South Korea Professional Acne Medication Market Set to Double by 2030: Leading Companies Driving Dermatological Innovation and Skincare Advancements

Published: 2025-09-11

South Korea Professional Acne Medication Market is anticipated to grow nearly double in size by 2030 based on NMSC analysis. The industry is valued at USD 145.3 million in 2024 and is expected to be valued at USD 284.3 million by 2030 with a CAGR of 9.8% from 2025-2030. It is influenced by various factors such as rising prevalence of acne, growing awareness regarding dermatological health, increasing demand for prescription-based treatments, and continuous product innovation in topical and oral acne medications.

South Korea Professional Acne Medication Market Overview

South Korea professional acne medication market comprises a wide range of dermatological solutions designed to treat varying severities of acne through both topical and systemic approaches. These formulations are developed to target acne at its source, reduce inflammation, regulate oil production, and promote skin regeneration, thereby offering long-term skincare benefits. South Korea's professional acne medications are supported by continuous advancements in dermatology, increased use of active ingredients such as retinoids, antibiotics, and hormonal agents, and rising consumer demand for clinically proven solutions.

Artificial intelligence-enhanced acne treatment technologies in South Korea are also emerging, enabling more personalized skincare regimens by analyzing skin conditions through digital imaging and data analytics. These AI-based acne medication tools assist dermatologists in optimizing treatment outcomes by tracking progress, predicting breakouts, and recommending targeted therapies, thus improving overall skin health and treatment compliance.

Curious about the South Korea Professional Acne Medication Market? Download FREE Sample Now!

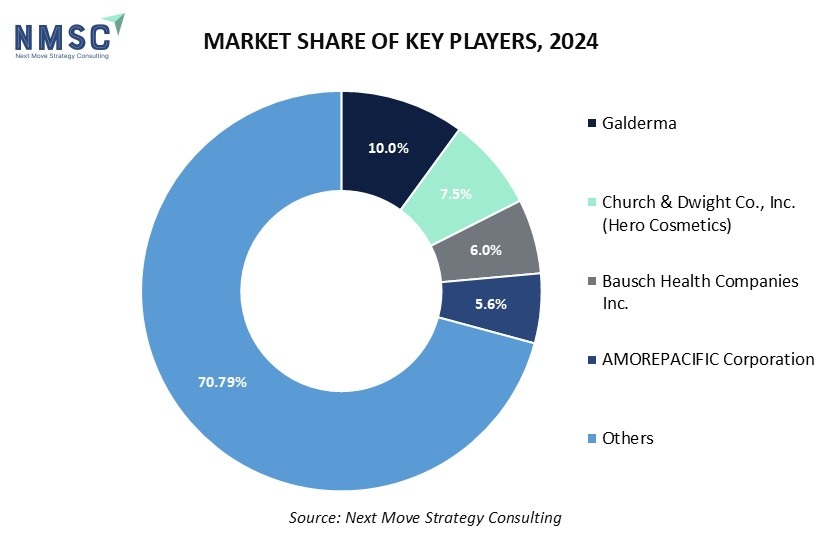

Leading companies in the South Korea professional acne medication market include Galderma, Church & Dwight Co., Inc. (Hero Cosmetics), Bausch Health Companies Inc., AMOREPACIFIC Corporation, HANDOK, Teva Pharmaceutical Industries Ltd., Johnson & Johnson Services, Inc., F. Hoffmann-La Roche Ltd, Pfizer Inc., and GSK plc. These players are actively contributing to market expansion through innovations, product launches, and enhanced dermatological research capabilities.

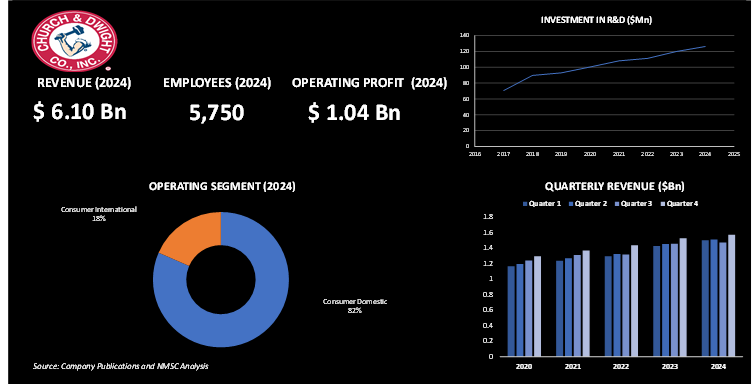

Highlights of Church & Dwight Co., Inc.,

Church & Dwight Co., Inc. is one of the leading American consumer goods companies specializing in personal care, household, and specialty products, with a growing presence in the professional acne medication business, particularly through its acquisition of Hero Cosmetics. Headquartered in Ewing, New Jersey, the company was founded in 1846 and has evolved into a major player in the consumer-packaged goods sector, reporting USD 6.107 billion in revenue and an operating profit of USD 1.045 billion in 2024. It employs 5,600 people and operates through three segments: consumer domestic (77%), consumer international (18%), and specialty products division (SPD) (5%). The company’s R&D investment has steadily increased, reaching approximately USD 140 million by 2025, up from USD 90 million in 2016, reflecting its commitment to innovation.

In 2022, Church & Dwight acquired Hero Cosmetics for USD 630 million, a strategic move to strengthen its position in the acne treatment market. Hero Cosmetics, founded in 2017 by Ju Rhyu, who discovered hydrocolloid pimple patches while living in South Korea from 2012 to 2014, is best known for its Mighty Patch brand. The Mighty Patch, which became the #1 patch brand in the U.S. acne category and the #2 overall acne brand, sells a box every two seconds and has been a top performer in skincare and acne care on Amazon. Hero’s product line has since expanded to 30 SKUs, including patches, balms, serums, and body care solutions, priced between USD 12.99 and USD 32, addressing the full lifecycle of acne treatment. The brand’s sales reached USD 140 million in 2022, up from USD 100 million in 2021, with a 40% EBITDA margin.

South Korea, a global leader in skincare innovation, played a pivotal role in Hero Cosmetics’ origin story. Ju Rhyu’s exposure to hydrocolloid patches in Seoul inspired the creation of Mighty Patch, tailored for Western markets. Although Hero initially focused on the U.S., where it is available in 8,000 retail doors like Target, Ulta Beauty, and CVS, Church & Dwight has plans to expand internationally, with Canada as the first target market.

Given South Korea’s advanced skincare market and the cultural significance of hydrocolloid patches, where they gained popularity over a decade ago, Hero’s expansion into South Korea seems a natural progression. The country’s acne treatment sector is robust, with high demand for innovative solutions, as over 95% of teens and 40% of adults globally experience acne, a trend exacerbated by stress and mask-wearing during the pandemic.

In response to which Church & Dwight’s expertise in scaling brands globally, combined with Hero’s strong fundamentals and appeal to younger consumers, positions it well to penetrate South Korea’s competitive market. The company’s portfolio, which includes power brands like Arm & Hammer, Trojan, and OxiClean, already spans household and personal care categories across regions like Canada, France, Australia, the UK, Mexico, and China. By leveraging its international infrastructure, Church & Dwight introduces Hero’s problem-solution products to South Korean consumers, potentially challenging local brands while capitalizing on the country’s skincare obsession.

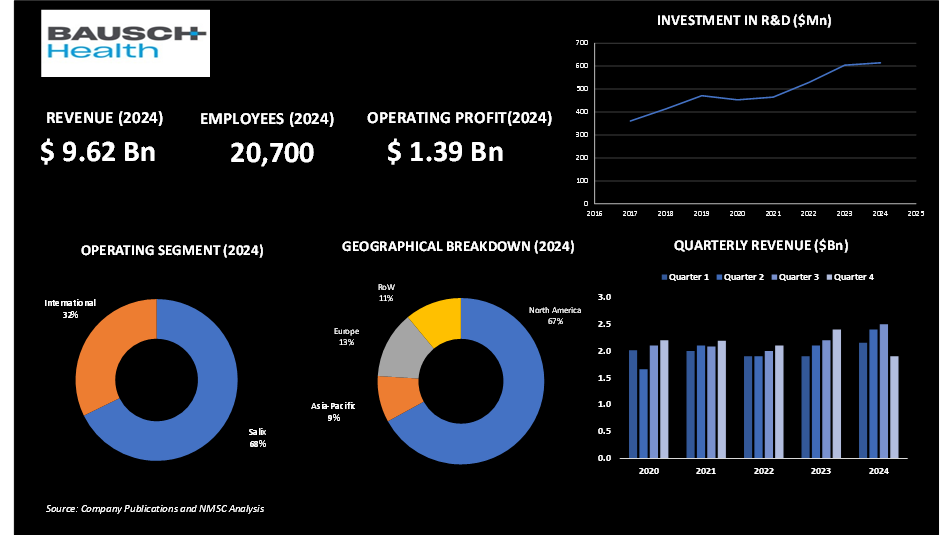

Highlights of Bausch Health Companies Inc.

Bausch Health Companies Inc. is one of the global leaders in the pharmaceutical and healthcare sector, with a significant presence in the professional acne medication business, notably through its dermatology division. Headquartered in Laval, Quebec, Canada, the company operates through key segments including Salix (60%), Solta Medical (11%), and International (29%), delivering innovative solutions for various medical needs.

In 2024, Bausch Health generated USD 9.62 billion in revenue and achieved an operating profit of USD 1.39 billion, supported by a workforce of 20,270 employees. The company’s R&D investment has grown steadily, reaching approximately USD 650 million by 2025, up from around USD 400 million in 2016, underscoring its commitment to advancing healthcare solutions.

Bausch Health’s dermatology portfolio, particularly through brands like Atralin, BenzaClin, and Solodyn, positions it as a key player in the professional acne medication market. These products cater to the growing global demand for effective acne treatments, with South Korea—a hub for advanced skincare innovation, serving as a critical market.

The company’s Solta Medical segment, known for devices like the Clear + Brilliant laser, enhances its ability to address acne and skin health, aligning with South Korea’s emphasis on cutting-edge dermatological technologies. With 67% of its 2024 revenue derived from North America, 13% from Europe, 9% from Asia-Pacific, and 11% from the rest of the world, Bausch Health is well-poised to expand its acne treatment offerings internationally.

The company’s quarterly revenue has remained robust, ranging between USD 2 billion and USD 2.5 billion from 2020 to 2024, reflecting stability and growth. Bausch Health’s focus on R&D drives the development of advanced formulations and devices, supporting acne management solutions tailored to diverse skin types and conditions. This aligns with South Korea’s professional acne medication industry, where over 95% of teens and 40% of adults experience acne, fueled by factors like stress and environmental changes. By leveraging its global reach and innovative pipeline, Bausch Health continues to shape the future of dermatological care, meeting the evolving needs of markets like South Korea with high-performance, clinically proven treatments.

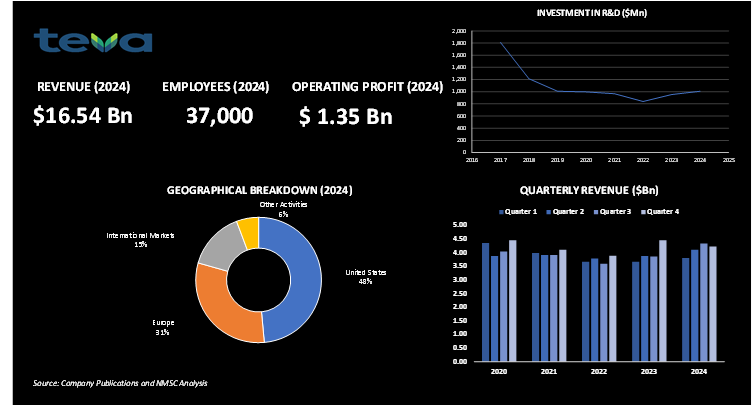

Highlights of Teva Pharmaceuticals Industries Ltd.

Teva Pharmaceutical Industries Ltd. is one of the global leading companies in generic pharmaceuticals and a significant player in the professional acne medication market, particularly through its dermatology offerings. Headquartered in Tel Aviv, Israel, the company specializes in developing, manufacturing, and marketing a wide range of generic and specialty medicines.

In 2024, Teva generated USD 16.544 billion in revenue and an operating profit of USD 1.354 billion, supported by a workforce of 37,000 employees. Geographically, 48% of its 2024 revenue came from the United States, 31% from Europe, 15% from International Markets, and 6% from other activities. The company’s R&D investment peaked at around USD 1,600 million in 2016 but has since declined to approximately USD 900 million by 2025, reflecting a strategic shift while maintaining innovation.

Teva’s dermatology portfolio includes products like Qbrexza and the generic version of Epiduo Forte, positioning it as a key contender in the professional acne medication sector of South Korea. The country is one of the global leaders in skincare innovation, represents a promising market due to its high prevalence of acne over 95% of teens and 40% of adults are affected, driven by stress and environmental factors. Teva’s expertise in generic formulations and specialty drugs, such as its focus on central nervous system disorders and respiratory treatments, extends to dermatological solutions tailored for global markets, including South Korea. The company’s quarterly revenue has remained steady, ranging between USD 3,500 million and USD 4,500 million from 2020 to 2024, showcasing resilience.

\Teva’s commitment to advancing healthcare is evident in its robust pipeline, which includes biosimilars and innovative therapies. Its rigorous approach to pharmaceutical development ensures reliable, high-performance solutions, adapting to diverse regulatory and market challenges across the globe. With a strong presence in over 60 countries and a focus on accessible healthcare, Teva is well-positioned to expand its acne treatment offerings in South Korea, to meet the region’s demand for effective, and affordable dermatological solutions.

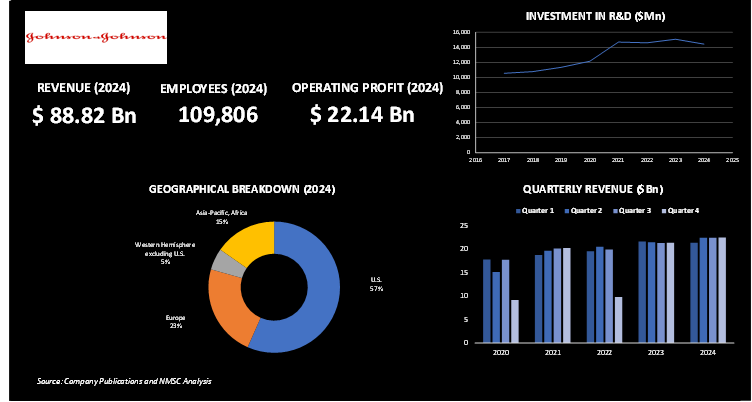

Johnson & Johnson Services, Inc. is one of the global leader in healthcare, renowned for its diverse portfolio spanning pharmaceuticals, medical devices, and consumer health products, with a significant presence in the professional acne medication market through its dermatology offerings. Headquartered in New Brunswick, New Jersey, USA, the company operates across three major segments: Pharmaceuticals, Medical Devices, and Consumer Health.

In 2024, Johnson & Johnson generated USD 88.821 billion in revenue and an operating profit of USD 22.141 billion, supported by a workforce of 109,806 employees. Its geographical revenue breakdown for 2024 shows 57% from the U.S., 23% from Europe, 15% from Asia-Pacific, Africa, and 5% from the Western Hemisphere excluding the U.S. The company’s R&D investment has grown steadily, reaching approximately USD 14,500 million by 2025, up from around USD 11,500 million in 2016, reflecting its commitment to innovation.

Highlights of Johnson & Johnson Services, Inc.

Johnson & Johnson’s Consumer Health segment includes its Neutrogena brand, a key player in the professional acne medication market. Neutrogena offers products like the Oil-Free Acne Wash and Stubborn Acne line, featuring ingredients such as salicylic acid and benzoyl peroxide, which are widely recommended by dermatologists for treating mild to moderate acne. South Korea, a global leader in skincare innovation, presents a significant opportunity for Johnson & Johnson due to the country’s high acne prevalence, driven by factors like stress, humidity, and mask-wearing trends post-pandemic.

Additionally, Johnson & Johnson leverages its global expertise to meet South Korea’s regulatory requirements, such as those set by the Ministry of Food and Drug Safety (MFDS), ensuring its products cater to local consumer preferences for lightweight, non-irritating acne treatments. The company’s strong presence in the Asia-Pacific region, contributing 15% of its 2024 revenue, supports its expansion into South Korea, where it competes with local brands like Cosrx and global players like Galderma. Neutrogena’s dermatologist-recommended formulations and Johnson & Johnson’s robust supply chain enable it to address the needs of South Korean consumers seeking effective, trusted acne solutions.

The company’s quarterly revenue, ranging between USD 20 billion and USD 23 billion from 2020 to 2024, reflects its financial stability to invest in market growth. Johnson & Johnson’s commitment to advancing healthcare is evident in its innovative pipeline, which includes new dermatological formulations and technologies aimed at improving skin health. With a presence in over 150 countries and a focus on accessible, science-driven products, Johnson & Johnson is well-positioned to strengthen its foothold in South Korea’s professional acne medication market, delivering high-performance solutions that meet the region’s demand for effective and safe dermatological care.

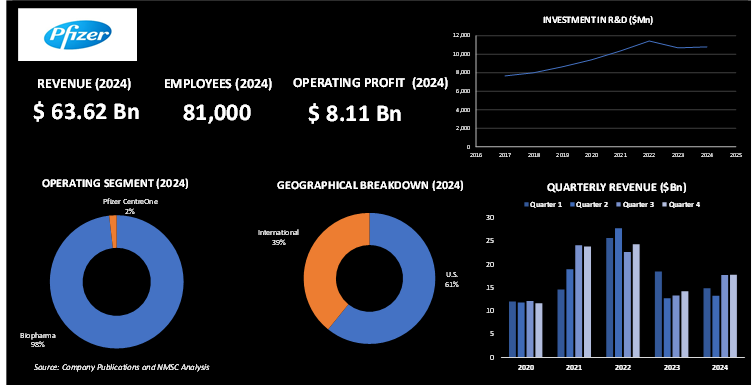

Highlights of Pfizer Inc.

Pfizer Inc. is one of the prominent biopharmaceutical company with a diversified portfolio that spans vaccines, oncology, and specialty medicines, including a notable footprint in the professional acne medication market through its dermatology offerings. Headquartered in New York City, USA, the company operates through two main segments: Biopharma, which accounts for 98% of its operations, and Pfizer CentreOne, making up the remaining 2%. In 2024, Pfizer reported revenue of USD 63.627 billion and an operating profit of USD 8.117 billion, supported by a global workforce of approximately 81,000 employees. Its revenue distribution in 2024 comprised 61% from the U.S. and 39% from international markets, reflecting its extensive global reach.

Pfizer has steadily increased its investment in research and development, with funding reaching approximately USD 10.5 billion by 2025, up from around USD 8 billion in 2016. This commitment to innovation has supported advancements across various therapeutic areas, including dermatology. Among its dermatological products, Aczone (dapsone gel) stands out as a topical treatment for acne vulgaris, specifically targeting inflammatory lesions in patients with mild to moderate acne. This product is particularly suited for markets like South Korea, where acne prevalence is high due to factors such as environmental stress, humidity, and dietary habits.

South Korea, recognized globally for its dynamic skincare industry, presents a strategic growth opportunity for Pfizer. The company leverages its international expertise to navigate the regulatory framework established by the Ministry of Food and Drug Safety (MFDS), ensuring its acne treatments meet local safety and efficacy standards. Aczone’s anti-inflammatory and antibacterial properties address a key concern among South Korean consumers—skin sensitivity—making it an attractive option in a market that values gentle yet effective skincare solutions.

With 39% of its 2024 revenue derived from international markets, Pfizer is well-positioned to expand its presence across the Asia-Pacific region, including South Korea, where it competes with both domestic companies like Cosrx and global dermatology leaders such as Galderma. Pfizer’s quarterly revenue, ranging between USD 10 billion and USD 25 billion from 2020 to 2024, highlights its strong financial base and ability to support regional growth strategies.

Further reinforcing its role in dermatological care, Pfizer continues to develop innovative formulations aimed at improving skin health outcomes. Its science-driven approach, combined with a robust global infrastructure, positions the company to strengthen its role in South Korea’s professional acne medication market by delivering effective, safe, and high-performance treatment options tailored to regional needs.

Summary South Korea Professional Acne Medication Market

The South Korea professional acne medication market is expected to witness record growth driven by rising skincare awareness, increasing prevalence of acne among adolescents and adults, and the growing demand for targeted dermatological treatments. Industry leaders are making significant investments in advanced dermatology research and product innovation, focusing on high-efficacy formulations such as retinoids, antibiotics, and hormonal treatments to address various acne types and skin sensitivities.

Despite challenges such as regulatory hurdles, rising competition from domestic and global brands, and fluctuating raw material costs, the demand for clinically backed, prescription-grade skincare solutions remain strong. These advancements continue to fuel innovation, leading to more effective acne management, improved patient outcomes, and the expansion of South Korea’s reputation as a global hub for cutting-edge skincare and dermatological science.

About the Author

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Retail and Consumer, Healthcare, Manufacturing, Automotive, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavors.

Sukanya Dey is a passionate and insightful writer with over three years of experience, she excels in providing clients with in-depth research and valuable insights, helping them navigate complex business challenges. She has a keen interest in various industries, including Retail and Consumer, Healthcare, Manufacturing, Automotive, and ICT & Media. Sukanya strives to offer fresh perspectives and innovative solutions through her comprehensive research. She finds immense joy in weaving her thoughts and ideas into captivating articles and blogs, where her passion for literature and art shines through. In her free time, she enjoys reading books, cooking, filming, often drawing inspiration from these activities for her creative writing endeavors.

About the Reviewer

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Debashree Dey is a skilled Content Writer, PR Specialist, and Assistant Manager with strong expertise in Digital Marketing. She specializes in crafting visibility strategies and delivering impactful, data-driven campaigns. Passionate about creating engaging, audience-focused content, she helps brands strengthen their online presence. Beyond work, she draws inspiration from creative projects and design pursuits.

Add Comment