Dog Service Market by Type (Small Breeds, Medium Breeds, Large Breeds), By Service Type [Pet Boarding {Long Term, Short Term} Pet Training, Pet Grooming, Pet Transportation, Pet Walking, Other Services], By Delivery Channel (Commercial Facilities, Mobile/Outdoors, Other Channels) – Global Analysis & Forecast, 2025–2030

Industry Outlook

The global Dog Service Market size was valued at USD 22.94 billion in 2024, and is expected to be valued at USD 24.22 billion by the end of 2025. The industry is projected to grow, hitting USD 31.76 billion by 2030, with a CAGR of 5.53% between 2025 and 2030.

The dog service market is experiencing rapid transformation driven by evolving consumer expectations and the expansion of complementary services such as pet insurance. Increased adoption of pet insurance provides dog owners with greater financial flexibility, enabling access to a broader range of services including boarding, grooming, training, and preventive wellness programs. This trend allows service providers to develop bundled care packages and subscription-based wellness offerings, enhancing customer engagement, fostering loyalty, and increasing overall revenue potential. By aligning service offerings with the needs of insured pet owners, companies deliver comprehensive, outcome-driven care that strengthens their market position.

Simultaneously, a growing emphasis on pet mental health is shaping service demand and innovation. Awareness of behavioural challenges such as anxiety and stress is encouraging owners to seek specialized services like behavior training, anxiety management programs, and therapeutic interventions. This cultural shift toward treating dogs as integral family members creates opportunities for providers to design targeted wellness and behavioural programs, expand service portfolios, and deepen client relationships. Together, these factors are driving innovation, broadening service applications, and reinforcing the growth and competitiveness of the market.

What are the key trends in dog service industry?

How is the dog service market being reshaped by on-demand platforms and pet tech?

Consumers are increasingly approaching dog services in the same way they use on-demand platforms for food delivery, ride-hailing, or home services. Scheduling dog walks, daycare sessions, training classes, or even veterinary consultations through mobile apps and online platforms is no longer a niche behavior but a mainstream expectation. The market is evolving rapidly as technology becomes a core enabler of efficiency and scalability. According to the U.S. Bureau of Labor Statistics, the rise of pet tech and gig-based platforms is significantly transforming how dog services are delivered, allowing providers to optimize routes, manage bookings in real-time, and track pet health or behavior digitally. This shift is not just operational; it’s fundamentally reshaping labor models in the sector, enabling flexible staffing and more precise matching of services to client demand. For the market, this trend represents both a growth opportunity and a competitive necessity: companies that invest in intuitive scheduling apps, GPS tracking, digital health records, and seamless communication with pet owners increase utilization rates, reduce no-shows, and create a measurable advantage in a rapidly professionalizing industry.

How is rising dog population translating into new service demand and segmentation opportunities?

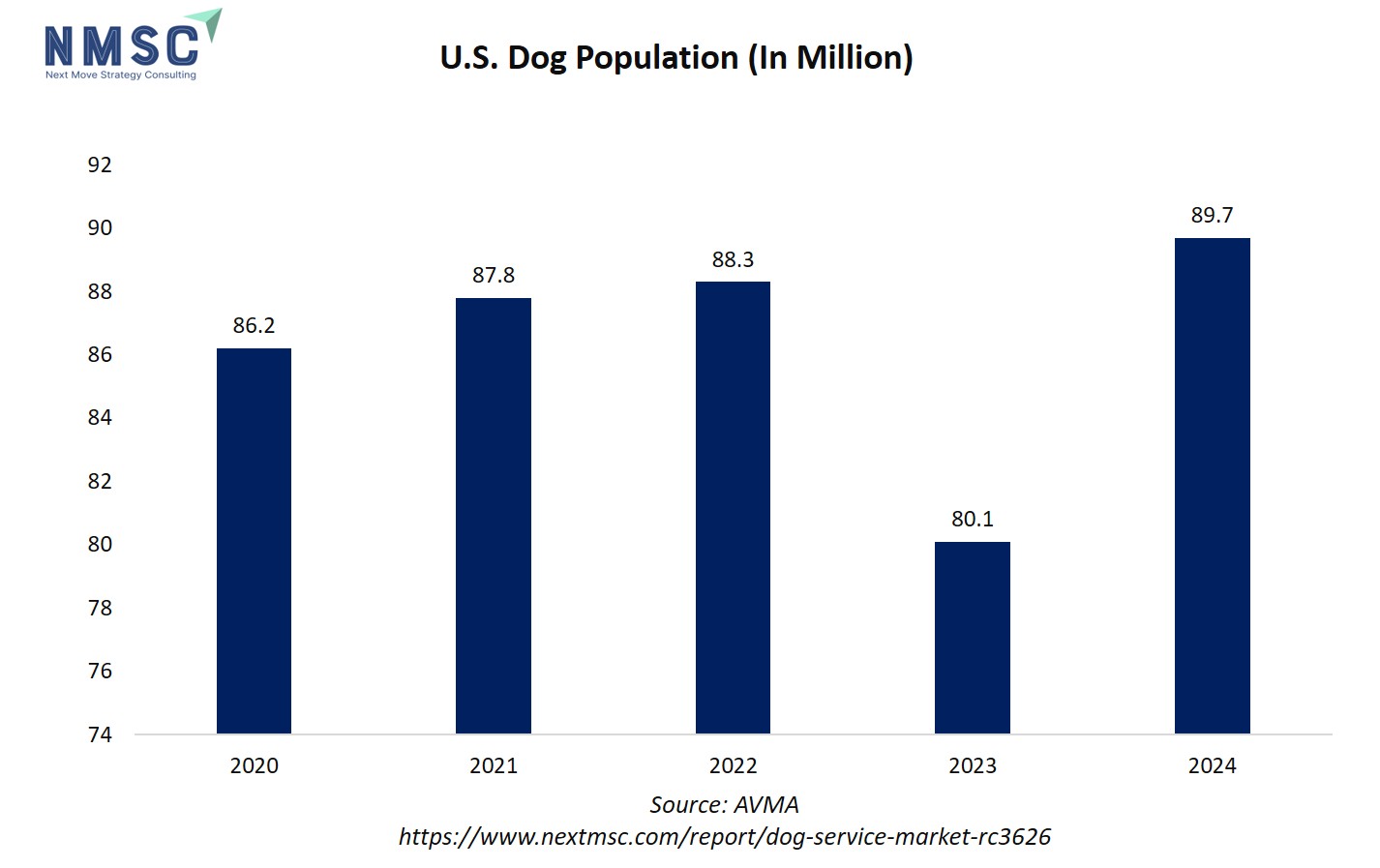

The growing scale of demand in the market is rapidly shaping business strategies and service delivery models. AVMA demographic data indicates that the U.S. dog population is nearing record levels, estimated in the mid- to high-80 million range, providing a large and stable customer base for services such as boarding, training, behavior consulting, and complementary offerings like grooming or daycare. Yet, this demand is far from uniform. Urban millennials tend to favor short, frequent services such as daily walks, city-based training sessions, or daycare visits, while suburban families gravitate toward bundled service packages that include boarding, grooming, and structured training programs. For dog service providers, this creates a clear opportunity to tailor offerings through both geographic and product segmentation focusing high-frequency, subscription-style services in densely populated urban areas, while promoting comprehensive, outcome-driven packages in suburban markets. Aligning service models with these demographic and geographic patterns allows companies to optimize staffing, resource allocation, and service mix, ultimately improving utilization rates, customer satisfaction, and revenue potential across the market.

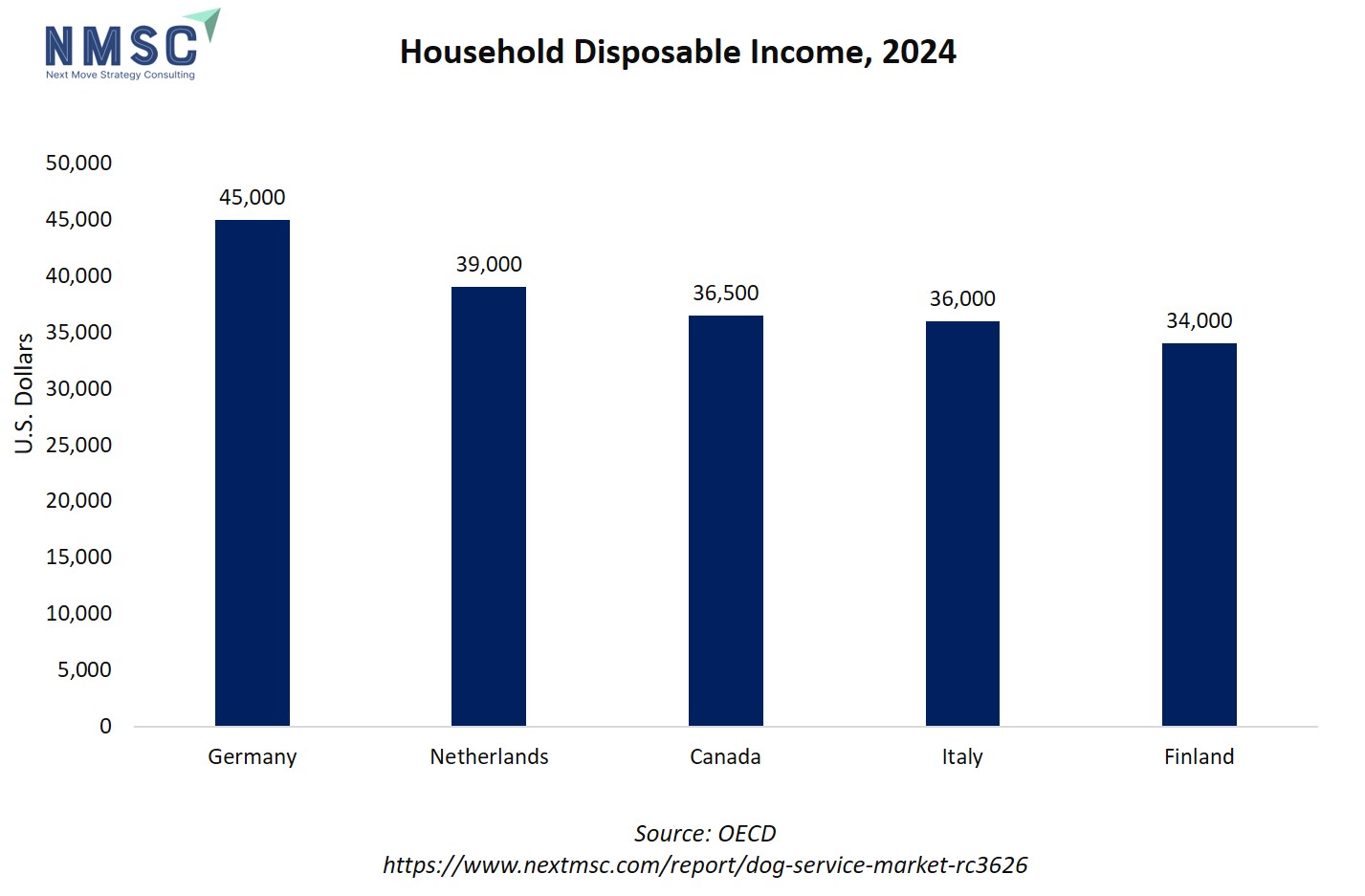

The chart showing household disposable income by country in 2024 is highly indicative, as higher disposable income strongly correlates with increased spending on premium and lifestyle-oriented services, including dog care. Countries with higher disposable incomes, such as Germany, the Netherlands, and Canada, represent attractive markets for dog service providers, as pet owners in these regions are more likely to invest in premium boarding, daycare, grooming, training, and wellness services. Higher income levels enable consumers to prioritize pet well-being and lifestyle, driving demand for personalized, high-quality, and innovative dog care solutions that cater to evolving expectations and the trend of pet humanization.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the dog service industry in next decade?

The global dog service market is witnessing strong growth, driven by innovations such as pet insurance and technology-enabled service platforms, which provide dog owners with greater flexibility and access to a wider range of services. By offering bundled care packages, wellness-focused subscriptions, and outcome-driven programs, service providers are able to personalize offerings, optimize operations, and enhance overall customer satisfaction. These solutions allow providers to cater to both routine and specialized needs, from boarding and grooming to training and preventive wellness, creating new revenue opportunities while fostering long-term client engagement. At the same time, the increasing focus on pet mental health is shaping service demand and market innovation. Awareness of behavioural challenges such as anxiety, stress, and emotional well-being is encouraging dog owners to seek specialized services including behavior training, anxiety management programs, and therapeutic interventions. This cultural shift toward treating dogs as full-fledged family members drives the adoption of premium, personalized care solutions. Collectively, these factors are expanding service applications, encouraging investment, and reinforcing the growth and competitiveness of the market by aligning offerings with evolving pet owner expectations.

Growth Drivers:

How is the increased availability of pet insurance influencing the demand for dog services?

The expansion of the pet insurance sector is becoming a key growth driver for the market. In 2024, North America’s pet health insurance industry exceeded USD 4.7 billion, covering over 6.4 million pets by year-end. This increased insurance adoption gives dog owners greater financial flexibility to access veterinary care and complementary services. As a result, demand is rising for a wider range of dog services, including training, boarding, grooming, and preventive wellness programs. Service providers capitalize on this trend by offering bundled care packages or wellness-focused subscriptions that align with insured owners’ willingness to invest in comprehensive, outcome-driven services. For the market, pet insurance is not just a financial enabler, it creates an opportunity to increase average revenue per client while fostering long-term engagement and loyalty.

How is the increasing focus on pet mental health influencing the demand for dog services?

The increasing focus on pet mental health is emerging as a significant growth driver in the dog service market. Pet owners are becoming more aware of behavioral challenges such as anxiety, stress, and depression in dogs, which is boosting demand for specialized services like behavior training, anxiety management programs, and therapeutic interventions. According to the American Veterinary Medical Association, pet anxiety-related insurance claims have risen sharply, with some states reporting increases of over 100% between 2019 and 2024. This cultural shift toward treating dogs as full-fledged family members is encouraging owners to invest in services that address both physical and emotional well-being. For dog service providers, this trend creates opportunities to design targeted behavioral and wellness programs, expand service offerings, and strengthen client loyalty, positioning their business to meet the evolving expectations of conscientious dog owners.

Growth Inhibitors:

How are economic uncertainties and consumer spending shifts impacting the demand for dog services?

Economic uncertainties, including inflation and potential recessions, are reshaping consumer spending patterns and affecting demand for discretionary services within the dog service market. The American Veterinary Medical Association reports that while veterinary revenues grew by an average of 5.7% between August 2021 and August 2023, client visits declined by 2.7% over the same period, reflecting that pet owners are spending more per visit but seeking services less frequently due to financial pressures. For dog service providers, this highlights the importance of adapting business models to sustain engagement offering flexible pricing, subscription-based plans, or bundled service packages encourage consistent patronage, while emphasizing essential and value-driven services ensures that owners continue investing in dog care even during economically challenging periods.

How Can Dog Service Providers Leverage Telehealth to Expand and Enhance Services?

The AVMA highlights that veterinary telehealth is increasingly recognized as a safe and effective method for providing guidance, as long as a valid Veterinarian-Client-Patient Relationship (VCPR) is maintained. This presents a strategic opportunity for the market: providers incorporate virtual behavior consultations, wellness check-ins, and minor health support into core services such as boarding, grooming, and training. Offering subscription-based telehealth plans enables businesses to reach clients in rural or underserved areas, improve engagement, and reduce missed appointments. By adopting telehealth, dog service providers scale operations more efficiently, strengthen client loyalty, and stand out in a competitive market, all while remaining fully compliant with AVMA VCPR guidelines.

How is the dog service industry is segmented in this report, and what are the key insights from segmentation analysis?

By Type Insights

How is the Dog Service Market Share Shaped by Type?

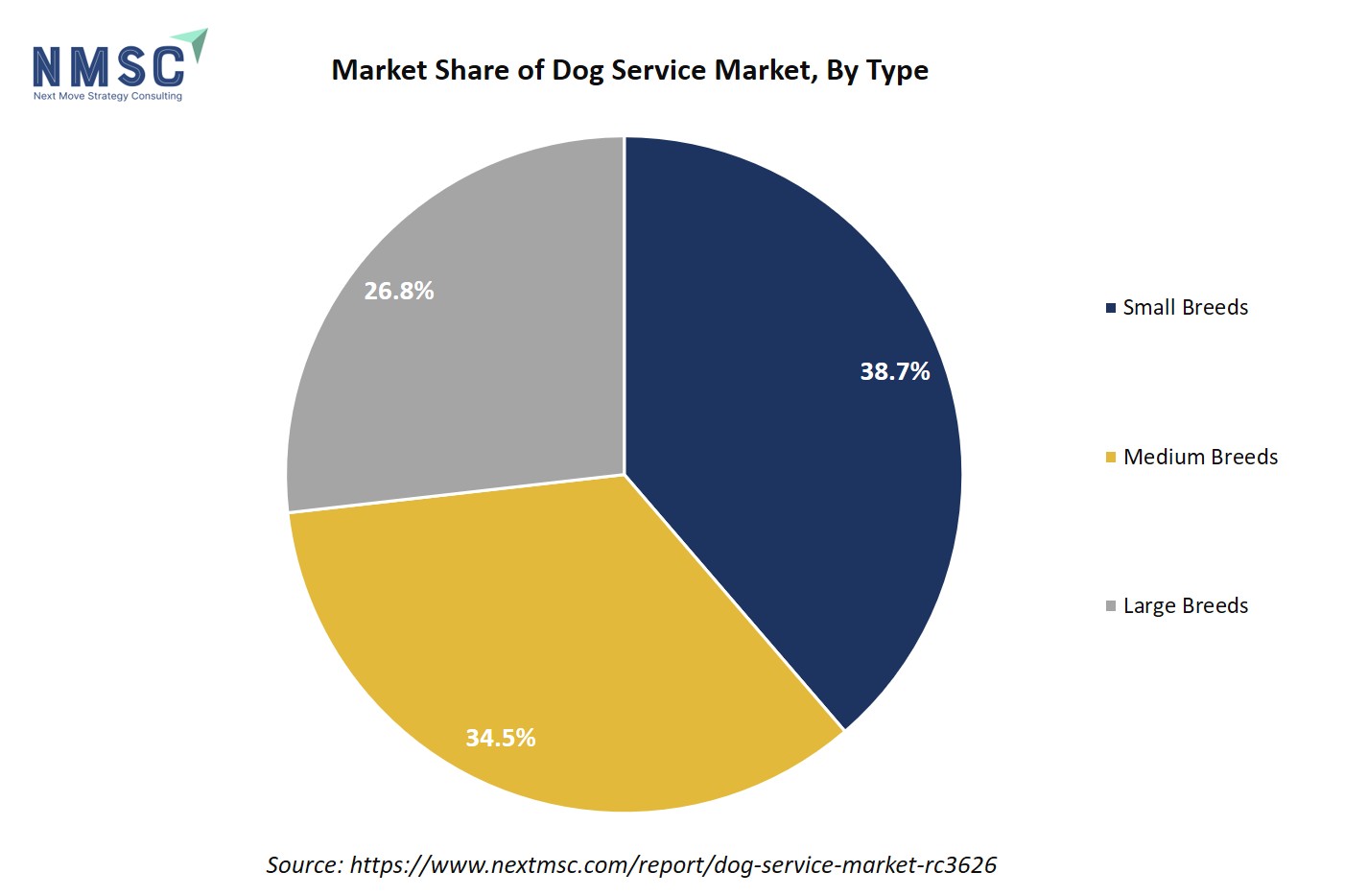

Based on type, the market is segmented into small breeds, medium breeds, large breeds.

The small breeds segment in the market focuses on services tailored specifically for smaller dog breeds, which have unique care, exercise, and wellness needs. Providers in this segment design boarding, daycare, grooming, and training programs that accommodate the size, temperament, and activity levels of small dogs. Facilities offer specialized play areas, appropriate equipment, and breed-sensitive handling to ensure safety and comfort. Additionally, small breeds benefit from personalized attention and structured socialization, making this segment an important part of the market. By catering to the specific requirements of smaller dogs, service providers enhance pet well-being and owner satisfaction, driving demand for dedicated small-breed services.

The chart represents the distribution of the Market by dog type, highlighting the relative demand for services across small, medium, and large breeds. Small breeds account for the largest share, reflecting their popularity among urban pet owners and the specialized care they require. Medium breeds also represent a significant portion, while large breeds occupy a smaller share due to their comparatively lower numbers and different service needs. This distribution impacts the market by guiding service providers to tailor offerings, allocate resources, and design facilities according to breed-specific requirements. Companies focusing on high-demand segments, such as small and medium breeds, optimize their services, enhance customer satisfaction, and capture greater market opportunities in boarding, grooming, training, and other pet care services.

By Service Type Insights

Which Service type is emerging as the most flexible in the Dog Service Industry?

Based on service type, the market is segmented into pet boarding, pet training and others.

Pet boarding refers to temporary care services provided for dogs when their owners are away. This service includes safe and comfortable accommodations, regular feeding, exercise, and attention to ensure the pets’ well-being during their stay. Boarding facilities offer amenities such as climate-controlled spaces, play areas, and supervision to provide a secure and stress-free environment. Many providers also offer additional services like grooming, training, or enrichment activities as part of the boarding experience. Pet boarding is essential for dog owners seeking reliable care, giving peace of mind while ensuring pets remain healthy, engaged, and comfortable in their absence.

By Delivery Channel Insights

How is the Dog Service Market shaped by delivery channel segmentation?

Based on delivery channel, the market is segmented into commercial facilities, mobile/outdoors and others.

Commercial facilities refer to dedicated physical locations where dog services such as boarding, daycare, grooming, training, and wellness programs are provided. These facilities are purpose-built to accommodate dogs safely and comfortably, featuring indoor and outdoor play areas, climate-controlled spaces, and specialized equipment. Commercial facilities allow service providers to offer structured, professional care with trained staff overseeing pets throughout the day. This channel is ideal for owners seeking reliable, high-quality services in a controlled environment, ensuring the safety, health, and overall well-being of their dogs. By centralizing services in a commercial setting, providers maintain consistent standards, deliver premium experiences, and build trust with pet owners.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, Latin America and the Middle East & Africa and each region is further studied across countries.

Dog Service Market in North America

Rising dog ownership and the growing professionalization of pet care are key drivers propelling the market forward. According to the American Veterinary Medical Association, the U.S. is witnessing record-high levels of pet dog ownership, which is directly fueling the demand for diverse services such as dog boarding, grooming, training, and digital care solutions. This expanding pet population is encouraging service providers to adopt more structured, technology-driven business models integrating subscription-based offerings, online booking systems, and telehealth consultations. As a result, North America is emerging as a mature and innovation-led hub within the global market, where convenience, preventive care, and digital engagement define the evolving service landscape.

Dog Service Market in the United States

In the U.S. market, growth is primarily fueled by the rising humanization of pets and the growing preference for premium, tailored care experiences. As dogs are increasingly regarded as family members, owners are seeking high-quality services ranging from luxury boarding and wellness grooming to behavior training and digital health consultations. This deep emotional bond, coupled with a strong inclination toward convenience and technology, is driving the evolution of integrated service models that merge in-person and virtual care. Consequently, the U.S. market is transforming into a highly dynamic, experience-driven ecosystem centered on comfort, personalization, and holistic pet well-being.

The significant growth of the U.S. dog population from 86.2 million in 2020 to 89.7 million in 2024 directly expands the total addressable market for dog services, creating a surge in demand for essential and premium offerings such as veterinary care, grooming, boarding, training, pet sitting, and specialized products, thereby driving increased competition, revenue potential, and market expansion as service providers strive to meet the needs of a rapidly growing pet-owning population.

Dog Service Market in Canada

In Canada, the market is experiencing strong growth driven by the increasing dog population estimated at about 7.9 million and the rising need to improve access to veterinary and grooming services, particularly in rural and underserved regions. This demand is propelling the expansion of mobile grooming vans, on-demand pet care, and telehealth-based veterinary support. Backed by insights from organizations such as the CAHI and CVMA, the industry is rapidly embracing flexible, mobile, and gig-economy service frameworks. As a result, Canada’s dog service market is evolving into a more accessible, technology-enabled ecosystem that prioritizes convenience, personalized care, and nationwide reach for pet owners.

Dog Service Market in Europe

In Europe, the industry is being driven by the substantial rise in dog ownership, with approximately 104 million dogs and 91 million households (46%) owning at least one pet as of 2023. This widespread ownership is creating strong demand for a wide range of services, including grooming, training, boarding, and veterinary care. As dogs increasingly become integral members of households, owners are seeking higher-quality, personalized, and convenient care solutions. This shift is encouraging service providers to adopt technology-enabled models, such as online booking, telehealth consultations, and mobile grooming, further fueling the growth and professionalization of the European market.

Dog Service Market in the United Kingdom

In the UK, the dog service market growth is being driven by stricter animal welfare regulations and import controls, including measures aimed at reducing puppy smuggling. These regulations are increasing demand for licensed, traceable boarding, rehoming, and daycare services, as pet owners increasingly seek providers who adhere to high welfare standards and maintain proper documentation. This focus on compliance and quality is encouraging professionalization across the market, prompting service providers to adopt transparent practices, certifications, and technology-enabled tracking systems. As a result, the UK market is evolving toward more trustworthy, regulated, and welfare-conscious service offerings.

Dog Service Market in Germany

In Germany, the dog service market is witnessing strong growth driven by the fast-paced urban lifestyle of modern pet owners, which has created a rising demand for convenient and flexible care solutions. As dog owners balance work and personal commitments, services such as dog walking, daycare, mobile grooming, and subscription-based offerings have become increasingly essential. This lifestyle shift is encouraging service providers to develop innovative, technology-enabled platforms that simplify scheduling, monitoring, and managing pet care. As a result, Germany’s market is evolving into a highly accessible, convenience-focused ecosystem that caters to the needs of busy, urban pet owners.

Dog Service Market in France

In France, the dog service sector is expanding due to a growing emphasis on pet wellness and holistic care. Dog owners are increasingly prioritizing services that address not only their pets’ basic needs but also their physical health, mental stimulation, and emotional well-being. This trend is driving the development of specialized offerings such as tailored nutrition plans, activity-based programs, behavior training, and wellness-focused daycare. As a result, service providers are innovating and diversifying their offerings, positioning France’s market as a premium, health-oriented, and comprehensive care ecosystem for pets.

Dog Service Market in Spain

In Spain, the dog service market is gaining momentum due to the rising popularity of pet-friendly tourism and travel. As more dog owners take their pets along on trips, the demand for services such as pet-friendly lodging, boarding, daycare, and transport solutions is increasing. This shift is prompting service providers to offer tailored solutions for traveling pets, including mobile care, temporary boarding, and travel support services. As a result, Spain’s market is evolving into a more experience-driven, flexible, and travel-oriented sector that caters to the needs of mobile and lifestyle-conscious pet owners.

Dog Service Market in Asia Pacific

In the Asia Pacific region, the market is being driven by the rapid growth of pet ownership, particularly in China, where the pet consumer market reached USD 41.9 billion in 2024. With a total pet population of 124.1 million, including 52.6 million dogs, there is a significant surge in demand for pet-related services such as grooming, training, boarding, and veterinary care. This expanding pet population, coupled with increased spending on pets, is encouraging service providers across the Asia Pacific to develop professional, technology-enabled, and premium offerings. As a result, the region’s market is evolving into a fast-growing, experience-oriented sector that caters to the needs of a more engaged and spending-savvy pet-owning population.

Dog Service Market in China

In China, the market is experiencing strong growth fueled by the rise of e-commerce and digital platforms that streamline access to pet care. Dog owners are increasingly relying on online apps to schedule grooming, training, boarding, and veterinary services, as well as to purchase pet products. This shift toward digital convenience enables busy urban consumers to access professional, on-demand care easily. Consequently, China’s market is evolving into a tech-driven ecosystem, where digital integration, seamless service delivery, and enhanced convenience are key factors driving market expansion.

Dog Service Market in Japan

In Japan, the dog service market is being driven by the country’s strict import quarantine and animal health regulations. These rules are increasing demand for certified boarding facilities, low-stress care programs, and teletriage services that manage pets’ health efficiently. Service providers capable of handling quarantine procedures and maintaining accurate digital health records are particularly well-positioned to serve both domestic pet owners and expatriates. As a result, Japan’s market is evolving toward highly professionalized, compliance-focused, and technology-enabled care solutions that prioritize safety, regulatory adherence, and pet well-being.

Dog Service Market in India

In India, the market is witnessing strong growth driven by the increasing humanization of pets and their integration into daily lifestyles. Dog owners are increasingly viewing their pets as family members and are seeking services that extend beyond basic care, including specialized training, wellness programs, and enrichment activities. This trend is prompting service providers to develop premium, experience-oriented offerings such as boutique daycare, behavioral training, and activity-focused wellness services. Consequently, India’s market is evolving into a lifestyle-driven and premium-focused sector, prioritizing personalized care and the holistic well-being of pets.

Dog Service Market in South Korea

In South Korea, the market is experiencing rapid growth driven by the rising demand for convenient and on-demand pet care. With more urban households owning dogs and managing busy lifestyles, services such as dog walking, mobile grooming, daycare, and subscription-based care have become increasingly essential. This trend is motivating service providers to adopt innovative, technology-enabled solutions, including app-based booking, home-visit services, and flexible care packages. Consequently, South Korea’s market is evolving into a tech-driven, convenience-focused ecosystem that prioritizes accessibility and time-saving solutions for modern pet owners.

Dog Service Market in Australia

The dog service market in Australia is gaining momentum due to the growing emphasis on eco-friendly and sustainable pet care. Dog owners are increasingly seeking services that incorporate environmentally conscious practices, such as organic grooming products, biodegradable waste management, and green boarding facilities. This shift toward sustainability is prompting service providers to adopt eco-responsible solutions and integrate green practices into their offerings. Consequently, Australia’s market is evolving into a more environmentally aware and responsible sector, catering to pet owners who value both high-quality care and a reduced ecological footprint.

Dog Service Market in Latin America

The dog service market demand in Latin America is being propelled by the region’s expanding commercial pet industry. In 2024, imports of U.S. dog and cat food reached USD 162 million, underscoring the growing scale and formalization of the pet supply chain. This commercial growth is driving increased consumer spending on pets and encouraging a shift toward professional, reliable, and technology-enabled services, including grooming, boarding, training, and telehealth. Consequently, Latin America’s market is evolving rapidly, with providers leveraging this expanding infrastructure to deliver higher-quality, accessible, and organized pet care solutions across the region.

Dog Service Market in the Middle East & Africa

In the Middle East and Africa, the dog service market is gaining momentum due to the growing trend of pet humanization and lifestyle-oriented care. As dog owners increasingly view pets as family members, there is rising demand for services that extend beyond basic care, including wellness programs, behavioural training, enrichment activities, and premium boarding. This shift is prompting service providers to deliver high-quality, personalized, and experience-driven offerings. Consequently, the market in the region is evolving into a premium, health- and lifestyle-focused sector that prioritizes the overall well-being and happiness of pets.

Competitive Landscape

Who are the Leading Companies in the Dog Service Market and How are they Competing?

The global dog service market competition is shaped by a mix of established service leaders and agile, innovation-driven specialists. Companies such as Pet Paradise, WorldCare Pet, Pet Resorts Australia, Camp Bow Wow, Wag Hotels, Fetch! Pet Care, and TK Petcare Solutions Private Limited dominate the market through extensive service networks, premium facilities, and strong brand presence. They focus on delivering high-quality boarding, daycare, grooming, training, and wellness services, while maintaining consistent customer experiences. Their emphasis on reliability, safety, and personalized care helps them cater to the growing trend of treating pets as family members, ensuring they remain key players in the evolving dog service landscape.

Meanwhile, specialized and digitally native innovators like Trupanion, Inc, Best Friends Pet Care, Wag Labs Inc, Petbacker, Pooch Dog Spa, Dogtopia, Highland Canine Training, and A Place of Rover Inc focus on niche services, unique offerings, and flexible service models. These companies emphasize technology-enabled solutions, mobile platforms, personalized care, and on-demand services. Their agility in responding to changing customer preferences and adopting new approaches to dog care creates competitive pressure on established players, pushing the market toward more personalized, experience-focused, and innovative service solutions.

Market Dominated by Dog Service Giants and Specialists

The dog service market is increasingly shaped by a mix of established service leaders and specialized innovators. Companies like Pet Paradise, WorldCare Pet, Pet Resorts Australia, Camp Bow Wow, Wag Hotels, Fetch! Pet Care, and TK Petcare Solutions Private Limited dominate the landscape by offering comprehensive service platforms that combine premium boarding, daycare, grooming, training, and wellness programs. These companies leverage standardized care processes, loyalty programs, and customer engagement systems to provide consistent, high-quality experiences for pets and their owners. Meanwhile, specialized players like Trupanion, Inc, Best Friends Pet Care, Wag Labs Inc, Petbacker, Pooch Dog Spa, Dogtopia, Highland Canine Training, and A Place of Rover Inc are introducing technology-driven and niche solutions such as app-based dog walking, personalized training, on-demand pet care, and luxury grooming services. Together, these players are driving innovation, creating competitive differentiation, and fueling the rapid growth of the market by responding to evolving pet owner expectations and the trend of treating pets as family members.

Market Players to Opt for Expansion Strategies to Expand their Presence

In the dog service market, strategic partnerships and collaborations are becoming essential for expanding capabilities and accelerating adoption. For instance, Camp Bow Wow planned to open 12 new camps by the end of 2024, with agreements already in place for an additional 50 locations. This move reflects a broader trend where leading service providers focus on scaling their operations, entering new geographic markets, and increasing accessibility for pet owners. By expanding their footprint, companies not only enhance brand visibility but also cater to the growing demand for premium dog care services, reinforcing their competitive position in the rapidly evolving market.

List of Key Dog Service in Healthcare Companies

-

Pet Paradise

-

WorldCare Pet

-

Pet Resorts Australia

-

Camp Bow Wow

-

Wag Hotels

-

TK Petcare Solutions Private Limited

-

Best Friends Pet Care

-

wag labs inc

-

petbacker

-

pooch dog spa

-

dogtopia

-

highland canine training

-

A place of rover Inc

What are the Latest Key Industry Developments?

The dog service market is experiencing significant growth as companies leverage a mix of comprehensive service offerings and innovative, technology-driven solutions. Established players like Pet Paradise, WorldCare Pet, Pet Resorts Australia, Camp Bow Wow, Wag Hotels, Fetch! Pet Care, and TK Petcare Solutions are expanding their presence through premium boarding, daycare, grooming, training, and wellness services, raising the overall standards of pet care. At the same time, specialized and agile providers such as Trupanion, Best Friends Pet Care, Wag Labs, Petbacker, Pooch Dog Spa, Dogtopia, Highland Canine Training, and A Place of Rover are driving market evolution by offering app-based, on-demand, and personalized solutions that meet changing pet owner expectations. Together, these players are broadening service accessibility, enhancing care quality, and fostering innovation, fueling the growth and modernization of the dog service industry.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Market?

Investment in the dog service market is increasingly driven by the growing demand for premium and personalized pet care solutions. Funding trends show that investors are drawn to companies offering innovative, technology-enabled services such as app-based dog walking, on-demand grooming, and digital platforms for pet care management. Valuations are influenced by a company’s ability to scale operations, expand into new geographies, and integrate value-added services that enhance customer loyalty and engagement. Investors are showing particular interest in businesses that combine convenience, safety, and wellness-focused offerings, reflecting the rising trend of pet humanization.

Geographically, urban centers and regions with high pet ownership are emerging as hotspots for investment opportunities, as these areas offer strong growth potential and higher adoption rates of premium services. Startups and specialized service providers are attracting attention for their agility, technology adoption, and niche service offerings, creating opportunities for partnerships, strategic acquisitions, and portfolio diversification. Collectively, these factors are shaping a dynamic investment landscape in the global market.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the dog service market trends, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major market segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 24.22 Billion |

|

Revenue Forecast in 2030 |

USD 31.76 Billion |

|

Growth Rate |

CAGR of 5.53% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Type

-

Small Breeds

-

Medium Breeds

-

Large Breeds

By Service Type

-

Pet Boarding

-

Long term

-

Short term

-

-

Pet Training

-

Pet Grooming

-

Pet Transportation

-

Pet Walking

-

Other Services

By Delivery Channel

-

Commercial facilities

-

Mobile/Outdoors

-

Other channels

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, Malaysia and rest of APAC.

-

Middle East & Africa (MEA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MEA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and Rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on the market transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Dog Service Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst