Why Is South Korea’s Skin Care Product Market Booming in 2024-2025?

Published: 2025-09-16

South Korea’s skin care product market, often dubbed K-Beauty, is a global phenomenon. Its innovative products, unique ingredients, and cultural influence have captivated consumers worldwide. But what’s driving this market’s growth in 2024 and 2025? Let’s dive into the trends, data, and strategies shaping this dynamic industry, focusing on credible insights from company filings, government sources, and top consulting firms.

While J-Beauty (Japan) is often perceived as more professional and premium compared to C-Beauty (China) and K-Beauty brands, the Korean skincare industry can still convince an APAC audience in terms of innovation, trends, and convenience:

What Makes K-Beauty a Global Leader?

South Korea’s skin care market is renowned for its innovation and consumer-centric approach. The facial care segment, a cornerstone of K-Beauty, is projected to reach KRW 5.41 trillion in 2024, reflecting a 2.5% growth from 2023. Japan’s K-Beauty imports surged by 120.8% in 2024, surpassing imports from France, highlighting South Korea’s growing export power.

Few places in the world hold men’s health and skincare in such high regard as South Korea. Seoul is a wellness haven known as the “Skincare Capital of the World.” With innovative formulas and ingredients, Korean products set the global standard for effective skincare. Further, it’s not only the products that differ but also men’s approach to skincare. Opposed to Western countries, Korean men view skincare as a way to gain an edge. A confidence boost that improves their career, relationships, and energy—similar to how one might view a good fitness or diet regimen.

Interest in South Korean pop culture:

Social media analysis in India shows that over the past two years, there have been 6.20 million posts discussing K-Drama, K-Pop, and K-Beauty trends, with the majority coming from users aged 19–24. The sustained popularity of K-Pop across the APAC region continues to drive consumer interest in Korean skincare and beauty products.

K-Culture’s impact is broadening across beauty, food, cinema, and more—fueled in part by popular Netflix K-Dramas like Crash Landing on You and Itaewon Class. Staying aligned with this cultural wave will be essential for beauty brands, as momentum remains strong. Both local and global brands should consider drawing inspiration from K-Dramas, adopting similar aesthetics to engage consumers and offering products that help replicate on-screen looks.

K-Beauty trends win customers

The key to appeal to consumers is to balance the demand for affordability with the desire for trendy looks, but without falling short on efficacy and safety. Young consumers especially, seek affordable beauty products - 30% of Gen Z in India agree that there should be more affordable beauty products. South Koreans prioritize convenience and multifunctionality, with 70% willing to pay more for products that simplify their routines.

South Korea’s skin care market thrives on innovation, cultural emphasis on skincare, and strong export growth. Its influence is expanding globally, driven by consumer demand for affordable, effective products.

Which Companies Are Leading the Market?

Major players like Amorepacific, LG Household & Health Care, and L’Oréal dominate the market through strategic innovation and global outreach:

-

Amorepacific: The company reported a consolidated sales of KRW 1.1648 trillion and operating profit of KRW 128.9 billion for the first quarter of 2025. Among leading subsidiary Amorepacific brands, LANEIGE, HERA, AESTURA, Ryo, illiyoon, LABO-H showed strong performance. Multi-brand stores (MBS) and online channels continued to demonstrate robust sales growth. The company exhibited strong results, primarily through MBS and online channels, driven by global campaigns for key products and the launch of diverse innovative products. This resulted in sales of KRW 577.3 billion, a 2.4% increase compared to the previous year, and operating profit of KRW 49.4 billion, a 0.6% increase.

-

LANEIGE increased skincare sales by introducing new products in the 'Water Bank' and 'Bouncy & Firm' lines. The 'Water Bank UV Barrier Sunscreen,' co-developed with travel YouTuber 1G, gained popularity and expanded the brand's customer base.

-

AESTURA, which maintained growth momentum with strong sales, also strengthened its global customer care capabilities through offline duty-free channel expansion and the launch of a global website.

-

Mamonde, which grew sales primarily through MBS channels, achieved notable success by ranking first in Daiso Mall's 'Hwajalmeok(good makeup day)' skincare category. HANYUL also increased its presence by ranking first in the cleansing category at Olive Young.

-

Ryo drove sales growth by launching an anti-aging care line under the 'ROOT:GEN' label.

-

LABO-H also recorded a strong performance through product diversification in its scalp-strengthening line.

-

illiyoon continued solid growth with the successful launch of third-generation renewed products in its flagship 'Ceramide Ato' line. mise-en-scène, which conducted marketing campaigns with brand ambassador aespa, and HAPPY BATH, which promoted massage routines co-developed with Banyan Tree Spa, enhanced awareness and appeal of their products.

-

-

LG Household & Health Care: LG H&H’s luxury skincare brand THE WHOO has surpassed 20 trillion won ($13.9 billion) in cumulative net sales, cementing its position as a leading global premium beauty brand.

-

L’Oréal: L’Oréal’s Big Bang Beauty Tech Innovation Program, launched in June 2024, integrates AI-driven skincare diagnostics, enhancing Laneige’s market presence

|

Theme |

Description |

|

Phygital Consumers |

AI-driven content creation and |

|

Future Science |

Breakthroughs in AI-powered biotech, longevity science, |

|

Operation 4.0 |

AI-optimized production safety and intelligent |

|

Sustainability |

Environmentally responsible, localized business |

Leading companies leverage innovation, premium branding, and technology to maintain market dominance. Their focus on R&D and global partnerships drives sustained growth.

How Do Natural Ingredients Fuel Growth?

K-Beauty’s appeal lies in its use of natural and unique ingredients like snail mucin, Centella Asiatica, and bee propolis. These ingredients cater to consumer demand for safe, effective products, particularly for sensitive skin.

-

Ingredient Innovation: COSRX, a key player, emphasizes minimalistic formulations with 96% skin-boosting ingredients like snail mucin, which is celebrated for its hydrating and healing properties.

-

Male Skincare: Men in South Korea spend more on skincare per person than men anywhere else in the world. South Korea is the world’s 10th largest beauty market, whilst men in South Korea spend more on skincare per person than their peers anywhere else in the world. Driven by cultural norms and societal expectations, the segment is also boosted by the phenomenal marketing creativity of Korean brands. With the influence of K-pop idols, actors, as well as influencers, projecting a flawless, youthful aesthetic male skincare is a must Celebrities in South Korea, from Song Hye Kyo, a notable ambassador for Laneige and Sulwhasoo and Park Seo Joon, who is known for promoting brands like TIRTIR regularly endorse skincare and makeup products, making it socially acceptable for men. Brands in Korea cater specifically to men by offering gender-targeted solutions. The plethora of specialized products, combined with powerful marketing campaigns has powered sales of skincare among South Korean men. In fact, as the world’s foremost consumers per-capita of skincare products, Korean men spend four times more than Denmark, which is in second-place.

-

Regulatory Support: The South Korean government supports cosmetic innovation through initiatives like the Korean International Trade Association (KITA), which played a crucial role in assisting small and medium-sized K-Beauty businesses in entering international markets. Additionally, the Korean government’s initiatives, including incorporating skincare/cosmetics in tourism and promoting K-Beauty through media, significantly boosted global interest in Korean beauty products.

-

Sustainability: The success of K-Beauty exports has paved the way for various sub-sectors, including Clean and Vegan Beauty, Organic Cosmetics, Derma Cosmetics, and Beauty Tech. Korean consumers' emphasis on sustainable, eco-friendly products has driven businesses to explore innovations like microbiome cosmetics and eco-conscious packaging solutions. Importers can tap into these emerging trends by sourcing these products from Korean suppliers and meeting the demand for eco-friendly beauty options in international markets.

Natural ingredients and rigorous quality standards underpin K-Beauty’s growth, aligning with consumer preferences for safe, effective skincare solutions.

Why Is Digital Marketing a Game-Changer?

Digital platforms and social media influencers are pivotal in K-Beauty’s global reach. Influencer marketing, for example, has become one of the most powerful tools for K-beauty brands looking to break into international markets like the United States. By partnering with creators who resonate with global audiences, brands can drive awareness, build trust, and translate product virality into long-term visibility.

-

E-Commerce Growth: In recent years, Korean beauty products, commonly known as K-beauty, have gained huge popularity in India. The growing demand for these skincare and cosmetic products has been greatly influenced by the rise of e-commerce platforms like Amazon, Nykaa, and Myntra, eliminating the need for specialized stores or international markets. Discounts, flash sales, and special offers on e-commerce platforms make K-beauty more affordable, increasing the demand. The popularity of K-pop and K-dramas has also increased interest in K-beauty, with e-commerce platforms tapping into this cultural wave to offer Korean-inspired products.

-

Korean Celebrity Credibility: The growing influence of the Korean Wave (K-Wave) has become a key driver in marketers' decisions to engage Korean celebrities as brand endorsers. These celebrities resonate strongly with target audiences, particularly younger demographics, due to their on-screen presence and aspirational appeal. Their influence often leads to audience imitation, amplifying the impact of brand messages. The deep loyalty of K-celebrity fanbases strengthens commercial partnerships, translating into increased product visibility and sales. A notable example is BTS’s collaboration with McDonald’s, which marked the first global menu partnership with an Asian artist group. The campaign saw overwhelming consumer response, with fans and non-fans alike queuing for the limited-edition meal, including in markets like Malaysia.

-

Influencer Impact: Laneige’s appointment of Sara Tendulkar as brand ambassador in May 2024 boosted its social media presence, driving sales. Recognized for her authenticity and influential presence online, Sara joins Laneige in advancing the brand's mission within the country. In conjunction with this announcement, Laneige has introduced its latest innovation, the Bouncy and Firm Sleeping Mask, designed to enhance skin vitality and promote a radiant complexion. This unveiling marks another milestone in Laneige's journey to redefine beauty standards and empower individuals to embrace their distinctiveness.

-

AI Integration: L’Oréal has undertaken a significant restructuring of its internal capabilities and human capital. The company has established a dedicated Generative AI Task Force, a centralized body charged with three critical missions: identifying high-impact use cases for the technology across the organization, upskilling employees to ensure they possess the necessary knowledge to leverage AI effectively, and fostering a vibrant internal community to disseminate AI knowledge across all 37 of its global brands.

Digital marketing, bolstered by influencers and AI technology, amplifies K-Beauty’s global appeal, making it accessible and personalized for diverse consumers.

What Challenges Does the Market Face?

Despite its growth, the K-Beauty market faces numerous challenges:

-

High Costs: K-beauty products can be more expensive than Western skincare products. However, it’s a myth - many drugstore skin-care brands tend to be from Western manufacturers, there are some instances in which Western products are extremely expensive. The same happens with Korean products!

-

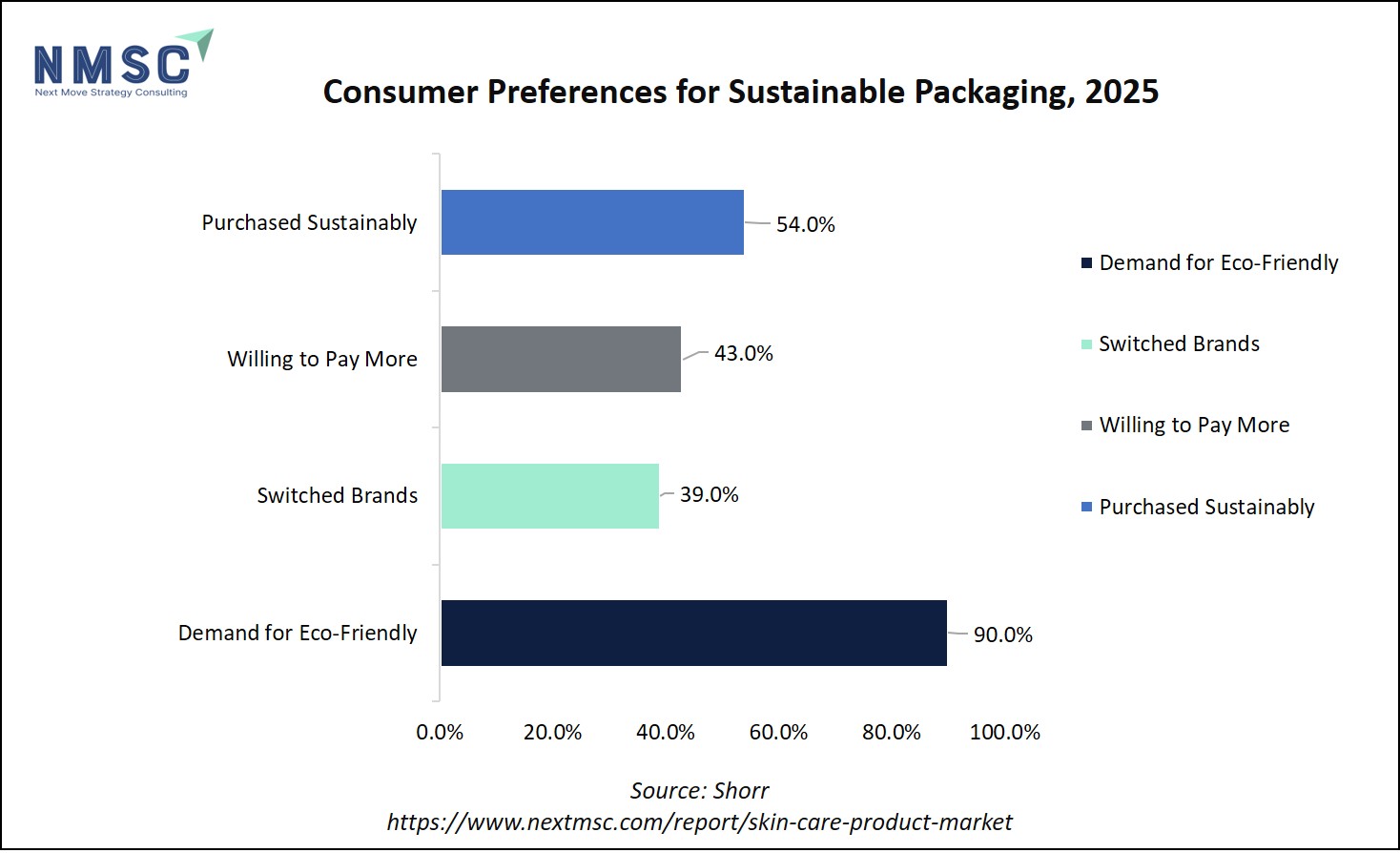

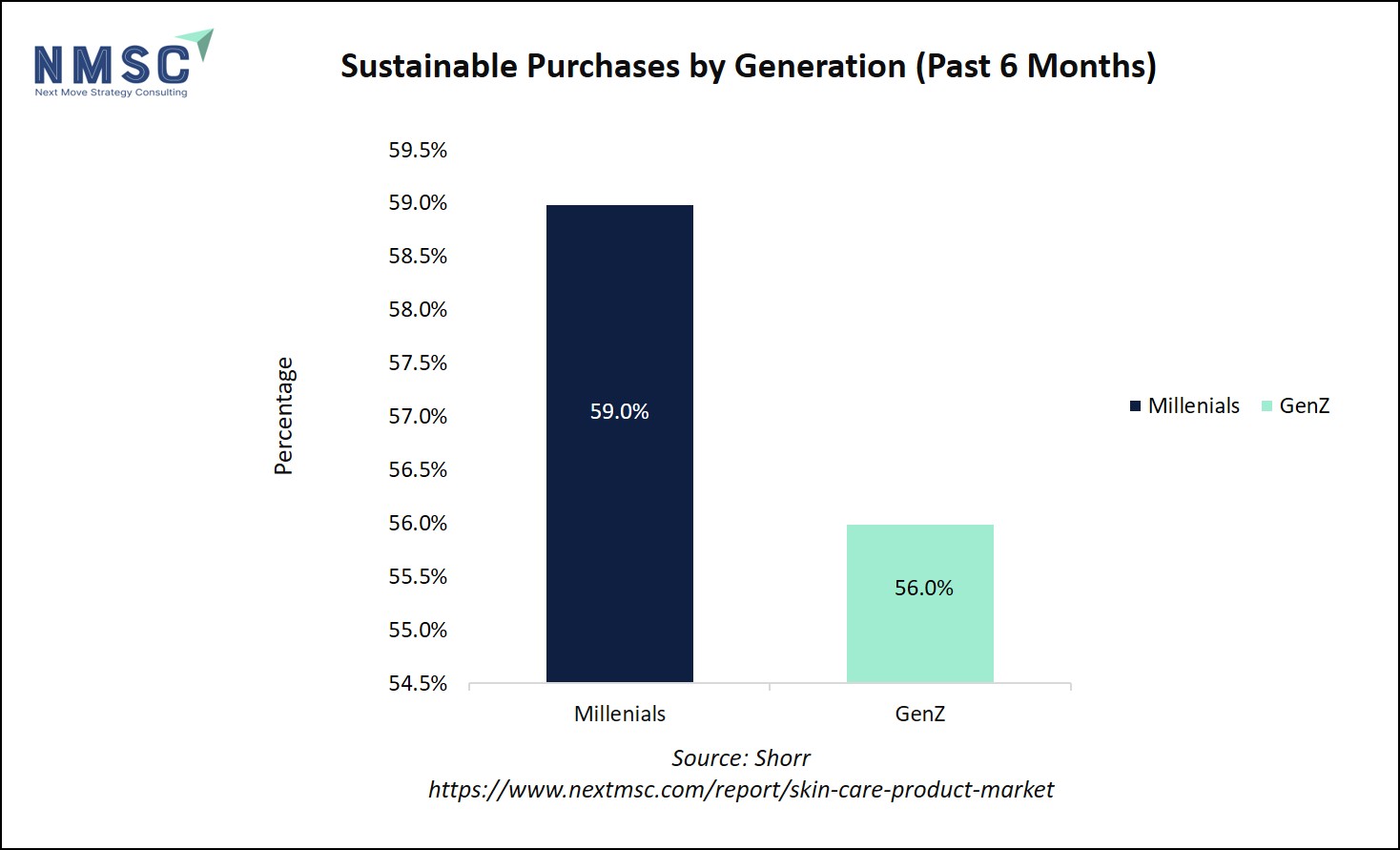

Sustainability Concerns: 90% consumers demand eco-friendly packaging, pushing brands to invest in sustainable practices. 54% of consumers reported consciously purchasing products with sustainable packaging in the last six months. More than half of Millennials (59%) and Gen Z (56%) consciously purchased products with sustainable packaging in the last six months. 43% of consumers are willing to pay extra for a product with sustainable packaging. More than one-third (39%) of consumers have switched to competing brands because they offer sustainable packaging.

-

Economic Factors: Inflation may impact affordability, though K-Beauty’s value-for-money positioning mitigates this challenge. They are known for creating looks tailored to Asian faces and are appreciated for their affordability, which is crucial during times of global inflation.

While competition and sustainability pressures pose challenges, K-Beauty’s adaptability and affordability maintain its competitive edge.

Next Steps: How to Leverage K-Beauty Trends

To capitalize on South Korea’s skin care market, brands and consumers can take actionable steps:

-

Invest in R&D: Focus on innovative, natural ingredients to meet consumer demand for safe, effective products.

-

Enhance Digital Presence: Leverage e-commerce and influencer partnerships to expand global reach.

-

Prioritize Sustainability: Adopt eco-friendly packaging to align with consumer values.

-

Explore AI Technology: Implement AI-driven diagnostics to offer personalized skincare solutions.

Conclusion:

South Korea’s skin care sector is a powerhouse of innovation, driven by natural ingredients, digital strategies, and cultural influence. By addressing challenges and embracing trends, brands can thrive in this vibrant industry.

About the Author

Sneha Chakraborty is a seasoned SEO Executive and Content Writer with over 4 years of experience in the digital marketing space, bringing a strong command of online visibility strategies and a keen insight into the evolving digital landscape. She specializes in enhancing online visibility and user engagement through data-driven strategies and creative content solutions. Sneha is passionate about translating complex digital concepts into accessible content for a wide audience. Outside of work, she enjoys reading, sketching, and exploring the outdoors through nature photography.

Sneha Chakraborty is a seasoned SEO Executive and Content Writer with over 4 years of experience in the digital marketing space, bringing a strong command of online visibility strategies and a keen insight into the evolving digital landscape. She specializes in enhancing online visibility and user engagement through data-driven strategies and creative content solutions. Sneha is passionate about translating complex digital concepts into accessible content for a wide audience. Outside of work, she enjoys reading, sketching, and exploring the outdoors through nature photography.

About the Reviewer

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Sanyukta Deb is a seasoned Content Writer and Team Leader in Digital Marketing, known for her expertise in crafting online visibility strategies and navigating the dynamic digital landscape. With a flair for developing data-driven campaigns and producing compelling, audience-focused content, she helps brands elevate their presence and deepen user engagement. Beyond her professional endeavors, Sanyukta finds inspiration in creative projects and design pursuits.

Add Comment