Data Center Power Solution Market By Power Infrastructure Components (Power Conversion & Backup, On-Site Generation, and Others), By IT Load (< 500 kW, 500 kW–2 MW, and Others), By Redundancy Level (N, N+1, and Others), By Power Source & Sustainability (Grid-Tied, On-Site Conventional, and Others), By Project Maturity Stage (Concept & Feasibility, Under Construction, and Others), By End-User (IT & Cloud Service Providers, Financial Services, and Others)– Global Analysis & Forecast,2025–2030

Industry Outlook

The global Data Center Power Solution Market size was valued at USD 18.69 billion in 2024, and is expected to be valued at USD 20.67 billion by the end of 2025. The industry is projected to grow, hitting USD 34.14 billion by 2030, with a CAGR of 10.5% between 2025 and 2030.

The global data center power solution market is experiencing strong growth in 2025, driven by accelerating digital transformation, widespread cloud adoption, and the expansion of hyperscale and edge facilities worldwide. Increasing demand for AI workloads, IoT applications, and 5G-enabled services is intensifying the need for reliable, scalable, and energy-efficient power infrastructure. Key adoption is occurring across industries including banking and financial services, e-commerce, healthcare, IT & telecom, and manufacturing, as organizations modernize data operations and enhance business continuity.

Innovation is advancing rapidly with the integration of renewable energy sources, modular UPS systems, advanced power distribution units, and AI-powered energy management tools, improving resilience and sustainability. Applications range from mission-critical backup systems and intelligent load balancing to predictive equipment monitoring and green power solutions designed for high-density computing environments. Demand is particularly strong for solutions that optimize energy efficiency, reduce carbon footprints, and support global sustainability initiatives and regulatory frameworks targeting low-carbon data centers.

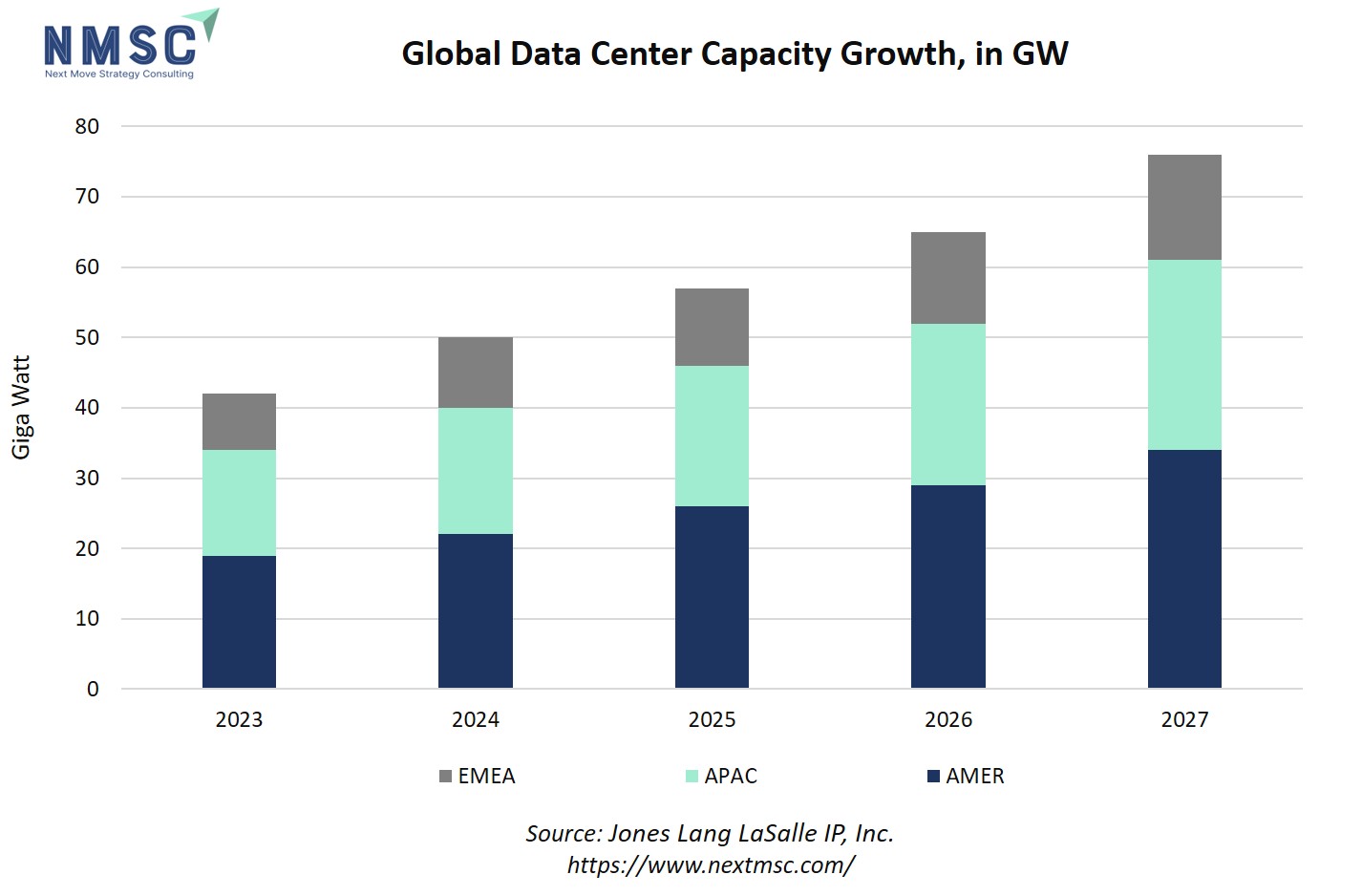

The above chart depicts the projected global data center capacity growth in gigawatts (GW) from 2023 to 2027, segmented by region, AMER (Americas), APAC (Asia-Pacific), and EMEA (Europe, Middle East, and Africa). The steady increase across all regions signals substantial expansion in power demand, directly driving the data center power solution market growth as operators require more advanced, efficient, and scalable energy infrastructure to support the rising load. This trend is expected to boost opportunities for innovation in power components, renewable integration, and efficient management systems, with regional differences shaping market strategies and technology adoption.

What are the Key Trends in Data Center Power Solution Industry?

How is the Integration of Renewable Energy Transforming Data Center Power Solutions?

The integration of renewable energy sources into data center power solutions is gaining momentum, driven by the need for sustainable operations and compliance with environmental regulations. For instance, California and Texas have significantly increased their clean energy generation, with California's grid reaching a clean energy share of 74% and Texas at 46.5% as of August 2025. This shift is prompting data centers to adopt on-site power solutions, such as solar panels and small modular reactors, to reduce reliance on traditional power grids. This trend indicates a move towards energy independence and sustainability in data center operations.

What Role Does Artificial Intelligence Play in Shaping Market Demands?

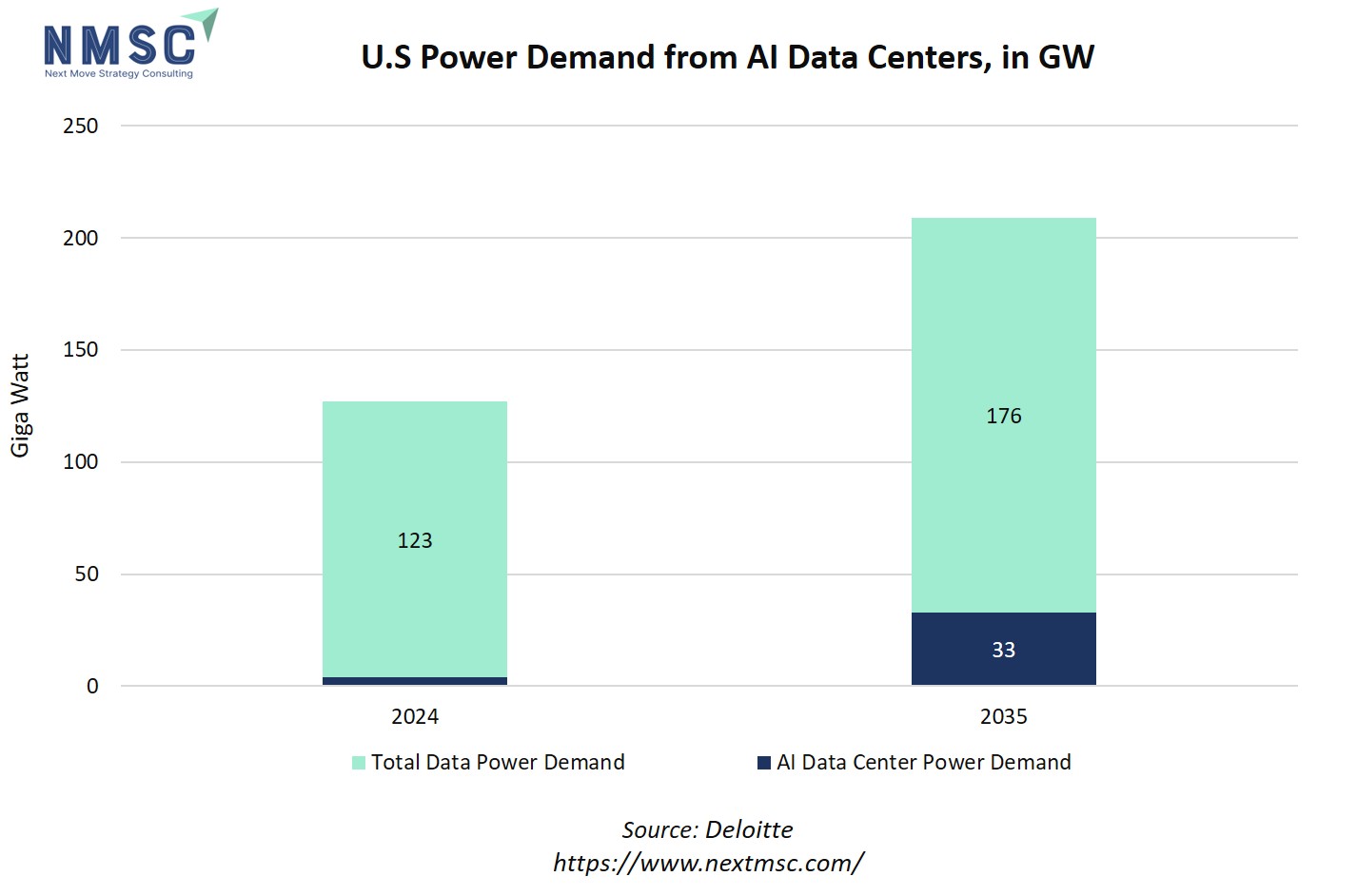

Artificial Intelligence (AI) is significantly influencing data center power requirements. Deloitte estimates that by 2035, power demand from AI data centers in the United States could grow more than thirtyfold, reaching 123 gigawatts, up from 4 gigawatts in 2024. This surge is attributed to the increasing complexity of AI models and the need for high-performance computing resources. The growing power demands necessitate the development of advanced cooling solutions and efficient power distribution systems. Data center operators should prioritize investments in scalable infrastructure and adopt AI-driven energy management systems to optimize power usage and enhance operational efficiency.

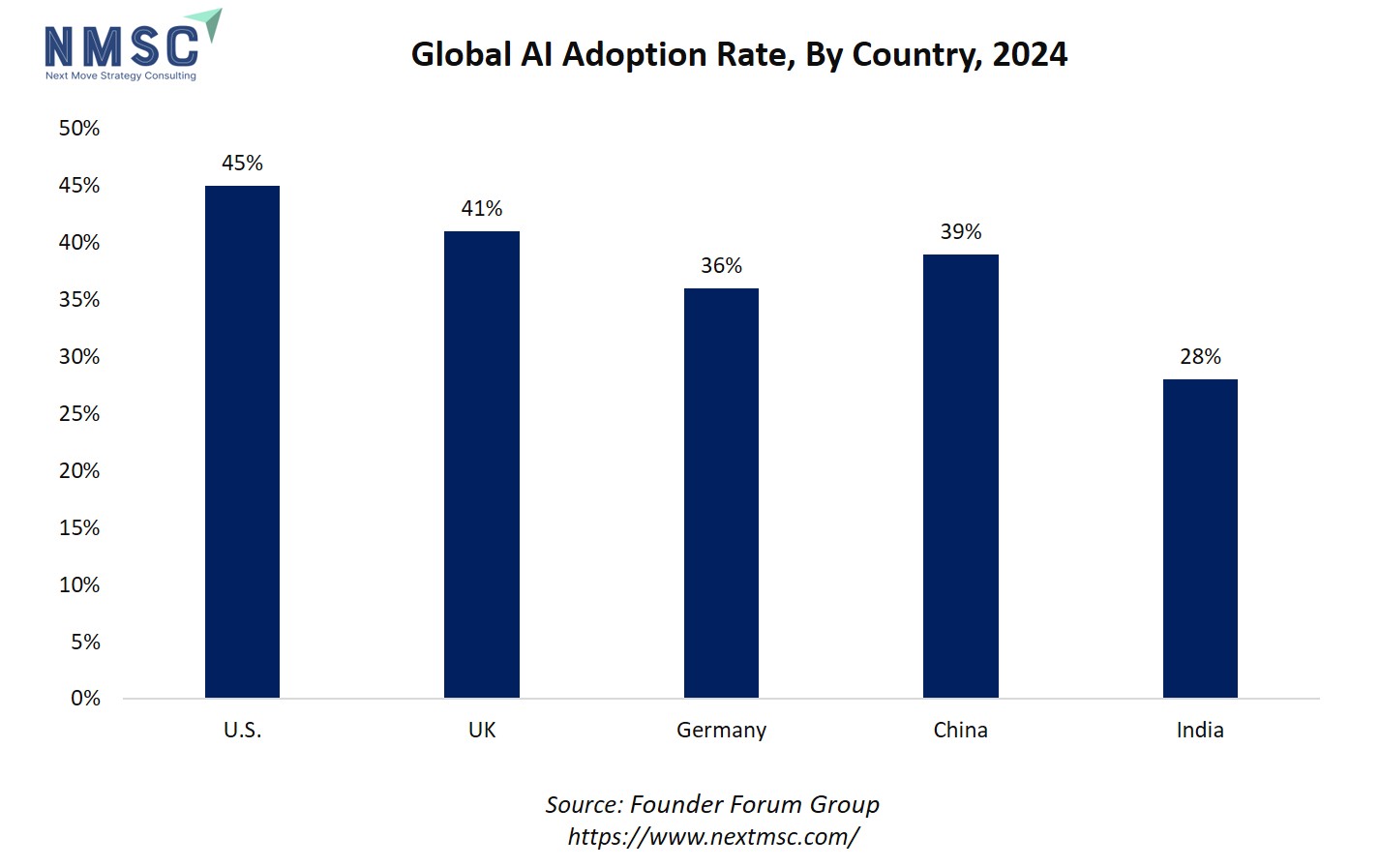

The chart shows the global AI adoption rate across five major countries in 2024, highlighting that the U.S. leads with 45%, followed by the UK at 41%, China at 39%, Germany at 36%, and India at 28%. The rising AI deployment, especially in the U.S., UK, and China, signals a significant boost in demand for data processing and storage, which in turn intensifies the need for advanced data center power solutions. Higher AI adoption accelerates data center expansion, propelling the data center power solution market for scalable, energy-efficient, and resilient power infrastructure across leading and emerging economies.

How are Power Infrastructure Bottlenecks Affecting Data Center Expansion?

Power infrastructure bottlenecks are emerging as significant challenges to data center expansion. The International Energy Agency highlights that integrating data centers into existing electricity grids can be difficult, as connection queues for supply and transmission projects are often long and complex. Building new transmission lines or upgrading grid components, such as transformers and cables, can take four to eight years, and wait times for critical equipment have doubled in the past three years. These bottlenecks can delay project timelines, increase costs, and impede the reliable operation of new data centers.

What Investment Opportunities are Emerging in Data Center Power Solutions?

The growing demand for data center power solutions presents significant investment opportunities. According to reports, data centers are projected to require USD 6.7 trillion worldwide by 2030 to keep pace with the demand for compute power, with USD 5.2 trillion allocated for AI-optimized data centers. This substantial investment underscores the need for innovative power solutions and infrastructure development.

What are the Key Market Drivers, Breakthroughs, and Investment Opportunities that will Shape the Data Center Power Solution Industry in the Next Decade?

The global data center power solution market is experiencing significant growth in 2025, driven by the increasing demand for digital services, cloud computing, and artificial intelligence. As enterprises and service providers expand their digital infrastructure, the need for reliable, scalable, and energy-efficient power solutions has become paramount. Innovations in power distribution, energy storage, and renewable energy integration are reshaping the landscape, offering opportunities for enhanced operational efficiency and sustainability.

However, this rapid expansion also presents challenges. Power infrastructure bottlenecks, regulatory complexities, and environmental concerns are emerging as critical inhibitors to growth. Addressing these challenges requires strategic investments, technological advancements, and collaborative efforts across the industry to ensure a resilient and sustainable power supply for the evolving data center ecosystem.

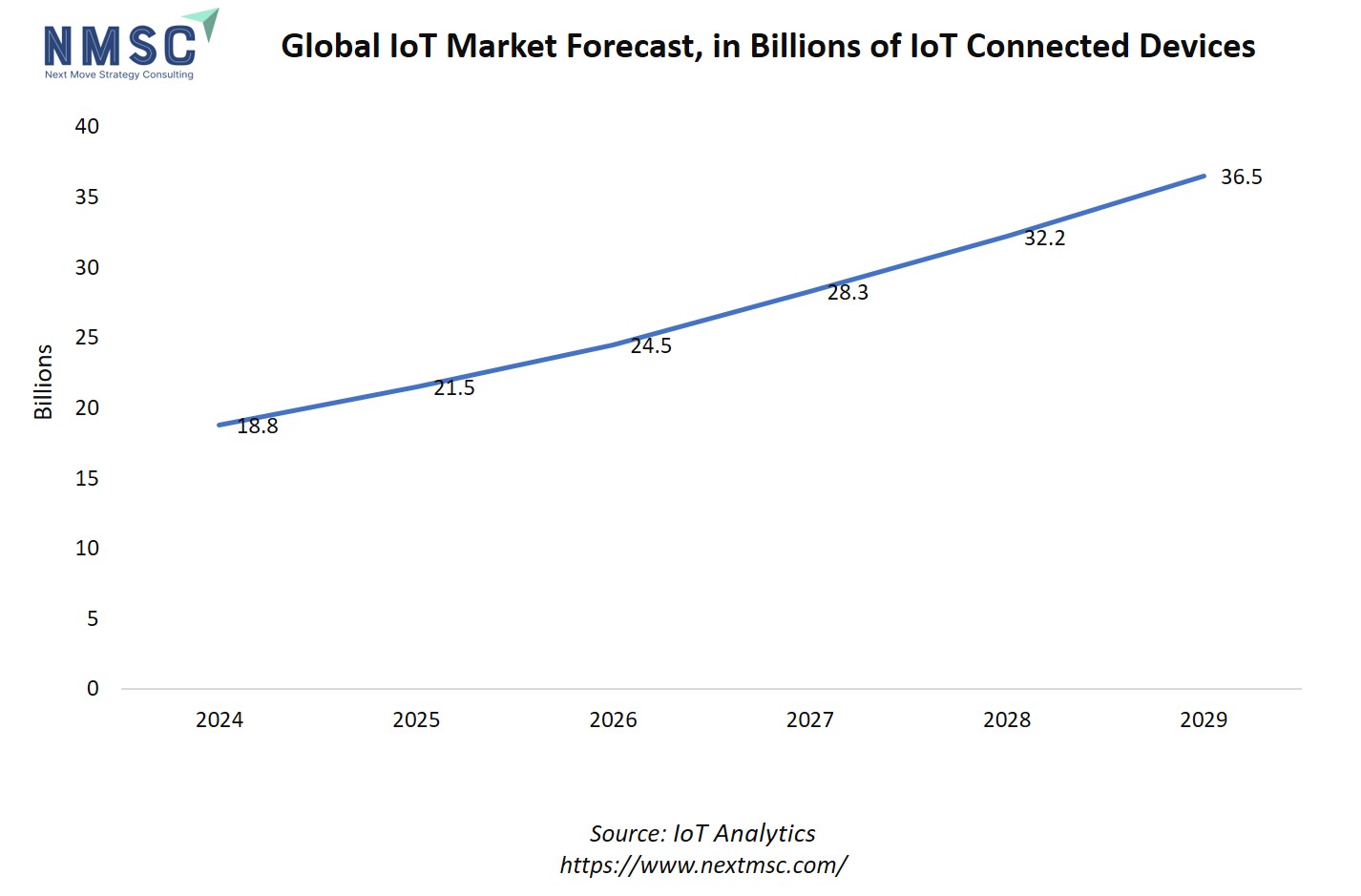

The above chart depicts a steady growth trajectory in the global Internet of Things (IoT) market, with the number of connected IoT devices expected to nearly double from 18.8 billion in 2024 to 36.5 billion by 2029. As IoT adoption accelerates, data centers must handle significantly higher workloads, intensifying requirements for robust UPS systems, modular power architecture, and advanced cooling solutions to ensure uninterrupted service and support the data deluge generated by these devices. This macro growth context underpins the strong investment and technological upgrade cycles for data center power solutions market.

Growth Drivers:

How is the Surge in AI Workloads Impacting Data Center Power Requirements?

The proliferation of AI applications is significantly increasing data center power demands. According to the IEA, electricity consumption by data centers is projected to more than double by 2030, with AI-optimized data centers accounting for a substantial portion of this increase. AI workloads, particularly those involving large-scale machine learning models, require high-density computing resources, leading to greater energy consumption. This surge necessitates the development of advanced power solutions, including efficient uninterruptible power supplies (UPS), energy storage systems, and renewable energy integration, to meet the escalating demands of AI-driven data centers.

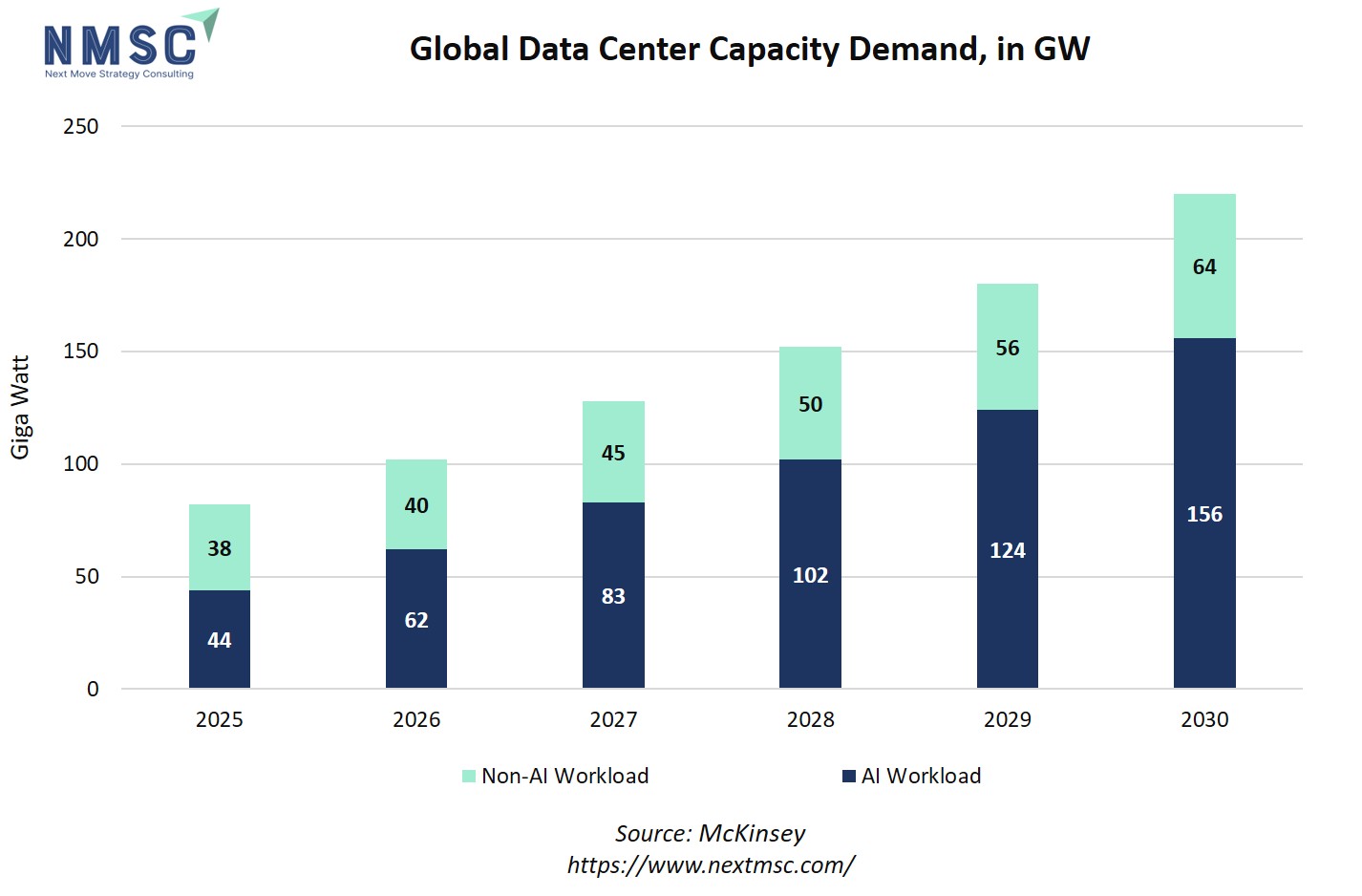

The chart above shows that both AI and non-AI workloads will significantly drive global data center capacity demand, which is projected to increase from 82 GW in 2025 to 219 GW by 2030, a 3.5-fold rise, with AI workloads rapidly outpacing non-AI demands. Such robust and accelerating growth means the data center power solution market must scale rapidly to provide advanced, reliable, and energy-efficient power infrastructure capable of handling higher densities and evolving computing requirements. The trend underlines crucial opportunities for innovation in power management technologies, as well as heightened pressure on providers to deliver sustainable and resilient energy solutions for future data center expansions.

What Role Does Renewable Energy Integration Play in Data Center Power Solutions?

Integrating renewable energy sources into data center power solutions is becoming increasingly important to meet sustainability goals and reduce carbon footprints. The adoption of renewable energy, such as solar and wind power, in conjunction with energy storage systems, enables data centers to operate more sustainably and efficiently. For instance, companies like Redwood Materials are repurposing second-life electric vehicle batteries for stationary energy storage, providing cost-effective and scalable solutions for data centers. This approach not only supports the transition to renewable energy but also addresses energy storage challenges associated with intermittent power sources.

Growth Inhibitors:

What are the Challenges Posed by Power Infrastructure Bottlenecks in Data Center Growth?

Power infrastructure constraints are a major challenge for global data center expansion. The IEA notes that integrating data centers into existing electricity grids can be difficult, as connection queues for supply and transmission projects are often long and complex. Building new transmission lines or upgrading grid components, such as transformers and cables, can take four to eight years, and wait times for critical equipment have doubled in the past three years. These bottlenecks can delay project timelines, increase costs, and impede the reliable operation of new data centers, highlighting the need for coordinated investments in grid modernization and capacity expansion.

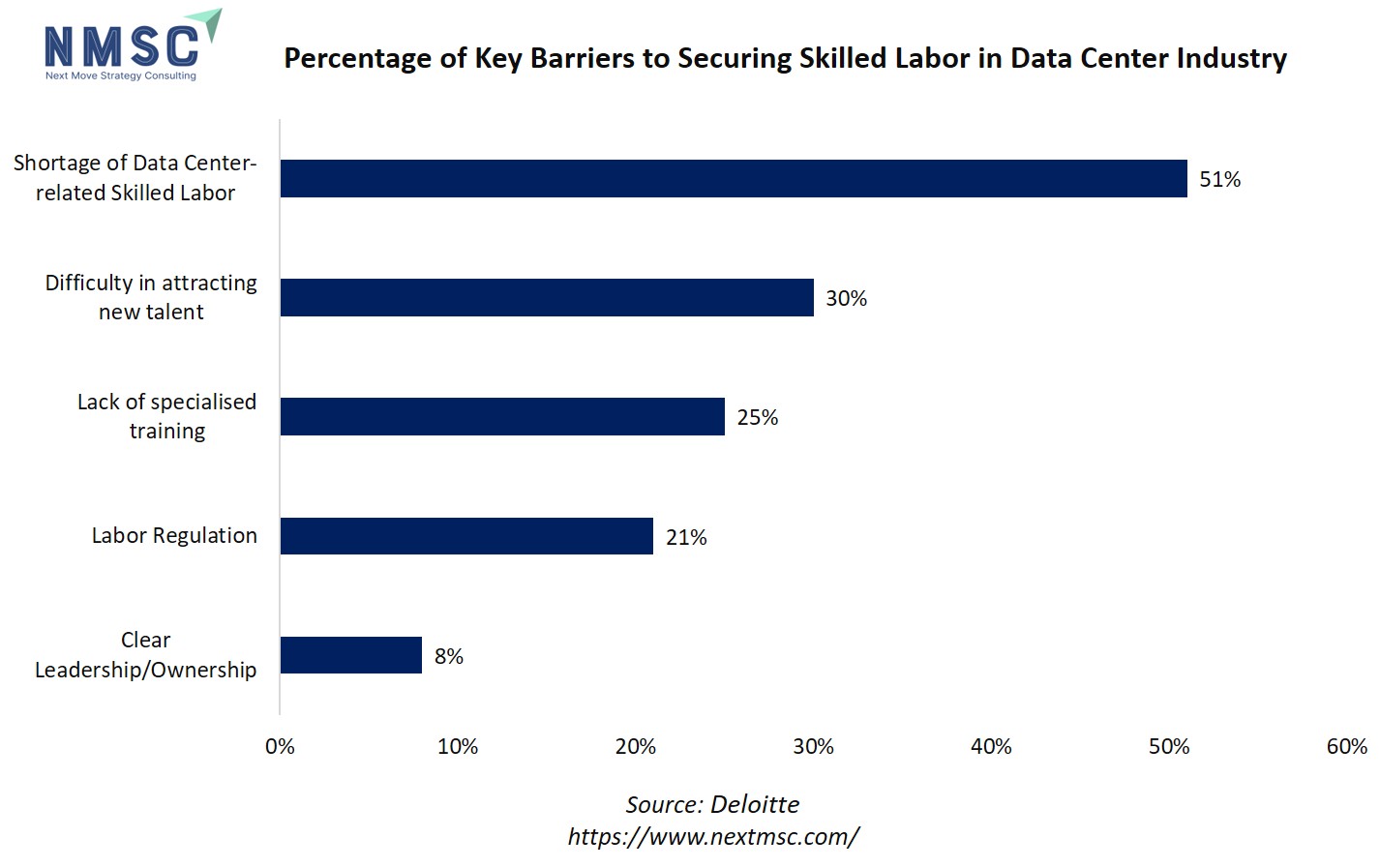

Also, the data center power solution market expansion is restrained by the challenge of a skilled labor shortage. As data centers expand rapidly to meet increasing power demands, especially driven by AI adoption and capacity growth, the need for highly skilled technicians and engineers who can design, implement, and maintain advanced power infrastructure becomes critical. The limited availability of trained professionals hinders efficient deployment, prolongs project timelines, escalates labor costs, and may impact the quality and reliability of power solutions, thereby slowing down overall market growth until sufficient skilled labor resources become accessible.

The chart highlights that competition for skilled labor, particularly the shortage of data center-related skilled professionals (51%), is among the most significant barriers facing data center growth, alongside issues like competition with other markets (53%), geographic limitations, and high turnover rates. Such shortages directly constrain the data center power solution market's expansion, as the delivery, deployment, and optimization of advanced power infrastructure depend on highly specialized talent.

How Can Small Modular Reactors (Smrs) Contribute to Data Center Power Solutions?

Small modular reactors (SMRs) are gaining attention as a potential solution to meet the growing power demands of data centers. SMRs offer a compact and scalable alternative to traditional nuclear power plants, providing a reliable and low-emission energy source. The 2025 Global Data Center Outlook report notes that the total amount of gigawatts from SMR announcements is expected to double, indicating a growing interest in nuclear power as a preferred solution to meet energy needs. Integrating SMRs into data center power solutions could enhance energy security and support sustainability objectives.

How Data Center Power Solution Market is Segmented in this Report, and What are the Key Insights from the Segmentation Analysis?

By Power Infrastructure Components Insights

How do Power Infrastructure Components Shape the Data Center Power Solution Market?

On the basis of power infrastructure components, the data center power solution market is segmented into power conversion & backup, on-site generation, power distribution hardware, monitoring & management and professional services.

Power conversion and backup solutions, including UPS systems and battery storage, account for the largest share of the data center power solution market. With increasing AI and high-density workloads, data centers demand reliable uninterrupted power supply to ensure zero downtime. For example, Schneider Electric’s AI-ready UPS offerings are being widely adopted across hyperscale and enterprise data centers. This segment’s dominance highlights the market’s focus on operational continuity and risk mitigation.

On-site generation, including diesel generators and hybrid renewable setups, is becoming critical due to grid limitations in some metro regions. Adoption is driven by energy resiliency needs and sustainability goals. Operators integrating hybrid renewable-diesel solutions benefit from lower operational costs, compliance with ESG mandates, and enhanced uptime, making on-site generation an attractive segment for investors and data center developers.

Power distribution hardware, including switchgear, transformers, and PDUs is essential for efficient energy delivery within data centers. As AI workloads and high-density racks increase energy demand, proper distribution ensures minimal losses and operational efficiency. Companies like ABB and Eaton are innovating modular, compact, and high-capacity distribution systems to accommodate scalable deployments.

By IT Load Insights

How is the Data Center Power Solution Market Segmented by IT Load and What Insights Can Be Drawn?

Based on IT load, the data center power solution market share is segmented into edge & micro (< 500 kW), medium (500 kW–2 MW), large (2–5 MW), and hyperscale (> 5 MW).

Edge and micro data centers, with IT loads under 500 kW, are increasingly deployed near end-users to reduce latency for applications like IoT, autonomous systems, and AI-driven analytics. Their smaller footprint allows rapid deployment and lower upfront costs, attracting telecom operators and localized enterprise applications.

Medium-sized data centers (500 kW–2 MW) cater to SMEs, cloud service providers, and regional enterprises. They balance cost-efficiency and computational capability, making them ideal for growing cities outside major metro hubs. Adoption of hybrid UPS and on-site generation solutions ensures reliability. The data center power solution market expansion in this segment is driven by digitalization mandates, AI adoption, and demand for resilient local infrastructure.

Large data centers with IT loads of 2–5 MW serve major enterprises, BFSI, and mid-sized hyperscalers. Their infrastructure requires high-density UPS, advanced cooling, and sophisticated power distribution networks.

Hyperscale data centers (>5 MW) represent the fastest-growing segment due to AI workloads, cloud services, and global hyperscalers. These facilities demand high-density power, redundant on-site generation, and advanced monitoring & management platforms. The data center power solution market growth is fueled by government incentives, data localization requirements, and renewable energy integration.

By Power Capacity Band Insights

How Does Power Capacity Influence Market Dynamics and Growth Opportunities?

Based on power capacity band, the data center power solution market is divided into < 0.05 GW, 0.05–0.1 GW, 0.1–0.2 GW, 0.2–0.5 GW and > 0.5 GW.

Smaller capacity projects (<0.05 GW) are typically edge or micro data centers, allowing rapid deployment and localized low-latency solutions, ideal for SMEs and IoT applications. Mid-tier capacities (0.05–0.5 GW) serve medium to large data centers, balancing scalability, cost-efficiency, and resilience with hybrid UPS and on-site generation. The >0.5 GW segment, including hyperscale facilities, demands high-density power, redundant generation, advanced monitoring, and renewable integration to support cloud, AI, and hyperscale enterprise workloads. Providers offering modular, energy-efficient, and scalable solutions can capture growth across all bands, especially in metro hubs.

By Redundancy Level Insights

How are Redundancy Levels Shaping Reliability and Investment Decisions in the Data Center Power Solution Market?

Based on redundancy level, the data center power solution market is divided into N (no redundancy), N+1 (single‐fault tolerant), N+2 (dual‐fault tolerant), 2N (full duplication), 2N+1 (concurrent maintain + extra spare), and 3N / 2N+2 (multi-backup fault tolerant)

N and N+1 configurations are typically deployed in edge and micro data centers where cost-efficiency is crucial, providing basic protection against outages. N+2 and 2N setups dominate medium to large facilities, offering dual-fault tolerance and high reliability for enterprise workloads. High-end configurations like 2N+1 and 3N are standard in hyperscale data centers, supporting critical AI, cloud, and BFSI operations where downtime is unacceptable. Market growth is driven by increasing AI and high-density workloads, demanding resilient power infrastructure. Providers offering flexible, scalable redundancy options are well-positioned to capture opportunities by balancing CAPEX, OPEX, and operational reliability.

By Rack Power Density Insights

How are Different Rack Power Densities Shaping Opportunities in Data Center Power Solution Market?

Based on rack power density, the data center power solution market is segmented into < 10 kW/Rack, 10–30 kW/Rack, and > 30 kW/Rack.

Low-density racks (<10 kW/Rack) are commonly deployed in edge and micro data centers, SMEs, and regional enterprise facilities. Their lower power requirements allow simpler UPS and cooling solutions, reducing upfront CAPEX and operational complexity. This segment supports localized AI, IoT, and latency-sensitive applications, enabling rapid deployment and flexible scaling.

Medium-density racks (10–30 kW/Rack) are deployed in medium to large data centers, balancing computational capacity with manageable power and cooling demands. They accommodate enterprise workloads, BFSI operations, and cloud services requiring reliable energy delivery without excessive infrastructure investment. Adoption of hybrid UPS, on-site generation, and modular PDUs ensures uptime and energy efficiency.

High-density racks (>30 kW/Rack) are primarily deployed in hyperscale facilities supporting cloud providers, AI workloads, and large enterprise operations. These racks demand advanced UPS systems, redundant on-site generation, high-capacity cooling, and AI-enabled monitoring to maintain uptime and optimize energy efficiency.

By Power Source & Sustainability Insights

How are Power Sources and Sustainability Driving the Data Center Power Solution Market Trends?

Based on power source & sustainability, the data center power solution market is segmented into grid-tied, on-site conventional, low-carbon & renewables, and emerging tech.

Grid-tied solutions remain the most widely adopted, leveraging the national electricity grid for continuous power supply. They are cost-effective for most data centers but may face reliability challenges in regions with unstable grids. On-site conventional power, whereas includes diesel and gas generators, often used for backup or primary power in areas with unreliable grid access. These systems provide high reliability and flexibility but have higher operational costs and carbon emissions.

Low-carbon & renewable solutions, such as solar, wind, and hybrid renewable-diesel systems, are rapidly gaining traction due to government incentives and corporate ESG mandates. Integration of renewables reduces carbon footprint, lowers OPEX, and enhances sustainability. Emerging technologies include fuel cells, energy storage systems, and AI-optimized microgrids. These solutions promise higher efficiency, lower emissions, and resilience for future high-density, AI-driven workloads.

By End-User Insights

How are End-User Segments Driving Growth in the Data Center Power Solution Market?

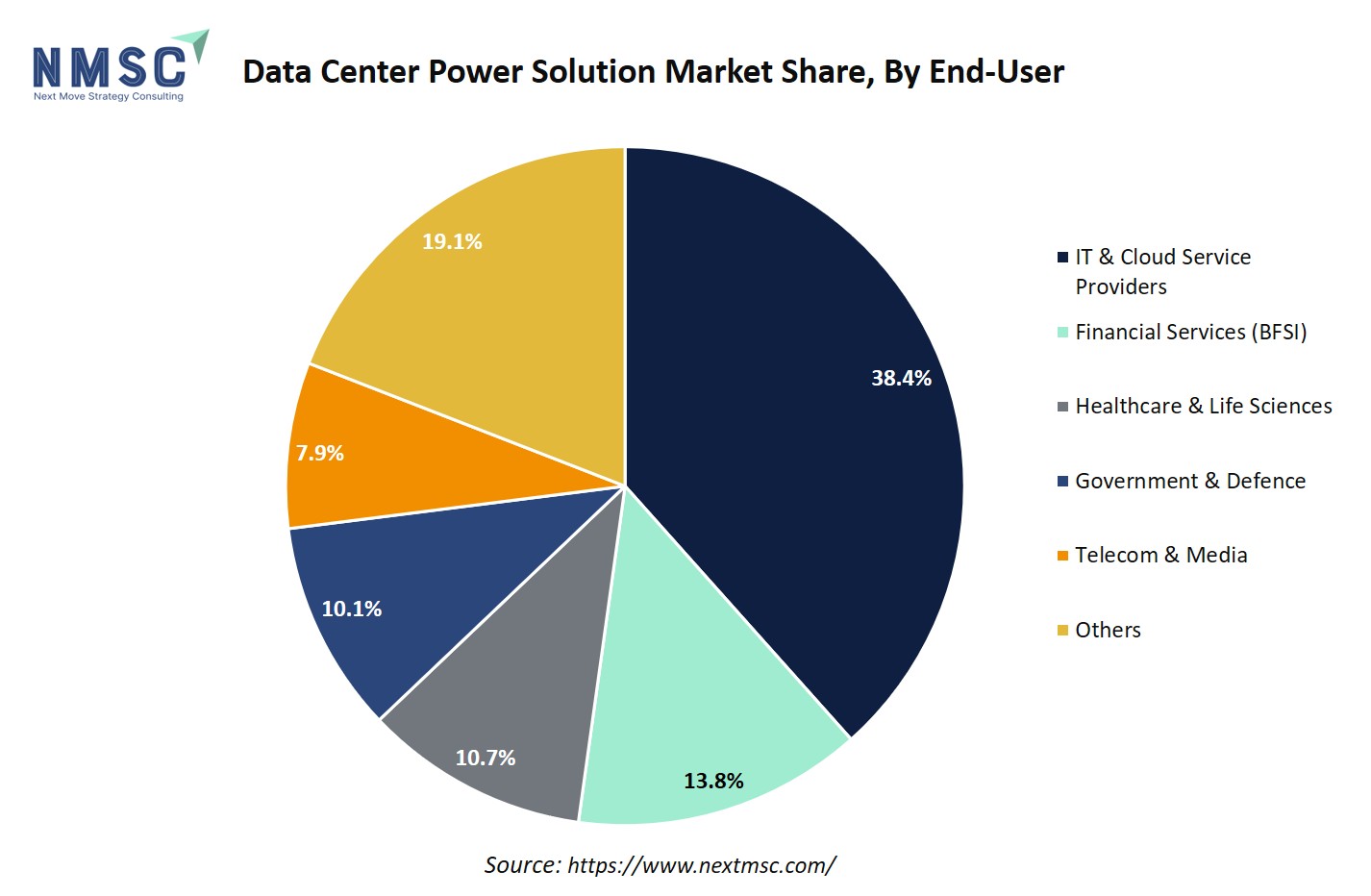

Based on end-user, the data center power solution market is bifurcated into it & cloud service providers, financial services (BFSI), healthcare & life sciences, government & defence, telecom & media, manufacturing & energy, retail & E-commerce, and others.

IT & Cloud Service Providers dominate demand, driven by hyperscale data centers, AI workloads, and digital services expansion. They require high-density racks, redundant power systems, and advanced monitoring to maintain uptime and energy efficiency. Financial Services (BFSI) require highly reliable, low-latency infrastructure to support online banking, trading platforms, and regulatory compliance. Redundant power systems and predictive energy management are critical for operational continuity. Adoption of hybrid power solutions and AI-based monitoring enhances efficiency and uptime. Similarly, Government & Defence facilities demand robust and secure power infrastructure to support mission-critical applications, cybersecurity requirements, and national data storage needs. Redundant and fault-tolerant systems are preferred for risk mitigation and continuity.

Manufacturing & Energy data centers support industrial automation, IoT, and process control systems. Providers offering hybrid and renewable-integrated solutions can help reduce costs while ensuring uptime for critical operations. Retail & E-commerce rely on robust data centers for online transactions, supply chain management, and AI-driven analytics. Redundant power, efficient cooling, and predictive maintenance platforms are increasingly adopted to support peak demand periods.

This chart presents the market share distribution for data center power solutions by end-user category, highlighting that IT & Cloud Service Providers dominate at 38.4%, followed by Financial Services (13.8%), Healthcare & Life Sciences (10.7%), Government & Defence (10.1%), Telecom & Media (7.9%), and Others accounting for the largest secondary share at 19.1%. The dominance of cloud and IT sectors underscores their outsized influence in driving innovation and capacity expansion in power solutions, while the growing needs from BFSI, healthcare, and government sectors highlight diversified demand. This varied end-user landscape stimulates competitive growth and technological advancements, pushing providers to deliver tailored, efficient, and resilient power infrastructure for multiple industries.

Regional Outlook

The data center power solution market is geographically studied across North America, Europe, the Middle East & Africa, and Asia Pacific, and each region is further studied across countries.

Data Center Power Solution Market in North America

North America continues to lead the global data center power solution market, driven by robust demand from AI, cloud computing, and digital services. In the first half of 2025, the region's primary market supply reached a record 8,155 megawatts, marking a 43.4% year-over-year increase. This surge underscores the escalating power needs of hyperscale and AI-driven data centers. However, the rapid expansion is straining existing grid infrastructures, leading to power shortages and delays in new deployments. To mitigate these challenges, companies are investing in on-site power generation solutions, such as natural gas plants and microgrids, to ensure reliability and scalability. For instance, Blackstone's acquisition of the Hill Top Energy Center in Pennsylvania exemplifies this trend, aiming to support the growing energy demands of data centers.

Data Center Power Solution Market in the United States

The U.S. remains a pivotal player in the data center power solution market, with states like Virginia, Texas, and California serving as major hubs. In 2025, Northern Virginia and Dallas accounted for 50% of the region's absorption, totaling 1,222 megawatts. This concentration highlights the critical role of infrastructure and energy availability in data center site selection. The increasing adoption of AI technologies is further intensifying power requirements, prompting operators to modernize electrical architectures and invest in energy-efficient solutions. Companies are exploring partnerships with utility providers and investing in renewable energy sources to meet the growing demand while adhering to sustainability goals.

This infographic illustrates the anticipated surge in US power demand from AI data centers, showing an exponential 31-fold increase in AI data center power consumption from 4 GW in 2024 to 123 GW in 2035, while the total data center power demand is expected to reach 176 GW by 2035. This dramatic rise will significantly impact the data center power solution market, driving urgent demand for scalable, energy-efficient, and innovative power infrastructure to support AI workloads at unprecedented scale. Companies specializing in power solutions will see robust opportunities and pressure to deliver advanced technologies capable of meeting both the immense energy requirements and sustainability goals of the future digital economy.

Data Center Power Solution Market in Canada

Canada's data center power solution market is experiencing steady growth, driven by the country's commitment to renewable energy and favorable regulatory environments. Provinces like Quebec and British Columbia offer abundant hydroelectric power, attracting data center operators seeking sustainable energy sources. The integration of renewable energy is not only reducing operational costs but also aligning with global sustainability trends. Additionally, Canada's stable political climate and robust infrastructure make it an attractive destination for data center investments. Companies are capitalizing on these advantages to expand their operations and enhance service offerings.

Data Center Power Solution Market in Europe

Europe's data center power solution market is undergoing significant transformation, driven by stringent energy efficiency regulations and the increasing demand for digital services. The European Commission's Green Deal and Germany's 1.2 Power Usage Effectiveness (PUE) cap are compelling operators to adopt energy-efficient technologies and renewable energy sources. In 2025, Europe's data center power demand is projected to double by 2030, potentially straining existing grid infrastructures.

Data Center Power Solution Market in the United Kingdom

The United Kingdom's data center power solution market is characterized by a strong emphasis on renewable energy integration and regulatory compliance. The government's commitment to achieving net-zero emissions by 2050 is driving investments in sustainable infrastructure. Operators are increasingly adopting renewable energy sources, such as wind and solar power, to meet the growing demand for data processing while minimizing environmental impact. Additionally, the UK's stable regulatory environment and access to advanced technologies make it an attractive destination for data center investments.

Data Center Power Solution Market in Germany

Germany's data center power solution market is experiencing robust growth, fueled by the country's industrial base and commitment to renewable energy. In 2025, Germany's data center power demand is projected to reach 4.26 gigawatts, the highest in Europe. This surge is prompting operators to invest in energy-efficient technologies and renewable energy sources to meet the increasing demand. The government's support for digital infrastructure development and sustainability initiatives further bolsters the market's growth prospects. Companies are focusing on enhancing operational efficiency and reducing carbon footprints to align with national and EU-wide sustainability goals.

Data Center Power Solution Market in France

France's market is evolving, driven by the country's emphasis on digital transformation and renewable energy adoption. The government's initiatives to promote green energy and digital infrastructure development are encouraging investments in sustainable data center solutions. Operators are increasingly integrating renewable energy sources, such as hydroelectric and solar power, to meet the growing demand for data processing while minimizing environmental impact. The stable regulatory environment and access to advanced technologies further enhance the market's attractiveness.

Data Center Power Solution Market in Spain

Spain's market is expanding, propelled by the country's focus on renewable energy and digital infrastructure development. The government's initiatives to promote green energy and digital transformation are attracting investments in sustainable data center solutions. Operators are increasingly integrating renewable energy sources, such as solar and wind power, to meet the growing demand for data processing while minimizing environmental impact. The stable regulatory environment and access to advanced technologies further enhance the market's growth prospects.

Data Center Power Solution Market in Italy

Italy's market is witnessing steady growth, driven by the country's digitalization efforts and commitment to renewable energy. The government's support for digital infrastructure development and green energy initiatives is fostering a conducive environment for data center investments. The growing emphasis on energy efficiency and regulatory compliance is prompting companies to invest in advanced power solutions and technologies.

Data Center Power Solution Market in Asia Pacific

Asia-Pacific is experiencing rapid growth in the market, fueled by the region's digital transformation and increasing demand for cloud services. This expansion is driven by factors such as AI adoption, sovereign cloud mandates, and government support for digital infrastructure development. Operators are investing in scalable and energy-efficient power solutions to meet the growing demand while ensuring sustainability.

Data Center Power Solution Market in China

China's market is evolving rapidly, driven by the country's ambition to become a global leader in AI and digital infrastructure. The Stargate of China project in Wuhu, a 760-acre island on the Yangtze River, exemplifies the nation's commitment to enhancing AI computing capabilities. Despite challenges such as limited access to advanced chips and reliance on smuggled components, China is aggressively investing in data center infrastructure to support AI workloads. The government's substantial support and corporate investments are accelerating the development of data centers, aiming to close the AI gap with other global powers.

Data Center Power Solution Market in Japan

Japan's market is characterized by a strong emphasis on technological innovation and energy efficiency. The country's aging infrastructure and high energy costs are prompting operators to adopt advanced power solutions and renewable energy sources. Government initiatives to promote digital transformation and sustainability are encouraging investments in data center infrastructure. Operators are also focusing on integrating renewable energy sources, such as solar and wind power, to meet the growing demand for data processing while minimizing environmental impact.

Data Center Power Solution Market in India

India's market is experiencing significant growth, driven by the country's digitalization efforts and increasing demand for cloud services. The government's initiatives, such as the Digital India program, are fostering a conducive environment for data center investments. In 2025, India's data center market is projected to witness substantial expansion, with a focus on renewable energy integration and energy-efficient technologies. Operators are investing in scalable power solutions to meet the growing demand while adhering to sustainability goals.

Data Center Power Solution Market in South Korea

South Korea's market is evolving, influenced by the country's technological advancements and commitment to renewable energy. The government's support for digital infrastructure development and green energy initiatives is attracting investments in sustainable data center solutions. Operators are increasingly adopting renewable energy sources, such as solar and wind power, to meet the rising demand for data processing while minimizing environmental impact. The stable regulatory environment and access to advanced technologies further enhance the market.

Data Center Power Solution Market in Taiwan

The rapid expansion of Taiwan’s AI workloads is driving the growth of data center power solution market demand, with companies like Foxconn and Nvidia planning a 100 MW AI data center in Kaohsiung. However, the surge in demand is straining the local power grid, prompting operators to invest in renewable energy sources and advanced cooling technologies to ensure sustainable operations.

Data Center Power Solution Market in Australia

Australia has seen a marked rise in data center activity, particularly in Sydney and Melbourne, due to increased cloud adoption and regional hyperscale deployments. The nation’s high renewable energy penetration, particularly solar and wind, is influencing power solution designs, with operators increasingly integrating on-site generation and energy storage systems to reduce dependence on the grid. The government's ambitious target of 82% renewable electricity by 2030 is driving the adoption of sustainable energy solutions in data centers.

Data Center Power Solution Market in Latin America

In Latin America, countries like Brazil, Chile, and Mexico are seeing heightened interest from hyperscale operators and cloud providers. Rising internet penetration, digital services expansion, and the need for localized data storage are driving demand for robust and reliable power solutions. Renewable energy adoption, particularly hydroelectric and solar, is becoming a core strategy to reduce operational risk and align with regional sustainability policies. Providers that can offer flexible, modular, and energy-efficient solutions are well-positioned to capitalize on this growing market.

Data Center Power Solution Market in the Middle East & Africa

The Middle East & Africa is witnessing accelerated data center development, led by UAE, Saudi Arabia, and South Africa, as governments push digital transformation and cloud adoption. High temperatures and energy-intensive operations are driving the adoption of efficient cooling systems, AI-powered energy management, and hybrid renewable power integration. Grid limitations and the push for energy independence make on-site generation and microgrid solutions attractive.

Competitive Landscape

Which Companies Dominate the Data Center Power Solution Market and how do they Compete?

The global data-center power market is led by a mix of diversified electrical giants like Schneider Electric, Eaton, and ABB, alongside infrastructure specialists such as Vertiv, Socomec, and Rittal, as well as generator and backup system providers including Cummins and Generac. These players compete across different layers of the value chain. Large multinationals leverage their broad portfolios, extensive global supply chains, and service capabilities, while specialists differentiate with highly optimized UPS systems, rack-level PDUs, and modular solutions tailored for hyperscale and colocation operators that demand speed, flexibility, and efficiency. For example, Schneider Electric completes transaction to combine its Low Voltage and Industrial Automation business with Larsen & Toubro’s Electrical & Automation business.

Market Dominated by Data Center Power Solution Giants and Specialists

Competition is shaped by the dominance of global giants that control large-scale electrical infrastructure and by focused specialists that serve niche segments. The former provides end-to-end integrated solutions, spanning grid connections to backup generation, which makes them trusted partners for hyperscale operators. Specialists, on the other hand, capitalize on emerging opportunities in edge data centers and regional markets by offering modular, high-efficiency power distribution products. Regional regulations, grid constraints, and sustainability targets further intensify competition, encouraging partnerships between data-center developers, energy providers, and equipment manufacturers to secure long-term, renewable power supplies. Company such as Intersect formed strategic partnership with Google and TPG Rise Climate to co-locate data center load and clean power generation.

Innovation and Adaptability Drive Market Success

Innovation is increasingly the key differentiator in the data-center power solution market. Market leaders are focusing on higher-efficiency UPS systems, energy storage integration, and digital monitoring software that improves reliability while reducing costs. Vertiv, for example, introduced its compact, high-power density UPS for large data centers and other critical applications. Also, product launches now emphasize compact, high-density designs to maximize floor space and lower operating costs. Additionally, many companies are investing in predictive analytics and AI-driven monitoring tools to improve system uptime and enhance energy optimization. These innovations are especially critical as AI and cloud workloads continue to drive unprecedented demand for power-dense, resilient, and sustainable data-center infrastructures worldwide.

Market Players to Opt for Merger & Acquisition Strategies to Expand their Presence

Mergers, acquisitions, and strategic partnerships are central strategies for companies aiming to expand their global presence and capabilities. Investment partnerships such as the USD 50 billion deal between KKR and Energy Capital Partners in 2024 highlight the scale of capital flowing into integrated data-center power and infrastructure projects. Similarly, Vantage Data Centers received a USD 6.4 billion equity investment led by DigitalBridge and Silver Lake which accelerates Vantage’s global expansion of hyperscale campuses in North America and EMEA, enabling over 3 gigawatts of additional data centre capacity. These moves reflect a clear trend: market players are seeking synergies and long-term resilience by bundling generation, storage, and critical-power services under unified strategies.

List of Key Data Center Power Solution Companies

-

ABB Ltd.

-

Caterpillar Inc.

-

Cummins Inc.

-

Vertiv Holdings Co.

-

Siemens

-

Delta Electronics, Inc.

-

Mitsubishi Electric Corporation

-

Legrand SA

-

Toshiba Energy Systems & Solutions Corp.

-

Huawei

-

Socomec Group SA

-

Generac

-

Kohler

What are the Latest Key Industry Developments?

-

March 2025- ADQ (Abu Dhabi) and ECP formed a USD 25 billion 50-50 partnership, aiming for ~25 GW of new power generation capacity in the U.S. and expansions to meet data-centre power demand across energy-intensive industries.

-

March 2025- EnerSys unveiled advanced embedded monitoring tech in its DataSafe TPPL battery systems (for data centres), improving backup power reliability and enabling predictive maintenance, key for continuous uptime and lower operating risk.

-

January 2024- TerraPower and Sabey Data Centers entered into an MOU to explore deployment of advanced nuclear Natrium plants to support growing power needs for Sabey’s data centre operations (new + future sites). Reflects interest in nuclear as a baseload / resilient power source for data centres.

-

December 2024- Google, Intersect Power & TPG Rise Climate forged a strategic partnership to deliver renewable energy + storage infrastructure to new data centres across the U.S., part of a power-first approach. Infrastructure investments are expected to reach ~USD 20 billion by 2030.

-

October 2024- KKR and ECP announced a USD 50 billion strategic partnership to build out data-centre power generation and transmission infrastructure, targeting AI / cloud-computing growth globally. This is significant for accelerating scalable, reliable power supply for hyperscalers.

What are the Key Factors Influencing Investment Analysis & Opportunities in the Data Center Power Solution Market?

Investment in the global market is being driven by accelerating digitalization, cloud adoption, and AI workloads, which are pushing demand for scalable and energy-efficient infrastructure. Funding trends show increasing capital inflows from private equity, infrastructure funds, and sovereign wealth funds, with investors targeting both hyperscale expansions and sustainable power solutions. Valuations remain strong, particularly for companies offering advanced UPS systems, battery energy storage, and renewable integration, reflecting long-term growth potential and resilience against energy price volatility.

Key investment hotspots include North America and Europe, where mature markets are focusing on decarbonization and grid stability, and Asia-Pacific, especially Singapore, India, and China, where rapid cloud growth and government support are creating high-return opportunities. Strategic partnerships between technology providers and utilities are further shaping the landscape, positioning clean energy and power optimization as central themes for future investments.

Key Benefits for Stakeholders:

Next Move Strategy Consulting (NMSC) presents a comprehensive analysis of the data center power solution market, covering historical trends from 2020 through 2024 and offering detailed forecasts through 2030. Our study examines the market at global, regional, and country levels, providing quantitative projections and insights into key growth drivers, challenges, and investment opportunities across all major data center power solution segments.

The data center power solution market creates multifaceted benefits for diverse stakeholders. Investors gain access to a high-growth, high-demand sector fueled by AI, cloud adoption, and data localization mandates, offering attractive returns through infrastructure development and M&A opportunities. Policymakers benefit from accelerated digitalization and energy-efficient practices that align with national sustainability and renewable energy targets, while also strengthening data sovereignty and cybersecurity resilience. Customers, including hyperscalers, telecom operators, and enterprises, enjoy reliable, scalable, and energy-optimized power solutions, ensuring uninterrupted operations and reduced total cost of ownership. Collectively, these stakeholders are empowered by a market that drives technological innovation, supports economic growth, and fosters a robust, future-ready digital infrastructure ecosystem.

Report Scope:

|

Parameters |

Details |

|

Market Size in 2025 |

USD 20.67 Billion |

|

Revenue Forecast in 2030 |

USD 34.14 Billion |

|

Growth Rate |

CAGR of 10.5% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Countries Covered |

28 |

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent to up to 80 analyst-working hours) after purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

|

Approach |

In-depth primary and secondary research; proprietary databases; rigorous quality control and validation measures. |

|

Analytical Tools |

Porter's Five Forces, SWOT, value chain, and Harvey ball analysis to assess competitive intensity, stakeholder roles, and relative impact of key factors. |

Key Market Segments

By Power Infrastructure Components

-

Power Conversion & Backup

-

Uninterruptible Power Supplies (UPS)

-

Energy Storage Systems

-

Lithium-ion Batteries

-

VRLA Lead-acid Batteries

-

Flywheels

-

-

-

On-Site Generation

-

Diesel & HVO-capable Generators

-

Natural-Gas Turbines

-

Fuel Cells (H₂, biogas)

-

-

Power Distribution Hardware

-

MV/LV Switchgear & Transformers

-

Busways & Intelligent PDUs

-

Automatic Transfer Switches

-

Panel boards & Breakers

-

-

Monitoring & Management

-

DCIM & Energy-Management Software

-

AI-Analytics & PUE-Optimization

-

-

Professional Services

-

Design & Integration

-

Maintenance & Managed Services

-

Consulting & Audit

-

By IT Load

-

Edge & Micro (< 500 kW)

-

Medium (500 kW–2 MW)

-

Large (2–5 MW)

-

Hyperscale (> 5 MW)

By Power Capacity Band

-

< 0.05 GW

-

0.05–0.1 GW

-

0.1–0.2 GW

-

0.2–0.5 GW

-

> 0.5 GW

By Redundancy Level

-

N (No Redundancy)

-

N+1 (Single‐fault tolerant)

-

N+2 (Dual‐fault tolerant)

-

2N (Full duplication)

-

2N+1 (Concurrent maintain + extra spare)

-

3N / 2N+2 (multi-backup fault tolerant)

By Rack Power Density

-

< 10 kW/Rack

-

10–30 kW/Rack

-

> 30 kW/Rack

By Power Source & Sustainability

-

Grid-Tied

-

On-Site Conventional

-

Diesel

-

Gas

-

-

Low-Carbon & Renewables

-

Emerging Tech

-

Hydrogen Fuel Cells

-

Microturbines

-

By End User Vertical

-

IT & Cloud Service Providers

-

Financial Services (BFSI)

-

Healthcare & Life Sciences

-

Government & Defense

-

Telecom & Media

-

Manufacturing & Energy

-

Retail & E-commerce

-

Others

Conclusion & Recommendations

Our report equips stakeholders, industry participants, investors, policy-makers, and consultants with actionable intelligence to capitalize on data center power solution transformative potential. By combining robust data-driven analysis with strategic frameworks, NMSC’s data center power solution market report serves as an indispensable resource for navigating the evolving landscape.

The data center power solution market presents a dynamic landscape driven by AI adoption, cloud expansion, and renewable energy integration. Strategic takeaways highlight the importance of modular, high-density, and energy-efficient power systems, proactive government engagement, and M&A-driven growth to capture emerging opportunities. Companies that innovate while aligning with regional regulatory frameworks and sustainability goals are poised to gain competitive advantage. Looking ahead, investment hotspots in Mumbai, Bengaluru, and Chennai, coupled with rising demand for AI-ready and hybrid energy solutions, indicate robust market expansion. Continued technological advancement, strategic partnerships, and cross-industry collaboration will define the market’s trajectory, positioning as a critical hub for global data center power infrastructure.

Speak to Our Analyst

Speak to Our Analyst