Cloud Robotics Market by Component (Software, Services), by Robot Type (Stationary Industrial Robots, Others), by Service Model (Infrastructure as a Service, Platform as a Service, Others), by Application (Manufacturing Operations, Logistics and Supply Chain, Field Services, Direct Service Provision), and by End-User (Industrial Enterprises, Commercial Businesses, Government Entities, Individual Consumers) – Global Opportunity Analysis and Industry Forecast, 2025–2030

Industry Overview

The global Cloud Robotics Market size was valued at USD 9.66 billion in 2024, with an estimation of USD 12.11 billion in 2025 and is predicted to reach USD 37.72 billion by 2030 with a CAGR of 25.50% from 2025-2030

The market is experiencing robust growth, driven by the rapid expansion of e-commerce, increased military spending, and rising automation in the automotive industry. As businesses seek greater efficiency in inventory and supply chain management, cloud-based robotic solutions are increasingly adopted for real-time coordination and scalability.

Meanwhile, defense applications are leveraging cloud robotics for surveillance and mission-critical operations amid a global military expenditure of USD 1,635 billion. In the automotive sector, a 10.7% rise in U.S. industrial robot installations highlights the shift toward intelligent manufacturing.

However, high upfront costs and complex integration challenges limit adoption, especially among SMEs. Future opportunities lie in IoT integration, with the emergence of the Internet of Robotic Things (IoRT) enabling enhanced connectivity, predictive maintenance, and autonomous decision-making, expanding the market’s potential across sectors.

E-commerce Expansion Drives the Market Growth

Growing e-commerce, driven by an increase in online shopping and consumer expectations for quick delivery, boost the cloud robotics market growth. As businesses automate warehousing and inventory management, it requires cloud-based robotics for enhancing operational efficiency and order fulfilment.

The International Trade Administration (ITA) in 2024, the Global B2C ecommerce revenue is expected to grow to USD 5.5 trillion by 2027 at a steady 14.4% compound annual growth rate. Thus, the growing ecommerce sector rises the demand for cloud robots for maintaining accuracy in inventory management.

Rising Military Spending Accelerates Adoption of Cloud Robotics for Defense Applications

The expansion in the military sector fuels the cloud robotics market demand as military sector seeks advanced automation for tasks such as logistics, surveillances and reconnaissance to optimize operations and improve mission effectiveness. The top five military spenders, the United States, China, Russia, Germany and India, accounted for 60 per cent of the global total, with combined spending of USD 1635 billion, according to new data published by the Stockholm International Peace Research Institute (SIPRI) in 2025. The surge in military expenditure accelerates cloud-based robots for enhancing real-time decision-making in critical missions that in turn propels the market growth.

Surge in Automotive Automation Accelerates Adoption of Cloud Robotics

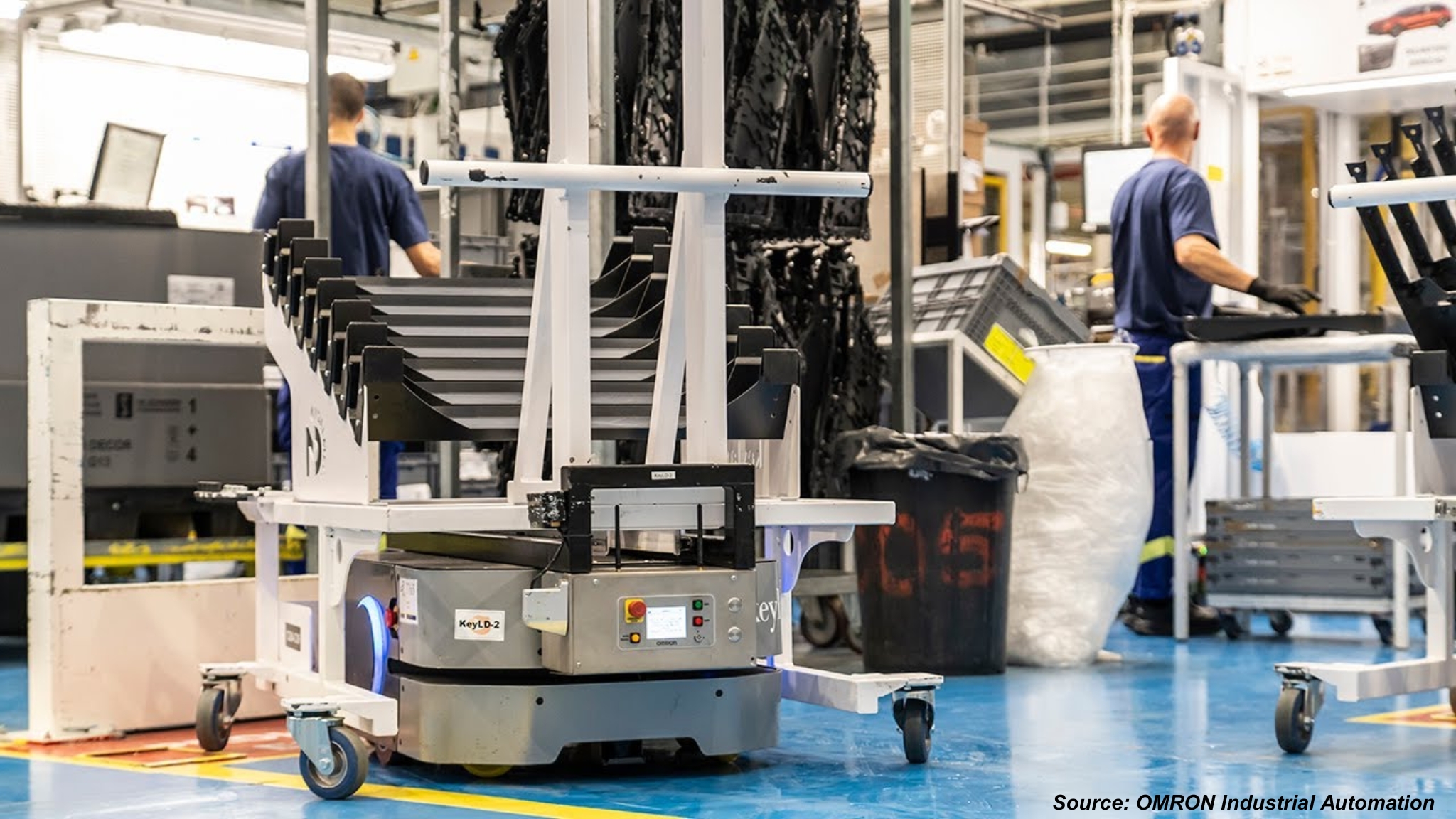

The growth of the automotive sector continues to fuel demand for cloud robotics, as manufacturers increasingly adopt smart automation to boost productivity and meet shifting consumer demands. Automakers are integrating cloud-based robotic systems to handle tasks such as assembly line automation, predictive maintenance, and real-time performance monitoring, streamlining operations and improving manufacturing agility.

According to the International Federation of Robotics (IFR) in 2025, industrial robot installations in the U.S. automotive industry rose by 10.7% in 2024, reaching 13,700 units. This significant investment in automation highlights the industry's shift toward intelligent, connected manufacturing environments.

As automakers ramp up automation, cloud robotics becomes essential for coordinating robotic systems, enabling centralized control, and optimizing supply chain and production workflows, ultimately propelling market growth.

High Upfront Implementation Costs Restrain Market Adoption

The adoption of cloud robotics is significantly hindered by the high initial investment required for implementation. Deploying cloud-enabled robotic systems involves substantial capital outlays for robotic hardware, sensors, cloud infrastructure, network upgrades, and software integration.

Additionally, organizations must invest in employee training and system customization to align the technology with existing operations. These upfront costs are particularly burdensome for small and medium-sized enterprises (SMEs), which lack the financial resources to support such large-scale transformations.

The delayed return on investment (ROI) further discourages early adoption, limiting the pace at which cloud robotics solutions are deployed across industries. As a result, high implementation costs remain a key restraint on the overall growth of the market.

IoT-Enabled Connectivity Unlocks New Growth Opportunities for Cloud Robotics

The integration of Internet of Things (IoT) in cloud robotics is anticipated to create future opportunity of the market through innovative convergence of robotics and IoT and enhancing the capabilities of cloud robotics. By integrating smart sensors, connectivity, and cloud computing, Internet of Robotic Things (IoRT) enables seamless collaboration among multiple robots and other connected devices. This technology allows for improved decision-making, predictive maintenance, and autonomous operation and thereby expected for a broader market in future.

Market Segmentations and Scope of the Study

The cloud robotics market report is segmented by component, robot type, service model, application, end-user and regions. Components include software and services such as support, implementation, and training. Service models encompass IaaS, PaaS, SaaS, and RaaS, enabling scalable deployment across environments. Applications cover manufacturing logistics & supply chain, field services and others. Regional growth spans North America, Europe, Asia-Pacific, and the Rest of the World, propelled by advances in cloud services and demand for smart automation solutions.

Geographical Analysis

North America’s cloud robotics market share is largely propelled by the region’s strong focus on industrial automation, especially across the manufacturing, logistics, and automotive sectors. Organizations in the United States and Canada are increasingly adopting cloud-connected robotic systems to improve operational efficiency, streamline supply chains, and lower production costs.

The widespread availability of advanced cloud infrastructure, combined with ongoing investments in research, development, and digital transformation, further supports this growth. The automotive and logistics industries, in particular, are experiencing notable increases in automation efforts. This dynamic and tech-forward industrial landscape continues to position North America as a major contributor to the global expansion of the sector.

The increasing emphasis on public safety and smart city development across Europe is driving the adoption of cloud robotics. Governments and municipalities are exploring the use of cloud-connected robots for surveillance, infrastructure monitoring, crowd management, and emergency response. These robots, supported by cloud infrastructure, operate in real time, access shared data, and coordinate with other digital systems across urban environments. As cities across Europe invest in becoming more connected and resilient, the integration of cloud robotics into public service operations is gaining traction, contributing to the region’s growing demand for intelligent robotic solutions.

Asia-Pacific’s market is experiencing steady growth, driven in part by the expansion and modernization of the healthcare sector. In India alone, the healthcare sector has become one of the country’s largest employers, engaging 7.5 million people as of FY24, reflecting the sector’s scale and ongoing development, according to the India Brand Equity Foundation (IBEF) in 2025.

As healthcare institutions across the region invest in improving service delivery, there is increasing interest in cloud-connected robotic solutions for tasks such as patient monitoring, remote diagnostics, and hospital logistics. This growing workforce, paired with a rising need for operational efficiency and smart infrastructure, is encouraging the gradual adoption of cloud robotics to support digital transformation in healthcare systems across the region.

In the Rest of the World (RoW) region, the increasing push toward digital transformation in the logistics and warehousing sectors is emerging as a major driver of cloud robotics adoption. Countries across Latin America, the Middle East, and Africa are investing in modernizing their supply chain infrastructure to meet the growing demands of e-commerce, urbanization, and cross-border trade.

Cloud robotics offers real-time data sharing, centralized control, and intelligent automation, enabling faster order fulfillment and reduced operational costs. As businesses in these regions strive to enhance logistics efficiency and stay competitive in a global market, the demand for scalable and flexible cloud-based robotic solutions is gaining momentum.

Strategic Innovations Adopted by Key Players

Key players in the cloud robotics industry are advancing innovation through AI-driven analytics, cloud-native robotic fleet orchestration, and strategic partnerships, enabling real-time coordination, predictive maintenance, and scalable automation across industries such as manufacturing, logistics, and warehousing.

-

In April 2025, AWS partnered with Rockwell Automation to deliver cloud-enabled industrial automation solutions tailored for fleet control, predictive maintenance, and real-time analytics, demonstrating AWS’s cloud applications in robotics and operational technology.

-

In July 2024, Rapyuta Robotics officially began offering its Automated Storage and Retrieval System (ASRS) in the U.S., showcasing scalable, cloud-connected warehouse automation technology designed for real-time, coordinated robotic operations.

-

In July 2024, Formant introduced Formant Analytics, a cloud-based dashboard tool that provides real-time operational data, predictive insights, and ROI tracking for robotics fleets.

-

In March 2024, Locus unveiled LocusHub, a cloud-enabled business intelligence engine that provides AI‑powered, predictive insights for warehouse operations and AMR coordination.

-

In 2024, InOrbit launched RobOps Copilot, a generative AI-powered assistant that transforms robot fleet data into real-time operational insights via natural language interfaces. The tool optimizes autonomous robot missions across mixed-fleet environments.

Key Benefits

-

The report provides quantitative analysis and estimations of the market from 2025 to 2030, which assists in identifying the prevailing industry opportunities.

-

The study comprises a deep-dive analysis of the current and future cloud robotics market trends to depict prevalent investment pockets in the sector.

-

Information related to key drivers, restraints, and opportunities and their impact on the market is provided in the report.

-

Competitive analysis of the players, along with their market share is provided in the report.

-

SWOT analysis and Porters Five Forces model is elaborated in the study.

-

Value chain analysis in the market study provides a clear picture of roles of stakeholders.

Cloud Robotics Market Key Segments

By Component

-

Software

-

Services

-

Support & Maintenance

-

Implementation

-

Training

-

By Robot Type

-

Stationary Industrial Robots

-

Articulated robotic arms

-

SCARA robots

-

Parallel/delta robots

-

Collaborative robots (cobots)

-

-

Mobile Ground Robots

-

Autonomous Mobile Robots (AMRs)

-

Automated Guided Vehicles (AGVs)

-

Inspection/maintenance robots

-

-

Aerial Robots

-

Delivery drones

-

Surveillance drones

-

Agricultural spraying drones

-

-

Specialized Service Robots

-

Medical/surgical robots

-

Agricultural field robots

-

Cleaning/disinfection robots

-

By Service Model

-

Infrastructure as a Service (IaaS)

-

Platform as a Service (PaaS)

-

Software as a Service (SaaS)

-

Robot as a Service (RaaS)

By Application

-

Manufacturing Operations

-

Assembly line automation

-

Material handling systems

-

Quality inspection stations

-

-

Logistics & Supply Chain

-

Warehouse automation

-

Inventory management

-

Package delivery systems

-

-

Field Services

-

Agricultural operations

-

Infrastructure inspection

-

Public safety missions

-

-

Direct Service Provision

-

Healthcare assistance

-

Retail/hospitality services

-

Residential/home services

-

By End-User

-

Industrial Enterprises

-

Automotive manufacturers

-

Electronics producers

-

Industrial equipment makers

-

-

Commercial Businesses

-

Logistics/transportation firms

-

Healthcare providers

-

Retail/hospitality chains

-

-

Government Entities

-

Defense/military organizations

-

Municipal/public works

-

Emergency services

-

-

Individual Consumers

-

Residential users

-

Educational institutions

-

Small farm operators

-

By Region

-

North America

-

The U.S.

-

Canada

-

Mexico

-

Europe

-

The UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Netherlands

-

Finland

-

Sweden

-

Norway

-

Russia

-

Rest of Europe

-

Asia-Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Singapore

-

Taiwan

-

Thailand

-

Rest of Asia-Pacific

-

RoW

-

Latin America

-

Middle East

-

Africa

Key Players

-

Amazon Web Services, Inc.

-

Google Cloud Platform

-

Microsoft Corporation

-

C2RO Cloud Robotics Inc.

-

Kuka AG

-

CloudMinds

-

V3 Smart Technologies

-

Rapyuta Robotics

-

Ortelio Ltd.

-

Aethon

-

InOrbit

-

Formant

-

OTTO Motors (by Clearpath Robotics)

-

Brain Corp

-

ABB Ltd.

-

Fanuc Corporation

-

Universal Robots

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 12.11 Billion |

|

Revenue Forecast in 2030 |

USD 37.72 Billion |

|

Growth Rate |

CAGR of 25.50% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

10 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst