Canada Lawn & Garden Consumables Market By Product Type (Seed and Planting Materials, Soil and Growing Media, Fertilizers and Plant Foods, Soil Amendments & Additives, Pest, Disease & Weed Control (Pesticides), Mulches, Landscape Fabric & Ground Covers, Ice Melts & Salts, Other Consumables), By Application (Residential, Commercial, Sports & Recreation, Municipal, Others) – Canada Analysis & Forecast, 2025–2030

Industry: Agriculture | Publish Date: 27-Nov-2025 | No of Pages: N/A | No. of Tables: N/A | No. of Figures: N/A | Format: PDF | Report Code : AG3736

Industry Outlook

The Canada Lawn & Garden Consumables Market was valued at USD 3619.0 million in 2024 and is expected to reach USD 3950.8 million by 2025. Looking ahead, the industry is projected to expand significantly, reaching USD 5168.3 million by 2030, registering a CAGR of 5.5% from 2025 to 2030.

The lawn & garden consumables market in Canada is evolving rapidly, shaped by technological innovation, environmental consciousness, and changing consumer lifestyles. Smart gardening tools such as robotic mowers, app-controlled irrigation systems, and soil sensors are redefining lawn maintenance by offering data-driven, automated, and sustainable solutions.

Growing environmental awareness is also driving demand for eco-friendly consumables like organic fertilizers, biodegradable mulch, and natural pest control products, aligning with Canada’s broader sustainability goals. At the same time, the rise of DIY culture has made all-in-one lawn care kits increasingly popular among homeowners seeking convenience, affordability, and personalised solutions. Together, these trends reflect a sector that is becoming more digital, sustainable, and consumer-centric, with innovation and green practices at its core.

What are the Key Trends in Canada Lawn & Garden Consumables Market?

Are Smart Gardening Tools Redefining the Canada Lawn Care Market?

The Canada lawn & garden consumables market demand is witnessing a rapid shift toward smart gardening technologies as homeowners increasingly adopt connected tools for precision lawn management. Devices such as robotic mowers, moisture sensors, and app-controlled irrigation systems are gaining traction among tech-savvy consumers seeking efficiency and sustainability.

For instance, brands like Husqvarna and Gardena are introducing smart lawn ecosystems that integrate real-time weather data and soil analytics for optimised care. This shift highlights a broader digital transformation where convenience, automation, and eco-consciousness intersect.

Consumers are now favouring data-driven lawn maintenance solutions that reduce water and fertilizer use while delivering healthier lawns. As connectivity continues to penetrate outdoor home care, smart gardening solutions are set to redefine consumer expectations and drive product innovation across the Canadian lawn care landscape

Is Sustainability Driving Demand for Eco-Friendly Lawn Consumables?

Yes, the growing environmental awareness among Canadian consumers is fueling demand for sustainable lawn care products such as organic fertilizers, biodegradable mulch, and natural pest control agents. This trend is reinforced by government initiatives promoting reduced chemical runoff and improved soil health.

Companies are responding by reformulating products with plant-based ingredients and offering eco-certified alternatives. This sustainable shift is transforming purchasing behaviour, with consumers increasingly prioritising non-toxic, pet-safe, and environmentally responsible options. Retailers and manufacturers that embrace green labelling and transparent sourcing practices are gaining a competitive advantage, positioning sustainability as a key driver for the Canada lawn & garden consumables market growth.

Are DIY Lawn Care Kits Becoming the Preferred Choice for Homeowners?

The rise of DIY culture is reshaping the Canada lawn & garden consumables market trends, as homeowners increasingly opt for easy-to-use, all-in-one care kits. These kits, which include pre-measured fertilizers, weed control, and seed blends, allow consumers to manage lawn maintenance without professional intervention. The shift accelerated post-pandemic, as more Canadians invested in home improvement and outdoor aesthetics.

Brands and retailers are responding with subscription-based lawn care programs and step-by-step digital guides, offering personalised solutions based on regional climates and grass types. This growing preference for convenience and affordability is democratizing lawn maintenance, creating new growth opportunities for consumer-focused product innovation.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Canada Lawn & Garden Consumables Market in the Next Decade?

The Canada lawn & garden consumables market is experiencing robust growth driven by multiple lifestyle, environmental, and technological factors. The surge in outdoor living and gardening culture has encouraged Canadians to invest in fertilizers, seeds, and pest control products as they transform outdoor spaces into areas for recreation and sustainability. Rapid urbanisation and residential expansion have further boosted demand, with new housing developments integrating green spaces that require ongoing maintenance.

The market is also witnessing a digital and sustainability transformation. E-commerce platforms like Amazon and Home Depot are becoming vital sales channels, enabling brands to reach wider audiences and offer subscription-based lawn care packages. Meanwhile, eco-conscious consumers are increasingly opting for organic, biodegradable, and low-impact products, pushing manufacturers to innovate with greener formulations and packaging.

However, climate challenges and seasonal limitations continue to restrain year-round sales, as Canada’s long winters and rising environmental risks disrupt gardening cycles. Despite these constraints, AI-driven pest control solutions are emerging as a major opportunity, offering intelligent, efficient, and sustainable alternatives for modern lawn management. Together, these forces are reshaping Canada’s lawn care landscape into a more connected, environmentally responsible, and innovation-driven market.

Growth Drivers:

Is Urban Growth and Residential Expansion Fueling Demand for Lawn and Garden Consumables?

Indeed, the rapid pace of urbanisation and residential expansion is a key factor driving the Canada lawn & garden consumables market dynamics. As per the World Bank, 82% of Canada’s population lived in urban areas in 2024, illustrating the scale of urban growth. Expanding cities and suburbs, along with new housing developments such as single-family homes, townhouses, and condominiums, are increasingly integrating private and communal green spaces that require regular maintenance.

This has spurred the demand for grass seeds, fertilizers, soil enhancers, and pest control products. Both property developers and homeowners are emphasising landscaping for its aesthetic and environmental benefits, driving the steady use of seasonal and recurring consumables. The trend is further supported by higher disposable incomes and a growing cultural preference for personalised, well-maintained outdoor environments, especially in fast-developing metropolitan areas.

Are Sustainability and Eco-Friendly Preferences Boosting the Canada Lawn & Garden Consumables Market?

Yes, sustainability and eco-friendly consumer preferences are emerging as powerful growth drivers in the market, reflecting the country’s deep commitment to environmental responsibility. According to the 2024 Sustainable Governance Indicators, Canada ranks 10th globally in environmental sustainability, underscoring its national focus on ecological stewardship.

This is mirrored in consumer behaviour, with more Canadians choosing organic fertilisers, natural pest control solutions, compost-enriched soils, and pollinator-friendly seeds over synthetic alternatives. Growing concerns about climate change, biodiversity loss, and soil degradation, combined with provincial restrictions on cosmetic pesticide use, are accelerating this shift toward low-impact, eco-certified products.

Consumers are increasingly aligning their lawn care choices with personal health and environmental values, fueling demand for biodegradable packaging, water-saving formulations, and carbon-conscious sourcing. This sustainability movement is reshaping the market and inspiring innovation in greener gardening practices

Growth Inhibitors:

Do Climate Challenges and Seasonal Constraints Limit Market Growth in Canada?

Yes, climate challenges and seasonal constraints remain key limitations on the Canada lawn & garden consumables market expansion. According to the OECD (2025), Canada faces rising climate risks such as floods and wildfires, which disrupt ecosystems, damage infrastructure, and alter traditional gardening cycles. The country’s long winters and short growing seasons already restrict outdoor gardening to limited months, and increasing climate volatility further reduces predictability around planting and harvest success.

Consequently, the industry experiences highly seasonal and fluctuating demand for fertilizers, seeds, and soil enhancers, complicating inventory management and limiting year-round sales potential. Additionally, these environmental disruptions discourage consumers from investing in lawn and garden care, posing ongoing challenges to market stability and sustained growth.

Is AI Integration in Pest Control Creating New Opportunities for Canada Lawn & Garden Consumables Market?

The integration of AI-assisted pest control is creating new opportunities in the market as both consumers and professionals seek smarter, more sustainable methods to protect plant health. As highlighted by Frontiers (2025), AI-based detection systems and language models for pest management in tomato cultivation have shown strong potential in enhancing accuracy and reducing chemical dependency.

Similar technologies be applied to residential and commercial gardening, where AI-enabled systems detect early pest infestations, assess severity, and recommend precise treatments. This approach minimizes the use of broad-spectrum pesticides while aligning with growing demand for eco-friendly and health-conscious lawn care.

As AI adoption expands within Canada’s agricultural and digital ecosystems, companies offering intelligent pest management solutions are likely to gain a competitive edge among urban gardeners and landscape professionals who value precision, efficiency, and sustainability.

How is the Canada Lawn & Garden Consumables Market Report Segmented, and What are the Key Insights from the Segmentation Analysis?

By Product Type Insights

How are product innovations shaping the Canada lawn & garden consumables market?

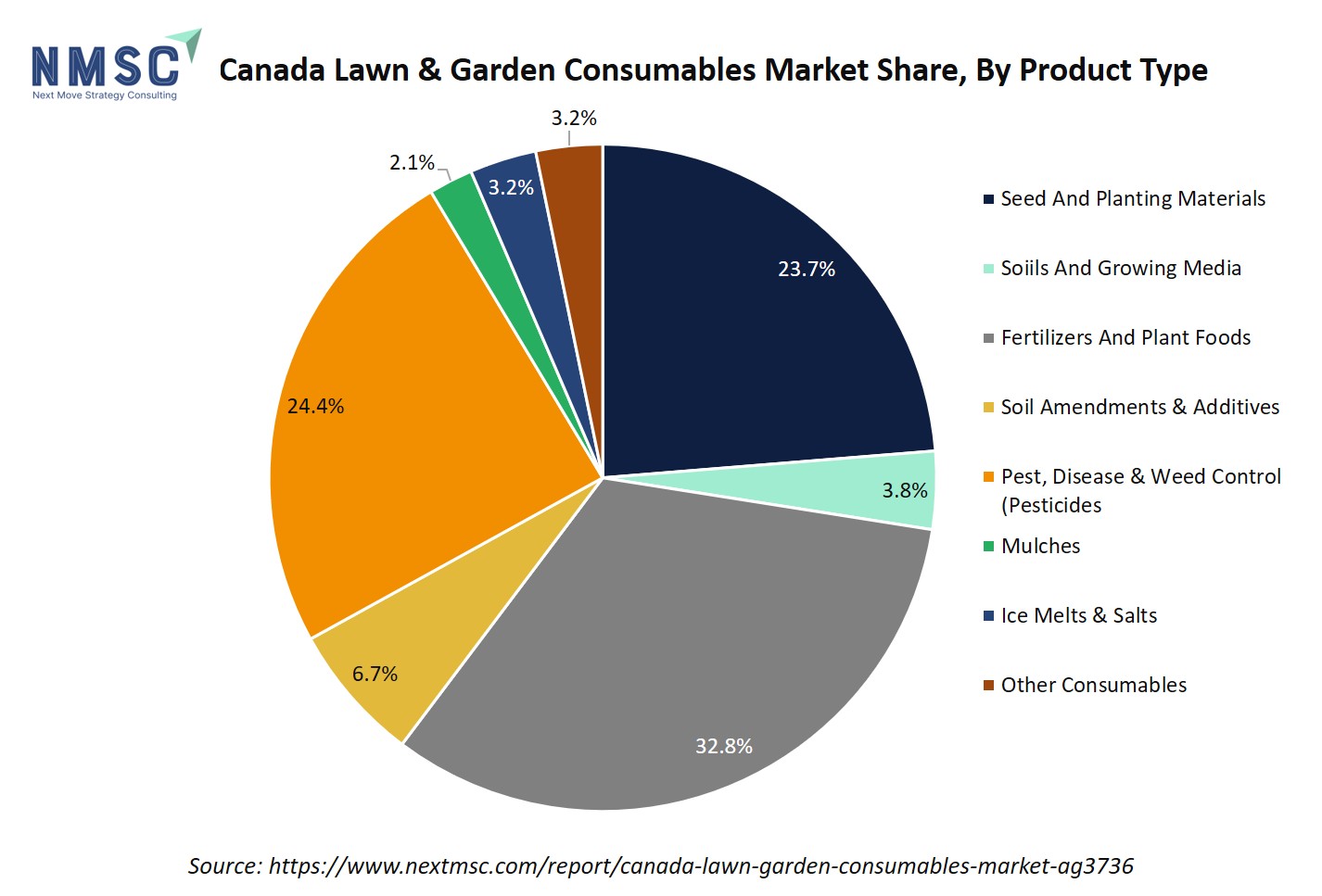

The market is segmented by product type into Seed and Planting Materials, Soil and Growing Media, Fertilizers and Plant Foods, Soil Amendments & Additives, Pest, Disease & Weed Control (Pesticides), Mulches, Landscape Fabric & Ground Covers, Ice Melts & Salts, and Other Consumables.

Among these, fertilizers and plant foods account for a major market share, driven by the growing demand for organic and nutrient-rich products tailored to Canada’s diverse soil and climatic conditions. Within this category, granular organic fertilizers are gaining traction due to their slow-release benefits and alignment with eco-friendly gardening practices. Soil and growing media form another crucial segment, led by compost and potting mixes, as more consumers engage in urban gardening and container-based planting.

The seed and planting materials segment, particularly flower and vegetable seeds, is expanding rapidly, supported by the surge in home gardening and backyard food production trends. Meanwhile, pest, disease & weed control products continue to evolve with an increasing shift toward bio-based herbicides and insecticides, reflecting the country’s tightening regulations on synthetic pesticides. Additionally, the rising use of mulches and soil conditioners for moisture retention and erosion control further underscores the market’s shift toward sustainable landscaping practices.

By Application Insights

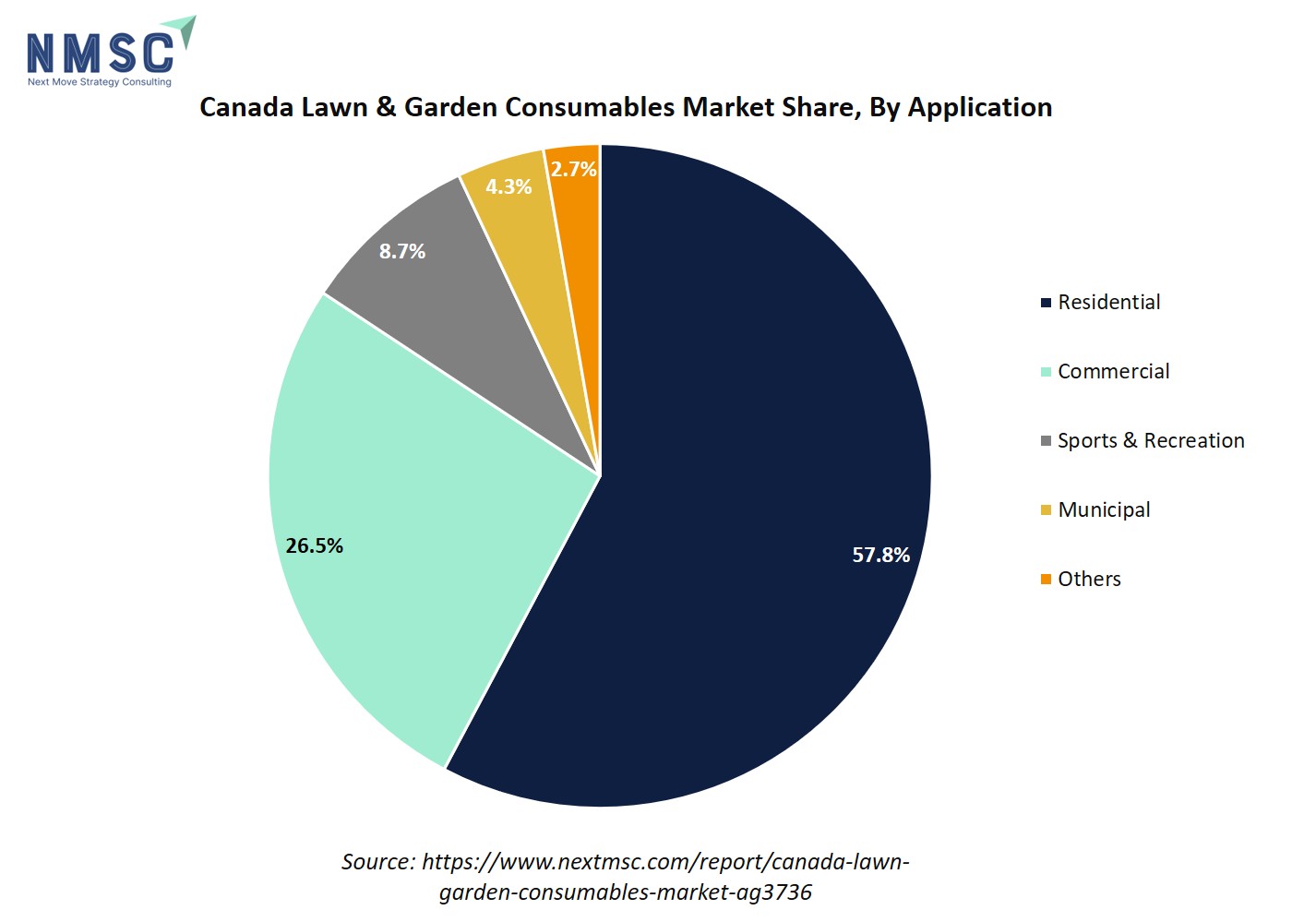

Which end-use segments are driving demand for lawn and garden consumables in Canada?

Based on application, the market is categorized into Residential, Commercial, Sports & Recreation, Municipal, and Others. The residential segment dominates the market, driven by growing homeowner interest in outdoor beautification, gardening, and eco-friendly lawn care solutions. The proliferation of detached and semi-detached housing with private lawns and gardens continues to boost recurring demand for seeds, fertilizers, and pest control products. The commercial segment, including office complexes, hotels, and retail properties, also holds a substantial share as landscaping is increasingly viewed as a value enhancer for business environments. The sports & recreation segment is witnessing notable growth with increased investments in turf management across golf courses, athletic fields, and community parks. Moreover, the municipal segment is expanding steadily as local governments invest in green infrastructure, including public parks and roadside plantations, to support urban sustainability initiatives. Together, these segments highlight the broadening scope of lawn and garden consumables across both private and public domains in Canada, with sustainability, urban greenery, and lifestyle enhancements serving as key growth pillars.

Competitive Landscape

Which Companies Dominate the Lawn & Garden Consumables Industry in Canada and How do they Compete?

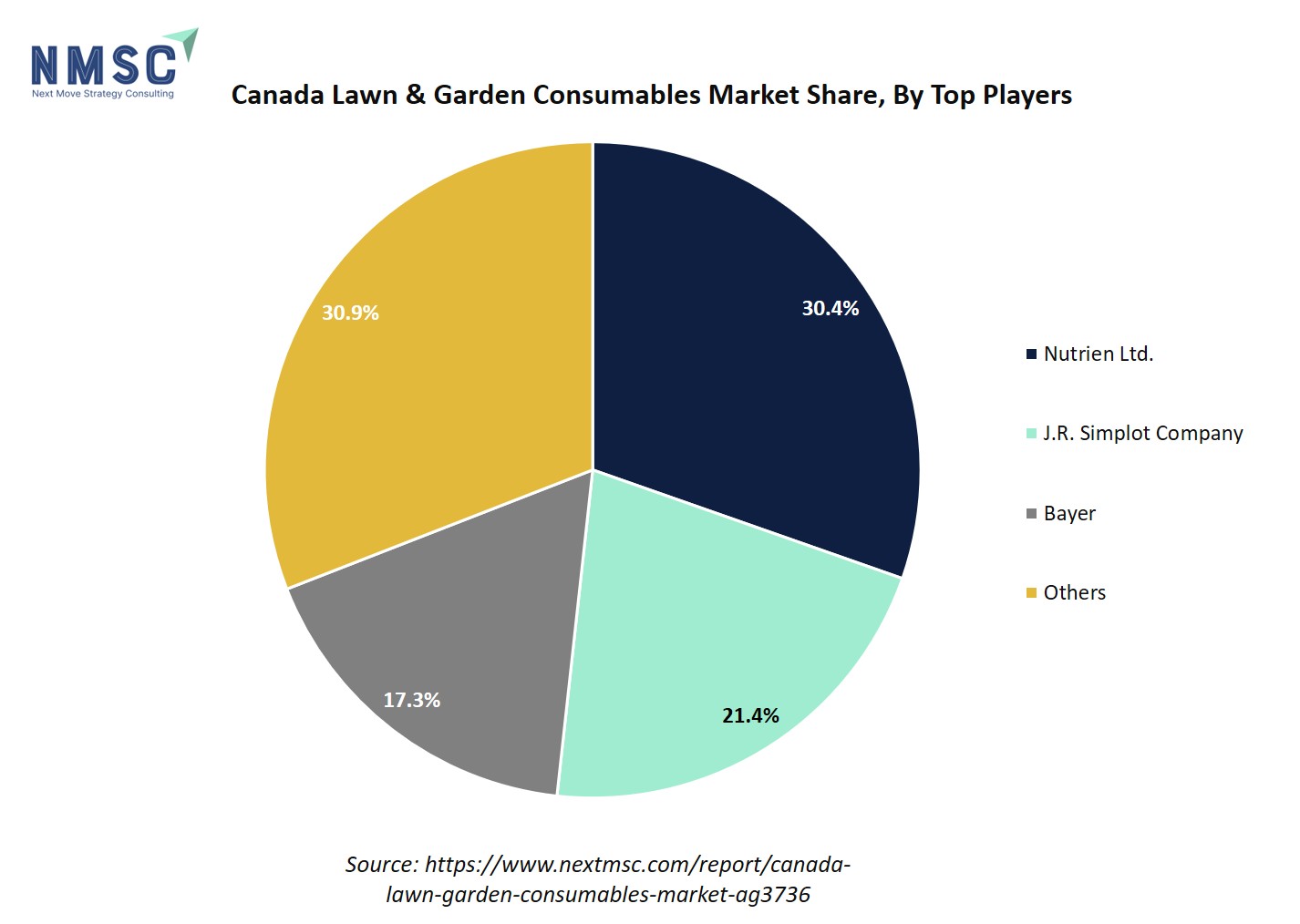

The market is led by major players such as Nutrien Ltd., J.R. Simplot Company, Bayer, Scotts Miracle-Gro Company, Basf SE, Brettyoung, FMC, Premier Tech, Omex Agriculture Inc. and Others. These companies compete through product innovation, sustainability initiatives, and strong retail and distribution networks.

While global giants like Scotts Miracle-Gro and Bayer lead with brand strength and advanced formulations, domestic firms such as Premier Tech and BrettYoung focus on organic, locally adapted products. The competition is increasingly centred on eco-friendly solutions, digital engagement, and customised lawn care offerings to meet evolving consumer preferences.

Market Dominated by Established Global and Regional Insurers

The Canada lawn & garden consumables market is dominated by a mix of established global corporations and strong regional players that collectively shape the competitive landscape. Global leaders such as Scotts Miracle-Gro, Bayer AG, BASF SE, and Nutrien Ltd., leverage their extensive R&D capabilities, brand recognition, and wide product portfolios to maintain a significant market presence.

Meanwhile, regional companies like Premier Tech and BrettYoung are gaining ground by focusing on localised production, sustainable formulations, and distribution partnerships tailored to Canadian climates and soil conditions. This balance between multinational innovation and regional expertise ensures a dynamic, competitive environment where product differentiation, eco-friendly solutions, and consumer trust remain key success factors.

Innovation and Adaptability Drive Market Success

In the Canada lawn & garden consumables market share, innovation and adaptability are central to maintaining competitiveness and capturing emerging opportunities. Companies are increasingly focusing on developing climate-resilient, sustainable, and technology-driven products that align with evolving consumer preferences and environmental priorities.

The sector is witnessing strong adoption of organic fertilizers, biodegradable mulches, and precision lawn management systems that utilise IoT sensors and mobile applications. These digital and eco-friendly innovations not only enhance efficiency and soil health but also cater to the growing consumer demand for sustainable and low-maintenance lawn care solutions.

Market Players Embrace Innovative Offerings and Expansion Strategies

Leading companies are actively pursuing strategic expansions, acquisitions, and product innovations to strengthen their market position. For instance, in November 2024, Nutrien Ag Solutions acquired Suncor Energy’s AgroScience assets, which include patented biocontrol technologies. This acquisition enhances Nutrien’s integrated pest management and bio-based crop protection capabilities, significantly broadening its garden and lawn consumables portfolio for Canadian growers.

Similarly, firms like Scotts Miracle-Gro and Premier Tech are investing in smart gardening technologies and sustainable product lines, while regional players such as BrettYoung and OMEX Agriculture Inc. continue to innovate with climate-adapted formulations and localised production. This collective emphasis on innovation, sustainability, and expansion underscores a rapidly evolving market landscape that rewards technological leadership and environmental responsibility.

Key Players

-

Nutrien Ltd.

-

Scotts Miracle-Gro Company

-

Bayer

-

BrettYoung

-

FMC

-

Premier Tech

-

Omex Agriculture Inc.

-

The Mosaic Company

-

Corteva Agriscience

-

Nufarm

-

Terralink Horticulture Inc.

-

Nova Turf

-

Brandt

What are the Latest Key Industry Developments?

-

In April 2024 – A new retail facility was inaugurated in Balgonie, Saskatchewan, featuring a dry fertilizer warehouse and an automated fertilizer blending plant to enhance operational efficiency and meet growing demand for lawn and garden consumables across Canada.

-

In May 2024 – Bayer acquired a license from Pairwise to commercialize genome-edited mustard greens, the first gene-edited food introduced to the North American market, offering enhanced nutrition and flavour compared to lettuce varieties.

-

In November 2024 – Nutrien Ag Solutions acquired Suncor Energy’s AgroScience assets, including patented biocontrol technologies, strengthening its integrated pest management portfolio and expanding bio-based crop protection offerings for Canadian growers.

-

In January 2023 – Simplot expanded its Portage la Prairie facility by 400,000 sq ft, incorporating advanced energy-efficient systems to boost production capacity and ensure a sustainable supply of lawn and garden consumables in Canada.

-

In June 2025 – Bayer developed new tomato varieties resistant to tomato brown rugose fruit virus (ToBRFV), set for launch across major glasshouse segments globally, enhancing crop resilience and reducing pesticide dependence.

-

In July 2025 – Bayer submitted registration applications for a novel herbicide across four major markets, including Canada, marking a significant milestone in its ongoing innovation for sustainable weed management solutions.

What are the Key Factors Influencing Investment Analysis & Opportunities in Canada Lawn & Garden Consumables Market?

Investment opportunities in the Canada lawn & garden consumables market are being shaped by a combination of sustainability trends, technological innovation, and evolving consumer preferences. The rising focus on eco-friendly gardening practices and organic fertilizers has created strong prospects for investors in green and bio-based product segments. Government initiatives promoting sustainable landscaping and restrictions on chemical pesticides are further encouraging innovation and market diversification.

The industry is also benefiting from digital transformation, with growing adoption of e-commerce channels, subscription-based lawn care kits, and AI-assisted pest management solutions. These innovations not only improve operational efficiency but also open new business models for direct-to-consumer engagement. Additionally, expanding residential construction and urban green space projects are driving consistent demand across both residential and commercial segments, making the market attractive for long-term investors.

Mergers, acquisitions, and capacity expansions, such as Nutrien’s acquisition of Suncor Energy’s AgroScience assets and Simplot’s facility upgrade, reflect a trend toward consolidation and capability enhancement. With stable economic growth, a strong culture of outdoor living, and increasing consumer inclination toward sustainability and smart gardening, Canada’s lawn care market offers investors a resilient and future-ready growth landscape

Key Benefits for Stakeholders:

Next Move Strategy Consulting presents a comprehensive analysis of the Canada Lawn & Garden Consumables Market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the sector at country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major Home Insurance segments.

Report Scope

|

Parameters |

Details |

|

Market Size in 2025 |

USD 3950.8 million |

|

Revenue Forecast in 2030 |

USD 5168.3 million |

|

Growth Rate |

CAGR of 5.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Million (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customisation (equivalent up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customised purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Canada Lawn & Garden Consumables Market Key Segments

By Product Type

-

Seed and Planting Materials

-

Grass Seed

-

Flower and Vegetable Seed

-

Bulbs and Tubers

-

-

Soil and Growing Media

-

Topsoil & Garden Soil

-

Potting Soil & Container Mixes

-

Compost & Manure

-

-

Fertilizers and Plant Foods

-

Granular Fertilizers

-

Organic

-

Inorganic

-

-

Liquid Feeds

-

Organic

-

Inorganic

-

-

Powdered Water-Soluble Feeds

-

Organic

-

Inorganic

-

-

-

Soil Amendments & Additives

-

PH Adjusters

-

Organic

-

Inorganic

-

-

Soil Conditioners

-

Organic

-

Inorganic

-

-

Micro-Nutrient Blends

-

Organic

-

Inorganic

-

-

-

Pest, Disease & Weed Control (Pesticides)

-

Herbicides

-

Organic

-

Inorganic

-

-

Insecticides

-

Organic

-

Inorganic

-

-

Fungicides

-

Organic

-

Inorganic

-

-

Other Controls

-

-

Mulches

-

Organic Mulch

-

Inorganic Mulch

-

-

Landscape Fabric & Ground Covers

-

Ice Melts & Salts

-

Other Consumables

By Application

-

Residential

-

Commercial

-

Sports & Recreation

-

Municipal

-

Others

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policymakers, and consultants with actionable insights to capitalize on the evolving Canada lawn & garden consumables market growth potential. By integrating robust data-driven analysis with strategic frameworks, Next Move Strategy Consulting’s Market Report serves as an indispensable resource for understanding market dynamics, identifying high-return investment avenues, and navigating the rapidly transforming lawn and garden care landscape.

Speak to Our Analyst

Speak to Our Analyst