Indonesia Insurance TPA Market by Type (Health Insurance, Property and Casualty Insurance, Workers' Compensation Insurance, Disability Insurance, Travel Insurance, Cyber Insurance, Gadgets and Personal Belongings Insurance, and Others), by Services (Claims Management and Risk Control Management), and by End-User (Healthcare, Construction, Real Estate and Hospitality, Transportation, Staffing, Banking, Travel and Tourism, and Others) – Opportunity Analysis and Industry Forecast, 2024 – 2030

Industry: ICT & Media | Publish Date: 07-Nov-2025 | No of Pages: 151 | No. of Tables: 125 | No. of Figures: 70 | Format: PDF | Report Code : IC2639

Indonesia Insurance TPA Market Overview

The Indonesia Insurance TPA Market size was valued at USD 1.66 billion in 2024 and is predicted to reach USD 5.32 billion by 2030, registering a CAGR of 20.6% from 2025 to 2030.

The Indonesia insurance third party administrator (TPA) market refers to the industry that provides administrative services to insurance companies including claims processing, policy management, and risk management. TPAs act as intermediaries between insurers and policyholders that streamline operations and improving the efficiency. This market plays a crucial role in enhancing customer experiences and ensuring compliance with regulatory requirements while allowing insurers to focus on core business activities.

The market for insurance provider network spans various sectors including health insurance, property and casualty insurance, and workers' compensation, and others that reflects its diverse applications and growing importance in the insurance landscape. The rise of digitalization leads many TPAs to integrate advanced technologies such as artificial intelligence (AI) and data analytics tools to streamline processes, reduce costs, and enhance service delivery. This evolution positions the TPA market as a critical component of the insurance industry’s future that is fueled by the need for increased operational efficiency and adaptability in a competitive landscape.

Rising Healthcare Costs and Expanding Insurance Coverage Drive TPA Demand

Indonesia's national health insurance program (JKN) continues to expand coverage, bringing millions of citizens under formal healthcare schemes. At the same time, private healthcare costs are rising, increasing the financial burden on both public and private insurers. This dynamic creates a growing need for TPAs, which help insurers manage claim volumes, control administrative expenses, and streamline healthcare service delivery. TPAs offer scalable operations and specialized systems that enhance cost efficiency and accuracy in claims management.

Digital Transformation Enhances TPA Value Proposition

The Indonesian insurance industry is accelerating its digitalization efforts, adopting technologies like API-integrated claim processing, mobile-first customer service platforms, AI-based fraud detection, and cloud-based data storage. TPAs that provide tech-driven services — including real-time tracking, e-claims processing, and automated provider networks — are becoming preferred partners for insurers seeking to modernize and optimize workflows. These capabilities are critical in improving turnaround times, ensuring compliance, and enhancing customer satisfaction.

Aging Population and Chronic Illness Trends Increase Demand for TPA Services

Indonesia's demographic shift toward an aging population, combined with rising rates of chronic diseases like diabetes and hypertension, is fueling demand for long-term care and specialized insurance plans. TPAs are instrumental in supporting these segments by managing complex benefit structures, coordinating care with healthcare providers, and ensuring timely reimbursement. Their role is especially vital for insurers offering products tailored to the needs of senior citizens and high-risk individuals.

The Regulatory Challenges and Cybersecurity Threats Hinders the Market Growth

The evolving regulatory environment in Indonesia presents a challenge for TPAs, with increased compliance obligations related to licensing, data protection, and reporting. Managing these requirements adds cost and operational complexity. At the same time, the growing frequency of cybersecurity incidents raises concerns about data breaches, particularly given the sensitive nature of insurance information. These risks can reduce insurer confidence in outsourcing, limiting the pace of TPA adoption across the market.

Integration of AI Creates Future Growth Opportunity for the TPA Market

Artificial intelligence and automation present a significant opportunity for TPAs in Indonesia. These technologies can revolutionize claims management by enabling faster adjudication, fraud detection, and personalized customer experiences. TPAs that invest in AI-powered platforms can offer higher operational efficiency and greater accuracy, creating new value for insurers. As digital transformation continues across the insurance landscape, AI integration is poised to become a defining factor in the competitiveness and scalability of TPA services.

By Type, P&C Insurance the Predominating Share in the Indonesia Insurance TPA Industry

Property and casualty insurance holds the largest in Indonesia insurance TPA market share as it covers risks related with property damage and liability. TPAs play a key role in managing these types of insurance by handling claims processing, policy administration, and risk management. They streamline the claims process, oversee policy details, and ensure compliance that helps insurers and policyholders manage risks effectively. By providing expert administrative support TPAs enable efficient handling of property and casualty claims ensuring that both assets and liabilities are properly managed and protected.

By Claim Processing, Puskesmas is Projected to Witness the Highest CAGR Growth Until 2030

Puskesmas are community health centers in Indonesia that deliver essential primary healthcare services to local residents. They play a vital role in providing preventive care, managing common illnesses, and supporting community health initiatives.

In the insurance TPA market, TPAs are crucial for managing insurance policies for Puskesmas. They handle claims processing, policy administration, and risk management, ensuring efficient interactions between Puskesmas, insurers, and healthcare providers.

TPAs assist Puskesmas by addressing insurance needs such as liability coverage, employee benefits, and regulatory compliance. Their support helps Puskesmas concentrate on offering quality healthcare services, ensuring that community health centers operate effectively and continue to serve their local populations efficiently.

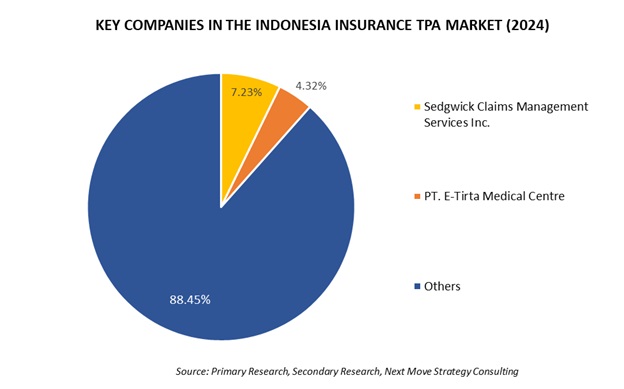

Competitive Landscape

The promising key players operating in the Indonesia Insurance TPA industry include Sedgwick (PT Sedgwick Indonesia), Crawford And Company, AP Companies Group (PT AP Companies), Fullerton Health Indonesia (PT Fullerton Health Indonesia), Charles Taylor (PT Charles Taylor Adjusting Indonesia), HealthMetrics Indonesia, AdMedika (PT Administrasi Medika), Global Excel (PT Prima Sarana Jasa), Mandiri Inhealth (with Lintasarta), Garda Medika (PT Asuransi Astra Buana), Meditap (PT Teknologi Pamadya Analitika), Manulife Indonesia, Persada Health Care (TPA Plus), Medilink-Global (PT Medilink Digital Medika), MSH International (PT MSH International Indonesia), and among others.

For updated market share, buy our latest report

These companies are engaged in various business expansion and partnership across various regions to maintain their dominance in the Indonesia insurance TPA market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

May-24 |

Sedgwick |

Sedgwick expanded its marine division in Indonesia for providing comprehensive risk benefits in areas such as cargo, hull, and marine liability claims management. |

|

Mar-24 |

Fullerton Health |

Fullerton Health expanded its presence in Indonesia by opening new clinics and increasing its service offerings. The company provides healthcare services through over 100 medical clinics, offering medical assistance, evacuation services, and third-party administration (TPA) of corporate health benefits. |

|

Mar-24 |

Pacific Cross |

Pacific Cross partnered with Qantev to deploy Qantev's AI-powered claims and fraud detection solutions across five countries including Indonesia. This collaboration empowers Pacific Cross with insights into claims processing and fraud detection, transforming the way Pacific Cross approaches claim management. |

|

Feb-24 |

Global Excel |

Global Excel Management partnered with Appian's Connected Claims solution to modernize its insurance claims processes. Through this partnership, the company aims to expedite claim settlements, reduce costs, and enhance the customer experience. |

|

Oct-23 |

Aon Plc |

Aon announced its plans to digitize and automate its reinsurance claims process by utilizing the Appian Platform. By leveraging Appian's AI Process Platform, Aon successfully automated its workflows, leading to improved operational efficiency and enhanced customer experiences. |

Indonesia Insurance TPA Market Key Segments

By Type

-

Health Insurance

-

Disease Insurance

-

Medical Insurance

-

Senior Citizens

-

Adults

-

Minors

-

-

-

Property and Casualty Insurance

-

Homeowners Insurance

-

Car Insurance

-

-

Workers' Compensation Insurance

-

Disability Insurance

-

Personal Accident Insurance

-

Death and Permanent Disability

-

Medical Expenses

-

-

Travel Insurance

-

Medical Coverage

-

Trip Cancellation

-

Baggage and Personal Belongings

-

Accidental Death and Dismemberment (AD&D)

-

-

Cyber insurance

-

Gadgets and Personal Belongings Insurance

-

Mobile Phone

-

Laptop

-

-

Others

By Services

-

Claims Management

-

Risk Control Management

By End-User

-

Healthcare

-

Construction

-

Real Estate and Hospitality

-

Transportation

-

Staffing

-

Banking

-

Travel and Tourism

-

Telecommunication

-

Other End-User

Key Players

-

Sedgwick (PT Sedgwick Indonesia)

-

Crawford and Company

-

AP Companies Group (PT AP Companies)

-

Fullerton Health Indonesia (PT Fullerton Health Indonesia)

-

Charles Taylor (PT Charles Taylor Adjusting Indonesia)

-

HealthMetrics Indonesia

-

AdMedika (PT Administrasi Medika)

-

Global Excel (PT Prima Sarana Jasa)

-

Mandiri Inhealth (with Lintasarta)

-

Garda Medika (PT Asuransi Astra Buana)

-

Meditap (PT Teknologi Pamadya Analitika)

-

Manulife Indonesia

-

Persada Health Care (TPA Plus)

-

Medilink-Global (PT Medilink Digital Medika)

-

MSH International (PT MSH International Indonesia)

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size Value in 2024 |

USD 1.66 Billion |

|

Revenue Forecast in 2030 |

USD 5.32 Billion |

|

Value Growth Rate |

CAGR of 20.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst