Pet Clothing Market by Product Type (Shirts and Tops, Coats and Jackets, Sweater and Hoodies, and Others), by Pet Type (Dogs, Cats, and Others), by Distribution Channel (Offline and Online), and by Pet Owner (Gen X, Millennial, Baby Boomer, Gen Z, and others) – Global Opportunity Analysis and Industry Forecast, 2024–2030

Industry: Retail and Consumer | Publish Date: 11-Jun-2025 | No of Pages: 605 | No. of Tables: 390 | No. of Figures: 307 | Format: PDF | Report Code : RC971

Industry Overview

The global Pet Clothing Market size was valued at USD 5.4 billion in 2024, and is expected to reach USD 5.7 billion by 2025. Additionally, the industry is projected to continue its growth trajectory, reaching USD 7.23 billion by 2030, with a CAGR of 4.8% from 2025 to 2030.

The apparel market is a rapidly growing segment within the broader pet care industry, driven by evolving consumer attitudes toward pet. As pets are increasingly regarded as family members, pet owners are more inclined to invest in their comfort, safety, and style, fueling demand for a wide range of pet apparel. Also, technological advancements and e-commerce proliferation have played pivotal roles, making pet apparel more accessible and customizable.

Moreover, the influence of social media and pet influencers have boosted consumer awareness and created a demand for aesthetically appealing and seasonal pet fashion trends. Sustainable and functional pet clothing is also gaining traction, with manufacturers responding to consumer demands for environmentally friendly and health-conscious products.

Overall, the market reflects broader societal shifts in how pets are perceived and cared for, representing a blend of fashion, function, and emotional connection. This evolving landscape offers ample opportunities for innovation and growth across regions and product categories.

Rising Pet Adoption is a Key Catalyst for Growth

The increasing rate of pet ownership is fueling the pet clothing market growth, globally. Cats and dogs have been the popular household pets for generations. This trend continues with the rising disposable income and the need for a companion in the rapidly evolving individualistic societies.

As more households’ adopt pets, the demand for pet-related products, including clothing is gaining traction. Pet owners often invest in clothing for their pets, both for functional purposes and as an expression of affection. This trend contributes to the overall growth of the market. For instance, the number of pets has reached 196.9 million in the U.S. in 2024. This surge in pet population corresponds to increased spending on pet apparel.

Humanization of Pets Drives the Demand for Pet Clothing

The trend of treating animals as integral family members has become a significant driver in the pet clothing market demand. Pet owners have started increasingly treating their pets as full-fledged family members, leading to a higher spending on their comfort and style.

This deep emotional bond is driving demand for pet costumes that reflects human fashion trends, including seasonal attire, holiday outfits, and coordinated ensembles. This trend has led pet owners to invest in apparel that reflects their own fashion preferences, resulting in a swell of demand for stylish and functional pet clothing.

Social-Media and Influencer Culture are Accelerating the Growth

The rise of social media and influencer culture has played a significant role in driving consumer demand in the pet clothing market trends. Platforms like Instagram and TikTok showcase pets in stylish outfits, with hashtags that magnifies this trend.

Pet influencers, or "petfluencers," with massive followings are now collaborating with high-end brands like Gucci and Valentino, showcasing luxury pet apparel and securing new fashion standards for pets. These collaborations elevate pet fashion and also influence consumer spending patterns, as pet owners increasingly seek to mirror the styles of their favorite pet personalities.

Pet influencers have an average of 5% engagement rate across major social media platforms, surpassing the typical 1-3% engagement rates of human influencers. This cultural shift underscores the growing intersection of social media influence and the industry.

Limited Awareness in Emerging Markets is a Key Restraint in the Pet Clothing Market Expansion

While the global market is experiencing a steady growth, limited awareness in developing economies remains a significant barrier to its expansion. In many developing regions, pet clothing is often recognised as a non-essential luxury rather than a fashionable necessity. This perception is influenced by cultural norms, lower disposable incomes, and limited exposure to pet fashion trends.

For instance, despite a surge in pet ownership in countries like India, Pakistan, and China, the concept of dressing pets is struggling to gain significant traction. In India, the pet population reached approximately 42 million in 2024, up from 26 million in 2019. However, the adoption of pet outfits remains limited due to a lack of awareness. This limited awareness in emerging markets presents a substantial barrier to the growth of the pet clothing industry.

Tech-Integrated Fashion Accessories Creates New Opportunity

The pet clothing market is witnessing a significant transformation with the rise of tech-integrated fashion, blending style with cutting-edge functionality. Smart collars and vests equipped with GPS tracking, health monitors, and LED displays allow pet owners to keep real-time observation on their pets' location and wellbeing, enhancing safety and convenience. Heated pet coats, featuring battery-powered heating elements, provide much-needed warmth during cold weather without compromising comfort or mobility, making them ideal for pets in colder climates.

Additionally, tech-integrated fashion accessories such as smart jackets and GPS-enabled collars are becoming increasingly popular, combining aesthetic appeal with practical benefits like health monitoring and tracking. These innovations are not only elevating the pet apparel segment but also catering to the growing demand from tech-savvy pet owners who seek to merge fashion with functionality for their beloved companions.

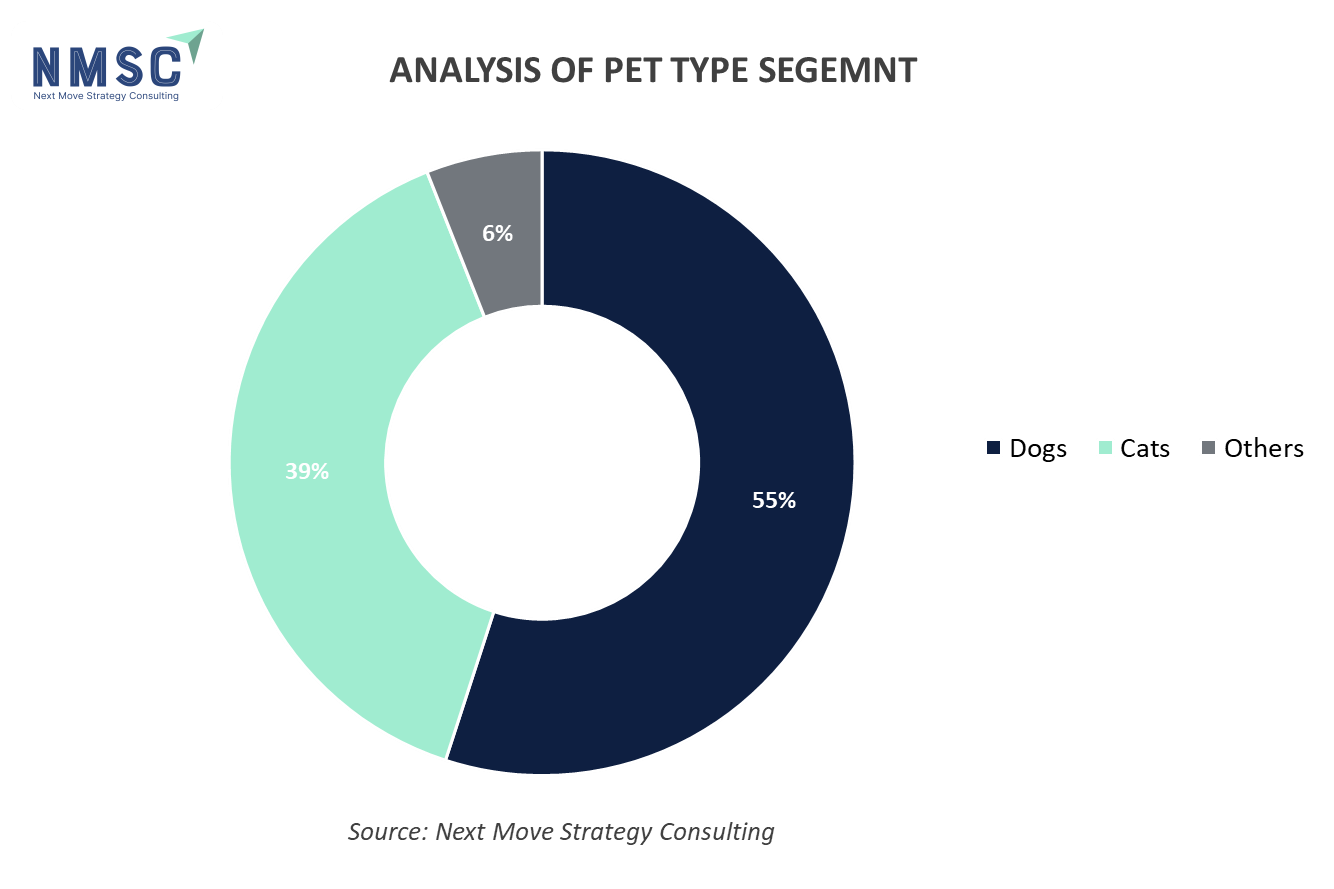

Dog’s Clothing Holds the Largest Market Share Among All Types

Dogs dominate the global pet clothing market share, significantly outpacing other pet types such as cats, birds, horses and others. This dominance is primarily driven by their status as the most commonly owned pets worldwide, particularly in urban and suburban households where pet humanization trends are strongest. Dogs lead the market, with an expected CAGR to surpass 5.3% by 2030 The wide variety of clothing options for dogs, such as jackets, sweaters, raincoats, costumes, and boots, caters to both practical needs and aesthetic.

Millennials Emerge as the Fastest-Growing Consumer Among All Other Generations

Millennials are not only the largest demographic of pet owners but also the most influential consumer group. Their deep emotional bonds with pets have transformed traditional pet care into a lifestyle-driven industry. This emotional investment translates into a willingness to spend on premium, stylish, and functional pet clothing that aligns with their values of comfort and well-being.

Their digital fluency has reshaped how pet clothing is discovered, marketed, and purchased, favouring brands that maintain strong online presences and offer seamless e-commerce experiences. Social media plays a pivotal role, as millennials not only seek inspiration from pet influencers but also contribute to trends by showcasing their own pets in fashionable attires. As this generation continues to age into peak earning years while retaining strong attachments to their pets, their influence on the market will remain dominant.

Asia-Pacific is Predominantly Leading the Market

The market of pet apparel in the Asia-Pacific region is growing at a modest rate, driven by cultural shift towards pet humanization and a growing appetite for fashion-forward pet clothing. The entire Asia-Pacific region is a dominant force, accounting for a significant 35% share of global demand. China is the leader in the APAC region, fueled by its massive population and a growing trend of pet ownership with a share percentage of 22% followed by Japan and South Korea.

Japan's pet industry is expanding rapidly due to increasing number of single-person households and the resulting rise in pet ownership. Similarly, South Korea is experiencing one of the fastest-growing pet economies in the region. It adds to the regional momentum, where the influence of K-pop culture and high social media engagement has turned pet fashion into a visible and aspirational trend.

Australia, on the other hand, though smaller in population, shows a high per-capita spending on pets, reflecting a strong culture of pet care and fashion. Collectively, these countries are not just consumers but trendsetters, propelling Asia-Pacific ahead in shaping global preferences in pet fashion. Together, these countries exemplify the diverse yet cohesive growth dynamics within the broader Asia-Pacific region.

North America is Expected to Witness the Fastest Growth

North America is leading the global market, driven by a robust pet population and evolving consumer attitudes toward pet care and is projected to grow at a CAGR of 5.4% from 2025 to 2030. This growth is propelled by the increasing humanization of pets, leading to higher spending on pet-related products, including clothing.

The U.S. pet population has been steadily rising, with over 70% of households owning a pet, according to the American Pet Products Association. This extensive pet ownership base creates a substantial demand for pet apparel, ranging from functional garments like coats and sweaters to fashionable accessories.

Furthermore, the influence of social media, particularly "petfluencers" with significant followings, has amplified the desire for stylish pet clothing, as these pets often showcase high-end fashion brands, driving consumer trends. The combination of a large pet population, cultural trends favoring pet humanization, and the impact of social media continues to fuel the growth in North America.

Strategic Analysis of Companies in the Pet Clothing Industry

Between 2024 and 2025, leading players in the global market have made significant strategic moves to differentiate themselves and expand their market share through innovation, sustainability, collaborations, and high-profile partnerships.

Canada Pooch has been particularly active, launching the Eco Alaskan Army Parka, crafted with eco-conscious materials and expanding its wellness focus with the Weighted Calm Collection to ease pet anxiety. Little Beast continues leveraging pop culture by launching an official NBA pet clothing line featuring teams like the Lakers, Celtics, and Warriors, tapping into the sportswear and fan merchandise market Luxury pet brand Max-Bone collaborated with the hit Netflix series Bridgerton to release a themed capsule collection, merging fashion-forward design with entertainment branding to reach a style-conscious audience.

Moshiqa, another premium label, teamed up with celebrity Paris Hilton to unveil the MetaPink Pet Collection, combining tech aesthetics with celebrity influence to expand into luxury and lifestyle sectors. On the artisan and design side, Mungo & Maud formed a creative collaboration with Japanese brand 45R, producing handcrafted, culturally inspired pet apparel that appeals to niche luxury buyers.

Together, these strategic initiatives reflect a dynamic competitive landscape where companies are using eco-innovation, celebrity collaborations, strategic distribution, and design exclusivity to enhance brand visibility, tap into new customer segments, and build long-term growth potential in the pet clothing industry.

Pet Clothing Market Key Segments

By Pet Type

-

Dogs

-

Cats

-

Birds

-

Horses

By Product Type

-

Shirts, Tops & Dresses

-

Coats and Jackets

-

Sweaters and Hoodies

-

Rainwear

-

Boots

-

Suits

-

Socks

-

Others

By Accessories

-

Collars and Leashes

-

Hats and Bandanas

-

Harnesses

-

Ties

-

Scarves

-

Others

By Clothing material

-

Cotton

-

Polyester

-

Nylon

-

Fleece

-

Woolen

-

Others

By Generation of Owners

-

Gen Z

-

Millennials

-

Gen X

-

Baby Boomers

By Distribution Channel

-

Online

-

Offline

-

Specialty Pet Stores

-

Supermarkets & Hypermarkets

-

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Rest of Asia-Pacific

-

-

RoW

-

Middle East

-

Africa

-

Latin America

-

Key Players

-

Ralph Lauren Pets

-

Ruffwear

-

Weatherbeeta

-

Ruby Rufus

-

Canine Styles

-

Chilly Dog Sweaters

-

Lucy and Co.

-

Muttluks

-

Hurtta

-

Canada Pooch

-

Mungo & Maud

-

Eco-Pup

-

Rororiri

-

Little Beast

-

Wagwear

Other Notable Key Players

-

Huxley & Kent

-

Max-Bone

-

Moshiqa

-

Fab Dog

-

LazyBonezz

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 5.7 Billion |

|

Revenue Forecast in 2030 |

USD 7.23 Billion |

|

Growth Rate |

CAGR of 4.8% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

24 |

|

Companies Profiled |

20 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst