1. INTRODUCTION

1.1. REPORT DESCRIPTION

1.2. WHO SHOULD READ THIS REPORT

1.3. KEY MARKET SEGMENTS

1.4. RESEARCH METHODOLOGY

1.4.1 SECONDARY RESEARCH

1.4.2 DATA ANALYSIS FRAMEWORK

1.4.3 MARKET SIZE ESTIMATION

1.4.4 FORECASTING

1.4.5 PRIMARY RESEARCH AND DATA VALIDATION

2. ASIA-PACIFIC COLD PIPE INSULATION MARKET – EXECUTIVE SUMMARY

2.1. MARKET SNAPSHOT, 2022 - 2030, MILLION USD

3. MARKET OVERVIEW

3.1. MARKET DEFINITION AND SCOPE

3.2. MARKET DYNAMICS

3.2.1 DRIVERS

3.2.1.1. GOVERNMENT INITIATIVES FOR ENERGY-EFFICIENT SOLUTIONS

3.2.1.2. THE GROWING IMPACT OF URBANIZATION & INDUSTRIALIZATION

3.2.1.3. RISING DEMAND FOR INSULATION IN THE OIL & GAS INDUSTRY

3.2.2 RESTRAINTS

3.2.2.1. THE HIGH INITIAL COST ASSOCIATED WITH THE INSTALLATION OF AN INSULATION SYSTEM

3.2.3 OPPORTUNITIES

3.2.3.1. EMERGING TECHNOLOGIES TO ACCELERATE THE ADOPTION OF COLD PIPE INSULATION

3.3. VALUE CHAIN ANALYSIS

3.4. PATTERN LANDSCAPE

3.5. PRICING ANALYSIS

3.6. KEY REGULATION ANALYSIS

4. MARKET SHARE ANALYSIS

4.1. MARKET SHARE ANALYSIS OF TOP COLD PIPE INSULATOIN PROVIDERS, 2022

5. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

5.1. OVERVIEW

5.2. FIBER GLASS

5.2.1 ASIA-PACIFIC FIBER GLASS, BY COUNTRY

5.3. FOAM GLASS

5.3.1 ASIA-PACIFIC FOAM GLASS, BY COUNTRY

5.4. ELASTOMERIC FOAM

5.4.1 ASIA-PACIFIC ELASTOMERIC FOAM, BY COUNTRY

5.5. POLYURETHANE FOAM

5.5.1 ASIA-PACIFIC POLYURETHANE FOAM, BY COUNTRY

5.6. POLYSTYRENE FOAM

5.6.1 ASIA-PACIFIC POLYSTYRENE FOAM, BY COUNTRY

5.7. POLYETHYLENE FOAM

5.7.1 ASIA-PACIFIC POLYETHYLENE FOAM, BY COUNTRY

5.8. RUBBER

5.8.1 ASIA-PACIFIC RUBBER, BY COUNTRY

5.9. OTHERS

5.9.1 ASIA-PACIFIC OTHERS, BY COUNTRY

6. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

6.1. OVERVIEW

6.2. UPTO -18C

6.2.1 ASIA-PACIFIC UPTO -18C, BY COUNTRY

6.3. -19C TO -180C

6.3.1 ASIA-PACIFIC -19C TO -180C, BY COUNTRY

6.4. -181C TO -210C

6.4.1 ASIA-PACIFIC -181C TO -210C, BY COUNTRY

6.5. LESS THAN -210C

6.5.1 ASIA-PACIFIC LESS THAN -210C, BY COUNTRY

7. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY APPLICATION

7.1. OVERVIEW

7.2. HVAC

7.2.1 ASIA-PACIFIC HVAC, BY COUNTRY

7.3. REFRIGERATION

7.3.1 ASIA-PACIFIC REFRIGERATION, BY COUNTRY

7.4. CRYOGENIC

7.4.1 ASIA-PACIFIC CRYOGENIC, BY COUNTRY

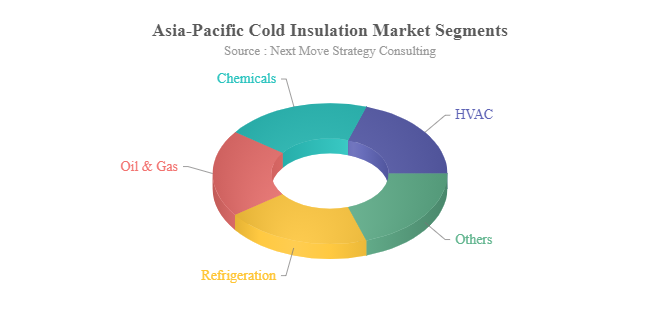

8. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

8.1. OVERVIEW

8.2. OIL AND GAS

8.2.1 ASIA-PACIFIC OIL AND GAS, BY COUNTRY

8.3. CHEMICALS

8.3.1 ASIA-PACIFIC CHEMICALS, BY COUNTRY

8.4. FOOD PROCESSING

8.4.1 ASIA-PACIFIC FOOD PROCESSING, BY COUNTRY

8.5. PHARMACEUTICALS

8.5.1 ASIA-PACIFIC PHARMACEUTICALS, BY COUNTRY

8.6. OTHERS

8.6.1 ASIA-PACIFIC OTHERS, BY COUNTRY

9. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY COUNTRY

9.1. OVERVIEW

9.2. CHINA

9.2.1 CHINA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.2.2 CHINA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.2.3 CHINA COLD PIPE INSULATION MARKET, BY APPLICATION

9.2.4 CHINA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.3. JAPAN

9.3.1 JAPAN COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.3.2 JAPAN COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.3.3 JAPAN COLD PIPE INSULATION MARKET, BY APPLICATION

9.3.4 JAPAN COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.4. INDIA

9.4.1 INDIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.4.2 INDIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.4.3 INDIA COLD PIPE INSULATION MARKET, BY APPLICATION

9.4.4 INDIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.5. SOUTH KOREA

9.5.1 SOUTH KOREA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.5.2 SOUTH KOREA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.5.3 SOUTH KOREA COLD PIPE INSULATION MARKET, BY APPLICATION

9.5.4 SOUTH KOREA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.6. AUSTRALIA

9.6.1 AUSTRALIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.6.2 AUSTRALIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.6.3 AUSTRALIA COLD PIPE INSULATION MARKET, BY APPLICATION

9.6.4 AUSTRALIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.7. INDONESIA

9.7.1 INDONESIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.7.2 INDONESIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.7.3 INDONESIA COLD PIPE INSULATION MARKET, BY APPLICATION

9.7.4 INDONESIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.8. SINGAPORE

9.8.1 SINGAPORE COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.8.2 SINGAPORE COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.8.3 SINGAPORE COLD PIPE INSULATION MARKET, BY APPLICATION

9.8.4 SINGAPORE COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.9. TAIWAN

9.9.1 TAIWAN COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.9.2 TAIWAN COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.9.3 TAIWAN COLD PIPE INSULATION MARKET, BY APPLICATION

9.9.4 TAIWAN COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.10. THAILAND

9.10.1 THAILAND COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.10.2 THAILAND COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.10.3 THAILAND COLD PIPE INSULATION MARKET, BY APPLICATION

9.10.4 THAILAND COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.11. MALAYSIA

9.11.1 MALAYSIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.11.2 MALAYSIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.11.3 MALAYSIA COLD PIPE INSULATION MARKET, BY APPLICATION

9.11.4 MALAYSIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.12. PHILIPPINES

9.12.1 PHILIPPINES COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.12.2 PHILIPPINES COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.12.3 PHILIPPINES COLD PIPE INSULATION MARKET, BY APPLICATION

9.12.4 PHILIPPINES COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.13. VIETNAM

9.13.1 VIETNAM COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.13.2 VIETNAM COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.13.3 VIETNAM COLD PIPE INSULATION MARKET, BY APPLICATION

9.13.4 VIETNAM COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

9.14. REST OF ASIA-PACIFIC

9.14.1 REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY MATERIAL TYPE

9.14.2 REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE

9.14.3 REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY APPLICATION

9.14.4 REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY END USER INDUSTRY

10. COMPANY PROFILES

10.1. DONGSUNG CHEMICAL CO LTD

10.1.1 COMPANY OVERVIEW

10.1.2 COMPANY SNAPSHOT

10.1.3 PRODUCT PORTFOLIO

10.1.4 BUSINESS PERFORMANCE

10.1.5 KEY STRATEGIC MOVES & DEVELOPMENTS

10.1.6 PRIMARY MARKET COMPETITORS

10.2. INSAFOAM INSULATION (MALAYSIA) SDN BHD.

10.2.1 COMPANY OVERVIEW

10.2.2 COMPANY SNAPSHOT

10.2.3 PRODUCT PORTFOLIO

10.2.4 KEY STRATEGIC MOVES & DEVELOPMENTS

10.2.5 PRIMARY MARKET COMPETITORS

10.3. SUPERLON HOLDINGS BERHAD

10.3.1 COMPANY OVERVIEW

10.3.2 OPERATING BUSINESS SEGMENTS

10.3.3 OPERATING BUSINESS SEGMENTS

10.3.4 PRODUCT PORTFOLIO

10.3.5 BUSINESS PERFORMANCE

10.3.6 SALES BY BUSINESS SEGMENT

10.3.7 SALES BY GEOGRAPHIC SEGMENT

10.3.8 KEY STRATEGIC MOVES & DEVELOPMENTS

10.3.9 PRIMARY MARKET COMPETITORS

10.4. EMATCO INDUSTRIAL PTE LTD.

10.4.1 COMPANY OVERVIEW

10.4.2 COMPANY SNAPSHOT

10.4.3 PRODUCT PORTFOLIO

10.4.4 KEY STRATEGIC MOVES & DEVELOPMENTS

10.4.5 PRIMARY MARKET COMPETITORS

10.5. INSULFLEX CORPORATION SDN BHD

10.5.1 COMPANY OVERVIEW

10.5.2 COMPANY SNAPSHOT

10.5.3 PRODUCT PORTFOLIO

10.5.4 KEY STRATEGIC MOVES & DEVELOPMENTS

10.5.5 PRIMARY MARKET COMPETITORS

10.6. ARMACELL INTERNATIONAL S.A.

10.6.1 COMPANY OVERVIEW

10.6.2 COMPANY SNAPSHOT

10.6.3 PRODUCT PORTFOLIO

10.6.4 KEY STRATEGIC MOVES & DEVELOPMENTS

10.6.5 PRIMARY MARKET COMPETITORS

10.7. OWENS CORNING

10.7.1 COMPANY OVERVIEW

10.7.2 COMPANY SNAPSHOT

10.7.3 OPERATING BUSINESS SEGMENTS

10.7.4 PRODUCT PORTFOLIO

10.7.5 BUSINESS PERFORMANCE

10.7.6 SALES BY BUSINESS SEGMENT

10.7.7 SALES BY GEOGRAPHIC SEGMENT

10.7.8 KEY STRATEGIC MOVES & DEVELOPMENTS

10.7.9 PRIMARY MARKET COMPETITORS

10.8. SUPREME INDUSTRIES LIMITED

10.8.1 COMPANY OVERVIEW

10.8.2 COMPANY SNAPSHOT

10.8.3 OPERATING BUSINESS SEGMENTS

10.8.4 PRODUCT PORTFOLIO

10.8.5 BUSINESS PERFORMANCE

10.8.6 SALES BY BUSINESS SEGMENT

10.8.7 KEY STRATEGIC MOVES & DEVELOPMENTS

10.8.8 PRIMARY MARKET COMPETITORS

10.9. BASF SE

10.9.1 COMPANY OVERVIEW

10.9.2 COMPANY SNAPSHOT

10.9.3 OPERATING BUSINESS SEGMENTS

10.9.4 PRODUCT PORTFOLIO

10.9.5 BUSINESS PERFORMANCE

10.9.6 SALES BY BUSINESS SEGMENT

10.9.7 SALES BY GEOGRAPHIC SEGMENT

10.9.8 KEY STRATEGIC MOVES & DEVELOPMENTS

10.9.9 PRIMARY MARKET COMPETITORS

10.10. NICHIAS CORPORATION

10.10.1 COMPANY OVERVIEW

10.10.2 COMPANY SNAPSHOT

10.10.3 OPERATING BUSINESS SEGMENTS

10.10.4 PRODUCT PORTFOLIO

10.10.5 BUSINESS PERFORMANCE

10.10.6 SALES BY BUSINESS SEGMENT

10.10.7 SALES BY GEOGRAPHIC SEGMENT

10.10.8 KEY STRATEGIC MOVES & DEVELOPMENTS

10.10.9 PRIMARY MARKET COMPETITORS

10.11. DUPONT

10.11.1 COMPANY OVERVIEW

10.11.2 COMPANY SNAPSHOT

10.11.3 OPERATING BUSINESS SEGMENTS

10.11.4 PRODUCT PORTFOLIO

10.11.5 BUSINESS PERFORMANCE

10.11.6 SALES BY BUSINESS SEGMENT

10.11.7 SALES BY GEOGRAPHIC SEGMENT

10.11.8 KEY STRATEGIC MOVES & DEVELOPMENTS

10.11.9 PRIMARY MARKET COMPETITORS

10.12. COVESTRO AG

10.12.1 COMPANY OVERVIEW

10.12.2 COMPANY SNAPSHOT

10.12.3 OPERATING BUSINESS SEGMENTS

10.12.4 PRODUCT PORTFOLIO

10.12.5 BUSINESS PERFORMANCE

10.12.6 SALES BY BUSINESS SEGMENT

10.12.7 SALES BY GEOGRAPHIC SEGMENT

10.12.8 KEY STRATEGIC MOVES & DEVELOPMENTS

10.12.9 PRIMARY MARKET COMPETITORS

10.13.M COMPANY

10.13.1 COMPANY OVERVIEW

10.13.2 COMPANY SNAPSHOT

10.13.3 OPERATING BUSINESS SEGMENTS

10.13.4 PRODUCT PORTFOLIO

10.13.5 BUSINESS PERFORMANCE

10.13.6 SALES BY GEOGRAPHIC SEGMENT

10.13.7 SALES BY GEOGRAPHIC SEGMENT

10.13.8 KEY STRATEGIC MOVES & DEVELOPMENTS

10.13.9 PRIMARY MARKET COMPETITORS

10.14. L’ISOLANTE K-FLEX S.P.A.

10.14.1 COMPANY OVERVIEW

10.14.2 COMPANY SNAPSHOT

10.14.3 PRODUCT PORTFOLIO

10.14.4 KEY STRATEGIC MOVES & DEVELOPMENTS

10.14.5 PRIMARY MARKET COMPETITORS

10.15. DAIKIN INDUSTRIES LTD

10.15.1 COMPANY OVERVIEW

10.15.2 COMPANY SNAPSHOT

10.15.3 OPERATING BUSINESS SEGMENTS

10.15.4 PRODUCT PORTFOLIO

10.15.5 BUSINESS PERFORMANCE

10.15.6 SALES BY BUSINESS SEGMENT

10.15.7 SALES BY GEOGRAPHIC SEGMENT

10.15.8 KEY STRATEGIC MOVES & DEVELOPMENTS

10.15.9 PRIMARY MARKET COMPETITORS

LIST OF TABLES

TABLE 1. PATTERN LANDSCAPE OF COLD PIPE INSULATION MARKET

TABLE 2. PRICING ANALYSIS OF COLD PIPE INSULATION MARKET

TABLE 3. KEY REGULATION ANALYSIS OF COLD PIPE INSULATION MARKET

TABLE 4. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 5. ASIA-PACIFIC FIBER GLASS, BY COUNTRY, 2022-2030, MILLION USD

TABLE 6. ASIA-PACIFIC FOAM GLASS, BY COUNTRY, 2022-2030, MILLION USD

TABLE 7. ASIA-PACIFIC ELASTOMERIC FOAM, BY COUNTRY, 2022-2030, MILLION USD

TABLE 8. ASIA-PACIFIC POLYURETHANE FOAM, BY COUNTRY, 2022-2030, MILLION USD

TABLE 9. ASIA-PACIFIC POLYSTYRENE FOAM, BY COUNTRY, 2022-2030, MILLION USD

TABLE 10. ASIA-PACIFIC POLYETHYLENE FOAM, BY COUNTRY, 2022-2030, MILLION USD

TABLE 11. ASIA-PACIFIC RUBBER, BY COUNTRY, 2022-2030, MILLION USD

TABLE 12. ASIA-PACIFIC OTHERS, BY COUNTRY, 2022-2030, MILLION USD

TABLE 13. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 14. ASIA-PACIFIC UPTO -18C, BY COUNTRY, 2022-2030, MILLION USD

TABLE 15. ASIA-PACIFIC -19C TO -180C, BY COUNTRY, 2022-2030, MILLION USD

TABLE 16. ASIA-PACIFIC -181C TO -210C, BY COUNTRY, 2022-2030, MILLION USD

TABLE 17. ASIA-PACIFIC LESS THAN -210C, BY COUNTRY, 2022-2030, MILLION USD

TABLE 18. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 19. ASIA-PACIFIC HVAC, BY COUNTRY, 2022-2030, MILLION USD

TABLE 20. ASIA-PACIFIC REFRIGERATION, BY COUNTRY, 2022-2030, MILLION USD

TABLE 21. ASIA-PACIFIC CRYOGENIC, BY COUNTRY, 2022-2030, MILLION USD

TABLE 22. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 23. ASIA-PACIFIC OIL AND GAS, BY COUNTRY, 2022-2030, MILLION USD

TABLE 24. ASIA-PACIFIC CHEMICALS, BY COUNTRY, 2022-2030, MILLION USD

TABLE 25. ASIA-PACIFIC FOOD PROCESSING, BY COUNTRY, 2022-2030, MILLION USD

TABLE 26. ASIA-PACIFIC PHARMACEUTICALS, BY COUNTRY, 2022-2030, MILLION USD

TABLE 27. ASIA-PACIFIC OTHERS, BY COUNTRY, 2022-2030, MILLION USD

TABLE 28. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY COUNTRY, 2022-2030, MILLION USD

TABLE 29. CHINA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 30. CHINA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 31. CHINA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 32. CHINA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 33. JAPAN COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 34. JAPAN COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 35. JAPAN COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 36. JAPAN COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 37. INDIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 38. INDIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 39. INDIA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 40. INDIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 41. SOUTH KOREA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 42. SOUTH KOREA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 43. SOUTH KOREA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 44. SOUTH KOREA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 45. AUSTRALIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 46. AUSTRALIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 47. AUSTRALIA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 48. AUSTRALIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 49. INDONESIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 50. INDONESIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 51. INDONESIA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 52. INDONESIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 53. SINGAPORE COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 54. SINGAPORE COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 55. SINGAPORE COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 56. SINGAPORE COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 57. TAIWAN COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 58. TAIWAN COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 59. TAIWAN COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 60. TAIWAN COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 61. THAILAND COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 62. THAILAND COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 63. THAILAND COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 64. THAILAND COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 65. MALAYSIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 66. MALAYSIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 67. MALAYSIA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 68. MALAYSIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 69. PHILIPPINES COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 70. PHILIPPINES COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 71. PHILIPPINES COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 72. PHILIPPINES COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 73. VIETNAM COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 74. VIETNAM COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 75. VIETNAM COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 76. VIETNAM COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 77. REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

TABLE 78. REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

TABLE 79. REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

TABLE 80. REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

TABLE 81. DONGSUNG CHEMICAL CO LTD: COMPANY SNAPSHOT

TABLE 82. DONGSUNG CHEMICAL CO LTD: PRODUCT PORTFOLIO

TABLE 83. DONGSUNG CHEMICAL CO LTD: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 84. INSAFOAM INSULATION (MALAYSIA) SDN BHD.: COMPANY SNAPSHOT

TABLE 85. INSAFOAM INSULATION (MALAYSIA) SDN BHD.: PRODUCT PORTFOLIO

TABLE 86. SUPERLON HOLDINGS BERHAD: OPERATING SEGMENTS

TABLE 87. SUPERLON HOLDINGS BERHAD: OPERATING SEGMENTS

TABLE 88. SUPERLON HOLDINGS BERHAD: PRODUCT PORTFOLIO

TABLE 89. SUPERLON HOLDINGS BERHAD: BUSINESS SEGMENT

TABLE 90. SUPERLON HOLDINGS BERHAD: GEOGRAPHIC SEGMENT

TABLE 91. EMATCO INDUSTRIAL PTE LTD.: COMPANY SNAPSHOT

TABLE 92. EMATCO INDUSTRIAL PTE LTD.: PRODUCT PORTFOLIO

TABLE 93. INSULFLEX CORPORATION SDN BHD: COMPANY SNAPSHOT

TABLE 94. INSULFLEX CORPORATION SDN BHD: PRODUCT PORTFOLIO

TABLE 95. ARMACELL INTERNATIONAL S.A.: COMPANY SNAPSHOT

TABLE 96. ARMACELL INTERNATIONAL S.A.: PRODUCT PORTFOLIO

TABLE 97. ARMACELL INTERNATIONAL S.A.: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 98. OWENS CORNING: COMPANY SNAPSHOT

TABLE 99. OWENS CORNING: OPERATING SEGMENTS

TABLE 100. OWENS CORNING: PRODUCT PORTFOLIO

TABLE 101. OWENS CORNING: BUSINESS SEGMENT

TABLE 102. OWENS CORNING: GEOGRAPHIC SEGMENT

TABLE 103. OWENS CORNING: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 104. SUPREME INDUSTRIES LIMITED: COMPANY SNAPSHOT

TABLE 105. SUPREME INDUSTRIES LIMITED: OPERATING SEGMENTS

TABLE 106. SUPREME INDUSTRIES LIMITED: PRODUCT PORTFOLIO

TABLE 107. SUPREME INDUSTRIES LIMITED: BUSINESS SEGMENT

TABLE 108. SUPREME INDUSTRIES LIMITED: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 109. BASF SE: COMPANY SNAPSHOT

TABLE 110. BASF SE: OPERATING SEGMENTS

TABLE 111. BASF SE: PR0DUCT PORTFOLIO

TABLE 112. BASF SE: BUSINESS SEGMENT

TABLE 113. BASF SE: GEOGRAPHIC SEGMENT

TABLE 114. BASF SE: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 115. NICHIAS CORPORATION: COMPANY SNAPSHOT

TABLE 116. NICHIAS CORPORATION: OPERATING SEGMENTS

TABLE 117. NICHIAS CORPORATION: PR0DUCT PORTFOLIO

TABLE 118. NICHIAS CORPORATION: BUSINESS SEGMENT

TABLE 119. NICHIAS CORPORATION: GEOGRAPHIC SEGMENT

TABLE 120. DUPONT: COMPANY SNAPSHOT

TABLE 121. DUPONT: OPERATING SEGMENTS

TABLE 122. DUPONT: PR0DUCT PORTFOLIO

TABLE 123. DUPONT: BUSINESS SEGMENT

TABLE 124. DUPONT: GEOGRAPHIC SEGMENT

TABLE 125. DUPONT: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 126. COVESTRO AG: COMPANY SNAPSHOT

TABLE 127. COVESTRO AG: OPERATING SEGMENTS

TABLE 128. COVESTRO AG: PR0DUCT PORTFOLIO

TABLE 129. COVESTRO AG: BUSINESS SEGMENT

TABLE 130. COVESTRO AG: GEOGRAPHIC SEGMENT

TABLE 131. COVESTRO AG: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 132.M COMPANY: COMPANY SNAPSHOT

TABLE 133.M COMPANY: OPERATING SEGMENTS

TABLE 134.M COMPANY: PRODUCT PORTFOLIO

TABLE 135.M COMPANY: BUSINESS SEGMENT

TABLE 136.M COMPANY: GEOGRAPHIC SEGMENT

TABLE 137. L’ISOLANTE K-FLEX S.P.A.: COMPANY SNAPSHOT

TABLE 138. L’ISOLANTE K-FLEX S.P.A.: PR0DUCT PORTFOLIO

TABLE 139. L’ISOLANTE K-FLEX S.P.A.: KEY STRATEGIC MOVES & DEVELOPMENTS

TABLE 140. DAIKIN INDUSTRIES LTD: COMPANY SNAPSHOT

TABLE 141. DAIKIN INDUSTRIES LTD: OPERATING SEGMENTS

TABLE 142. DAIKIN INDUSTRIES LTD: PR0DUCT PORTFOLIO

TABLE 143. DAIKIN INDUSTRIES LTD: BUSINESS SEGMENT

TABLE 144. DAIKIN INDUSTRIES LTD: GEOGRAPHIC SEGMENT

TABLE 145. DAIKIN INDUSTRIES LTD: KEY STRATEGIC MOVES & DEVELOPMENTS

LIST OF FIGURES

FIGURE 1. VALUE CHAIN ANALYSIS OF COLD PIPE INSULATION MARKET

FIGURE 1. MARKET SHARE ANALYSIS OF TOP COLD PIPE INSULATION PROVIDERS, 2022

FIGURE 2. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 3. ASIA-PACIFIC FIBER GLASS, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 4. ASIA-PACIFIC FOAM GLASS, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 5. ASIA-PACIFIC ELASTOMERIC FOAM, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 6. ASIA-PACIFIC POLYURETHANE FOAM, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 7. ASIA-PACIFIC POLYSTYRENE FOAM, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 8. ASIA-PACIFIC POLYETHYLENE FOAM, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 9. ASIA-PACIFIC RUBBER, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 10. ASIA-PACIFIC OTHERS, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 11. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 12. ASIA-PACIFIC UPTO -18C, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 13. ASIA-PACIFIC -19C TO -180C, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 14. ASIA-PACIFIC -181C TO -210C, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 15. ASIA-PACIFIC LESS THAN -210C, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 16. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 17. ASIA-PACIFIC HVAC, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 18. ASIA-PACIFIC REFRIGERATION, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 19. ASIA-PACIFIC CRYOGENIC, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 20. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 21. ASIA-PACIFIC OIL AND GAS, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 22. ASIA-PACIFIC CHEMICALS, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 23. ASIA-PACIFIC FOOD PROCESSING, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 24. ASIA-PACIFIC PHARMACEUTICALS, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 25. ASIA-PACIFIC OTHERS, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 26. ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY COUNTRY, 2022-2030, MILLION USD

FIGURE 27. CHINA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 28. CHINA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 29. CHINA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 30. CHINA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 31. JAPAN COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 32. JAPAN COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 33. JAPAN COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 34. JAPAN COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 35. INDIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 36. INDIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 37. INDIA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 38. INDIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 39. SOUTH KOREA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 40. SOUTH KOREA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 41. SOUTH KOREA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 42. SOUTH KOREA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 43. AUSTRALIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 44. AUSTRALIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 45. AUSTRALIA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 46. AUSTRALIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 47. INDONESIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 48. INDONESIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 49. INDONESIA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 50. INDONESIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 51. SINGAPORE COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 52. SINGAPORE COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 53. SINGAPORE COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 54. SINGAPORE COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 55. TAIWAN COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 56. TAIWAN COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 57. TAIWAN COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 58. TAIWAN COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 59. THAILAND COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 60. THAILAND COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 61. THAILAND COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 62. THAILAND COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 63. MALAYSIA COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 64. MALAYSIA COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 65. MALAYSIA COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 66. MALAYSIA COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 67. PHILIPPINES COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 68. PHILIPPINES COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 69. PHILIPPINES COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 70. PHILIPPINES COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 71. VIETNAM COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 72. VIETNAM COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 73. VIETNAM COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 74. VIETNAM COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 75. REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY MATERIAL TYPE, 2022-2030, MILLION USD

FIGURE 76. REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY TEMPERATURE RANGE, 2022-2030, MILLION USD

FIGURE 77. REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY APPLICATION, 2022-2030, MILLION USD

FIGURE 78. REST OF ASIA-PACIFIC COLD PIPE INSULATION MARKET, BY END USER INDUSTRY, 2022-2030, MILLION USD

FIGURE 79. DONGSUNG CHEMICAL CO LTD: NET SALES, 2020–2022 ($MILLION)

FIGURE 80. DONGSUNG CHEMICAL CO LTD: PRIMARY MARKET COMPETITORS

FIGURE 81. INSAFOAM INSULATION (MALAYSIA) SDN BHD.: PRIMARY MARKET COMPETITORS

FIGURE 82. SUPERLON HOLDINGS BERHAD: NET SALES, 2019–2021 ($MILLION)

FIGURE 83. SUPERLON HOLDINGS BERHAD: PRIMARY MARKET COMPETITORS

FIGURE 84. EMATCO INDUSTRIAL PTE LTD.: PRIMARY MARKET COMPETITORS

FIGURE 85. INSULFLEX CORPORATION SDN BHD: PRIMARY MARKET COMPETITORS

FIGURE 86. ARMACELL INTERNATIONAL S.A.: PRIMARY MARKET COMPETITORS

FIGURE 87. OWENS CORNING: NET SALES, 2020–2022 ($MILLION)

FIGURE 88. OWENS CORNING: PRIMARY MARKET COMPETITORS

FIGURE 89. SUPREME INDUSTRIES LIMITED: NET SALES, 2019–2021 ($MILLION)

FIGURE 90. SUPREME INDUSTRIES LIMITED: PRIMARY MARKET COMPETITORS

FIGURE 91. BASF SE: NET SALES, 2020-2022 ($MILLION)

FIGURE 92. BASF SE: PRIMARY MARKET COMPETITORS

FIGURE 93. NICHIAS CORPORATION: NET SALES, 2019-2021 ($MILLION)

FIGURE 94. NICHIAS CORPORATION: PRIMARY MARKET COMPETITORS

FIGURE 95. DUPONT: NET SALES, 2019-2021 ($MILLION)

FIGURE 96. DUPONT: PRIMARY MARKET COMPETITORS

FIGURE 97. COVESTRO AG: NET SALES, 2020-2022 ($MILLION)

FIGURE 98. COVESTRO AG: PRIMARY MARKET COMPETITORS

FIGURE 99. M COMPANY: NET SALES, 2020-2022 ($MILLION)

FIGURE 100. M COMPANY: PRIMARY MARKET COMPETITORS

FIGURE 101. L’ISOLANTE K-FLEX S.P.A.: PRIMARY MARKET COMPETITORS

FIGURE 102. DAIKIN INDUSTRIES LTD: NET SALES, 2020-2022 ($MILLION)

FIGURE 103. DAIKIN INDUSTRIES LTD: PRIMARY MARKET COMPETITORS