AMR Fleet Management Market by Type (Indoor, Outdoor, Hybrid AMRs), by Product Component (Software–Fleet Management, Multi-Robot Orchestration, Other Supporting Software, Hardware, Services), by Software Delivery & License Model (SaaS Subscription, Perpetual License, and Others), by Fleet Compatibility (Single Vendor, Multi-Vendor Heterogeneous Fleet, Vendor Neutral Orchestration), and Others – Global Opportunity Analysis and Forecast 2024–2030

AMR Fleet Management Industry Outlook

The global AMR Fleet Management Market size was valued at USD 3.61 billion in 2024 and is estimated to reach USD 4.32 billion in 2025 and is predicted to reach USD 10.55 billion by 2030 with a CAGR of 19.56% from 2025-2030.

The AMR fleet management market is experiencing strong growth driven by rising labor costs, workforce shortages, and the increasing demand for warehouse automation. Industries such as logistics, warehousing, and manufacturing are adopting AMRs to streamline material handling, picking, sorting, and transportation tasks, reducing reliance on manual labor while improving efficiency and productivity. Integration with Industry 4.0 and smart warehousing technologies further accelerates adoption, enabling seamless data exchange, intelligent decision-making, and enhanced operational visibility.

However, high capital investment remains a major restraint, particularly for small and medium enterprises. Looking ahead, the development of standardized communication protocols is expected to create significant opportunities, enabling interoperability and driving broader market expansion.

Rising Labor Costs and Workforce Shortages Boost the Market Demand

The logistics, warehousing, and manufacturing sectors are facing mounting challenges due to rising labor costs and a shortage of skilled workers. Traditional material handling operations rely heavily on manual labor, which increases operational expenses and slows down throughput.

AMR fleet management solutions automate repetitive and time-consuming tasks such as transporting goods, picking, and sorting. By reducing dependency on human operators, companies control labor costs, maintain consistent productivity, and address workforce shortages, making AMR adoption a cost-effective and strategic decision.

Increase in Demand for AMRs to Automate Warehouse Tasks Drives the Market Growth

The growing need to automate warehouse operations such as picking, sorting, and product transportation, especially within the manufacturing sector, is significantly driving the AMR fleet management market demand. Autonomous mobile robots (AMRs) enhance inventory management, optimize logistics workflows, and reduce operational inefficiencies, leading to faster delivery times and improved customer satisfaction.

For example, WEG launched an autonomous mobile robot designed to optimize manufacturing operations and production logistics, showcasing the rising adoption of AMRs in industrial settings. As more companies integrate AMRs to streamline warehouse processes, the demand for comprehensive fleet management solutions continues to expand, propelling overall AMR fleet management market expansion.

Integration with Smart Warehousing and Industry 4.0 Fuels Market Expansion

The shift toward Industry 4.0 and smart warehousing is transforming how warehouses and factories operate. IoT-enabled sensors, AI-driven warehouse management systems, and ERP platforms are creating data-rich environments where automation thrives. AMR fleet management solutions integrate seamlessly with these systems, allowing robots to operate intelligently in dynamic environments, communicate with other automated equipment, and execute complex tasks with minimal human intervention. This integration enhances workflow visibility, reduces errors, and enables data-driven decision-making, positioning AMR fleets as a cornerstone of modern automated operations.

High Capital Investment Restraint the Market Growth

The high initial investment required to implement AMR fleet management systems remains a key barrier, particularly for small and medium-sized enterprises. Costs associated with purchasing autonomous mobile robots, integrating them into existing workflows, maintaining the systems, and training personnel be prohibitive. This significant financial burden deters many potential adopters from investing in AMR technologies, limiting market penetration among smaller players.

Introduction of Standardized Communication Protocols Creates Future Opportunity

The advancement of standardized communication protocols presents a significant growth opportunity for the AMR fleet management market. Standardization allows AMRs from different manufacturers to communicate effectively, understand each other’s commands, and share operational data seamlessly. This reduces integration complexity, provides companies with greater flexibility in selecting AMRs, and encourages broader adoption across industries, thereby unlocking new growth potential for fleet management solutions.

Market Segmentation and Scope of Study

The AMR fleet management market report is segmented by type, product component, software delivery and license model, fleet compatibility, navigation and guidance technology, security and compliance, customer size and buyer type, fleet scale, deployment model, application, end-user, and region. By type, it includes indoor AMRs, outdoor AMRs, and hybrid AMRs. Based on product component, the market covers software, hardware, and services. Software delivery and license models include SaaS subscription, perpetual license, consumption pay-as-you-go, and managed service.

Deployment models include on-premise, cloud, and hybrid. Applications cover transportation, pick and place, palletizing/depalletizing, sorting, tracking, monitoring, and others. End-users include warehousing and logistics, manufacturing, healthcare, retail, agriculture, food & beverage, and others, with regional analysis across North America, Europe, Asia-Pacific, and Rest of the World (RoW).

Geographical Analysis

A major driver of the AMR fleet management market share in North America is the rapid growth of the e-commerce sector. According to Coursera in 2025, the U.S. holds the second-largest share of global e-commerce, valued at USD 1,064,290.8 million, generating USD 90,069 million in revenue in 2024 alone. This surge in online shopping has created immense pressure on warehouses and distribution centers to accelerate order fulfillment, enhance accuracy, and reduce operational bottlenecks. To meet this demand, businesses are increasingly adopting AMR fleets integrated with advanced fleet management systems, enabling efficient automation of picking, sorting, and material transport, thereby ensuring scalability and faster delivery in a highly competitive market.

In Europe, a key driver of the market is the growing emphasis on warehouse automation to support e-commerce expansion. With rising online retail activity across countries like Germany, the UK, and France, companies are under pressure to improve order accuracy, reduce delivery times, and manage high-volume logistics. The strong focus on digitalization and adoption of Industry 4.0 practices further boosts the deployment of AMR fleets. Fleet management solutions play a critical role in coordinating multi-robot operations, optimizing workflows, and ensuring seamless integration with warehouse management systems, enabling European businesses to stay competitive while meeting the region’s increasing demand for fast and efficient order fulfillment.

In Asia Pacific, the integration of advanced technologies such as AI, IoT, and machine learning is a significant driver of the market. These innovations allow AMRs to navigate dynamic warehouse environments, optimize routes, and execute tasks with greater precision. AI-driven fleet management platforms enhance task allocation, predictive maintenance, and overall operational efficiency, while IoT-enabled connectivity ensures seamless communication between robots and warehouse systems. As industries in Asia Pacific rapidly adopt smart logistics and digital transformation, these technological advancements are accelerating the deployment of AMR fleets, strengthening supply chain automation, and positioning the region as a hub for intelligent warehouse operations.

In Rest of the World (ROW), the AMR fleet management sector is driven by the growing adoption of automation in emerging economies across Latin America, the Middle East, and Africa. Rising industrial activities, expansion of retail and logistics infrastructure, and increasing demand for faster order fulfillment are encouraging companies to integrate AMRs into their operations. Additionally, government initiatives supporting smart manufacturing and digital transformation are fostering adoption. AMR fleet management solutions in ROW help businesses overcome challenges related to labor shortages, improve material handling efficiency, and enhance supply chain visibility, making them a strategic investment for companies aiming to stay competitive in rapidly evolving markets.

Strategic Innovations Adopted by Key Players

Key players in the AMR Fleet Management industry are driving growth through advanced product launches, next-generation software upgrades, and strategic collaborations.

-

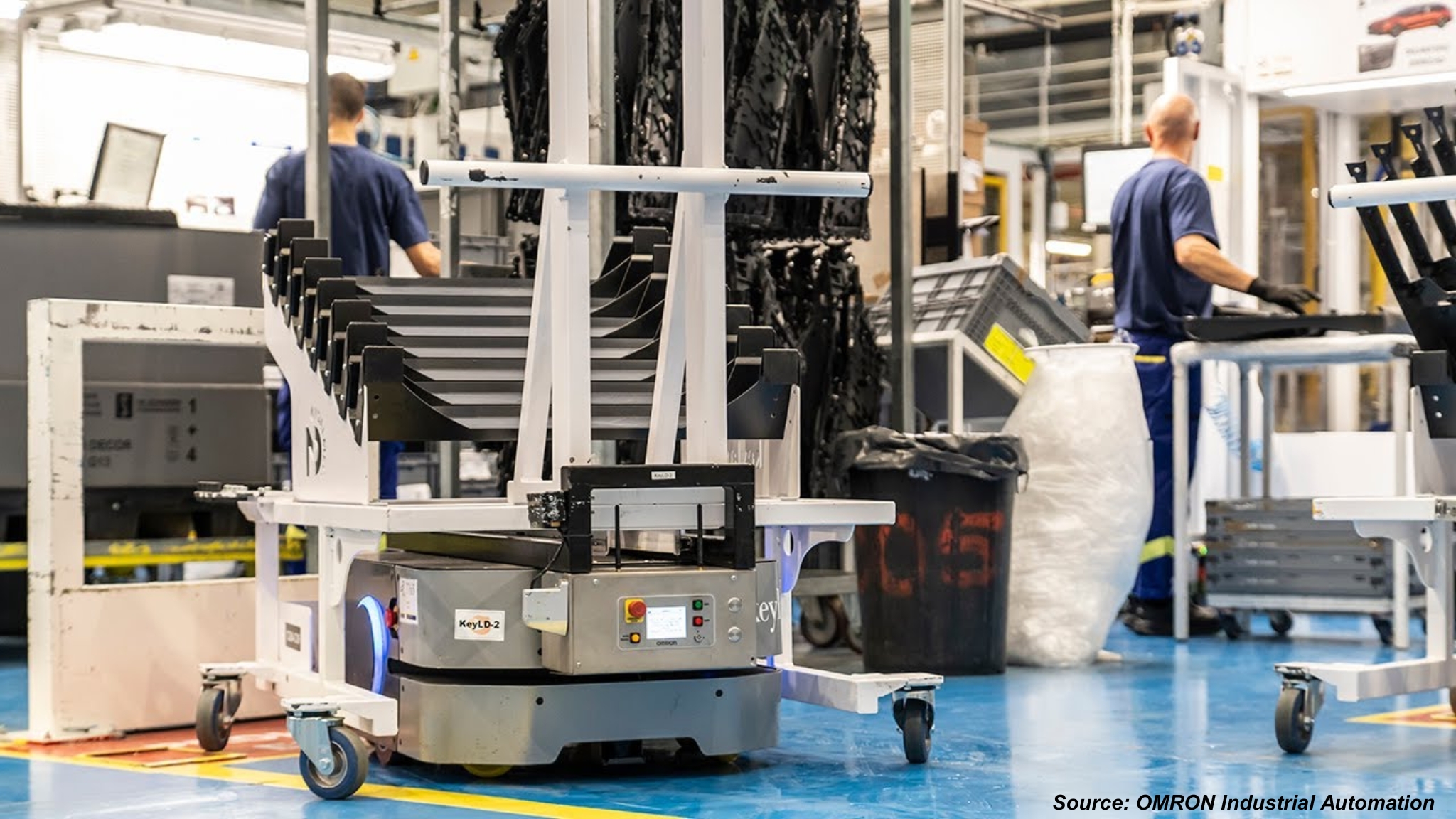

In May 2025, OMRON Corporation introduced the OL-450S, a new versatile AMR designed for high-efficiency material transport (up to 450 kg payload) with omni-directional movement, wireless charging, 360° safety, and seamless integration with the FLOW Core software ecosystem.

-

In March 2025, Zebra unveiled advanced automation solutions, including the Aurora Velocity scan tunnel and wearable/mobile computing innovations, further enhancing AMR integration in warehousing.

-

In January 2025, Zebra launched its Symmetry Fulfillment solution, combining Zebra Connect Fulfillment AMRs with software, wearable tech, and analytics. It boosts warehouse picking productivity while reducing the required AMR count by up to 30% through an AI-driven Team Intelligence system.

-

In April 2024, OMRON Corporation released FLOW Core 4.0 and Virtual Fleet Manager, next-gen AMR fleet management software. It introduces 3D LiDAR support, hypervisor-based deployment, customizable docking strategies, dynamic wireless diagnostics, and enhanced analytical capabilities via FLOW iQ and MobilePlanner 8.

-

In March 2024, Locus Robotics partnered with John Lewis to deploy Locus AMRs at the latter’s distribution center in Milton Keynes. The LocusBots work alongside human workers to increase productivity, efficiency, and accuracy in order fulfilment allowing them to better meet rising customer demand.

Key Benefits

-

The report provides quantitative analysis and estimations of the industry from 2024 to 2030, which assists in identifying the prevailing AMR fleet management market opportunities.

-

The study comprises a deep-dive analysis of the current and future AMR fleet management market trends to depict prevalent investment pockets in the sector.

-

Information related to key drivers, restraints, and opportunities and their impact on the AMR fleet management market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

AMR Fleet Management Market Key Segments

By Type

-

Indoor AMRs

-

Outdoor AMRs

-

Hybrid AMRs

By Product Component

-

Software

-

Fleet Management Software

-

Multi Robot Orchestration Software

-

Other Supporting Software

-

-

Hardware

-

Services

By Software delivery and license model

-

SaaS subscription

-

Perpetual license

-

Consumption pays as you go

-

Managed service

By Fleet compatibility

-

Single vendor

-

Multi-vendor heterogeneous fleet

-

Vendor neutral orchestration

By Navigation and guidance technology

-

Visual SLAM

-

Map based localization

-

Magnetic guidance

-

Beacon or tag based

-

GNSS for outdoor

By Security and compliance

-

Basic access control and logging

-

Advanced cybersecurity and encryption

-

Regulatory safety compliance

By Customer size and buyer type

-

Small and medium enterprise SME

-

Large enterprise

-

System integrator and reseller

By Fleet scale

-

Small fleet

-

Medium fleet

-

Large fleet

-

Multi-site global fleets

By Deployment model

-

On Premise

-

Cloud

-

Hybrid

By Application

-

Transportation

-

Pick and Place

-

Palletizing and Depalletizing

-

Sorting

-

Tracking and Monitoring

-

Others

By End-User

-

Warehousing and Logistics

-

Manufacturing

-

Healthcare

-

Retail

-

Agriculture

-

Food and beverage

-

Others

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

-

RoW

-

Latin America

-

Middle East

-

Africa

-

Key Players

-

OMRON Corporation

-

KNAPP AG

-

Swisslog AG

-

Geekplus Technology Co., Ltd.

-

GreyOrange Pte. Ltd.

-

Clearpath Robotics Inc.

-

Locus Robotics Corp.

-

Boston Dynamics, Inc.

-

Seegrid Corporation

-

Exotec SAS

-

HAI ROBOTICS Co., Ltd.

-

ForwardX Robotics Co., Ltd.

-

Vecna Robotics, Inc.

Report Scope and Segmentation

|

Parameters |

Details |

|

Market Size in 2025 |

USD 4.32 Billion |

|

Revenue Forecast in 2030 |

USD 10.55 Billion |

|

Growth Rate |

CAGR of 19.56% from 2024 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst