Industrial Process Automation Market by Component (Manufacturing Execution System (MES), Distributed Control System (DCS), Programmable Logic Control (PLC), Supervisory Control & Data Acquisition (SCADA), by Enduser (Oil & Gas, Chemicals & Refining, Energy & Power, Pulp & Paper, Metals & Mining, Pharmaceutical, Cement & Glass, and Others) – Global Opportunity Analysis and Industry Forecast, 2023–2030

Industry: Semiconductor & Electronics | Publish Date: 08-Oct-2025 | No of Pages: 426 | No. of Tables: 315 | No. of Figures: 260 | Format: PDF | Report Code : SE596

Industry Overview

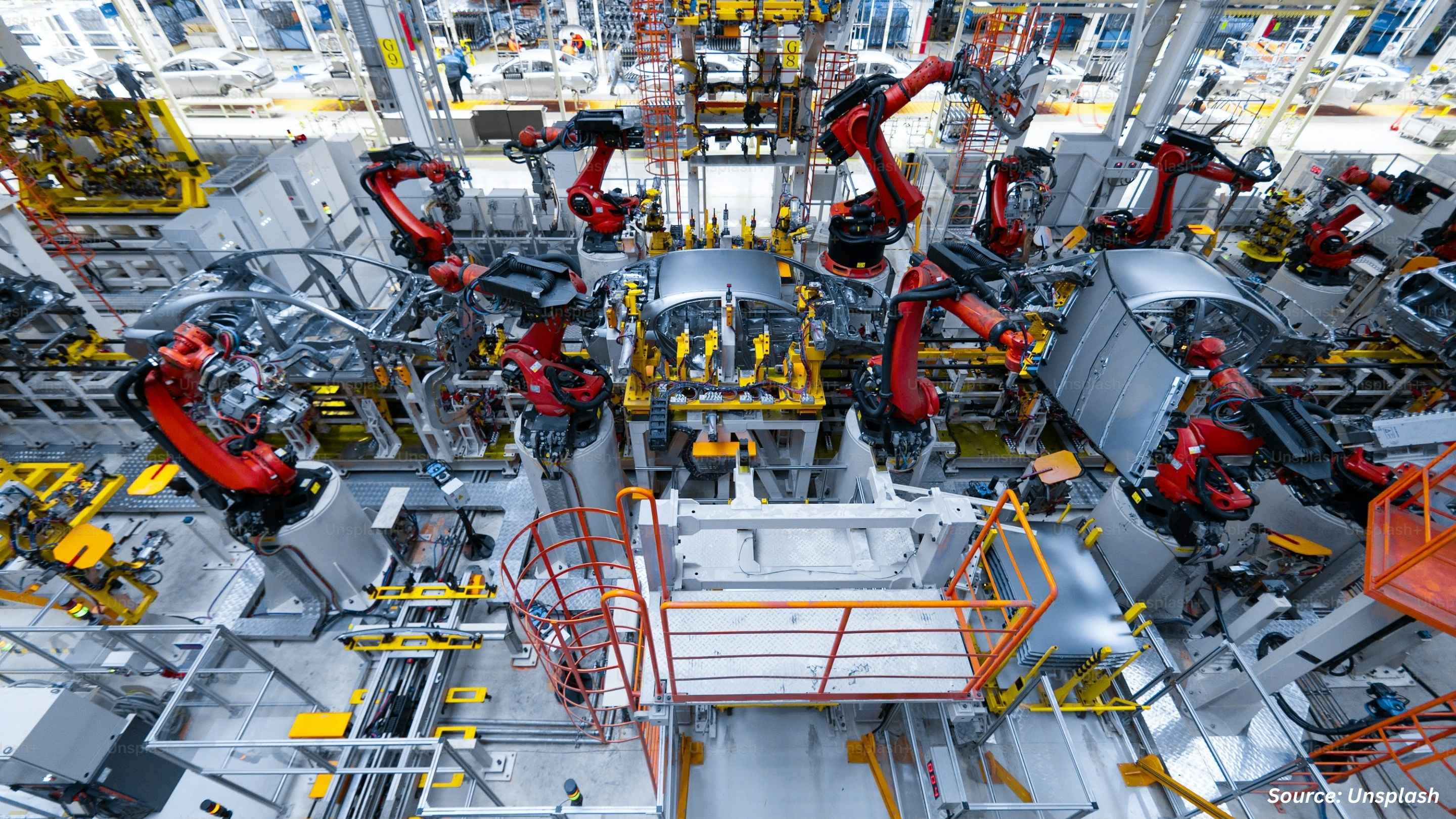

The global Industrial Process Automation Market size was valued at USD 58.36 billion in 2022 and is predicted to reach USD 96.06 billion by 2030, with a CAGR of 5.4% from 2023 to 2030. Industrial process automation refers to the use of computer technology and hardware to control and monitor industrial processes such as inventory management, manufacturing, and production of goods.

It involves the integration of various technologies and systems, such as sensors, programmable logic controllers (PLCs), human-machine interfaces (HMIs), and supervisory control & data acquisition (SCADA) systems, to streamline and optimize production processes, including quality control, assembling, testing & inspection, and packaging & labeling. Process automation is applied to a wide range of industries, including oil & gas, chemical processing, food & beverage, pharmaceuticals, and others.

The goal of process automation is to improve efficiency, quality, and safety while reducing costs and minimizing human error. Thus, industrial process automation plays a significant role in modern manufacturing and production activities, enabling companies to operate more efficiently, produce higher-quality products, and create safer working environments for their employees compared to traditional manual methods.

Increasing Adoption of Industrial IoT

The Internet of Things (IoT) is essential to automation technology as it facilitates the development of efficient, cost-effective, and flexible system architectures. Solutions for the Industrial Internet of Things (IIoT) help connect industrial assets rapidly and generate transparency into the operational and performance aspects of industrial assets, processes, and systems. They also boost the efficiency of machine performance, product quality, and inventory levels in industrial processes.

Companies are implementing IIoT technologies to automate the manufacturing process and improve the customer experience. For instance, Gartner anticipates that 20% of industrial equipment manufacturers will use remote IIoT capabilities in 2023, which is a sizable increase from the near-zero adoption rate in 2021.

Integration of Digital Twins in Manufacturing

A digital twin is a virtual representation of a physical manufacturing system, machine, or product. It is created by collecting real-time data from sensors, machines, and other sources throughout the manufacturing process and using that data to create a digital model that can simulate the behavior of the physical system.

The simulation of physical systems helps manufacturing organizations in industries such as automotive, aerospace, electronics, and industrial equipment to evaluate the feasibility of a particular manufacturing system, machine, or product. Digital twin technology also assists in reducing risks such as safety hazards, equipment failure, and quality issues during implementation while also providing an estimate of potential improvements. Implementing and maintaining digital twins has been more manageable than before with the development of the IIoT, which includes cloud-based technologies and smart sensors.

Lack of Standardization of Industrial Processes Hinders the Market Growth

Lack of standardization is a significant challenge that can restrain the the industrial process automation market growth. Vendors may create proprietary systems that are difficult to replace or upgrade without standards. This may lead to vendor lock-in, as companies become reliant on the technology of a particular vendor, limiting their ability to work with different vendors.

Vendor lock-in can lead to higher costs, lower flexibility, and less innovation, which can negatively impact the growth of the industrial process automation industry. Companies may hesitate to invest in automation systems if they are concerned about being locked into a particular vendor's technology. This, in turn, limits the growth of the market.

Collaborations and Partnerships in the Era of Industry 4.0

Advancements in the Industry 4.0 technologies, such as the Internet of Things (IoT), cloud computing, and artificial intelligence (AI), are creating significant opportunities for the industrial process automation market. These technologies enable companies to collect and analyze vast amounts of data in real time, providing insights into operational processes and identifying areas for improvement. With the rapid technological evolution, market players collaborate with tech-savvy companies to develop new solutions based on proven technologies.

This collaboration creates more efficient and effective automation solutions that help companies optimize their production processes and profitability. For instance, in January 2023, Emirates Global Aluminum (EGA) and Microsoft UAE collaborated to accelerate Industry 4.0 adoption across industries in the UAE. This collaboration aims to set the global best practices for the aluminum industry while improving the sustainability of EGA’s computing operations.

Moreover, Schneider Electric partnered with consultancy firm Accenture to create Digital Services Factory (DSF), a program aimed to boost digital innovation and accelerate the commercialization of new products. With the implementation of the Digital Services Factory in collaboration with Accenture, Schneider Electric has decreased the time taken to develop and release new digital services by 80%.

Geographical Analysis

Europe holds a major share of the industrial process automation market and is expected to continue its dominance during the forecast period. This is attributed to the adoption of industrial automation solutions by numerous industries in the region, including energy & utilities, oil & gas, and pharmaceutical.

Also, rapid advancements in automation technology drive the adoption of automation across a wide range of industries. Developments such as autonomous mobile robots (AMRs), 5G networks, and edge computing enable businesses to automate more complex tasks and achieve greater efficiency and productivity. For instance, in August 2021, Mobile Industrial Robots (MiR) launched two AMRs called MiR600 and MiR1350 AMRs, which can lift 1322 and 2976 pounds, respectively. They are designed to safely and efficiently perform material handling tasks in challenging industrial environments.

Moreover, the European Union (EU) implemented strict environmental regulations, which drive the adoption of automation technologies to help businesses reduce waste, minimize emissions, and conserve energy. Developments such as energy-efficient sensors and smart building systems enable businesses to reduce their environmental footprint while enhancing profitability. Industrial process automation plays a significant role in helping companies achieve their sustainability goals while improving their financial performance.

On the other hand, Asia-Pacific is expected to show a steady rise in the industrial process automation market share, owing to the growing adoption of automation in industries such as oil & gas, pharmaceuticals, food & beverages, power generation, and chemicals.In addition, the increasing adoption of Industry 4.0 in countries such as India, South Korea, and Indonesia fuels the demand for industrial process automation systems. These systems offer real-time monitoring and control of industrial processes, enabling superior optimization and efficiency.

Moreover, various market leaders are taking initiatives to revolutionize automation processes with Industry 4.0 technologies. This, in turn, drives the market growth. For instance, in December 2022, Honeywell announced that Regreen Excel EPC India implemented the PlantCruise by Experion DCS solution and modular systems and field instruments (FI) for 40 of their plant projects in India. Presently, over 80% of Regreen Excel's projects utilize Experion PlantCruise DCS. This system offers a connected platform with advanced HMI and tools, comprehensive connectivity, and software-enabled solutions that deliver greater operational efficiencies and help achieve new business outcomes.

Competitive Landscape

The industrial process automation industry report includes various market players such as Hitachi Ltd., Siemens AG, Mitsubishi Electric, Schneider Electric, Honeywell International, ABB Ltd., Toshiba Corp., Emerson Electric Co., Rockwell Automation, Omron Corp., Fanuc Corp., Valmet OYJ, Yokogawa Electric, Endress Hauser, and Dwyer Instruments. These market players are adopting several strategies, such as product launches and partnerships, across various regions to maintain their dominance in the global market.

For instance, in February 2023, Yokogawa Electric Corporation launched a new sensor called FKDPP for measuring oxygen concentration in industrial processes. The sensor offers high accuracy and stability even in harsh environments and is expected to improve productivity and efficiency in various industries.

In addition, in December 2022, Emerson introduced a new Crosby J-Series pressure relief valve product line to offer reliable and efficient overpressure protection for various industries. The new product line features advanced technology, a soft-seat design for tightness and durability, and customization options for users.

Moreover, in December 2022, Valmet announced a strategic partnership with Koja to create an Industrial Internet ecosystem that enables energy producers to optimize their operations and maintenance. The ecosystem combines Valmet's automation and data analytics expertise with Koja's process control solutions to provide real-time insights. The goal is to reduce maintenance costs and improve efficiency in the energy industry.

Industrial Process Automation Market Key Segments

By Component

-

Manufacturing Execution System (MES)

-

Hardware

-

Software

-

Services

-

-

Distributed Control System (DCS)

-

Hardware

-

Software

-

Services

-

-

Programmable Logic Control (PLC)

-

Hardware

-

Software

-

Services

-

-

Supervisory Control & Data Acquisition (SCADA)

-

Hardware

-

Software

-

Services

-

-

Field Instruments

-

Industrial Robots

-

Human Machine Interface

-

Industrial PCS

-

Process Analyzers & Drives

By End User

-

Oil & Gas

-

Chemicals & Refining

-

Energy & Power

-

Pulp & Paper

-

Metals & Mining

-

Pharmaceutical

-

Cement & Glass

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

Hitachi Ltd.

-

Siemens

-

Mitsubishi Electric Corporation

-

Schneider Electric SE

-

Honeywell International Inc

-

ABB Ltd.

-

Toshiba Corporation

-

Emerson Electric Co.

-

Rockwell Automation Inc

-

Omron Corporation

-

Fanuc Corporation

-

Valmet OYJ

-

Yokogawa Electric

-

Endress+Hauser

-

Dwyer Instruments Inc.

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2022 |

USD 58.36 Billion |

|

Revenue Forecast in 2030 |

USD 96.06 Billion |

|

Growth Rate |

CAGR of 5.4% from 2023 to 2030 |

|

Analysis Period |

2022–2030 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

Increasing adoption of industrial IoT Integration of AR technology and digital twins in manufacturing Government initiatives to promote industrial automation |

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 15 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst