India Real Estate Market by Property Size (Small (<500 sq. ft.), Medium (500–2000 sq. ft.), Large (2000+ sq. ft.)), by Property Type (Residential, Commercial, Land, Industrial), by Business Type (Buying, Selling, Leasing, and Others), by Ownership (Owner-Occupied Properties, Rental Properties, Co-ownership), by Property Value (Affordable Housing, Luxury Housing, and Others), by End User (Individual Buyers, Business Entities, and Others) – Opportunity Analysis and Industry Forecast, 2025–2030.

Industry: Construction & Manufacturing | Publish Date: 10-Sep-2025 | No of Pages: 180 | No. of Tables: 144 | No. of Figures: 89 | Format: PDF | Report Code : CM1210

India Real Estate Market Overview

The India Real Estate Market size was valued at USD 385.18 billion in 2024, and is predicted to reach USD 1044.43 billion by 2030, at a CAGR of 16.6% from 2025 to 2030. The Indian real estate market includes a wide range of residential, commercial, and industrial properties located throughout cities and villages in the country. It forms the most essential component for developers, investors, and home buyers that enables transactional and investment possibilities in flats, office spaces, retail shops, and industrial site purchases.

The key component includes agents of real estate, property developers, and governmental structures are a part of complex regulation systems. Moreover, it plays a significant role in boosting the economy and meeting the demands of a rapidly urbanizing population.

Surging Demand For Remote And Hybrid-friendly Housing

The accelerated adoption of remote and hybrid work models across India has transformed housing preferences, with buyers and renters increasingly seeking properties that accommodate work-from-home lifestyles. This shift is driving demand for larger homes, dedicated office spaces, and properties in suburban or tier-2 cities offering better space, affordability, and quality of life compared to central urban areas. Developers are responding with innovative layouts, co-working amenities within residential complexes, and flexible interior designs tailored to the needs of remote professionals.

Growing Dependence On Digital Real Estate Platforms

India’s real estate sector is witnessing a digital revolution, as consumers increasingly turn to online property portals for property search, comparison, and transaction. These platforms offer immersive experiences through virtual tours, 3D walkthroughs, AI-driven recommendations, and real-time updates, allowing users to explore options from the comfort of their homes. The convenience and transparency provided by digital tools are streamlining decision-making and expanding the reach of real estate services to rural and underserved regions, enhancing market participation and driving transaction volumes.

Regulatory Bottlenecks And Economic Uncertainties Challenge Growth

The Indian real estate market faces persistent regulatory hurdles, including complex land acquisition processes, slow project approvals, and inconsistent implementation of building codes across states. Lengthy clearance timelines and compliance requirements often delay project execution and escalate costs. Additionally, economic concerns such as inflationary pressures, income stagnation, and fluctuating interest rates influence homebuyer affordability and investor confidence. These structural challenges necessitate continuous policy reforms and financial innovations to maintain growth momentum in the sector.

Smart City Missions And Green Infrastructure Fuel Growth Prospects

India’s ongoing Smart Cities Mission and push toward sustainable urban development are unlocking vast opportunities for real estate expansion. With initiatives promoting digital infrastructure, integrated mobility, energy-efficient construction, and green public spaces, developers are increasingly aligning projects with government visions of smarter, cleaner cities. The rise in demand for green buildings, integrated townships, and smart commercial zones is not only creating a new asset class in real estate but also encouraging long-term investments focused on livability, technology, and environmental performance. These trends are shaping the future landscape of urban India and offering a sustainable growth pathway for developers and investors alike.

By Property Type, Residential Buildings and Dwellings Holds Dominates the Market, With the Highest CAGR

Residential buildings and dwellings hold both the dominant and fastest growing share due to the rising urbanization and a growing population with higher disposable incomes. Additionally, both affordable and premium housing segments are witnessing substantial growth, fueled by rising consumer aspirations and government initiatives promoting homeownership.

Policies such as housing subsidies, low-interest loans, and tax benefits have further encouraged real estate development. Moreover, the increasing preference for nuclear families over joint family setups has amplified the need for independent living spaces, contributing to the sustained demand for residential properties.

By Business Type, Sales is Anticipated to Grow at a Fastest Rate in the Future

The sales segment is expected to grow at the highest CAGR in the Indian real estate market. The major factors for the growth are majorly urbanization, an increase in disposable income, and the increasing middle-class population. Also, the government initiatives such as PMAY along with the decreased home loan interest rates have also heightened the demand to purchase residential properties.

Moreover, demand for commercial real estate is on the rise with office spaces and retail outlets, as business is expanding, and the e-commerce industry is doing well. As digitalization digitizes the sales transaction, the sales segment will have excellent growth potential in the near future as real estate developers are now offering creditable financing options.

The key market players operating in the India real estate industry include DLF Limited, Macrotech Developers (Lodha Group), Godrej Properties Limited, Oberoi Realty Limited, Prestige Estates Projects Ltd., Brigade Group, Sobha Limited, Phoenix Mills Limited, Mahindra Lifespaces Developers Ltd., Puravankara Limited, L & T Realty, Sunteck Realty Limited, Ansal Properties and Infrastructure Ltd., Equinox India Developments Ltd. (Embassy Developments), K Raheja Corp, and others.

India Real Estate Market Key Segments

By Property Size

-

Small (<500 sq. ft.)

-

Medium (500–2000 sq. ft.)

-

Large (2000+ sq. ft.)

By Property Type

-

Residential

-

Apartments/Flats

-

Single-Family Homes

-

Multi-Family Homes

-

Condominiums

-

Townhouses

-

Vacation Homes

-

-

Commercial

-

Office Spaces

-

Retail Spaces

-

Co-working Spaces

-

Warehouses

-

-

Land

-

Urban Plots

-

Suburban/Rural Plots

-

-

Industrial

-

Manufacturing Plants

-

Distribution Centers

-

Data Centers

-

By Business Type

-

Buying

-

Selling

-

Leasing

-

Renting

-

Real Estate Investment

-

Direct Property Investment

-

Real Estate Investment Trusts (REITs)

-

By Ownership

-

Owner-Occupied Properties

-

Rental Properties

-

Co-ownership

By Property Value

-

Affordable Housing

-

Luxury Housing

-

Ultra-Luxury Housing

By End User

-

Individual Buyers

-

First-time Homebuyers

-

Repeat Buyers

-

Luxury Buyers

-

Seniors/Retirees

-

-

Business Entities

-

Startups

-

SMEs

-

Large Corporations

-

-

Government

-

Civic Projects

-

Affordable Housing Initiatives

-

-

Institutional Investors

Key Players

-

DLF Limited

-

Macrotech Developers (Lodha Group)

-

Godrej Properties Limited

-

Oberoi Realty Limited

-

Prestige Estates Projects Ltd.

-

Brigade Group

-

Sobha Limited

-

Phoenix Mills Limited

-

Mahindra Lifespaces Developers Ltd.

-

Puravankara Limited

-

L & T Realty

-

Sunteck Realty Limited

-

Ansal Properties and Infrastructure Ltd.

-

Equinox India Developments Ltd. (Embassy Developments)

-

K Raheja Corp

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 385.18 Billion |

|

Revenue Forecast in 2030 |

USD 1044.43 Billion |

|

Growth Rate |

CAGR of 16.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

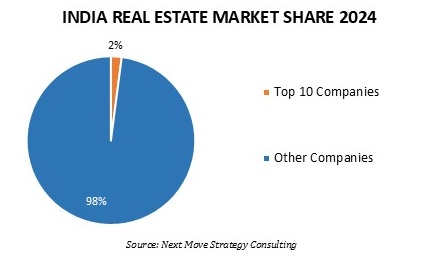

Market Share |

Available for 10 companies |

|

Customization Scope |

|

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst