Denmark Waste Management Market by Waste Type (Hazardous Waste, and Non-Hazardous Waste), by Service (Collection, and Disposal), and by Source (Residential or Municipal Waste, Commercial Waste, and Industrial Waste) – Opportunity Analysis and Industry Forecast, 2025–2030

Industry: Energy & Power | Publish Date: 14-Nov-2025 | No of Pages: 206 | No. of Tables: 166 | No. of Figures: 111 | Format: PDF | Report Code : EP2734

Denmark Waste Management Market Overview

Denmark waste management market size was valued at USD 17.17 billion in 2024 and is predicted to reach USD 23.69 billion by 2030, registering a CAGR of 4.36% from 2025 to 2030.

The Denmark waste management market is driven by factors such as increasing urbanization, growing industrial sector, and rising government initiatives promoting circular economy practices. However, challenges such as high operational costs and complex waste sorting requirements hinder market growth.

On the other hand, advancements in recycling technologies, including waste to energy and chemical recycling, present promising opportunities by enhancing efficiency and sustainability.

Moreover, key players have been investing through innovative waste solutions and upgrading capacity in recycling such as Vestforbrænding, RenoNord, ARC. In future, as companies are progressing towards a healthier environment, thus the waste sector will remain among the pillars behind the fulfillment of national environmental agenda.

Extensive Single-Use Plastics Extended Producer Responsibility (EPR) and Producer Compliance Spur Recycling Infrastructure Growth

Denmark is rolling out a mandatory Extended Producer Responsibility (EPR) scheme for single-use plastic products starting January 1, 2025, covering eight categories—such as food and beverage containers, cups, bags, wet wipes, balloons, and tobacco filters—even when containing minimal plastic. This regulatory push is compelling producers to register, report quantities placed on market, and shoulder financial cleanup responsibilities for litter and public waste collection. The outcome: accelerated investments in plastic collection, sorting systems, and recycling infrastructure to meet compliance and circular economy goals.

Capitalizing on Iconic Waste-to-Energy Landmarks and Low-Carbon Urban Goals

Copenhagen’s Amager Bakke (CopenHill) has emerged as a global symbol of innovative waste-to-energy infrastructure—combining high-efficiency incineration with recreational use, supporting the city’s carbon neutrality ambitions. Though Copenhagen narrowly missed its 2025 target, CO₂ emissions have already fallen by 75% since 2005. Such landmark facilities are boosting public and investor confidence, accelerating growth in waste-to-energy projects and modernized recovery systems across Denmark.

Unclear Regulatory Frameworks Constrain Reuse Initiatives and Holistic Circularity

Efforts to move beyond recycling toward preparing materials and products for reuse (PfR) face legal and regulatory ambiguity. Danish municipal waste companies attempting to operate reuse shops or other PfR initiatives encounter uncertainty over whether such items are still considered “waste” and who bears responsibility. This vagueness hinders broader adoption of reuse practices and innovation in circular economy models beyond established recycling pathways.

Industrial Symbiosis at Kalundborg Eco-Industrial Park Unlocks Circular Resource Loops

The Kalundborg Eco-Industrial Park exemplifies Denmark’s advanced industrial symbiosis model: surplus heat, gypsum, fly ash, and other by-products from power production are repurposed—benefiting nearby facilities, including pharmaceutical and road construction companies. Extending such networks within waste management presents a compelling chance to transform waste into valuable inputs across industrial systems, amplifying environmental efficiency and fostering sustainable partnerships.

By Waste Type, Municipal Solid Waste (MSW) or Household Dominates the Denmark Waste Management Market Share

MSW constitutes 54% of Denmark Waste Management. This sector mainly comprises household waste, packaging waste, organic waste as well as recyclables coming from households. Functioning MSW management depends highly on sorting systems, waste-to-energy plants, recycling plants, and smart collection systems that improve the processing efficiency of waste while minimizing landfills and supporting Danish sustainability objectives. The integration of advanced sorting technologies and automated waste processing solutions has been instrumental in improving recycling rates and minimizing environmental impact.

By Waste Treatment, Recycling, holds the highest CAGR of 4.75%

The recycling segment in the waste management industry in Denmark is growing because of increasing regulatory emphasis on sustainability and circular economy initiatives. Technologies included in this segment are automated sorting systems, material recovery facilities, chemical recycling, and AI-powered waste classification. These solutions help in efficient separation, processing, and repurposing of recyclable materials to reduce landfill waste and help businesses and municipalities meet environmental targets.

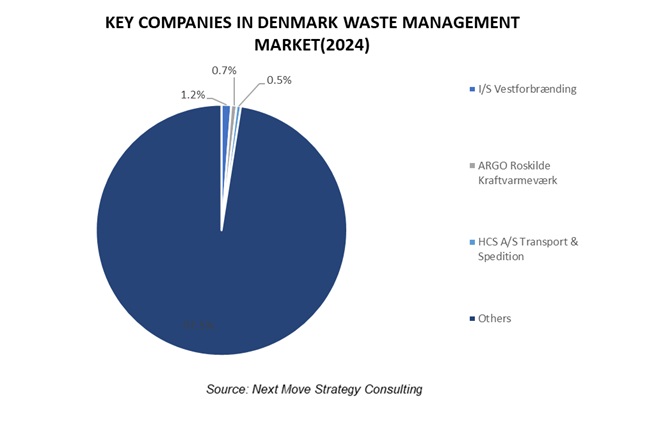

Competitive Landscape

The key players operating in Denmark waste management industry include Vestforbrænding I/S, Amager Resource Center (ARC), NG Nordic, REMONDIS A/S, Ragn-Sells Danmark A/S, Stena Recycling, RGS Nordic A/S, Kredsløb A/S, ARGO Affaldsenergi A/S, Nordværk I/S, AffaldPlus I/S, Renosyd I/S, Marius Pedersen A/S, ReSource Denmark ApS, HJHansen Recycling Group among others.

These players are engaged in various partnership, and business expansion across various regions to maintain their dominance in the market.

|

Date |

Company |

Recent Developments |

|

November 2024 |

ARGO Roskilde Kraftvarmeværk |

Argo expanded its direct reuse initiative by opening a new facility in Bjæverskov that aims to promote sustainability and reduce waste through community engagement. This expansion is part of a broader effort to encourage recycling and the reuse of items across various municipalities. |

|

October 2024 |

ARGO Roskilde Kraftvarmeværk |

Argo collaborated with Stevns Municipality and launched a new initiative for direct reuse at their recycling centers in Harlev and Store Heddinge. This program allows individuals to donate or pick up various reusable items, including building materials, furniture, electronics, and toys, all at no cost. |

|

July 2024 |

Remondis |

Remondis SE & Co. KG partnered with KeyKeg to launch a collection network for used KeyKegs in Denmark, focusing on enhancing sustainability and recycling within the beverage industry. |

|

June 2024 |

Kredsløb Holding A/S |

Kredsløb Holding A/S expanded its business by opening a new local recycling station in Denmark. This initiative is part of their broader efforts to enhance recycling and promote a circular economy in the region. |

|

October 2023 |

I/S Vestforbrænding |

Vestforbrænding expanded the district heating network in the Greater Copenhagen area. This initiative, is part of the company’s Heat Plan for 2030 to provide 39,000 additional residents with district heating by utilizing waste heat and surplus energy from businesses |

|

August 2023 |

Amager Resource Center (ARC) |

Amager Resource Center in Copenhagen launched a new carbon capture facility that captures CO2 emissions from its waste-to-energy plant. With a capacity of up to 4 tons of CO2 per day, the facility will supply the captured carbon to local vegetable growers, integrating waste management with sustainable agricultural practices. |

|

March 2023 |

Nordværk (RenoNord) |

Nordværk partnered with Gemidan A/S to lease a significant area for the construction of a pre-treatment plant for food waste in Aalborg East. This collaboration aims to enhance regional waste management efforts and complements Nordværk's existing operations in the area. |

Denmark Waste Management Market Key Segments

By Waste Type

-

Hazardous Waste

-

Solid Waste

-

Liquid Waste

-

Gaseous Waste

-

-

Non-Hazardous Waste

-

Food

-

Paper and Cardboard

-

Plastic

-

Glass

-

Metal

-

Water

-

E-Waste

-

Others

-

By Service

-

Collection

-

Collection and Transportation

-

Storage and Handling

-

Sorting

-

-

Disposal

-

Open Dumping

-

Incineration/Combustion

-

Landfills

-

Recycling

-

Composting and Anaerobic Digestion

-

By Source

-

Residential or Municipal Waste

-

Commercial Waste

-

Offices and Retail Stores

-

Hospitals

-

Restaurants

-

Other Commercial Sources

-

-

Industrial Waste

-

Manufacturing Waste

-

Construction, Renovation, and Demolition Waste

-

Agriculture Waste

-

Medical Waste

-

Other Industrial Sources

-

Key Players

-

Vestforbrænding I/S

-

Amager Resource Center (ARC)

-

NG Nordic

-

REMONDIS A/S

-

Ragn-Sells Danmark A/S

-

Stena Recycling

-

RGS Nordic A/S

-

Kredsløb A/S

-

ARGO Affaldsenergi A/S

-

Nordværk I/S

-

AffaldPlus I/S

-

Renosyd I/S

-

Marius Pedersen A/S

-

ReSource Denmark ApS

-

HJHansen Recycling Group

REPORT SCOPE AND SEGMENTATION:

|

Parameters |

Details |

|

Market Size in 2024 |

USD 17.17 Billion |

|

Revenue Forecast in 2030 |

USD 23.69 Billion |

|

Growth Rate |

CAGR of 4.36% from 2025 to 2030 |

|

Analysis Period |

2024–2030 |

|

Base Year Considered |

2024 |

|

Forecast Period |

2025–2030 |

|

Market Size Estimation |

Billion (USD) |

|

Growth Factors |

|

|

Companies Profiled |

15 |

|

Market Share |

Available for 10 companies |

|

Customization Scope |

Free customization (equivalent up to 80 working hours of analysts) after purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. |

Speak to Our Analyst

Speak to Our Analyst