Global Commercial Real Estate Market Rebalances: Recovery, Regional Shifts, and Strategic Innovation

Published: 2025-09-12

Commercial Real Estate Market evolves amid headwinds—from the United States to China and Europe—highlighting sector resilience, innovation, and opportunity.

Latest Developments (2024–2025)

-

U.S. Heat in Office Markets: In New York City, The Wall Street Journal highlights JPMorgan’s new $3 billion headquarters at 270 Park Avenue as a bellwether for revival. Occupancy above pre-pandemic levels and strong leasing in premium spaces signal confidence. Reuters also reports renewed investor interest (e.g., Blackstone, Amazon) in office properties as return-to-office trends accelerate.

-

Tax Loss Becomes Municipal Headache: Office buildings across major U.S. cities lost an estimated $557 billion in value between 2019 and 2023, denting local tax revenues and prompting reallocation toward volatile income and sales taxes.

-

Office-to-Residential Conversions: In Houston, underutilized office stock is being redeveloped. A 27-story tower will convert to 553 apartments, reflecting adaptive reuse strategies spurred by 25.9 % vacancy rates.

-

Global Investment Moves: Brookfield raised nearly $6 billion in Q1 2025 toward a $16 billion real estate fund targeting distressed properties, particularly in warehousing and residential sectors.

-

United Kingdom Rebound: Canary Wharf Group’s office assets rose by £10 million in H1 2025, buoyed by heightened leasing—office occupancy hit 89.2 %.

Applications Across Industries

CRE is increasingly serving non-traditional functions:

-

Logistics & Industrial: Persistent demand for distribution and warehouse facilities.

-

Tech & Data: Escalating need for data centers, driven by digital transformation and artificial intelligence deployment.

-

Life Sciences & Flexible Office: Growth in flexible labs and “we” office spaces catering to collaborative models.

-

Residential Hybridization: Office-to-living conversions highlight industry flexibility—creating mixed-use equity.

Components of CRE Market

|

Segment |

Description |

|

Property Types |

Offices, industrial/logistics, retail, multifamily, data centers, life sciences |

|

Transaction Models |

Sales, leasing, conversion, redevelopment, investment funds |

|

Funding Sources |

Bank loans, non-bank financing, opportunistic equity, public-private partnerships |

Key Players & Recent Strategies

-

Brookfield Asset Management: Aggressively raising capital ($16 B fund) to buy distressed CRE at 20–40 % discounts. Fund includes logistics and residential assets.

-

CoStar Group: Expanding data and mapping reach by acquiring Matterport (3D spatial mapping) for $1.6 B, and Domain Group in Australia for $1.92 B.

-

RXR & Naftali Group: RXR acquired 590 Madison Ave for $1.08 B as part of its office recovery strategy; Naftali Group is redeveloping 800 Fifth Ave into luxury condos.

Other notable players from Technavio’s tracking include CBRE, Prologis, Segro, WeWork, Dalian Wanda, etc.

Future Prospects in Commercial Real Estate: 2025 and Beyond

-

Conversion activity outpaces new builds: CBRE projects that in 2025, conversions and demolitions of office space will exceed new office construction—an unprecedented shift in the CRE landscape.

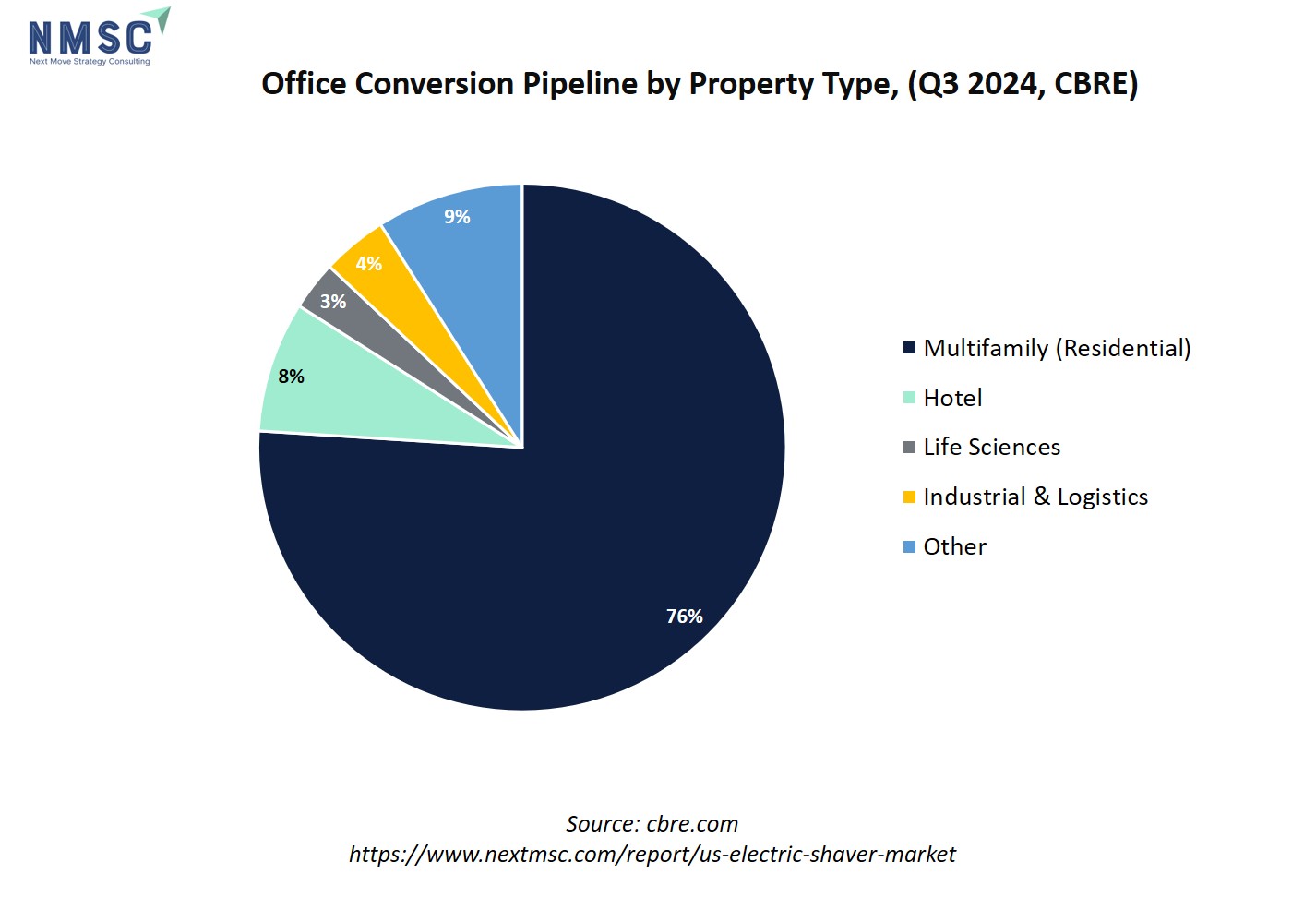

The latest CBRE analysis highlights a strong trend in commercial real estate conversions, with 76% of active projects shifting toward multifamily housing. This dominance reflects rising housing demand in urban centers and the push to repurpose underutilized office buildings into residential units. Hotels represent the second-largest share at 8%, as certain properties find renewed life in short-term accommodation markets. Meanwhile, industrial and logistics conversions (4%) are benefiting from the surge in e-commerce, while life sciences projects (3%) have declined amid tighter funding conditions. The remaining 9% fall under “other” uses, such as mixed-use developments. This distribution underscores a clear future trajectory: repurposing vacant commercial spaces into multifamily housing will remain the primary growth avenue, with niche opportunities in logistics and hospitality depending on regional demand.

-

Scale of conversions: Over 23.3 million sq ft of office space will be repurposed or demolished in the U.S., compared to just 12.7 million sq ft of new office construction.

-

Urban redevelopment example: In New York, large-scale conversions like 25 Water Street, transitioning from office to housing with over 1,300 apartments, highlight the trend’s scale and impact.

Conclusion

Overall, the Commercial Real Estate market in 2024–2025 is undergoing correction but shows resilience in key sectors and regions. The United States leads, particularly in premium offices and tech-driven CRE. Asia-Pacific, led by China, remains the fastest-growing but faces structural headwinds. Europe shows pockets of strength amid broader caution. Key players are pursuing opportunistic investments and technological enhancements. Recovery, adaptive reuse, and strategic innovation will define CRE’s trajectory in the near term.

About Next Move Strategy Consulting:

Next Move Strategy Consulting is a premier market research and management consulting firm that has been committed to provide strategically analysed well documented latest research reports to its clients. The research industry is flooded with many firms to choose from, what makes Next Move different from the rest is its top-quality research and the obsession of turning data into knowledge by dissecting every bit of it and providing fact-based research recommendation that is supported by information collected from over 500 million websites, paid databases, industry journals and one on one consultations with industry experts across a diverse range of industry sectors. The high-quality customized research reports with actionable insights and excellent end-to-end customer service help our clients to take critical business decisions that enables them to move beyond time and have competitive edge in the industry.

We have been servicing over 1000 customers globally that includes 90% of the Fortune 500 companies over a decade. Our analysts are constantly tracking various high growth markets and identifying hidden opportunities in each sector or the industry. We provide one of the industry’s best quality syndicate as well as custom research reports across 10 different industry verticals. We are committed to deliver high quality research solutions in accordance to your business needs. Our industry standard delivery solutions that ranges from the pre consultation to after-sales services, provide an excellent client experience and ensure right strategic decision making for businesses.

For more information please contact:

Next Move Strategy Consulting

5th Floor 867

Boylston St, STE 500,

Boston, MA 02116, U.S.

E-Mail: [email protected]

Direct: +18577585017

Website: www.nextmsc.com

Add Comment