Europe Industrial Process Automation Market by Component {MES (Hardware, Software, Services); DCS (Hardware, Software, Services); PLC (Hardware, Software, Services); SCADA (Hardware, Software, Services); Field Instruments; Industrial Robots; Human Machine Interface; Industrial PCs; Process Analyzers & Drives} and by End User (Oil & Gas, Chemicals & Refining, Energy & Power, Pulp & Paper, Metals & Mining, Pharma, & Others) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Semiconductor & Electronics | Publish Date: 31-Oct-2025 | No of Pages: 219 | No. of Tables: 146 | No. of Figures: 91 | Format: PDF | Report Code : SE981

Industry Outlook

The Europe Industrial Process Automation Market size was valued at USD 23.87 billion in 2024 and is projected to grow to USD 25.46 billion by 2025. Additionally, the industry is expected to continue its growth trajectory, reaching USD 31.22 billion by 2030, with a CAGR of 4.57% from 2025 to 2030.

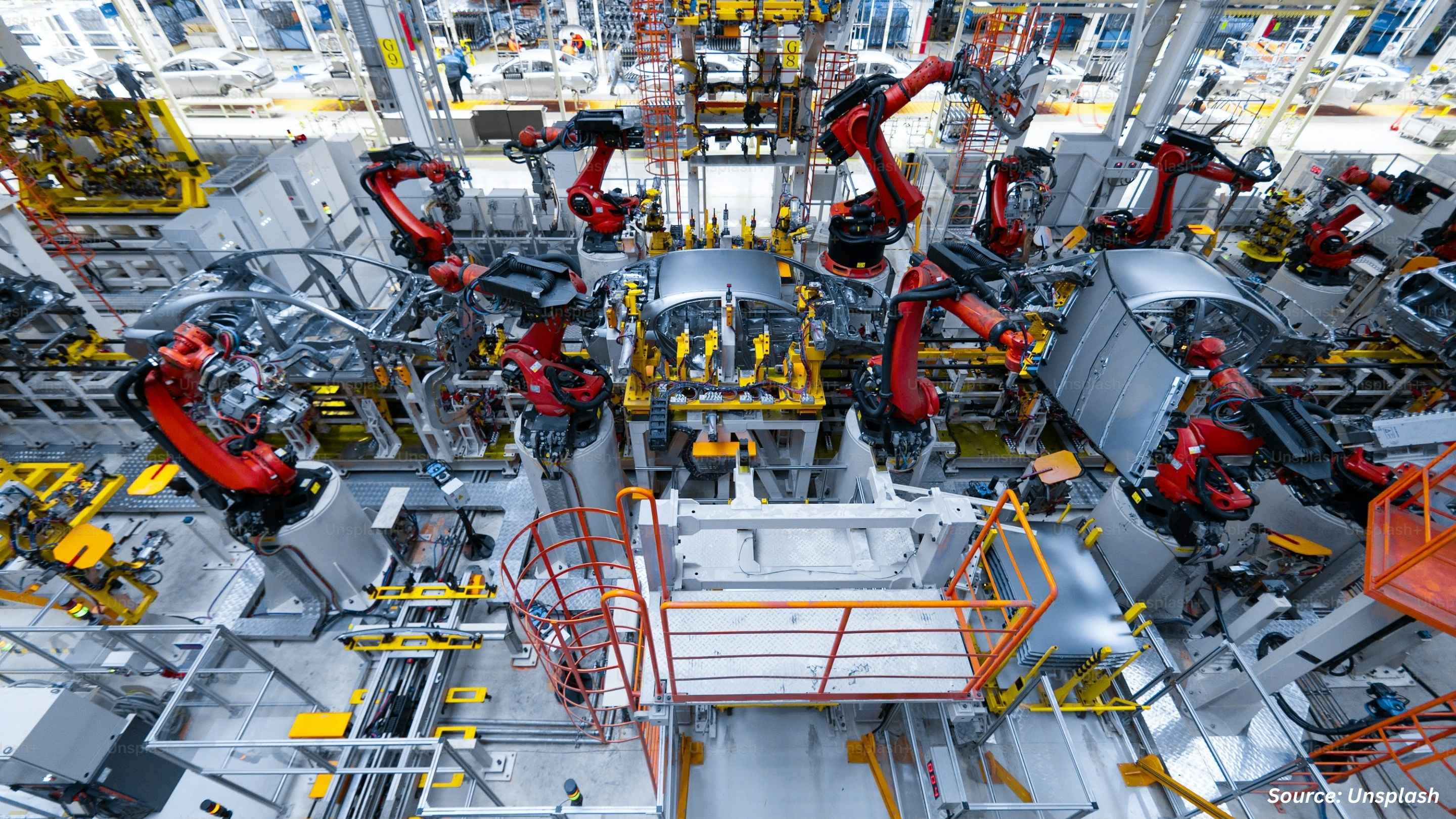

The growing adoption of robotics in manufacturing and the expansion of the chemical sector are major drivers of the Europe industrial process automation market growth. Robotics enhances precision, efficiency, and scalability by automating repetitive tasks and minimizing human error, supporting industries in maintaining a competitive edge. The chemical sector’s expansion further fuels demand for automation to optimize production processes, control costs, and ensure high product consistency, with technologies like robotics and AI improving operational efficiency. However, regulatory and compliance challenges remain a significant restraint, as industries must navigate complex frameworks to integrate new automation systems. On the horizon, the integration of AI and machine learning (ML) offers promising opportunities, enhancing predictive maintenance, real-time decision-making, and process optimization, which drives future growth, innovation, and competitiveness in the automation sector

Robotics Adoption Accelerates the Europe Industrial Process Automation Market Demand

The growing adoption of robotics in the manufacturing industry is a significant driver of industrial process automation, as businesses strive for greater precision, efficiency, and scalability. Robots are increasingly deployed to automate repetitive tasks, minimize human error, and optimize workflows, enabling seamless production processes. This shift toward automation reflects the industry's need for enhanced operational flexibility and improved productivity. The increasing robot density in the sector highlights the growing reliance on automation technologies to address evolving industrial requirements and maintain a competitive edge in an increasingly globalized market.

Chemical Sector Expansion Drives Automation Demand

The rapid growth of the chemical sector is driving the demand for industrial process automation, as manufacturers seek to optimize operations, control production costs, and maintain high levels of product consistency. As the chemical industry faces increasing pressure to enhance operational efficiency and ensure safety, automation technologies are critical in managing complex production processes such as chemical reactions, mixing, and packaging. This growing reliance on automation helps manufacturers boost productivity, reduce human error, and meet stringent quality standards, thereby fueling market expansion in the region.

Growing Chemical Sales Fuel Automation Adoption in Europe

In Europe, the expansion of the chemical sector is further driving the demand for industrial process automation. With manufacturers aiming to scale production, reduce operational costs, and enhance product consistency, automation is increasingly integrated into core processes. Technologies such as robotics, AI, and advanced control systems play a critical role in optimizing production lines, improving safety, and maintaining consistent quality. As chemical sales continue to rise, manufacturers are adopting more sophisticated automation solutions to streamline workflows, meet market demand, and improve efficiency, supporting long-term growth and sustainability in the sector.

Regulatory and Compliance Challenges Restrain the Europe Industrial Process Automation Market Expansion

Despite the growing demand for automation, regulatory and compliance challenges remain a key barrier to market growth in the region. Meeting industry-specific standards requires significant adjustments to automation systems, which delays the adoption of new technologies. Businesses must navigate complex regulatory frameworks to ensure compliance, and these challenges slow the pace of innovation and integration, limiting the broader adoption of industrial process automation technologies.

AI and ML Integration Unlocks Future Growth in Industrial Process Automation

The integration of artificial intelligence (AI) and machine learning (ML) presents a major opportunity for the industrial process automation market. These technologies enable predictive maintenance, improve real-time decision-making, and streamline repetitive tasks with minimal human input. By enhancing operational efficiency, improving product quality, and reducing costs, AI and ML offer manufacturers the ability to optimize processes and boost competitiveness. As the adoption of AI and ML grows, industries benefit from more agile, flexible, and intelligent automation systems, driving innovation and productivity across sectors.

Germany Holds the Dominant Market Share in the European Region

The deployment of robots in the manufacturing industry propels the Europe industrial process automation market growth as businesses prioritize efficiency, accuracy, and adaptability in production processes. Robots streamline operations by speeding up production and minimizing human error, fostering the adoption of automation technologies across various sectors. According to the International Federation of Robotics (IFR) in 2024, Germany's robot density reached 429 units per 10,000 employees in 2023. This shift in robot density emphasizes the increasing reliance on robotics to boost productivity and expand the application of automation solutions.

Italy to Witness Substantial Growth in the Europe Industrial Process Automation Market

The growth of the chemical industry in the country is significantly driving the demand for industrial process automation industry, as the need for enhanced efficiency, precision, and safety in manufacturing processes becomes increasingly crucial. With the expansion of chemical production to meet global demand, advanced automation solutions are essential to optimize complex workflows and minimize human error. The strong sales performance in the chemical sector underscores the importance of automation technologies in improving operational efficiency, thus fueling market growth.

Additionally, the rise of robotics in manufacturing further accelerates this trend by providing greater precision, adaptability, and faster workflows, reducing the likelihood of errors. According to the 2024 report by the International Federation of Robotics (IFR), the country achieved a robot density of 228 units per 10,000 employees in 2023, highlighting the vital role of robotics in boosting productivity and driving the adoption of advanced automation technologies across industries.

Competitive Landscape

The promising players operating in the Europe industrial process automation industry include Siemens AG, Schneider Electric SE, ABB Ltd., Emerson Electric Co., Honeywell International Inc., Rockwell Automation, Inc., Yokogawa Electric Corporation, Mitsubishi Electric Corporation, Endress+Hauser Group, KROHNE Group, Omron Corporation, Bosch Rexroth GmbH, Phoenix Contact GmbH & Co. KG, Beckhoff Automation GmbH & Co. KG, and Danfoss A/S,and others.

Europe Industrial Process Automation Market Key Segments

By Component

-

Manufacturing Execution Systems (MES)

-

Hardware

-

Software

-

Services

-

-

Distributed Control Systems (DCS)

-

Hardware

-

Software

-

Services

-

-

Programmable Logic Control (PLC)

-

Hardware

-

Software

-

Services

-

-

Supervisory Control and Data Acquisition (SCADA)

-

Hardware

-

Software

-

Services

-

-

Field Instruments

-

Industrial Robots

-

Human Machine Interface (HMI)

-

Industrial PCs

-

Process Analyzers and Drives

By End User

-

Oil and Gas

-

Chemicals and Refining

-

Energy and Power

-

Pulp and Paper

-

Metals and Mining

-

Pharma

-

Cement & Glass

-

Others

By Country

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

Key Players

-

Siemens AG

-

Schneider Electric SE

-

ABB Ltd.

-

Rockwell Automation, Inc.

-

Yokogawa Electric Corporation

-

Mitsubishi Electric Corporation

-

Endress+Hauser AG

-

KROHNE Group

-

Omron Corporation

-

Bosch Rexroth GmbH

-

Phoenix Contact GmbH & Co. KG

-

Beckhoff Automation GmbH & Co. KG

-

Danfoss A/S

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size Value in 2025 |

USD 25.46 billion |

|

Revenue Forecast in 2030 |

USD 31.22 billion |

|

Value Growth Rate |

CAGR of 4.57%from 2024 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

Robotics adoption accelerates demand for industrial process automation. Chemical sector expansion drives automation demand. Growing chemical sales fuel automation adoption in Europe. |

|

Companies Profiled |

15 |

|

Countries Covered |

10 |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst