Green Hydrogen Market By Plant Capacity (Pilot, Small, Medium, and Large), By Production Technology (Alkaline Electrolysers, Proton Exchange Membrane, and Others), By Renewable Power Source (Solar PV-Driven, Onshore Wind-Driven, and Others), By Project Maturity Stage (Concept & Feasibility, Under Construction, and Others), By End-User (Chemicals & Fertilisers, Refining & Petrochemicals, Steel & Heavy Industry, and Others) – Global Analysis & Forecast, 2025–2030.

Industry Outlook

The global Green Hydrogen Market size was valued at USD 6.52 billion in 2024, and is expected to be valued at USD 10.03 billion by the end of 2025. The industry is projected to grow, hitting USD 86.44 billion by 2030, with a CAGR of 53.8% between 2025 and 2030.

The industry is witnessing significant growth, driven by increasing investments in renewable energy, advancements in electrolyser technologies, and supportive policies from governments worldwide. Rising adoption across industrial, commercial, and energy sectors, including transportation, power generation, and heavy industries such as steel and chemicals, is accelerating demand, positioning hydrogen as a critical clean and sustainable energy source.

The market is evolving with a focus on cost-efficient production, large-scale infrastructure development, and global electrolyser manufacturing expansion, enabling wider scalability and integration of green hydrogen into energy systems across regions. Innovation is advancing in hydrogen storage, fuel cells, and clean mobility solutions, improving both the feasibility and economic viability of green hydrogen applications.

International collaborations, regulatory frameworks, and sustainability standards are shaping the market, ensuring production and utilization meet efficiency, reliability, and environmental benchmarks. As investments continue and technologies mature, the global green hydrogen market is set to play a pivotal role in decarbonization, supporting the worldwide transition toward cleaner and more sustainable energy system.

What are the key trends in the Green Hydrogen Industry?

How Are Electrolyzer Innovations Accelerating Green Hydrogen Production?

Advancements in electrolyzer technology, particularly in Proton Exchange Membrane (PEM) and alkaline systems, are playing a critical role in lowering the cost and improving the efficiency of green hydrogen production. Modern electrolyzers now operate with higher energy efficiency, faster start-up times, and greater scalability, enabling continuous and flexible hydrogen generation even when paired with variable renewable energy sources like solar and wind. These technological improvements are not only reducing production costs but also expanding the potential for regional hydrogen hubs where industrial demand is high.

Is Green Hydrogen Fueling the Decarbonization of Heavy Industries?

Green hydrogen is increasingly being recognized as a key enabler in decarbonizing heavy industries such as steel and chemicals. The International Energy Agency has highlighted hydrogen's potential in reducing emissions in these sectors. For instance, Salzgitter, Germany's second-largest steelmaker, is progressing with its USD 2.94 billion Salcos project, aiming for a 30% CO₂ emission cut by 2027. However, the project faces delays due to economic conditions and slow regulatory progress. This indicates that while green hydrogen holds promise, its implementation in heavy industries requires supportive policies and infrastructure.

What Role Are Policy and Investment Shifts Playing in Green Hydrogen Deployment?

Government policies and investments are crucial in accelerating the deployment of green hydrogen. India's approval of a USD 2.3 billion plan aims to produce at least 5 million metric tons of green hydrogen by 2030. Similarly, the U.S. green hydrogen market is growing, indicating strong policy support.

However, some companies are reassessing their green hydrogen targets due to high costs and reliance on subsidies. For example, Repsol has reduced its 2030 target by up to 63%, citing delays in market development and regulatory frameworks. To navigate this landscape, companies should align their strategies with national hydrogen missions and seek public-private partnerships to share risks and benefits.

How Are Storage and Mobility Innovations Enhancing Green Hydrogen Viability?

Innovations in hydrogen storage and mobility are expanding the applicability of green hydrogen and their growth is driven by advancements in storage materials and technologies. In the mobility sector, hydrogen fuel cells are gaining traction for applications in transportation. This indicates a growing acceptance of hydrogen as a clean fuel alternative.

Companies should therefore invest in R&D to develop efficient storage solutions and collaborate with automotive manufacturers to integrate hydrogen fuel cells into vehicles. Building infrastructure for refueling stations can also support the adoption of hydrogen-powered transportation.

What are the key market drivers, breakthroughs, and investment opportunities that will shape the Green Hydrogen Industry in the next decade?

The global green hydrogen market demand is experiencing rapid growth, driven by advancements in renewable energy technologies, supportive government policies, and increasing industrial demand for clean energy solutions. Governments worldwide are investing in infrastructure and offering incentives to promote green hydrogen adoption, aiming to achieve net-zero emissions targets. Industries such as steel, chemicals, and transportation are exploring green hydrogen as a viable alternative to fossil fuels, recognizing its potential to decarbonize operations.

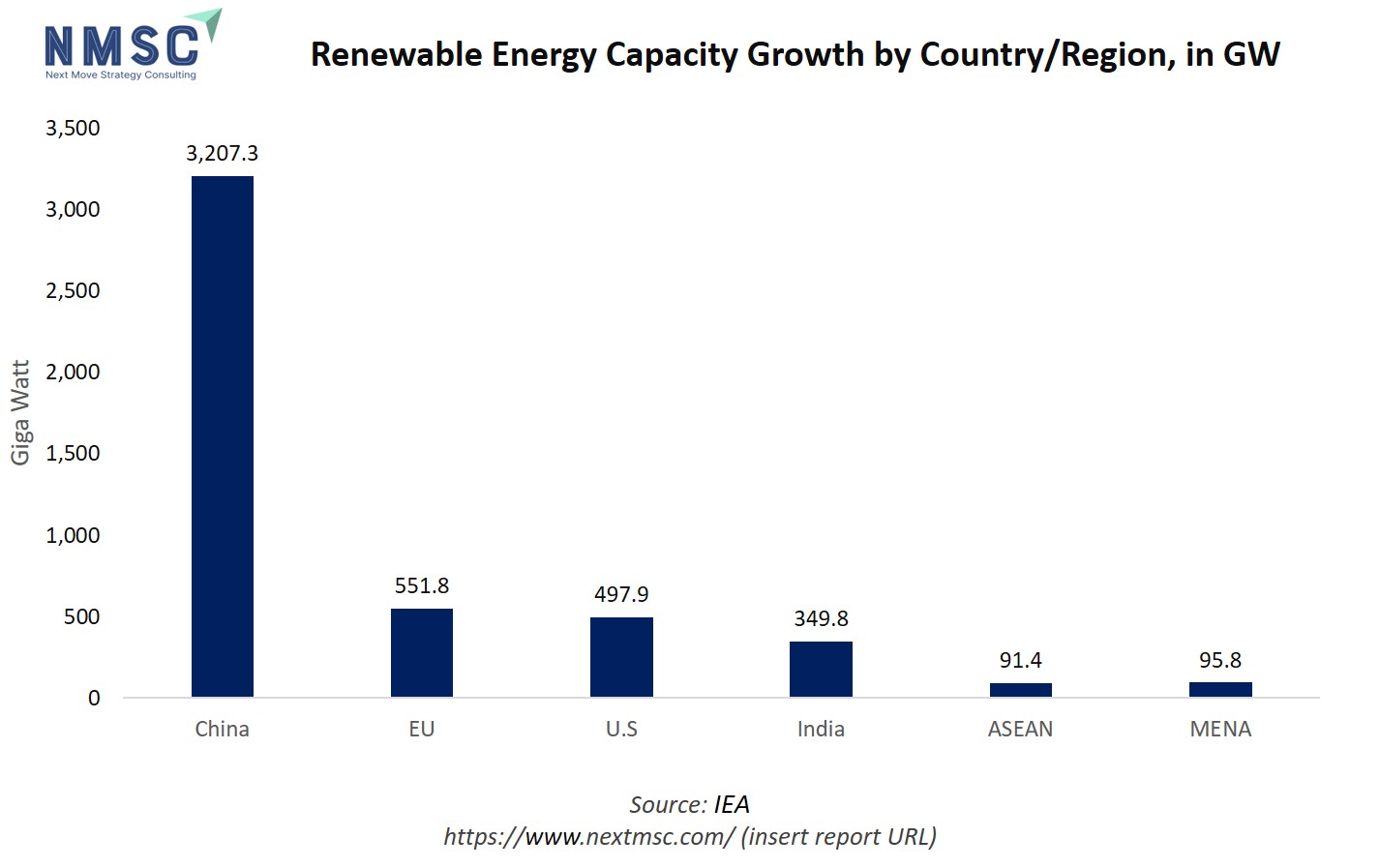

Renewable energy is a fundamental driver of the green hydrogen market as it provides the clean electricity required for electrolysis, enabling the production of hydrogen with zero carbon emissions. The growth and availability of renewable sources like solar, wind, and hydropower directly reduce the cost and environmental impact of green hydrogen, making it a crucial element for decarbonizing industries and supporting sustainable energy transitions globally.

The chart depicts the renewable energy capacity growth by country or region, showing that China has overwhelmingly led global expansion with 3,207.3 GW, far outpacing the EU (551.8 GW), the U.S. (497.9 GW), India (349.8 GW), ASEAN (91.4 GW), and MENA (95.8 GW). The dominance of China in renewable capacity signals its pivotal role in enabling new green technologies such as green hydrogen production, which relies on abundant renewables for large-scale electrolysis. Regions with higher renewable capacity, like China, the EU, and the U.S. are better positioned to scale up green hydrogen initiatives, reduce costs through economies of scale, and meet ambitious decarbonization goals.

Growth Drivers:

How Is Decarbonization Driving Green Hydrogen Adoption?

The push toward decarbonization is a major growth driver for green hydrogen. Countries are adopting ambitious net-zero emissions targets, leading to investments in renewable energy and hydrogen production. For example, India’s National Green Hydrogen Mission plans to produce at least 5 million metric tons of green hydrogen by 2030, backed by a USD 2.3 billion investment. Such initiatives enhance production capacity, reduce costs, and increase market demand, encouraging companies to invest in hydrogen-based solutions to meet both industrial and energy-sector needs.

How Are Electrolyzer Innovations Making Green Hydrogen Production Cost-Effective?

Technological breakthroughs in electrolyzers are improving energy efficiency and reducing production costs. Modern Proton Exchange Membrane (PEM) and alkaline electrolyzers now operate with higher efficiency and faster response times, enabling integration with variable renewable energy sources like solar and wind.

Programs like the U.S. Department of Energy’s Hydrogen Shot Initiative aim to reduce the cost of green hydrogen to USD 1 per kilogram by 2031. Companies can leverage these innovations by investing in advanced electrolyzer technologies and partnering with renewable energy providers to ensure a steady, cost-effective hydrogen supply.

Growth Inhibitors:

What cost and limited infrastructure challenges are slowing the Green Hydrogen Market?

High production costs and limited infrastructure remain key inhibitors for the green hydrogen market growth. The capital cost of electrolyzers and renewable electricity continues to make green hydrogen less competitive than fossil-fuel-based alternatives. Additionally, the lack of storage, transport, and refueling infrastructure slows adoption. Addressing these issues requires coordinated investments in infrastructure, supportive regulations, and public-private partnerships to make green hydrogen a commercially viable energy solution.

How Are Regional Green Hydrogen Hubs Creating Investment Opportunities?

Emerging regional green hydrogen hubs are opening significant avenues for strategic investments across production, infrastructure, and supply chain development. For instance, Andhra Pradesh’s Green Hydrogen Valley initiative aims to transform the state into a comprehensive green hydrogen ecosystem by 2030, including large-scale electrolyzer manufacturing, hydrogen production facilities, storage solutions, and distribution networks. These hubs are designed to connect renewable energy generation directly with hydrogen production and industrial demand centers, creating integrated value chains.

How Green Hydrogen Market is segmented in this report, and what are the key insights from the segmentation analysis?

By Plant Capacity (MW) Insights

How Is the Green Hydrogen Market Segmented by Plant Capacity?

On the basis of plant capacity (MW), the market is segmented into pilot (< 1 MW), small (1–10 MW), medium (10–50 MW) and large (> 50 MW).

The pilot segment (<1 MW) primarily includes demonstration and R&D projects. These small-scale plants allow technology validation, process optimization, and operational learning before large-scale deployment. Small-scale plants (1–10 MW) are bridging the gap between pilot demonstrations and medium-scale commercial deployments. These plants cater to industrial clusters, such as refineries, steel mini-plants, and fertilizer units, where localized hydrogen supply reduces dependency on fossil-based hydrogen.

Medium-scale plants (10–50 MW) serve as backbone hydrogen hubs for multiple industrial consumers. These projects integrate renewable energy generation, electrolysers, and storage to optimize operational efficiency. For instance, VNG's 30 MW electrolysis plant in Bad Lauchstaedt, Germany, exemplifies this trend, producing 2,700 tonnes of green hydrogen annually to supply the Leuna chemicals and oil park. The segment emphasizes scalable, cost-efficient operations and represents a critical step toward commercial profitability. Large-scale green hydrogen projects (>50 MW) are positioned to lead the next wave of market expansion, targeting industrial offtake, blending applications, and export markets.

By Production Technology Insights

Which Electrolyzer Technologies Are Driving Growth in the Green Hydrogen Market?

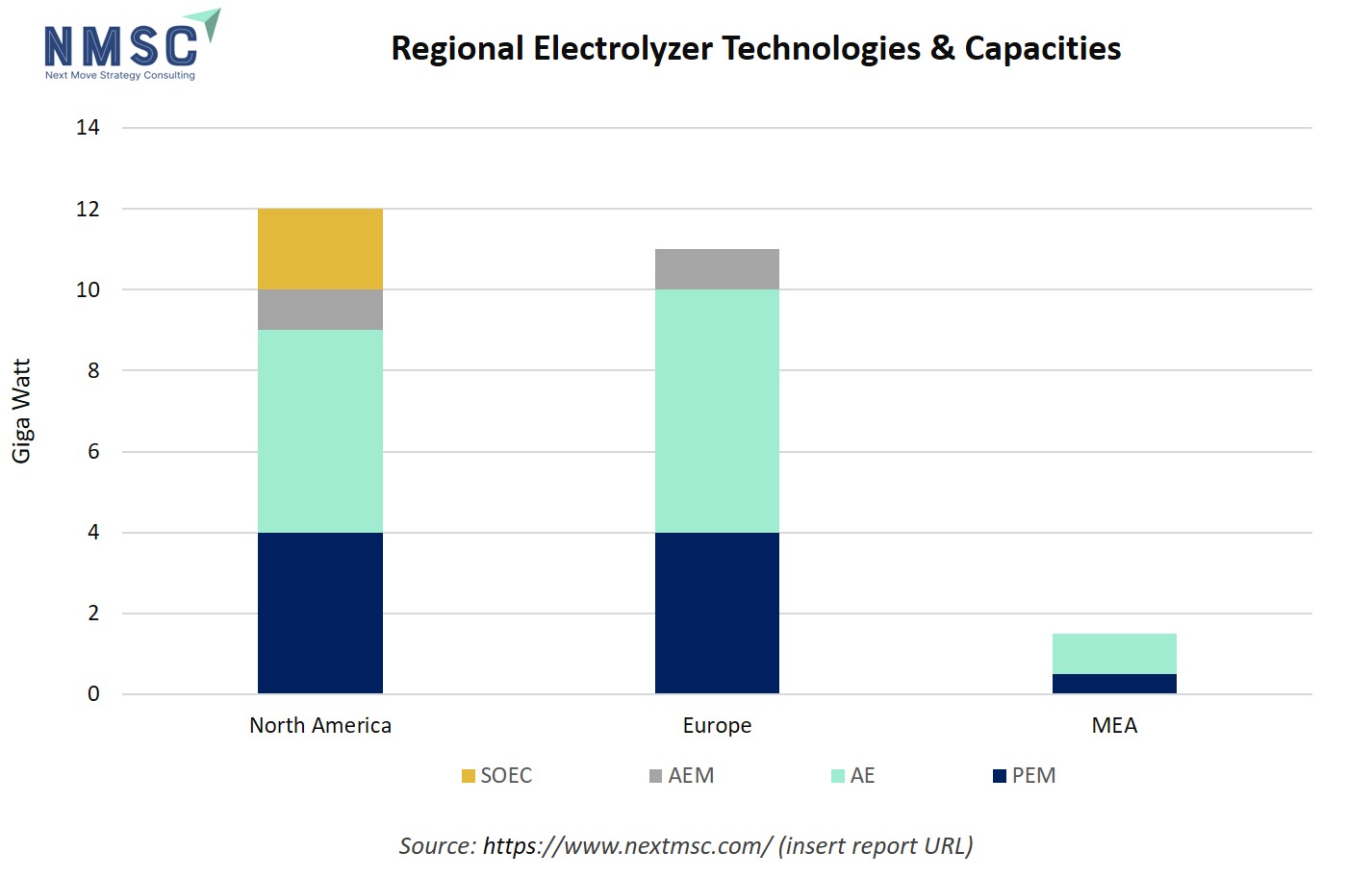

Based on production technology, the market is segmented into alkaline electrolyzers (AEL), proton exchange membrane (PEM), anion exchange membrane (AEM), solid oxide electrolysers (SOEC) and others.

Alkaline electrolysis remains the most mature and widely deployed technology for high-capacity projects globally and in India because of its relative cost-competitiveness and long operational history. The IEA notes that alkaline and PEM systems can have comparable efficiencies but alkaline systems are typically favoured where low capital cost per kW and large, steady operation matter.

PEM electrolyzers, on the other hand, are the technology of choice for projects requiring high-purity hydrogen, fast ramping with variable renewables, and compact plant footprint. AEM seeks to combine the low-cost materials of alkaline with the dynamic performance of PEM. Beyond the main families, emerging or hybrid approaches (membrane innovations, pressurised modules, coupled chemical carriers) are being trialled to address storage, transport, and integration pain points.

The chart depicts the regional distribution of electrolyzer capacities across different technologies. It highlights the varying adoption and deployment levels of these technologies in key global regions, such as, Europe, Middle East & Africa, and North America. Notably, North America leads with approximately 12 GW of total capacity, showing significant deployment across Solid Oxide Electrolyzer Cell (SOEC), Alkaline Electrolyzer (AE), Proton Exchange Membrane (PEM), and a smaller portion of Anion Exchange Membrane (AEM) technologies. Europe also demonstrates a robust capacity of over 11 GW, primarily dominated by AE and PEM technologies, with a notable share of AEM as well. In contrast, MEA has a more modest capacity, mainly split between AE and PEM, but lacking significant SOEC or AEM deployment. This regional breakdown highlights North America and Europe as the frontrunners in scaling up green hydrogen production using diversified electrolyzer technologies, which in turn positions these regions to lead innovation, cost reduction, and wider adoption of green hydrogen. The relatively lower capacity in MEA signals an emerging market that could grow as technology investments and infrastructure expand, further influencing the global green hydrogen landscape.

By Renewable Power Source Insights

Which Renewable Energy Sources Are Powering the Growth of Green Hydrogen Market?

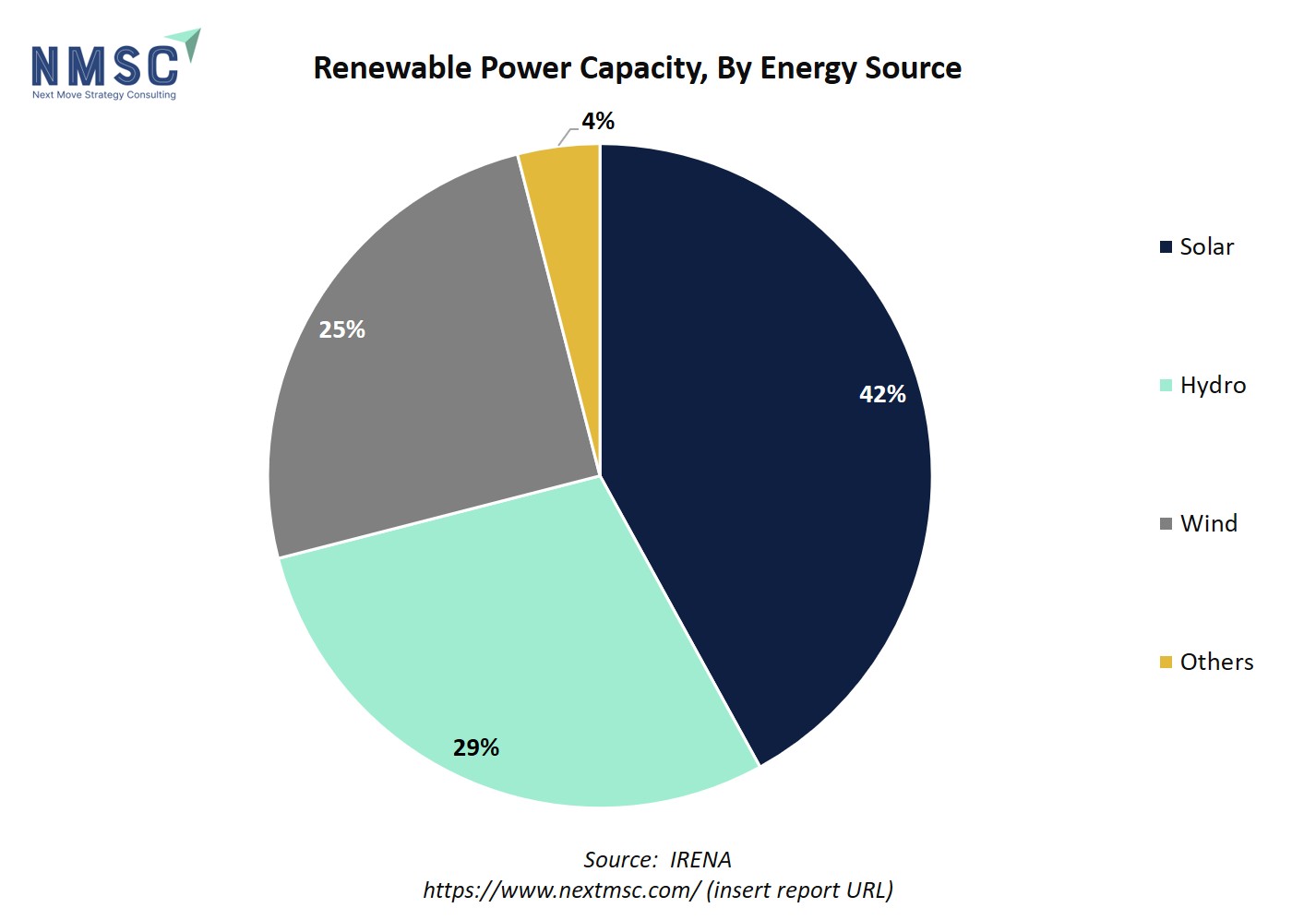

Based on renewable power source, the market is divided into solar PV-driven, onshore wind-driven, offshore wind-driven, hydro / biomass / geothermal and others.

Solar PV is the dominant renewable source for green hydrogen production, due to the high solar irradiance and falling solar tariffs. Projects such as Iberdrola’s 20 MW solar-powered electrolyser in Spain produce green hydrogen for industrial and mobility applications. Many pilot and commercial electrolyser projects co-locate with solar farms to achieve lower levelized cost of hydrogen (LCOH). This segment highlights the market’s focus on cost-competitive, scalable renewable integration.

Onshore wind farms are increasingly paired with electrolysers, where wind resources are abundant. Onshore wind-driven hydrogen production allows industrial clusters and export hubs to benefit from predictable renewable supply. While hydro, biomass, and geothermal energy sources contribute to renewable energy mix, their role in green hydrogen production is currently limited. Hydropower, for example, accounted for a smaller share compared to wind and solar energy in recent installations.

The chart illustrates the global renewable power capacity by energy source, showing that solar leads with 42% of the total 4,448 GW capacity, followed by hydropower at 29%, wind at 25%, and other sources (like bioenergy, geothermal, and marine) at 4%. The data highlights solar as the dominant contributor to renewable energy expansion, supplying a large, clean electricity base crucial for green hydrogen production via electrolysis. Hydropower and wind also provide substantial, stable renewable resources that can support large-scale hydrogen projects. A diverse and robust renewable energy mix directly benefits the global green hydrogen market by ensuring a steady and low-carbon electricity supply, enabling cost-effective and scalable hydrogen generation, and driving the transition away from fossil-fuel-based hydrogen to cleaner alternatives worldwide.

By System Ownership Model Insights

Which System Ownership Models Are Shaping Green Hydrogen Market in 2025?

Based on system ownership model, the market is divided into captive (single-user industrial), merchant hubs (dedicated export/hub) and public-private partnerships (large-scale export).

Captive systems, owned by a single industrial user, are becoming popular in sectors like steel, chemicals, and refineries, enabling on-site green hydrogen production and reducing dependency on external suppliers. The insight is that captive ownership ensures reliability, cost predictability, and direct integration with industrial processes, although it may limit flexibility for selling excess hydrogen externally.

Merchant hubs are dedicated hydrogen production facilities supplying multiple industrial consumers or export markets. These hubs leverage scale economies and co-located renewable energy to supply regional clusters or international buyers. For instance, ACWA Power’s planned green hydrogen hub in NEOM, Saudi Arabia, is designed to produce hydrogen for domestic use and export to international markets. For instance, ACWA Power’s planned green hydrogen hub in NEOM, Saudi Arabia, is designed to produce hydrogen for domestic use and export to international markets.

Similarly, PPP models are being implemented for giga-scale green hydrogen projects aimed at domestic and international markets. These models combine government incentives, policy support, and private sector efficiency to establish large-scale hubs.

By Project Maturity Stage Insights

How Are Concept, FID, Construction, and Operational Projects Driving Green Hydrogen Market?

Based on project maturity stage, the market is segmented into concept & feasibility, final investment decision (FID), under construction and operational.

Concept and feasibility-stage projects represent the earliest planning phase of green hydrogen plants. These projects focus on site selection, technology assessment, and techno-economic modelling. For example, ACWA Power’s early feasibility studies for multi-hundred MW green hydrogen plants in NEOM, Saudi Arabia, are assessing optimal electrolyser technologies, renewable energy sources, and potential export logistics. FID-stage projects indicate that technical, financial, and regulatory approvals have been secured, and project execution is imminent.

Projects under construction are a clear indicator of the market transitioning from planning to operational scale. For example, ITM Power’s 120 MW electrolyser installation for Uniper’s Humber H2ub® project in the UK is under construction, targeting hydrogen supply for industrial and mobility applications. The insight is that under-construction projects demonstrate technological readiness, stakeholder confidence, and near-term capacity expansion, reducing market entry risk for investors.

By Delivery & Distribution Insights

How Are Different Delivery and Distribution Methods Driving Green Hydrogen Market?

Based on delivery & distribution, the market is segmented into on-site captive, merchant / third-party offtake, pipeline transport, compressed-gas tube trailers and liquefied-hydrogen shipping.

On-site captive delivery involves producing and using hydrogen at the same facility, eliminating transport needs and ensuring a stable supply. Industries such as steel, refining, and fertilizer units are adopting on-site hydrogen production to decarbonize processes efficiently. Merchant or third-party offtake involves producing hydrogen at a central hub and supplying multiple industrial or commercial users. This model allows economies of scale and regional distribution.

Hydrogen pipelines enable continuous, high-volume transport over short and medium distances with minimal losses. Linde and Air Products operate extensive pipeline networks supplying industrial clusters in Germany and the U.S., reducing the need for repeated compression or liquefaction. The insight is that pipeline infrastructure is critical for industrial hubs and city-scale hydrogen ecosystems, offering reliable and cost-efficient delivery.

By End-User Sector Insights

How Do Chemicals, Steel, Mobility, and Power Drive Green Hydrogen Demand?

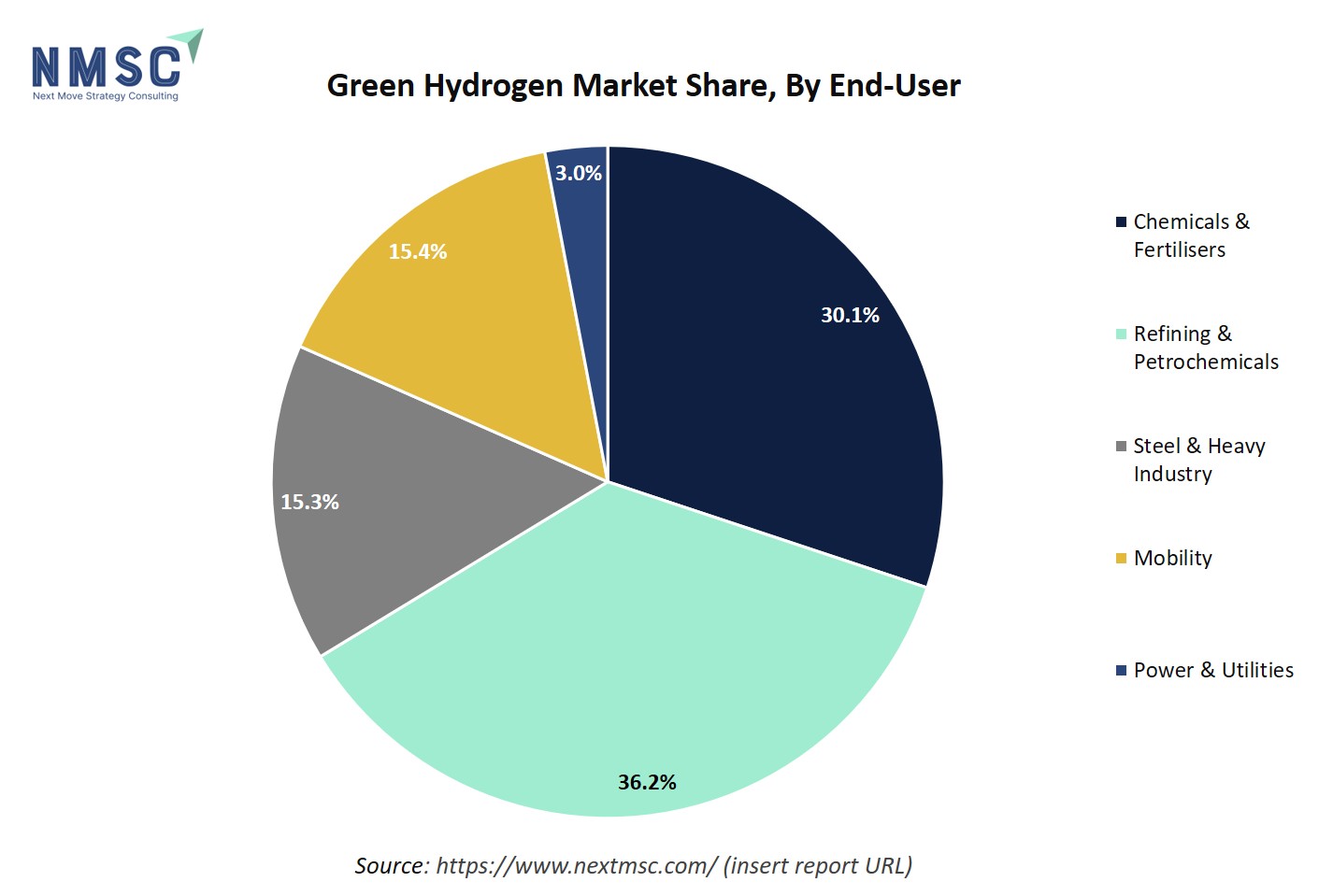

Based on end-user sector, the green hydrogen market report is bifurcated into chemicals & fertilisers (e.g. ammonia, methanol), refining & petrochemicals, steel & heavy industry (DRI), mobility (road, rail, maritime, aviation), and power & utilities (grid services, peaking, storage).

The chemicals and fertiliser sector remains the largest early adopter of green hydrogen, primarily for ammonia and methanol production. The push to decarbonize nitrogenous fertiliser production, combined with pilot projects integrating electrolysers with renewable power, positions this sector as a key driver. Similarly, Green hydrogen is increasingly used in refineries and petrochemical complexes for hydrogenation and fuel processing.

The mobility applications include road, rail, maritime, and aviation sectors. Trials are underway for hydrogen fuel-cell buses, trucks, and port logistics vehicles. Power generation and utility applications use hydrogen for grid balancing, peaking, and long-duration energy storage. Hydrogen-to-power projects help integrate variable renewables into the grid, improve system reliability, and provide backup power.

The above chart illustrates the market share distribution of green hydrogen consumption across major end-user sectors globally. Such segmentation reveals that the industrial sectors, particularly refining, petrochemicals, and chemical production are currently driving most of the demand for green hydrogen, reflecting established applications and infrastructure already in place for hydrogen utilization. The significant shares for steel/heavy industry and mobility sectors highlight their increasing adoption of green hydrogen to support clean fuel transitions, decarbonization, and new manufacturing processes. Meanwhile, the comparatively lower market share of power and utilities suggests that its use in grid services and energy storage is still emerging but poised for growth.

Overall, this market structure impacts the global green hydrogen industry by directing investment and innovation primarily toward industries where demand and scale are strongest, while also indicating future opportunities for expansion in transportation and energy applications as technologies and policies evolve.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Green Hydrogen Market in North America

North America is experiencing rapid growth in the green hydrogen market share, driven by robust policy support and increasing industrial demand. In the United States, the Inflation Reduction Act's Section 45V provides substantial tax credits for low-emission hydrogen production, significantly reducing production costs. Additionally, the region is witnessing large-scale projects such as SoHyCal, the largest green hydrogen production plant powered entirely by renewable energy in North America. These developments are enhancing the region's competitiveness in the global green hydrogen market.

Green Hydrogen Market in the United States

The U.S. market is experiencing accelerated growth, primarily due to federal incentives like the 45V tax credit, which offers up to USD 3/kg for hydrogen produced with minimal emissions. This policy framework has spurred significant investments in hydrogen infrastructure and technology development, positioning the U.S. as a leader in green hydrogen production. Regions with strong renewable generation, like Texas and California, are particularly attractive for project development. Combined policy clarity and technological support enhance investor confidence and accelerate the commercial viability of hydrogen-based projects nationwide.

Green Hydrogen Market in Canada

Canada's green hydrogen strategy focuses on leveraging its abundant renewable energy resources to produce low-carbon hydrogen. The country aims to develop a robust hydrogen economy by investing in infrastructure and fostering innovation in hydrogen technologies. These efforts are expected to contribute significantly to Canada's decarbonization goals and economic growth. Provinces like Quebec and Alberta are developing hydrogen hubs, connecting renewable electricity with electrolyser production and industrial offtake. By aligning resource availability, policy support, and private investment, Canada is positioning itself to serve both domestic and international hydrogen markets while ensuring sustainable growth.

Green Hydrogen Market in Europe

Europe’s market is shaped by ambitious decarbonization goals, the REPowerEU plan, and EU funding for hydrogen production and import projects. Countries such as Germany, France, and Spain are establishing hydrogen clusters and industrial hubs to decarbonize heavy industries like steel, chemicals, and transport. Cross-border cooperation ensures supply security and export potential. However, cost competitiveness remains dependent on renewable electricity prices and efficient permitting. Strategic funding and policy frameworks are fostering private investment, technology scaling, and a structured rollout of green hydrogen infrastructure across the continent.

Green Hydrogen Market in the United Kingdom

The UK government has approved ten commercial-scale green hydrogen projects, marking a significant step in its clean energy transition. These projects, supported by over USD 1.36 billion in subsidies, are expected to begin construction between 2025 and 2028 and will create more than 700 jobs across various sectors. The initiatives are part of the Hydrogen Allocation Round (HAR1) and aim to contribute to the UK's target of achieving 10 GW of hydrogen production capacity by 2030. Additionally, the government has waived licensing requirements for pipelines transporting 100% hydrogen to accelerate infrastructure development. These efforts align with the UK's broader strategy to decarbonize industry and enhance energy security.

Green Hydrogen Market in Germany

Germany's green hydrogen strategy emphasizes the development of a hydrogen infrastructure to support its industrial base. The country plans to import green hydrogen to meet its energy needs, recognizing the importance of international partnerships in achieving its hydrogen goals. Industrial demand in steel and chemicals is the main driver, while international partnerships are critical for securing cost-competitive hydrogen supply. Investment in electrolyser manufacturing, pipelines, and storage infrastructure is being accelerated through EU and federal funding. While the strategy mitigates domestic resource limitations, execution depends on grid access, project financing, and cross-border regulations.

Green Hydrogen Market in France

France is advancing green hydrogen with national hydrogen valleys, targeted electrolyser capacity, and integration into industrial sectors. The government is investing in R&D to reduce production costs and improve technology efficiency. Hydrogen is being positioned for steel, chemical, and transport sectors, supported by regulatory clarity and coordinated infrastructure development. The combination of policy, industrial demand, and renewable electricity ensures projects are bankable and scalable, helping France emerge as a key European player in green hydrogen production and technology export.

Green Hydrogen Market in Spain

Spain is aggressively promoting green hydrogen through substantial subsidies, the development of hydrogen valleys, and large-scale electrolysis projects. The government has allocated USD 1.67 billion across seven projects to establish over 1,000 MW of electrolyser capacity, supporting industrial hubs in regions such as Aragon, Andalusia, and Catalonia. These hubs integrate hydrogen into fertilizer production, refineries, and other industrial applications, leveraging Spain’s abundant solar and wind resources.

Green Hydrogen Market in Italy

Italy leverages renewable energy potential, industrial clusters, and geographic proximity to North Africa to develop its hydrogen market. Hydrogen valleys and large-scale electrolyser projects are being implemented to decarbonize heavy industry and integrate into transport. Coordination with EU funding ensures project feasibility, while port infrastructure and cross-border pipelines provide export opportunities. Growth depends on timely grid upgrades, regulatory stability, and project execution. Italy’s strategy combines domestic industrial decarbonization with potential export revenue streams, positioning the country as a regional hydrogen hub.

Green Hydrogen Market in the Nordics

Nordics like Denmark, Norway, Sweden, Finland, and Iceland are capitalizing on abundant offshore wind and hydro to establish hydrogen valleys. Industrial applications in steel, fertilizer, and shipping benefit from local hydrogen production and export-oriented planning. Cross-border collaboration and integration of ports and electrolyser manufacturing hubs reduce investment risk. The region’s coordinated approach provides a model for industrial decarbonization, demonstrating how renewable abundance, policy, and industrial demand converge to drive hydrogen market growth.

Green Hydrogen Market in Asia Pacific

Asia-Pacific presents a heterogeneous but rapidly growing market. Japan, China, Korea, India, Taiwan, and Australia are investing heavily in electrolyser production, renewable integration, and industrial applications. Export-oriented countries like Australia plan large-scale green hydrogen plants for Asia, while industrial nations like Japan and South Korea focus on technology deployment and fuel-cell mobility. Coordinated infrastructure, grid integration, and cross-border logistics are central to capturing market opportunities, positioning the region as a hub for production, consumption, and export.

Green Hydrogen Market in China

China’s provincial and national policies aggressively support hydrogen development. Massive electrolyser deployment, provincial subsidies, and industrial integration are scaling production. State-led manufacturing reduces costs, while industrial adoption in steel, chemicals, and transport ensures domestic demand. China’s approach combines production scale, technology development, and export potential, but market growth depends on grid integration, water availability, and policy consistency across provinces.

Green Hydrogen Market in Japan

Japan prioritizes hydrogen for energy storage, industrial heat, and mobility. Collaboration with Australia and other exporters secures low-carbon hydrogen supply. National R&D focuses on fuel cells, electrolyzers, and ammonia transport. Industrial conglomerates provide stable demand, de-risking investments. Market expansion depends on achieving cost-competitive production and establishing international supply chains.

Green Hydrogen Market in India

India’s National Green Hydrogen Mission targets 5 million tons of production by 2030 with public funding and renewable capacity expansion. Focus areas include steel, fertilizer, and mobility sectors. Grid expansion, water availability, and electrolyser manufacturing capacity are critical for achieving scale. Policy incentives reduce early-stage investment risk, while local renewable resources support competitive hydrogen production costs. India is positioning itself as both a domestic and export-oriented hydrogen producer.

Green Hydrogen Market in South Korea

South Korea promotes hydrogen via its Hydrogen Economy Roadmap and Hydrogen Law. Fuel-cell mobility, industrial adoption, and refuelling networks provide structured demand. Domestic manufacturing and export capabilities strengthen market growth. Challenges remain in aligning renewable electricity supply and ensuring competitive production costs for green hydrogen.

Green Hydrogen Market in Taiwan

Taiwan integrates hydrogen into its industrial decarbonization roadmap, targeting MW-scale electrolyser capacity by 2030. Component manufacturing and pilot projects in transport and industry demonstrate potential. Land constraints and grid limitations may necessitate imports or regional collaboration. Taiwan is attractive for R&D and technology deployment rather than mass production.

Green Hydrogen Market in Indonesia

Indonesia is piloting green hydrogen plants using solar and geothermal energy for export and domestic consumption. Abundant renewable resources and proximity to demand centers create opportunities, but cost and infrastructure challenges remain. Phased rollout, clear PPAs, and export regulations are critical for market development.

Green Hydrogen Market in Australia

Australia is a leading prospective exporter due to vast renewable potential. Flagship projects like the Hydrogen Energy Supply Chain aim to produce hydrogen for Asia-Pacific markets. Government funding reduces early-stage risks, while project success depends on electrolyser supply chains, grid integration, and international offtake agreements.

Green Hydrogen Market in Latin America

Chile and Brazil are driving regional green hydrogen initiatives. Chile’s solar and wind resources allow low-cost hydrogen production for export, while Brazil focuses on industrial decarbonization. Government incentives, combined with high renewable potential, support competitive electrolyser deployment. Market growth depends on consistent policy and securing international offtake.

Green Hydrogen Market in the Middle East & Africa

Middle East nations like Saudi Arabia and UAE are developing large-scale green hydrogen plants to diversify energy portfolios. Africa is exploring hydrogen exports using solar-rich regions in South Africa and Namibia. Sovereign funds, pilot projects, and EU partnerships support infrastructure and skill development. Growth hinges on execution of large-scale projects, export corridor development, and integration with renewable generation.

Competitive Landscape

Which Companies Dominate the Green Hydrogen Market and How Do They Compete?

The green hydrogen market trends is witnessing intense competition among leading companies striving to establish dominance in this emerging sector. Major players such as Linde plc, Air Liquide, Siemens Energy, Nel ASA, Plug Power, and Thyssenkrupp Nucera are at the forefront, each leveraging their unique strengths to capture market share.

For instance, Linde plc and Air Liquide are expanding their hydrogen production capacities through strategic partnerships and investments in large-scale projects. Siemens Energy focuses on integrating digital solutions to enhance the efficiency of hydrogen production processes. Nel ASA is advancing electrolyzer technologies to reduce costs and improve scalability. Plug Power is vertically integrating its operations, combining hydrogen production with fuel cell technology.

Thyssenkrupp Nucera is capitalizing on its expertise in industrial applications to develop high-efficiency electrolyzers. These companies are not only competing in terms of technological advancements but also in securing government subsidies, forming strategic alliances, and expanding their global footprints to lead in the green hydrogen economy.

Market dominated by Green Hydrogen Giants and Specialists

The green hydrogen industry is primarily led by established industrial gas companies and specialized technology firms. Major players include Linde plc, Air Liquide, Air Products and Chemicals, Siemens Energy, Nel ASA, and Plug Power. These companies are actively involved in large-scale projects, such as Air Liquide and TotalEnergies' joint investment of over USD 1.17 billion in electrolyser projects in the Netherlands. Their competition is intensifying across various regions and niches, with a focus on securing government subsidies, forming strategic partnerships, and expanding production capacities to meet the growing demand for clean hydrogen solutions.

Innovation and Adaptability Drive Market Success

Innovation is a key differentiator in the green hydrogen industry. Companies like Nel ASA are advancing electrolyzer technologies to enhance efficiency and reduce costs. For instance, Nel ASA has opened a fully automated electrolyzer factory in Norway and plans a similar facility in Michigan, USA. Similarly, Plug Power is expanding its hydrogen production capacity and fuel cell offerings to cater to various industries. Adaptability to regulatory changes and market dynamics is crucial, as companies navigate evolving policies and fluctuating energy prices to maintain competitiveness and capitalize on emerging opportunities.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Merger and acquisition activities are becoming increasingly prevalent in the green hydrogen industry as companies seek to bolster their technological capabilities and market reach. A notable example is Thyssenkrupp Nucera's acquisition of core technology assets from Green Hydrogen Systems, which strengthens its position in the market.

Additionally, Electric Hydrogen's merger with Ambient Fuels, backed by a USD 400 million investment from Generate Capital, aims to accelerate the deployment of zero-carbon hydrogen projects worldwide. These strategic moves reflect a broader trend of consolidation in the industry, driven by the need for scale, technological advancement, and enhanced competitiveness.

List of Key Green Hydrogen Companies

-

Nel ASA

-

Thyssenkrupp

-

Air Products and Chemicals, Inc.

-

ITM Power

-

McPhy

-

Cummins Inc.

-

Air Liquide

-

AES Corporation

-

Linde plc

-

Air Products

-

Green Hydrogen Systems

-

ACWA Power Co

-

Iberdrola S.A

What are the Latest Key Industry Developments?

-

September 2025- Accelera, a business segment of Cummins Inc., delivered a 35 MW proton exchange membrane (PEM) electrolyzer system to Linde’s facility in Niagara Falls, New York. Powered by renewable hydroelectric energy, this system aims to produce green hydrogen, contributing to the decarbonization of industrial operations.

-

June 2025- Thyssenkrupp Nucera secured a contract to design a 600 MW green hydrogen plant, one of Europe's largest. The project is set to play a pivotal role in advancing the continent's hydrogen infrastructure, with a final investment decision expected in the coming year.

-

May 2025- ITM Power was chosen by Uniper to supply six 20 MW POSEIDON core electrolyser modules for the Humber H2ub (Green) project. This selection underscores ITM’s role in advancing large-scale green hydrogen production in the UK.

-

October 2024- Nel ASA partnered with Saipem to introduce IVHY™ 100, a scalable 100 MW green hydrogen solution. This collaboration aims to accelerate decarbonization in hard-to-abate industries by leveraging Nel’s electrolyser technology. The modular design enhances flexibility and scalability for large-scale hydrogen production.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Green Hydrogen Market?

Investment in the green hydrogen market is being shaped by a mix of policy support, technological innovation, and growing private-sector participation. Funding trends show a surge in capital flows toward electrolyser manufacturing, large-scale hydrogen hubs, and integrated renewable-hydrogen projects, with venture capital and institutional investors increasingly active in early- and growth-stage companies. Valuations remain strong, reflecting high expectations for long-term demand, though investors are closely monitoring cost reductions and scalability to ensure commercial viability.

Geographically, investment hotspots are emerging in regions with ambitious hydrogen roadmaps and abundant renewable resources, such as Europe, the Middle East, Australia, India, and North America. These regions are attracting public-private partnerships, cross-border collaborations, and government-backed financing. As the sector matures, opportunities will expand in downstream applications like green steel, ammonia, and heavy mobility, making strategic capital allocation crucial for capturing value in this evolving market.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the Green Hydrogen Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the industry at country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Green Hydrogen segments.

The industry offers distinct benefits to different stakeholders across the value chain. Investors gain access to a rapidly growing clean energy market with long-term returns driven by government incentives and increasing corporate demand for low-carbon solutions. Policymakers benefit from advancing national decarbonization goals, enhancing energy security by reducing fossil fuel dependence, and creating new employment opportunities in emerging technologies.

Customers, including industrial users and transport operators, benefit from a reliable, sustainable alternative to fossil fuels that reduces carbon footprints, aligns with ESG commitments, and supports long-term cost competitiveness as technologies mature. Together, these advantages make green hydrogen a transformative opportunity for all stakeholders.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 10.03 Billion |

|

Revenue Forecast in 2030 |

USD 86.44 Billion |

|

Growth Rate |

CAGR of 53.8% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Plant Capacity (MW)

-

Pilot (< 1 MW)

-

Small (1–10 MW)

-

Medium (10–50 MW)

-

Large (> 50 MW)

By Production Technology

-

Alkaline Electrolysers (AEL)

-

Proton Exchange Membrane (PEM)

-

Anion Exchange Membrane (AEM)

-

Solid Oxide Electrolysers (SOEC)

-

Other

By Renewable Power Source

-

Solar PV-Driven

-

Onshore Wind-Driven

-

Offshore Wind-Driven

-

Hydro / Biomass / Geothermal

-

Other

By System Ownership Model

-

Captive (single-user industrial)

-

Merchant Hubs (dedicated export/hub)

-

Public-Private Partnerships (large-scale export)

By Project Maturity Stage

-

Concept & Feasibility

-

Final Investment Decision (FID)

-

Under Construction

-

Operational

By Delivery & Distribution

-

On-Site Captive

-

Merchant / Third-Party Offtake

-

Pipeline Transport

-

Compressed-Gas Tube Trailers

-

Liquefied-H₂ Shipping

By End Use Sector

-

Chemicals & Fertilisers (e.g. ammonia, methanol)

-

Refining & Petrochemicals

-

Steel & Heavy Industry (DRI)

-

Mobility (road, rail, maritime, aviation)

-

Power & Utilities (grid services, peaking, storage)

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on green hydrogen’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Green Hydrogen Market Report serves as an indispensable resource for navigating the evolving landscape.

The market is steadily transitioning from pilot projects to large-scale commercialization, supported by strong policy frameworks, technological advancements, and rising demand from hard-to-abate industries. Strategic takeaways point toward the need for continued investment in electrolyser innovation, infrastructure development, and renewable integration to lower costs and enhance efficiency.

Collaboration between governments, private players, and research institutions will be critical in shaping a competitive and resilient hydrogen ecosystem. Looking ahead, green hydrogen is expected to play a central role in global decarbonization strategies, not only as a clean fuel but also as an energy carrier that bridges renewables with industrial, transport, and power sectors, making it a cornerstone of the future sustainable energy economy.

Speak to Our Analyst

Speak to Our Analyst