Australia Elevator Market By Product Type (Passenger Elevator, Freight Elevator and Others), By Technology (Traction and Hydraulic), By Service (Modernization, Maintenance, and New Installation), By Capacity (Less than 1500 kg, 1501 to 2500 kg, and Others), By Speed (Less than 1M/S, Between 1 to 4 M/S and Others), By Designation Control (Smart and Conventional), By Door Type (Automatic and Manual), End User (Residential; Commercial and Industrial) –Australia Analysis & Forecast, 2025–2030

Industry: Construction & Manufacturing | Publish Date: 10-Oct-2025 | No of Pages: 282 | No. of Tables: 234 | No. of Figures: 147 | Format: PDF | Report Code : CM1657

Australia Elevator Industry Outlook

The Australia Elevator Market was valued at USD 1,002.2 million in 2024 and is expected to reach USD 1,064.3 million by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 1,437.2 million by 2030, registering a CAGR of 6.19% from 2025 to 2030. In terms of volume, the market recorded 6,185 units in 2024, with forecasts indicating growth to 6,506 units by 2025 and further to 8,536 units by 2030, reflecting a CAGR of 5.6% over the same period.

The Australia elevator industry is undergoing consistent growth, largely fueled by rapid urbanisation and the rising number of high-rise residential, commercial, and infrastructure projects. This growth is also supported by ongoing investments in construction and redevelopment of public infrastructure such as hospitals, airports, and railway stations.

The industry is evolving with a strong emphasis on energy efficiency, smart elevator technologies, and improved accessibility. Regulatory frameworks focusing on safety, retrofitting, and building compliance are also shaping the Australia elevator market, ensuring that elevator systems meet high standards of performance and sustainability.

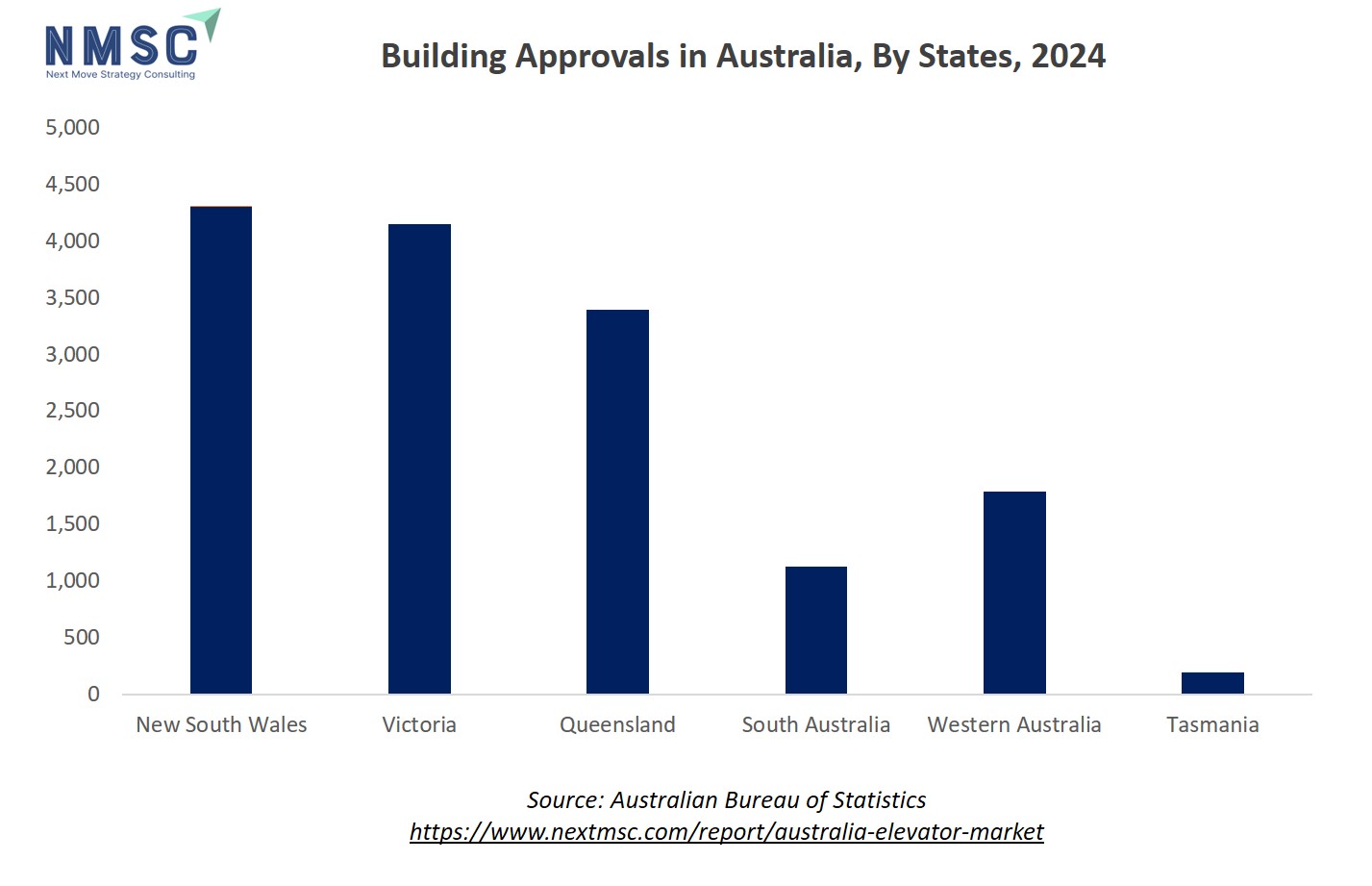

The above chart illustrates the distribution of building approvals across Australian states in 2024 and highlights its direct relevance to the country’s elevator market. New South Wales records the highest number of approvals, followed by Victoria and Queensland, reflecting strong urban growth and housing demand in these populous states, while Western Australia and South Australia show moderate activity and Tasmania records the lowest. Building approvals serve as a leading indicator of elevator demand, as many of these projects involve multi-storey residential, commercial, and mixed-use developments that require elevators for accessibility and compliance. As urban centres densify, the correlation between new constructions and elevator installations strengthens, creating significant growth opportunities for elevator manufacturers, service providers, and maintenance companies nationwide.

What are the Key Australia Elevator Industry Trends?

Are Energy-Efficient and Green Elevators A Must-Have in Australia?

Certainly, Australia’s focus on eco-friendly building standards and regenerative drives has made sustainable elevators essential. Locally, New South Wales and Victoria lead this push toward greener retrofits. The analysis is clear: energy-efficient drives cut operational costs and help buildings meet rising environmental benchmarks, like Green Star and NABERS. Companies accelerate R&D in regenerative motors, LED lighting, and low-carbon materials. For instance, RegenMaster retrofit kits in Australia enable existing lift systems to recover and reuse energy through regenerative braking technology, delivering up to 70% energy savings. They are ideal for offices, hotels, and residential buildings and offer a cost-effective path to improve efficiency and sustainability.

Can Modernization of Aging Stock Drive Australia’s Elevator Boom?

Yes, Australia’s existing elevators are aging fast, and modernization is booming. The market for retrofits in Australia is hitting a high. Many legacy systems, especially in Sydney and Melbourne, fall short of current safety codes and performance expectations. Modernization enhances capacity, safety, and compliance, offering a compelling ROI. In May 2025, in Australia, Otis completed a USD 100 million Gen3 modernization project at the 48-story office tower at 101 Collins Street. This upgrade reduced downtime by 30%, cut energy costs by 25% using regenerative drives, and added IoT-driven monitoring with Otis ONE, including a USD 2.5 million annual service contracts through 2031, which sets a clear example of large-scale, ROI-driven retrofit demand.

Also, Australia’s smart elevator market is gaining momentum as urban development, high-rise construction, and smart building adoption accelerate. These advanced systems, equipped with IoT connectivity, AI-driven traffic management, and touchless controls, are enhancing safety, efficiency, and user convenience. Growing focus on sustainability and green building standards is also encouraging the integration of energy-efficient passenger elevators technologies. Additionally, modernization of aging infrastructure is creating strong demand for retrofitting projects, positioning smart elevators as a key component in Australia’s shift toward smarter, more sustainable urban environments.

Will AI-Powered Traffic Control Redefine Elevator Service?

AI-driven destination control systems (DCS) are transforming how elevators manage traffic in Australia’s high-rise buildings. These systems group people by their floor destination, which helps reduce wait times, save energy, and make rides smoother. In Australia, they’re becoming common in modern office and residential towers. KONE Australia, for example, uses smart dispatch systems along with energy-efficient technologies like regenerative drives and predictive maintenance. This combination not only improves how elevators perform but also helps buildings run more efficiently. It's a smart solution for property owners looking to upgrade to safer, faster, and greener elevator systems.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Australia Elevator Industry in Next Decade?

The Australia elevator market is experiencing dynamic shifts driven by urban densification, rising high-rise construction, and growing focus on sustainability. With smart building integration becoming a norm in major cities like Sydney, Melbourne, and Brisbane, the demand for energy-efficient, digitally enabled elevator systems is surging. The government’s infrastructure push, alongside strong commercial real estate growth and an aging elevator base, is fueling market expansion and modernization projects.

However, the Australia elevator market isn’t without friction. Regulatory complexity, high installation costs, and skills shortages present persistent barriers. At the same time, breakthroughs in AI, IoT, and eco-efficient technologies are opening new frontiers. Companies that can align their offerings with Australia's energy and safety codes while embracing automation and connectivity stand to gain significantly. Amid this landscape, strategic innovation and regional customization are key to unlocking the full potential of this evolving sector.

Growth Drivers:

How is Urban High-Rise Development Driving Australia Elevator Market Demand?

Australia’s surge in urban high-rise development, driven by increasing density in cities like Sydney, where approximately 70% of residents live in apartment buildings, has significantly escalated the need for advanced elevator systems. This vertical expansion is fueling demand for high-capacity, high-speed, and smart elevator solutions. Property developers are increasingly seeking systems that not only deliver efficient vertical transportation but also meet stringent sustainability requirements. Elevator manufacturers that focus on the high-rise residential and commercial sectors by offering technology-integrated, tailored solutions stand to capture a substantial share of this growing market.

Is Government Infrastructure Investment Accelerating Australia Elevator Market Growth?

Australia’s government-backed infrastructure pipeline, valued at around USD 78.29 billion over the next ten years, is fueling demand for elevators in public and commercial facilities. Major initiatives in urban redevelopment, transport, and healthcare, such as the Sydney Metro expansions and significant hospital upgrade programs are creating a backlog of projects that necessitate high-capacity, durable lift systems. This sustained, government-driven activity offers elevator manufacturers stable, long-term contract opportunities. To fully leverage this momentum, companies should position themselves as reliable, compliant partners for the public sector, emphasizing robust performance and the scalability of their service offerings.

Growth Inhibitors:

Are Skilled Labour Shortages Delaying Elevator Installations and Upgrades?

Yes, a shortage of certified lift technicians is slowing down installation timelines and inflating project costs. For instance, many maintenance providers in Australia are now reporting longer wait times and higher quotes for elevator services due to an aging workforce and limited pool of qualified staff, exacerbating delays in modernization projects. According to a report, many companies are struggling to keep up with the volume of clients and are experiencing longer wait times for preventative maintenance, callbacks, and repairs, a direct result of the shortage of experienced technicians.

Is Retrofitting Aging Elevator Systems an Untapped Investment Opportunity in Australia?

Absolutely, over 60% of elevators in buildings over 30 years old require modernization to meet current performance and safety standards. Retrofitting offers a cost-effective alternative to complete replacements. This opens an investment opportunity in modular, upgrade-friendly systems targeting mid-tier residential and commercial buildings. Firms offering smart retrofit solutions with minimal downtime can tap into a sizable and underserved market segment.

How Australia Elevator Market is Segmented in this Report, And What Are the Key Insights from the Segmentation Analysis?

By Type Insights

How are Passenger, Freight, and Other Elevator Types Shaping the Australia Elevator Market in 2025?

On the basis of type, the Australia elevator market is segmented into passenger, freight, and others.

Passenger elevators dominate the Australian market, contributing over 75% of total demand in 2025. Their widespread use in high-rise apartments, offices, and public buildings reflects rising urban density. With increasing expectations for energy efficiency and smart technology, companies should prioritize compact, modular passenger elevators that integrate seamlessly with intelligent building systems.

Freight elevators represent around 15% of the market, catering to industrial sites, hospitals, and warehouses. As Australia’s logistics and healthcare sectors expand, demand for robust, high-capacity lift systems is rising. Customizable solutions with enhanced safety features and durable components can position suppliers favourably within this stable but essential segment.

The Others segment, including dumbwaiters, vehicle lifts, and service elevators, accounts for roughly 10% of the market. Though niche, it offers high-margin opportunities in luxury homes, hotels, and specialized commercial applications.

By Technology Insights

Which Elevator Technology—Traction or Hydraulic—is Leading Australia Elevator Market in 2025?

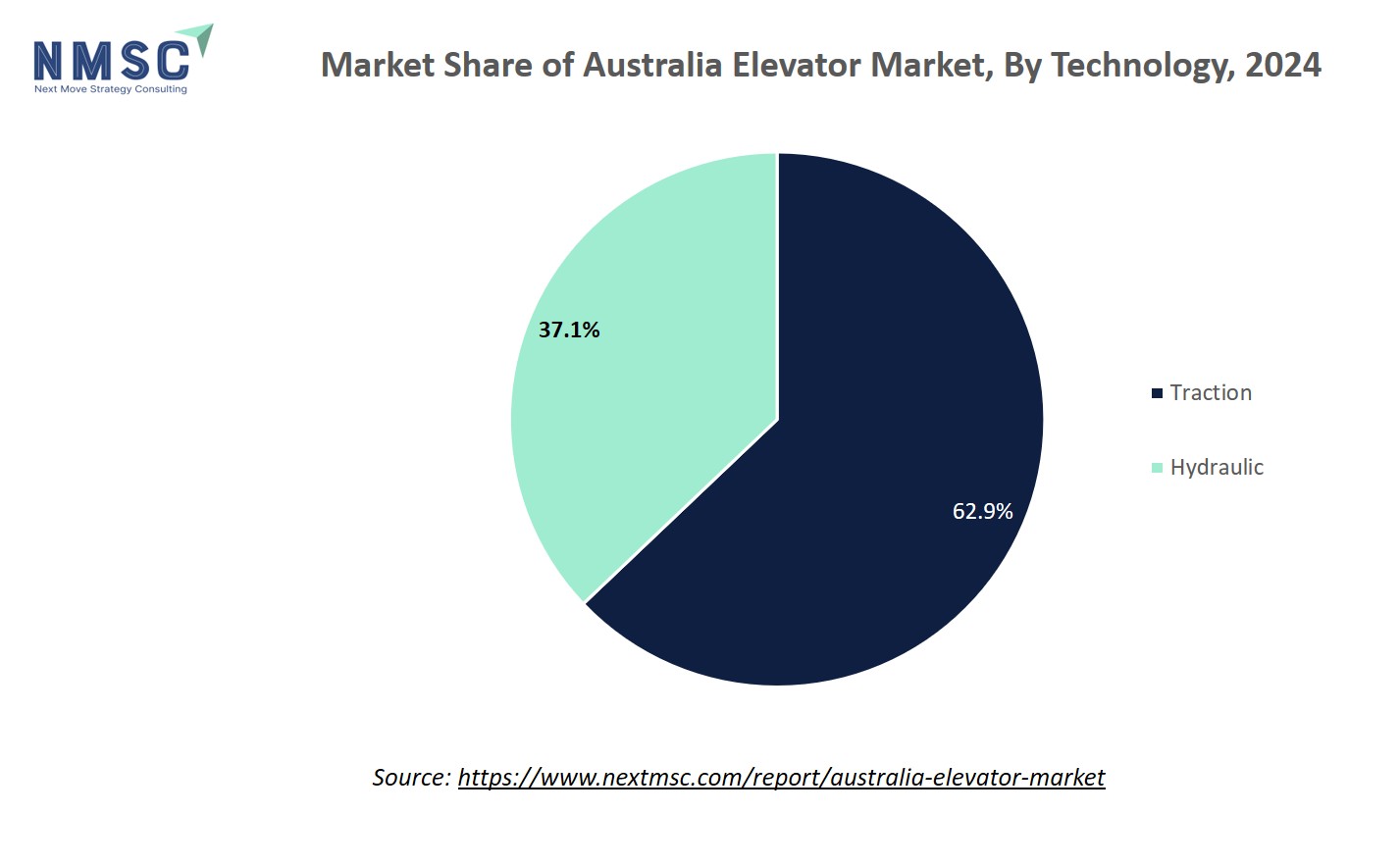

Based on technology, the Australia elevator market is segmented into traction and Hydraulic.

Traction elevators lead the Australian market in 2025, preferred for mid- to high-rise buildings due to their superior speed, energy efficiency, and smoother ride. With urban high-rise developments increasing, traction systems, especially machine-room-less variants are in high demand. Companies should focus on advancing smart traction systems with regenerative drives to meet green building requirements.

Hydraulic elevators hold a smaller market share, mainly used in low-rise buildings and renovations where space constraints or lower installation costs are key. Though slower and less efficient than traction systems, they remain viable for residential, retail, and small commercial spaces. Suppliers can retain relevance by offering eco-friendly hydraulic fluids and compact designs tailored for tight shafts.

By Service Insights

How is Modernization Outpacing New Installations and Maintenance?

Based on service type, the Australia elevator market is bifurcated into new installation, maintenance, and modernization.

Modernization claims the largest service segment, driven by ageing systems and stricter compliance. With a 2024 modernization market worth about USD 304.87 million and climbing, retrofit and upgrade projects are essential. Insight: Service providers should create bundled upgrade offerings combining compliance audits, smart IoT retrofits, and lease-to-own models to capture long-tail modernization demand. Maintenance is the second largest segment and is expected to rise to USD 292.94 million by 2030 at a CAGR of 5.2%.

By Capacity Insights

Which Capacity Segments Dominate Australia Elevator Market?

On the basis of capacity, the Australia elevator market is segmented into less than 1500 kg, 1501 to 2500 kg, 2501-4000 kg, and more than 4000 kg.

In Australia, the 1500–2500 kg capacity segment is the leader, mirroring global smart elevator trends where the 1000–2000 kg range commands about 40 % market share, thanks to demand in medium-rise residential and commercial buildings. Following closely, the under 1500 kg segment ranks second; globally, units below 1000 kg account for roughly a 30 % share, driven by smaller-scale residential and low traffic setups, and this pattern aligns with Australia’s installation mix.

By Speed Insights

Which Speed Segments Dominate Australia Elevator Market?

Based on speed, the market is segmented into less than 1M/S, between 1 to 4 M/S, and between 5 to 6 M/S.

Australian data on speed-specific elevator volumes is limited, but some studies suggest the 1–4 m/s segment leads, making up roughly 50–60% of installations in mid-to-high-rise residential and commercial buildings, aligning with Australia’s growing skyline. The less than 1 m/s category likely ranks second, particularly in low-rise residential and garden-villa applications where comfort and affordability are key. While the high-speed 5–6 m/s segment is vital for skyscrapers, it remains a smaller niche due to fewer ultra-tall structures in Australia compared to Asia.

By Deck Insights

Are Double-Deck Elevators Gaining Momentum over Single-Deck in High-Rise Developments?

On the basis of deck, the Australia elevator market is segmented into single-deck and double-deck.

Double-deck elevators are seeing a gradual rise in demand, particularly in premium high-rise commercial spaces. These systems can transport passengers to two consecutive floors simultaneously, improving vertical transport efficiency in tall buildings. With the increasing number of skyscrapers, the double-deck segment is poised for expansion.

By Designation Control Insights

Are Smart Elevators Redefining Passenger Experience in Urban Australia?

Based on designation control, the Australia elevator market is segmented into Smart and Conventional.

Yes, smart elevators are rapidly transforming the urban mobility experience in Australia's high-tech commercial and residential spaces. Integrated with IoT, AI, and destination dispatch systems, these elevators enable reduced waiting times and personalized travel experiences. smart elevators accounted for high installations in 2024, driven by smart building trends in cities like Sydney and Melbourne.

By Door Type Insights

Are Automatic Doors the Standard for Modern Vertical Mobility?

Based on door type, the Australia elevator market is segmented into automatic and manual.

Yes, automatic elevator doors dominate the Australian landscape. A report states that, based on elevator-door type, the automatic segment is expected to lead, offering safety, accessibility, and efficient operation across various indoor and outdoor venues. Their widespread adoption stems from user convenience, compliance with disability standards, and ease of integration with modern control systems.

By End-User Insights

Is Commercial End-User Leading the Australia Elevator Market in 2025?

On the basis of end-user, the Australia elevator market is segmented into residential, commercial and industrial.

Yes, commercial buildings occupy the largest share of the market. Commercial, residential, and industrial are key end-user segments, with commercial demand strongly bolstered by new office towers, malls, hotels, and hospitals in cities like Sydney and Melbourne. In 2024, approximately 4.9k new installations were recorded, projected to reach 6.7 thousand by 2029 at a 5.3% CAGR. This surge is driven by smart-city initiatives and infrastructure investments like Sydney’s USD 2.5B twin-tower project and Melbourne’s North Bank developments.

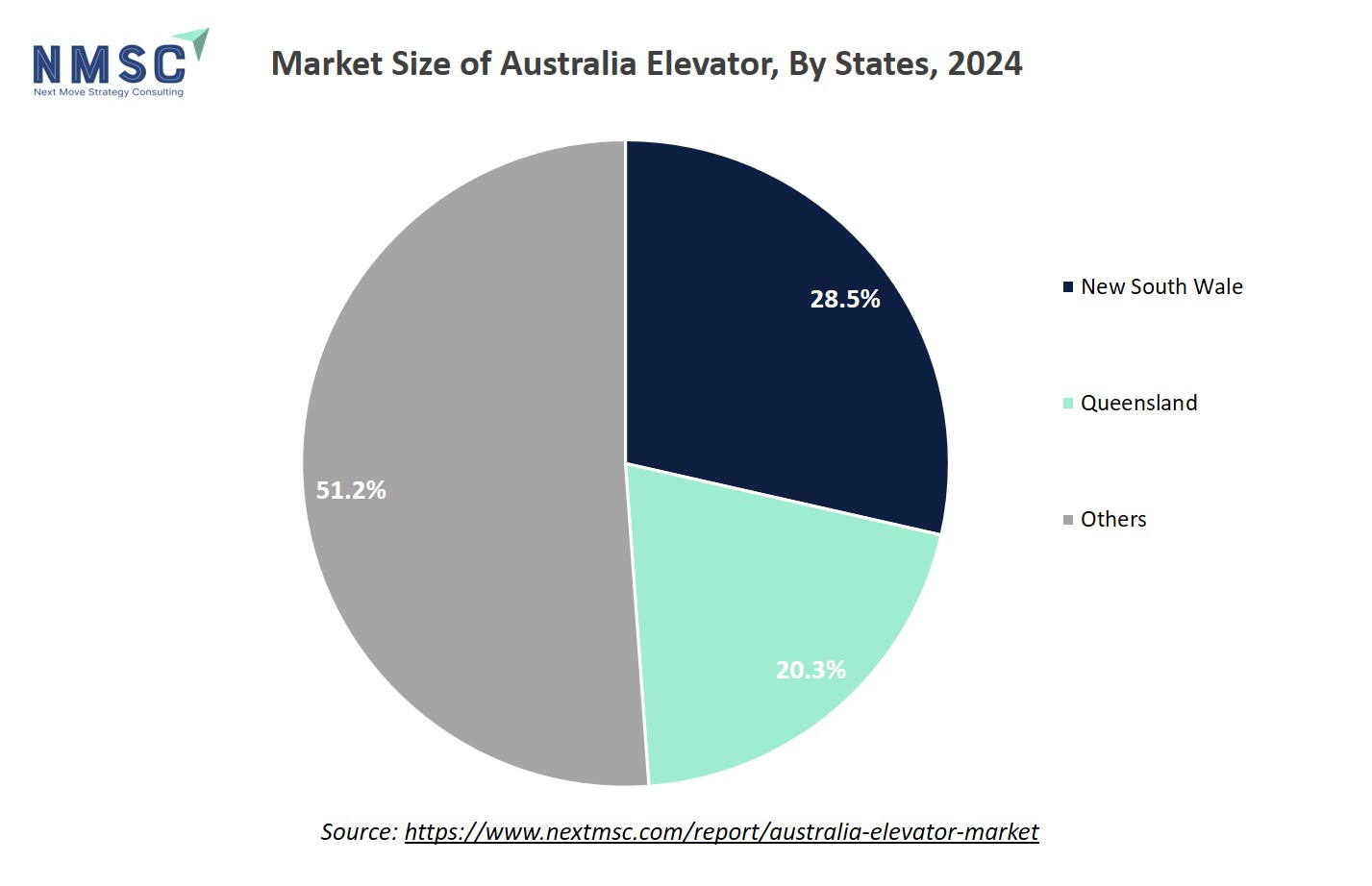

Regional Outlook

The market is geographically studied across the states of Australia - New South Wales, Queensland, South Australia, Tasmania, Victoria, Western Australia, and also their territories Northern Territory and Australian Capital Territory.

Australia Elevator Market in New South Wales

In New South Wales, the population grew approximately 1.7 % annually, reaching around 8.484 million by 30 June 2024, with interstate outflows slightly moderating growth even as net overseas migration contributed 142,000 to that total. Meanwhile, dwelling approvals averaged over 50,000 per year but fell by 7.8 % in the year to April 2025, bringing total approvals to about 42,100, including roughly 42,109 dwellings in the 12 months to November 2024. Despite this slowdown, substantially high-density approvals in Sydney's growth corridors, particularly north west and south west, signal sustained elevator demand in mid to high-rise residential developments. Migration-driven housing pressure underpins long-term elevator market growth, especially in new multi-unit projects.

Australia Elevator Market in Queensland

Queensland recorded strong annual growth of 2.26 %, reaching approximately 5.58 million residents by June 30, 2024, driven by both international and interstate migration. Building approvals remained solid at around 22,912 approvals in SE Queensland during FY 2024–25 (to March), down from the pandemic highs but still healthy. SE Queensland (Brisbane, Gold Coast, Sunshine Coast) leads urban densification, with regional home prices rising roughly 8.5 % for houses and 10.2 % for units over the year to March 2024, supporting increasing elevator installations in multi-storey apartments across Greater Brisbane and the Gold Coast.

Australia Elevator Market in South Australia

In South Australia, the population grew by approximately 1.35 % to about 1.878 million by 30 June 2024. Dwelling approvals in 2023 24 rose roughly 14 % to around 11,264 homes, spurred by continued infrastructure and residential starts trending upward. Metropolitan Adelaide, which contains about 77 % of the state's residents, is planning substantial new housing and transport infrastructure to support growth toward 2 million by 2051. These dynamic further bolsters elevator market potential, especially within emerging medium-density precincts and targeted infill redevelopment zones.

Australia Elevator Market in Tasmania

Tasmania remains the slowest-growing state, with population up just 0.3 % to about 575,500 by 30 June 2024. Dwelling approvals declined sharply, total approvals for FY 2024–25 (to March) were around 1,801 statewide, down roughly 12.6 % year-on-year. Hobart continues to add approximately 700 new homes per year, equating to around 3 to 3.5 homes per 1,000 residents, well below mainland averages. With limited high-rise development and a predominance of detached housing, elevator market growth is likely modest, confined to selective commercial and boutique residential developments.

Australia Elevator Market in Victoria

In Victoria, the population reached approximately 6.93 million by 30 June 2024, growing at 2.4 %, making it the second-fastest growing of all Australian states. Dwelling approvals declined by 13.5 % over the year to June 2024, totalling around 51,726 homes, mirroring a broader national slowdown. Melbourne continues to be Australia’s most urbanised state, with nearly 90 % of residents living in cities or towns. Outer-west and northwest suburbs around Melbourne are experiencing a surge in dwelling stock, up by over 40 % and projections suggest Victoria will need roughly 422,000 additional dwellings to accommodate close to a million more residents by the mid-2030s. All of this translates directly into a booming elevator market across mid- and high-rise apartment corridors.

Australia Elevator Market in Western Australia

Western Australia continues to lead Australia in growth, recording a 2.4 % increase to a population of 3.009 million as of December 31, 2024, the fastest growth rate among the states. In the 2023–24 financial year, WA saw 17,337 dwelling approvals, rebounding from prior volatility. Housing construction is booming, dwelling commencements surged to 19,360 in 2024, a 46 % rise from the previous year, with 6,146 completions in Q4 (December 2024), up 33 % year-on-year, which is the best performance since 2017. WA also led the nation in private housing starts, contributing to this uplift. On the finance side, the state topped the country in residential loan activity, with WA investor loan volumes rising approximately 43 % in late 2024, and owner-occupier loans growing fastest among states. Finally, dwelling stock is expanding rapidly in Perth’s outer suburbs, fueled by this upswing in approvals, commencements, and financing, trends that are driving strong elevator demand in emerging suburban mid-rise and multi-story residential developments, thanks to mining industry-driven inward migration.

Australia Elevator Market in the Northern Territory

Northern Territory’s growth has remained modest, with its population reaching 255,069 (growing ~0.79 %) by June 30, 2024, driven by modest natural increase (~593 in Jun 2024) and overseas migration, but partly offset by interstate outflows. Dwelling approvals in 2023–24 was low and volatile, with only around 397 residential approvals recorded by March 2025. Growth remains heavily concentrated in Darwin and surrounds Palmerston, a key outer urban centre, saw population gains (notably ~400 new residents over the year) and increased dwelling additions at the SA2 level. Consequently, elevator demand in the Territory stays niche, focused on selective commercial or multi-unit developments in Darwin and Palmerston, with little broader suburban momentum.

Australia Elevator Market in Australian Capital Territory

As of 31 December 2024, the Australian Capital Territory’s population reached 481,677, marking a 1.4 % increase over the year, driven by both natural increase and net overseas migration, despite a slight interstate outflow. In the 2023–24 financial year, ACT dwelling approvals softened, with apartment approvals leading but overall numbers declining (notably private sector high-density approvals fell 19% to 4,999 in April 2025). Meanwhile, mid- and high-density completions remained strong: in the six months to June 2024, 73 % of multi-unit projects completed were high-density apartments, with the remainder split between medium-density and townhouses. Major precincts across Inner North (Reid, Dickson), Belconnen, and the Molonglo Corridor continue to drive rapid multi-unit development. Taken together, this concentrated apartment boom supports a robust elevator market, especially in government, mixed-use, and multi-story residential infrastructure.

Competitive Landscape

Which Companies Dominate the Elevator Industry in Australia and How Do They Compete?

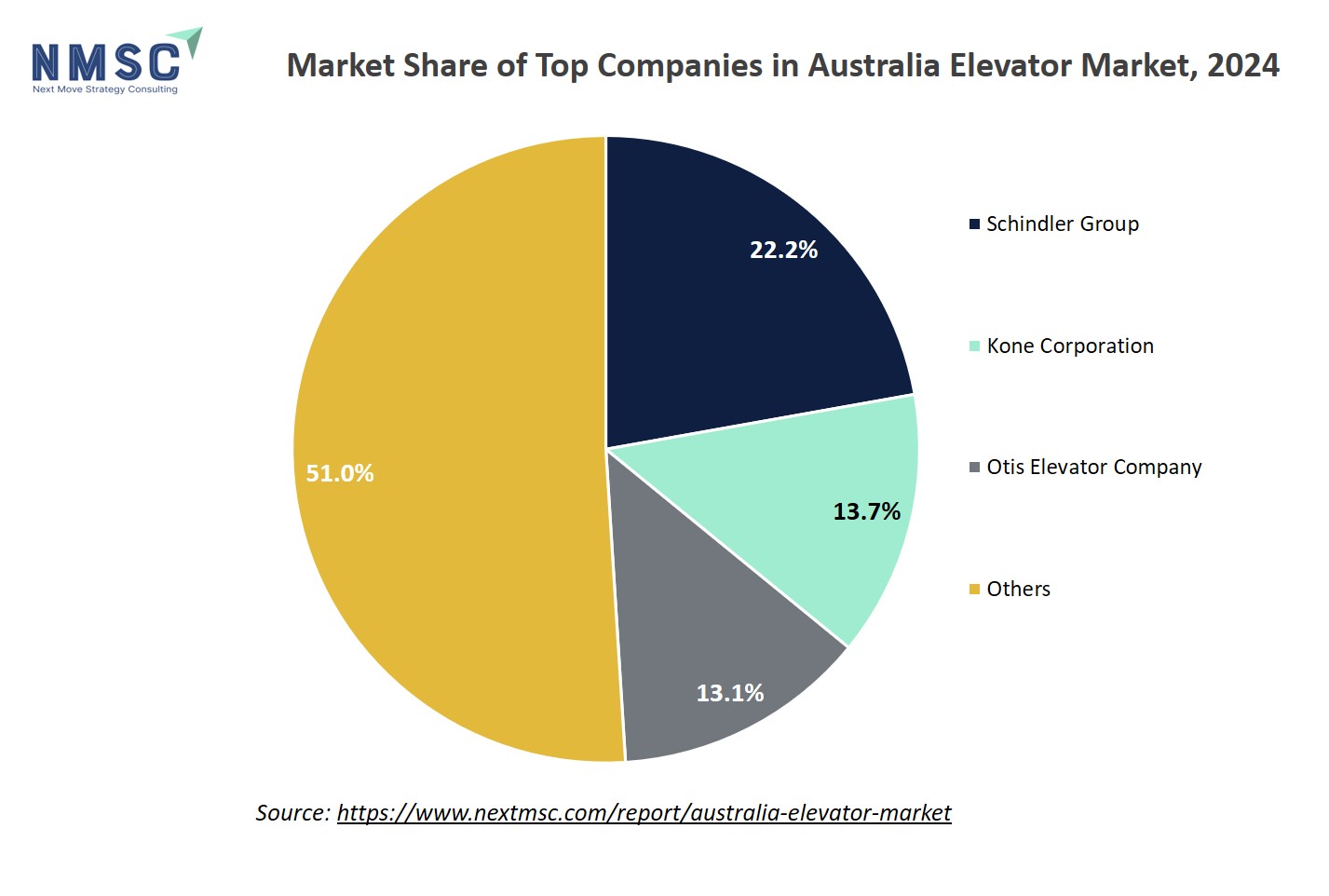

The Australia elevator market is led by major players such as Schindler Group, TK Elevator, Mitsubishi Electric Corporation, Otis Elevator Company, Kone Corporation, and Hitachi. These companies are driving growth through consistent innovation and strong investment in research and development. Their strategies focus on enhancing elevator technology with smart systems, including AI-powered diagnostics, predictive maintenance, and energy-efficient designs. To remain competitive, these firms are also adopting modular and cloud-based platforms that support faster deployment and customization across different building types.

The competitive landscape is shaped by frequent product upgrades, with emphasis on automation, safety features, and data-driven service models. Market leaders are expanding their Australian footprint through infrastructure investments, local partnerships, and strategic acquisitions. They are also building innovation networks by collaborating with universities, training institutes, and tech developers to foster future-ready elevator technologies tailored to Australia’s growing urban and high-density developments.

Market Dominated by Elevator Giants and Specialists

Australia elevator market is primarily led by global heavyweights, KONE, Otis, Schindler, and TK Elevator (TKE) who together control about 58% of the market. These firms compete fiercely across regions like NSW, Victoria, and Queensland, offering niche services from high-rise and transit systems to residential lifts. Local players specialize in maintenance and modernization, creating a dynamic where giants push cutting-edge tech while specialists excel in customer proximity and flexible service.

Innovation and Adaptability Drive Market Success

In recent years, competition has been fuelled by smart and energy efficient solutions. KONE launched its High Rise MiniSpace DX in Melbourne Square (Jan 2025), offering compact design and sustainability features. Otis focuses on IoT-enabled platforms like Otis ONE, which will modernize 20 elevators for New South Wales Land and Housing Corporation (LAHC), a government agency that owns and maintains a portfolio of 125,000 social housing properties across the state. Schindler’s Ahead platform uses IoT sensors and cloud analytics for real-time elevator health monitoring. It features the Ahead Cube, which enables over-the-air updates, edge-computing diagnostics, and integration with tools like ActionBoard (for dashboards) and Remote Monitoring. This closed-loop system improves uptime, detects faults early, and streamlines service dispatch, leading to up to 34% faster fault recovery and proactive issue resolution.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Industry consolidation is key to growth. KONE expanded its presence in Australia by acquiring Gold Coast–based Orbitz Elevators in May 2024, strengthening its local service network and bringing in 40 experienced technicians. Meanwhile, Otis Australia pivoted to modernization projects post 2023, notably upgrading 30 elevators at Melbourne’s 101 Collins Street with Gen3 MOD and Otis ONE IoT, instead of pursuing acquisitions.

List of Key Australia Elevator Companies

-

Schindler Group

-

Kone Corporation

-

Mitsubishi Electric Corporation

-

Empire Elevators

-

Toshiba

-

Hitachi

-

Platinum Elevators

-

Liftronic Pty Ltd.

-

Easy Living Home Elevators

-

Shotton Lifts

-

Next Level Elevators

-

Velocity Home Lifts

-

Savaria Corporation

-

Hyundai Elevator

-

Fujitec

-

Orona Group

-

Lift Shop

-

Stannah Lifts

-

Kleemann Lifts

-

Jade Elevators

-

Direct Lifts Australia

What Are the Latest Key Industry Developments?

-

In October 2024 - TK Elevator delivered elevators & escalators to the newly opened Sydney Metro City Line, bolstering rapid transit capacity and commuter mobility in Australia’s largest urban rail project.

-

October, 2024 – Otis modernized lifts at 101 Collins Street, Melbourne. They were also

-

awarded a contract to upgrade 30 elevators in this landmark CBD office tower, enhancing energy efficiency, ride quality, and dispatching with its latest technology.

-

January, 2025 – KONE Australia introduced its compact, energy-saving MiniSpace DX model in the BLVD tower of Melbourne Square, marking the local debut of next-gen high-rise elevator tech.

-

May, 2025 –Otis secured a government contract to modernize lifts for the NSW Land & Housing Corp., upgrading aging social housing infrastructure with improved safety and reliability.

-

June, 2025 – Global consultancy, Elevating Studio formed a strategic collaboration with Australia’s VT Studio, aiming to enhance consultancy services and expand expertise in vertical transportation projects.

What Are the Key Factors Influencing Investment Analysis & Opportunities in Australia Elevator Market?

Investment in the Australia elevator market is being shaped by several key factors, notably strong urban infrastructure development, a growing emphasis on smart and sustainable buildings, and rising demand for modernization. Funding trends reveal increased venture capital and private equity interest in companies offering IoT-integrated elevator solutions, particularly in major cities like Sydney, Melbourne, and Brisbane. These cities remain investment hotspots due to high-rise residential and commercial construction booms.

Valuations for Australian elevator service and tech firms are experiencing an uplift, driven by digital transformation, predictive maintenance capabilities, and energy-efficient retrofitting solutions. Government incentives for green building initiatives and public transport projects like the Sydney Metro expansion further amplify investor interest. The long-term outlook remains positive, with a focus on innovation and partnerships fostering new growth opportunities in both new installations and after-market services.

Key Benefits for Stakeholders:

Next Move Strategy Consulting presents a comprehensive analysis of the Australia elevator market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Australian Elevator segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 1064.3 million |

|

Revenue Forecast in 2030 |

USD 1437.2 million |

|

Growth Rate |

CAGR of 6.19% from 2025 to 2030 |

|

Market Volume in 2025 |

6185 units |

|

Volume Forecast in 2030 |

8536 units |

|

Growth Rate |

CAGR of 5.6% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

States Covered |

6 States and 2 Territories |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Type

-

Passenger Elevator

-

Freight Elevator

-

Others

By Technology

-

Traction

-

Machine Room [MR] Traction

-

Machine Roomless [MRL] Traction

-

-

Hydraulic

By Service

-

New Installation

-

Maintenance

-

Modernization

By Capacity

-

Less than 1500 kg

-

1500 to 2500 kg

-

2501 to 4000 kg

-

More than 4000 kg

By Speed

-

Less than 1 M/S

-

Between 1 to 4 M/S

-

More than 5 M/S

By Deck Type

-

Single Deck

-

Double Deck

By Designation Control

-

Smart

-

Conventional

By Door Type

-

Automatic

-

Manual

By Application

-

Residential

-

Low Rise: 10 floors

-

Mid Rise: 11-30 floors

-

High Rise: above 30 floors

-

Villa/home

-

-

Commercial

-

Airport

-

Hotel & Hospitality

-

Leisure and Education

-

Marine & Port Facilities

-

Medical & Healthcare

-

Multiuse Buildings (Mixed-Use)

-

Retail & Shopping Centers

-

Public Transportation Hubs

-

Office Buildings

-

Low Rise: 10 floors

-

Mid Rise: 11-30 floors

-

High Rise: above 30 floors

-

-

-

Industrial

Geographical Breakdown

Australia: New South Wales, Queensland, South Australia, Tasmania, Victoria, Western Australia, Northern Territory and Australian Capital Territory.

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on Australia Elevator’s transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s Australia elevator market report serves as an indispensable resource for navigating the evolving Elevator landscape.

Speak to Our Analyst

Speak to Our Analyst