Elevator Advertising Market by Type (Digital Screens, Static Displays, Interactive Displays, Audio Advertising, Elevator Wraps, Projection Advertising, Frame Advertising), by Duration of Campaign (Short-term Campaigns, Long-term Campaigns, Event-specific Campaigns, Promotional Campaigns), by Application (Office & Retail Buildings, Residential Complexes, Shopping Centres, Hotels, Healthcare Facilities, Institutions, Transportation, Market, Others) – Global Analysis & Forecast, 2025–2030

Elevator Advertising Industry Outlook

The global Elevator Advertising Market size was valued at USD 12.10 billion in 2024, and is expected to be valued at USD 13.18 billion by the end of 2025. The industry is projected to grow, hitting USD 20.29 billion by 2030, with a CAGR of 9.0% between 2025 and 2030.

The elevator advertising market is rapidly evolving, driven by digital transformation, smart screens, and growing urbanization. IoT-connected elevator displays enable real-time, location-specific content delivery, making campaigns more dynamic and engaging. As per UNCTAD’s 2024 Digital Economy Report, digital infrastructure now accounts for 6% to 12% of global electricity use, prompting the need for energy-efficient practices alongside technological adoption. Urbanization is another key growth driver, by 2024, 37% of India’s and 84% of the U.S. population live in urban areas (World Bank), creating a captive audience within residential, office, and transit buildings. These high-traffic zones allow frequent ad exposure, boosting recall and cost-effectiveness.

However, limited screen time per viewer, typically 30 seconds to 2 minutes restricts message delivery, with multiple ads competing in short loops, reducing engagement potential. Amid these constraints, AI integration offers a significant opportunity. With the global AI market expected to reach USD 4.8 million by 2033 (UNCTAD, 2025), elevator networks leverage AI to analyze real-time data and deliver personalized, context-aware content. This shift from static ads to intelligent targeting enhances relevance and ROI, positioning elevator digital advertising as a key player in smart urban media ecosystems.

What are the key trends in Elevator Advertising industry?

Are Digital Elevator Screens Becoming the Norm?

The elevator advertising market is experiencing a steady transition from traditional print-based posters to digital screens. These connected displays allow advertisers to deliver video content, real-time promotions, and dynamic schedules tailored to different audiences. The adoption of digital signage is particularly strong in urban centers and smart buildings, driven by real estate modernization and government-led urban initiatives. According to UNCTAD’s Digital Economy Report 2024, the production and use of digital devices, data centres, and ICT networks account for an estimated 6% to 12% of global electricity use. This shift toward digitalization enhances ad flexibility and reduces the operational cost of physically replacing posters, making digital elevator ads a preferred choice for many advertisers.

Is Real-Time and Location-Based Advertising Gaining Popularity?

One of the most significant trends in elevator advertising technology is the use of real-time and geo-contextual advertising. With the support of cloud-based content management systems, digital screens in elevators now deliver advertisements that change based on time of day, audience demographics, and even weather. This functionality enables highly relevant campaigns, such as coffee shop promotions in the morning or local clinic ads in residential complexes during the day. In regions like Singapore and Dubai, where smart urban planning policies promote tech-enabled infrastructure, location-aware elevator advertising is becoming a mainstream solution for brands targeting city dwellers.

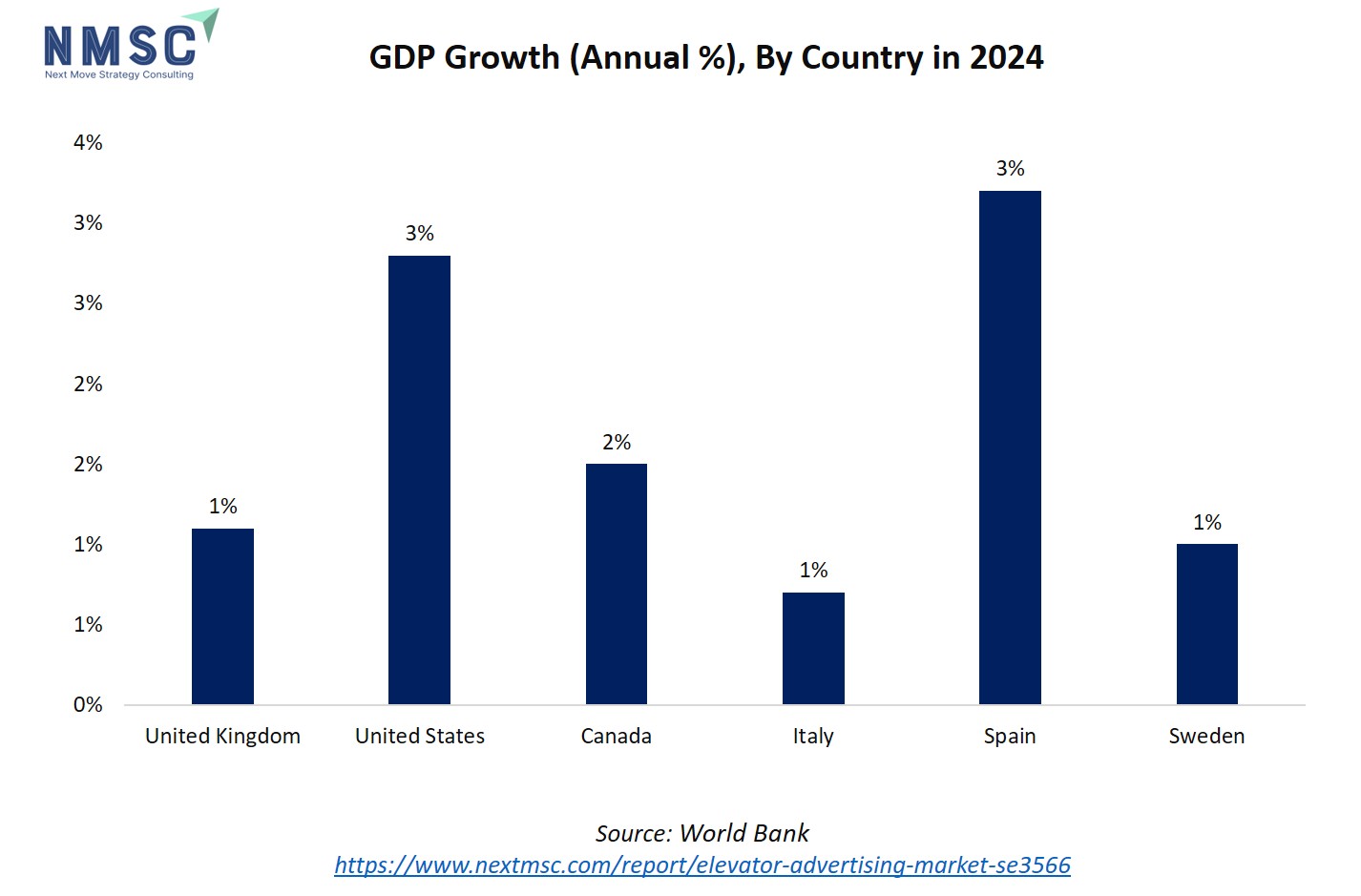

The chart illustrates annual GDP growth rates in 2024 across selected countries, highlighting Spain with the highest growth at 3.20%, followed by the United States at 2.80%, Canada at 1.50%, the United Kingdom at 1.10%, Sweden at 1.00%, and Italy at 0.70%. Stronger GDP growth reflects healthier economic activity, higher consumer spending, and increased business investment, all of which directly support the elevator advertising market expansion. Rapidly growing economies, such as Spain and the U.S., are more likely to see rising demand for advertising in commercial buildings, shopping centers, hotels, and residential complexes. Conversely, markets with slower GDP growth, like Italy and Sweden, adopt elevator screen advertising at a steadier pace but still provide opportunities through targeted, cost-effective campaigns. Overall, robust GDP growth correlates with greater construction activity, expanding retail and hospitality sectors, and higher advertising budgets, reinforcing the role of elevator advertising as a strategic medium in urban economies.

Is the Demand for Hyperlocal and Community-Oriented Ads Growing?

Advertisers are recognizing the power of hyperlocal engagement through elevator screens, especially in residential apartments and gated communities. These platforms are being used not only for commercial purposes but also for delivering community-oriented content, such as building notices, event announcements, and neighborhood alerts. This localized approach builds trust and boosts viewer attention, since the content feels relevant to the immediate surroundings. According to the Brookings Institution, local messaging platforms enjoy higher audience receptivity and response rates, making elevator screens ideal for blending commercial promotions with community updates.

Are Brands Using Elevator Ads for Premium Positioning?

Elevator advertising is gaining strong momentum in premium segments such as high-end real estate, luxury hospitality, and corporate towers, where it is used to engage affluent and business-oriented audiences. Sleek digital screens embedded within elevators serve as strategic touchpoints for delivering curated brand messages related to luxury fashion, financial services, and elite travel experiences. The controlled and sophisticated environment of premium hotels, residential skyscrapers, and airports enables advertisers to maintain brand integrity and deliver high-impact, exclusive promotions. This trend is further reinforced by the resurgence of international travel.

According to the World Tourism Organization (UN Tourism), approximately 1.4 billion international tourist arrivals were recorded in 2024, representing 99% of pre-pandemic levels. As global tourism rebounds, the demand for targeted, in-premise advertising, particularly in upscale hotels and airport elevators is accelerating, offering brands a unique opportunity to reach high-value travelers and guests in a captive, high-dwell setting.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Elevator Advertising industry in next decade?

The elevator advertising market is evolving rapidly with the rise of digital technologies and smart urban infrastructure. The integration of smart screens, IoT, and cloud-based platforms is transforming traditional static displays into dynamic, data-driven systems capable of delivering real-time, location-specific content. Urbanization further strengthens this market, as densely populated cities offer a captive and high-frequency audience in residential and commercial buildings.

However, the market also faces challenges, particularly the limited screen time per viewer, which restricts the depth and complexity of messages advertisers convey. Despite this, the growing adoption of AI technologies presents a significant growth opportunity. AI allows for intelligent targeting based on real-time data such as viewer demographics and elevator usage, improving campaign efficiency and personalization. As the global AI market expands, it is set to become a key enabler of smarter and more effective elevator advertising solutions.

Growth Drivers:

How Smart Screens and Digital Transformation Powers Elevator Advertising ?

The rapid shift toward digital transformation and smart screens is reshaping the elevator advertising market, enabling dynamic, interactive, and data-driven campaigns. These smart elevator displays, connected via IoT and cloud platforms, allow advertisers to deliver real-time, location-specific content with improved flexibility and engagement. However, this digital evolution also brings energy considerations. According to UNCTAD’s Digital Economy Report 2024, the production and use of digital devices, data centres, and ICT networks account for an estimated 6% to 12% of global electricity use. As elevator advertising becomes more reliant on such technologies, there is a growing need to balance innovation with energy-efficient practices, ensuring that the expansion of digital screens contributes to sustainable and intelligent urban advertising ecosystems.

How Urbanization Fuels the Elevator Advertising Market Growth?

High urban population density is a major driver of the market, as it creates a captive and concentrated audience in spaces like residential towers, offices, and metro stations. According to the World Bank, 37% of India’s population and 84% of the U.S. population live in urban areas as of 2024, offering significant advertising potential in both emerging and mature markets. In such urban settings, elevators are used frequently, allowing repeated brand exposure that boosts recall and engagement. This makes elevator advertising a cost-effective medium for both local and national advertisers, especially as urbanization continues to rise across regions like Asia-Pacific.

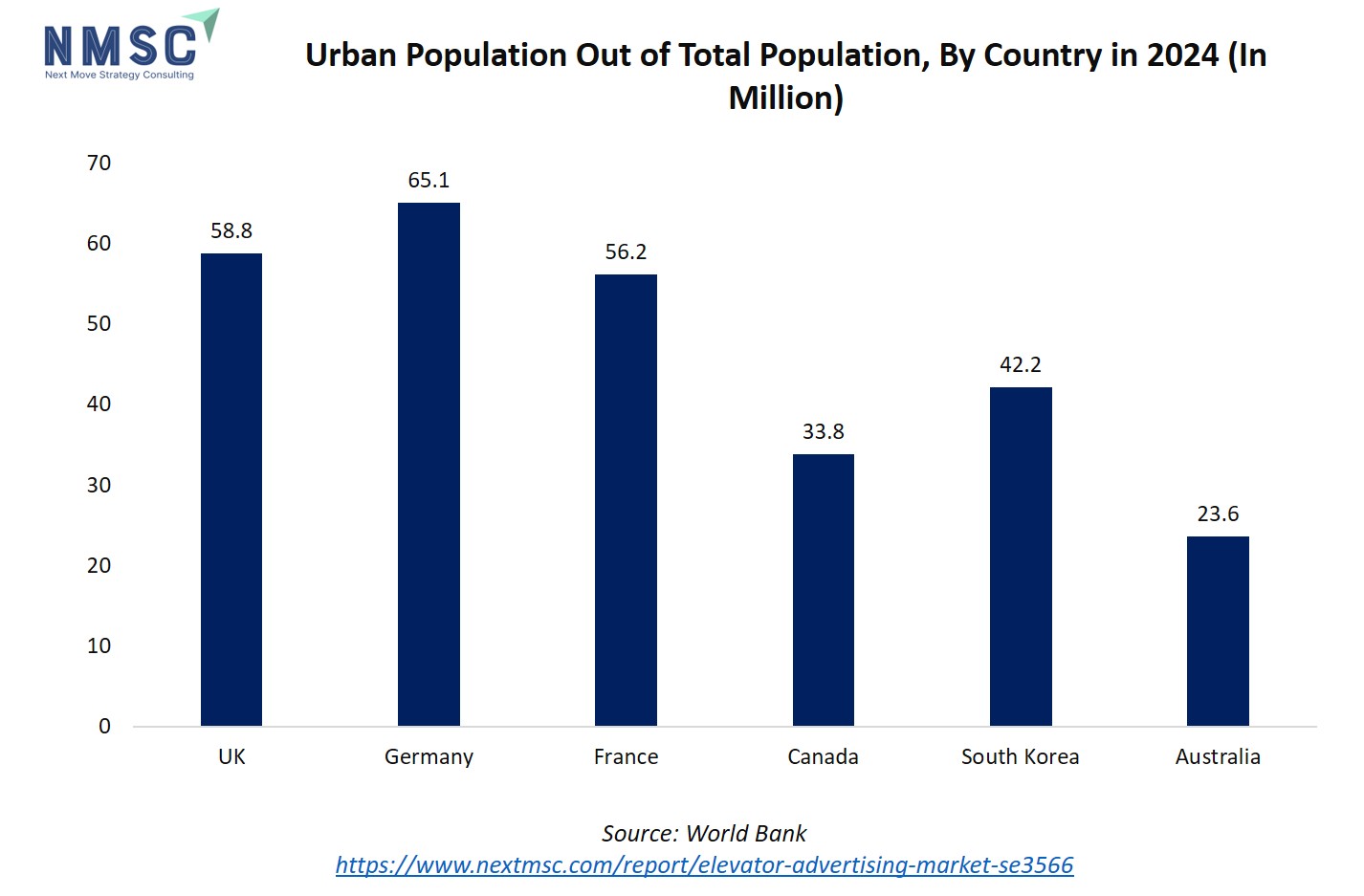

In 2024, countries such as Australia, the UK, Canada, France, Germany, and South Korea exhibit significant urban populations, with Australia at 23.6 million (90.8% urbanized), the UK at 58.76 million (86.4%), Canada at 33.84 million (84.6%), France at 56.21 million (83.9%), South Korea at 42.17 million (81.1%), and Germany at 65.05 million (77.4%). High urbanization indicates a dense concentration of people in high-rise buildings, commercial complexes, shopping centers, hotels, and offices, key venues for elevator advertising. This concentration provides a captive audience for various formats such as digital screens, static displays, interactive displays, audio advertising, elevator wraps, projection advertising, and frame advertising. As urban populations grow, the demand for short-term, long-term, event-specific, and promotional elevator campaigns is likely to increase, making highly urbanized regions strategic growth markets for the global elevator advertising industry.

Growth Inhibitors:

How Limited Screen Time Per Viewer Hinders Elevator Advertisement ?

One of the key restraints of the elevator advertising market is the limited screen time per viewer. Most elevator rides last between 30 seconds to 2 minutes, giving advertisers only a brief window to capture attention and deliver their message. When multiple ads are queued in a loop, each individual ad receive just a few seconds of exposure, reducing its impact, recall, and engagement. This short duration makes it challenging to communicate complex or detailed messages, requiring content to be overly simplified. As a result, advertisers must compete not just for viewer attention, but also for valuable seconds within that confined timeframe, limiting the overall effectiveness of campaigns.

What Opportunity Does AI Integration Unlocks in Elevator Advertising Market?

The integration of Artificial Intelligence (AI) with smart building ecosystems presents a significant opportunity for the market. AI integration is emerging as a transformative force in the elevator advertising industry, enabling dynamic and data-driven ad delivery. As per UNCTAD in 2025, the global AI market is projected to reach USD 4800000 million by 2033, highlighting its growing dominance as a frontier technology. This surge opens new avenues for elevator ad networks to leverage AI for analysing real-time data, such as viewer demographics, elevator usage, and time patterns to serve personalized, context-aware content. By adopting AI-powered systems, the market significantly enhance ad relevance, engagement, and return on investment.

How the Elevator Advertising Market is segmented in this report, and what are the key insights from the segmentation analysis?

By Type Insights

Will audio-based elevator ads effectively capture user attention in noise- sensitive environments and enhance message recall?

On the basis of type, the elevator advertising market share is segmented into digital screens, static displays, interactive displays, audio advertising, elevator wraps, projection advertising and frame advertising.

Audio-based elevator ads effectively capture attention in noise-sensitive environments and enhance message recall when executed thoughtfully. In typically quiet settings like offices or residential buildings, audio ads stand out due to minimal background noise, allowing clear and focused engagement. When designed with short, clear messaging, appropriate volume, and professional sound quality, these ads leave a lasting impression, especially through frequent repetition during elevator rides. However, if poorly implemented, they risk being intrusive or annoying. Overall, with the right tone and content, audio ads offer a low-cost, high-impact alternative where visual engagement is limited.

By Duration Of Campaign Insights

Do promotional elevator ad campaigns effectively drive immediate consumer action and purchase decisions within a confined timeframe?

Based on duration of campaign, the market is segmented into short-term campaigns, long-term campaigns, event-specific campaigns and promotional campaigns.

Promotional elevator ad campaigns effectively drive immediate consumer action and purchase decisions when designed with urgency and clarity. Elevators offer a captive audience in a distraction-free environment, making them ideal for delivering concise, persuasive messages. Promotional ads that highlight limited-time offers, discounts, or QR codes for instant access to deals trigger impulse responses, especially in high-traffic areas like malls, offices, or residential towers. The key lies in clear calls-to-action, bold visuals, and relevance to the audience’s daily needs. While the exposure time is short, the high frequency of rides and repeated impressions help reinforce the message and prompt quicker decision-making.

By Application Insights

Can elevator advertising in hotels be used effectively to promote premium services and enhance guest experience through targeted messaging?

Based on enterprise type, the market is bifurcated into office & retail buildings, residential complexes, shopping centres, hotels, healthcare facilities, institutions, transportation, market and others.

Elevator advertising in hotels be highly effective in promoting premium services and enhancing the overall guest experience. Hotel elevators offer a captive, upscale audience with frequent exposure opportunities, making them ideal for showcasing in-house offerings such as spas, fine dining, concierge services, or exclusive events. With the right messaging and visuals, ads be tailored to match the hotel's brand tone and guest preferences, segmented by travel purpose (business or leisure). Because guests use elevators multiple times a day, strategically placed and visually appealing ads reinforce brand value, encourage service uptake, and contribute to a more personalized and luxurious stay.

Regional Outlook

The market is geographically studied across North America, South America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

Elevator Advertising Market in North America

Urban growth is a major driver of elevator advertising in North America, as increasing vertical development boosts elevator traffic in densely populated cities. The surge in urban density has led to a rise in high-rise residential and commercial buildings across cities like Toronto, New York, and Chicago. As buildings grow taller, elevator usage increases, creating frequent and predictable audience touchpoints. These enclosed spaces offer advertisers captive attention, resulting in higher engagement and brand recall, especially when compared to more cluttered or mobile environments.

Elevator Advertising Market in the United States

The United States leads the regional elevator advertising market due to its extensive installed elevator infrastructure and growing emphasis on digital transformation in buildings. Elevators serve as high-frequency, captive environments for advertising in office towers, residential complexes, malls, and healthcare facilities. This trend is reinforced by the country’s high level of urbanization, 84% of the U.S. population resided in urban areas as of 2024, according to the World Bank. As urban density drives vertical development, the integration of digital screens in both new and retrofitted buildings, particularly those aligned with energy-efficient and smart infrastructure goals, continues to expand, strengthening the presence of elevator advertising across major U.S. cities.

Elevator Advertising Market in Canada

Canada mirrors U.S. trends, with a highly urbanized population and a strong focus on smart infrastructure in buildings. According to the World Bank, 82% of Canada’s total population was living in urban areas as of 2024, reflecting the continent-wide trend of rapid urbanization. Elevator advertising is gaining traction in office and residential towers in cities like Toronto, Montreal, and Vancouver, supported by provincial incentives for modernization and digital integration. Although public stats about the exact number of elevators are limited, the high density of vertical developments indicates significant opportunities for localized elevator advertising solutions.

Elevator Advertising Market in Europe

The push for smart urban development and environmentally responsible infrastructure is accelerating the growth of elevator advertising across Europe. As cities adopt digitally connected and energy-efficient buildings, elevators are increasingly equipped with interactive digital screens that offer dynamic advertising opportunities. These screens not only enhance audience targeting but also align with low-energy, space-efficient communication needs. According to the European Union in 2024, Europe is aiming for climate-neutral cities by 2030 under the EU Mission on Climate-Neutral and Smart Cities, the demand for sustainable and intelligent advertising platforms, such as elevator-based digital ads is expected to rise sharply. This shift reflects a broader movement toward eco-friendly and smart advertising solutions that support both technological innovation and green city planning.

Elevator Advertising Market in the United Kingdom

As one of Europe's most urbanized markets, with urban population of 85% as on 2024 as per world bank , the UK features high-rise office clusters and residential developments. Elevator advertising networks are increasingly adopted in London, Manchester, and Birmingham, where digital signage in elevators serves both commercial advertisers and building managers. Although specific unit counts are not publicly disclosed, the UK’s strong emphasis on smart urban infrastructure and energy-efficient commercial buildings supports elevator media growth.

Elevator Advertising Market in Germany

Germany’s elevator industry is actively expanding with modernization and infrastructure upgrades. Installing new elevators and retrofitting with digital screens in office and residential towers aligns with energy efficiency and smart building mandates, making Germany a key region for elevator advertising adoption.

Elevator Advertising Market in France

France’s elevator advertising market benefits from a high urban population share, which stood at approximately 82% in 2024, according to the World Bank. Elevator advertising is increasingly adopted in dense metropolitan environments, where modern residential high-rises, commercial towers, and hospitals are integrating sleek digital screens within elevator cabins. These placements enable advertisers to reach captive city dwellers repeatedly during daily commutes. Additionally, France’s emphasis on smart building retrofits and energy efficient infrastructure supports the incorporation of networked elevator media systems that deliver localized messaging, community alerts, and targeted campaigns within luxury hotels and corporate spaces.

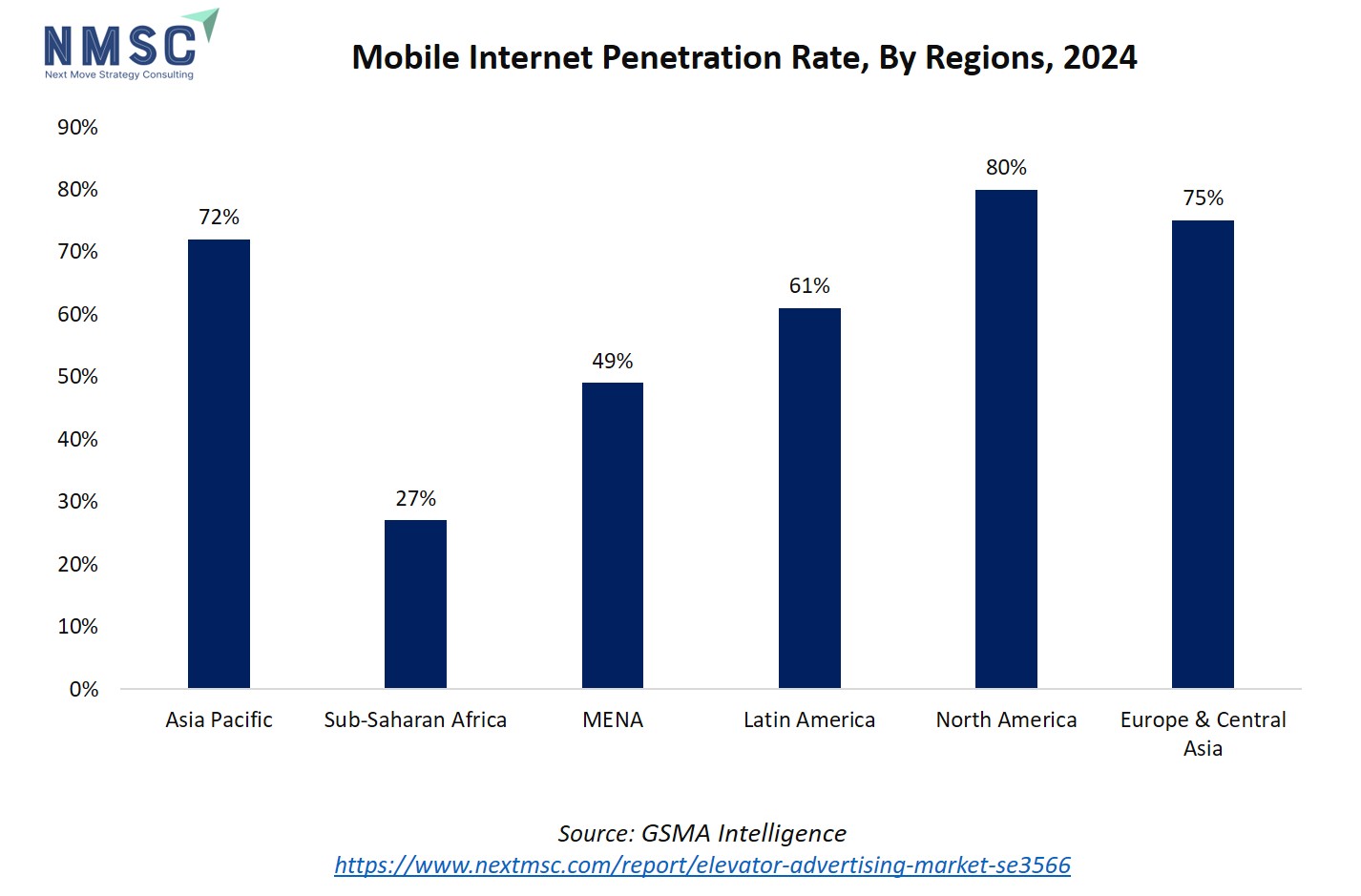

The chart highlights mobile internet penetration across regions in 2024, with North America (80%) and Europe & Central Asia (75%) showing the highest connectivity levels. This widespread mobile access supports the expansion of programmatic elevator advertising, allowing for real-time, data-driven content delivery to urban audiences. In the Asia Pacific (72%) and Latin America (61%), growing mobile internet usage indicates increasing potential for connected elevator screens in commercial and residential buildings. Even in the MENA region (49%) and Sub-Saharan Africa (27%), rising mobile connectivity suggests emerging opportunities for digital elevator advertising, particularly as urbanization and smartphone adoption continue to increase. High mobile internet penetration enhances engagement with dynamic, location-specific ads, making digitally connected elevators an effective medium in both mature and developing markets.

Elevator Advertising Market in Spain

Spain also presents a strong scenario for vertical-based advertising, with the urban population estimated around 82% in 2024, based on World Bank. Elevator advertising in Spain is advancing through the deployment of digital screens in smart buildings and upscale properties, where advertisers capitalize on captive audiences in elevators to deliver seasonal promotions, cultural events, and location-based offers. Spain’s growing tourism sector and rising real estate modernization, supported by urban digital initiatives, has allowed elevator screens in hotels and mixed-use developments to emerge as a premium advertising channel, delivering curated brand messaging to both residents and tourists.

Elevator Advertising Market in Italy

Italy’s elevator advertising market is gaining traction in urbanized and densely populated cities. According to the World Bank, 72% of Italy’s population lived in urban areas as of 2024, reflecting strong potential for vertical advertising channels within city centers. The country’s mature real estate infrastructure, comprising high-rise residential buildings, historic office blocks, shopping arcades, and medical institutions creates ample elevator traffic in both public and private settings. As smart building technologies expand across Italian cities through both new constructions and retrofits, digital elevator screens are being installed to deliver localized, time-sensitive promotions. The prevalence of condominiums and mixed-use developments makes elevators a strategic point for reaching residents with high dwell times. Additionally, the tourism sector, which Italy continues to lead in Europe, encourages the use of elevator ads in hotels, offering brands access to international visitors in a brand-safe, high-impact format.

Elevator Advertising Market in the Nordics

The Nordic countries comprising Sweden, Norway, Denmark, and Finland, offer a highly urbanized and technologically advanced environment ideal for the growth of elevator advertising. As of 2024, urbanization rates are particularly high: Sweden (89%), Norway (84%), Denmark (89%), and Finland (86%), according to the World Bank. These figures highlight the concentration of population in cities like Stockholm, Oslo, Copenhagen, and Helsinki, where vertical living and working spaces dominate the built landscape.

The region’s commitment to smart urban planning, sustainable construction, and digital public infrastructure has led to the integration of smart displays in elevators within commercial buildings, residential complexes, and transportation hubs. In countries like Sweden and Denmark, where climate-conscious real estate design is a priority, digital elevator advertising also aligns with broader eco-efficiency goals by replacing paper-based notices with programmable content. With high per capita income and strong digital literacy, elevator screens in the Nordics are increasingly seen as effective platforms for reaching time-sensitive, tech-savvy urban consumers.

Elevator Advertising Market in Asia Pacific

The Asia-Pacific region is witnessing a rapid evolution in digital infrastructure, which is significantly driving the elevator advertising market trends. Countries like China, Japan, and South Korea are embracing smart city technologies, including AI-enabled and IoT-connected elevator screens that support real-time, data-driven advertising. The expansive 5G network enables ultra-fast, low-latency data transmission, allowing advertisers to deliver dynamic, location-specific content to elevator screens in high-rise buildings across urban centres. With a tech-savvy population and advanced programmatic advertising capabilities, the region offers ideal conditions for highly personalized, responsive elevator ad campaigns. As smart buildings become more common, elevator advertising is transforming into a sophisticated, high-impact medium that blends technology, interactivity, and targeted communication.

