How Leading Companies Are Powering the $270M Boom in Brazil’s Intralogistics Market

Published: 2025-09-10

According to NMSC analysis, the Brazil Intralogistics Software Industry is poised to sustain its robust growth momentum, projected to reach approximately USD 270.35 million by 2030—representing a remarkable 2X expansion from 2025 to 2030. The market, valued at USD 123.56 million in 2024, is projected to grow to USD 147.53 million by 2025, driven by accelerating demand and innovation.

With a strong CAGR of 12.9% during this period, the sector's growth is being fueled by rapid advancements in automation technologies, increased adoption of AI-driven warehouse and supply chain management systems, and a growing emphasis on operational efficiency and real-time logistics visibility. These factors are reshaping Brazil’s intralogistics landscape, creating new opportunities across key sectors such as e-commerce, retail, manufacturing, and transportation.

Brazil Intralogistics Software Market Overview

The Brazil intralogistics software market trends is undergoing rapid transformation as companies increasingly adopt digital solutions to streamline warehouse and supply chain operations. With the rise of e-commerce, growing consumer expectations, and the need for greater inventory accuracy, businesses are turning to advanced intralogistics platforms to enhance efficiency, visibility, and automation across their logistics networks.

Driven by Industry 4.0 trends, Brazilian enterprises are integrating technologies such as AI, IoT, real-time tracking, and warehouse management systems into their logistics infrastructure. This digital shift is helping companies reduce operational costs, minimize errors, and respond faster to market demands, positioning the intralogistics software sector as a critical enabler of smart supply chains.

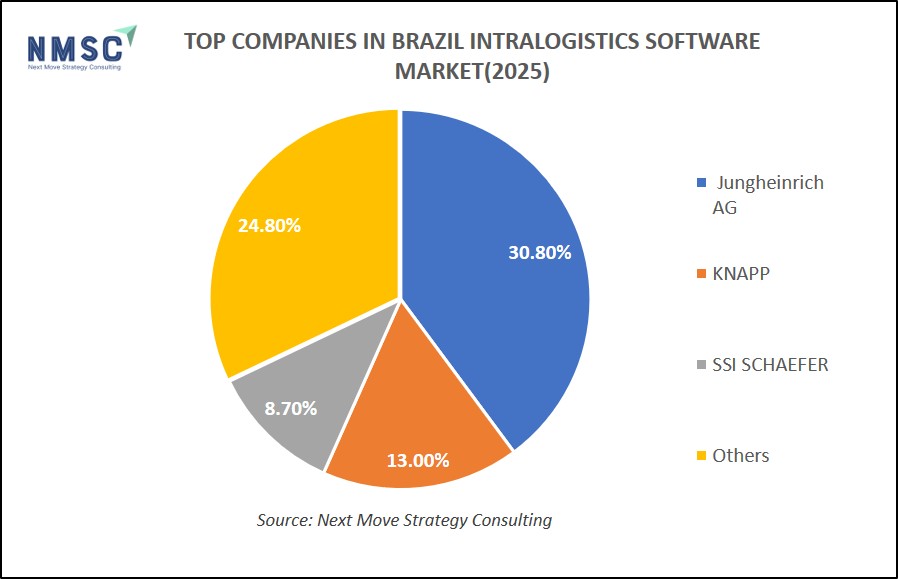

Several major companies operating in the Brazil intralogistics software market, includes Dematic (Part of KION Group), Vanderlande, KNAPP, SSI SCHAEFER, Honeywell, ULMA Handling Systems, Jungheinrich AG, Manhattan Associates, AutoStore, Generix Group among others. These industry leaders are at the forefront of innovation, automation, and digital transformation, playing a pivotal role in advancing Brazil’s intralogistics capabilities.

Through continued investments in research and development, these companies are driving smarter, more efficient logistics operations and are well-positioned to meet the rising demand for agile, sustainable, and tech-driven supply chain solutions across the countries.

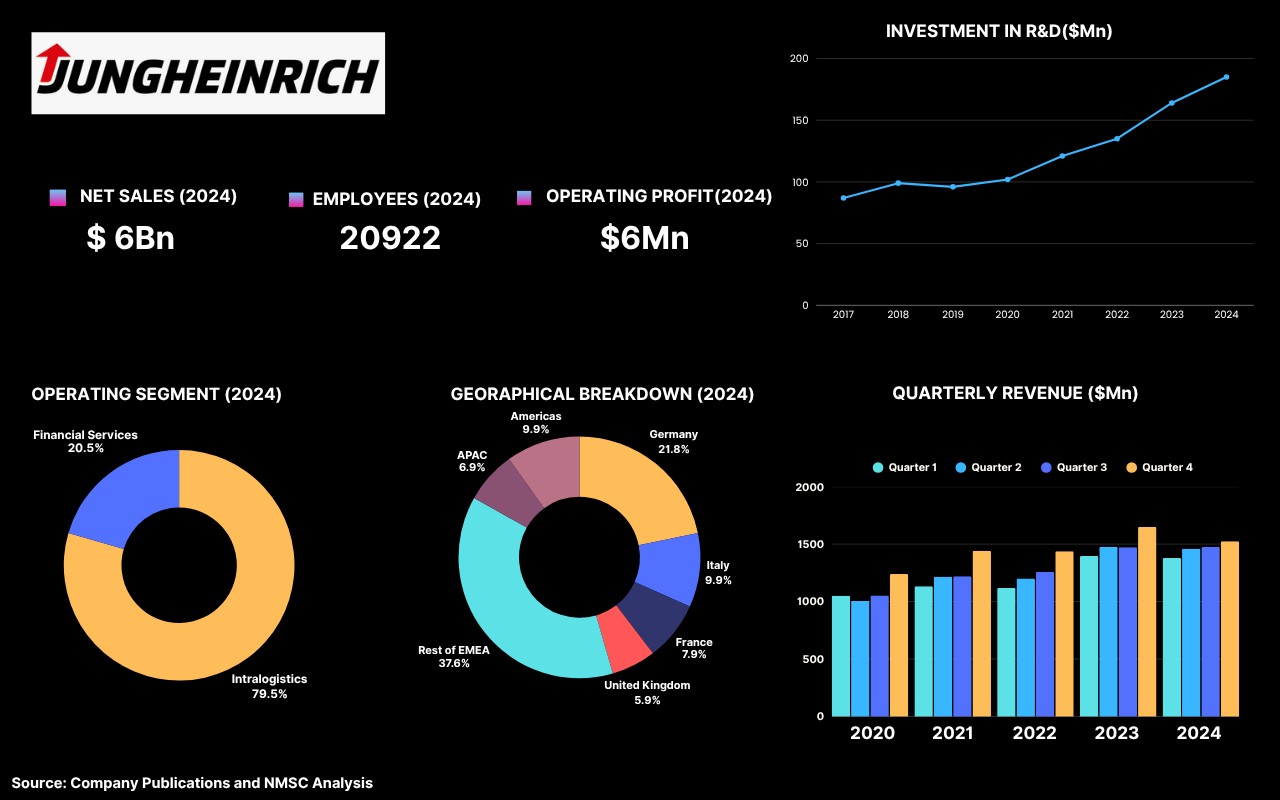

Highlights Of Jungheinrich AG

Jungheinrich, headquartered in Hamburg, Germany is a global leader in material handling equipment, warehouse technology, and intralogistics solutions. The company has been expanding its presence in the Latin American market, including Brazil, where it provides advanced intralogistics software solutions to optimize warehouse and supply chain operations. These solutions include warehouse management systems and automation technologies tailored to the region's growing e-commerce and industrial sectors.

Jungheinrich AG holds a leading position in Brazil’s intralogistics software market by delivering integrated digital solutions that drive operational efficiency and recurring revenue. Its offerings, including telematics-enabled fleet management, IoT-ready Logistics Interface, and automation platforms like PowerCube and arculee AMRs, help Brazilian warehouses optimize performance and reduce downtime. Recent product launches, such as the ETV 3i reach truck and SLH 700i smart charger, further enhance system connectivity and energy management. These innovations strengthen Jungheinrich’s footprint in Brazil by enabling scalable automation and fueling software-driven revenue across logistics hubs.

Highlights Of KNAPP

KNAPP is recognized as the leading provider of intralogistics software in Brazil; commanding market share due to its advanced Warehouse Management System (KiSoft) and AI-enabled control systems for automated storage and transport. Their solutions, such as OSR Shuttle Evo, autonomous mobile robots (Open Shuttle), and intelligent pocket sortation like AutoPocket are enabling Brazilian warehouse operators across e‑commerce, retail, healthcare, and manufacturing to increase throughput, reduce labor costs, and minimize errors. By integrating robotics, software, and data analytics, KNAPP helps Brazilian companies optimize inventory flow, improve order accuracy, and lower operational expenses, directly contributing to higher ROI and recurring software and service revenue streams.

In 2024–2025 KNAPP rolled out key new intralogistics offerings that are particularly relevant to Brazilian operations, including the AI-enhanced KiSoft Vision augmented reality picking technology—part of their zero defect strategy and their “Mission: Zero Touch” ecosystem combining Pick it Easy Robot with AutoPocket and KiSoft FCS fleet control. These advances provide Brazilian clients direct access to the latest software innovation driving further market dominance.

Highlights Of SSI SCHAEFER

SSI SCHAEFER is a prominent intralogistics provider in Brazil, recognized for its modular and scalable software platforms, particularly the WAMAS Warehouse Management System and its integration with intelligent automation solutions. The company maintains a strong foothold in the Brazilian market by delivering turnkey systems that include high-bay storage, shuttle systems, AGVs, and robotics.

Industries such as retail, food & beverage, pharma, and 3PL rely on SSI SCHAEFER’s solutions to enhance picking efficiency, reduce space consumption, and ensure seamless system integration across warehouse operations. Through tight integration of software and mechatronics, the company enables Brazilian clients to accelerate order fulfilment, improve storage density, and optimize energy usage—driving measurable performance and cost advantages.

In 2024–2025, SSI SCHAEFER launched several innovative solutions tailored to the demands of Brazilian warehouses. Among the most significant is the WAMAS Case Picking Module, leveraging AI-based sequencing algorithms and digital twin simulation to fully automate case order processing—ideal for large-volume retail distribution centres in Brazil. The company also introduced its WEASEL Lite AGV line, a lower-cost, rapidly deployable transport solution for smaller facilities and e-commerce micro-fulfilment centres.

Additionally, the enhanced WAMAS LRM (Logistics Resource Management) tool is now being promoted to Brazilian customers, providing real-time workforce analytics, predictive maintenance, and dynamic resource allocation. These rollouts position SSI SCHAEFER as a key technology partner in Brazil's evolving logistics ecosystem, especially as local players seek to digitize and scale operations post-pandemic.

By combining flexible software architecture with vertical integration of robotics and automation, SSI SCHAEFER supports Brazilian firms in meeting rising customer expectations, reducing downtime, and increasing warehouse responsiveness. This contributes to stronger ROI, long-term service agreements, and increased software-led revenue—solidifying SSI SCHAEFER’s role in shaping Brazil’s modern intralogistics infrastructure

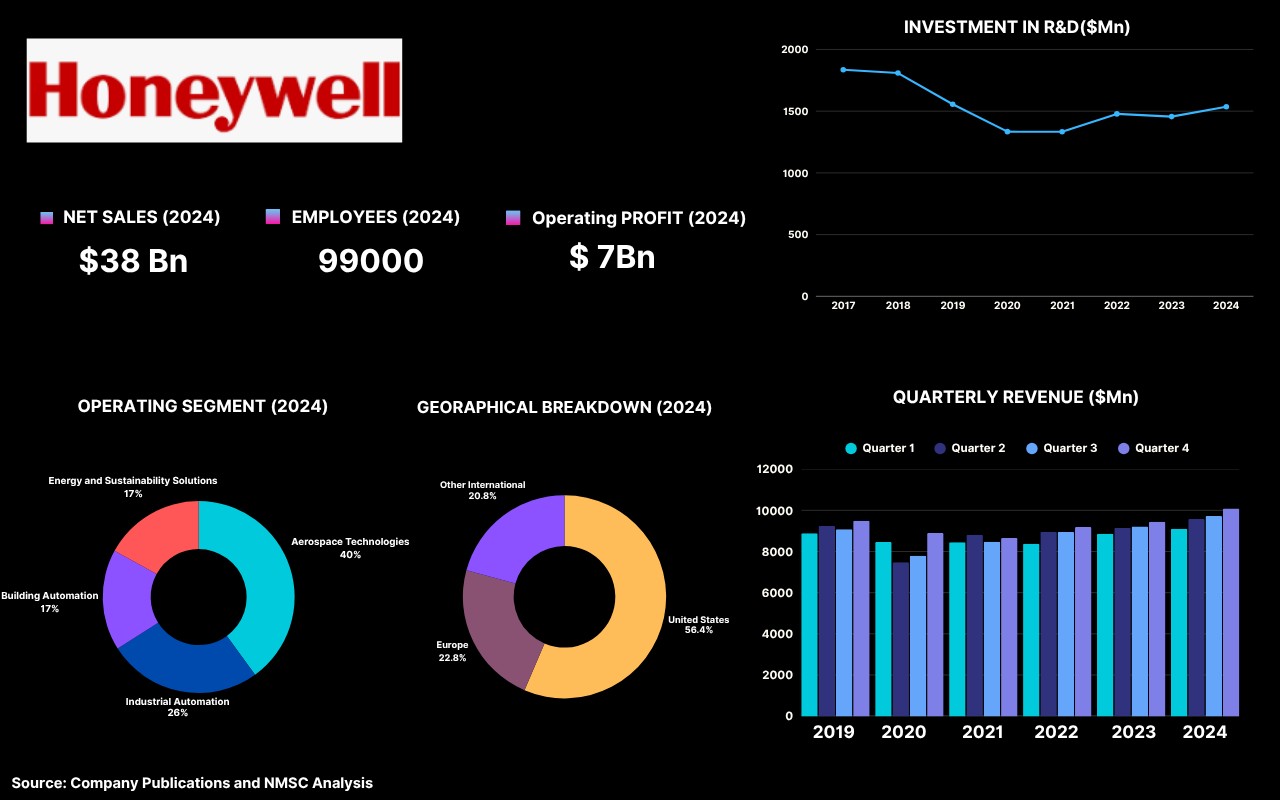

Highlights Of Honeywell

Honeywell International Inc. is a multinational conglomerate headquartered in Charlotte, North Carolina, specializing in aerospace, building technologies, performance materials, and safety solutions. Its business role extends to advanced software solutions, including intralogistics software, which optimizes warehouse and supply chain operations.

In Brazil, Honeywell has been expanding its presence in intralogistics through its Honeywell Intelligrated division, offering automated material handling and software solutions tailored to the region's growing e-commerce and industrial sectors. But Honeywell continues to innovate, with potential updates expected given its ongoing R&D efforts. Recent industry trends suggest Honeywell might be exploring AI-driven logistics solutions, aligning with its technological expertise.

Recently, Honeywell launched the SmartFlexible Depalletizer and expanded its AMR and AS/RS offerings in Brazil. The SmartFlexible Depalletizer, showcased on Honeywell’s Brazil robotics page, integrates AI-driven ML to unload mixed pallets at high speed (~650 cartons/hour), freeing labor and improving throughput. Honeywell’s Smart Flexible Depalletizer automates the unloading of mixed-SKU pallets using AI and machine vision, handling up to 650 cartons per hour.

Integrated with Honeywell’s Momentum WES, it enhances warehouse automation by optimizing material flow and reducing manual labor. In Brazil’s intralogistics software market, it boosts operational efficiency, lowers costs, and supports scalable automation which is critical for high-volume logistics and e-commerce fulfilment.

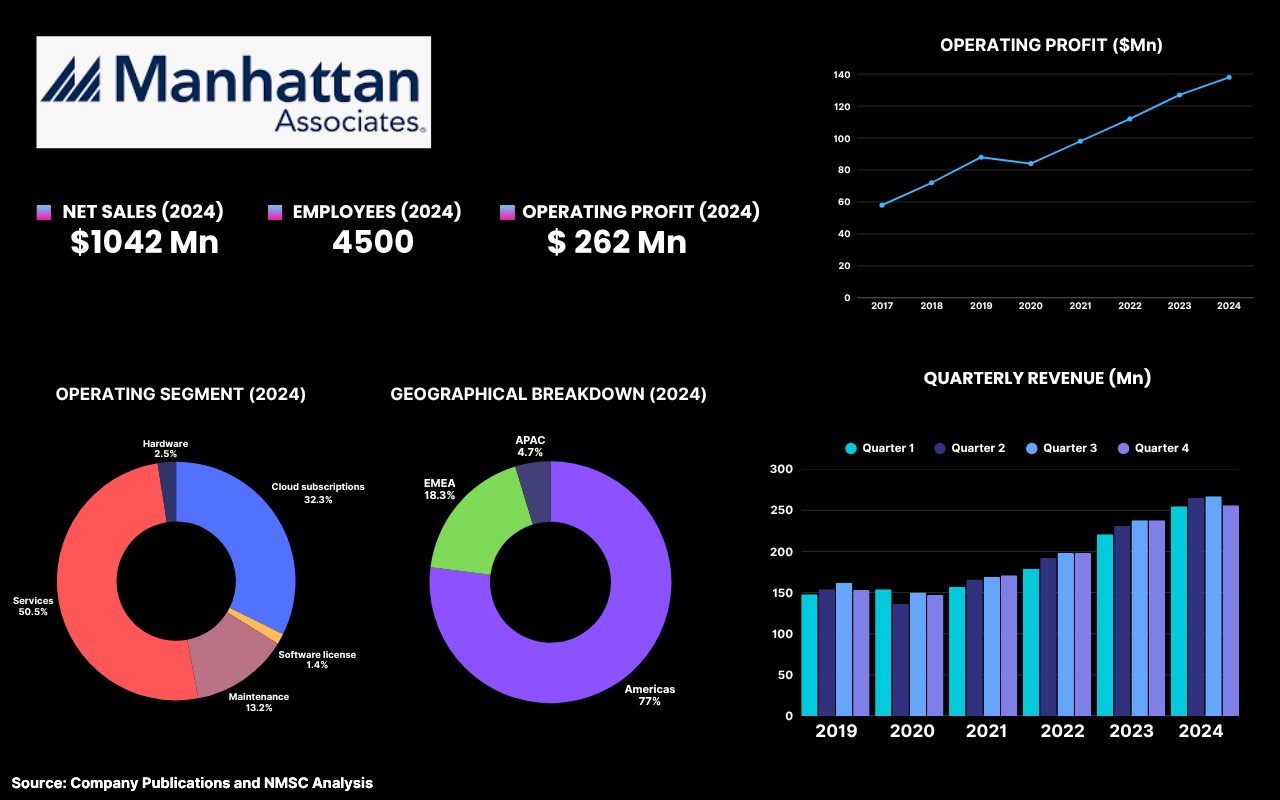

Highlights Of Manhattan Associates

Manhattan Associates is a global leader in supply chain and omnichannel commerce software, specializing in warehouse management systems (WMS), transportation management, and inventory optimization solutions. Its cloud-based platforms, like Manhattan Active, enhance intralogistics efficiency, making it relevant to Brazil’s growing e-commerce and industrial sectors, where demand for automated logistics solutions is rising.

In Brazil, the company likely supports intralogistics through WMS tailored for complex supply chains, addressing the country’s need for real-time inventory tracking and order fulfilment amid urban expansion. Recent developments include the launch of Manhattan Active Transportation in 2024, expanding its intralogistics offerings. The broader market saw a collaboration between DHL and Dematic in 2024 for automated systems, suggesting potential similar partnerships for Manhattan Associates to strengthen its Brazil presence.

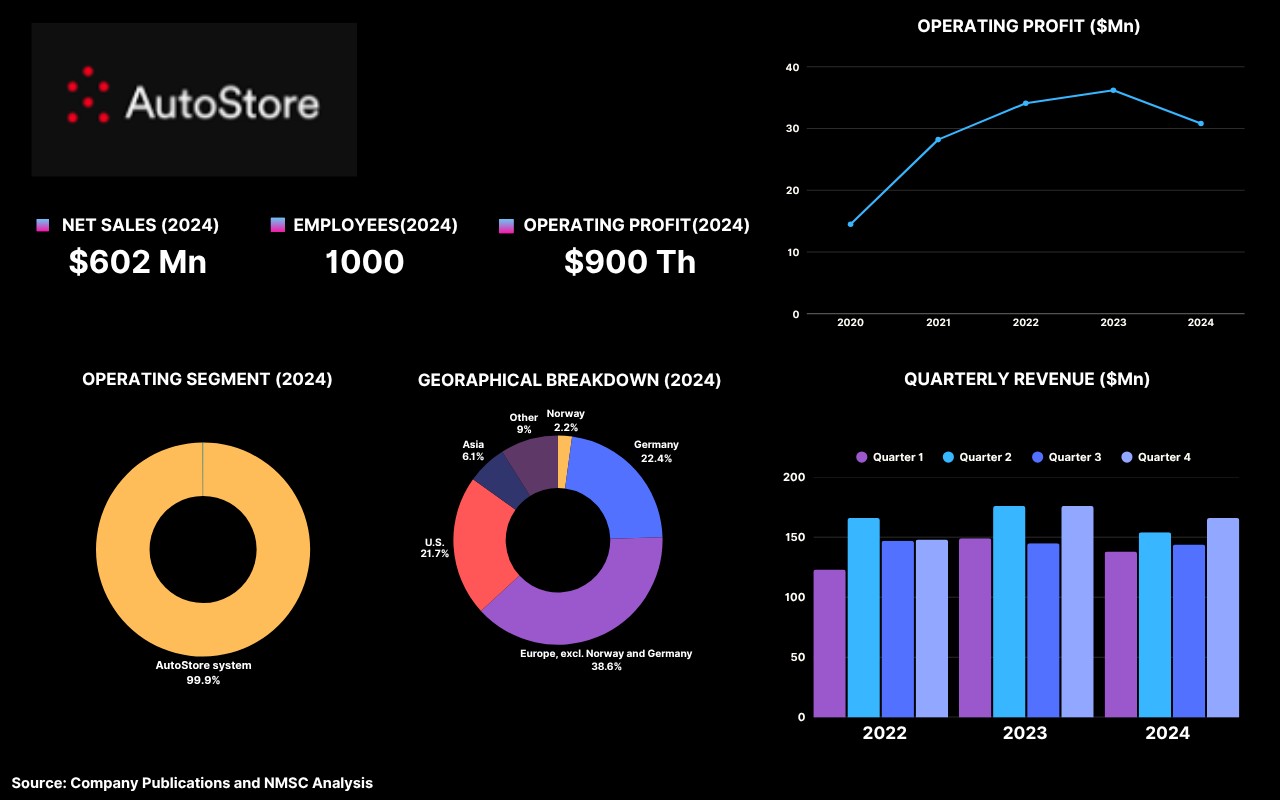

Highlights Of Autostore

AutoStore is a global leader in automated storage and retrieval systems, providing innovative intralogistics solutions through its robotic warehouse technology. The company, headquartered in Norway, designs and delivers compact, efficient systems that optimize warehouse space and improve order fulfilment speeds, serving industries like e-commerce, retail, and manufacturing.

Regarding Brazil, AutoStore has been expanding its footprint in Latin America, where intralogistics software solutions are increasingly vital due to the region's growing e-commerce sector. AutoStore's technology aligns with the demand for advanced warehouse automation in Brazil, potentially positioning it for collaborations with local logistics firms or software providers to enhance intralogistics efficiency.

AutoStore leads the intralogistics software market in Brazil by combining its high-density cube-based AS/RS hardware with powerful orchestration software such as Router, Unify Analytics, and Qubit platforms—enabling local partners and integrators to deploy fast, scalable, and data driven fulfillment systems (e.g., the Dafiti warehouse handling 4,800 items/hour). These integrated solutions help Brazilian clients generate revenue by significantly reducing order cycle times, cutting labor costs, and improving SKU visibility, leading to faster delivery and better margins.

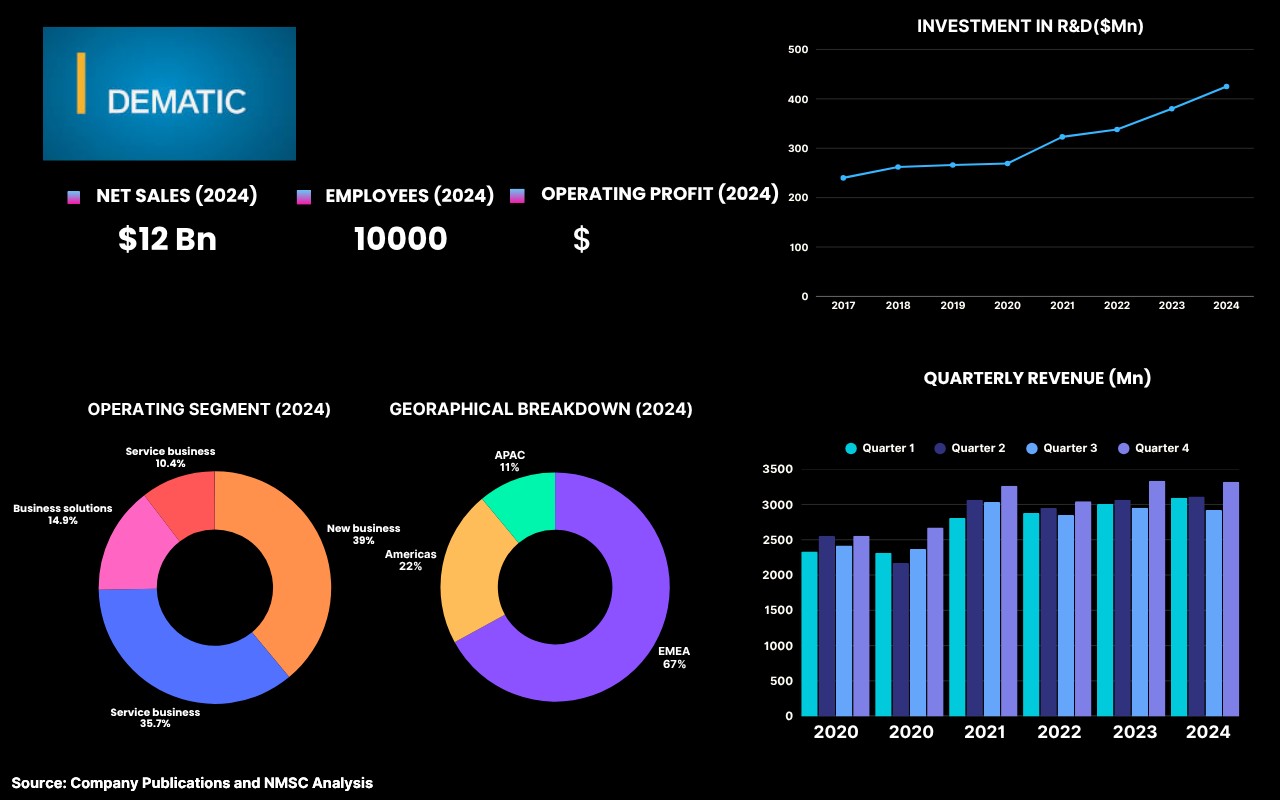

Highlights Of Dematic

Dematic, a subsidiary of the KION Group, holds a leading position in Brazil’s intralogistics software market by delivering a comprehensive automation ecosystem that includes warehouse management systems (WMS), material flow control, AS/RS, conveyors, AMRs, sortation systems, and digital twin technologies.

These integrated solutions enable faster throughput, labor efficiency, and real-time operational visibility—key factors driving revenue growth for Brazilian e-commerce and manufacturing sectors. Dematic’s offerings also include predictive maintenance, energy-efficient retrofits, and drone-enabled visual inspections, helping operators reduce downtime and operational costs.

In early 2025, Dematic introduced a Visual Remote Inspection Service, which utilizes drones and digital twins to perform fast, cost-effective equipment assessments, enhancing maintenance workflows and system uptime. These innovations strengthen Dematic’s role as a vital partner for digital transformation in Brazil’s evolving intralogistics landscape.

Summary Of Brazil Intralogistics Software Market

The Brazil intralogistics software landscape is experiencing rapid expansion, closely tied to the booming warehouse automation sector and surging logistics robot adoption. As software solutions, such as warehouse management systems (WMS) and transportation management systems (TMS) emerge as the fastest-growing segment within automation, Brazilian businesses are increasingly leveraging digital platforms to enhance efficiency, visibility, and real-time control across their supply chains.

Local and global vendors are responding by investing in AI, IoT, robotics integration, and scalable cloud-based architectures. These innovations are supporting various industries, including e-commerce, retail, manufacturing, and third-party logistics, helping companies streamline inventory, order fulfilment, and internal logistics operations. This evolution is fostering a digitally integrated intralogistics environment that is essential for boosting operational agility and long-term competitiveness in Brazil.

About the Author

Mayurima Roy is a seasoned researcher with over two years of experience, specializing in various industry verticals such as Pet apparels, recycling market, and consumer electronics. With a strong passion for writing, she views blogging as a valuable platform to share her industry insights and expertise. Outside of tracking market trends and developments, Mayurima enjoys crafting, cooking, and exploring her creativity through photography.

Mayurima Roy is a seasoned researcher with over two years of experience, specializing in various industry verticals such as Pet apparels, recycling market, and consumer electronics. With a strong passion for writing, she views blogging as a valuable platform to share her industry insights and expertise. Outside of tracking market trends and developments, Mayurima enjoys crafting, cooking, and exploring her creativity through photography.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment