Battery Energy Storage System Market By Power Capacity (Small < 20 MW, Medium 20–100 MW, Large > 100 MW), By Application/Service (Renewable Integration & Firming, Energy Arbitrage, Ancillary Services, T&D Deferral, Microgrids & Islanding), By Discharge Duration (0–2 h, 2–4 h, 4–8 h, >8 h), By Installation (Front-of-Meter, Behind-the-Meter), By Business Model (Utility-Owned, Third-Party/IPPs, Customer-Owned, PPP) – India Analysis & Forecast, 2025–2030

Industry Outlook

The global Battery Energy Storage System Market size was valued at USD 44.17 billion in 2024, and is expected to be valued at USD 52.73 billion by the end of 2025. The industry is projected to grow, hitting USD 127.92 billion by 2030, with a CAGR of 19.39% between 2025 and 2030.

The battery energy storage system (BESS) market is undergoing rapid transformation, driven by renewable energy adoption, grid modernization, urbanization, and the expansion of electric mobility and smart infrastructure. Globally, demand for reliable, scalable, and technologically advanced storage solutions is rising sharply, fueled by growth in utility-scale solar and wind projects, EV charging networks, industrial electrification, and microgrid applications. Expansion of fast-charging hubs, smart grids, and decentralized energy systems further intensifies the need for high-performance BESS capable of balancing supply-demand fluctuations and ensuring grid stability. Advancements in battery chemistries, modular designs, energy management software, vehicle-to-grid (V2G) capabilities, and IoT-enabled monitoring are reshaping solutions, enhancing operational efficiency, and extending system lifespans.

What are the Key Battery Energy Storage System Market Trends?

What are the Major Technological Trends Shaping the Battery Energy Storage System Market?

Technology is transforming the market by making systems more efficient, reliable, and intelligent. Advancements in chemistries such as sodium-ion, solid-state, and flow batteries are improving lifespan, safety, and performance. Innovations in thermal management, including liquid cooling, hybrid cooling, and phase-change materials, are being adopted to maintain stable performance under high load conditions. Digitalization through IoT- and AI-enabled platforms allows real-time monitoring, predictive maintenance, and optimization of charge and discharge cycles. Modular and containerized designs are becoming standard, making deployment and scaling easier across diverse applications. At the same time, recycling innovations and circular economy approaches are improving sustainability, while cyber-physical security solutions are increasingly important to protect storage assets as they integrate with digital energy networks.

How is Demographic Change Influencing the Market?

Demographic and societal changes are having a direct impact on BESS demand. Rapid urbanization is driving energy consumption in cities, creating the need for decentralized storage solutions that stabilize smart grids, power EV hubs, and provide reliable supply to residential communities. Younger, tech-savvy populations are accelerating clean energy adoption, particularly rooftop solar combined with home storage systems. In developed countries, aging populations are indirectly fueling demand for reliable backup power in hospitals, assisted living facilities, and emergency services. More broadly, global population growth is leading to rising electricity demand, which intensifies the need for stable, clean, and scalable energy storage systems to ensure resilience in power supply.

What Role Does Government Support Play in Driving The Battery Energy Storage System Industry Growth?

Government support plays a critical role in expanding the market. Many national and regional governments are offering subsidies, tax credits, and incentives to accelerate storage deployment, while regulatory reforms are allowing storage to participate in capacity markets and ancillary services, creating new revenue opportunities. Public investment in grid resilience, renewable energy integration, and transport electrification is driving utility-scale adoption. Decarbonization targets and net-zero policies further position BESS as essential infrastructure for modern energy systems. In addition, government initiatives promoting domestic manufacturing, standardization, and innovation are strengthening supply chains and creating a competitive growth environment for the industry.

How is Consumer Preference Changing in the Battery Energy Storage System Market?

Consumer preferences in the market are shifting toward flexible, intelligent, and sustainable solutions. Utilities increasingly favor large-scale, long-duration systems that improve grid reliability and enable greater renewable penetration. Commercial and industrial users prefer modular and cost-efficient systems that reduce peak demand costs and ensure operational continuity. Residential consumers are showing strong interest in compact, easy-to-use storage paired with rooftop solar, enabling energy independence and cost savings. Across all segments, sustainability has become a key factor, with rising demand for recyclable systems designed with longer lifespans and lower environmental footprints. At the same time, customers expect advanced smart features such as real-time monitoring, predictive analytics, and seamless integration with renewable energy assets.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Battery Energy Storage System Industry in Next Decade?

The battery energy storage system market is witnessing strong growth, driven by the accelerating adoption of electric vehicles and the rapid expansion of renewable energy sources. As EV penetration surges, BESS plays a crucial role in easing grid stress by storing energy during off-peak periods and enabling fast-charging and vehicle-to-grid systems. Similarly, the intermittent nature of solar and wind power highlights the need for storage to balance supply and demand, positioning BESS as a cornerstone of sustainable energy infrastructure. However, high upfront investment costs remain a key restraint, particularly in developing regions. Meanwhile, growing deployment in microgrids and off-grid applications offers significant opportunities, especially for enhancing energy access and resilience.

Growth Drivers:

How is Growth of Electric Vehicles (EVs) Driving the BESS Market Demand?

Global electric car adoption is accelerating rapidly, creating a strong demand driver for Battery Energy Storage Systems (BESS). According to the International Energy Agency (IEA), global electric car sales exceeded 17 million units in 2024, highlighting the scale of electrification in the transport sector. This surge in EV adoption puts significant stress on existing power grids, especially during peak charging hours, making advanced storage solutions increasingly critical. BESS helps address this challenge by storing energy during off-peak periods and supplying it when charging B spikes, thereby easing grid pressure and improving efficiency. Furthermore, when integrated with EV charging infrastructure, battery management system enables the development of fast-charging hubs, smart charging networks, and vehicle-to-grid (V2G) systems, which not only enhance grid stability but also open new revenue opportunities. As governments and industries continue to push for decarbonization, the synergy between EV growth and BESS deployment will become a cornerstone of sustainable energy infrastructure.

In 2024, electric vehicle (EV) sales across major countries and regions demonstrate the growing adoption of clean mobility solutions worldwide. China leads the market with 6.4 million EVs sold, reflecting strong government incentives, robust manufacturing capacity, and rising consumer adoption. Europe follows with 2.2 million units, driven by stringent emissions regulations, renewable energy integration, and expanding EV infrastructure. The United States records 1.2 million EV sales, supported by federal and state incentives and accelerating adoption of passenger and commercial EVs. The Rest of the World contributes approximately 1 million units, reflecting emerging markets’ gradual entry into electric mobility.

These sales patterns are directly linked to the battery energy storage system (BESS) market, as the growth of EVs increases demand for charging infrastructure, grid support, and storage solutions. Higher EV penetration necessitates scalable energy storage to manage peak loads, integrate renewable energy, and ensure stable and resilient power supply, positioning BESS as a critical enabler of the global transition to electric mobility.

How Rising Renewable Energy Accelerating the BESS Market Growth?

The rapid expansion of renewable energy sources such as solar and wind is a key driver of the battery energy storage system (BESS) market. Unlike conventional generation, renewables are variable and intermittent, with solar producing only during daylight hours and wind fluctuating with weather conditions. This variability creates challenges for maintaining grid stability and ensuring a reliable power supply. BESS provides an effective solution by storing excess energy generated during periods of high renewable output and releasing it when production falls short or demand rises, thereby balancing supply and demand. The growing global push toward clean energy, supported by ambitious decarbonization targets and renewable portfolio standards, is making energy storage indispensable. By enabling higher levels of renewable penetration without compromising grid reliability, BESS is emerging as a cornerstone technology in the transition to a sustainable energy future.

Growth Inhibitors:

How Does High Initial Investment Costs Limit the Battery Energy Storage System Market Expansion?

One of the major restraints in the battery energy storage system (BESS) market is the high upfront investment required for deployment. While the costs of lithium-ion and other advanced batteries have been steadily declining, large-scale storage projects still demand significant capital expenditure for equipment, installation, and integration with existing grid infrastructure. For many utilities, commercial users, and especially residential consumers in developing economies, these costs act as a barrier to adoption. In addition, expenses related to advanced thermal management systems, safety features, and smart control software add to the overall project cost. Although long-term operational savings and efficiency gains offset the initial expense, the challenge of securing financing and justifying the upfront capital investment continues to slow widespread adoption, particularly in cost-sensitive markets.

How is Deployment of BESS in Microgrids and Off-Grid Applications Creating Opportunity for the Market?

A further opportunity for the market is its growing role in microgrids and off-grid energy solutions. Remote areas, islands, and industrial sites face unreliable grid connections or high dependency on diesel generators. By integrating BESS with solar, wind, or hybrid renewable systems, these locations achieve stable, continuous, and cleaner electricity supply. Microgrids equipped with BESS not only enhance energy reliability and resilience but also reduce carbon emissions and operational costs. As governments and private players increasingly invest in rural electrification, disaster-resilient infrastructure, and energy access initiatives, BESS adoption in microgrids and off-grid applications presents a significant growth opportunity, particularly in emerging markets.

How Battery Energy Storage System Market is Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Power Capacity (MW) Insights

Which Power Capacity Segments Dominate India’s BESS Market?

On the basis of power capacity, the India market is segmented into small (< 20 MW), medium (20–100 MW), and large (> 100 MW) systems. Small-scale systems currently lead the market, driven by pilot projects, behind-the-meter (BTM) applications, and lower capital requirements. Medium-capacity systems are gaining traction among utilities and renewable developers for applications such as peak shaving, solar and wind output smoothing, and energy arbitrage. Large-scale systems are emerging, supported by government and utility tenders, providing grid-scale energy storage, ancillary services, and transmission & distribution (T&D) capacity firming.

By Technology Insights

Which Battery Technologies are Most Widely Adopted in India?

Based on technology, the market is segmented into lithium-ion (LFP, NMC/NCA), flow batteries (vanadium redox, zinc-bromine), advanced lead-acid/lead-carbon, sodium-based (NaS, Na-NiCl₂), and emerging technologies (solid-state, Li-S, metal-air). Lithium-ion batteries dominate due to high energy density, declining costs, and faster deployment cycles. LFP chemistry is particularly preferred for large-scale grid applications due to safety and longer cycle life. Flow batteries and advanced lead-acid solutions are primarily used in niche applications requiring long-duration discharge, while emerging technologies are in early demonstration phases but are expected to grow as cost and performance improve.

By Application / Service Insights

What are the Main Applications Driving Demand for BESS in India?

The India BESS market is segmented by application into renewable integration & firming, solar PV smoothing, wind output smoothing, energy arbitrage, peak shaving, load shifting, ancillary services (frequency regulation, voltage support, spinning/non-spinning reserve, black-start capability), T&D deferral/capacity firming, and microgrids & islanding. Renewable integration and firming remain the largest drivers, propelled by India’s ambitious solar and wind expansion targets. Ancillary services and peak shaving are also growing as utilities look to stabilize the grid, optimize transmission assets, and manage demand peaks efficiently.

By Discharge Duration Insights

Which Discharge Duration Segments are Most Relevant in India?

The market is categorized by discharge duration into 0–2 h, 2–4 h, 4–8 h, and > 8 h. Short-duration (0–2 h) systems dominate, primarily for frequency regulation, load shifting, and peak shaving. Medium-duration (2–8 h) systems are increasingly deployed for renewable firming and energy arbitrage. Long-duration systems (> 8 h) are limited but are gaining attention for utility-scale applications and microgrid support in remote regions, where grid reliability is critical.

By Installation Insights

What Installation Types are Prevalent in the India BESS Market?

BESS installations are classified as front-of-the-meter (FTM) and behind-the-meter (BTM). BTM installations are widespread for commercial & industrial (C&I) customers and renewable developers looking to optimize self-consumption and demand charges. FTM systems are growing in utility-scale projects, co-located with solar or wind farms, and are supported by government tenders and incentives for grid stability.

By Business Model Insights

Which Business Models are Shaping India’s BESS Market?

The market is segmented into utility-owned (e.g., DISCOMs), third-party / independent power producers (IPP, lease/PPA), customer-owned (captive/C&I aggregates), and public-private partnerships (VGF, loan guarantees). Utility-owned projects dominate early adoption due to government-led tenders, while third-party IPPs and customer-owned models are rapidly growing, driven by declining battery costs and commercial demand. Public-private partnerships support large-scale infrastructure projects, leveraging financial incentives and risk-sharing mechanisms to encourage faster deployment.

Regional Outlook

The market is geographically studied across North America, Europe, Asia Pacific, and the Middle East & Africa, and each region is further studied across countries.

Battery Energy Storage System Market in North America

The North American BESS market is growing rapidly, driven by rising renewable energy integration, supportive government policies, and the surge in electric vehicle adoption. Utilities across the region are deploying large-scale storage projects to stabilize grids, manage peak demand, and improve energy resilience. Investments in smart grids and decarbonization initiatives further strengthen market demand. In addition, the development of microgrids for rural communities, military bases, and disaster-prone areas is expanding opportunities for advanced storage solutions.

Battery Energy Storage System Market in the United States

In the U.S., strong federal and state-level incentives for clean energy are accelerating BESS deployment. The country is witnessing large-scale integration of solar and wind power, making storage systems essential for balancing intermittency and ensuring grid reliability. The rapid growth of EV charging infrastructure is another key driver, with storage enabling fast charging, peak load management, and vehicle-to-grid applications. Increasing emphasis on energy resilience, particularly during extreme weather events, is further fueling adoption across utilities, commercial facilities, and residential sectors.

Battery Energy Storage System Market in Canada

In Canada, the market is being shaped by renewable integration, industrial electrification, and grid modernization efforts. With ambitious clean energy targets and vast potential for wind and hydropower, storage is becoming critical for balancing regional supply-demand fluctuations. The country’s remote and off-grid communities, dependent on diesel, are increasingly turning to BESS paired with renewables for cleaner, more reliable power. Additionally, extreme cold weather conditions underscore the need for advanced, durable storage technologies that operate efficiently in harsh environments, driving further innovation and adoption.

Battery Energy Storage System Market in Europe

The European market is experiencing rapid growth, driven by ambitious renewable energy targets, strong regulatory support, and large-scale decarbonization initiatives. Countries across the region are investing heavily in storage to balance intermittent solar and wind generation, stabilize grids, and support the expansion of EV charging infrastructure. The integration of BESS into smart grids and energy transition projects is creating significant opportunities. With the EU’s commitment to net-zero emissions, storage technologies are becoming central to sustainable energy development.

Battery Energy Storage System Market in the United Kingdom

In the U.K., the market is primarily fueled by the country’s aggressive push toward renewable integration and grid flexibility. Large-scale storage deployments are supporting offshore wind projects, one of the fastest-growing in Europe. The growth of EV adoption and charging networks is also accelerating demand for advanced storage systems that ensure grid stability and enable vehicle-to-grid applications. With strong policy support and private investments, the U.K. is emerging as one of the leading markets in Europe.

Battery Energy Storage System Market in Germany

Germany represents one of the most advanced markets in Europe, supported by its ambitious Energiewende (energy transition) policies. The rapid deployment of solar PV and wind capacity is creating significant demand for storage to handle intermittency and stabilize the national grid. Additionally, Germany’s strong focus on electric mobility is driving adoption of storage solutions for EV charging hubs and vehicle-to-grid applications. With government incentives and a well-developed renewable infrastructure, Germany continues to lead the region in BESS innovation and deployment.

Battery Energy Storage System Market in France

In France, the market is being shaped by renewable expansion, energy resilience goals, and modernization of energy infrastructure. The integration of solar and wind into the national grid is fueling demand for storage to balance fluctuations and ensure reliability. Additionally, BESS is gaining traction in industrial and transport sectors, where it supports stable power supply for rail networks, highways, and manufacturing hubs. With government-backed clean energy initiatives and a growing focus on sustainable infrastructure, France is becoming a key market for energy storage adoption in Europe.

Battery Energy Storage System Market in Spain

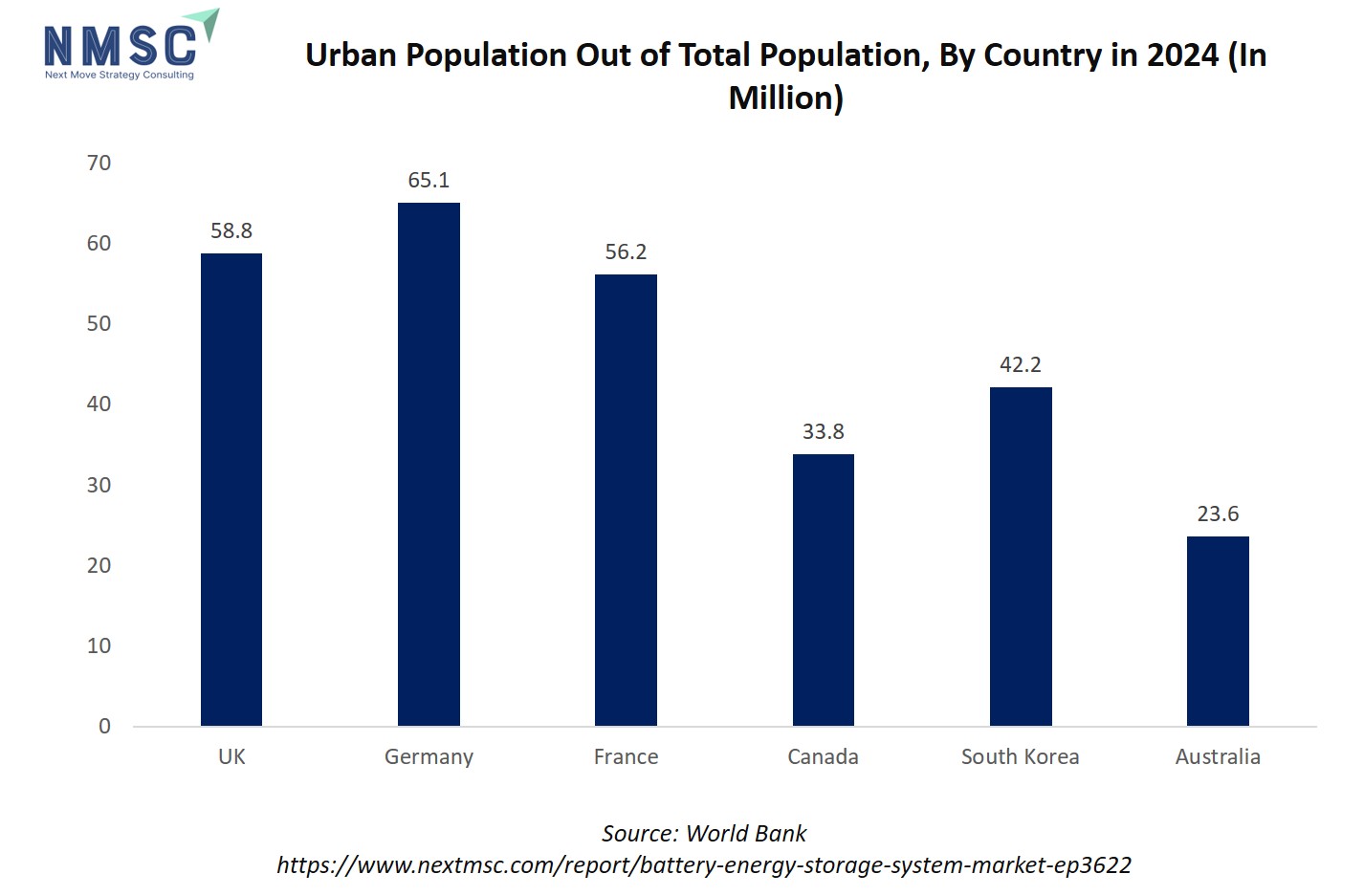

In Spain, the market is gaining momentum due to rapid urbanization and the rising need for reliable energy infrastructure. According to the World Bank, the urban population accounted for 82% of Spain’s total population in 2024, highlighting the high concentration of energy demand in cities. This urban density is driving the deployment of storage systems to stabilize grids, support renewable integration, and enhance energy resilience. With the country’s strong focus on solar and wind power, alongside smart city initiatives, BESS is becoming essential to balance intermittency and ensure a stable, sustainable electricity supply across urban and semi-urban areas.

In 2024, the urban population across major economies highlights a clear link to the growing demand for battery energy storage systems (BESS). Germany leads with 65.05 million urban residents, followed by the UK with 58.76 million and France with 56.21 million, all of which are highly industrialized nations with significant electricity demand in dense metropolitan regions. South Korea, with 42.17 million urban dwellers, reflects a technologically advanced and energy-intensive society where storage is critical for supporting EV adoption and smart city development. Canada, at 33.84 million, and Australia, with 23.60 million, though smaller in absolute terms, represent highly urbanized markets with high per-capita energy consumption and strong renewable integration efforts. The concentration of populations in urban centers across these countries directly fuels the need for grid modernization, renewable integration, and backup storage solutions, positioning the market as a key enabler of stable, efficient, and sustainable power systems.

Battery Energy Storage System Market in Italy

Italy’s market is expanding rapidly, fueled by renewable energy adoption and the rise of EV charging infrastructure. As solar and wind capacity grows, storage systems are becoming essential for maintaining grid stability and maximizing clean energy utilization. Government-backed incentives for energy transition and electric mobility are further accelerating adoption. BESS is increasingly being integrated with EV charging networks, enabling efficient load management and supporting the country’s sustainability goals. This combination of renewable expansion and e-mobility is positioning Italy as a growing market for advanced storage solutions.

Battery Energy Storage System Market in the Nordics

In the Nordic region, the market is supported by strong renewable penetration, industrial electrification, and transportation modernization. Countries like Sweden, Norway, Finland, and Denmark are integrating storage to manage variable wind and hydropower, enhance grid flexibility, and improve energy security. Harsh weather conditions in the region highlight the need for advanced storage systems capable of withstanding extreme cold while ensuring reliable performance. Additionally, the electrification of transport networks, ports, and industries is driving demand for scalable, durable storage solutions across commercial, municipal, and industrial sectors.

Battery Energy Storage System Market in Asia Pacific

The Asia Pacific BESS market is growing rapidly, driven by urbanization, clean energy adoption, and infrastructure modernization. Countries such as China, India, South Korea, Japan, and Australia are witnessing massive renewable energy deployments, creating strong demand for storage to stabilize grids and balance intermittent generation. The rise of electric mobility and smart city projects is further boosting adoption, with storage supporting fast-charging infrastructure, grid resilience, and rural electrification. Government initiatives and investments in clean technology are positioning Asia Pacific as one of the fastest-growing and most dynamic markets for BESS globally.

Battery Energy Storage System Market in China

In China, the market is expanding rapidly, fueled by large-scale renewable energy integration, grid modernization, and the country’s strong push for electrification. Massive solar and wind projects across different provinces are driving demand for storage to manage intermittency and stabilize grid operations. The rapid growth of electric vehicles is further boosting the need for BESS to support charging infrastructure and enable vehicle-to-grid (V2G) solutions. Backed by significant government policies and investments in clean energy, China is emerging as the largest global hub for advanced energy storage deployment.

Battery Energy Storage System Market in Japan

Japan’s market is primarily driven by energy security concerns, renewable adoption, and modernization of transportation infrastructure. With frequent natural disasters such as earthquakes and typhoons, reliable backup power and grid resilience are critical, positioning storage as a strategic necessity. BESS is being widely deployed alongside solar PV, in industrial automation, and across railway and urban transit networks to ensure uninterrupted power supply. The government’s push for carbon neutrality by 2050 further reinforces investment in advanced storage technologies, driving steady growth in the Japanese market.

Battery Energy Storage System Market in India

India’s BESS market is gaining momentum due to rapid urbanization, rising electricity demand, and strong government initiatives promoting clean energy and smart infrastructure. According to the World Bank, the country’s urban population reached around 534.91 million in 2024, highlighting the increasing concentration of demand in cities. This is driving the need for storage to stabilize smart grids, support renewable integration, and expand EV charging networks. Government-backed programs such as the National Energy Storage Mission and smart city projects are accelerating adoption, creating significant opportunities for both grid-scale and distributed storage solutions.

Battery Energy Storage System Market in South Korea

In South Korea, the market is being driven by the country’s rapid smart city development, renewable expansion, and focus on energy reliability. With growing solar and wind installations, storage is critical for balancing supply-demand fluctuations and ensuring grid stability. The government’s strong policies for carbon neutrality and investments in advanced energy technologies are fostering large-scale deployments. Additionally, South Korea’s leadership in battery manufacturing provides a competitive advantage, supporting the integration of BESS into EV infrastructure, smart grids, and IoT-enabled energy systems across urban regions.

Battery Energy Storage System Market in Taiwan

In Taiwan, the market is expanding with the rapid adoption of renewable energy and grid modernization initiatives. As the country pushes forward with 5G rollout, smart cities, and electrification, energy storage is becoming critical to ensure grid stability and reliable supply. BESS supports renewable integration, particularly solar, while enabling advanced applications like smart grids and EV charging networks. Government initiatives aimed at sustainability and energy resilience are positioning Taiwan as a key growth market for advanced storage technologies in Asia Pacific.

Battery Energy Storage System Market in Indonesia

Indonesia’s market is being driven by industrial growth, electrification, and renewable energy deployment. With rising urbanization and government-led efforts to expand clean power access across islands, storage systems are playing a crucial role in microgrids and hybrid renewable projects. BESS enables reliable energy supply for manufacturing plants, transport networks, and utility systems while reducing dependence on diesel. As the government accelerates investments in energy transition and smart infrastructure, demand for scalable and durable storage solutions is growing significantly across the country.

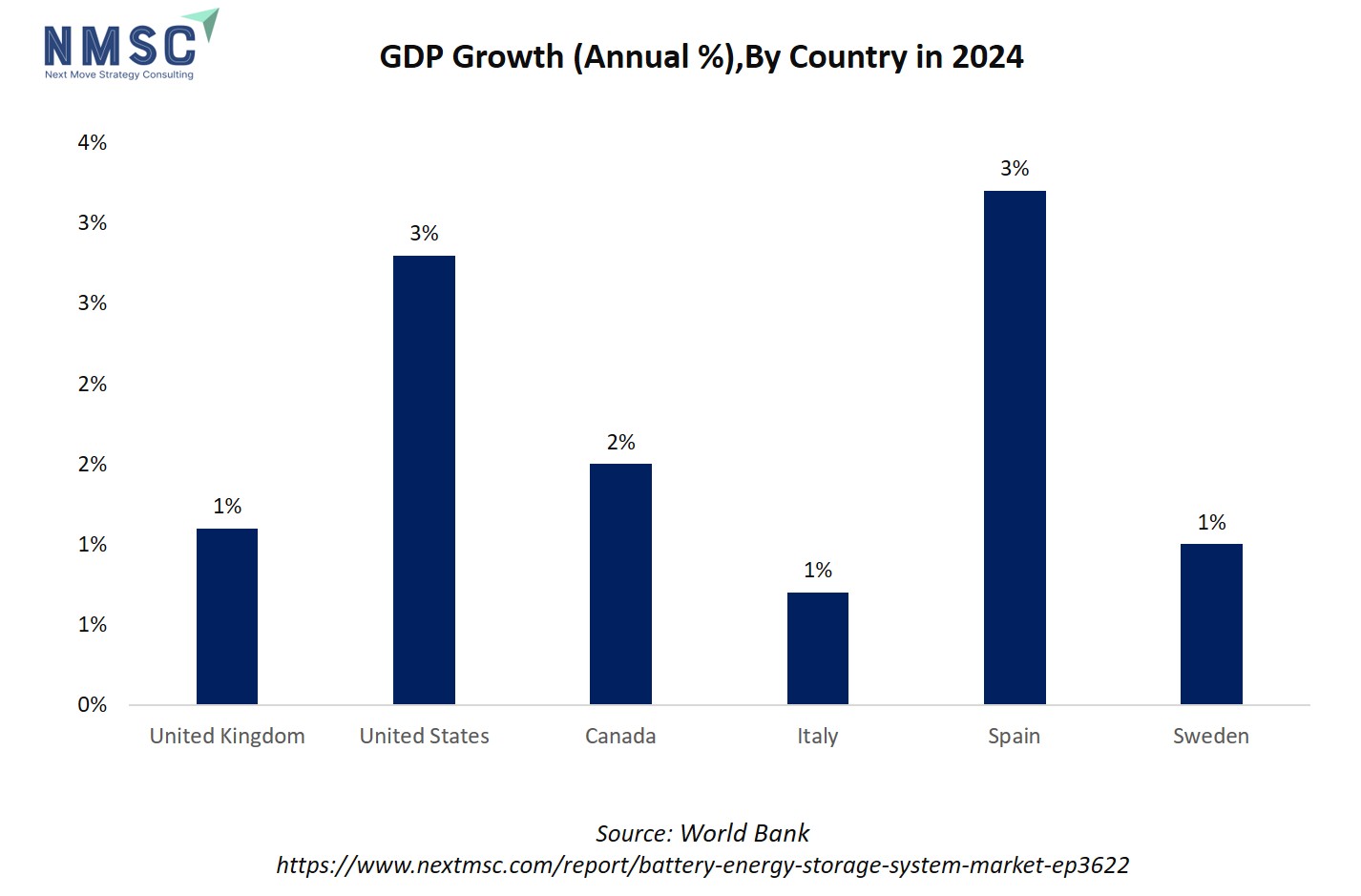

The chart shows the GDP growth rates (annual %) for selected countries in 2024, highlighting economic performance across regions. Spain records the highest growth at 3.20%, reflecting strong post-pandemic recovery and investment momentum, followed by the United States at 2.80%, driven by robust consumer spending and clean energy investments. Canada (1.50%), the United Kingdom (1.10%), and Sweden (1.00%) show moderate growth, while Italy trails at 0.70%, indicating slower economic expansion.

This trend directly relates to the battery energy storage system (BESS) market. High GDP growth in economies like Spain and the U.S. creates favorable conditions for renewable energy deployment, infrastructure modernization, and large-scale storage integration. Moderate growth in countries like the UK, Canada, and Sweden still supports investments in smart grids, urban electrification, and EV charging infrastructure, where BESS plays a crucial role in balancing supply and demand. Even in slower-growth economies such as Italy, the push for grid stability and renewable adoption ensures continued relevance of energy storage solutions.

Battery Energy Storage System Market in Australia

In Australia, the market is fuelled by large-scale renewable energy projects, urbanization, and EV charging expansion. According to the World Bank, the country’s urban population reached about 23.6 million in 2024, highlighting rising electricity demand in cities. Storage systems are essential for managing solar and wind intermittency, supporting smart grid operations, and enabling sustainable transportation. Government incentives promoting clean energy and carbon reduction are further boosting adoption. With harsh climate conditions and strong renewable capacity, Australia is emerging as one of the fastest-growing markets in the region.

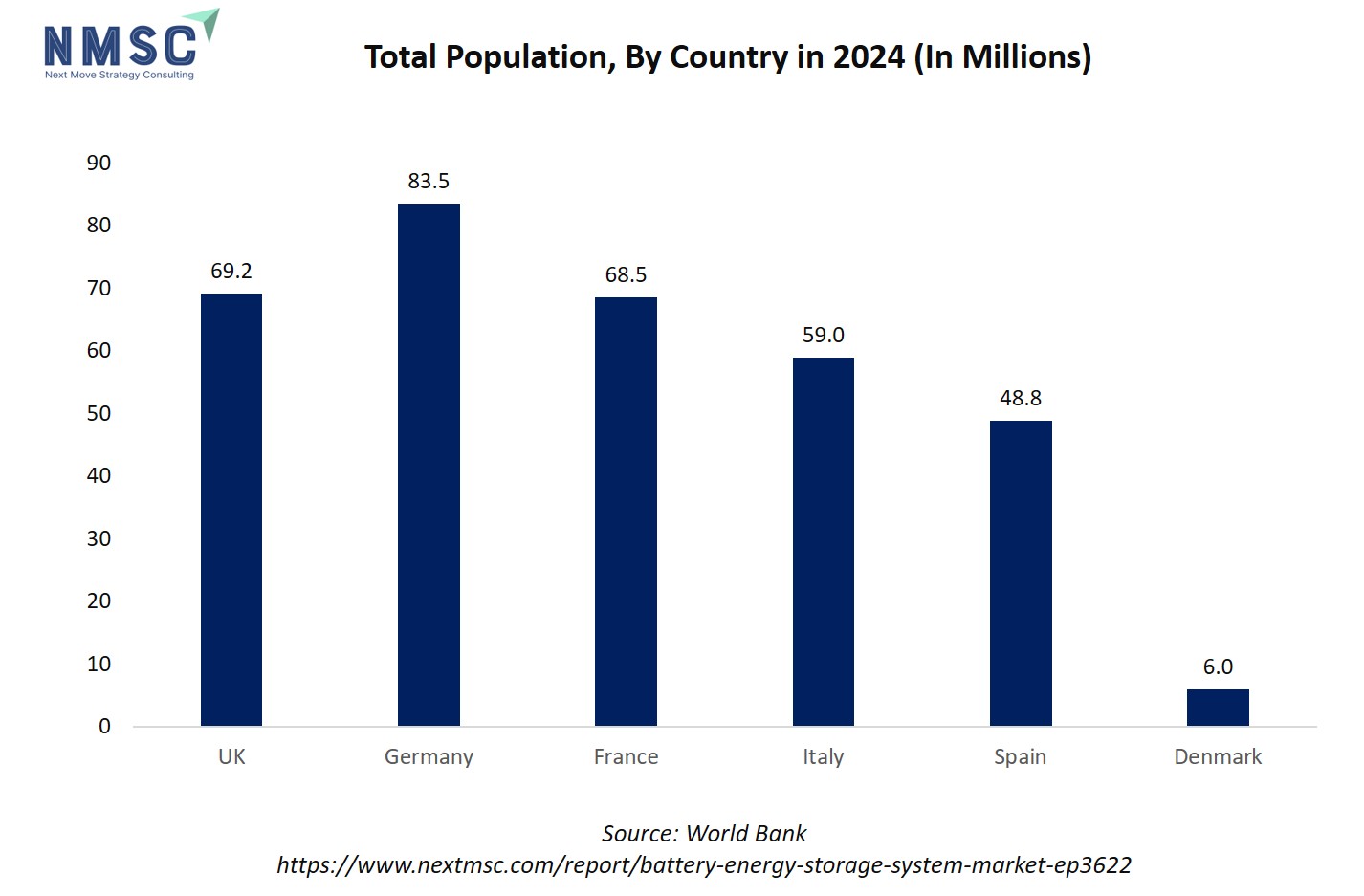

The chart illustrates the population growth across selected countries in 2024 (in millions). Among them, Germany records the highest population at 83.51 million, followed by the UK (69.22 million), France (68.51 million), Italy (58.98 million), and Spain (48.80 million), while Denmark has the smallest population at 5.97 million.

This demographic distribution has a direct connection to the battery energy storage system (BESS) market. Countries with larger populations, such as Germany, the UK, and France, experience greater electricity demand, peak load pressures, and renewable integration challenges, all of which drive investment in large-scale energy storage. Southern European nations like Italy and Spain, with high solar potential and growing populations, further rely on BESS to ensure grid stability and maximize renewable utilization. Even smaller countries like Denmark, despite a modest population, are leaders in renewable adoption, where BESS plays a crucial role in balancing wind energy output.

Battery Energy Storage System Market in Latin America

In Latin America, the market is being propelled by urbanization, renewable integration, and infrastructure modernization. Countries such as Brazil, Mexico, and Argentina are investing in solar, wind, and hydropower projects, where storage systems are critical to stabilize grids and improve reliability. Urban growth and the rollout of smart city initiatives are also driving adoption of BESS in distributed networks and EV charging infrastructure. Supportive government policies and private-sector initiatives are creating significant opportunities for storage deployment across both metropolitan hubs and semi-urban areas.

Battery Energy Storage System Market in the Middle East & Africa

In the Middle East and Africa, the market is expanding rapidly due to renewable energy investments, industrial infrastructure development, and the need for energy resilience. Countries in the region are deploying large-scale solar and wind projects, where storage ensures continuous supply despite fluctuating generation. Harsh environmental conditions such as heat, sand, and humidity increase the importance of advanced, durable storage technologies. Governments are also promoting smart grid adoption and electrification of remote communities, creating strong growth prospects for BESS in utility, commercial, and industrial applications.

Competitive Landscape

Which Companies Dominate the Battery Energy Storage System Market and how do they Compete?

The global battery energy storage system market is dominated by established players such as Exide Industries, Amara Raja Energy & Mobility, Fluence Energy India (ASE), BYD, Sungrow, Larsen & Toubro, HBL Power Systems, Exicom Tele-Systems, Livguard, OKAYA Power, Tata Power, JSW Energy, Adani Green Energy, LG Energy Solution (LGES), and Waaree Energies. These companies compete by offering a broad portfolio of energy storage solutions across utility-scale projects, renewable energy integration, grid balancing, electric vehicle charging, telecom backup, and residential applications.

Market leaders differentiate themselves through investments in advanced cell technologies, containerized and modular BESS systems, hybrid renewable + storage solutions, and smart monitoring capabilities. Strategies include gigafactory-scale manufacturing of lithium-ion and LFP batteries, EPC and turnkey execution of solar-plus-storage projects, integration of EV charging with storage, and customized solutions for telecom and residential backup power. Companies are also expanding their regional and global footprints through partnerships, joint ventures, and acquisitions, ensuring strong supply chain networks and localized production. Competition further intensifies with regional specialists and niche providers focusing on tailored, small-batch, or application-specific BESS solutions for telecom, EV infrastructure, and distributed renewable systems. As demand grows from renewable energy expansion, EV adoption, smart grids, and urban infrastructure projects, companies that combine large-scale manufacturing, project execution expertise, and technology-driven innovation are consolidating market share and positioning themselves as leaders in the battery energy storage system market.

Market dominated by Battery Energy Storage System Market Giants and Specialists

The market is divided between global energy leaders and specialized regional providers. Large multinational players dominate through large-scale deployments, advanced battery technologies, and extensive supply chains, offering turnkey solutions for utilities, EV infrastructure, and renewable integration. Meanwhile, specialist and regional firms focus on customized systems, microgrid applications, and localized projects, delivering flexible, modular, and cost-effective solutions. This creates a two-tier market where customers choose between high-capacity global providers or agile, specialized players depending on project scale, budget, and customization needs.

Innovation and Adaptability Drive Market Success

Leading BESS providers are investing heavily in next-generation technologies to improve performance, efficiency, and reliability. Companies are enhancing systems with advanced energy management software, AI-driven grid optimization, thermal management solutions, and vehicle-to-grid (V2G) capabilities. Modular and scalable designs are increasingly favored, enabling flexibility for both large-scale utility projects and distributed energy systems. Providers offering interoperable, future-ready solutions that integrate seamlessly with smart grids, EV charging, and renewable power plants are securing strong market positions as demand for sustainable, resilient energy grows.

Market Players to Opt for Merger & Acquisition Strategies to Expand Their Presence

Mergers and acquisitions are becoming a key strategy for BESS providers to expand their capabilities and market presence. Global players are acquiring niche energy storage firms and technology innovators to diversify product portfolios, enter emerging markets, and strengthen expertise in software, grid services, and renewable integration. These M&A activities accelerate large-scale deployment, improve technological competitiveness, and enable companies to serve a wider range of applications, including utility-scale projects, commercial facilities, residential storage, and microgrids. This consolidation trend is reshaping the competitive landscape and supporting rapid global market growth.

List of Key Battery Energy Storage System Companies

-

Amara Raja Energy & Mobility Limited

-

BYD Company Limited

-

Sungrow

-

Larsen & Toubro Ltd.

-

HBL Power Systems Ltd.,

-

Exicom Tele-Systems Ltd

-

Livguard

-

OKAYA POWER PVT. LTD.

-

Tata Power

-

JSW Energy Ltd

-

Adani Green Energy Ltd

-

LG Energy Solution (LGES)

-

Waaree Energies Ltd

What are the Latest Key Industry Developments?

-

September 2025 - BYD unveiled the "HaoHan," a DC energy storage system with a 14.5 MWh single-unit capacity, at the International Digital Energy Expo in Shenzhen. This development sets a new benchmark in utility-scale storage.

-

July 2025 - Exide invested approximately USD 516 million in a lithium-ion cell manufacturing facility in Bengaluru. Phase I, with an initial 6 GWh capacity, is set for trial production by the end of FY2024–25.

-

November 2024 - Fluence reported a record USD 1.3 billion in quarterly orders, doubling its order intake from 6.3 GWh in 2023 to 14.6 GWh in 2024. The company's project pipeline reached USD 21 billion, marking a 60% year-over-year growth.

-

July 2024 - At ees Europe 2024, Exide introduced the "Solition Mega Three," a containerized energy storage module, and showcased over 100 MWh of installed lithium-ion storage projects.

-

June 2024 - Amara Raja entered into a licensing agreement with Gotion-InoBat-Batteries, a subsidiary of China's Gotion High Tech Co., to produce lithium-ion batteries in India. This collaboration aims to establish gigafactory facilities and integrate into Gotion's global supply chain.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Battery Energy Storage System Market?

The market is drawing strong investor interest as demand accelerates for grid stability, renewable integration, and clean energy infrastructure worldwide. Key factors influencing investment include the rapid expansion of solar and wind power, rising electric vehicle adoption, and the modernization of transmission and distribution networks. Investors are particularly attracted to companies offering scalable, modular, and technologically advanced storage systems with features such as AI-driven energy management, smart grid integration, and vehicle-to-grid (V2G) capabilities. High-growth regions such as North America, Europe, and Asia-Pacific present strong opportunities, supported by government incentives and decarbonization policies. Strategic mergers, acquisitions, and partnerships among leading players further highlight consolidation and innovation as critical pathways for growth. For investors, the most promising opportunities lie in providers that combine advanced technology, operational efficiency, and flexible deployment models across utility, commercial, and residential applications.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the battery energy storage system market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major battery energy storage system market segments.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 52.73 Billion |

|

Revenue Forecast in 2030 |

USD 127.92 Billion |

|

Growth Rate |

CAGR of 19.39% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Countries Covered |

28 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Power Capacity (MW)

-

Small (< 20 MW)

-

Medium (20 – 100 MW)

-

Large (> 100 MW)

By Technology

-

Lithium-Ion

-

LFP

-

NMC / NCA

-

-

Flow Batteries

-

Vanadium Redox (VRB)

-

Zinc-Bromine

-

-

Advanced Lead-Acid / Lead-Carbon

-

Sodium-Based (NaS, Na-NiCl₂)

-

Emerging (Solid-State, Li-S, Metal-Air)

By Application / Service

-

Renewable Integration & Firming

-

Solar PV Smoothing

-

Wind Output Smoothing

-

-

Energy Arbitrage (Time-Shift)

-

Peak Shaving

-

Load Shifting

-

-

Ancillary Services

-

Frequency Regulation

-

Voltage Support

-

Spinning / Non-Spinning Reserve

-

Black-Start Capability

-

-

T&D Deferral / Capacity Firming

-

Microgrids & Islanding

By Discharge Duration

-

0–2 h

-

2–4 h

-

4–8 h

-

> 8 h

By Installation

-

Front-of-Meter (FTM)

-

Behind-the-Meter (BTM)

By Business Model

-

Utility-Owned (e.g., DISCOMs)

-

Third-Party / IPP (Lease / PPA)

-

Customer-Owned (Captive / C&I Aggregates)

-

Public-Private Partnership (VGF, Loan Guarantees)

Geographical Breakdown

-

North America: U.S., Canada, and Mexico.

-

Europe: U.K., Germany, France, Italy, Spain, Sweden, Denmark, Finland, Netherlands, and rest of Europe.

-

Asia Pacific: China, India, Japan, South Korea, Taiwan, Indonesia, Vietnam, Australia, Philippines, and rest of APAC.

-

Middle East & Africa (MENA): Saudi Arabia, UAE, Egypt, Israel, Turkey, Nigeria, South Africa, and rest of MENA.

-

Latin America: Brazil, Argentina, Chile, Colombia, and rest of LATAM

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on battery energy storage system market transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s battery energy storage system market report serves as an indispensable resource for navigating the evolving landscape.

Speak to Our Analyst

Speak to Our Analyst