South Korea Professional Acne Medication Market by Type (Inflammatory and Non-Inflammatory), by Formulation (Topical Medications and Others), by Acne Severity (Mild Acne and Others), by Skin Type (Normal/Combination and Others), by Age Group (Teenagers and Others), by Therapeutic Class (Retinoids and Others), by Applications (Facial Acne Treatment, and Others) and by Distribution Channel (Dermatologist & Aesthetician, and Others)– Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Retail and Consumer | Publish Date: 10-Nov-2025 | No of Pages: 164 | No. of Tables: 125 | No. of Figures: 70 | Format: PDF | Report Code : RC1128

South Korea Professional Acne Medication Market Overview

The South Korea Professional Acne Medication Market size was valued at USD 99.4 million in 2019 and grew to USD 132.7 million by 2023, achieving a CAGR of 7.7% during 2019-2023. In 2024, the market size reached USD 145.3 million and is projected to grow to USD 177.8 million by 2025. Additionally, the industry is expected to continue its growth trajectory, reaching USD 284.3 million by 2030, with a CAGR of 9.8% from 2025 to 2030.

The South Korea professional acne medication market is experiencing significant growth, driven by the booming K-beauty industry, which reflects growing global demand for Korean skincare innovations. Government initiatives to advance personalized skin diagnosis within the bio-health sector further propel market expansion by enhancing treatment precision.

Additionally, the increasing consumer focus on health, safety, and authenticity, with a shift toward natural and organic formulations, boosts demand for professional acne solutions.

However, high treatment costs pose a restraint, limiting accessibility to a broader population. A promising opportunity lies in AI-powered precision acne treatments, which use advanced technology for customized skincare, potentially improving outcomes and market share through tailored, data-driven solutions.

Surging Growth of the South Korean Cosmetic Industry Fuels the Demand for Professional Acne Medication

The remarkable success of the South Korean cosmetic industry, referred to as K-beauty, serves as a significant driver for the South Korea professional acne medication market trends. This success is evidenced by the record-breaking cosmetic exports from South Korea, which reached USD 9.3 billion from January to November 2024.

This figure surpasses the previous high of USD 9.2 billion in 2021, clearly demonstrating the increasing global admiration for Korean beauty products and their substantial influence on international trade. This consistent upward trajectory underscores the escalating global demand for Korean skincare and beauty innovations, which are now widely considered benchmarks within the cosmetics industry.

Government Initiatives Supporting Personalized Skin Diagnosis Within the Bio-Health Sector Drives the South Korea Professional Acne Medication Market Demand

Government initiatives in South Korea that actively support the development of personalized skin diagnosis technologies within the broader bio-health sector are a crucial driver for the professional acne medication market.

For instance, in March 2023, the Korean government announced strategic plans to cultivate the Korean bio-health industry by developing technologies related to bespoke cosmetics and personalized skin diagnosis programs using the Internet of Things (IoT) and big data. This governmental focus signals a commitment to advancing the field of personalized skincare, which directly impacts how acne and other skin conditions are diagnosed and treated professionally.

The Increasing Consumer Emphasis on Health, Safety, and Authenticity in Skincare Accelerates the South Korea Professional Acne Medication Market Growth

The growing emphasis placed by Korean consumers on health, safety, and authenticity in their skincare choices represents another significant driver for the growth of professional acne medication market. As highlighted by the 2023 Glowpick 1st Half Awards, Korean consumer values are shifting towards health, safety, and authenticity, more emotional attachments and meaningful experiences, steering away from mass consumption.

This trend is further evidenced by the increasing interest in "natural/organic and ‘free from’ formulations, reducing or replacing artificial ingredients with natural alternatives". This preference for trustworthy and transparent skincare options directly impacts how consumers approach the treatment of skin concerns like acne, thus propelling the market trends.

High Cost of Treatment Acts as a Market Restrain for the South Korea Professional Acne Medication Market Expansion

A significant restraint on the growth of the professional acne medication market in South Korea is the high cost of prescription-based treatments and advanced skincare medications. The cost of prescription medications and advanced dermatological procedures entails higher expenses compared to over-the-counter solutions. This price sensitivity limits the accessibility of such treatments to a smaller segment of the population, potentially restraining the overall market size and market share that professional acne medication can achieve, especially when more affordable alternatives are available.

AI-Powered Precision Acne Treatment Offers Promising Opportunities for Market Expansion

A significant opportunity for the professional acne medication market lies in the integration of AI-powered skin diagnosis. SmartSKN's K-OWN platform exemplifies this potential by using AI for real-time diagnostics to create personalized skincare products. Customers can select base formulas and active ingredients targeting specific concerns like acne, and the product is then freshly manufactured using 3D printing. This merging of AI-driven precision with robotic manufacturing offers a glimpse into the future of personalized skincare.

Professionals in the acne treatment market can leverage similar AI technologies to provide highly accurate skin assessments, leading to the development of customized and more effective treatment plans tailored to individual patient needs. This level of personalization can enhance treatment outcomes, increase patient satisfaction, and drive growth within the professional acne medication sector by offering solutions that are precisely matched to individual skin concerns, thereby increasing its growth potential and potentially expanding its market share by offering superior, data-driven results.

Inflammatory Acne Leads Type Segment in the South Korea Professional Acne Medication Market

In the South Korea professional acne medication market, inflammatory acne dominates the type segment due to its higher prevalence and the urgent need for effective, specialized treatment. Characterized by red, swollen, and often painful lesions, it drives significant demand for dermatological interventions such as topical retinoids, antibiotics, and combination therapies, particularly among adolescents and young adults in South Korea’s skincare-conscious population.

The cultural emphasis on flawless skin further amplifies the preference for professional treatments that deliver rapid, reliable results for severe cases. Projections indicate that inflammatory acne treatments will maintain their leading position through 2030, fueled by ongoing demand and rising triggers like stress, diet, and environmental pollution.

Body Acne Treatment Emerges as the Fastest-Growing Segment in the Application Segment

In the professional acne medication market in South Korea, body acne treatment is the fastest-growing segment within the application category. This rapid rise is driven by increasing awareness of body acne, particularly among young adults and those with active lifestyles, who seek specialized dermatological solutions for areas like the back, chest, and shoulders. The demand for targeted treatments, such as prescription-strength topical creams, chemical peels, and laser therapies, is fueled by South Korea’s cultural emphasis on comprehensive skincare and aesthetic perfection.

Additionally, lifestyle factors like stress, hormonal imbalances, and humidity are contributing to the prevalence of body acne, further necessitating professional interventions. Projections indicate that the body acne treatment segment will sustain its strong growth through 2030, supported by advancements in dermatological technology and a growing consumer focus on holistic skin health.

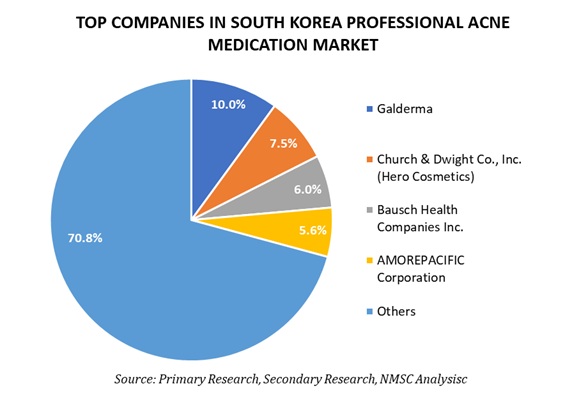

Strategic Analysis of Companies in South Korea Professional Acne Medication Industry

The industry is shaped by strategic moves from key players like Galderma, AMOREPACIFIC Corporation, COSRX, and others, each navigating unique challenges and opportunities.

Galderma has strengthened its portfolio with advanced formulations like Epiduo Forte, blending adapalene and benzoyl peroxide, while expanding its footprint through partnerships and a focus on prescription-grade solutions. AMOREPACIFIC, a K-beauty giant, leverages its acquisition of COSRX in 2023 to integrate natural ingredients like centella asiatica into clinical offerings, aligning with market trends favoring gentle, effective products. COSRX itself continues to innovate with low-irritation retinoids, capturing a growing share of the professional segment.

However, challenges include high R&D costs and stringent regulatory requirements, overseen by South Korea’s MFDS, slow product launches, as seen with delays in novel biologics from companies like Pfizer and GSK plc. Price sensitivity also pushes consumers toward cheaper OTC alternatives, eroding market share for professional treatments. On the other hand, opportunities such as South Korea’s medical tourism surge, particularly in dermatology hubs like Gangnam, boosts the demand for premium services from players like Bausch Health and HANDOK.

Additionally, AI-driven personalized skincare, adopted by firms like NEOGENLAB US and DONG-A-Pharmaceutical, promises tailored solutions, enhancing growth potential. For instance, Johnson & Johnson’s Neutrogena brand is exploring digital diagnostics to complement its acne portfolio. By balancing innovation with affordability, these companies are well-positioned to thrive in this dynamic industry.

South Korea Professional Acne Medication Market Key Segments

By Type

-

Inflammatory Acne

-

Non-Inflammatory Acne

By Formulation

-

Topical Medications

-

Combination Treatments

-

Laser And Light-Based Treatments

-

Oral Medications

By Acne Severity

-

Mild Acne

-

Moderate Acne

-

Severe Acne

-

Post-Inflammatory Hyperpigmentation (Pih)

By Skin Type

-

Normal/Combination Skin

-

Dry Skin

-

Oily Skin

-

Sensitive Skin

By Age Group

-

Teenagers and Young Adults (13-30 years)

-

Adults (31 years and above)

By Therapeutic Class

-

Retinoids

-

Antibiotics

-

Salicylic Acid

-

Benzoyl Peroxide

-

Others

By Applications

-

Facial Acne Treatment

-

Body Acne Treatment

-

Scalp Acne Treatment

By Distribution Channel

-

Dermatologist & Aesthetician

-

Pharmacies & Drug Store

-

E-Commerce

Key Players

-

Galderma

-

Church & Dwight Co., Inc. (Hero Cosmetics)

-

Bausch Health Companies Inc.

-

AMOREPACIFIC Corporation

-

HANDOK

-

Teva Pharmaceutical Industries Ltd.

-

Johnson & Johnson Services, Inc.

-

F. Hoffmann-La Roche Ltd

-

Pfizer Inc.

-

GSK plc.

Other Notable Key Players

-

COSRX

-

NEOGENLAB US

-

AbbVie Inc.

-

DONG-A Pharmaceutical

-

Hugel Inc.

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 145.3 Million |

|

Revenue Forecast in 2030 |

USD 284.3 Million |

|

Growth Rate |

CAGR of 9.8% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst