U.S. Health Insurance TPA Market by Insurance Type (Group Health Insurance, Individual Health Insurance, and Others), by Service Type (Claims Processing, Cashless Services, Pre-Authorization, Customer Support, and Hospital Network Management), by Deployment Model (In-House TPAs and Outsourced TPAs), by Sales Channel (Direct Selling, Agents, and Broker) – Global Opportunity Analysis and Industry Forecast, 2025- 2030

Industry: BFSI | Publish Date: 06-Oct-2025 | No of Pages: 80 | No. of Tables: 115 | No. of Figures: 60 | Format: PDF | Report Code : BF3095

U.S. Health Insurance TPA Market Overview

The U.S. Health Insurance TPA Market size was valued USD 100.55 billion in 2024, and it is projected to reach USD 129.08 billion by 2030, with a CAGR of 3.9% from 2025-2030.

The health insurance TPA market is driven by the factors such as surge in health insurance premiums, strategic partnerships between TPA providers and self-funded employers, and rising healthcare expenditure. However, regulatory complexity and compliance burden hinders the expansion of the market. Conversely the increasing demand for faster claim processing and cost optimization is accelerating the digital transformation in the health insurance TPA market and this act as a significant opportunity for the market in upcoming years. The key players of the market such as United HealthCare Services Inc and Meritain Health are adopting various developmental strategies to maintain their dominance in the market.

Surge in Health Insurance Premiums Drives Demand for Third Party Administrators

Rising health insurance premiums in the country, driven by factors such as increased healthcare costs and disease prevalence, are fueling the growth of the health insurance TPA (Third-Party Administrator) market as insurers seek efficient claims processing and cost management solutions. As per the latest report published by the National Association of Insurance Commissioners, U.S. Health Insurance net earned premium reached 1,087,176 million in 2023, rising at a rate of 7.9% from 2022. Such rise in the health insurance premiums, is propelling the growth of the TPA market by increasing the demand for efficient claims management and cost control.

Rising Healthcare Expenditure Fuels, the Growth of the Market

The increasing healthcare expenditure in U.S. is driving the growth of the insurance TPA market. As more individuals and businesses invest in health insurance to cover rising medical costs it surges the demand for efficient and reliable TPA services. According to the latest report by the U.S. Centers for Medicare & Medicaid Services, Health care spending in the US reached USD 4.9 trillion and increased 7.5 percent in 2023, growing from a rate of 4.6 percent in 2022. In 2023, the insured share of the population reached 92.5 percent, as enrolment in private health insurance increased at a strong rate for the second year in a row, and both private health insurance and Medicare spending grew faster than in 2022. This trend is prompting TPAs to enhance their offerings and expand their networks that ultimately fosters a more competitive and robust insurance market.

Strategic Partnerships Fueling the Growth of TPA Solutions for Self-funded Employers in the U.S.

The rising demand for customized health plans and efficient claims management is driving strategic partnerships in the health insurance TPA market in U.S. As businesses increasingly opt for self-funded insurance model, insurers and TPAs are collaborating to enhance service delivery, reduce administrative cost and provide more flexible healthcare solutions. For example, Priority Health a U.S. based company partnered with Healthcare Management Administrators (HMA) to launch a TPA solution for self-funded employer. This collaboration enables businesses to gain control over their healthcare plans whole ensuring cost effective and high-quality service delivery. Such strategic alliances highlight a growing industry trend where insurers and TPAs collaborates to create innovative, employer focused healthcare solutions, ultimately fuelling the growth of the TPA market.

Regulatory Complexity and Compliance Burden Hinders the Expansion of the U.S. Health Insurance TPA Market

The expansion of the health insurance TPA market in the U.S. is significantly hindered by complex regulatory requirements at both federal and state level. TPAs must comply with strict laws such as HIPAA, that mandates robust data privacy measures, ACA that imposes coverage and reporting regulations, and others. Additionally, varying state-specific regulations add another level of complexity, requiring TPAs to navigate multiple legal frameworks. These challenges create significant operational burdens, increasing costs, and discouraging new entrants, ultimately restraining the expansion of the market.

Digital Transformation Creates Ample Opportunities for the Market in Upcoming Years

The increasing demand for efficiency, faster claim processing, and cost optimization is accelerating the digital transformation in the health insurance TPA market and this act as a significant opportunity for the market in upcoming years. As insurers and employers demand faster claims processing, cost optimization, and enhanced service delivery, TPAs can leverage digital technologies to revolutionize their operations. The integration of AI-driven automation, cloud computing, and blockchain is helping TPAs streamline claims administration, detect fraud, and ensure compliance with complex healthcare regulations.

By Service Type Claims Processing Holds the Dominating Share of the Market

The claim processing segment involves the end-to-end management of insurance claims including submission along with verification and reimbursement. Insurers validate policyholder eligibility and treatment authenticity before processing payments either as reimbursements to policyholders or direct settlements with healthcare providers. The growing adoption of automation and artificial intelligence driven solutions is enhancing accuracy and reducing processing time while regulatory compliance ensures transparency. Many insurers leverage third party Administrators to streamline claim handling along with improving efficiency and customer experience in an increasingly digitalized healthcare landscape.

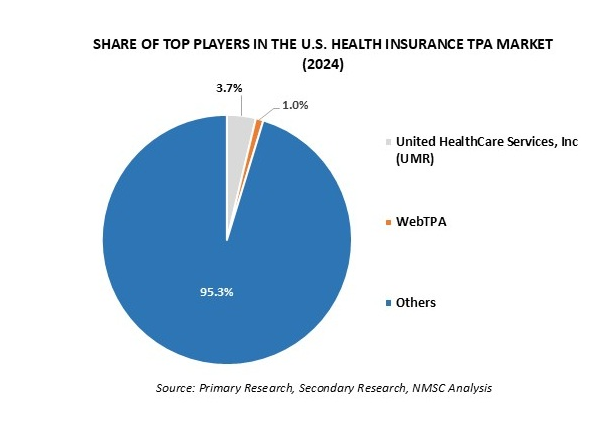

Competitive Landscape

The U.S. health insurance TPA industry comprises various market players such as WebTPA, Personify Health, Allied Benefit Systems, LLC, Meritain Health, Lucent Health, United HealthCare Services, Inc (UMR), HealthEZ, PointC, Flores And Associates, LLC, Health Plans Inc, S And S Health, Access Health Services, FirstEnroll, Luminare Health, Imagine360, and others.

These market players are adopting various strategies including partnership, product launch and acquisition to maintain their dominance in the U.S. health insurance TPA market.

|

DATE |

COMPANY |

RECENT DEVELOPMENTS |

|

November 2024 |

PointC |

Point C partnered with a Chicago based company Shore Capital Partners to address rising healthcare costs by promoting self-funding and TPA services. |

|

October 2024 |

Personify Health |

Personify Health launched a comprehensive care navigation and advocacy solution that combines human expertise with AI-driven technology to enhance health outcomes and reduce expenses by guiding members to suitable care option and providing support in understanding treatment plans and medical claims. |

|

July 2023 |

Allied Benefit Systems, LLC |

Allied Benefit Systems, LLC a healthcare administrator for employee benefit plans, acquired Medxoom Inc. a digital benefit platform. This acquisition aims to integrate Medxoom’s technology to enhance Allied’s member experience and reduce employer risk. |

The U.S. Health Insurance TPA Market Key Segmentation

By Insurance Type

-

Group Health Insurance

-

Individual Health Insurance

-

Others

By Service Type

-

Claims Processing

-

Cashless Services

-

Pre-Authorization

-

Customer Support

-

Hospital Network Management

By Deployment Model

-

In-House TPAs

-

Outsourced TPAs

By Sales Channel

-

Direct Selling

-

Agents

-

Broker

By Enterprise Size

-

Small and Medium Size Enterprise (SME)

-

Large Enterprise

By End-Users

-

Insurance Companies

-

Hospitals & Healthcare Providers

-

Corporate sector

-

Others

Key Players

-

WebTPA

-

Personify Health

-

Allied Benefit Systems, LLC

-

Meritain Health

-

Lucent Health

-

United HealthCare Services, Inc (UMR)

-

HealthEZ

-

PointC

-

Flores And Associates, LLC

-

Health Plans Inc

-

S And S Health

-

Access Health Services

-

FirstEnroll

-

Luminare Health

-

Imagine360

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2024 |

USD 100.55 Billion |

|

Revenue Forecast in 2030 |

USD 129.08 Billion |

|

Growth Rate |

CAGR of 3.9% from 2024 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst