Artificial Intelligence as a Service Driving Industry Growth

Published: 2025-09-10

Artificial Intelligence as a Service (AIaaS) is no longer a futuristic concept. Today, it is a practical and scalable solution powering real-time decision-making, customer engagement, and cost optimization. From utilities to agriculture, independent pharmacies to financial services, AIaaS is becoming central to business operations.

Virtual AI Agents: The Future of Customer Service

Nedgia, the gas distributor under the Naturgy Group, has revamped its customer service model through a major digital transformation project driven by generative artificial intelligence. Designed and implemented by IBM (NYSE: IBM) Consulting, the initiative introduced an advanced contact center supported by virtual AI agents.

This state-of-the-art generative AI solution enhances customer service by integrating intelligent virtual agents across both phone and digital channels. It enables the company to replicate and scale automation use cases, allowing AI agents to effectively handle the majority of customer interactions.

Summary:

-

Nedgia, with IBM Consulting, implemented generative AI-powered virtual agents to modernize its customer service across phone and digital channels.

-

The solution enables scalable automation, allowing AI agents to resolve most customer interactions efficiently.

AI Agents Take Over Calls with High Satisfaction Rates

Artificial intelligence is no longer just a tool for supporting call center employees—it is now leading customer conversations. AI agents are handling both inbound and outbound calls with minimal human intervention, delivering high satisfaction levels across interactions. While originally implemented as cost-saving measures, these AI systems, when executed effectively, result in improved customer satisfaction and stronger sales outcomes.

Regal is one such company at the forefront of this shift. CEO Alex Levin highlighted a key advancement—the “I don’t know” breakthrough—which allows their AI agents to manage calls independently. Although human support is available when needed, most customers are content with their issues being resolved, regardless of whether the agent is human or artificial.

Summary:

-

AI agents are now independently handling inbound and outbound customer calls, leading to high satisfaction and improved sales, beyond just cost savings.

-

Regal’s “I don’t know” breakthrough enables AI to manage calls autonomously, with most customers accepting AI-led resolutions over human intervention.

Wipro and Cropin Partner to Advance AI-Driven Agriculture and Supply Chains

Wipro has partnered with Cropin to integrate its technology services with Cropin’s specialized agricultural AI platform. The collaboration aims to tackle persistent challenges in agriculture, such as lack of transparency, fragmented data systems, and the growing impact of unstable weather, shifting markets, and global disruptions.

By leveraging artificial intelligence and digital technologies, the partnership will enable deeper farm-level insights, enhance decision-making, and promote sustainable agricultural practices. The AI tools developed through this initiative will also benefit adjacent sectors like quick-service restaurants, food distribution, and packaged goods—industries that depend on reliable, efficient, and traceable supply chains.

Summary:

-

Wipro and Cropin are combining AI and digital tools to address agricultural challenges like fragmented data and climate unpredictability.

-

The partnership aims to enhance farm-level decision-making and also improve supply chain efficiency in related industries such as food services and packaged goods.

Independent Pharmacies Embrace AI to Boost Efficiency and Patient Experience

At McKesson ideaShare 2025, pharmacy owners Raj Chhadua, PharmD, of ReNue Apothecary in Texas, and Marc Ost, CPhT, co-owner of Eric’s Rx Shoppe in Pennsylvania, emphasized that artificial intelligence (AI) is no longer a concept of the future. It is a practical, present-day solution that is helping independent pharmacies address staffing shortages, ease administrative workloads, and enhance overall operational efficiency.

An AI system now manages around 60% of prescription volume at the pharmacy. Recently, Raj Chhadua has also started using AI to improve patient experience through their interactive voice response (IVR) system. This goes beyond standard phone menus, offering chatbot-style conversations that let patients confirm refills or get alerts when other prescriptions are ready.

Chhadua noted that adopting these tools took time and effort, but the system keeps getting better. When choosing vendors, he looks for those with strong pharmacy expertise, the ability to cut down 60% to 80% of administrative or nonjudgmental tasks, and support for common challenges like handling prior authorizations.

Summary:

-

Independent pharmacies like ReNue Apothecary are using AI to manage 60% of prescription volume and enhance patient interactions through advanced IVR systems.

-

Raj Chhadua emphasizes the importance of selecting AI vendors with pharmacy expertise who can reduce 60%–80% of administrative tasks and assist with prior authorizations.

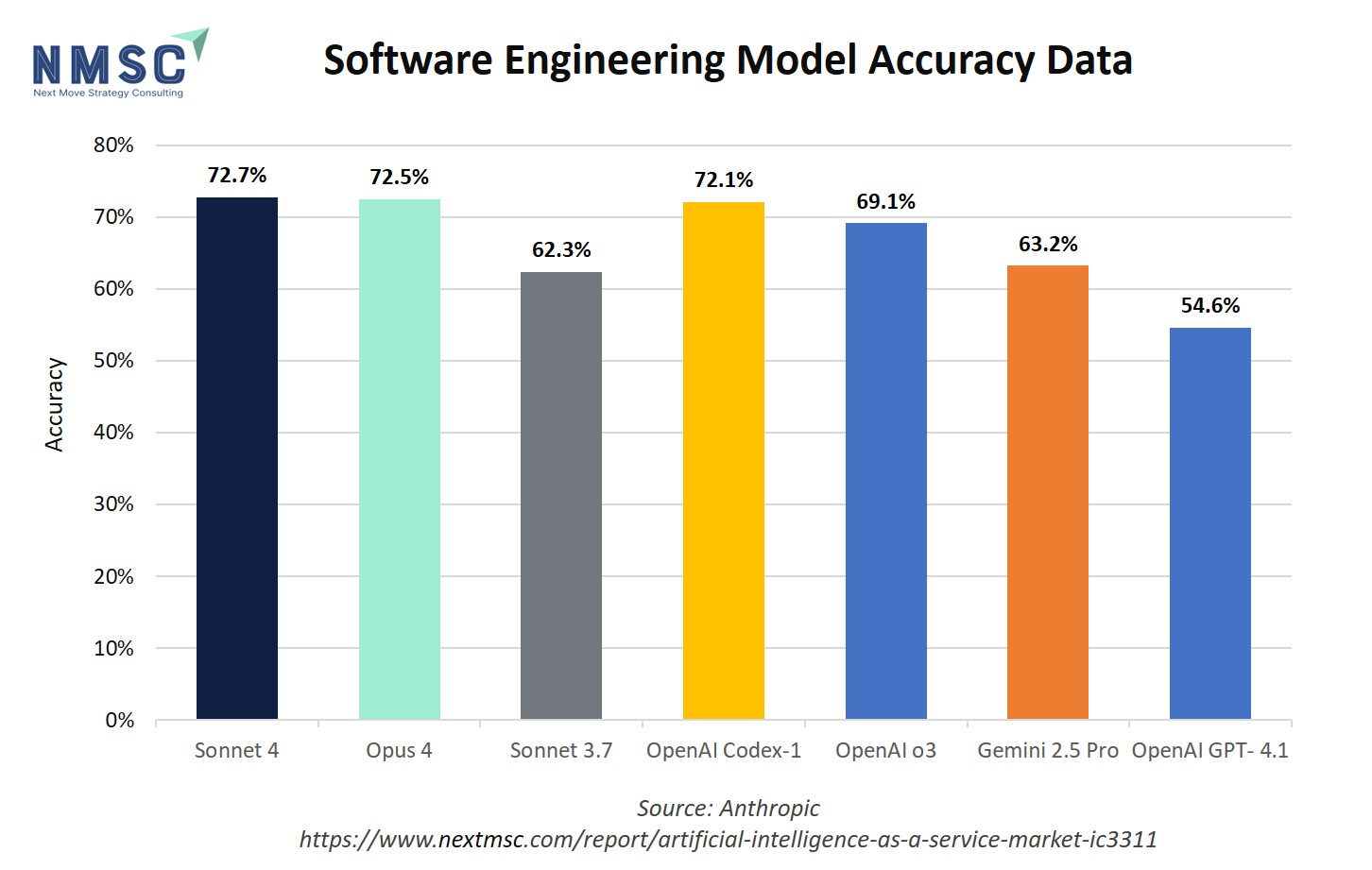

Software Engineering Model Accuracy (SWE-bench Verified):

Implementing AI in financial solutions

The implementation of AI in financial inclusion initiatives is making a significant difference in Latin America and the Caribbean. AI is being used to develop innovative solutions that address traditional barriers to financial access, allowing more people and small businesses to participate in the formal financial system. Among its main applications are:

-

Alternative credit assessment: Use of unconventional data, such as purchase behavior and utility payment history, to algorithmically assess the ability to pay of those without a formal credit history.

-

Digital payments: AI-powered platforms that offer fast and secure transactions, reducing reliance on cash.

-

Inclusive financial products: Design of personalized and accessible financial products that assess user preferences and needs more accurately and process claims quickly and efficiently.

-

Automated financial advice: Chatbots and virtual assistants that provide personalized and accessible financial guidance.

-

Financial education: Interactive tools that teach financial management, savings and investment, among other things.

-

Fraud prevention: Real-time analysis of the security of financial transactions through fraud detection and prevention, protecting users and increasing trust in digital financial services.

-

Risk management: Use of predictive analytics to identify user behavior patterns and mitigate risks more effectively.

-

GovTech Solutions: Optimizing government-citizen interaction with chatbots, sentiment analysis and other tools, improving consumer protection and financial transparency.

-

RegTech Solutions: Improving regulatory compliance of financial institutions through the use of natural language processing, data analytics and machine learning, strengthening fraud detection and resource optimization.

-

SupTech Solutions: Supporting financial supervisors and regulators with big data, machine learning and blockchain to monitor, analyze and assess financial system performance and risks more effectively.

Conclusion

Artificial Intelligence as a Service (AIaaS) is driving a major transformation across industries by making advanced technologies accessible, scalable, and practical. From agriculture to finance and healthcare, AIaaS empowers organizations to automate operations, enhance customer engagement, and make smarter decisions. As adoption grows, the focus must remain on strategic alignment, ethical implementation, and continuous improvement—turning AI into a true engine of innovation and efficiency.

About the Author

Karabi Sonowal is an experienced SEO Executive and Content Writer in digital marketing. She excels in SEO, content creation, and data-driven strategies that boost online visibility and engagement. Known for simplifying complex concepts, Karabi creates impactful content aligned with industry trends.

Karabi Sonowal is an experienced SEO Executive and Content Writer in digital marketing. She excels in SEO, content creation, and data-driven strategies that boost online visibility and engagement. Known for simplifying complex concepts, Karabi creates impactful content aligned with industry trends.

About the Reviewer

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Add Comment