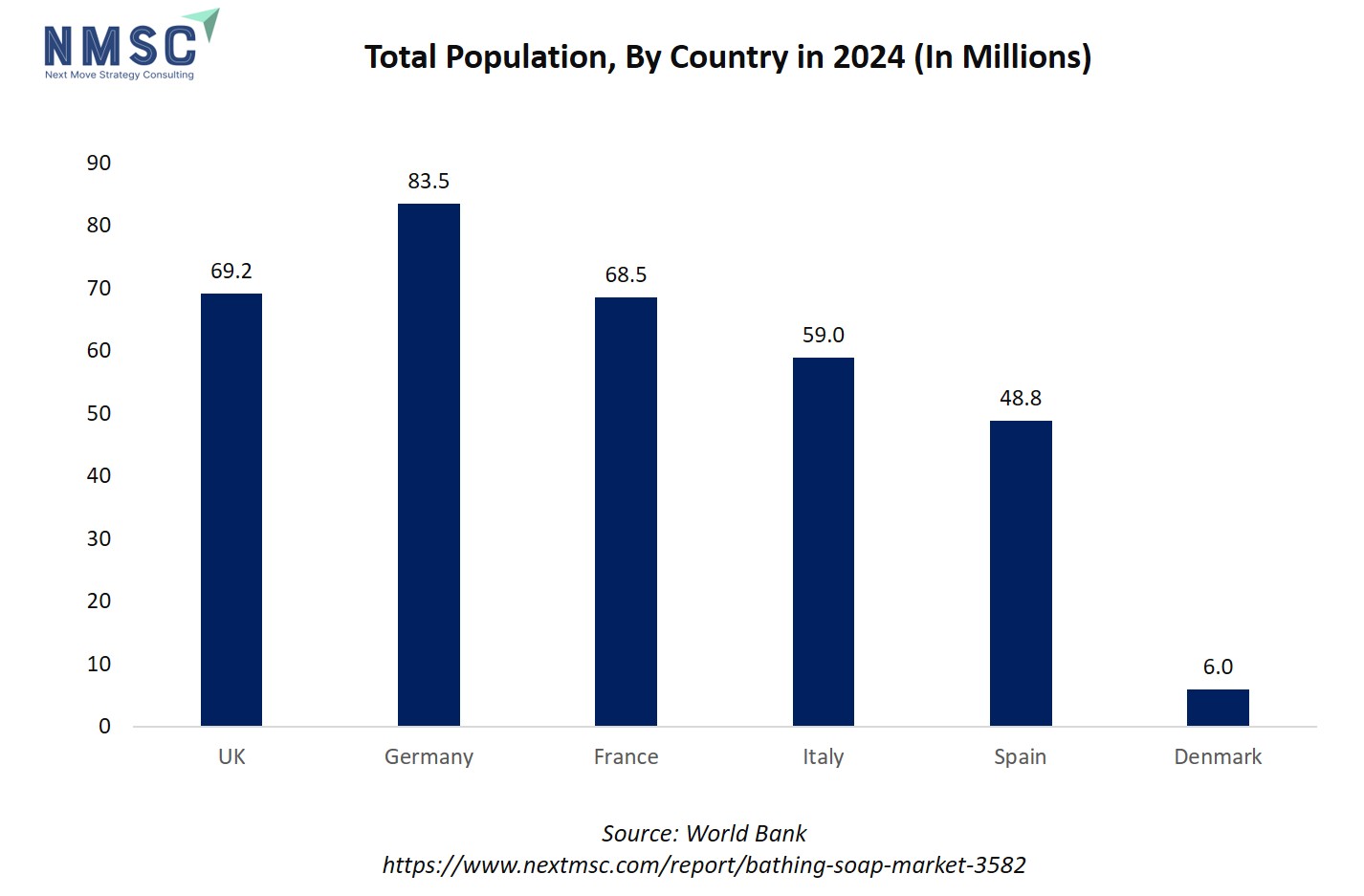

The bar chart illustrates the population in millions for selected European countries in 2024. Germany has the highest population at 83.51 million, followed by the UK with 69.22 million, France at 68.51 million, Italy at 58.98 million, Spain at 48.80 million, and Denmark with the smallest population of 5.97 million.

Population size is a key driver for the bathing soap market expansion, as it directly determines the number of potential consumers. Countries with larger populations, such as Germany, the UK, and France, represent significant market opportunities due to higher overall demand for both mass-market and premium bathing soaps. Smaller countries, like Denmark, while having a limited total consumer base, exhibit higher per capita consumption and a focus on premium or specialty products.

Additionally, population trends influence distribution strategies and marketing approaches. High-population countries require extensive retail coverage and mass-market penetration, while lower-population nations benefit from targeted marketing and niche product offerings. Overall, understanding population distribution helps companies optimize product availability, pricing, and promotional activities in the market.

Bathing Soap Market in Germany

Germany’s market is primarily driven by consumer preference for premium, natural, and skin-friendly soaps, coupled with high awareness of personal hygiene and wellness. Urban populations with higher disposable incomes are increasingly seeking herbal, moisturizing, and multifunctional soaps. The expansion of modern retail outlets and e-commerce platforms enhances accessibility, while sustainability trends encourage the adoption of eco-friendly and chemical-free products, supporting steady market growth.

Bathing Soap Market in France

In France, the market growth is fueled by urbanization and rising health-consciousness. Consumers are increasingly adopting natural, organic, and multifunctional soaps, with a focus on skincare benefits. Modern retail channels, including supermarkets, specialty stores, and online platforms, are improving product visibility and availability. The demand for premium and wellness-oriented soaps is further supported by public awareness of hygiene and eco-friendly lifestyles.

Bathing Soap Market in Spain

Spain’s market is significantly influenced by urbanization and growing disposable incomes, which are expanding access to modern retail and online shopping platforms. Consumers in urban areas are showing strong preference for premium, natural, and multifunctional soaps, creating opportunities for brands to innovate in fragrance, formulation, and packaging. Sustainability trends and eco-conscious purchasing behavior are also encouraging the adoption of herbal and chemical-free soaps, driving market growth.

Bathing Soap Market in Italy

Italy’s market growth is being driven by increasing health and wellness awareness, along with a strong demand for premium and natural soaps. Consumers are increasingly seeking products with moisturizing, antibacterial, and herbal benefits, supported by urbanization and rising disposable incomes. The expansion of modern retail and e-commerce channels enhances product accessibility, while growing interest in sustainable, eco-friendly, and chemical-free formulations provides opportunities for differentiation and brand loyalty.

Bathing Soap Market in the Nordics

In the Nordic countries, the market is primarily driven by high consumer awareness of personal hygiene, wellness, and natural skincare products. Urban populations with higher disposable incomes are seeking premium, herbal, and multifunctional soaps. The market is also influenced by strong trends toward sustainable, eco-friendly, and chemical-free products, while modern retail chains and e-commerce platforms provide greater accessibility and visibility. Consumers in these regions increasingly prefer products that combine wellness, skin benefits, and environmentally responsible formulations, supporting steady market growth.

Bathing Soap Market in Asia Pacific

The market in Asia Pacific is fueled by rapid urbanization, rising disposable incomes, and growing health consciousness. Countries such as India, China, South Korea, and Australia are witnessing strong demand for premium, natural, and multifunctional soaps driven by expanding urban populations and lifestyle changes.

The growth of modern retail outlets and online shopping platforms is increasing accessibility, while consumers are increasingly opting for herbal, eco-friendly, and chemical-free formulations. Rising awareness of personal hygiene, wellness trends, and sustainability considerations is creating significant opportunities for product innovation and market expansion.

Bathing Soap Market in China

China’s market growth is primarily driven by urbanization, rising disposable incomes, and increasing demand for premium and herbal soaps. Consumers are seeking moisturizing, multifunctional, and natural formulations, supported by strong awareness of wellness and personal care. The expansion of e-commerce platforms and modern retail chains enhances product availability, while growing interest in eco-friendly and sustainable soaps is fostering brand differentiation and market development.

Bathing Soap Market in Japan

Japan’s market is influenced by aging populations, high health consciousness, and premiumization of personal care products. Consumers increasingly prefer gentle, moisturizing, herbal, and multifunctional soaps that cater to sensitive skin and wellness needs. The availability of products through supermarkets, specialty stores, and online platforms supports accessibility, while sustainability trends and natural formulations encourage innovation and product differentiation.

Bathing Soap Market in India

In India, the market is being significantly driven by rapid urbanization, rising disposable incomes, and increasing awareness of personal hygiene. According to the World Bank, India’s urban population is approximately 534.91 million, highlighting the concentration of consumers in cities. This demographic shift, combined with growing health consciousness, is boosting demand for premium, herbal, and multifunctional soaps.

Expansion of modern retail outlets and e-commerce platforms, along with increasing focus on eco-friendly and chemical-free formulations, is creating strong opportunities for product innovation and market growth across urban centers.

Bathing Soap Market in South Korea

In South Korea, the market is primarily driven by urbanization, rising disposable incomes, and increasing consumer awareness of personal hygiene and wellness. Urban populations are increasingly seeking premium, herbal, and multifunctional soaps. Growing demand for natural and eco-friendly products, along with widespread availability through modern retail chains and e-commerce platforms, supports consistent market growth and encourages innovation in product formulations and packaging.

Bathing Soap Market in Taiwan

Taiwan’s market growth is fueled by health-conscious and wellness-oriented consumers who prefer premium, herbal, and multifunctional soaps. Expansion of urban areas, higher disposable incomes, and exposure to global personal care trends are driving adoption of natural, chemical-free, and skin-friendly products. Retail modernization and online shopping platforms improve accessibility, while trends toward eco-friendly and sustainable soaps create opportunities for product differentiation and innovation.

Bathing Soap Market in Indonesia

In Indonesia, the market is being driven by rapid urbanization, growing middle-class populations, and increasing awareness of personal hygiene. Consumers are demanding multifunctional, moisturizing, and natural soaps, while e-commerce and modern retail channels improve accessibility and variety. Rising interest in eco-friendly and chemical-free formulations encourages brands to innovate in ingredients, fragrances, and packaging, creating strong growth prospects across urban and semi-urban markets.

Bathing Soap Market in Australia

Australia’s market is supported by urbanization, rising disposable incomes, and growing preference for premium and natural soaps. Urban consumers increasingly seek herbal, moisturizing, and multifunctional soaps that offer wellness and skincare benefits.

The expansion of modern retail outlets and online platforms enhances product visibility, while sustainability trends and eco-conscious purchasing behaviour drive demand for chemical-free, biodegradable, and environmentally responsible products, fostering innovation and market growth across the country.

Bathing Soap Market in Latin America

In Latin America, the market is primarily driven by rapid urbanization, rising disposable incomes, and increasing awareness of personal hygiene and wellness. Growing urban populations in countries such as Brazil, Mexico, and Argentina are fuelling demand for premium, herbal, and multifunctional soaps.

Expansion of modern retail outlets and e-commerce platforms enhances accessibility and product visibility, while consumer preference for natural, eco-friendly, and skin-friendly formulations encourages innovation and market growth across metropolitan and semi-urban areas.

Bathing Soap Market in the Middle East & Africa

In the Middle East and Africa, market growth is supported by urbanization, rising health consciousness, and increasing adoption of personal care products. Consumers are seeking premium, moisturizing, and multifunctional soaps, with a growing focus on natural and chemical-free ingredients.

The expansion of retail channels, including supermarkets, specialty stores, and online platforms, improves product availability, while the demand for eco-friendly and sustainable products presents opportunities for differentiation and innovation, driving steady growth across the region.

Competitive Landscape

Which Companies Dominate the Bathing Soap Industry and How Do They Compete?

The global market is dominated by established multinational manufacturers and regional players such as Unilever PLC, Colgate-Palmolive Company, Kao Corporation, Reckitt Benckiser Group plc, Henkel AG & Co. KGaA, Godrej Consumer Products Limited, Nirma Limited, Johnson & Johnson (Consumer Health), Natura &Co, L’Occitane International S.A., Dabur India Limited, Klar Seifen GmbH, Vanguard Soap Company, L’Amour Industries, and Regal Manufacturing CC. These companies compete by offering a broad range of bathing soaps across mass-market, premium, herbal, organic, and niche segments, catering to diverse consumer preferences globally.

Market leaders differentiate themselves through innovative formulations, sustainable and eco-friendly ingredients, multifunctional benefits, and premium packaging. Strategies also focus on expanding global and regional distribution networks, brand recognition, marketing campaigns, and product diversification.

Regional specialists and niche brands compete by offering customized, artisanal, or herbal soaps, targeting specific consumer demographics and local markets. As demand grows for natural, herbal, and wellness-oriented products, companies that combine technological innovation in formulations, sustainability, and operational efficiency are capturing market share and establishing strong brand loyalty in the sector.

Market dominated by Bathing Soap Giants and Specialists

The market is split between large multinational manufacturers and regional or niche players. Large companies compete on scale, brand recognition, extensive distribution networks, and broad product portfolios, offering a wide range of soaps from mass-market to premium and specialty variants.

Smaller or specialist providers focus on organic, herbal, or customized formulations, catering to specific consumer preferences, local markets, or premium segments. This creates a dual market structure where consumers either choose well-established brands for reliability and variety or opt for specialized products that meet unique skin, fragrance, or wellness requirements.

Innovation and Adaptability Drive Market Success

Market leaders are investing in innovative formulations, sustainable ingredients, and advanced production technologies to enhance product quality, effectiveness, and consumer appeal. Companies are developing moisturizing, multifunctional, herbal, and chemical-free soaps, alongside eco-friendly packaging to meet evolving consumer preferences.

Brands that adapt to trends like personalization, natural and organic ingredients, and wellness-oriented offerings are securing stronger market presence and loyalty. Continuous innovation in fragrance, texture, packaging, and skin benefits is key to maintaining competitive advantage.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Mergers and acquisitions have become a strategy for bathing soap companies to expand product portfolios, enter new geographic markets, and acquire specialized formulations or production capabilities. Leading manufacturers are acquiring regional or niche soap brands to strengthen market share, diversify offerings, and integrate advanced production technologies.

These M&A activities enable companies to reach new consumer segments, scale operations, and respond effectively to growing demand for premium, herbal, and eco-friendly soaps, while enhancing their competitive positioning in both mass-market and specialty categories.

List of Key Bathing Soap Companies

-

Unilever PLC

-

Colgate-Palmolive Company

-

Reckitt Benckiser Group plc

-

Godrej Consumer Products Limited

-

Nirma Limited

-

Johnson & Johnson (Consumer Health)

-

Natura &Co (Natura Brasil / Group brands)

-

L'Occitane International S.A.

-

Dabur India Limited

-

Klar Seifen GmbH

-

Vanguard Soap Company

-

L’Amour Industries (Pty) Ltd

-

Regal Manufacturing CC

What are the Latest Key Industry Developments?

-

September 2025 - Dabur India announced a reduction in the prices of its products, including Vatika hair care products and Chyawanprakash, following a cut in GST rates. This move aims to make essential goods more affordable and accessible to consumers.

-

September 2025 - Natura entered into a binding agreement to sell Avon International to an acquisition vehicle affiliated with Regent. This move excludes Avon's operations in Russia, Latin America, and the Avon brand itself. Natura will receive a nominal sum of USD 1.35 Million at the deal's closing, with the possibility of earning up to USD 81 million in contingent payments.

-

December 2024 - Kao Corporation announced the launch of Bioré UV Aqua Rich Watery Hold Cream across Japan. This product is notable for being the company's first non-chemical (UV absorber-free) sunscreen.

-

August 2024 - Godrej Consumer Products reported a 54% increase in net profit for the quarter. However, sales declined by 3% to USD 375.6 Million. The company also announced plans to enter the pet care business with an investment of USD 56.6 Million over five years.

-

April 2024 - Dove reaffirmed its commitment to authentic representation by pledging never to use AI-generated images of real women in its advertisements.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Bathing Soap Market?

The market is attracting growing investor attention as global demand rises for premium, natural, herbal, and multifunctional personal care products. Companies offering innovative formulations, sustainable and eco-friendly ingredients, and differentiated packaging are particularly appealing, with investments focused on scalable production and product innovation.

Market activity is strong in North America, Europe, and Asia-Pacific, where urbanization, rising disposable incomes, health consciousness, and wellness trends are driving rapid adoption of high-quality soaps. Strategic mergers, acquisitions, and partnerships by leading manufacturers highlight consolidation as a key growth strategy.

For investors, the most promising opportunities lie in companies that combine diverse product portfolios, technological and formulation innovation, operational efficiency, and the ability to cater to evolving consumer preferences across mass-market, premium, and niche segments.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the global Bathing Soap Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the industry at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 28.16 Billion |

|

Revenue Forecast in 2030 |

USD 36.29 Billion |

|

Growth Rate |

CAGR of 5.2% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

28 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Product Type

-

Bar Soap

-

Liquid Soap

-

Others

By Formulation

-

Organic

-

Synthetic

-

Combination

By Distribution Channel

-

Online Retail

-

Supermarkets/Hypermarkets

-

Specialty Stores

-

Pharmacies

-

Convenience Stores

-

Others

By End-User

-

Individual Consumers

-

Commercial Use

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on bathing soap market’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s market report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst