Containerboard Market by Material (Virgin Fibres, Recycled Fibres and Mixed Fibers), by Type (Linerboard and Flutting), by Wall Type (Single Face, Single Wall, Double Wall and Triple Wall), and by End User (Food and Beverage, Personal Care & Cosmetics, Consumer Electronics, and Other End User) – Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Materials and Chemical | Publish Date: 14-May-2025 | No of Pages: 502 | No. of Tables: 432 | No. of Figures: 391 | Format: PDF | Report Code : MC1436

Containerboard Market Overview

The global Containerboard Market size was valued at USD 138.04 billion in 2023 and is predicted to reach USD 177.18 billion by 2030, registering a CAGR of 3.3% from 2024 to 2030. Containerboard packaging, also known as corrugated packaging, refers to a segment of the paper industry that produces a specialized type of paperboard used in the manufacturing of corrugated boxes and packaging materials.

This market includes the production, distribution, and consumption of these containerboard products for the packaging needs of various industries. Containerboards offer numerous advantages, including their exceptional strength and durability that minimizes shipping costs and environmental impact of companies.

The versatility of these boards allows for customization to meet the diverse packaging requirements, from small boxes to large containers, making them a valuable resource for a wide range of industries.

Rising E-commerce Industry Across the Globe Drives the Containerboard Market Growth

The rapid expansion of online shopping is leading to a substantial increase in the demand for shipping boxes and packaging materials, that in turn drives the containerboard market demand.

As more and more consumers turn to online shopping, there is a notable increase in the number of products packaged and shipped every day. According to the International Trade Administration (ITA), the global B2B ecommerce sales is growing at a significant rate co over the past decade, and it is projected to reach a value of USD 36 trillion by 2026.

Additionally, the global B2C ecommerce revenue is expected to reach USD 5.5 trillion by 2027, growing at a robust 14.4% compound annual growth rate. This surge is anticipated to fuel continued expansion within the sustainable packaging sector, driving manufacturers to innovate and develop increasingly durable packaging solutions to meet the evolving demands of the rapidly transforming retail landscape.

Growing Adoption of Containerboards in Food and Beverage Industry Drives the Market Expansion

The food and beverage sector is undergoing significant expansion, driving the need for containerboard packaging solutions. Companies in this industry are looking for flexible and environmentally friendly options that adhere to strict sustainability standards and regulations while maintaining product quality.

Furthermore, these containerboards provide a variety of advantages including being able to be recycled, sourced from renewable materials, and having excellent preservation abilities for packaged food.

The food and beverage industry holds substantial economic influence globally, as evident in the UK, where it surpassed the automotive and aerospace sectors in 2022. In India, the industry is projected to reach USD 535 billion in 2026, underscoring the vital role of containerboard packaging in meeting the diverse needs of this dynamic industry.

These statistics illustrate the importance of containerboard packaging in addressing the various needs of the constantly changing packaging industry, as companies work to maintain a balance between sustainability and product quality.

Presence of Alternative Materials Hinders the Containerboard Market Expansion

The containerboard industry encounters difficulties due to the increasing use of alternative packaging materials such as plastics, metals, glass, and composites. Advancements in alternative packaging materials is leading to a shift in their adoption by industries traditionally reliant on containerboard. This results in a decline in the containerboard industry share, particularly in cases where competing materials offer advantages such as lower costs, superior performance, or unique benefits.

Integration of Nanotechnology and Smart Packaging in Containerboard Creates Market Opportunity

The containerboard industry is poised for significant growth as it incorporates emerging technologies such as nanotechnology and smart packaging. Nanotechnology and smart packaging create significant market opportunities for the industry by enhancing material strength, durability, and barrier properties, while also incorporating interactive elements and real-time tracking.

These advancements improve product protection, consumer engagement, and supply chain efficiency, catering to industry needs and promoting sustainability through better recyclability and intelligent expiry monitoring. With these innovations driving the industry, the containerboard sector is well-positioned for substantial growth, as it meets the evolving needs of consumers and industries.

By Material, Recycled Fibers Holds the Dominant Share in the Containerboard Market

Recycled fibres account for around 53% of the containerboard market share. Recycled fiber, obtained from post-consumer and pre-consumer waste, provides eco-friendly advantages, cost savings, and a range of quality choices to fulfill diverse packaging requirements.

Popular varieties include test liner and corrugating medium, which are ideal for the exterior and interior of corrugated boxes, respectively, offering durability, shielding, and structural stability. Using recycled fiber helps businesses save resources, reduce waste, and lower energy consumption, making it a preferred choice for industries focused on eco-friendly packaging.

By Wall Type, Double Wall Holds the Highest CAGR of 4.3%

Double wall type is expected for significant growth, with a projected CAGR of 4.3%, driven by its strength, durability, and cushioning, making it suitable for heavier or more fragile. These double wall corrugated cardboards are well-positioned to be the packaging solution of the future.

Their exceptional strength and durability make them ideal for safely transporting heavy or bulky products, while their versatility allows for customization to meet specific industry and customer needs. As supply chains become more complex and environmental consciousness grows, the demand for robust, adaptable, and eco-friendly packaging solutions will continue to increase.

Asia-Pacific Holds the Dominating Share in the Global Containerboard Industry

Asia-Pacific holds the dominant share in the containerboard market due to the presence of one of the largest e-commerce industries within the region. The rapid expansion of e-commerce in countries such as China, Japan, South Korea, and India is leading to a significant increase in demand for shipping boxes and packaging materials to ensure effective packaging and delivery of orders to consumers.

China, being the world's largest online retail market, witnessed a surge in e-commerce exports, reaching USD 257.56 billion in 2023, a 19.6% increase compared to the previous year. As e-commerce sector continues to drive growth in Asia-Pacific, the demand for efficient packaging solutions is expected to remain strong, fueling the containerboard market demand.

Moreover, the food and beverage industry serves as a significant driver of containerboard industry, as corrugated boxes made from containerboard are essential for the safe transportation and storage of various food products. These boxes offer durability and the ability to withstand stacking, vibration, and crushing, making them ideal for the packaging and delivery of a diverse range of food items.

As per the report published by the U.S. Department of Agriculture, Japan's retail food and beverage market reached an approximate value of USD 327 billion in 2022, highlighting the substantial demand for a wide range of food and beverage packaging products. This underscores the vital role of the food and beverage industry in propelling the growth of Japan's containerboard sector.

North America Region Witnesses Fastest Growth in the Containerboard Industry

North America shows steady growth in the containerboard domain owing to the expansion of the manufacturing sector in countries such as the U.S., Canada and Mexico which further drives the containerboard market trends.

Manufacturers require reliable and durable packaging solutions to protect products during storage and transportation, which is evident in key sectors such as electronics, automotive, pharmaceuticals, and consumer goods.

The U.S. manufacturing sector contributed USD 2.3 trillion to the economy in 2022, representing 11.4% of the total Gross Domestic Product (GDP), with a diversified presence of computer and electronic products, chemical manufacturing, food & beverage, and tobacco products. This variation of manufacturing activities is driving the demand for cutting-edge and eco-friendly containerboard packaging solutions.

In addition, the containerboard sector in North America is further driven by the robust international trade in this region. Mexico, as a major exporter of products including automotive parts, electronics, and food items, drives the demand for reliable packaging solutions to safely transport goods globally.

Mexico's geographic location and extensive network of free trade agreements facilitate easier access to international markets for businesses, further amplifying the demand for containerboard packaging.

In 2022, Mexico became the world's 10th largest exporter, with USD 549 billion in exports, led by the thriving manufacturing sectors. As Mexico's exports continue to grow, the demand for eco-friendly corrugated packaging is also expected to rise steadily.

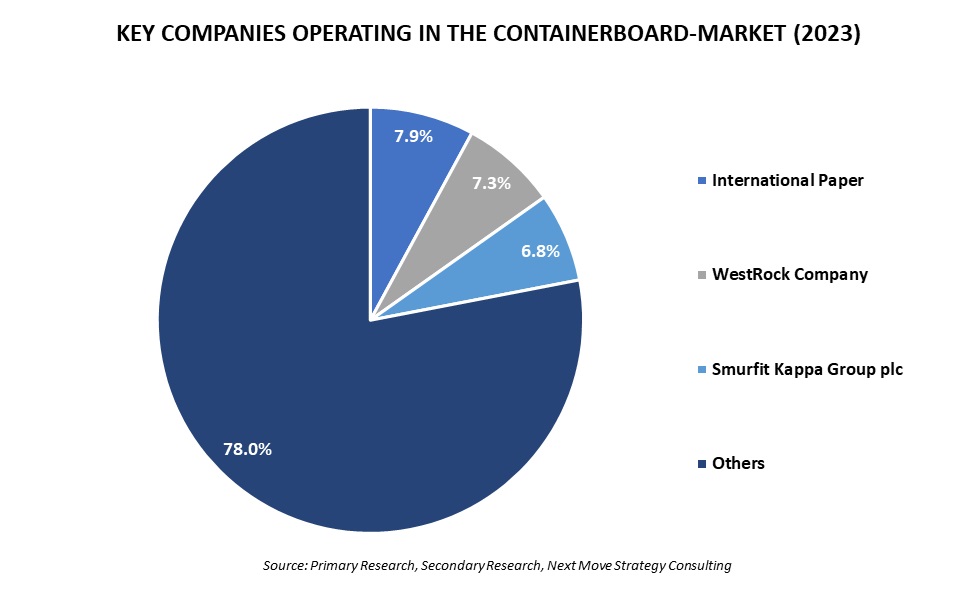

Competitive Landscape

Several market players operating in the global containerboard industry include International Paper, Westrock Company, Smurfit Kappa Group Plc, Nine Dragons Paper (Holdings) Limited, DS Smith Plc, Packaging Corporation of America, Graphic Packaging International, Rengo Co., Ltd, Stora Enso, Greif, Inc. among others. Other companies include Mondi Plc, Klabin, Amcor Plc, Crown Holdings, Inc., SCG Packaging Public Company Limited, Berry Global Group, Inc., and others.

These key players are engaged in various acquisition, partnership, product launch, and business expansion across various regions to maintain their dominance in the global containerboard market landscape.

|

Date |

Company |

Recent Developments |

|

April 2024 |

Rengo Co., Ltd |

Rengo Co., Ltd. acquired RM Tohchello Co. through an absorption-type merger, integrating the Packaging Solution business of SunTox Co., Ltd. and Mitsui Chemicals Tohcello, Inc. This acquisition aims to develop Rengo's flexible packaging business and enhance its capabilities in the industry. |

|

March 2024 |

DS Smith |

DS Smith launched DryPack, a sustainable, fiber-based packaging solution in the U.S. market, targeting seafood processors to replace plastic containers. It is the only containerboard seafood box approved for air freight, significantly reducing space and enhancing sustainability. |

|

March 2024 |

Greif, Inc. |

Greif, Inc. partnered with CDF Corporation to launch an innovative redesign of its GCUBE intermediate bulk container (IBC) for transporting sterile products. This innovative solution is designed to meet the unique requirements of the pharmaceutical and biotechnology industries. |

|

January 2024 |

Westrock Company |

Westrock Company announced to build a cutting-edge corrugated box plant in Pleasant Prairie, Wisconsin, marking a significant expansion of its presence in the Great Lakes region. The new facility will enhance WestRock's production capabilities, improve cost efficiency, and elevate quality standards. |

|

September 2023 |

Graphic Packaging International |

Graphic Packaging International announced to build a facility in Waco, Texas which is expected to be operational by 2026. The facility produces recycled paperboard using the latest technology and is capable of recycling up to 15 million paper cups per day. |

|

June 2023 |

DS Smith |

DS Smith partnered with Voith to rebuild their paper machine in Croatia. This partnership aimed to enhance the efficiency and productivity of the machine, enabling DS Smith to meet growing demands for packaging materials while maintaining a focus on sustainability. |

|

February 2023 |

International Paper |

International Paper invested USD 25.42 million to enhance its production capabilities and expand its facility in Spain. The investment is aimed at meeting the growing demand for sustainable corrugated packaging driven by the ecommerce sector in Spain. |

|

November 2022 |

Nine Dragons Paper |

Nine Dragons Paper expanded its production capabilities by opening a new facility in China's Zhejiang province, dedicated to manufacturing virgin carton board. This new facility complements the company's existing network of production sites across China, further solidifying its position in the industry. |

Containerboard Market Key Segments

By Material

-

Virgin Fibres

-

Recycled Fibres

-

Mixed Fibres

By Type

-

Linerboard

-

Kraftliner

-

Testliner

-

-

Flutting

By Wall Type

-

Single Face

-

Single Wall

-

Double Wall

-

Triple Wall

By End User

-

Food and Beverage

-

Consumer Electronics

-

Personal Care & Cosmetics

-

Other End User

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Finland

-

Netherlands

-

Norway

-

Russia

-

Sweden

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

Rest of World

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

International Paper

-

WestRock Company

-

Smurfit Kappa Group Plc

-

Nine Dragons Paper (Holdings) Limited

-

DS Smith

-

Packaging Corporation of America

-

Graphic Packaging International

-

Rengo Co., Ltd.

-

Stora Enso

-

Greif, Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2023 |

USD 138.04 Billion |

|

Revenue Forecast in 2030 |

USD 177.18 Billion |

|

Growth Rate |

CAGR of 3.3% from 2024 to 2030 |

|

Analysis Period |

2023–2030 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst