How The Global Real Estate Market Is Shaping the Future of Urban Living

Published: 2025-11-26

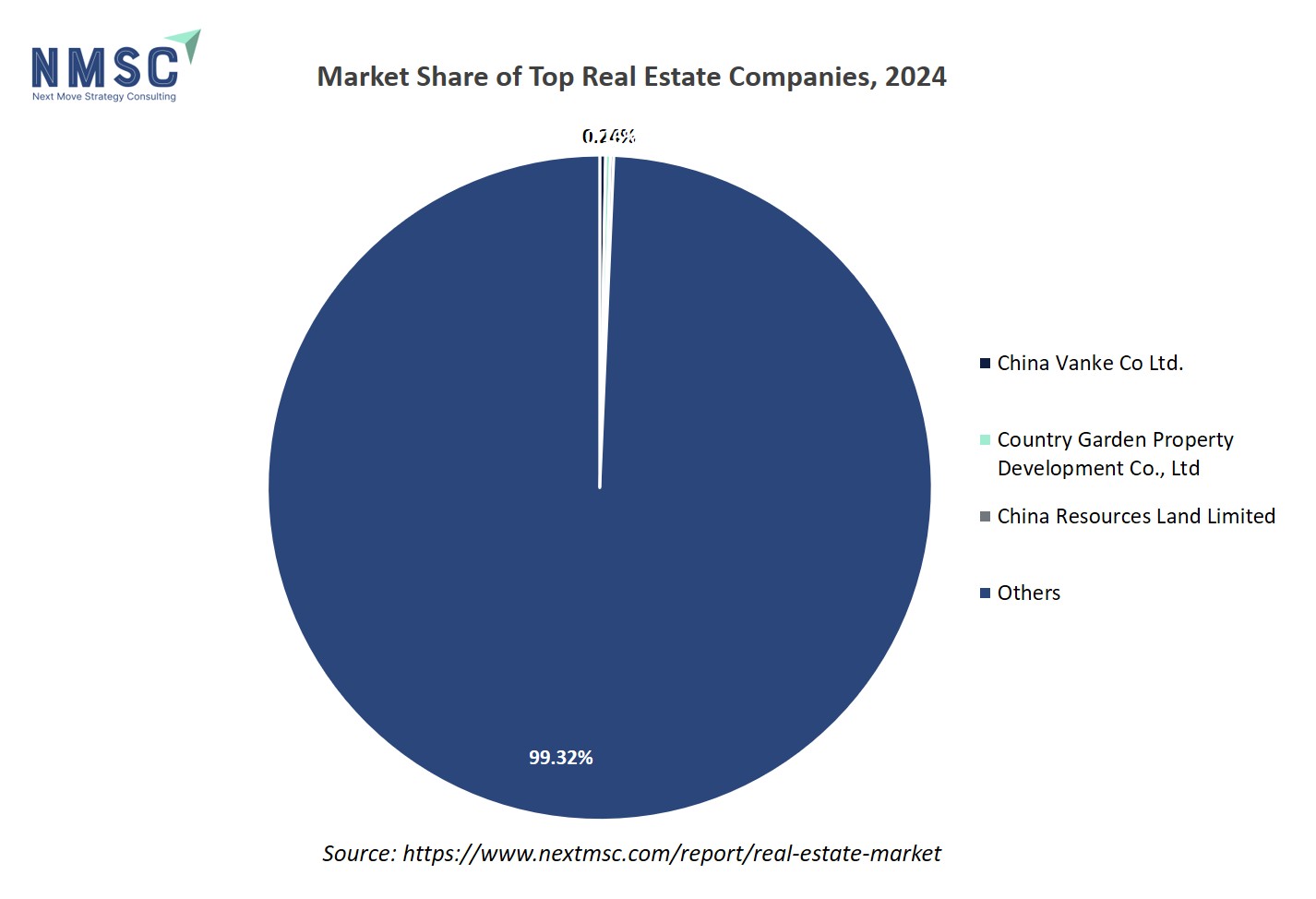

As per NMSC analysis, the Real Estate industry is set to maintain strong growth momentum, with the market size expected to reach around USD 33.61 trillion by 2030, marking a solid CAGR of 5.87%. Valued at USD 22.64 trillion in 2024, the Real Estate Market is projected to rise to USD 25.26 trillion by 2025. The global real estate market is undergoing a profound transformation, driven by rapid urbanization, digital innovation, and an increasing commitment to sustainability. Once dominated by traditional development models, the sector is now embracing smart technologies, data-driven decision-making, and eco-friendly construction practices that are reshaping how properties are built, managed, and experienced.

From AI-powered building management and IoT-enabled energy optimization to the rise of green-certified and net-zero developments, real estate is evolving into a technology-infused, environmentally responsible industry. Developers and investors worldwide are leveraging digital twins, proptech platforms, and advanced analytics to enhance asset performance, improve tenant satisfaction, and achieve long-term value creation. This shift toward intelligent and sustainable real estate is not only redefining property valuation but also positioning the market at the forefront of global urban innovation and resilient economic growth.

Curious about the Real Estate Market? Grab a FREE Sample Now

Real Estate Market Overview

The global real estate market is entering a dynamic phase of transformation, shaped by digital innovation, sustainability imperatives, and evolving urban lifestyles. As cities expand and infrastructure modernizes, real estate is transitioning from traditional brick-and-mortar developments to intelligent, data-driven ecosystems. Modern properties are increasingly equipped with smart building technologies, IoT-enabled monitoring systems, AI-based energy optimization, and integrated sustainability features that enhance operational performance and tenant experience.

The convergence of proptech, renewable energy integration, and green construction is redefining how spaces are designed, built, and managed—creating assets that are not only efficient and resilient but also future-ready. Simultaneously, regulatory support for sustainable urban development, coupled with rising investor and tenant demand for ESG-compliant properties, is accelerating adoption of net-zero and adaptive reuse projects. In essence, the real estate landscape is evolving into a connected, sustainable, and technology-empowered ecosystem, where intelligence, efficiency, and environmental responsibility are emerging as the new benchmarks for value creation and long-term growth.

Furthermore, the global real estate market is witnessing an accelerating shift toward modular, scalable, and technology-driven development models designed to meet diverse urban and demographic needs. As cities evolve and sustainability becomes central to investment strategies, developers are increasingly adopting flexible construction techniques, digital design tools, and adaptive space utilization concepts that can respond dynamically to changing market conditions. Smart buildings equipped with IoT-enabled energy systems, AI-driven maintenance, and real-time analytics are redefining operational efficiency and tenant engagement, while modular and prefabricated construction methods are streamlining delivery timelines and reducing environmental impact.

The integration of renewable energy, digital twins, and proptech solutions is enabling smarter decision-making and long-term value creation across residential, commercial, and mixed-use segments. At the same time, governments and investors are emphasizing green infrastructure, urban resilience, and ESG-aligned portfolios driving innovation and collaboration across the value chain. With sustainability, flexibility, and intelligence at its core, the modern real estate landscape is transforming into a future-ready ecosystem that supports both economic growth and environmental stewardship.

Several leading companies are shaping the future of the global real estate market, including Public Storage, CBRE Group, Inc., American Tower Corporation, Prologis, Inc., and Digital Realty Trust. These industry leaders are driving transformation through innovation, digital integration, and sustainable development strategies that redefine asset performance and long-term value creation. Public Storage continues to expand its footprint through advanced facility management and smart infrastructure upgrades, catering to rising demand for efficient and secure storage solutions.

CBRE Group, Inc. is at the forefront of digital real estate services, leveraging data analytics, AI, and integrated project management platforms to optimize property performance and client experience. American Tower Corporation is revolutionizing real estate in the telecommunications sector by developing next-generation, network-enabled infrastructure that supports global connectivity. Prologis, Inc. leads the logistics real estate space by developing sustainable, technology-driven warehouses and distribution centers aligned with the e-commerce boom. Meanwhile, Digital Realty Trust is redefining commercial real estate through its global portfolio of high-performance data centers that power the digital economy. Together, these companies exemplify how innovation, sustainability, and digital transformation are converging to shape a more resilient, intelligent, and future-ready global real estate landscape.

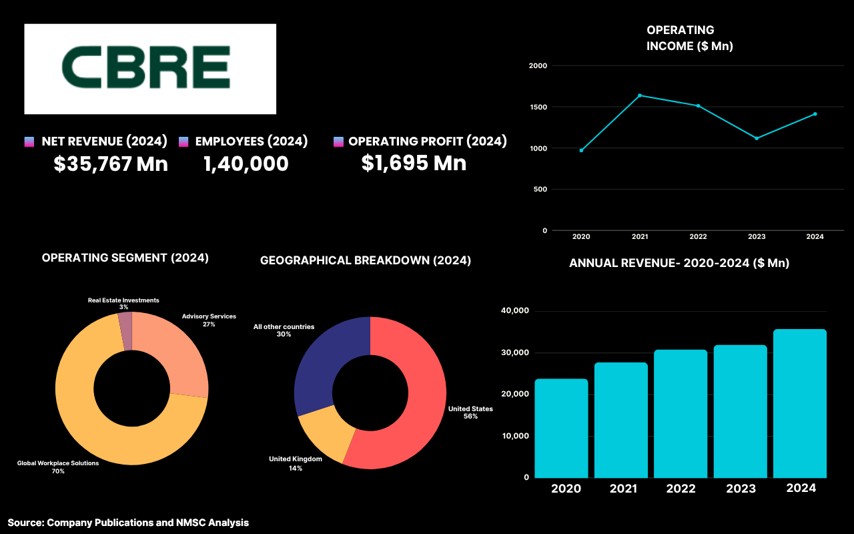

Highlights Of CBRE Group Inc.

CBRE Group, Inc. is a global commercial real-estate services and investment firm headquartered in Dallas, Texas. The company specialises in providing services to both occupiers and investors across the real-estate sector: for occupiers it offers facilities management, transaction services, valuation and advisory, and for investors it offers investment management, development, capital markets, and consulting. The real-estate market it operates in is the commercial real estate market, meaning the market for office, industrial, retail, data-centre and other non-residential property, activity in this market directly affects CBRE’s service volumes, advisory pipelines and overall revenue.

In June 2024, CBRE announced plans to merge its Project Management business with its majority-owned subsidiary Turner & Townsend, creating a unified platform operating across more than 60 countries and projected to add approximately USD 0.15 in incremental run-rate core EPS by 2027. This strategic move aligns closely with the dynamics of the global real estate market, where increasing demand for large-scale infrastructure, industrial, and commercial developments is driving the need for integrated project management expertise. By consolidating its capabilities, CBRE strengthens its role in delivering end-to-end solutions across the real estate value chain, enhancing its competitiveness and growth potential within a rapidly evolving commercial real estate environment.

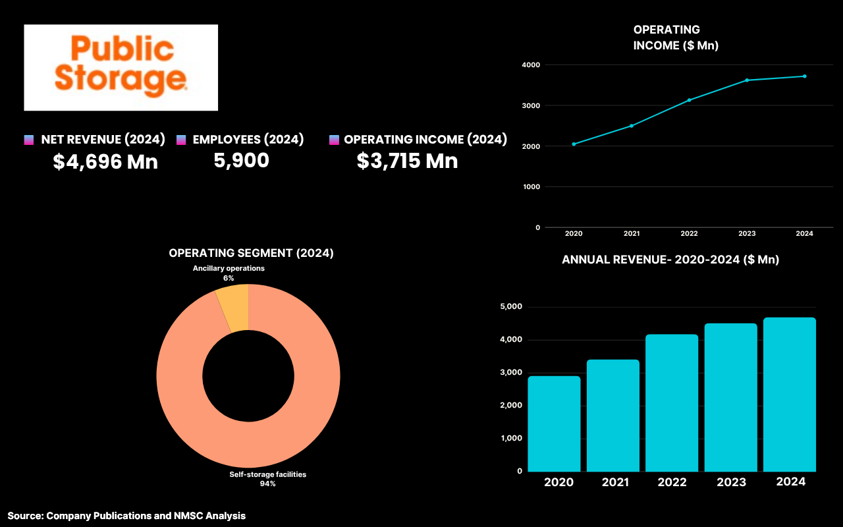

Highlights Of Public Storage

Public Storage is a leading US-based real estate investment trust headquartered in Glendale, California. The company specialises in acquiring, developing, owning, and operating self-storage facilities, serving both individual consumers and businesses by providing rentable storage space. This means the company operates within the self-storage segment of the real-estate market, whereby trends such as occupancy rates, rental rate growth, supply of new units and consumer demand directly influence Public Storage’s revenue, asset values and profitability.

In 2025, Public Storage reported acquiring nine self-storage facilities totaling 0.7 million net rentable square feet for approximately USD 141 million and opening three newly developed facilities adding another 0.7 million rentable square feet at a cost of USD 144.4 million. The company also announced an active development and expansion pipeline of 3.7 million square feet valued at around USD 665.5 million. This growth initiative aligns with the evolving self-storage real estate market, where rising urban density, housing mobility, and e-commerce activity continue to drive demand for flexible storage solutions. By expanding its property portfolio and geographic reach, Public Storage is reinforcing its leadership position, optimizing occupancy levels, and enhancing long-term asset value in a market characterized by steady rental growth and resilient consumer demand.

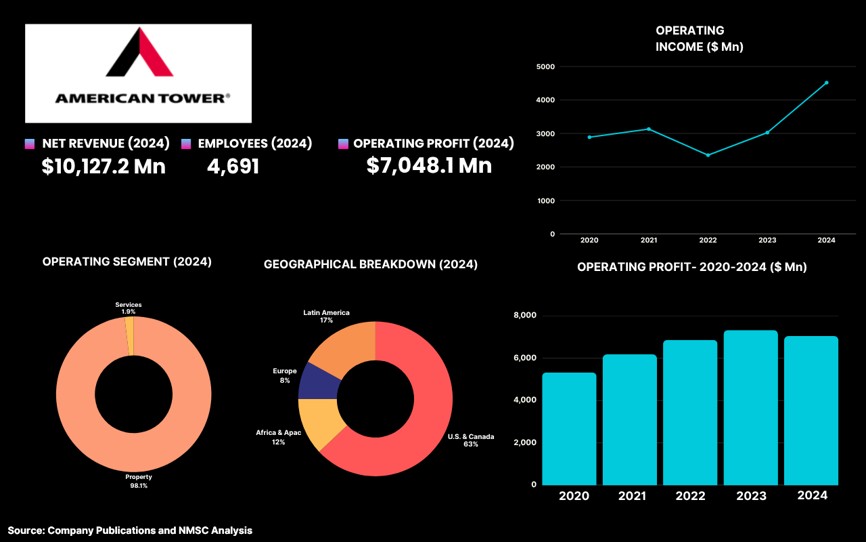

Highlights of American Tower Corporation

American Tower Corporation is a Boston, Massachusetts-based real-estate investment trust (REIT) that owns, operates and develops multitenant wireless and broadcast communications infrastructure around the world. The company specialises in leasing space on its towers, rooftop and ground-site infrastructure to wireless service providers, broadcasters and other network owners. It operates in the communications infrastructure real-estate market, meaning the market for telecom towers, data-centre facilities and other connectivity-enabled real-estate assets, activity in this market directly influences American Tower’s leasing volumes, site-development pipeline and overall growth potential.

American Tower Corporation is transforming the communications infrastructure real estate market by providing the essential physical foundation for global digital connectivity. With a portfolio exceeding 220,000 tower sites worldwide, the company supports the expansion of 4G, 5G, and emerging network technologies for telecom operators and data providers. Its investments in energy-efficient infrastructure, renewable power integration, and edge data centers are enhancing network reliability while promoting sustainable growth. By combining large-scale asset ownership with long-term leasing strategies, American Tower strengthens network capacity, drives digital inclusion, and shapes the evolution of modern telecommunications real estate globally.

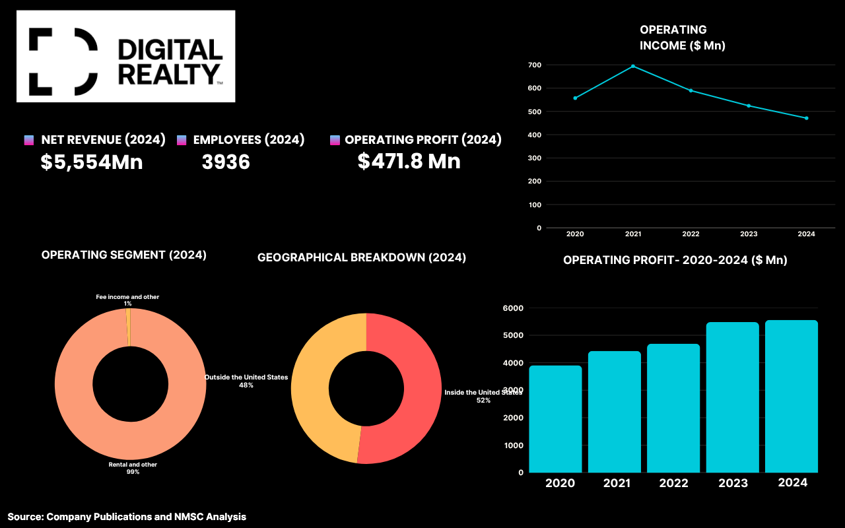

Highlights of Digital Realty Trust

Digital Realty Trust, Inc. is a global real estate investment trust headquartered in Austin, Texas, United States. The company owns, develops, and operates carrier-neutral data centers and interconnection facilities across the Americas, Europe, and Asia. It specializes in providing data center, colocation, and interconnection services through its PlatformDIGITAL offering, which enables customers to deploy and scale digital infrastructure efficiently. Digital Realty operates in the data center real estate market, where factors such as cloud adoption, artificial intelligence computing demand, and data traffic growth directly affect its occupancy rates, leasing activity, and development strategy.

In March 2025, Digital Realty made headlines by entering the Indonesian market through a new joint venture, digital realty bersama, with Bersama Infrastructure Group. The company invested approximately USD 100 million for a 50% stake in data centers and adjacent land in central Jakarta, marking a strategic expansion into one of Southeast Asia’s fastest-growing digital economies. This development represents a major milestone for Digital Realty, as it aligns with the rapid evolution of the data center real estate market, where rising cloud adoption, AI workloads, and digital transformation are driving strong demand for high-capacity infrastructure. By establishing a presence in Indonesia, the company is tapping into a new growth frontier, enhancing regional connectivity, and strengthening its competitive position within the global real estate landscape for digital infrastructure.

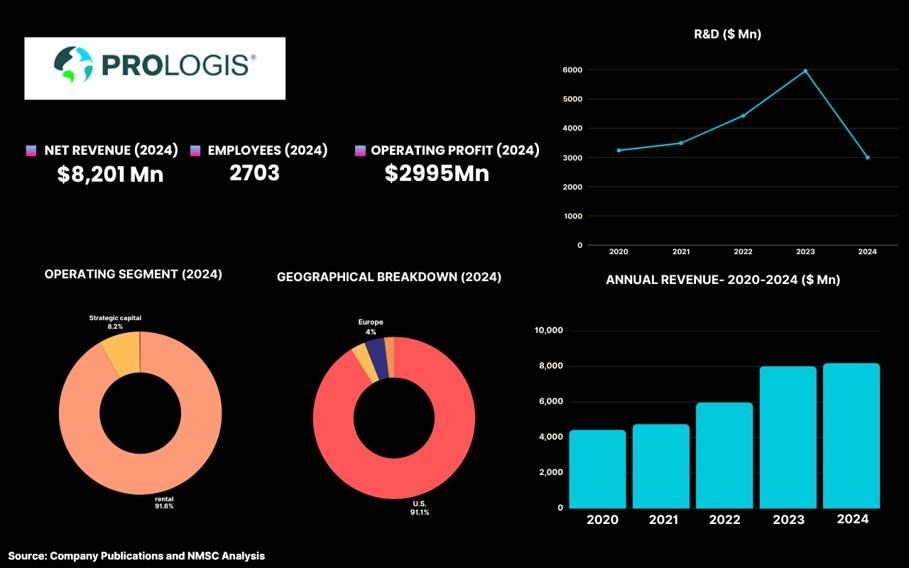

Highlights of Prologis, Inc

Prologis, Inc. is a global real-estate investment trust headquartered in San Francisco, California, United States. The company specialises in owning, developing and managing logistics real-estate assets such as warehouses, distribution centres and fulfilment hubs across major markets worldwide. It operates in the logistics real-estate market, meaning the market for industrial facilities used for storage, transportation and e-commerce fulfilment — trends in global trade, supply-chain efficiency, and e-commerce growth directly influence Prologis’s occupancy rates, rental growth and development pipeline.

In March 2025, Prologis announced its plan to invest approximately USD 1 billion over the next five to seven years in India’s logistics real estate sector, focusing on key metropolitan hubs such as Delhi, Mumbai, Pune, Bengaluru, and Chennai. This strategic move reflects the accelerating momentum of the logistics real estate market, which is being driven by rapid e-commerce expansion, supply chain modernization, and industrial growth across emerging economies. By entering India’s high-demand logistics corridors, Prologis is strengthening its global portfolio, positioning itself to benefit from rising warehouse and distribution space requirements, and reinforcing its role as a key enabler of global trade and digital commerce infrastructure.

Summary of Real Estate Market

The real estate market is undergoing a period of rapid evolution, driven by technological innovation, sustainability imperatives, and changing urban and commercial dynamics. Traditional property models are being reshaped by smart building systems, AI-driven asset management, and ESG-aligned development, enabling enhanced operational efficiency, tenant experience, and long-term value creation. Across commercial, industrial, and data center segments, developers and investors are increasingly prioritizing adaptive reuse, energy-efficient construction, and technology-enabled management to meet evolving market demands and regulatory expectations.

Leading players such as Public Storage, CBRE Group, Inc., American Tower Corporation, Prologis, Inc., and Digital Realty Trust are at the forefront of this transformation. These companies are leveraging advanced infrastructure, data-driven solutions, and sustainable development practices to optimize property performance, enhance occupant satisfaction, and expand portfolio resilience. From smart storage facilities and high-performance logistics hubs to technology-enabled commercial and data center assets, their initiatives demonstrate how innovation, digitalization, and sustainability are converging to shape the future of the real estate market and create long-term investment value.

About the Author

Bidhudhyoti Nag is a seasoned researcher with over two years of experience, specializing in various industry verticals such as healthcare, construction and manufacturing, automotive & transportation. With a strong passion for writing, he views blogging as a valuable platform to share her industry insights and expertise. Outside of tracking market trends and developments, Bidhudhyoti is interested in sports, travelling, and exploring new experiences.

Bidhudhyoti Nag is a seasoned researcher with over two years of experience, specializing in various industry verticals such as healthcare, construction and manufacturing, automotive & transportation. With a strong passion for writing, he views blogging as a valuable platform to share her industry insights and expertise. Outside of tracking market trends and developments, Bidhudhyoti is interested in sports, travelling, and exploring new experiences.

About the Reviewer

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others.

Sikha Haritwal is a researcher with more than 5 years of experience. She has been keeping a close eye on several industry verticals, including construction & manufacturing, personal care products, and consumer electronics. She has avid interest in writing news articles and hopes to use blog as a platform to share her knowledge with others.

Add Comment