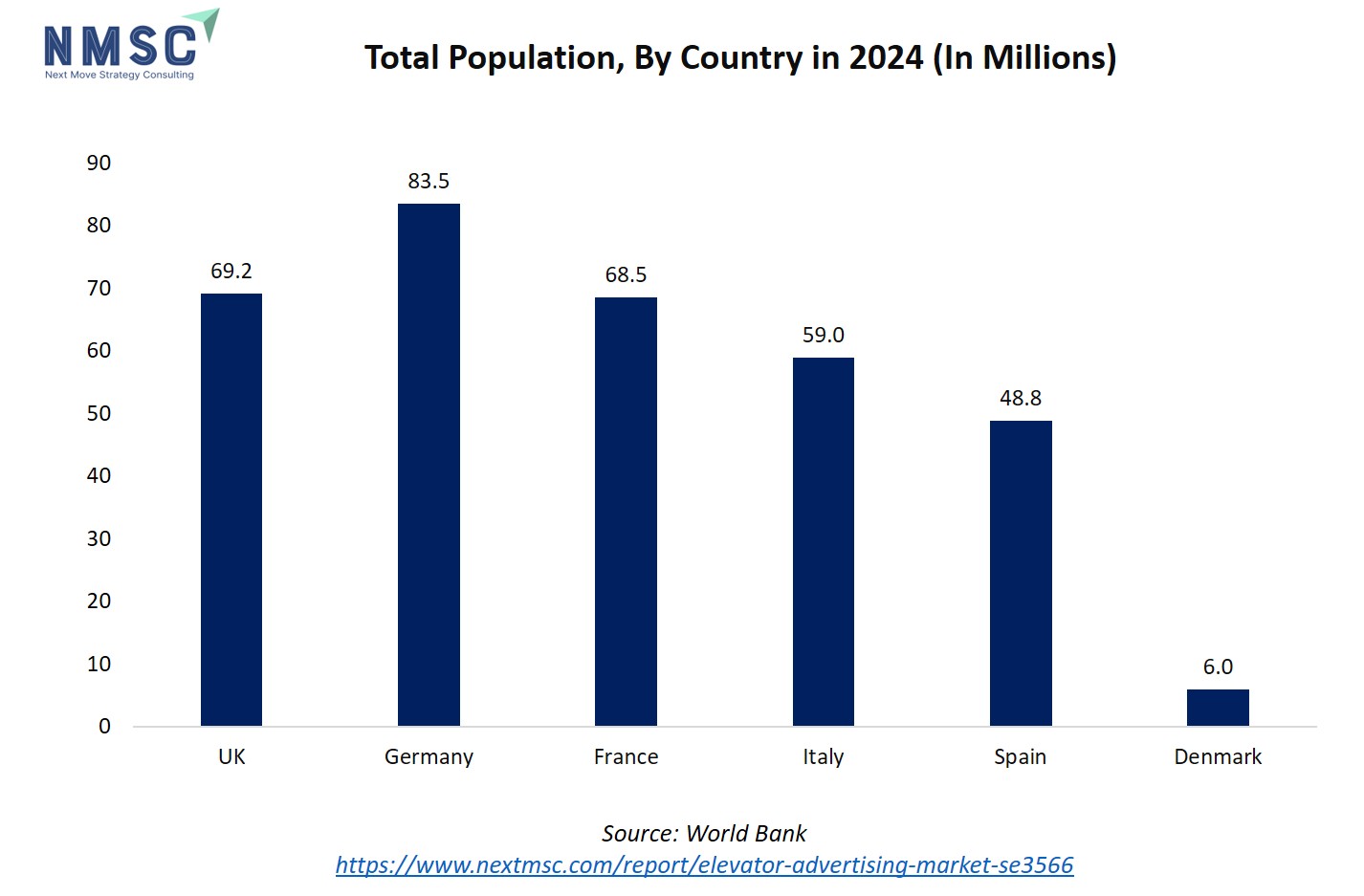

The bar chart above illustrates the total population (in millions) across countries in 2024, including Germany (83.51 Mn), the UK (69.22 Mn), France (68.51 Mn), Italy (58.98 Mn), Spain (48.80 Mn), and Denmark (5.97 Mn). These countries feature significant populations, many of which are concentrated in urban areas, providing a substantial captive audience for elevator advertising. Highly populated nations like Germany, the UK, and France represent key markets for deploying digital screens, static displays, interactive panels, and other elevator-based media in offices, shopping centers, residential complexes, and hotels. The combination of large populations and increasing urbanization makes these regions strategically important for expanding elevator advertising campaigns and reaching diverse consumer segments.

Elevator Advertising Market in China

As the world’s largest elevator market, China presents vast potential for the growth of elevator advertising. Digital screens are being widely installed in high-rise residential buildings, transit hubs, malls, and commercial towers, offering high-frequency exposure to urban dwellers. This expansion is supported by China’s rapid digital infrastructure development. According to the National Development Administration (NDA), the country deployed over 4.25 million 5G base stations by 2025, laying a robust foundation for connected digital services, including real-time elevator advertising. The integration of these networks enables smart content delivery that is location-aware and time-sensitive, enhancing the relevance and impact of ads in dense urban settings.

Elevator Advertising Market in Japan

Japan’s elevator advertising market is growing steadily, driven by the country's dense urban development and widespread use of vertical infrastructure. The vertical spaces present ideal conditions for elevator-based digital advertising, offering a captive audience and consistent daily footfall. With a strong culture of technology adoption and a focus on innovation in public and private infrastructure, digital screens are becoming a standard feature inside elevators. These displays are used to deliver timely, localized content ranging from commercial promotions to public service messages. Elevator advertising in Japan is particularly effective in premium locations such as business districts and upscale retail environments, where it helps brands engage with professionals and high-income consumers in a calm, controlled setting.

Elevator Advertising Market in India

With an urbanization rate of around 37% as of 2024 as per World Bank, India is undergoing rapid growth in vertical infrastructure. As part of this transformation, elevator advertising is gaining momentum within high-rise residential developments, hospitals, commercial buildings, and metro stations. The Smart Cities Mission, a flagship initiative driving urban modernization, received a significant allocation of USD 19670 million in the Union Budget 2024–25, according to India Brand Equity Foundation. This investment is accelerating the deployment of digital infrastructure, including elevator screens that offer hyper-local, targeted advertising to urban populations. As cityscapes grow vertically, elevators are becoming a key medium to engage residents and commuters with context-specific content in controlled, high-dwell-time environments.

Elevator Advertising Market in South Korea

South Korea presents a strong market for elevator advertising, underpinned by high urban density, advanced connectivity, and consumer tech adoption. As of 2024, approximately 81% of South Korea’s population resides in urban areas, according to the World Bank. Major cities such as Seoul, Busan, Incheon, and Daegu are home to thousands of mid- to high-rise buildings, where elevators play a central role in daily commuting. The country's focus on smart city development and widespread 5G infrastructure makes elevator screens an effective channel for delivering dynamic, real-time advertisements. These displays are commonly found in residential towers, co-working spaces, universities, and hospitals, targeting a wide range of audiences including students, professionals, and families. South Korea’s digital-savvy population is especially receptive to short-form, visually engaging elevator content, making this platform attractive for local retailers, tech brands, and service providers aiming to capture attention in compact, high-traffic vertical spaces.

Elevator Advertising Market in Taiwan

Taiwan is experiencing steady growth in elevator advertising as cities continue to expand vertically. With limited land area and a strong emphasis on high-rise construction, especially in residential and mixed-use developments, elevators have become key points of engagement for advertisers. Taiwan’s advancement in digital infrastructure and smart building systems supports the integration of interactive and programmable elevator screens. These are being deployed in condominiums, tech parks, and retail centers, offering localized, digital content tailored to residents and commuters. In a society with high smartphone penetration and digital media consumption, elevator ads provide an offline yet digitally synchronized platform to deliver targeted messages in high-dwell-time settings.

Elevator Advertising Market in Indonesia

Indonesia’s elevator advertising market is emerging as a promising segment amid fast-paced urbanization and infrastructure expansion. In these high-traffic vertical environments, elevator screens are being introduced as a modern alternative to traditional noticeboards and static signage. These digital platforms allow advertisers to reach middle- and upper-income consumers with targeted content in both residential and commercial settings. The growing adoption of digital solutions across Indonesian cities, particularly under urban modernization efforts, is helping position elevator advertising as a practical and scalable media format.

Elevator Advertising Market in Australia

Australia is witnessing notable growth in elevator advertising, driven by its highly urbanized landscape. As per the World Bank, 87% of Australia’s population lived in urban areas in 2024, underscoring the nation’s strong concentration of people. This high urban density has led to increased vertical development, with a growing number of residential towers, co-working hubs, hospitals, and commercial properties. Within these environments, digital elevator screens are being deployed as impactful advertising tools that reach consumers during moments of extended attention. Particularly in premium and smart buildings, these screens deliver timely, localized content, ranging from brand promotions to public updates, making elevator media a compelling format for advertisers seeking to engage tech-savvy, affluent urban audiences in a focused and measurable manner.

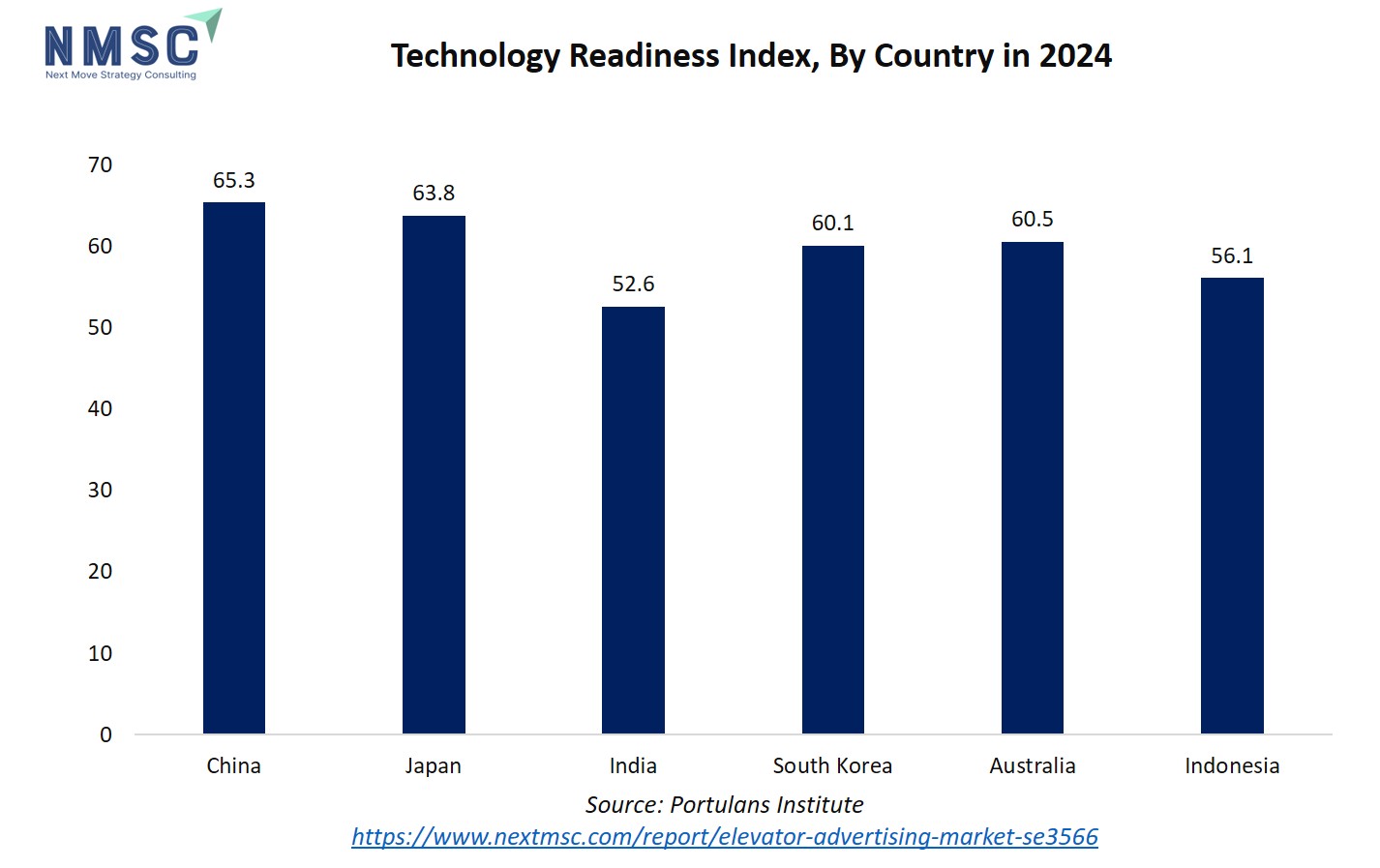

In 2024, the technology readiness index (TRI) scores across key Asia-Pacific countries indicate varying levels of digital infrastructure and innovation capacity relevant to the elevator advertising market. China leads with a TRI score of 65.34, followed by Japan (63.78), Australia (60.54), South Korea (60.10), Indonesia (56.08), and India (52.56). Higher TRI scores reflect stronger technological infrastructure, digital adoption, and readiness for connected and programmatic advertising solutions. Countries like China, Japan, South Korea, and Australia are better positioned to implement interactive and data-driven elevator advertising campaigns, leveraging IoT-enabled and smart building integrations. In contrast, markets with lower TRI scores, such as India and Indonesia, present growth opportunities as digital infrastructure improves. Overall, technology readiness directly influences the adoption of advanced elevator advertising formats, the effectiveness of dynamic content delivery, and the potential for real-time, audience-targeted campaigns, making high-TRI regions strategic priorities for market expansion.

Elevator Advertising Market in Latin America

Elevator advertising is growing in Latin American countries including Brazil, Mexico, Argentina, and Colombia, especially in dense cities like São Paulo, Rio de Janeiro, Mexico City, and Buenos Aires. With 88% of Brazil’s population in urban areas as on 2024 as per World Bank and a significant vertical residential footprint, elevators are valuable advertising environments in both residential and commercial towers . Programs supported by the Inter-American Development Bank (IDB) for smart infrastructure and digital urban modernization further facilitate the adoption of digital signage and elevator advertising in public and private vertical real estate.

Elevator Advertising Market in the Middle East & Africa

The strong recovery and expansion of the tourism and hospitality sector in the Middle East & Africa is emerging as a key driver for elevator advertising. According to UN Tourism 2025, Africa recorded the strongest tourism performance globally in Q1 2025 with a 9% growth, highlighting the region’s increasing appeal to international and regional travellers. This surge in tourism is leading to the rapid development of hotels, resorts, airports, shopping malls, and entertainment complexes. As vertical infrastructure grows within these venues, elevators are becoming high-traffic zones where captive, mobile audiences be reached with localized, multilingual advertisements. Brands are leveraging this opportunity to promote travel services, local attractions, restaurants, and ride-hailing apps in a targeted, context-aware manner. With travel rebounding and hospitality investments rising, elevator advertising is gaining traction as a cost-effective, high-impact medium to engage affluent and time-sensitive tourists throughout their journey.

Competitive Landscape

What are the Top Companies in Elevator Advertising Market and How They are Competing Against One Another?

Leading players in the elevator advertising market, including Screenverse, Vertical Impression, Focus Media Holding Ltd, Captivate, and Schindler India Pvt. Ltd are driving competition through network expansion, technology upgrades, and strategic partnerships. Screenverse has rapidly scaled its programmatic DOOH network to 100,000+ digital screens across 210 U.S. markets, following a USD 10.5 million funding round. Its 2025 partnership with Vertical Impression enabled automated, targeted elevator advertising using platforms like Vistar and Place Exchange. Vertical Impression is enhancing campaign insights with its upgraded AVA (Anonymous Video Analytics) tech, offering deep viewer engagement data across 2,400+ elevator screens. Schindler India renewed its collaboration with HOWL Digital to expand elevator-based activations in India, blending infrastructure expertise with brand engagement. Other players like Elevision Media, Target Media Hong Kong, Vertical City, and HYGH are growing their presence by targeting premium real estate, emphasizing smart content delivery and regional partnerships.Technology, programmatic buying, and integration with smart infrastructure are key competitive drivers in this evolving market.

Market Dominated by Tech Giants and Specialists

The elevator advertising market reveals a diverse competitive structure where major out-of-home (OOH) advertising networks compete alongside specialized elevator media operators. The market remains moderately fragmented, with established players leveraging their extensive screen networks, relationships with real estate owners, and proprietary content management systems to secure dominant positions across high-traffic venues like office towers, residential high-rises, and transportation hubs. While large OOH players capitalize on scale and programmatic reach, niche elevator-focused companies are carving out territory by offering hyper-targeted content and smart display technology in premium and tech-integrated buildings. Companies like Screenverse, Vertical Impression, and Captivate are focusing on innovation in programmatic ad buying, real-time audience analytics, and integration with building infrastructure.

The market is shaped by ongoing collaborations, acquisitions, and regional expansion efforts. Strategic alliances such as those between screen operators and real estate developers or digital advertising platforms, are helping to unlock new elevator inventory and improve ad delivery efficiency. Meanwhile, regional players in markets like China, India, and the Middle East are leveraging local insights, language customization, and urban development trends to strengthen their presence in fast-growing urban centers. This evolving competitive landscape is driven by digital transformation, smart city initiatives, and the growing demand for targeted, location-based advertising in high-dwell-time environments.

Innovation and Adaptability Drive Market Success

Success in the elevator advertising market depends on continuous innovation, adaptability to audience behavior, and strategic positioning within high-traffic environments. Leading players must invest in display technology upgrades, programmatic ad delivery systems, and dynamic content personalization to stay ahead of shifting advertising trends. They also need to tailor campaigns to diverse venue types, ranging from residential towers and hospitals to transit hubs and co-working spaces by providing flexible ad formats and localized messaging that resonate with specific audiences. Building strong partnerships with real estate developers, property managers, and digital out-of-home (DOOH) platforms is essential to securing premium inventory and expanding reach. Companies must also ensure that content management systems are scalable, privacy-conscious, and compatible with both new builds and retrofit installations, particularly in smart and sustainable buildings.

For emerging players and new entrants, success lies in targeting niche segments such as luxury hospitality, student housing, or suburban malls, where high dwell times and underserved audiences create room for innovation. Differentiation be achieved by offering advanced analytics, touchless interaction features, or hyperlocal advertising packages for small businesses. While customer churn is typically low due to fixed contracts and hardware integration, firms must remain agile to respond to evolving regulations on digital signage, tenant engagement policies, and data collection practices. As cities grow smarter and vertical living increases, the ability to deliver context-aware, location-specific advertising will be a key factor for long-term competitiveness.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Elevator advertising market leaders are continuously enhancing their offerings to meet evolving advertiser expectations and technological trends. With growing demand for programmatic advertising and data-driven audience targeting, companies are upgrading their networks with smart displays, real-time analytics, and cloud-based content management systems. In line with this, key players are actively pursuing strategic partnerships and acquisitions to broaden their capabilities and geographic reach. By merging their core competencies with the localized expertise, inventory access, or tech platforms of acquired firms, elevator advertising companies aim to deliver more integrated and scalable solutions across diverse building types and regions. This strategy helps accelerate innovation, streamline operations, and cater to a broader spectrum of advertisers, from local businesses to global brands.

List of Key Elevator Advertising Companies

-

Focus Media Holding Ltd

-

Vertical Impression

-

Screenverse

-

Vertical city

-

Elevision Media LLC

-

Oneroad Media

-

Nickelytics

-

World Media Group

-

Yetronic

-

Target Media Hong Kong Ltd

-

XPO screens

-

HYGH

-

Schindler India Pvt. Ltd

What are the Latest Key Industry Developments?

-

June 2025 - Screenverse highlighted strong growth following a USD 10.5 million funding round led by Volition Capital in May 2024. The investment fuelled the rapid expansion of its programmatic DOOH network across 30+ venue types, including elevators, billboards, and transit screens.

-

March 2025 - Schindler extended its partnership with Indian agency HOWL Digital for the fourth year. The mandate covers digital transformation, PR, customer retention, and includes elevator-based digital activations to increase brand visibility and lead generation.

-

February 2025 - Vertical Impression, a leading elevator digital signage operator in North America with over 2,400 screens across 98 U.S. markets, made a partnership with Screenverse. The collaboration enabled programmatic elevator advertising through platforms like Vistar and Place Exchange, allowing for more precise targeting and broader campaign reach within various building types.

-

February 2025 - Screenverse expanded its programmatic DOOH network to over 100,000 digital screens across 210 U.S. markets. The network now spans elevators, gas stations, billboards, lobbies, and transit hubs, offering brands wide programmatic reach and targeted advertising opportunities.

-

February 2025 - Vertical Impression released an enhanced version of its Anonymous Video Analytics (AVA) technology in Canada. The upgraded system now provides advertisers with deeper attention insights: average attention duration, key frame tracking, active attention rate (percentage of viewers watching more than 2.5 seconds), and campaign performance comparisons across markets and benchmarks.

What are the Key Factors Influencing Investment Analysis & Opportunities in Elevator Advertising Market?

Several small- to mid-sized companies in the elevator advertising market are actively securing funding to scale their digital infrastructure and expand screen networks. This trend is exemplified by Screenverse, which reported strong growth following a USD 10.5 million funding round led by Volition Capital in May 2024. The investment fueled the rapid expansion of its programmatic DOOH network, including elevator placements, highlighting growing investor interest in high-dwell-time, tech-integrated advertising formats. Unlike traditional out-of-home (OOH) media, elevator advertising offers advantages such as indoor targeting, programmatic compatibility, and smart building integration, factors that are increasingly attractive to venture capitalists. Funding momentum is especially notable for companies focusing on AI-powered audience analytics and smart city-aligned deployments. As the sector matures, strategic capital is flowing toward scalable, location-based advertising models, reinforcing confidence in the long-term value of elevator media in both residential and commercial high-rises.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the global elevator advertising market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 13.18 Billion |

|

Revenue Forecast in 2030 |

USD 20.29 Billion |

|

Growth Rate |

CAGR of 9.0% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

30 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Type

-

Digital Screens

-

Static Displays

-

Interactive Displays

-

Audio Advertising

-

Elevator Wraps

-

Projection Advertising

-

Frame Advertising

By Duration of Campaign

-

Short-term Campaigns

-

Long-term Campaigns

-

Event-specific Campaigns

-

Promotional Campaigns

By Application

-

Office & Retail Buildings

-

Residential Complexes

-

Shopping Centres

-

Hotels

-

Healthcare Facilities

-

Institutions

-

Transportation

-

Market

-

Others

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants, with actionable intelligence to capitalize on the markets transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Elevator Advertising Market Report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst